Global Biopolymers Market size was valued at USD 8.06 Bn in 2023 and is expected to reach USD 22.37 Bn by 2030, at a CAGR of 15.3%.Biopolymers Market Overview

Biopolymers, derived from natural sources such as plants and microbes, are polymers composed of monomeric units bonded together by covalent bonds. Biopolymers offer a renewable and sustainable alternative due to their origin from living organisms. They are inherently degradable, presenting significant environmental advantages. Biopolymers have diverse applications across industries such as food, manufacturing, packaging, and biomedical engineering, due to their abundance, biocompatibility, and unique properties such as non-toxicity. Their potential is enhanced by ongoing research aimed at incorporating nanosized reinforcements to augment their properties and expand their practical applications which boost Biopolymers Market growth. As industries continue to prioritize sustainability and seek eco-friendly alternatives, biopolymers emerge as promising materials capable of addressing both environmental concerns and the diverse needs of modern manufacturing and technology.To know about the Research Methodology :- Request Free Sample Report The increasing environmental concerns and the pressing need for sustainable alternatives to conventional plastics have boosted the demand for biopolymers. These polymers, derived from renewable sources such as plants and microorganisms, offer biodegradability and reduced carbon footprint. The advancements in biotechnology and bioengineering have led to enhanced production processes, resulting in improved scalability and cost-effectiveness of biopolymer manufacturing. This has not only made biopolymers more accessible but also economically viable for a wide array of applications across industries. The packaging sector is witnessing a surge in the adoption of biopolymers due to their biodegradable and compostable nature, aligning with consumer preferences for eco-friendly products. The stringent government regulations and initiatives promoting sustainability drive Biopolymers Market growth by encouraging the use of renewable materials and incentivizing investments in biopolymer research and development. With increasing consumer awareness and industry focus on sustainability, the Biopolymers industry is expected to have continuous growth, offering opportunities for innovation, technological advancements, and market penetration in diverse sectors across the globe.

Biopolymers Market Trend

Increasing focus on bio-based and biodegradable alternatives The increasing awareness of the detrimental impacts of traditional petroleum-based plastics on ecosystems, wildlife, and human health has catalyzed a global shift towards more sustainable alternatives. Bio-based and biodegradable polymers provide a compelling solution as they are derived from renewable resources such as plants, algae, or bacteria, mitigating reliance on finite fossil fuel reserves and reducing carbon emissions. The biodegradable nature of these materials addresses concerns about plastic pollution, particularly in marine environments where conventional plastics persist for centuries, harming marine life and ecosystems which helps to boost Biopolymers Market growth. Regulatory pressures aimed at curbing plastic waste and promoting circular economy principles have accelerated the adoption of bio-based and biodegradable polymers, with governments implementing policies such as bans on single-use plastics and incentives for biopolymer innovation and production. The worldwide production capacity of bioplastics, including both biodegradable and biobased biopolymers, continues to grow, driven by increasing demand for sustainable alternatives to traditional plastics. This expansion has a significant impact on the Biopolymer Market, boosting innovation, investment, and environmental sustainability efforts globally.The evolving consumer preferences towards eco-friendly products have driven demand for biodegradable packaging, compostable utensils, and bio-based textiles, prompting businesses to integrate biopolymers into their supply chains to meet market demand and enhance brand reputation. The advancements in biopolymer technology, including improved material properties, processing techniques, and scalability, have enhanced the viability and competitiveness of bio-based alternatives compared to traditional plastics which drive Biopolymers Market growth. Collaborative efforts between industry stakeholders, research institutions, and government agencies have fostered innovation in biopolymer development, leading to the introduction of new bio-based polymers with tailored properties for diverse applications.

