Global Computed Tomography Market size was valued at USD 5.31 Bn. in 2023 and is expected to reach USD 9.4 Bn. by 2030, at a CAGR of 8.5%.Computed Tomography Market Overview

Computed tomography, or a CT scan, is a sophisticated diagnostic imaging technique integrating X-ray technology with computer analysis to create detailed internal body images. It provides a comprehensive view of bones, muscles, organs, and blood vessels. Unlike traditional X-rays, CT scans utilize a rotating X-ray beam that captures multiple angles around the body, offering highly detailed cross-sectional images. These images, interpreted by computer software, generate both two-dimensional and three-dimensional visuals, providing a deeper understanding of internal structures. CT scans are essential in the medical landscape, serving as a cornerstone in diagnosing ailments, identifying tumors, and investigating internal bleeding or injuries. These scans play a crucial role in healthcare by facilitating tissue or fluid biopsies, thereby enabling precise and comprehensive evaluations. Their significance lies in contributing significantly to accurate diagnoses and effective treatment planning across various medical conditions, enhancing patient care and outcomes within the Computed Tomography Market. Computed tomography (CT) stands as a key diagnostic imaging method, blending X-ray technology with advanced computing to generate detailed internal body scans. By providing comprehensive views of bones, organs, muscles, and blood vessels, CT scans exceed conventional X-rays in their level of detail. CT scans stand as instrumental tools in healthcare, enabling tissue and fluid biopsies that enhance their pivotal role. These scans contribute significantly to accurate diagnoses and effective treatment planning, allowing precise evaluations across various medical conditions within the Computed Tomography Market. The versatility and detailed imagery produced by CT scans present a wealth of opportunities in healthcare, ensuring accurate diagnosis and comprehensive evaluation across a wide array of medical conditions and injuries.To know about the Research Methodology:- Request Free Sample Report

Computed Tomography Market Dynamics:

Increasing demand for portable and point-of-care CT scanners. The increasing demand for portable and point-of-care CT scanners represents a significant trend in the evolution of the Computed Tomography (CT) market. This shift marks a paradigm change in healthcare delivery, allowing diagnostic processes to occur directly at the patient's bedside or at the point of care. Such portable imaging technologies, including handheld ultrasound devices and mobile CT scanners, considerably improve healthcare efficiency, patient comfort, and the immediacy of treatment decisions. One of the key advantages lies in markedly reducing the duration from patient presentation to diagnosis. Bringing imaging devices directly to patients, especially in emergencies, intensive care units, or areas with limited access to comprehensive radiology departments, accelerates diagnoses and enables swift interventions, benefiting the healthcare landscape within the Computed Tomography Market. Thees’s devices enhance patient-centered care by enabling increased patient-physician interaction during diagnostics, fostering an inclusive environment. Portable and point-of-care CT scanners are essential in managing infectious diseases by minimizing patient transportation and reducing infection spread within healthcare facilities, a role underscored during the COVID-19 pandemic. As these devices advance technologically, offering image qualities akin to traditional systems and integrating with telemedicine platforms for remote diagnostics, they expand immediate, high-quality care. The challenges encompass training for accurate diagnoses, potential overutilization leading to increased costs, and logistical issues in maintaining and sterilizing these devices in high-turnover settings. The future landscape of this field incorporates several pivotal trends, including the integration of AI, the introduction of wearable technology for continuous monitoring, the expansion of telemedicine, increased device portability, the utilization of 3D printing for device customization, integration with healthcare systems, improvements in imaging quality, cost reduction initiatives, regulatory support, and educational adaptations tailored for healthcare professionals. These trends are poised to redefine the Computed Tomography Market, shaping its trajectory in innovative and impactful ways. Increasing demand for portable and point-of-care CT scanners.The growing demand for portable and point-of-care CT scanners is significantly shaping the Computed Tomography Market. These scanners serve as critical tools for immediate and precise diagnoses at the patient's bedside or the point of care, enabling rapid interventions in emergency scenarios and critical care units. Their integration enhances healthcare efficiency and patient comfort, marking a significant shift towards accessible and swift diagnostic solutions in the evolving landscape of the Computed Tomography Market. Technological advancements lead to enhanced imaging capabilities to Boost Market Growth The evolution of Computed Tomography (CT) technology has been marked by significant advancements, particularly in resolution, speed, and safety. With ongoing developments in computational power and software algorithms, CT scanners are poised to deliver even finer, faster, and more detailed images. Efforts to reduce radiation exposure have led to innovations in low-dose techniques, ensuring exceptional image quality while minimizing potential risks. The incorporation of Artificial Intelligence (AI) presents significant potential in refining image interpretation, improving diagnostic precision, and optimizing radiology workflows within the Computed Tomography Market. The emergence of portable and point-of-care CT scanners marks a paradigm shift in emergency diagnostics, offering swift access to imaging in crucial scenarios. Future CT technology aims for enhanced functionalities, emphasizing personalized medicine and multimodal imaging, promising better diagnoses, treatment outcomes, and overall patient care. These advancements position CT scans at the forefront of modern medical diagnostics, offering immense potential for evolving healthcare practices. Technological strides in imaging capabilities have been essential in propelling the growth trajectory of the market. These advancements, particularly in imaging technology such as Computed Tomography (CT), Magnetic Resonance Imaging (MRI), and ultrasound, have significantly augmented diagnostic precision and efficiency. The evolution of imaging technology has led to superior capabilities, such as increased resolution, faster scan durations, and heightened sensitivity, significantly benefiting healthcare providers with detailed and precise diagnostic information within the Computed Tomography Market. The continuous evolution of imaging modalities, marked by improvements in resolution, contrast, and speed, has not only expanded the scope of medical imaging but has also enabled the early detection of ailments resulting in timely interventions and improved patient outcomes. The integration of advanced technologies, coupled with ongoing research and development, promises enhancements in imaging technologies, thereby fostering growth and innovation in the medical imaging market.

