Corporate Wellness Market size was valued at US$ 64.85 Bn in 2023 and the total revenue is expected to grow at 7.1% through 2024 to 2030, reaching nearly US$ 104.82 Bn.Corporate Wellness Market Overview

The market has experienced significant growth and transformation in recent years. This is attributed to the increasing recognition of organizations of the importance of employee well-being in fostering a healthy and productive work environment. The Corporate Wellness Market includes a wide range of programs, services, and initiatives that are designed to promote and support the health and wellness of employees within a corporate setting. As per the study, the market is expected to grow rapidly during the forecast period. The future trends are expected to focus on a more holistic approach to employee well-being, integrating physical, mental, and social dimensions. Comprehensive wellness strategies that address the overall quality of life is expected to gain prominence.To know about the Research Methodology :- Request Free Sample Report

Corporate Wellness Market Dynamics

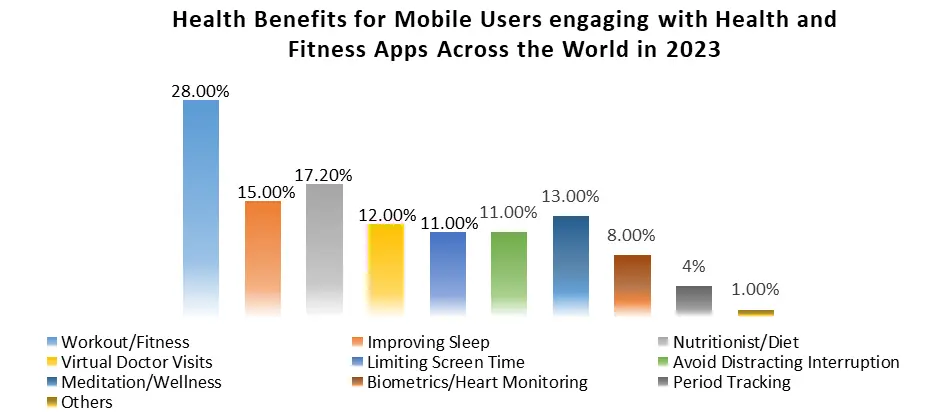

Wellness Programs Driving the Corporate Wellness Market Corporations are actively using corporate wellness programs to promote employee performance and well-being, eliminate health risks, and reduce employee healthcare expenses. Organizations are increasingly conscious of the need of maintaining a psychologically and physically fit workforce. As a result, businesses have increased their spending on employee welfare programs, products, and services. Workplace wellness programs offer employees a range of benefits aimed at enhancing their overall lifestyle. These programs encompass initiatives promoting healthy movement, offering health screenings, supporting smoking cessation, managing diabetes, and more. These programs majorly drive the global corporate wellness market. In certain cases, participation in these programs is incentivized with financial rewards. According to MMR the findings of a study on employee well-being, remote work is expected to foster a sense of trust between employers and employees. Moreover, despite potential distractions, working from home alleviates a considerable amount of work-related stress that may be experienced in an office environment. In the corporate wellness market, the popularity of virtual wellness programs is on the rise, providing employees with a convenient avenue to tap into wellness resources and assistance. These programs encompass online fitness classes, stress management webinars, and coaching sessions on healthy eating. Virtual wellness programs offer a convenient solution for employees, especially those working remotely or managing busy schedules. Employers leverage these programs to grant employees easy access to wellness resources, fostering increased engagement and contributing to improved overall health outcomes. Technology-driven Innovations in Corporate Wellness Creating Opportunities for the Corporate Wellness Market Growth The integration of advanced technologies, such as artificial intelligence, wearables and mobile apps are creates opportunities for the creation of interactive and personalized wellness platforms. This integration of advanced technologies enhance engagement, provide real-time health insights, and facilitate data-driven decision-making. Within the corporate wellness market, wearable technology has gained widespread popularity. Devices like fitness trackers, smartwatches, and heart rate monitors serve as wearables, tracking various health metrics such as physical activity, heart rate, and sleep patterns. Wearables provide employees with a convenient means to monitor their health and wellness, while simultaneously furnishing employers with valuable data regarding employee well-being. This data becomes instrumental for designing personalized wellness programs tailored to meet the specific needs of individual employees. Wearables have demonstrated effectiveness in promoting physical activity, mitigating sedentary behavior, and contributing to enhanced overall health outcomes. In the corporate wellness industry, the prevalence of wellness apps is steadily growing, providing employees with a convenient means to oversee their health and well-being. These apps can monitor various health metrics such as food intake, exercise routines, and sleep patterns. Users leverage wellness apps to establish health goals, receive timely notifications and reminders, and keep track of their progress. Employers, too, harness the potential of wellness apps to formulate tailored wellness programs that align with the unique needs of their workforce. Wellness apps have proven to be effective in encouraging health-conscious behaviors, boosting employee engagement, and contributing to overall improvements in health outcomes.