Biopolymers Market Dynamics

The growing global emphasis on sustainability and environmental conservation to Boost Market Growth The increasing awareness of the detrimental impacts of traditional petroleum-based plastics on ecosystems, wildlife and human health has spurred a shift towards more eco-friendly alternatives. Biopolymers provide a promising solution as they are derived from renewable resources such as plants, algae, or bacteria, making them inherently more sustainable. The production of biopolymers typically involves lower carbon emissions compared to their conventional counterparts, aligning with international efforts to combat climate change which boosts Biopolymers Market growth. The stringent regulations and policies aimed at reducing plastic pollution and promoting sustainable practices incentivize industries to adopt biopolymers. Beyond regulatory compliance, consumer preferences are also evolving towards eco-conscious purchasing habits, driving demand for products packaged in biodegradable or compostable materials. This consumer-driven demand encourages businesses to integrate biopolymers into their supply chains as part of their corporate sustainability initiatives, thereby driving Biopolymers Market growth. As research and technological advancements continue to enhance the performance and cost-effectiveness of biopolymer materials, their adoption across several sectors including packaging, automotive, textiles, and healthcare is expected to accelerate, solidifying their essential role in the transition towards a more sustainable and environmentally responsible global economy. As concerns over climate change, plastic pollution, and resource depletion escalate, there is a mounting demand for natural alternatives to synthetic polymers. Biopolymers, consisting of cellular components such as proteins, nucleotides, lipids, and polysaccharides, offer a sustainable solution due to their renewable nature and eco-friendly characteristics. Biopolymers such as chitosan, lignin, and cellulose have garnered significant attention in the energy and environmental sectors for their diverse qualities, including adsorption, flocculation, and anticoagulation abilities, which make them valuable for wastewater treatment and pollutant removal. Recent advancements have seen biopolymers being utilized in energy storage devices and as anticorrosive agents due to their strong coordination connections with metal surfaces. This growing emphasis on sustainable materials is driving innovation and investment in biopolymer research and development, positioning biopolymers as pivotal players in achieving environmental sustainability across various industries globally which drives Biopolymers Market growth. Challenge of Cost Competitiveness Compared to Traditional Petroleum-Based Plastics to hamper Market Growth The challenge of cost competitiveness compared to traditional petroleum-based plastics stands as a significant restraint in the Biopolymers Market. Biopolymers incur higher production costs due to various factors. The sourcing of bio-based feedstocks, such as plant-derived materials or microbial fermentation, is more expensive and subject to market fluctuations compared to the abundant and relatively inexpensive petroleum feedstocks. The processing technologies involved in converting these renewable resources into biopolymers require specialized equipment or methods, increasing production costs. The economies of scale play a crucial role, as the current production volumes of biopolymers are generally lower compared to traditional plastics, limiting opportunities for cost efficiencies. The lack of established infrastructure for biopolymer processing and recycling also contributes to higher costs, as it needs investments in new facilities and logistics networks. The higher cost of biopolymers acts as a deterrent to their widespread adoption, particularly in industries where price sensitivity is paramount, such as packaging and consumer goods which hamper Biopolymer Market growth.Biopolymers Market Segment Analysis

Based on End User, the market is segmented into Packaging, Agriculture, Automotive, Textile, Healthcare and Others. Packaging dominated the Biopolymers Market in 2023 and is expected to have the highest CAGR during the forecast period. Packaging emerges as the dominant end user of the Biopolymers industry, driven by the increasing need to enhance food safety, quality preservation, and environmental sustainability. While traditional non-biodegradable plastics have historically dominated food packaging due to their exceptional protective properties during transportation and storage, the current is shifting towards more sustainable alternatives. Biopolymers present a promising solution in this landscape, offering eco-friendly packaging options that not only mitigate environmental impact but also meet the necessary functionality and performance standards. Recent advancements in biopolymer-based packaging films have been pivotal, focusing on improving moisture resistance, heat tolerance, and barrier properties to match or surpass those of conventional plastics. Through innovations such as composite films and multilayer structures, biopolymers have successfully closed the gap in performance and cost-effectiveness, positioning themselves as viable alternatives in the packaging industry. Sustainable options such as PLA, PBAT, PVA, chitosan, and gelatin have emerged as frontrunners, demonstrating their efficacy in food preservation while addressing environmental concerns. The integration of essential oils, natural extracts, or nanoparticles into biopolymer formulations has enhanced their functionality and antimicrobial properties, ensuring prolonged shelf life and improved safety of packaged food products which Biopolymers Market growth. Beyond their technical capabilities, biopolymers provide a compelling narrative for brands and consumers alike, aligning with growing sustainability trends and consumer preferences for eco-friendly packaging solutions. This shift towards biopolymer-based packaging represents not only a strategic business opportunity for manufacturers but also a significant step towards a more sustainable and environmentally responsible future in the packaging industry.