Substantial Initial Investments and Ongoing Maintenance Costs Associated with Acquiring and Operating CT scanners hamper Market Growth The restraint in the Computed Tomography (CT) market stems from the considerable financial commitments entailed in procuring and sustaining CT scanners. The substantial initial investment required for acquiring sophisticated CT equipment, alongside the recurring expenses for skilled personnel, continuous technical upgrades, and routine maintenance, presents a significant financial burden for healthcare providers and facilities. This financial outlay extends beyond the initial purchase`, encompassing ongoing operational costs that encompass consumables, infrastructure, and specialized workforce training that hamper the Computed Tomography Market. The complexity of CT technology necessitates skilled professionals for accurate operation, which leads to additional expenses related to staffing and continuous training. This cost-intensive nature of CT scanners potentially limits their adoption, especially in settings with limited financial resources or smaller healthcare facilities, thereby impeding the widespread accessibility and utilization of this advanced imaging technology.

Device Applications Handheld Ultrasound Cardiac function assessment, abdominal examinations, pregnancy monitoring, vascular access, musculoskeletal injuries Portable X-Ray Chest radiography, bone fractures, bedside imaging for immobile patients Mobile CT Scanner Brain imaging for strokes, head injuries, lung imaging, intraoperative assessments Portable MRI Brain scans, spinal cord imaging, musculoskeletal system, emergency room assessments Digital Stethoscope Cardiac and pulmonary assessments, heart and lung sounds analysis, telemedicine consultations Dermatoscope Skin lesion analysis, melanoma detection, teledermatology Ophthalmoscope Retinal exams, glaucoma screening, assessment of diabetic retinopathy Otoscope Ear examinations, tympanic membrane visualization, diagnosis of ear infections Capnography Monitoring ventilation status, end-tidal CO2 levels in intubated patients, procedural sedation Spirometer Lung function tests, asthma management, COPD monitoring Computed Tomography Market Segment Analysis

