The Biosimilar Market size was valued at USD 24.86 Billion in 2023 and the total Biosimilars revenue is expected to grow at a CAGR of 17.02 % from 2024 to 2030, reaching nearly USD 74.70 Billion by 2030. The biosimilar market involves biologic drug production that are highly similar and functionally identical versions of approved reference biologics, offering cost-effective alternatives while maintaining comparable efficacy and safety profiles. Currently, the Biosimilar market is experiencing robust growth driven by various factors including patent expirations of biologic drugs, escalating healthcare costs, and the need for more accessible treatments. Key players like Pfizer, Sandoz (Novartis), Amgen, and Biocon have made significant strides in this landscape. For instance, Pfizer's biosimilar portfolio includes Ruxience (rituximab), a biosimilar gaining FDA approval for multiple indications, expanding patient access to essential therapies. Amgen's biosimilar efforts include Kanjinti (trastuzumab), addressing critical needs in breast cancer treatment. Strategic alliances such as the partnership between Biocon and Mylan have boosted biosimilar developments, aiming to address unmet medical needs and expand market reach. The biosimilar market trajectory is marked by innovation, strategic collaborations, and regulatory approvals, offering cost-effective therapeutic alternatives without compromising quality or efficacy, and reshaping the landscape of accessible healthcare options.To know about the Research Methodology :- Request Free Sample Report

Biosimilar Market Dynamics:

Clinical Efficacy and Safety with affordable pricing driving the market growth The expiration of patents for biological drugs serves as a pivotal driver, creating pathways for biosimilar entry into the market. This phenomenon, exemplified by the patent expiry of Humira, facilitated the introduction of biosimilars such as Amgen's Amjevita and Pfizer's Abrilada. These biosimilars offer cost-effective alternatives for autoimmune conditions, igniting competition and reducing treatment costs. The resulting competition fosters an environment where affordability and accessibility are prioritized, benefiting patients and healthcare systems alike. Pfizer's biosimilar Ruxience (rituximab) stands as a testament to this trend, providing a lower-cost option compared to reference biologics. This not only addresses the financial strain on healthcare systems but also ensures improved access to critical treatments, aligning with the increasing demand for cost-effective therapies, especially in the face of rising healthcare expenses. The escalating incidence of chronic diseases further drives the demand for affordable treatment options, necessitating the emergence of biosimilars. In response, biosimilars such as Kanjinti (trastuzumab) by Amgen have emerged, catering to conditions like breast cancer. These biosimilars ensure broader accessibility for patients seeking more affordable therapies. Supportive regulatory frameworks play a pivotal role in encouraging biosimilar market growth. Europe's robust regulatory environment, for instance, facilitated approvals for biosimilars Sandoz's Zarxio (filgrastim), expediting market entry and offering viable alternatives to expensive biologics. Physician and patient acceptance are key drivers that fuel biosimilar adoption rates, evident in the growing confidence and uptake of biosimilars like Pfizer's Inflectra (infliximab) for treating autoimmune diseases. This growing acceptance influences biosimilar market growth by encouraging increased adoption and usage of biosimilar therapies. Additionally, strategic partnerships between major players, such as the collaboration between Biocon and Mylan, have led to the development of biosimilars like Fulphila (pegfilgrastim), reinforcing market presence and expanding choices in oncology supportive care. These partnerships signify concerted efforts to offer diverse, cost-effective treatment options and fortify the biosimilar landscape.Biologic Complexity and Evolving Regulatory Landscape Hamper Market Growth The Biosimilar Market faces numerous of growth challenges, spanning regulatory, manufacturing, market access, and education domains. Stringent regulatory hurdles, exemplified by Amgen's Avastin biosimilar delay due to FDA review, hinder biosimilar market entry and growth. Replicating complex biological structures, such as Rituxan, posed challenges for Celltrion, stalling market access. Patent litigations, such as AbbVie's against Humira biosimilars, delay launches, and restrain biosimilar market growth. Intense competition impacts pricing strategies, limiting margins for Neupogen biosimilars. Lack of awareness among physicians and patients, exclusive contracts, and scale-up issues for biosimilar production also impede market growth. Confusion arising from naming conventions, reimbursement complexities, and evolving regulatory guidelines pose formidable challenges, hindering biosimilar adoption and market entry. Manufacturing complexities further compound challenges, demanding costly analytical testing for quality and similarity to reference biologics, impacting consistency and efficacy. Business challenges encompass navigating market access barriers, pricing negotiations, and compliance with diverse chemical laws and regulatory frameworks across regions, affecting development timelines and global market access strategies for biosimilar manufacturers. These multifaceted challenges collectively impede the biosimilar market's growth trajectory, impacting adoption, market-entry, and competitiveness.