Biopolymers Market Regional Insights

Asia Pacific held the largest Biopolymers Market share in 2023 and is expected to continue its dominance over the forecast period. The rapid industrialization and urbanization witnessed across Asia Pacific countries, including China, India, Japan, South Korea, and Southeast Asian nations, have fueled substantial demand for plastic materials across various sectors such as packaging, automotive, construction, and consumer goods. Alongside this growth comes increasing concerns about environmental degradation and plastic pollution, prompting governments, industries, and consumers to seek sustainable alternatives. As a result, there's a significant drive towards the adoption of biopolymers, which offer an eco-friendly option compared to traditional petroleum-based plastics. The region is home to a wealth of natural resources and agricultural commodities, providing abundant feedstock for the production of biopolymers which drive the regional Biopolymers Market growth. Countries such as Thailand, Malaysia, and Indonesia, for instance, boast extensive palm oil plantations, which are utilized to manufacture biobased polymers. Similarly, India and China have vast agricultural lands suitable for cultivating crops including sugarcane, corn, and cassava, which serve as feedstocks for bioplastics production. This availability of raw materials at relatively lower costs compared to regions such as Europe and North America enhances the competitiveness of biopolymer production in the Asia Pacific. Many countries in the region have implemented regulatory measures aimed at reducing plastic waste and promoting sustainable practices. 1. For example, China has introduced bans on single-use plastics in major cities and is investing in biopolymer research and development. Similarly, India has launched initiatives to encourage the use of biodegradable plastics and incentivize the development of biopolymer manufacturing facilities. Several governments offer tax incentives, subsidies, and grants to support the production and adoption of biopolymers, stimulating market growth. The increasing consumer awareness and preferences for environmentally friendly products are driving demand for biopolymers across various end-user industries. Consumers in countries such as Japan and South Korea, known for their advanced technological capabilities and high environmental consciousness, are increasingly opting for biodegradable and compostable packaging solutions, thereby boosting the Biopolymers Market in the region. The region is witnessing significant investments in research and development, leading to innovations in biopolymer technology and the development of novel materials with enhanced properties and functionalities.Biopolymers Market Scope: Inquire before buying

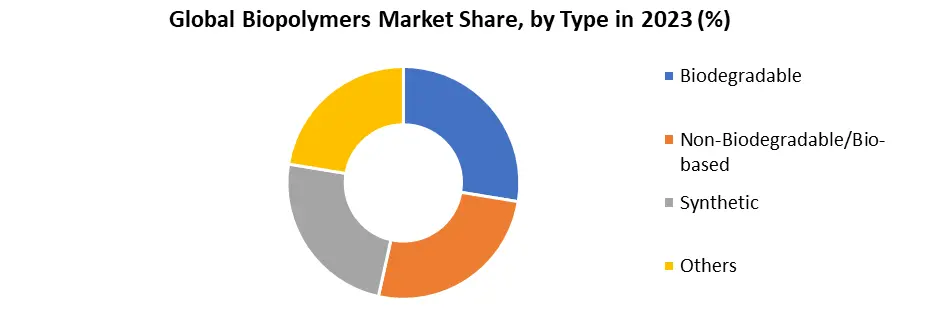

Global Biopolymers Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.06 Bn. Forecast Period 2024 to 2030 CAGR: 15.3% Market Size in 2030: US $ 22.37 Bn. Segments Covered: by Type Biodegradable Non-Biodegradable/Bio-based Synthetic Others by Application Films Bottle Fibers Seed Coating Vehicle Components Medical Implants Others by End User Packaging Agriculture Automotive Textile Healthcare Others Biopolymers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&ABiopolymers Key Players

