The Cardiovascular Drugs Market size was valued at US 148.65 Bn in 2023 and market revenue is growing at a CAGR of 4.1 % from 2023 to 2030, reaching nearly USD 196.93 Bn by 2030.Cardiovascular Drugs Market Overview:

The global cardiovascular drugs market is a dynamic sector witnessing steady growth. With an increasing prevalence of cardiovascular diseases (CVDs) across the, including hypertension, coronary artery disease, and heart failure, the demand for effective medications continues to rise. The market encompasses a diverse range of drugs aimed at managing various aspects of CVDs, such as antihypertensives, antiplatelets, statins, beta-blockers, and anticoagulants. Aging populations and rising healthcare expenditures significantly boost the Cardiovascular Drugs Market Growth. The COVID-19 pandemic disrupted healthcare, increasing cardiovascular drug demand due to higher infection risks among cardiovascular disease patients. Research suggested drug efficacy against COVID-19, amplifying demand, expected to fuel market growth.To know about the Research Methodology:-Request Free Sample Report According to MMR Study Report in April 2023, there more than 1,139,140 inpatient admissions for heart and circulatory diseases in National Health Service hospitals in the United Kingdom. Among these admissions, 273,991 were for coronary heart disease, and 114,452 were for heart failure during the 2021-2022 period. These significant numbers of CVD-related hospital admissions underscore the crucial demand for cardiovascular drugs to facilitate treatment. Consequently, this trend is expected to fuel the growth of the cardiovascular drugs market.

Cardiovascular Drugs Market: Dynamics

Driver Increasing Cardiovascular Diseases (CVDs) boosts the Cardiovascular Drugs Market Growth The Cardiovascular Drugs Market thrives due to the pervasive impact of cardiovascular diseases (CVDs) worldwide. Responsible for a staggering 32% of global deaths, CVDs claim over 17 million lives annually, primarily through heart attacks and strokes. This stark reality underscores the urgent need for effective treatments, driving relentless innovation within the pharmaceutical industry and sparking demand for cardiovascular drugs. Particularly noteworthy is the disproportionate burden of CVD deaths in low- and middle-income countries, highlighting significant growth opportunities for the market in these regions. Addressing key Behavioral risk factors such as tobacco use, unhealthy diet, and physical inactivity is essential in combating this epidemic, emphasizing the crucial role of cardiovascular drugs in prevention and treatment strategies. Advancements in drug therapies targeting hypertension, diabetes, and high blood lipids serve as key drivers for market growth. These innovations are indispensable for reducing cardiovascular risk and preventing potentially life-threatening complications. In essence, the Cardiovascular Drugs Market emerges as a cornerstone of global healthcare, essential for addressing the alarming burden of CVDs and ensuring access to dynamic treatments for affected populations worldwide. As the prevalence of CVDs continues to escalate, the market's significance in delivering effective solutions to combat this widespread health challenge cannot be overstated.Restrain Stringent Regulatory Approval Process Limits the Cardiovascular Drugs Market Growth The stringent regulatory approval process presents a significant hurdle limiting the growth of the Cardiovascular Drugs Market. Pharmaceutical companies developing cardiovascular drugs must navigate a complex and rigorous regulatory framework enforced by health authorities such as the FDA (Food and Drug Administration) in the United States and the EMA (European Medicines Agency) in Europe. This process involves extensive preclinical and clinical studies to demonstrate the safety, efficacy, and quality of the drug candidate. The lengthy and resource-intensive nature of regulatory approval leads to substantial delays in bringing new cardiovascular drugs to market, resulting in increased development costs and prolonged time-to-market. The stringent requirements lead to a higher likelihood of regulatory rejection and requests for additional data, further prolonging the approval timeline and increasing development expenses. These challenges hinder innovation and investment in cardiovascular drug development, limiting the introduction of new therapeutic options for patients with cardiovascular diseases. Therefore, the prolonged regulatory process impedes competition, as smaller pharmaceutical companies lack the resources to navigate the approval pathway, resulting in a less diverse pipeline of cardiovascular drugs. The stringent regulatory environment poses a formidable barrier to market growth, constraining the ability of pharmaceutical companies to bring innovative cardiovascular therapies to patients in need. Addressing these challenges through streamlined regulatory pathways and increased collaboration between industry and regulatory agencies is crucial to fostering innovation and advancing the treatment of cardiovascular diseases. Opportunity Innovative Drug Deliveries Create Lucrative Growth Opportunity for the Cardiovascular Drugs Market. Innovative drug delivery systems, particularly nanoparticle-mediated delivery, revolutionize cardiovascular drug treatments. These systems enhance drug efficacy, reduce side effects, and enable targeted delivery to affected areas, fostering a lucrative growth environment for the cardiovascular drugs market. Nanoparticle carriers encapsulate cardiovascular drugs, protecting them from degradation and enabling controlled release Also, advancements in Nano formulations offer novel opportunities for delivering commonly used cardiovascular drugs such as atorvastatin and valsartan, enhancing their therapeutic outcomes. Personalized therapies, another burgeoning area, address the diverse needs of patients, presenting significant market potential. Researchers continue to explore nanosystems and other innovative approaches, aiming to overcome existing limitations in cardiovascular drug delivery. These efforts include utilizing nanomaterials, targeting specific cellular receptors, and optimizing drug release kinetics. Such advancements hold promise for improving patient outcomes and driving market growth. The convergence of nanotechnology, personalized medicine, and innovative drug delivery systems creates a fertile ground for the growth of the Cardiovascular Drugs Market. Companies investing in these technologies stand to gain substantial market share and contribute to advancing cardiovascular care.