Biosimilar Market Segment Analysis:

Based on Application, oncology dominated the Biosimilar Market in 2023 and is expected to continue its dominance during the forecast period. The increasing prevalence of cancer worldwide serves as a primary driver for the oncology segment's substantial share in the biosimilar market. Statistics from the International Agency for Research on Cancer (IARC) highlight the alarming rise in new leukemia cases globally, reaching 474,519 in 2025, with a substantial death toll of 311,594. Projections suggest a further surge to 27.5 million new cancer cases and 16.3 million deaths globally by 2040. This escalating incidence fuels the demand for advanced cancer treatments, propelling the need for biosimilars. Moreover, heightened research endeavors by industry leaders focusing on oncology, coupled with regulatory approvals, contribute to market expansion. Notable instances include Amgen's FDA clearance for RIABNI (rituximab-Marx) in treating various cancers and Biocon Biologics Ltd. and Viatris Inc.'s Health Canada approval for Abevmy (Bevacizumab) across multiple oncology indications, demonstrating a commitment to addressing critical medical needs in oncology through biosimilars. This dominance in oncology applications signifies the biosimilar market's alignment with addressing critical medical requirements in cancer treatment.Based on the Technology, Recombinant DNA Technology dominated the market as it plays a pivotal role in biosimilar production, especially in generating biosimilar versions of various therapeutic proteins like insulin and growth hormones. This technology's widespread application extends to diverse medical areas, contributing to the development of biosimilar drugs addressing chronic diseases, growth hormone deficiencies, and autoimmune disorders. On the other hand, Monoclonal antibody (MAb) Technology stands out for its specialized focus on generating biosimilar versions of monoclonal antibody-based therapeutics. MAb technology finds extensive application in the biosimilar market for drugs targeting inflammatory diseases, oncology, and autoimmune disorders. The adoption rate of MAb technology is on the rise due to the increasing demand for targeted therapies in areas like cancer treatment and autoimmune conditions. The diverse applications and evolving adoption trends of these technologies underscore their crucial roles in driving innovation and market growth within the biosimilar industry.

Biosimilar Market Regional Insights:

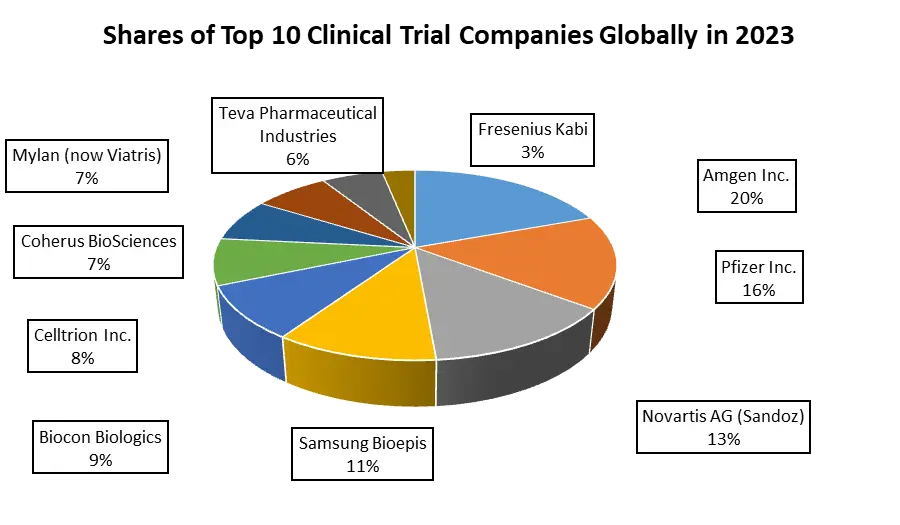

Europe and North America are the major manufacturers of biosimilars. Europe stands out prominently as a leading force due to its established regulatory frameworks, robust infrastructure, and prowess in biosimilar production. Countries such as Germany, the Netherlands, and Switzerland spearhead this dominance in biosimilar manufacturing. Following closely is North America, particularly led by the United States, which emerges as a primary consumer in the biosimilar landscape. This region's high demand is fueled by a significant healthcare burden and an increased need for innovative therapies, especially in addressing chronic diseases such as various cancers. The emerging region in the biosimilar market is Asia-Pacific. This region, includes countries such as India and South Korea, serves as an emerging manufacturing hub for biosimilars. Asia-Pacific contributes substantially to both regional demands and global exports, showcasing its evolving significance in biosimilar production. The region's growing expertise and investments in biosimilar manufacturing technologies position it as an emerging force in the global biosimilar market.Biosimilar Market Competitive Landscapes: The biosimilar market is highly competitive with prominent players such as Amgen Inc., Pfizer Inc., Mylan NV, and Coherus Biosciences Inc. lead the market with significant contributions to biosimilar development and manufacturing. Amgen secured approval for RIABNI (rituximab-Marx), Pfizer's Nyvepria received approval for infection reduction, Mylan remains actively engaged in biosimilar production, while Coherus' CHS-1420, a Humira biosimilar, underwent FDA review. Emerging players like Biocon Biologics Ltd. and Samsung Bioepis are making headway in the market, with approvals for Abevmy (Bevacizumab) across multiple oncology indications and the biosimilar Ontruzant (trastuzumab), respectively. Strategic partnerships, such as Biocon Biologics Ltd. collaborating with Viatris Inc., showcase joint efforts in expanding biosimilar availability. These mergers, acquisitions, and partnerships underscore the collective commitment of industry leaders and emerging companies toward advancing biosimilar therapies for enhanced accessibility and cost-effectiveness.

Biosimilar Market Scope: Inquire before buying

Global Biosimilar Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 24.86 Bn. Forecast Period 2024 to 2030 CAGR: 17.02% Market Size in 2030: US $ 74.70 Bn. Segments Covered: by Type Human growth hormone Erythropoietin Monoclonal antibodies Insulin Granulocyte-colony stimulating factor Others by Application Oncology Inflammatory Autoimmune diseases Chronic diseases Blood disorders Growth hormone deficiency Infectious diseases Other by Technology Recombinant DNA Technology Monoclonal Antibodies (MAb) Technology by End-User Hospital Pharmacies Retail Pharmacies Online Pharmacies Biosimilar Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Biosimilar Market Key Players:

North America: 1. Pfizer Inc. 2. Amgen Inc. 3. Coherus BioSciences 4. Viatris (formerly Mylan) 5. Teva Pharmaceutical Industries Europe: 1. Novartis AG (Sandoz) 2. Biocon Biologics 3. Samsung Bioepis 4. Fresenius Kabi 5. Biogen Asia-Pacific: 1. Biocon Biologics 2. Samsung Bioepis 3. Celltrion Inc. 4. Dr. Reddy's Laboratories 5. Lupin Limited FAQs: 1] What segments are covered in the Global Biosimilar Market report? Ans. The segments covered in the Biosimilar Market report are based on Type and Application. 2] Which region is expected to hold the highest share in the Global Biosimilar Market? Ans. Europe region is expected to hold the highest share in the biosimilar market. 3] What is the market size of the Global Biosimilar Market by 2030? Ans. The market size of the Biosimilar Market by 2030 is expected to reach US$ 74.70 Bn. 4] What is the forecast period for the Global Biosimilar Market? Ans. The forecast period for the Biosimilar Market is 2023-2029. 5] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 24.86 Bn.