North America 1. Danimer Scientific (Bainbridge, Georgia, USA 2. BioLogiQ, Inc. (Idaho Falls, Idaho, USA) 3. DuPont (Wilmington, Delaware, USA) 4. ADM (Archer Daniels Midland Company) 5. RETRN Bio 6. Ecovia Renewables 7. NatureWorks LLC (Minnetonka, Minnesota, USA) Europe 8. Corbion N.V. (Amsterdam, Netherlands) 9. Total Corbion PLA (Gorinchem, Netherlands) 10. Biome Bioplastics Ltd. (Southampton, United Kingdom) 11. Marine Biopolymers 12. Solanyl Biopolymers 13. Rodenburg Biopolymers 14. Biopolymer Solutions APAC 15. Mitsubishi Chemical Corporation (Tokyo, Japan) 16. Tianjin GreenBio Materials Co., Ltd. (Tianjin, China) 17. Jiangsu Torise Biomaterials Co., Ltd. (Jiangsu, China) 18. Suzhou Hanbang Biomaterials Co., Ltd. (Suzhou, China) 19. Tianan Biologic Material Co., Ltd. (Tianjin, China) 20. Jiangsu Tiansheng New Materials Co., Ltd. (Jiangsu, China) 21. SKYi FKuR Biopolymers Middle East & Africa 22. Saudi Polymers Company 23. Polymeron 24. Eagle Chemicals Group South America 25. Polynatural Frequently Asked Questions: 1] What is the growth rate of the Global Biopolymers Market? Ans. The Global Biopolymers Market is growing at a significant rate of 15.7% during the forecast period. 2] Which region is expected to dominate the Global Biopolymers Market? Ans. Asia Pacific is expected to dominate the Biopolymers Market during the forecast period. 3] What is the expected Global Biopolymers Market size by 2030? Ans. The Biopolymers Market size is expected to reach USD 22.37 Billion by 2030. 4] Which are the top players in the Global Biopolymers Market? Ans. The major top players in the Global Biopolymers Market are NatureWorks LLC (Minnetonka, Minnesota, USA), BASF SE (Ludwigshafen, Germany),Novamont S.p.A. (Novara, Italy),Danimer Scientific (Bainbridge, Georgia, USA),Corbion N.V. (Amsterdam, Netherlands),Green Dot Bioplastics (Cottonwood Falls, Kansas, USA), BioLogiQ, Inc. (Idaho Falls, Idaho, USA) and Others. 5] What are the factors driving the Global Biopolymers Market growth? Ans. The increasing environmental concerns, rising demand for sustainable materials, stringent regulations on conventional plastics, technological advancements in biopolymer production, and growing consumer awareness are expected to drive market growth during the forecast period.

