Clinical Diagnostics Market size was valued at USD 79.34 Bn. in 2023 and the total Clinical Diagnostics revenue is expected to grow by 6.5% from 2024 to 2030, reaching nearly USD 123.29 Bn.Clinical Diagnostics Market Overview:

Clinical Diagnostics refers to the administration of FDA-approved clinical diagnostic test(s) on human tissue or other human biological samples, the results of which are provided to healthcare providers for use in the clinical management of individual patients. Clinical diagnostics are medical devices that perform diagnostic tests on biological samples such as blood, urine, and tissues. These tests aid in the detection and monitoring of infectious diseases, autoimmune diseases, and a variety of medical conditions used to evaluate drug therapies. Technological advancements such as rapid test kits for the Clinical Diagnostics market have grown at a surprising rate in recent years and are expected to continue in the forecast period. Clinical diagnostics is used in many different aspects of healthcare. Thanks to increased awareness of point-of-care testing, the use of clinical testing has increased around the world and same has been tracked in the report. Key players are focusing on the introduction of new transportable, portable, and handheld instruments that can be used outside of laboratory settings. Moreover, the high sensitivity and specificity associated with in vitro diagnostic testing contribute significantly to their adoption. The aforementioned aspects contribute to the growth of the clinical diagnostics market. Sales of clinical diagnostics products have increased significantly in the United States in recent years. The trend is expected to continue during the forecast period, due to an increasing geriatric population, increased patient awareness of the value of laboratory tests, and an increase in the prevalence of infectious and chronic disease patients all these aspects are expected to support the clinical diagnostics market. The growing number of COVID-19 infections has resulted in increased funding and testing, which has boosted the overall market growth. For example, the National Institutes of Health in the United States announced in September 2021 that it provided USD 130.3 million in funding to nine companies, including MatMaCorp, Maxim Biomedical Inc., MicroGEM International, and others, to scale-up manufacturing support for a new set of COVID-19 testing technologies as part of its Rapid Acceleration of Diagnostics (RADx) initiative.To know about the Research Methodology :- Request Free Sample Report

Report Scope:

The report on Clinical Diagnostics provides a quantitative analysis of market size, price, M&A, demand, supply chain, investment and expansion plans by key competitors, and predictions. Porter's five forces study explains how buyers and suppliers build supplier-buyer networks and make profit-driven decisions. The present Clinical Diagnostics Market potential is assessed through detailed analysis and segmentation. The analysis will provide investors with a full insight into the industry's future, as well as the elements likely to affect the firm favorably or adversely. The research offers a complete understanding of the market for those investors wishing to invest. This study contains scenarios for the Clinical Diagnostics Market from the past and present, along with projected market numbers. The report's thorough analysis of important competitors, including market leaders, followers, and new entrants, covers every aspect of the market. The research contains strategic profiles of the top market participants, a full examination of their key competencies, and their company-specific plans for the introduction of new products, growth, partnerships, joint ventures, and acquisitions. With its clear portrayal of competitive analysis of significant companies by product, pricing, financial condition, product portfolio, growth strategies, and regional presence in the domestic as well as the local market, the research acts as an investor's guide.Clinical Diagnostics Market Dynamics:

Drivers: Growing demand for diseases detection The development of sophisticated and specialized tests for early disease detection and disease management, as well as the growing demand for lab automation, are expected to drive growth in the global clinical diagnostics market during the forecast period. The rapidly increasing use of point-of-care diagnostic products has ushered in a trend of decentralization in the healthcare industry. Patients and healthcare facilities are decentralizing their facilities in an effort to encourage early diagnosis, cater to medical facilities remotely, and reduce costs. A wide range of clinical tests, including blood and urine tests ranging from simple to complex, molecular expression genetic analysis, and various medical chemistry panels, help healthcare specialists detect disease progression. Other key factors driving the market include the increasing prevalence of chronic diseases such as diabetes, heart failure, and colon cancer, growing demand for personalized medicine, an growing geriatric population base, and increased patient awareness of disease diagnosis. Growing Expenditure on Healthcare Sector Antimicrobial Coatings devices, combined with analytics and software, are transforming the retail pharmacy system around the world. Automation has not only increased the industry's efficiency but also made it more profitable. With automation, there is a significant reduction in medication waste, resulting in lower per-dose costs. It has also made it easier for pharmacists to manage workflow, with a greater emphasis on patient satisfaction. In recent years, the annual expenditure on prescription and over-the-counter drugs has skyrocketed. These factors are boosting the clinical diagnostics market growth. According to the American Academy of Actuaries, the annual expenditure on prescription drugs alone cost USD 3,80 billion in 2016, accounting for 18.9% of the US GDP. Another additional cost is the waste of medicines in pharmacies and healthcare systems. Automation in the retail pharmacy sector has been a boon for lowering costs in terms of medication wastage, both viable and expired. According to a Reuters study, wastage of cancer drugs (unused) costs the United States $ 3.5 billion per year. According to an OECD study, approximately 17,650 tonnes of expired or unused medicines were discarded in France in 2018. The amount of medicine wasted has been steadily increasing. In the same study, 33% of respondents in Germany reported flushing their liquid medications, and 10.5% reported flushing their solid medications as well. Technological advancements in the industry have resulted in significant reductions in inventory management, medication wastage, cost per dose reductions, and improved patient safety. The introduction of technologies such as automated dispensing units or cabinets, tele-pharmacy, automated patient CRM outreach, drug monitoring programs, maintenance, medication reminders, and others has significantly contributed to streamlining industry processes and lowering costs incurred due to wastage or incorrect disposal of medicines. Prevalence of Chronic Diseases, Significant R&D Investments, and Innovations to boosts the market According to the World Health Organization's (WHO) Noncommunicable Diseases Key Facts, published in April 2021, chronic diseases kill approximately 41 million people each year, accounting for 72% of all deaths worldwide. The demand for healthcare systems is increasing as the prevalence of chronic diseases rises. Thus, the clinical diagnostics market has proven to be beneficial in chronic disease conditions and has been found to be useful for disease prevention, detection, and management. Clinical diagnostics aid in the detection of early warning signs and individual risk factors, opening up new avenues for prevention and early intervention. Thus, the growing prevalence of chronic diseases is expected to drive the overall clinical diagnostic market even in the forecast years. The increase in testing due to the pandemic can be attributed to the increasing adoption of clinical diagnostics. During the forecast period, the development of automated clinical diagnostics systems for laboratories and hospitals to provide efficient, accurate, and error-free diagnoses is expected to drive clinical diagnostic market growth. The increasing number of clinical diagnostics products launched by key players is also fueling the market growth. Clinical diagnostics products with molecular diagnostic capabilities provide accurate and effective results. The market is expected to grow due to the growing prevalence of infectious and chronic diseases, as well as the increased adoption of automated platforms. The increasing number of tests due to the constant increase in patients, as well as government funding, are expected to drive the demand for COVID-19 test kits and drive the overall market growth exponentially. The growing demand for point-of-care clinical diagnostics devices, as well as their increasing adoption, has fueled the clinical diagnostics market growth. This is bolstered further by increased investment in R&D by key players in order to innovate products and explore new applications of clinical diagnostics techniques. Restraints: Growth to hamper by the high cost of clinical diagnostics instruments Clinical diagnostics products have seen significant advancements and developments in terms of new product adoption and design changes over the last decade. However, the high cost of clinical diagnostics instruments, as well as the high cost of instrument maintenance, have hampered clinical diagnostics market growth to some extent. Additionally, clinical diagnostics instruments must be operated by skilled professionals. As a result, the device's maintenance costs rise, stifling the market's overall growth. RT-PCR systems range in price from USD 15,000 to more than USD 90,000. The aforementioned cost aspects have contributed to the relatively low adoption of clinical diagnostics products in a number of countries and regions. Growing opportunities in the emerging economies Aging is the leading risk factor for the development of diseases such as cardiovascular and neurological diseases, the growing geriatric population is expected to be a significant driving force in the clinical diagnostics market. Because aging weakens the immune system and increases a patient's susceptibility to infectious diseases, the growing geriatric population in Asian nations such as Japan and China, as well as the presence of numerous untapped opportunities in these countries, are expected to drive industry growth during the forecast period. A major factor driving steep revenue generation is the rising prevalence of infectious diseases. According to the National Conference of State Legislatures in 2021, the rate of gonorrhea infections in the United States has increased by 57% since 2015, chlamydia by 19%, and hepatitis A by 2 %. Furthermore, 40% of HIV cases are transmitted by people who are unaware of their HIV status. This demonstrates an unmet need for HIV diagnostic tests. The acquisition is quickly becoming a popular strategy for growth and portfolio diversification. For example, in December 2021, Co-Diagnostics, Inc. purchased the portfolios of Advanced Conceptions, Inc. and Idaho Molecular, Inc., gaining access to intellectual property rights and streamlining the commercialization of its integrated product line for infectious diseases. The multiplex assays targeting STI, respiratory, and other infections accommodated in the company's PCR device broaden the customer base.Clinical Diagnostics Market Segment Analysis:

Based on Test, The Lipid Panel Tests segment is expected to grow rapidly during the forecast period. The lipid panel is a blood test that measures the lipids, fats, and fatty substances that the body uses as an energy source. Total cholesterol, HDL cholesterol, triglycerides, LDL cholesterol, cholesterol/HDL ratio, and non-HDL cholesterol are all tested as part of the lipid panel. Numerous studies have found that patients with COVID-19 infections have lower total cholesterol, LDL-C, and HDL-C levels. According to various studies, the decrease in LDL-C and/or HDL-C was more pronounced as the severity of the illness increased. As a result, patients with low HDL-C levels during hospitalization were at an increased risk of developing a severe disease compared to patients with high HDL-C levels, increasing test demand. With recovery from COVID-19, serum lipid levels return to pre-infection levels. A lipid panel assesses the risk of cardiovascular disease by measuring the level of specific lipids in the blood. It is used in screening populations to identify subjects who are at high risk of developing a cardiac event. According to the World Health Organization's Cardiovascular Diseases Key Facts, cardiovascular diseases (CVDs) will be the leading cause of death globally in June 2023, accounting for approximately 32% of all global deaths. Furthermore, more than three-quarters of CVD deaths occur in middle- and low-income countries. As a result of the increased prevalence and mortality rate of cardiovascular diseases, there is a greater need for lipid profile testing at an early stage, which is driving the lipid panel segment. To capitalize on potential opportunities, key companies are focusing on novel product development and launches. As a result of the aforementioned factors, the segment is expected to grow over the forecast period.Based on the Product, The instruments segment dominated the Clinical Diagnostics market in 2023 and is expected to grow at a CAGR of 6.0% during the forecast period. This segment's growth can be attributed to continuous innovations in the instruments used in the Clinical Diagnostics process. Additionally, the growing adoption of advanced instruments in the setting, as well as rapid investments by the public and private sectors in laboratory infrastructure in developing countries, is expected to boost the segment's growth over the analysis period. Moreover, most complex and sensitive diagnostic tests are performed in laboratories and necessitate skilled lab personnel, specialized equipment, and slightly more time to complete. During the forecast period, the instruments segment is expected to grow at a rapid CAGR. Because of the increased burden of patient populations suffering from various diseases (diabetes, infectious disease, HIV), medical device behemoths are focusing on developing innovative and accurate testing kits.