1. Biosimilar Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Biosimilar Market: Dynamics 2.1. Biosimilar Market Trends by Region 2.1.1. North America Biosimilar Market Trends 2.1.2. Europe Biosimilar Market Trends 2.1.3. Asia Pacific Biosimilar Market Trends 2.1.4. Middle East and Africa Biosimilar Market Trends 2.1.5. South America Biosimilar Market Trends 2.2. Biosimilar Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Biosimilar Market Drivers 2.2.1.2. North America Biosimilar Market Restraints 2.2.1.3. North America Biosimilar Market Opportunities 2.2.1.4. North America Biosimilar Market Challenges 2.2.2. Europe 2.2.2.1. Europe Biosimilar Market Drivers 2.2.2.2. Europe Biosimilar Market Restraints 2.2.2.3. Europe Biosimilar Market Opportunities 2.2.2.4. Europe Biosimilar Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Biosimilar Market Drivers 2.2.3.2. Asia Pacific Biosimilar Market Restraints 2.2.3.3. Asia Pacific Biosimilar Market Opportunities 2.2.3.4. Asia Pacific Biosimilar Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Biosimilar Market Drivers 2.2.4.2. Middle East and Africa Biosimilar Market Restraints 2.2.4.3. Middle East and Africa Biosimilar Market Opportunities 2.2.4.4. Middle East and Africa Biosimilar Market Challenges 2.2.5. South America 2.2.5.1. South America Biosimilar Market Drivers 2.2.5.2. South America Biosimilar Market Restraints 2.2.5.3. South America Biosimilar Market Opportunities 2.2.5.4. South America Biosimilar Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis for the Biosimilars Industry 2.8. Analysis of Government Schemes and Initiatives for Biosimilars Industry 2.9. The Global Pandemic Impact on Biosimilar Market 3. Biosimilar Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Biosimilar Market Size and Forecast, by Type (2023-2030) 3.1.1. Human growth hormone 3.1.2. Erythropoietin 3.1.3. Monoclonal antibodies 3.1.4. Insulin 3.1.5. Granulocyte-colony stimulating factor 3.1.6. Others 3.2. Biosimilar Market Size and Forecast, by Application (2023-2030) 3.2.1. Oncology 3.2.2. Inflammatory 3.2.3. Autoimmune diseases 3.2.4. Chronic diseases 3.2.5. Blood disorders 3.2.6. Growth hormone deficiency 3.2.7. Infectious diseases 3.2.8. Other 3.3. Biosimilar Market Size and Forecast, by Technology (2023-2030) 3.3.1. Recombinant DNA Technology 3.3.2. Monoclonal Antibodies (MAb) Technology 3.4. Biosimilar Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospital Pharmacies 3.4.2. Retail Pharmacies 3.4.3. Online Pharmacies 3.5. Biosimilar Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Biosimilar Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Biosimilar Market Size and Forecast, by Type (2023-2030) 4.1.1. Human growth hormone 4.1.2. Erythropoietin 4.1.3. Monoclonal antibodies 4.1.4. Insulin 4.1.5. Granulocyte-colony stimulating factor 4.1.6. Others 4.2. North America Biosimilar Market Size and Forecast, by Application (2023-2030) 4.2.1. Oncology 4.2.2. Inflammatory 4.2.3. Autoimmune diseases 4.2.4. Chronic diseases 4.2.5. Blood disorders 4.2.6. Growth hormone deficiency 4.2.7. Infectious diseases 4.2.8. Other 4.3. North America Biosimilar Market Size and Forecast, by Technology (2023-2030) 4.3.1. Recombinant DNA Technology 4.3.2. Monoclonal Antibodies (MAb) Technology 4.4. North America Biosimilar Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospital Pharmacies 4.4.2. Retail Pharmacies 4.4.3. Online Pharmacies 4.5. North America Biosimilar Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Biosimilar Market Size and Forecast, by Type (2023-2030) 4.5.1.1.1. Human growth hormone 4.5.1.1.2. Erythropoietin 4.5.1.1.3. Monoclonal antibodies 4.5.1.1.4. Insulin 4.5.1.1.5. Granulocyte-colony stimulating factor 4.5.1.1.6. Others 4.5.1.2. United States Biosimilar Market Size and Forecast, by Application (2023-2030) 4.5.1.2.1. Oncology 4.5.1.2.2. Inflammatory 4.5.1.2.3. Autoimmune diseases 4.5.1.2.4. Chronic diseases 4.5.1.2.5. Blood disorders 4.5.1.2.6. Growth hormone deficiency 4.5.1.2.7. Infectious diseases 4.5.1.2.8. Other 4.5.1.3. United States Biosimilar Market Size and Forecast, by Technology (2023-2030) 4.5.1.3.1. Recombinant DNA Technology 4.5.1.3.2. Monoclonal Antibodies (MAb) Technology 4.5.1.4. United States Biosimilar Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospital Pharmacies 4.5.1.4.2. Retail Pharmacies 4.5.1.4.3. Online Pharmacies 4.5.2. Canada 4.5.2.1. Canada Biosimilar Market Size and Forecast, by Type (2023-2030) 4.5.2.1.1. Human growth hormone 4.5.2.1.2. Erythropoietin 4.5.2.1.3. Monoclonal antibodies 4.5.2.1.4. Insulin 4.5.2.1.5. Granulocyte-colony stimulating factor 4.5.2.1.6. Others 4.5.2.2. Canada Biosimilar Market Size and Forecast, by Application (2023-2030) 4.5.2.2.1. Oncology 4.5.2.2.2. Inflammatory 4.5.2.2.3. Autoimmune