1. Biopolymers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Biopolymers Market: Dynamics 2.1. Biopolymers Market Trends by Region 2.1.1. North America Biopolymers Market Trends 2.1.2. Europe Biopolymers Market Trends 2.1.3. Asia Pacific Biopolymers Market Trends 2.1.4. Middle East and Africa Biopolymers Market Trends 2.1.5. South America Biopolymers Market Trends 2.2. Biopolymers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Biopolymers Market Drivers 2.2.1.2. North America Biopolymers Market Restraints 2.2.1.3. North America Biopolymers Market Opportunities 2.2.1.4. North America Biopolymers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Biopolymers Market Drivers 2.2.2.2. Europe Biopolymers Market Restraints 2.2.2.3. Europe Biopolymers Market Opportunities 2.2.2.4. Europe Biopolymers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Biopolymers Market Drivers 2.2.3.2. Asia Pacific Biopolymers Market Restraints 2.2.3.3. Asia Pacific Biopolymers Market Opportunities 2.2.3.4. Asia Pacific Biopolymers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Biopolymers Market Drivers 2.2.4.2. Middle East and Africa Biopolymers Market Restraints 2.2.4.3. Middle East and Africa Biopolymers Market Opportunities 2.2.4.4. Middle East and Africa Biopolymers Market Challenges 2.2.5. South America 2.2.5.1. South America Biopolymers Market Drivers 2.2.5.2. South America Biopolymers Market Restraints 2.2.5.3. South America Biopolymers Market Opportunities 2.2.5.4. South America Biopolymers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Biopolymers Industry 2.8. Analysis of Government Schemes and Initiatives For Biopolymers Industry 2.9. Biopolymers Market Trade Analysis 2.10. The Global Pandemic Impact on Biopolymers Market 3. Biopolymers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Biopolymers Market Size and Forecast, by Type (2023-2030) 3.1.1. Biodegradable 3.1.2. Non-Biodegradable/Bio-based 3.1.3. Synthetic 3.1.4. Others 3.2. Biopolymers Market Size and Forecast, by Application (2023-2030) 3.2.1. Films 3.2.2. Bottle 3.2.3. Fibers 3.2.4. Seed Coating 3.2.5. Vehicle Components 3.2.6. Medical Implants 3.2.7. Others 3.3. Biopolymers Market Size and Forecast, by End User (2023-2030) 3.3.1. Packaging 3.3.2. Agriculture 3.3.3. Automotive 3.3.4. Textile 3.3.5. Healthcare 3.3.6. Others 3.4. Biopolymers Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Biopolymers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Biopolymers Market Size and Forecast, by Type (2023-2030) 4.1.1. Biodegradable 4.1.2. Non-Biodegradable/Bio-based 4.1.3. Synthetic 4.1.4. Others 4.2. North America Biopolymers Market Size and Forecast, by Application (2023-2030) 4.2.1. Films 4.2.2. Bottle 4.2.3. Fibers 4.2.4. Seed Coating 4.2.5. Vehicle Components 4.2.6. Medical Implants 4.2.7. Others 4.3. North America Biopolymers Market Size and Forecast, by End User (2023-2030) 4.3.1. Packaging 4.3.2. Agriculture 4.3.3. Automotive 4.3.4. Textile 4.3.5. Healthcare 4.3.6. Others 4.4. North America Biopolymers Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Biopolymers Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Biodegradable 4.4.1.1.2. Non-Biodegradable/Bio-based 4.4.1.1.3. Synthetic 4.4.1.1.4. Others 4.4.1.2. United States Biopolymers Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Films 4.4.1.2.2. Bottle 4.4.1.2.3. Fibers 4.4.1.2.4. Seed Coating 4.4.1.2.5. Vehicle Components 4.4.1.2.6. Medical Implants 4.4.1.2.7. Others 4.4.1.3. United States Biopolymers Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Packaging 4.4.1.3.2. Agriculture 4.4.1.3.3. Automotive 4.4.1.3.4. Textile 4.4.1.3.5. Healthcare 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Biopolymers Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Biodegradable 4.4.2.1.2. Non-Biodegradable/Bio-based 4.4.2.1.3. Synthetic 4.4.2.1.4. Others 4.4.2.2. Canada Biopolymers Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Films 4.4.2.2.2. Bottle 4.4.2.2.3. Fibers 4.4.2.2.4. Seed Coating 4.4.2.2.5. Vehicle Components 4.4.2.2.6. Medical Implants 4.4.2.2.7. Others 4.4.2.3. Canada Biopolymers Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Packaging 4.4.2.3.2. Agriculture 4.4.2.3.3. Automotive 4.4.2.3.4. Textile 4.4.2.3.5. Healthcare 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Biopolymers Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Biodegradable 4.4.3.1.2. Non-Biodegradable/Bio-based 4.4.3.1.3. Synthetic 4.4.3.1.4. Others 4.4.3.2. Mexico Biopolymers Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Films 4.4.3.2.2. Bottle 4.4.3.2.3. Fibers 4.4.3.2.4. Seed Coating 4.4.3.2.5. Vehicle Components 4.4.3.2.6. Medical Implants 