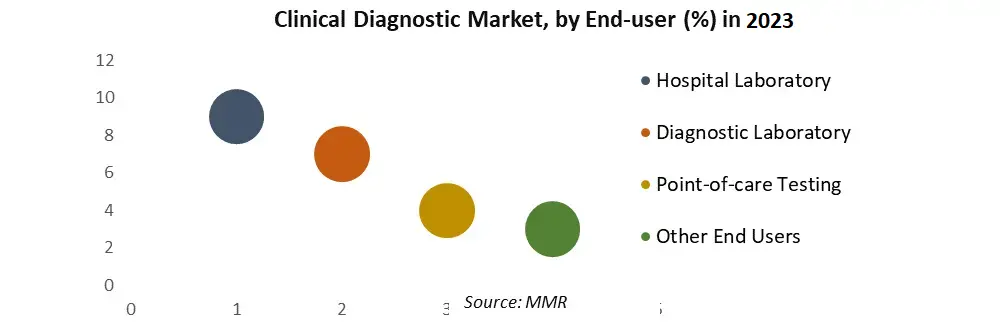

Based on the End-user, In 2023, the Hospital Laboratories test location segment dominated the Clinical Diagnostics industry, accounting for more than 54.80% of total revenue. When compared to point-of-care tests, hospital laboratory-based tests are more accurate and reliable. Other benefits include the availability of complex tests that are not available in PoC or homecare settings. Additionally, the availability of tests that allow patients to collect samples at home and send them to laboratories for testing makes testing extremely convenient for patients. For example, in October 2021, Labcorp received FDA EUA for its home collection kit that allows testing for flu and SARS-CoV-2 at the same time. The increased demand for point-of-care tests has resulted from the high demand for faster turnaround times. COVID-19 has boosted segment growth and increased demand for these products. This segment's products have a competitive advantage due to their quick turnaround time and low complexity. Hospitals are regarded as specialized healthcare facilities. The most significant advantage of hospitals performing infectious disease IVD tests is that test results can be provided even in an emergency. The adoption rate of IVD tests in hospitals has increased as they become easier to use. With an increasing number of hospitals aiming to provide all services under one roof for patients, advancements in hospital laboratories are becoming increasingly important in order to meet changing patient demands.

Clinical Diagnostics Market Regional Insights:

North America dominates the Clinical Diagnostics market and is expected to the same during the forecast period. The growing geriatric population, rising patient awareness of the value of laboratory tests, and the rising prevalence of infectious and chronic disease patients are driving the clinical diagnostics market in the United States. The rising number of COVID-19 infections has resulted in increased funding and testing, which has boosted the overall market growth. According to the Centers for Disease Control and Prevention (CDC), four out of every ten adults in the United States have two or more chronic diseases, and six out of every ten adults have a chronic disease.Chronic diseases such as cancer, heart disease, and diabetes are the leading causes of death and disability in the United States, accounting for the majority of the USD 3.8 trillion spent on health care each year. This has increased the demand for better treatment with efficient management, driving the market in the United States even further. As a result, the rising prevalence of infectious and chronic diseases, as well as increased awareness of the importance of laboratory tests, are expected to drive market growth in the country.

Clinical Diagnostics Market Scope: Inquire before buying

Clinical Diagnostics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 79.34 Bn. Forecast Period 2024 to 2030 CAGR: 6.5% Market Size in 2030: US $ 123.29 Bn. Segments Covered: by Test Lipid Panel Liver Panel Renal Panel Complete Blood Count Electrolyte Testing Infectious Disease Testing Other Tests by Product Instruments Reagents Other Products by End-user Hospital Laboratory Diagnostic Laboratory Point-of-care Testing Other End Users Clinical Diagnostics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Clinical Diagnostics Market, Key Players are

1. Abbott Laboratories 2. Becton, Dickinson, and Company 3. BioMerieux 4. Bio-Rad Laboratories Inc. 5. Bioscientia Healthcare 6. Bio-Reference Laboratories 7. ARUP Laboratories 8. Labco S.A. 9. Healthscope Limited., 10. Labcorp 11. Danaher Corporation 12. Siemens AG 13. Hologic Inc. 14. Qiagen NV 15. F. Hoffmann-La Roche AG 16. Thermo Fisher Scientific 17. Quest Diagnostics Inc. 18. Sysmex Corporation 19. Sonic Healthcare Ltd 20. Charles River Laboratories Frequently Asked Questions: 1] What are clinical diagnostics? Ans. The process of determining a disease, condition, or injury based on a patient's signs and symptoms, as well as the patient's health history and physical exam. Following a clinical diagnosis, additional testing, such as blood tests, imaging tests, and biopsies, may be performed+. 2] What is the future of diagnostics? Ans. Point-of-care testing, self-testing kits, genome testing, and the implementation of artificial intelligence (AI)-based analytic solutions are the way forward for diagnostics in order to deal with the anticipated increase in the total volume of tests in the aftermath of a possible third wave. 3] What are examples of clinical diagnosis? Ans. The clinical diagnosis is based on explosive watery diarrhea, cramping abdominal pain, abdominal distension, and flatulence after consuming milk or milk products. Furthermore, careful observation of a patient "at rest" as well as during attempts at eating and drinking can be extremely beneficial to clinical diagnosis. 4] What is the diagnostic industry? Ans. The diagnostics industry is divided into two categories: pathology (which is offered by all and accounts for nearly 58% of the industry's revenue) and general diagnostics. And radiology (which accounts for 42% of industry revenue) is concerned with imaging diagnoses such as x-rays, CT scans, and ultrasounds. 5] What is the most common medical diagnosis? Ans. The most common ICD-10 diagnoses seen by primary care doctors in the United States are essential (primary) hypertension (I10), type II diabetes mellitus without complications (E11. 9), and other specified diabetes mellitus without complications (E13. 9), and hyperlipidemia, unspecified (E13. 9). (E78. 5) 6] What is a diagnostic doctor called? Ans. A radiologist specializes in using medical imaging tests to diagnose and treat conditions. They might read and interpret X-rays, MRIs, mammograms, ultrasounds, and CT scans. They could be one of three kinds: Radiologists (diagnostic): These doctors use imaging procedures to diagnose health issues.