Corporate Wellness Market Segment Analysis

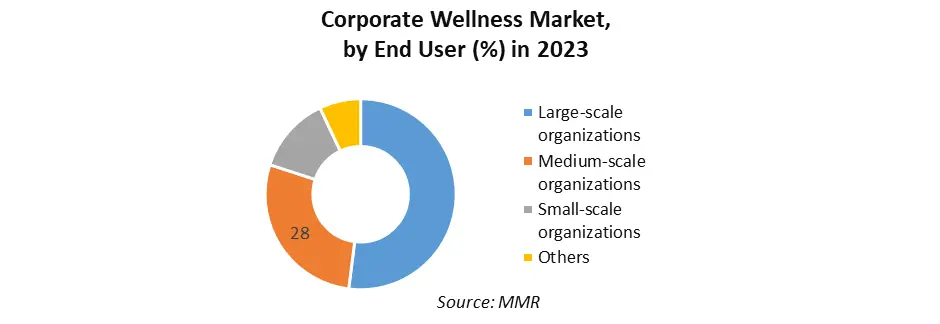

Based on Category: the market is segmented into Fitness and nutrition consultants, Organizations/employers, and Psychological therapists. The Organizations/employers segment held the largest corporate wellness market share in 2023 and is expected to remain in its leading position during the forecast period. The service providers provide in-house as well as outsourced health management services for large as well as small-scale corporations. The trend of on-site fitness that contains yoga and meditation is becoming popular. Thus, the fitness and nutrition consultants’ segment is expected to witness a growth rate of xx% during the forecast period owing to increasing awareness regarding secured healthcare. Healthcare consultants offer various components including exercise, nutrition coupled with character strength and behavioral health. Many programs provide various solutions dependent upon individual health status, thereby augmenting segmental growth. Based on End-User: the market is segmented into Small-scale organizations, Medium-scale organizations, Large-scale organizations, and Others. The large-scale organizations segment held the largest corporate wellness market share in 2023. According to well-documented studies, integrated management programs can give a 3:1 rate of return. Programs and services can be integrated into the foundation of larger companies. Small businesses might profit from corporate associations and service contracting.

Corporate Wellness Market Regional Insights

North America Corporate Wellness Market dominated the global market in 2023. The region held the largest market share due to the presence of corporate wellness providers, changing lifestyles along with the growing incidence of chronic diseases (cardiovascular diseases, obesity, and diabetes), increasing expenditure on healthcare, and rising adoption of wellness activities in the US and Canada. According to the RAND employer survey, almost 50% of the employers in the U.S. provide wellness programs to their staff. Larger employers provide more complex wellness initiatives. Asia Pacific Corporate Wellness Market is expected to grow at a higher CAGR of over the forecast period owing to growing awareness about corporate wellness programs. Also, the rising number of working professionals coupled with high adoption of such programs raises regional growth. Increasing initiatives for maintaining and securing employee mental health in emerging countries is expected to contribute to the regional market growth. The shift towards remote and flexible work arrangements due to the advanced technologies has prompted organizations to adapt their wellness programs to cater to the diverse needs of an evolving workforce.Corporate Wellness Market Scope: Inquire before buying

Global Corporate Wellness Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 64.85 Bn. Forecast Period 2024 to 2030 CAGR: 7.1% Market Size in 2030: US $ 104.82 Bn. Segments Covered: by Service 1Fitness Health risk assessment Health screening Nutrition and weight management Smoking cessation Stress management Others by Category Fitness and nutrition consultants Organizations/employers Psychological therapists by End User Small-scale organizations Medium-scale organizations Large-scale organizations Other Corporate Wellness Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Corporate Wellness Key Players