4.4.3.2.7. Others 4.4.3.3. Mexico Biopolymers Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Packaging 4.4.3.3.2. Agriculture 4.4.3.3.3. Automotive 4.4.3.3.4. Textile 4.4.3.3.5. Healthcare 4.4.3.3.6. Others 5. Europe Biopolymers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Biopolymers Market Size and Forecast, by Type (2023-2030) 5.2. Europe Biopolymers Market Size and Forecast, by Application (2023-2030) 5.3. Europe Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4. Europe Biopolymers Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Biopolymers Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Biopolymers Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Biopolymers Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Biopolymers Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Biopolymers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Biopolymers Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Biopolymers Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Biopolymers Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Biopolymers Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Biopolymers Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Biopolymers Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Biopolymers Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Biopolymers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Biopolymers Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Biopolymers Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Biopolymers Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Biopolymers Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Biopolymers Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Biopolymers Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Biopolymers Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Biopolymers Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Biopolymers Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Biopolymers Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Biopolymers Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Biopolymers Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Biopolymers Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Biopolymers Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Biopolymers Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Biopolymers Market Size and Forecast, by End User (2023-2030) 8. South America Biopolymers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Biopolymers Market Size and Forecast, by Type (2023-2030) 8.2. South America Biopolymers Market Size and Forecast, by Application (2023-2030) 8.3. South America Biopolymers Market Size and Forecast, by End User(2023-2030) 8.4. South America Biopolymers Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Biopolymers Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Biopolymers Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Biopolymers Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Biopolymers Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Biopolymers Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Biopolymers Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Biopolymers Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Biopolymers Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Biopolymers Market Size and Forecast, by End User (2023-2030) 9. Global Biopolymers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Biopolymers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Danimer Scientific (Bainbridge, Georgia, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BioLogiQ, Inc. (Idaho Falls, Idaho, USA) 10.3. DuPont (Wilmington, Delaware, USA) 10.4. ADM (Archer Daniels Midland Company) 10.5. RETRN Bio 10.6. Ecovia Renewables 10.7. NatureWorks LLC (Minnetonka, Minnesota, USA) 10.8. Corbion N.V. (Amsterdam, Netherlands) 10.9. Total Corbion PLA (Gorinchem, Netherlands) 10.10. Biome Bioplastics Ltd. (Southampton, United Kingdom) 10.11. Marine Biopolymers 10.12. Solanyl Biopolymers 10.13. Rodenburg Biopolymers 10.14. Biopolymer Solutions 10.15. Mitsubishi Chemical Corporation (Tokyo, Japan) 10.16. Tianjin GreenBio Materials Co., Ltd. (Tianjin, China) 10.17. Jiangsu Torise Biomaterials Co., Ltd. (Jiangsu, China) 10.18. Suzhou Hanbang Biomaterials Co., Ltd. (Suzhou, China) 10.19. Tianan Biologic Material Co., Ltd. (Tianjin, China) 10.20. Jiangsu Tiansheng New Materials Co., Ltd. (Jiangsu, China) 10.21. SKYi FKuR Biopolymers 10.22. Saudi Polymers Company 10.23. Polymeron 10.24. Eagle Chemicals Group 10.25. Polynatural 11. Key Findings 12. Industry Recommendations 13. Biopolymers Market: Research Methodology 14. Terms and Glossary