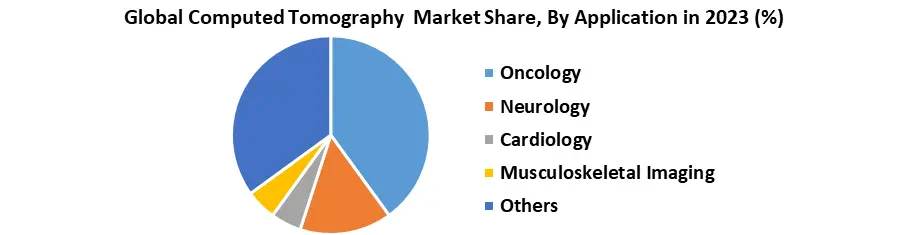

Based on Application, the market is segmented into Oncology, Neurology, Cardiology, Musculoskeletal Imaging and Others. Oncology is expected to dominate the Computed Tomography Market over the forecast period. The domain of Computed Tomography (CT) finds its paramount importance in oncology, a field where it serves as the linchpin for diagnosis, treatment and continual management of cancer. With its unparalleled capability to render intricate cross-sectional images of the body's internal structures, CT imaging holds an essential position in oncology. CT scans prove instrumental in detecting metastases, offering crucial insights into cancer spread and significantly aiding in treatment planning. Beyond diagnosis, CT scans are indispensable for treatment planning in oncology. These imaging modalities offer detailed images enabling oncologists to precisely delineate tumor boundaries and adjacent vital structures, facilitating highly targeted and effective therapies. This precision empowers radiation oncologists in planning and administering radiation therapy with utmost accuracy, minimizing damage to healthy tissues while effectively targeting cancerous cells. CT scans assist surgeons by mapping precise surgical approaches, enabling minimally invasive procedures and enhancing surgical precision. CT imaging continues essential in monitoring cancer treatment responses. It enables oncologists to track changes in tumor size and appearance over time, providing crucial insights into the efficacy of treatments like chemotherapy or radiation therapy. This real-time evaluation aids in modifying treatment strategies, ensuring optimal therapeutic outcomes for patients.

Computed Tomography Market Regional Insight

North America dominated the Computed Tomography Market in 2023 and is expected to continue its dominance over the forecast period. North America stands as the dominant force in the Computed Tomography (CT) market due to a confluence of factors that underscore its leading position in the adoption, development, and utilization of this diagnostic imaging technology. The region boasts a robust healthcare infrastructure coupled with a high level of awareness and acceptance of advanced medical technologies, propelling the widespread integration of CT scanners across various medical specialties and healthcare facilities. The prevalence of chronic diseases, coupled with an aging population, has heightened the demand for precise diagnostic tools, thus bolstering the usage of CT imaging systems. North America's steadfast focus on research and development has spurred continuous innovation in CT technology, resulting in the introduction of state-of-the-art scanners with improved imaging resolution, faster scan times, and reduced radiation doses, aligning with patient safety and comfort. In the region, prominent manufacturers and technological innovators have spurred the swift uptake of advanced CT models. Collaborative efforts among academia, research institutions, and healthcare providers have propelled CT utilization across various specialized fields like oncology, cardiology, and neurology, augmenting its significance and impact within these focused domains. The Strong regulatory environment and favorable reimbursement policies have also played a key role, providing impetus for healthcare facilities to invest in and expand their CT capabilities. The convergence of an advanced healthcare ecosystem, persistent technological innovation, heightened demand for precise diagnostics, and supportive regulatory frameworks solidify North America's pre-eminence in the Computed Tomography market, positioning the region at the forefront of CT technology innovation and utilization.Computed Tomography Market Scope: Inquire before buying

Global Computed Tomography Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.31 Bn. Forecast Period 2024 to 2030 CAGR: 8.5% Market Size in 2030: US $ 9.4 Bn. Segments Covered: By Type Low Slice CT Scanners Medium Slice CT Scanners High Slice CT Scanners Portable/Point-of-Care CT Scanners Others By Application Oncology Neurology Cardiology Musculoskeletal Imaging Others By End User Hospitals and Clinics Diagnostic Imaging Centers Ambulatory Surgical Centers (ASCs) Research and Academic Institutes Others Global Computed Tomography Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Computed Tomography Key Players