Global 1. Sodexo Group [Issy-les-Moulineaux, France] 2. EXOS [Phoenix, Arizona, USA] 3. ComPsych [Chicago, Illinois, USA] 4. Virgin Pulse [Providence, Rhode Island, USA] 5. Vitality Group [Chicago, Illinois, USA] North America 1. Wellness Corporate Solutions [Bethesda, Maryland, USA] 2.Provant Health Solutions [East Greenwich, Rhode Island, USA] 3. Marino Wellness [Irving, Texas, USA] 4. Central Corporate Wellness [New York, New York, USA] 5. Well Nation [Dallas, Texas, USA] 6. Alyfe Wellbeing Strategies [Chicago, Illinois, USA] 7. Burner Fitness [Los Angeles, California, USA] 8. Aptora [Lenexa, Kansas, USA] 9. Rival Health [Tulsa, Oklahoma, USA] 10. MediKeeper [San Diego, California, USA] 11. ADURO, INC. [Redmond, Washington, USA] 12. Beacon Health Options [Boston, Massachusetts, USA] 13. Fitbit, Inc. [San Francisco, California, USA] 14. Privia Health [Arlington, Virginia, USA] Europe 1. Wellsource, Inc. [Portland, Oregon, USA] Asia Pacific 1 Truworth Wellness [Pune, Maharashtra, India] 2 SOL Wellness [Mumbai, Maharashtra, India] Frequently Asked Questions: 1] What segments are covered in Corporate Wellness Market report? Ans. The segments covered in Corporate Wellness Market report are based on Service, Category, and End-Users. 2] Which region is expected to hold the largest Corporate Wellness Market share during the forecast period? Ans. North America is expected to hold the largest Corporate Wellness Market share during the forecast period. 3] What is the expected Corporate Wellness Market size by 2030? Ans. The expected Corporate Wellness Market size by 2030 is USD 104.82 Bn. 4] Who are the top players in the global Corporate Wellness Market? Ans. ComPsych, Wellness Corporate Solutions, Virgin Pulse, Provant Health Solutions, EXOS, and Marino Wellness are the top players in the global Corporate Wellness Market. 5] What was the Corporate Wellness Market size in 2023? Ans. The Corporate Wellness Market size in 2023 was USD 64.85 Bn.