diseases 4.5.2.2.4. Chronic diseases 4.5.2.2.5. Blood disorders 4.5.2.2.6. Growth hormone deficiency 4.5.2.2.7. Infectious diseases 4.5.2.2.8. Other 4.5.2.3. Canada Biosimilar Market Size and Forecast, by Technology (2023-2030) 4.5.2.3.1. Recombinant DNA Technology 4.5.2.3.2. Monoclonal Antibodies (MAb) Technology 4.5.2.4. Canada Biosimilar Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospital Pharmacies 4.5.2.4.2. Retail Pharmacies 4.5.2.4.3. Online Pharmacies 4.5.3. Mexico 4.5.3.1. Mexico Biosimilar Market Size and Forecast, by Type (2023-2030) 4.5.3.1.1. Human growth hormone 4.5.3.1.2. Erythropoietin 4.5.3.1.3. Monoclonal antibodies 4.5.3.1.4. Insulin 4.5.3.1.5. Granulocyte-colony stimulating factor 4.5.3.1.6. Others 4.5.3.2. Mexico Biosimilar Market Size and Forecast, by Application (2023-2030) 4.5.3.2.1. Oncology 4.5.3.2.2. Inflammatory 4.5.3.2.3. Autoimmune diseases 4.5.3.2.4. Chronic diseases 4.5.3.2.5. Blood disorders 4.5.3.2.6. Growth hormone deficiency 4.5.3.2.7. Infectious diseases 4.5.3.2.8. Other 4.5.3.3. Mexico Biosimilar Market Size and Forecast, by Technology (2023-2030) 4.5.3.3.1. Recombinant DNA Technology 4.5.3.3.2. Monoclonal Antibodies (MAb) Technology 4.5.3.4. Mexico Biosimilar Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospital Pharmacies 4.5.3.4.2. Retail Pharmacies 4.5.3.4.3. Online Pharmacies 5. Europe Biosimilar Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Biosimilar Market Size and Forecast, by Type (2023-2030) 5.2. Europe Biosimilar Market Size and Forecast, by Application (2023-2030) 5.3. Europe Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.4. Europe Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5. Europe Biosimilar Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.1.2. United Kingdom Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.1.3. United Kingdom Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.1.4. United Kingdom Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.2.2. France Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.2.3. France Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.2.4. France Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.3.2. Germany Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.3.3. Germany Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.3.4. Germany Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.4.2. Italy Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.4.3. Italy Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.4.4. Italy Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.5.2. Spain Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.5.3. Spain Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.5.4. Spain Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.6.2. Sweden Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.6.3. Sweden Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.6.4. Sweden Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.7.2. Austria Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.7.3. Austria Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.7.4. Austria Biosimilar Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Biosimilar Market Size and Forecast, by Type (2023-2030) 5.5.8.2. Rest of Europe Biosimilar Market Size and Forecast, by Application (2023-2030) 5.5.8.3. Rest of Europe Biosimilar Market Size and Forecast, by Technology (2023-2030) 5.5.8.4. Rest of Europe Biosimilar Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Biosimilar Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Biosimilar Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Biosimilar Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.4. Asia Pacific Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Biosimilar Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.1.2. China Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.1.3. China Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.2. China Biosimilar Market Size and Forecast, by End User (2023-2030) S Korea 6.5.2.1. S Korea Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.2.2. S Korea Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.2.3. S Korea Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.2.4. S