Global 1. Siemens Healthineers (Erlangen, Germany) 2. GE Healthcare (Chicago, Illinois, United States) 3. Philips Healthcare (Amsterdam, Netherlands) 4. Canon Medical Systems Corporation (Otawara, Japan) 5. Hitachi Healthcare (Tokyo, Japan) North America 1. Carestream Health (Rochester, New York, United States) 2. Hologic, Inc. (Marlborough, Massachusetts, United States) 3. CurveBeam (Hatfield, Pennsylvania, United States) 4. Konica Minolta Healthcare (Wayne, New Jersey, United States) 5. Xoran Technologies (Ann Arbor, Michigan, United States) 6. NeuroLogica Corporation (Danvers, Massachusetts, United States) 7. Sirona Dental Systems (York, Pennsylvania, United States) 8. Analogic Corporation (Peabody, Massachusetts, United States) Europe 1. Shimadzu Corporation (Kyoto, Japan) 2. Planmed Oy (Helsinki, Finland) 3. Bracco Imaging (Milan, Italy) 4. Esaote (Genoa, Italy) 5. Planmeca (Helsinki, Finland) 6. 3Shape (Copenhagen, Denmark) Asia Pacific 1. Samsung Medison (Seoul, South Korea) 2. Neusoft Medical Systems (Shenyang, China) 3. United Imaging Healthcare (Shanghai, China) 4. Mindray (Shenzhen, China)Frequently Asked Questions:

1] What is the growth rate of the Global Computed Tomography Market? Ans. The Global Computed Tomography Market is growing at a significant rate of 8.5% during the forecast period. 2] Which region is expected to dominate the Global Computed Tomography Market? Ans. North America is expected to dominate the Computed Tomography Market during the forecast period. 3] What is the expected Global Computed Tomography Market size by 2030? Ans. The Computed Tomography Market size is expected to reach USD 9.4 Billion by 2030. 4] Which are the top players in the Global Computed Tomography Market? Ans. The major top players in the Global Computed Tomography Market are Siemens Healthineers (Erlangen, Germany),GE Healthcare (Chicago, Illinois, United States), Philips Healthcare (Amsterdam, Netherlands), Canon Medical Systems Corporation (Otawara, Japan),Hitachi Healthcare (Tokyo, Japan) and Others. 5] What are the factors driving the Global Computed Tomography Market growth? Ans. Rising Prevalence of Chronic diseases and technological advancements are expected to drive market growth during the forecast period.

