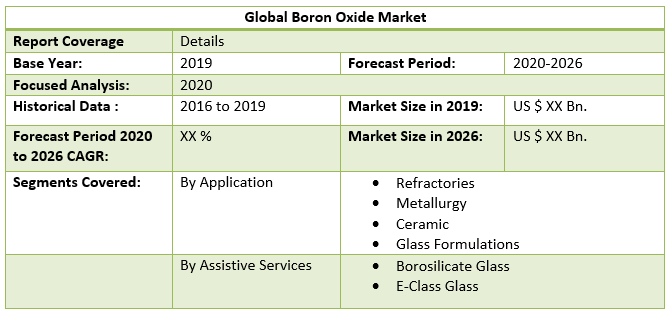

Global Boron Oxide Market size was valued at USD 2.2 billion in 2019 and is expected to reach US $ xx billion by 2026, at a CAGR of xx% during a forecast period. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region. The Global Boron Oxide Market is segmented By Application, By End-User and Region. The report provides qualitative and quantitative insights on the atherectomy and Thromboctomy devices industry trends and a detailed analysis of the market size and growth rate of all segments in the market.Global Boron Oxide Market Dynamics

Growing adoption of boron oxide as raw material or as an additive in different materials production processes.

The production of glass involves a great number of chemical reactions involving boron oxide as raw materials. Most laboratory glassware is now made of borosilicate glass which is made from boron oxides, such as Pyrex or Hysil. An increase in awareness about energy conservation methods and materials are expected to trigger the global boron oxide market. Boron Oxide has various opportunities in the surging electronics application. Various forms of BO have been used as a lubricant and abrasive material for their electronic properties of them.Gradual popularity of boron free glass fiber and flat glass

Boron-free glass fiber has better fundamental properties than borosilicate glass. The corrosion-resistant boron-free E-glass fiber effectively prevents the brittle fracture failures which are occurred by acid.Global Boron Oxide Market Segment Analysis – by Application

To know about the Research Methodology :- Request Free Sample Report

The Glass Formulation segment is expected to share XX% in coming years

Boron oxide is widely used in a large number of manufactured glass formulations. There are currently no alternatives, known to the use of boron oxide in the glass formulation for applications such as heat resistant cookware, laboratory ware, and liquid crystal display (LCD) screens, etc. The use of borosilicate glasses also delivers user convenience applications such as low coefficient of thermal expansion, high thermal shock resistance, and good chemical inertness.Global Boron Oxide Market Segment Analysis – by End User

The soldering and welding fluxes segment leads the market with the largest share Boron has many applications in the Metallurgical industry. Clean welded seams and soldered joints can be consistently achieved using boron nitride coatings. Growth in White goods and electronic goods led to give lucrative opportunity for the global market.Global Boron Oxide Market Regional Analysis

The Asia Pacific is the dominant region in the global boron oxide market in 2019 & is expected to maintain its position in the forecast period.

The Asia Pacific is the largest producer of glass fiber, electronic devices, and ancillary parts in the world. The export-oriented manufacturing services in the Asia Pacific are the main reason behind the surging demand in the region. The Asia Pacific accounts for over 50% of the global demand, led by China, Japan, Korea, and India. Demand for boron oxide from North America and Europe follows that from the Asia Pacific. North America is the second-largest growing region for the boron oxide market due to the increase in demand for boron oxide in the metals, alloy, and glass industry.Global Boron Oxide Market Report Scope

The objective of the report is to present a comprehensive analysis of the global boron oxide market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global boron oxide market dynamics, structure by analyzing the market segments and projects the global boron oxide market clear representation of competitive analysis of key players by price, financial position, by detection and equipment portfolio, growth strategies, and regional presence in the global boron oxide market make the report investor’s guide.Global boron oxide market, Key Highlights:

• Global boron oxide market analysis and forecast, in terms of value. • Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Global boron oxide market • Global boron oxide market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. • Global boron oxide market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. • Global boron oxide market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. • Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. • Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Global boron oxide market are also profiled.Global Boron Oxide Market Report Scope: Inquire before buying

Global Boron Oxide Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaGlobal Boron Oxide Market Key Players

• GFS Chemicals Inc. • The Chemical Company • HDG Chemicals Ltd. • Acemler Chemco San A.S • Okandan Cam Sanayi Chemical Co. • Eti Maden • American Borate Company • Rio Tinto Group • Boron Specialist LLC • Searles Valley Minerals Inc. • Gremont Chemicals Co. Ltd. • Rose Mill Co. • Mitsui Chemicals Inc. • Xi'an Unique Electronic & Chemical • Maas Graphite & Carbon Products • YingKou liaobin Fine Chemicals • Liaoning Pengda Technology • Nippon Denko Co., Ltd. • Joylong Chemicals Co • Jinmei Gallium • Nanografi Nano Technology