1. Global Clinical Diagnostics Market Size: Research Methodology 2. Global Clinical Diagnostics Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Clinical Diagnostics Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Clinical Diagnostics Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Clinical Diagnostics Market Size Segmentation 4.1. Global Clinical Diagnostics Market Size, by Test (2023-2030) • Lipid Panel • Liver Panel • Renal Panel • Complete Blood Count • Electrolyte Testing • Infectious Disease Testing • Other Tests 4.2. Global Clinical Diagnostics Market Size, by Product (2023-2030) • Instruments • Reagents • Other Products 4.3. Global Clinical Diagnostics Market Size, by End User (2023-2030) • Hospital Laboratory • Diagnostic Laboratory • Point-of-care Testing • Other End Users 5. North America Clinical Diagnostics Market (2023-2030) 5.1. North America Clinical Diagnostics Market Size, by Test (2023-2030) • Lipid Panel • Liver Panel • Renal Panel • Complete Blood Count • Electrolyte Testing • Infectious Disease Testing • Other Tests 5.2. North America Clinical Diagnostics Market Size, by Product (2023-2030) • Instruments • Reagents • Other Products 5.3. North America Clinical Diagnostics Market Size, by End User (2023-2030) • Hospital Laboratory • Diagnostic Laboratory • Point-of-care Testing • Other End Users 5.4. North America Semiconductor Memory Market, by Country (2023-2030) • United States • Canada • Mexico 6. European Clinical Diagnostics Market (2023-2030) 6.1. European Clinical Diagnostics Market, by Test (2023-2030) 6.2. European Clinical Diagnostics Market, by Product (2023-2030) 6.3. European Clinical Diagnostics Market, by End User (2023-2030) 6.4. European Clinical Diagnostics Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Clinical Diagnostics Market (2023-2030) 7.1. Asia Pacific Clinical Diagnostics Market, by Test (2023-2030) 7.2. Asia Pacific Clinical Diagnostics Market, by Product (2023-2030) 7.3. Asia Pacific Clinical Diagnostics Market, by End User (2023-2030) 7.4. Asia Pacific Clinical Diagnostics Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Clinical Diagnostics Market (2023-2030) 8.1. Middle East and Africa Clinical Diagnostics Market, by Test (2023-2030) 8.2. Middle East and Africa Clinical Diagnostics Market, by Product (2023-2030) 8.3. Middle East and Africa Clinical Diagnostics Market, by End User (2023-2030) 8.4. Middle East and Africa Clinical Diagnostics Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Clinical Diagnostics Market (2023-2030) 9.1. South America Clinical Diagnostics Market, by Test (2023-2030) 9.2. South America Clinical Diagnostics Market, by Product (2023-2030) 9.3. South America Clinical Diagnostics Market, by End User (2023-2030) 9.4. South America Clinical Diagnostics Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Abbott Laboratories 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Becton, Dickinson, and Company 10.3. BioMerieux 10.4. Bio-Rad Laboratories Inc. 10.5. Bioscientia Healthcare 10.6. Bio-Reference Laboratories 10.7. ARUP Laboratories 10.8. Labco S.A. 10.9. Healthscope Limited., 10.10. Labcorp 10.11. Danaher Corporation 10.12. Siemens AG 10.13. Hologic Inc. 10.14. Qiagen NV 10.15. F. Hoffmann-La Roche AG 10.16. Thermo Fisher Scientific 10.17. Quest Diagnostics Inc. 10.18. Sysmex Corporation 10.19. Sonic Healthcare Ltd 10.20. Charles River Laboratories