1. Computed Tomography Market: Research Methodology 2. Computed Tomography Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Computed Tomography Market: Dynamics 3.1. Computed Tomography Market Trends by Region 3.1.1. North America Computed Tomography Market Trends 3.1.2. Europe Computed Tomography Market Trends 3.1.3. Asia Pacific Computed Tomography Market Trends 3.1.4. Middle East and Africa Computed Tomography Market Trends 3.1.5. South America Computed Tomography Market Trends 3.2. Computed Tomography Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Computed Tomography Market Drivers 3.2.1.2. North America Computed Tomography Market Restraints 3.2.1.3. North America Computed Tomography Market Opportunities 3.2.1.4. North America Computed Tomography Market Challenges 3.2.2. Europe 3.2.2.1. Europe Computed Tomography Market Drivers 3.2.2.2. Europe Computed Tomography Market Restraints 3.2.2.3. Europe Computed Tomography Market Opportunities 3.2.2.4. Europe Computed Tomography Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Computed Tomography Market Drivers 3.2.3.2. Asia Pacific Computed Tomography Market Restraints 3.2.3.3. Asia Pacific Computed Tomography Market Opportunities 3.2.3.4. Asia Pacific Computed Tomography Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Computed Tomography Market Drivers 3.2.4.2. Middle East and Africa Computed Tomography Market Restraints 3.2.4.3. Middle East and Africa Computed Tomography Market Opportunities 3.2.4.4. Middle East and Africa Computed Tomography Market Challenges 3.2.5. South America 3.2.5.1. South America Computed Tomography Market Drivers 3.2.5.2. South America Computed Tomography Market Restraints 3.2.5.3. South America Computed Tomography Market Opportunities 3.2.5.4. South America Computed Tomography Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Computed Tomography Market 3.8. Analysis of Government Schemes and Initiatives For Computed Tomography Market 4. Computed Tomography Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Computed Tomography Market Size and Forecast, by Type (2023-2030) 4.1.1. Low Slice CT Scanners 4.1.2. Medium Slice CT Scanners 4.1.3. High Slice CT Scanners 4.1.4. Portable/Point-of-Care CT Scanners 4.1.5. Others 4.2. Computed Tomography Market Size and Forecast, by Application (2023-2030) 4.2.1. Oncology 4.2.2. Neurology 4.2.3. Cardiology 4.2.4. Musculoskeletal Imaging 4.2.5. Others 4.3. Computed Tomography Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals and Clinics 4.3.2. Diagnostic Imaging Centers 4.3.3. Ambulatory Surgical Centers (ASCs) 4.3.4. Research and Academic Institutes 4.3.5. Others 4.4. Computed Tomography Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Computed Tomography Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Computed Tomography Market Size and Forecast, by Type (2023-2030) 5.1.1. Low Slice CT Scanners 5.1.2. Medium Slice CT Scanners 5.1.3. High Slice CT Scanners 5.1.4. Portable/Point-of-Care CT Scanners 5.1.5. Others 5.2. North America Computed Tomography Market Size and Forecast, by Application (2023-2030) 5.2.1. Oncology 5.2.2. Neurology 5.2.3. Cardiology 5.2.4. Musculoskeletal Imaging 5.2.5. Others 5.3. North America Computed Tomography Market Size and Forecast, by End User (2023-2030) 5.3.1. Hospitals and Clinics 5.3.2. Diagnostic Imaging Centers 5.3.3. Ambulatory Surgical Centers (ASCs) 5.3.4. Research and Academic Institutes 5.3.5. Others 5.4. North America Computed Tomography Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Computed Tomography Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. Low Slice CT Scanners 5.4.1.1.2. Medium Slice CT Scanners 5.4.1.1.3. High Slice CT Scanners 5.4.1.1.4. Portable/Point-of-Care CT Scanners 5.4.1.1.5. Others 5.4.1.2. United States Computed Tomography Market Size and Forecast, by Application (2023-2030) 5.4.1.2.1. Oncology 5.4.1.2.2. Neurology 5.4.1.2.3. Cardiology 5.4.1.2.4. Musculoskeletal Imaging 5.4.1.2.5. Others 5.4.1.3. United States Computed Tomography Market Size and Forecast, by End User (2023-2030) 5.4.1.3.1. Hospitals and Clinics 5.4.1.3.2. Diagnostic Imaging Centers 5.4.1.3.3. Ambulatory Surgical Centers (ASCs) 5.4.1.3.4. Research and Academic Institutes 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Computed Tomography Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. Low Slice CT Scanners 5.4.2.1.2. Medium Slice CT Scanners 5.4.2.1.3. High Slice CT Scanners 5.4.2.1.4. Portable/Point-of-Care CT Scanners 5.4.2.1.5. Others 5.4.2.1.6. 5.4.2.2. Canada Computed Tomography Market Size and Forecast, by Application (2023-2030) 5.4.2.2.1. Oncology 5.4.2.2.2. Neurology 5.4.2.2.3. Cardiology 5.4.2.2.4. Musculoskeletal Imaging 5.4.2.2.5. Others 5.4.2.3. Canada Computed Tomography Market Size and Forecast, by End User (2023-2030) 5.4.2.3.1. Hospitals and Clinics 5.4.2.3.2. Diagnostic Imaging Centers 5.4.2.3.3. Ambulatory Surgical Centers (ASCs) 5.4.2.3.4. Research and Academic Institutes 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Computed Tomography Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. Low Slice CT Scanners 5.4.3.1.2. Medium Slice CT Scanners 5.4.3.1.3. High Slice CT Scanners 5.4.3.1.4. Portable/Point-of-Care CT Scanners 5.4.3.1.5. Others 5.4.3.2. Mexico Computed Tomography Market Size and Forecast, by Application (2023-2030) 5.4.3.2.1. Oncology 5.4.3.2.2. Neurology 5.4.3.2.3. Cardiology 5.4.3.2.4. Musculoskeletal Imaging 5.4.3.2.5. Others 5.4.3.3. Mexico Computed Tomography Market Size and Forecast, by End User (2023-2030) 5.4.3.3.1. Hospitals and Clinics 5.4.3.3.2. Diagnostic Imaging Centers 5.4.3.3.3. Ambulatory Surgical Centers (ASCs) 5.4.3.3.4. Research and Academic Institutes 5.4.3.3.5. Others 6. Europe Computed Tomography Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.2. Europe Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.3. Europe Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4. Europe Computed Tomography Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.1.3. United Kingdom Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4.2. France 