Cardiovascular Drugs Market: Segment Analysis

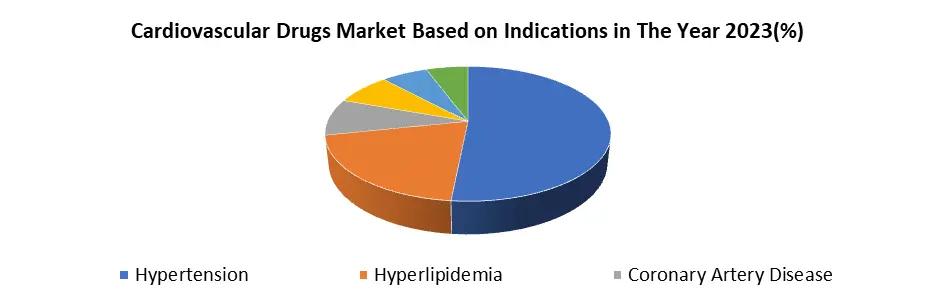

Based on Indications, The Hypertension segment dominated the Indications segment of the Cardiovascular Drugs Market in the year 2023. hypertension, characterized by high blood pressure, is exceptionally widespread globally, affecting a significant proportion of the population. Its status as a primary risk factor for cardiovascular diseases such as heart attacks and strokes underscores its importance in healthcare. Hypertension often manifests as a chronic condition, necessitating long-term management and medication. This results in a sustained demand for antihypertensive drugs, ensuring the segment's continued growth within the market. Lifestyle changes, including sedentary habits, poor dietary choices, and increasing stress levels, contribute to the rising prevalence of hypertension in modern society, further driving the demand for medications to manage it. Also, with populations aging in many regions, the incidence of hypertension is expected to escalate, given its correlation with advancing age. Healthcare guidelines and recommendations consistently stress the importance of controlling hypertension to prevent cardiovascular complications, encouraging widespread prescription of antihypertensive medications by healthcare providers. The ongoing investment in research and development by pharmaceutical companies leads to continuous innovation, enhancing existing treatments and fostering the development of novel therapies for hypertension. So, the convergence of high prevalence, chronic nature, lifestyle factors, demographic shifts, medical guidelines, and research advancements solidifies hypertension as a Domina indication within the Cardiovascular Drugs Market.

Cardiovascular Drugs Market: Regional Analysis

North America region dominated the Cardiovascular Drugs Market in the year 2023. North America stands as a prominent hub for the cardiovascular drugs industry. The region boasts a sizable and prosperous population where cardiovascular diseases, ranging from hypertension to coronary artery disease and heart failure, prevail extensively. This heightened disease burden necessitates a substantial demand for cardiovascular medications. North America hosts numerous leading pharmaceutical firms equipped with cutting-edge research and development capabilities, fostering innovation and the introduction of novel cardiovascular therapies. The well-established healthcare infrastructure and strong reimbursement systems, particularly in nations like the United States and Canada, ensure widespread accessibility to cardiovascular drugs for patients. Favorable governmental regulations and policies, alongside substantial investments in healthcare, further bolster market growth. Also, heightened awareness regarding cardiovascular health, coupled with proactive initiatives aimed at prevention and management, contributes significantly to market growth. Altogether, the amalgamation of these factors firmly establishes North America as a dominant force within the global cardiovascular drugs market.Cardiovascular Drugs Market: Competitive Analysis