Korea Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Japan Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.3.3. Japan Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.3.4. Japan Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.4.2. India Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.4.3. India Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.4.4. India Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Australia Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.5.3. Australia Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.5.4. Australia Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Indonesia Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.6.3. Indonesia Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.6.4. Indonesia Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Malaysia Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.7.3. Malaysia Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.7.4. Malaysia Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Vietnam Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.8.3. Vietnam Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.8.4. Vietnam Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.9.2. Taiwan Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.9.3. Taiwan Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.9.4. Taiwan Biosimilar Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Biosimilar Market Size and Forecast, by Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Biosimilar Market Size and Forecast, by Application (2023-2030) 6.5.10.3. Rest of Asia Pacific Biosimilar Market Size and Forecast, by Technology (2023-2030) 6.5.10.4. Rest of Asia Pacific Biosimilar Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Biosimilar Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Biosimilar Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Biosimilar Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Biosimilar Market Size and Forecast, by Technology (2023-2030) 7.4. Middle East and Africa Biosimilar Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Biosimilar Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Biosimilar Market Size and Forecast, by Type (2023-2030) 7.5.1.2. South Africa Biosimilar Market Size and Forecast, by Application (2023-2030) 7.5.1.3. South Africa Biosimilar Market Size and Forecast, by Technology (2023-2030) 7.5.2. South Africa Biosimilar Market Size and Forecast, by End User (2023-2030) GCC 7.5.2.1. GCC Biosimilar Market Size and Forecast, by Type (2023-2030) 7.5.2.2. GCC Biosimilar Market Size and Forecast, by Application (2023-2030) 7.5.2.3. GCC Biosimilar Market Size and Forecast, by Technology (2023-2030) 7.5.2.4. GCC Biosimilar Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Biosimilar Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Nigeria Biosimilar Market Size and Forecast, by Application (2023-2030) 7.5.3.3. Nigeria Biosimilar Market Size and Forecast, by Technology (2023-2030) 7.5.3.4. Nigeria Biosimilar Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Biosimilar Market Size and Forecast, by Type (2023-2030) 7.5.4.2. Rest of ME&A Biosimilar Market Size and Forecast, by Application (2023-2030) 7.5.4.3. Rest of ME&A Biosimilar Market Size and Forecast, by Technology (2023-2030) 7.5.4.4. Rest of ME&A Biosimilar Market Size and Forecast, by End User (2023-2030) 8. South America Biosimilar Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Biosimilar Market Size and Forecast, by Type (2023-2030) 8.2. South America Biosimilar Market Size and Forecast, by Application (2023-2030) 8.3. South America Biosimilar Market Size and Forecast, by Technology (2023-2030) 8.4. South America Biosimilar Market Size and Forecast, by End User (2023-2030) 8.5. South America Biosimilar Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Biosimilar Market Size and Forecast, by Type (2023-2030) 8.5.1.2. Brazil Biosimilar Market Size and Forecast, by Application (2023-2030) 8.5.1.3. Brazil Biosimilar Market Size and Forecast, by Technology (2023-2030) 8.5.1.4. Brazil Biosimilar Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Biosimilar Market Size and Forecast, by Type (2023-2030) 8.5.2.2. Argentina Biosimilar Market Size and Forecast, by Application (2023-2030) 8.5.2.3. Argentina Biosimilar Market Size and Forecast, by Technology (2023-2030) 8.5.2.4. Argentina Biosimilar Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Biosimilar Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Rest Of South America Biosimilar Market Size and Forecast, by Application (2023-2030) 8.5.3.3. Rest Of South America Biosimilar Market Size and Forecast, by Technology (2023-2030) 8.5.3.4. Rest Of South America Biosimilar Market Size and Forecast, by End User (2023-2030) 9. Global Biosimilar Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Biosimilar Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amgen Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Biocon Biologics 10.3. Biogen 10.4. Celltrion Inc. 10.5. Coherus BioSciences 10.6. Dr. Reddy's Laboratories 10.7. Fresenius Kabi 10.8. Lupin Limited 10.9. Novartis AG (Sandoz) 10.10. Pfizer Inc. 10.11. Samsung Bioepis 10.12. Teva Pharmaceutical Industries 10.13. Viatris (formerly Mylan) 11. Key Findings 12. Industry Recommendations 13.Biosimilar Market: Research Methodology