6.4.2.1. France Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.2.3. France Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Germany Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.4.3. Italy Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Spain Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Sweden Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Austria Computed Tomography Market Size and Forecast, by End User (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Computed Tomography Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Computed Tomography Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Rest of Europe Computed Tomography Market Size and Forecast, by End User (2023-2030) 7. Asia Pacific Computed Tomography Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.3. Asia Pacific Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4. Asia Pacific Computed Tomography Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.1.3. China Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.2.3. S Korea Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Japan Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.4. India 7.4.4.1. India Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.4.3. India Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.5.3. Australia Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.6.3. Indonesia Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.7.3. Malaysia Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.8.3. Vietnam Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.9.3. Taiwan Computed Tomography Market Size and Forecast, by End User (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Computed Tomography Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Computed Tomography Market Size and Forecast, by Application (2023-2030) 7.4.10.3. Rest of Asia Pacific Computed Tomography Market Size and Forecast, by End User (2023-2030) 8. Middle East and Africa Computed Tomography Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Computed Tomography Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Computed Tomography Market Size and Forecast, by Application (2023-2030) 8.3. Middle East and Africa Computed Tomography Market Size and Forecast, by End User (2023-2030) 8.4. Middle East and Africa Computed Tomography Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Computed Tomography Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Computed Tomography Market Size and Forecast, by Application (2023-2030) 8.4.1.3. South Africa Computed Tomography Market Size and Forecast, by End User (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Computed Tomography Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Computed Tomography Market Size and Forecast, by Application (2023-2030) 8.4.2.3. GCC Computed Tomography Market Size and Forecast, by End User (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Computed Tomography Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Computed Tomography Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Nigeria Computed Tomography Market Size and Forecast, by End User (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Computed Tomography Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Computed Tomography Market Size and Forecast, by Application (2023-2030) 8.4.4.3. Rest of ME&A Computed Tomography Market Size and Forecast, by End User (2023-2030) 9. South America Computed Tomography Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 9.1. South America Computed Tomography Market Size and Forecast, by Type (2023-2030) 9.2. South America Computed Tomography Market Size and Forecast, by Application (2023-2030) 9.3. South America Computed Tomography Market Size and Forecast, by End User (2023-2030) 9.4. South America Computed Tomography Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Computed Tomography Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Computed Tomography Market Size and Forecast, by Application (2023-2030) 9.4.1.3. Brazil Computed Tomography Market Size and Forecast, by End User (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Computed Tomography Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Computed Tomography Market Size and Forecast, by Application (2023-2030) 9.4.2.3. Argentina Computed Tomography Market Size and Forecast, by End User (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Computed Tomography Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Computed Tomography Market Size and Forecast, by Application (2023-2030) 9.4.3.3. Rest Of South America Computed Tomography Market Size and Forecast, by End User (2023-2030) 10. Global Computed Tomography Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Computed Tomography Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Siemens Healthineers (Erlangen, Germany) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Recent Developments 11.2. GE Healthcare (Chicago, Illinois, United States) 11.3. Philips Healthcare (Amsterdam, Netherlands) 11.4. Canon Medical Systems Corporation (Otawara, Japan) 11.5. Hitachi Healthcare (Tokyo, Japan) 11.6. Carestream Health (Rochester, New York, United States) 11.7. Hologic, Inc. (Marlborough, Massachusetts, United States) 11.8. CurveBeam (Hatfield, Pennsylvania, United States) 11.9. Konica Minolta Healthcare (Wayne, New Jersey, United States) 11.10. Xoran Technologies (Ann Arbor, Michigan, United States) 11.11. NeuroLogica Corporation (Danvers, Massachusetts, United States) 11.12. Sirona Dental Systems (York, Pennsylvania, United States) 11.13. Analogic Corporation (Peabody, Massachusetts, United States) 11.14. Shimadzu Corporation (Kyoto, Japan) 11.15. Planmed Oy (Helsinki, Finland) 11.16. Bracco Imaging (Milan, Italy) 11.17. Esaote (Genoa, Italy) 11.18. Planmeca (Helsinki, Finland) 11.19. 3Shape (Copenhagen, Denmark) 11.20. Samsung Medison (Seoul, South Korea) 11.21. Neusoft Medical Systems (Shenyang, China) 11.22. United Imaging Healthcare (Shanghai, China) 11.23. Mindray (Shenzhen, China) 12. Key Findings 13. Industry Recommendations