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Boron Oxide Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Boron Oxide Market 3.4. Geographical Snapshot of the Boron Oxide Market, By Manufacturer share 4. Global Boron Oxide Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Boron Oxide Market 5. Supply Side and Demand Side Indicators 6. Global Boron Oxide Market Analysis and Forecast, 2019-2026 6.1. Global Boron Oxide Market Size & Y-o-Y Growth Analysis. 7. Global Boron Oxide Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 7.1.1. Refractories 7.1.2. Metallurgy 7.1.3. Ceramic 7.1.4. Glass Formulations 7.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 7.2.1. Borosilicate Glass 7.2.2. E-Class Glass 8. Global Boron Oxide Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Boron Oxide Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 9.1.1. Refractories 9.1.2. Metallurgy 9.1.3. Ceramic 9.1.4. Glass Formulations 9.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 9.2.1. Borosilicate Glass 9.2.2. E-Class Glass 10. North America Boron Oxide Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Boron Oxide Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 12. Canada Boron Oxide Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 13. Mexico Boron Oxide Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 14. Europe Boron Oxide Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 15. Europe Boron Oxide Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Boron Oxide Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 17. France Boron Oxide Market Analysis and Forecasts, 2019-2026 17.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 17.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 18. Germany Boron Oxide Market Analysis and Forecasts, 2019-2026 18.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 18.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 19. Italy Boron Oxide Market Analysis and Forecasts, 2019-2026 19.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 19.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 20. Spain Boron Oxide Market Analysis and Forecasts, 2019-2026 20.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 20.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 21. Sweden Boron Oxide Market Analysis and Forecasts, 2019-2026 21.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 21.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 22. CIS Countries Boron Oxide Market Analysis and Forecasts, 2019-2026 22.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 22.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 23. Rest of Europe Boron Oxide Market Analysis and Forecasts, 2019-2026 23.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 23.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 24. Asia Pacific Boron Oxide Market Analysis and Forecasts, 2019-2026 24.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 24.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 25. Asia Pacific Boron Oxide Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Boron Oxide Market Analysis and Forecasts, 2019-2026 26.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 26.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 27. India Boron Oxide Market Analysis and Forecasts, 2019-2026 27.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 27.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 28. Japan Boron Oxide Market Analysis and Forecasts, 2019-2026 28.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 28.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 29. South Korea Boron Oxide Market Analysis and Forecasts, 2019-2026 29.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 29.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 30. Australia Boron Oxide Market Analysis and Forecasts, 2019-2026 30.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 30.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 31. ASEAN Boron Oxide Market Analysis and Forecasts, 2019-2026 31.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 31.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 32. Rest of Asia Pacific Boron Oxide Market Analysis and Forecasts, 2019-2026 32.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 32.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 33. Middle East Africa Boron Oxide Market Analysis and Forecasts, 2019-2026 33.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 33.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 34. Middle East Africa Boron Oxide Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Boron Oxide Market Analysis and Forecasts, 2019-2026 35.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 35.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 36. GCC Countries Boron Oxide Market Analysis and Forecasts, 2019-2026 36.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 36.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 37. Egypt Boron Oxide Market Analysis and Forecasts, 2019-2026 37.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 37.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 38. Nigeria Boron Oxide Market Analysis and Forecasts, 2019-2026 38.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 38.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 39. Rest of ME&A Boron Oxide Market Analysis and Forecasts, 2019-2026 39.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 39.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 40. South America Boron Oxide Market Analysis and Forecasts, 2019-2026 40.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 40.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 41. South America Boron Oxide Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Boron Oxide Market Analysis and Forecasts, 2019-2026 42.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 42.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 43. Argentina Boron Oxide Market Analysis and Forecasts, 2019-2026 43.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 43.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 44. Rest of South America Boron Oxide Market Analysis and Forecasts, 2019-2026 44.1. Market Size (Value) Estimates & Forecast By Application, 2019-2026 44.2. Market Size (Value) Estimates & Forecast By End User, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Boron Oxide Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1 GFS Chemicals Inc. 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. The Chemical Company 45.3.3. HDG Chemicals Ltd. 45.3.4. Acemler Chemco San A.S 45.3.5. Okandan Cam Sanayi Chemical Co. 45.3.6. Eti Maden 45.3.7. American Borate Company 45.3.8. Rio Tinto Group 45.3.9. Boron Specialist LLC 45.3.10. Searles Valley Minerals Inc. 45.3.11. Gremont Chemicals Co. Ltd. 45.3.12. Rose Mill Co. 45.3.13. Mitsui Chemicals Inc. 45.3.14. Xi'an Unique Electronic & Chemical 45.3.15. Maas Graphite & Carbon Products 45.3.16. YingKou liaobin Fine Chemicals 45.3.17. Liaoning Pengda Technology 45.3.18. Nippon Denko Co., Ltd. 45.3.19. Joylong Chemicals Co 45.3.20. Jinmei Gallium 45.3.21. Nanografi Nano Technology 46. Primary Key Insights