The cardiovascular drugs market is highly competitive with numerous key players witnessing significant developments such as in January 2023, with Lupin Pharmaceuticals and Glenmark Pharmaceuticals introduced new products in India. Lupin Pharmaceuticals, a renowned player in drug discovery, capitalized on the patent expiry of Novartis' blockbuster heart drug Sacubitril and Valsartan by launching the generic version. Marketed under the brand names Valentas and Arnipin, this combination drug targets patients suffering from Heart Failure (HF), offering cost-effective treatment options. Simultaneously, Glenmark Pharmaceuticals, another global pharmaceutical company, entered the market with its sacubitril + valsartan prescription-only tablets marketed as 'Sacu V.' This moves further intensified competition in the HF treatment segment, providing patients with additional therapeutic choices. These launches reflect the growing competition among pharmaceutical companies to capture market share in the cardiovascular drugs segment. As players vie for prominence, the market is likely to witness increased innovation, pricing strategies, and marketing efforts to meet the diverse needs of patients and healthcare providers. These developments signify a dynamic and competitive landscape in the cardiovascular drugs market, promising advancements in treatment options for cardiovascular diseases.Global Cardiovascular Drugs Markets Scope: Inquire before buying

Global Cardiovascular Drugs Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 148.65 Bn. Forecast Period 2024 to 2030 CAGR: 4.1% Market Size in 2030: US $ 196.93 Bn. Segments Covered: by Drug Class Anti hyperlipidemics Anti-hypertensives Anti-coagulants Anti-fibrinolytics Anti-arrhythmic by Indications Hypertension Hyperlipidemia Coronary Artery Disease Peripheral Artery Disease Arrhythmia Others by Distribution Channel Hospital Pharmacies Online Pharmacies Retail Pharmacies Cardiovascular Drugs Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cardiovascular Drugs Market Key Players

North America 1. Pfizer Inc. - New York, USA 2. Merck & Co., Inc. - Kenilworth, New Jersey, USA 3. Bristol Myers Squibb Co. - New York, USA 4. Johnson & Johnson - New Brunswick, New Jersey, USA 5. Eli Lilly and Company - Indianapolis, Indiana, USA 6. Amgen Inc. - Thousand Oaks, California, USA 7. AbbVie Inc. - North Chicago, Illinois, USA 8. Mylan N.V. - Canonsburg, Pennsylvania, USA Europe 1. Novartis AG - Basel, Switzerland 2. AstraZeneca PLC - Cambridge, UK 3. Sanofi S.A. - Paris, France 4. Boehringer Ingelheim GmbH - Ingelheim am Rhein, Germany 5. Bayer AG - Leverkusen, Germany 6. GlaxoSmithKline plc - Brentford, UK 7. Novo Nordisk A/S - Bagsværd, Denmark Asia Pacific 1. Daiichi Sankyo Company, Limited - Tokyo, Japan 2. Takeda Pharmaceutical Company Limited - Tokyo, Japan 3. Otsuka Holdings Co., Ltd. - Tokyo, Japan 4. Astellas Pharma Inc. - Tokyo, Japan Frequently Asked Questions 1] What segments are covered in the Global Cardiovascular Drugs Market report? Ans. The segments covered in the Cardiovascular Drugs Market report are based on, Drug Class, Indications, Distribution Channels, and Regions. 2] Which region is expected to hold the highest share of the Global Cardiovascular Drugs Market? Ans. The North America region is expected to hold the highest share of the Cardiovascular Drugs Market. 3] What is the market size of the Global Cardiovascular Drugs Market by 2030? Ans. The market size of the Cardiovascular Drugs Market by 2030 is expected to reach US$ 196.93 Bn. 4] What was the market size of the Global Cardiovascular Drugs Market in 2023? Ans. The market size of the Cardiovascular Drugs Market in 2023 was valued at US$ 148.65Bn. 5] Key players in the Cardiovascular Drugs Market. Ans. Pfizer Inc. - New York, USA, Merck & Co., Inc. - Kenilworth, New Jersey, USA, Bristol Myers Squibb Co. - New York, USA, Johnson & Johnson - New Brunswick, New Jersey, USA, and Eli Lilly and Company - Indianapolis, Indiana, USA