1. Corporate Wellness Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Corporate Wellness Market: Dynamics 2.1. Corporate Wellness Market Trends by Region 2.1.1. North America Corporate Wellness Market Trends 2.1.2. Europe Corporate Wellness Market Trends 2.1.3. Asia Pacific Corporate Wellness Market Trends 2.1.4. Middle East and Africa Corporate Wellness Market Trends 2.1.5. South America Corporate Wellness Market Trends 2.2. Corporate Wellness Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Corporate Wellness Market Drivers 2.2.1.2. North America Corporate Wellness Market Restraints 2.2.1.3. North America Corporate Wellness Market Opportunities 2.2.1.4. North America Corporate Wellness Market Challenges 2.2.2. Europe 2.2.2.1. Europe Corporate Wellness Market Drivers 2.2.2.2. Europe Corporate Wellness Market Restraints 2.2.2.3. Europe Corporate Wellness Market Opportunities 2.2.2.4. Europe Corporate Wellness Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Corporate Wellness Market Drivers 2.2.3.2. Asia Pacific Corporate Wellness Market Restraints 2.2.3.3. Asia Pacific Corporate Wellness Market Opportunities 2.2.3.4. Asia Pacific Corporate Wellness Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Corporate Wellness Market Drivers 2.2.4.2. Middle East and Africa Corporate Wellness Market Restraints 2.2.4.3. Middle East and Africa Corporate Wellness Market Opportunities 2.2.4.4. Middle East and Africa Corporate Wellness Market Challenges 2.2.5. South America 2.2.5.1. South America Corporate Wellness Market Drivers 2.2.5.2. South America Corporate Wellness Market Restraints 2.2.5.3. South America Corporate Wellness Market Opportunities 2.2.5.4. South America Corporate Wellness Market Challenges 2.3. PORTER’s Five Products Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For the Corporate Wellness Industry 2.7. Analysis of Government Schemes and Initiatives For the Corporate Wellness Industry 2.8. The Global Pandemic Impact on the Corporate Wellness Market 3. Corporate Wellness Market: Global Market Size and Forecast (by Value) (2023-2030) 3.1. Corporate Wellness Market Size and Forecast, by Service (2023-2030) 3.1.1. Fitness 3.1.2. Health risk assessment 3.1.3. Health screening 3.1.4. Nutrition and weight management 3.1.5. Smoking cessation 3.1.6. Stress management 3.1.7. Others 3.2. Corporate Wellness Market Size and Forecast, by Category (2023-2030) 3.2.1. Fitness and nutrition consultants 3.2.2. Organizations/employers 3.2.3. Psychological therapists 3.3. Corporate Wellness Market Size and Forecast, by End User (2023-2030) 3.3.1. Small-scale organizations 3.3.2. Medium-scale organizations 3.3.3. Large-scale organizations 3.3.4. Others 3.4. Corporate Wellness Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Corporate Wellness Market Size and Forecast (by Value in USD Million) (2023-2030) 4.1. North America Corporate Wellness Market Size and Forecast, by Service (2023-2030) 4.1.1. Fitness 4.1.2. Health risk assessment 4.1.3. Health screening 4.1.4. Nutrition and weight management 4.1.5. Smoking cessation 4.1.6. Stress management 4.1.7. Others 4.2. North America Corporate Wellness Market Size and Forecast, by Category (2023-2030) 4.2.1. Fitness and nutrition consultants 4.2.2. Organizations/employers 4.2.3. Psychological therapists 4.3. North America Corporate Wellness Market Size and Forecast, by End User (2023-2030) 4.3.1. Small-scale organizations 4.3.2. Medium-scale organizations 4.3.3. Large-scale organizations 4.3.4. Others 4.4. North America Corporate Wellness Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Corporate Wellness Market Size and Forecast, by Service (2023-2030) 4.4.1.1.1. Fitness 4.4.1.1.2. Health risk assessment 4.4.1.1.3. Health screening 4.4.1.1.4. Nutrition and weight management 4.4.1.1.5. Smoking cessation 4.4.1.1.6. Stress management 4.4.1.1.7. Others 4.4.1.2. United States Corporate Wellness Market Size and Forecast, by Category (2023-2030) 4.4.1.2.1. Fitness and nutrition consultants 4.4.1.2.2. Organizations/employers 4.4.1.2.3. Psychological therapists 4.4.1.3. United States Corporate Wellness Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Small-scale organizations 4.4.1.3.2. Medium-scale organizations 4.4.1.3.3. Large-scale organizations 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Corporate Wellness Market Size and Forecast, by Service (2023-2030) 4.4.2.1.1. Fitness 4.4.2.1.2. Health risk assessment 4.4.2.1.3. Health screening 4.4.2.1.4. Nutrition and weight management 4.4.2.1.5. Smoking cessation 4.4.2.1.6. Stress management 4.4.2.1.7. Others 4.4.2.2. Canada Corporate Wellness Market Size and Forecast, by Category (2023-2030) 4.4.2.2.1. Fitness and nutrition consultants 4.4.2.2.2. Organizations/employers 4.4.2.2.3. Psychological therapists 4.4.2.3. Canada Corporate Wellness Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Small-scale organizations 4.4.2.3.2. Medium-scale organizations 4.4.2.3.3. Large-scale organizations 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Corporate Wellness Market Size and Forecast, by Service (2023-2030) 4.4.3.1.1. Fitness 4.4.3.1.2. Health risk assessment 4.4.3.1.3. Health screening 4.4.3.1.4. Nutrition and weight management 4.4.3.1.5. Smoking cessation 4.4.3.1.6. Stress management 4.4.3.1.7. Others 4.4.3.2. Mexico Corporate Wellness Market Size and Forecast, by Category (2023-2030) 4.4.3.2.1. Fitness and nutrition consultants 4.4.3.2.2. Organizations/employers 4.4.3.2.3. Psychological therapists 4.4.3.3. Mexico Corporate Wellness Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Small-scale organizations 4.4.3.3.2. Medium-scale organizations 4.4.3.3.3. Large-scale organizations 4.4.3.3.4. Others 5. Europe Corporate Wellness Market Size and Forecast (by Value in USD Million) (2023-2030) 5.1. Europe Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.2. Europe Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.3. Europe Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4. Europe Corporate Wellness Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.1.2. United Kingdom Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.1.3. United