1. Cardiovascular Drugs Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cardiovascular Drugs Market: Dynamics 2.1. Cardiovascular Drugs Market Trends by Region 2.1.1. North America Cardiovascular Drugs Market Trends 2.1.2. Europe Cardiovascular Drugs Market Trends 2.1.3. Asia Pacific Cardiovascular Drugs Market Trends 2.1.4. Middle East and Africa Cardiovascular Drugs Market Trends 2.1.5. South America Cardiovascular Drugs Market Trends 2.2. Cardiovascular Drugs Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Cardiovascular Drugs Market Drivers 2.2.1.2. North America Cardiovascular Drugs Market Restraints 2.2.1.3. North America Cardiovascular Drugs Market Opportunities 2.2.1.4. North America Cardiovascular Drugs Market Challenges 2.2.2. Europe 2.2.2.1. Europe Cardiovascular Drugs Market Drivers 2.2.2.2. Europe Cardiovascular Drugs Market Restraints 2.2.2.3. Europe Cardiovascular Drugs Market Opportunities 2.2.2.4. Europe Cardiovascular Drugs Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Cardiovascular Drugs Market Drivers 2.2.3.2. Asia Pacific Cardiovascular Drugs Market Restraints 2.2.3.3. Asia Pacific Cardiovascular Drugs Market Opportunities 2.2.3.4. Asia Pacific Cardiovascular Drugs Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Cardiovascular Drugs Market Drivers 2.2.4.2. Middle East and Africa Cardiovascular Drugs Market Restraints 2.2.4.3. Middle East and Africa Cardiovascular Drugs Market Opportunities 2.2.4.4. Middle East and Africa Cardiovascular Drugs Market Challenges 2.2.5. South America 2.2.5.1. South America Cardiovascular Drugs Market Drivers 2.2.5.2. South America Cardiovascular Drugs Market Restraints 2.2.5.3. South America Cardiovascular Drugs Market Opportunities 2.2.5.4. South America Cardiovascular Drugs Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Cardiovascular Drugs Industry 2.8. Analysis of Government Schemes and Initiatives For Cardiovascular Drugs Industry 2.9. Cardiovascular Drugs Market Trade Analysis 2.10. The Global Pandemic Impact on Cardiovascular Drugs Market 3. Cardiovascular Drugs Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 3.1.1. Anti hyperlipidemics 3.1.2. Anti-hypertensives 3.1.3. Anti-coagulants 3.1.4. Anti-fibrinolytics 3.1.5. Anti-arrhythmic 3.2. Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 3.2.1. Hypertension 3.2.2. Hyperlipidemia 3.2.3. Coronary Artery Disease 3.2.4. Peripheral Artery Disease 3.2.5. Arrhythmia 3.2.6. Others 3.3. Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Hospital Pharmacies 3.3.2. Online Pharmacies 3.3.3. Retail Pharmacies 3.4. Cardiovascular Drugs Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Cardiovascular Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 4.1.1. Anti hyperlipidemics 4.1.2. Anti-hypertensives 4.1.3. Anti-coagulants 4.1.4. Anti-fibrinolytics 4.1.5. Anti-arrhythmic 4.2. North America Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 4.2.1. Hypertension 4.2.2. Hyperlipidemia 4.2.3. Coronary Artery Disease 4.2.4. Peripheral Artery Disease 4.2.5. Arrhythmia 4.2.6. Others 4.3. North America Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Hospital Pharmacies 4.3.2. Online Pharmacies 4.3.3. Retail Pharmacies 4.4. North America Cardiovascular Drugs Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 4.4.1.1.1. Anti hyperlipidemics 4.4.1.1.2. Anti-hypertensives 4.4.1.1.3. Anti-coagulants 4.4.1.1.4. Anti-fibrinolytics 4.4.1.1.5. Anti-arrhythmic 4.4.1.2. United States Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 4.4.1.2.1. Hypertension 4.4.1.2.2. Hyperlipidemia 4.4.1.2.3. Coronary Artery Disease 4.4.1.2.4. Peripheral Artery Disease 4.4.1.2.5. Arrhythmia 4.4.1.2.6. Others 4.4.1.3. United States Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Hospital Pharmacies 4.4.1.3.2. Online Pharmacies 4.4.1.3.3. Retail Pharmacies 4.4.2. Canada 4.4.2.1. Canada Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 4.4.2.1.1. Anti hyperlipidemics 4.4.2.1.2. Anti-hypertensives 4.4.2.1.3. Anti-coagulants 4.4.2.1.4. Anti-fibrinolytics 4.4.2.1.5. Anti-arrhythmic 4.4.2.2. Canada Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 4.4.2.2.1. Hypertension 4.4.2.2.2. Hyperlipidemia 4.4.2.2.3. Coronary Artery Disease 4.4.2.2.4. Peripheral Artery Disease 4.4.2.2.5. Arrhythmia 4.4.2.2.6. Others 4.4.2.3. Canada Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Hospital Pharmacies 4.4.2.3.2. Online Pharmacies 4.4.2.3.3. Retail Pharmacies 4.4.3. Mexico 4.4.3.1. Mexico Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 4.4.3.1.1. Anti hyperlipidemics 4.4.3.1.2. Anti-hypertensives 4.4.3.1.3. Anti-coagulants 4.4.3.1.4. Anti-fibrinolytics 4.4.3.1.5. Anti-arrhythmic 4.4.3.2. Mexico Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 4.4.3.2.1. Hypertension 4.4.3.2.2. Hyperlipidemia 4.4.3.2.3. Coronary Artery Disease 4.4.3.2.4. Peripheral Artery Disease 4.4.3.2.5. Arrhythmia 4.4.3.2.6. Others 4.4.3.3. Mexico Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Hospital Pharmacies 4.4.3.3.2. Online Pharmacies 4.4.3.3.3. Retail Pharmacies 5. Europe Cardiovascular Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.2. Europe Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.3. Europe Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Cardiovascular Drugs Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.1.2. United Kingdom Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.1.3. United Kingdom Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.2.2. France Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.2.3. France Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.3.2. Germany Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.3.3. Germany Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.4.2. Italy Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.4.3. Italy Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.5.2. Spain Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.5.3. Spain Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.6.2. Sweden Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.6.3. Sweden Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.7.2. Austria Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.7.3. Austria Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 5.4.8.2. Rest of Europe Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 5.4.8.3. Rest of Europe Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Cardiovascular Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.2. Asia Pacific Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.3. Asia Pacific Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Cardiovascular Drugs Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.1.2. China Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.1.3. China Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.2.2. S Korea Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.2.3. S Korea Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.3.2. Japan Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.3.3. Japan Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.4.2. India Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.4.3. India Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.5.2. Australia Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.5.3. Australia Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.6.2. Indonesia Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.6.3. Indonesia Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.7.2. Malaysia Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.7.3. Malaysia Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.8.2. Vietnam Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.8.3. Vietnam Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.9.2. Taiwan Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.9.3. Taiwan Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 6.4.10.2. Rest of Asia Pacific Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 6.4.10.3. Rest of Asia Pacific Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Cardiovascular Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 7.2. Middle East and Africa Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 7.3. Middle East and Africa Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Cardiovascular Drugs Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 7.4.1.2. South Africa Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 7.4.1.3. South Africa Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 7.4.2.2. GCC Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 7.4.2.3. GCC Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 7.4.3.2. Nigeria Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 7.4.3.3. Nigeria Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 7.4.4.2. Rest of ME&A Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 7.4.4.3. Rest of ME&A Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Cardiovascular Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 8.2. South America Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 8.3. South America Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Cardiovascular Drugs Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 8.4.1.2. Brazil Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 8.4.1.3. Brazil Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 8.4.2.2. Argentina Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 8.4.2.3. Argentina Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Cardiovascular Drugs Market Size and Forecast, by Drug Class (2023-2030) 8.4.3.2. Rest Of South America Cardiovascular Drugs Market Size and Forecast, by Indications (2023-2030) 8.4.3.3. Rest Of South America Cardiovascular Drugs Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Cardiovascular Drugs Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Cardiovascular Drugs Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Pfizer Inc. - New York, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Merck & Co., Inc. - Kenilworth, New Jersey, USA 10.3. Bristol Myers Squibb Co. - New York, USA 10.4. Johnson & Johnson - New Brunswick, New Jersey, USA 10.5. Eli Lilly and Company - Indianapolis, Indiana, USA 10.6. Amgen Inc. - Thousand Oaks, California, USA 10.7. AbbVie Inc. - North Chicago, Illinois, USA 10.8. Mylan N.V. - Canonsburg, Pennsylvania, USA 10.9. Novartis AG - Basel, Switzerland 10.10. AstraZeneca PLC - Cambridge, UK 10.11. Sanofi S.A. - Paris, France 10.12. Boehringer Ingelheim GmbH - Ingelheim am Rhein, Germany 10.13. Bayer AG - Leverkusen, Germany 10.14. GlaxoSmithKline plc - Brentford, UK 10.15. Novo Nordisk A/S - Bagsværd, Denmark 10.16. Daiichi Sankyo Company, Limited - Tokyo, Japan 10.17. Takeda Pharmaceutical Company Limited - Tokyo, Japan 10.18. Otsuka Holdings Co., Ltd. - Tokyo, Japan 10.19. Astellas Pharma Inc. - Tokyo, Japan 11. Key Findings 12. Industry Recommendations 13. Cardiovascular Drugs Market: Research Methodology 14. Terms and Glossary