Kingdom Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.2.2. France Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.2.3. France Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.3.2. Germany Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.3.3. Germany Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.4.2. Italy Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.4.3. Italy Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.5.2. Spain Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.5.3. Spain Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.6.2. Sweden Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.6.3. Sweden Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.7.2. Austria Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.7.3. Austria Corporate Wellness Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Corporate Wellness Market Size and Forecast, by Service (2023-2030) 5.4.8.2. Rest of Europe Corporate Wellness Market Size and Forecast, by Category (2023-2030) 5.4.8.3. Rest of Europe Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Corporate Wellness Market Size and Forecast (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.2. Asia Pacific Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.3. Asia Pacific Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Corporate Wellness Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.1.2. China Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.1.3. China Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.2.2. S Korea Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.2.3. S Korea Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.3.2. Japan Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.3.3. Japan Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.4.2. India Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.4.3. India Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.5.2. Australia Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.5.3. Australia Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.6.2. Indonesia Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.6.3. Indonesia Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.7.2. Malaysia Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.7.3. Malaysia Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.8.2. Vietnam Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.8.3. Vietnam Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.9.2. Taiwan Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.9.3. Taiwan Corporate Wellness Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Corporate Wellness Market Size and Forecast, by Service (2023-2030) 6.4.10.2. Rest of Asia Pacific Corporate Wellness Market Size and Forecast, by Category (2023-2030) 6.4.10.3. Rest of Asia Pacific Corporate Wellness Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Corporate Wellness Market Size and Forecast (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Corporate Wellness Market Size and Forecast, by Service (2023-2030) 7.2. Middle East and Africa Corporate Wellness Market Size and Forecast, by Category (2023-2030) 7.3. Middle East and Africa Corporate Wellness Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Corporate Wellness Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Corporate Wellness Market Size and Forecast, by Service (2023-2030) 7.4.1.2. South Africa Corporate Wellness Market Size and Forecast, by Category (2023-2030) 7.4.1.3. South Africa Corporate Wellness Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Corporate Wellness Market Size and Forecast, by Service (2023-2030) 7.4.2.2. GCC Corporate Wellness Market Size and Forecast, by Category (2023-2030) 7.4.2.3. GCC Corporate Wellness Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Corporate Wellness Market Size and Forecast, by Service (2023-2030) 7.4.3.2. Nigeria Corporate Wellness Market Size and Forecast, by Category (2023-2030) 7.4.3.3. Nigeria Corporate Wellness Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Corporate Wellness Market Size and Forecast, by Service (2023-2030) 7.4.4.2. Rest of ME&A Corporate Wellness Market Size and Forecast, by Category (2023-2030) 7.4.4.3. Rest of ME&A Corporate Wellness Market Size and Forecast, by End User (2023-2030) 8. South America Corporate Wellness Market Size and Forecast (by Value in USD Million) (2023-2030) 8.1. South America Corporate Wellness Market Size and Forecast, by Service (2023-2030) 8.2. South America Corporate Wellness Market Size and Forecast, by Category (2023-2030) 8.3. South America Corporate Wellness Market Size and Forecast, by End User (2023-2030) 8.4. South America Corporate Wellness Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Corporate Wellness Market Size and Forecast, by Service (2023-2030) 8.4.1.2. Brazil Corporate Wellness Market Size and Forecast, by Category (2023-2030) 8.4.1.3. Brazil Corporate Wellness Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Corporate Wellness Market Size and Forecast, by Service (2023-2030) 8.4.2.2. Argentina Corporate Wellness Market Size and Forecast, by Category (2023-2030) 8.4.2.3. Argentina Corporate Wellness Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Corporate Wellness Market Size and Forecast, by Service (2023-2030) 8.4.3.2. Rest Of South America Corporate Wellness Market Size and Forecast, by Category (2023-2030) 8.4.3.3. Rest Of South America Corporate Wellness Market Size and Forecast, by End User (2023-2030) 9. Global Corporate Wellness Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Corporate Wellness Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ComPsych 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Recent Developments 10.2. Wellness Corporate Solutions 10.3. Virgin Pulse 10.4. Provant Health Solutions 10.5. EXOS 10.6. Marino Wellness 10.7. Privia Health 10.8. Vitality Group 10.9. Wellsource, Inc. 10.10. Central Corporate Wellness 10.11. Truworth Wellness 10.12. SOL Wellness 10.13. Well Nation 10.14. ADURO, INC. 10.15. Beacon Health Options 10.16. Fitbit, Inc. 10.17. Aptora 10.18. Alyfe Wellbeing Strategies 10.19. Burner Fitness 10.20. Sodexo Group 10.21. MediKeeper 10.22. Rival Health 11. Key Findings 12. Industry Recommendations 13. Corporate Wellness Market: Research Methodology 14. Terms and Glossary