The Big Data Market size was valued at USD 217.2 Billion in 2023 and the total Big Data revenue is expected to grow at a CAGR of 12.4 % from 2024 to 2030, reaching nearly USD 492.29 Billion by 2030.Big Data Market Overview:

Big Data refers to the immense volume of structured, semi-structured, and unstructured data that exceeds the capabilities of traditional data processing methods. The Big Data market focuses on harnessing the potential within this wealth of information, offering tools and technologies to extract valuable insights, patterns, and trends. The utilization of advanced analytics, machine learning, and artificial intelligence distinguishes the Big Data market as a driving force behind data-driven decision-making and innovation across various industries. In essence, the Big Data market revolves around empowering businesses to leverage their data for strategic purposes, unlocking new avenues for growth, efficiency, and competitiveness. As organizations recognize the significance of turning data into actionable intelligence, the Big Data market continues to enlarge, providing solutions that cater to the evolving needs of enterprises seeking to navigate the complexities of the digital age. The Big Data market is a dynamic and rapidly evolving sector that plays a pivotal role in transforming the way organizations handle and derive insights from vast and complex datasets. Characterized by the continuous influx of information from diverse sources such as social media, IoT devices, and digital platforms, the Big Data market encompasses a spectrum of solutions and services tailored to manage, process, and analyze this massive volume of data. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Big Data Market.To know about the Research Methodology :- Request Free Sample Report

Big Data Market Dynamics

Increasing Data Volume with Business Intelligence and Analytics Demand Driving Big Data Market Penetration The exponential growth in data generation, fueled by digitalization, IoT devices, and online activities, is a significant driver for the Big Data market. Businesses are leveraging big data analytics to extract valuable insights from vast datasets, enabling informed decision-making and contributing to the overall growth of the Big Data Market. The rising demand for business intelligence and analytics solutions drives the Big Data market penetration. Organizations recognize the potential of extracting actionable insights from large datasets to gain a competitive edge, optimize operations, and identify new business opportunities, leading to increased market penetration. Technological advancements, including machine learning, artificial intelligence, and data science, contribute to the growth of the Big Data market. These technologies enhance the capabilities of big data analytics, allowing for more sophisticated analysis and predictive modeling, fostering innovation in the industry. Industries such as finance, healthcare, and telecommunications require real-time data processing capabilities. The Big Data market addresses this demand by offering solutions that enable organizations to process and analyze data in real-time, leading to quicker and more accurate decision-making and creating new opportunities in the Big Data Market. Businesses across various sectors are placing a greater emphasis on enhancing customer experience. Big Data analytics helps organizations understand customer behavior, preferences, and trends, enabling personalized services and targeted marketing strategies, reflecting an emerging trend in the Big Data Market. Data Privacy and Security Concerns Impacting Big Data Market Fluctuation As the volume of data collected and processed increases, concerns about data privacy and security become more pronounced. Stringent regulations and the need for robust security measures pose challenges for organizations utilizing Big Data solutions, contributing to fluctuations in the Big Data Market. The implementation of Big Data solutions often involves substantial upfront costs for hardware, software, and skilled personnel. This cost barrier be a restraint for smaller organizations or those with budget constraints, necessitating a thorough pricing analysis in the Big Data Market. The shortage of skilled professionals in the field of big data analytics poses a challenge for organizations seeking to fully capitalize on their data. The complex nature of big data technologies requires expertise in data science, machine learning, and related domains, impacting the overall share in the Big Data Market. Integrating big data solutions with existing IT infrastructure is challenging. Compatibility issues, data migration complexities, and the need for seamless integration with other enterprise systems hinder the adoption of Big Data technologies, affecting the industry dynamics in the Big Data Market. The quality of data is crucial for accurate analysis and decision-making. Incomplete, inaccurate, or inconsistent data lead to erroneous insights, impacting the overall share in the Big Data Market. Maintaining data quality remains a challenge, especially when dealing with large and diverse datasets.

Big Data Market Segment Analysis

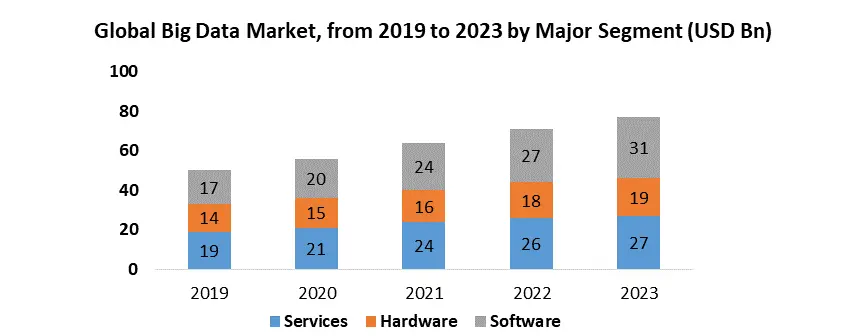

Component: Big Data Analytics software plays a pivotal role in extracting meaningful insights from vast datasets. It involves advanced analytical techniques, including predictive modeling and machine learning, contributing significantly to the Big Data Market's growth. Data discovery and visualization software empower users to explore and understand complex datasets through intuitive visual representations. This component enhances decision-making processes within organizations, making it a major segment in the Big Data Market with a significant share. Data management software ensures efficient storage, retrieval, and processing of large volumes of data. It encompasses tools for data cleansing, integration, and governance, critical for maintaining data quality. As a dominant segment, data management holds a key position in shaping the Big Data Market. Consulting and system integration services assist organizations in implementing and optimizing Big Data solutions. Experts provide strategic guidance and seamlessly integrate these solutions into existing IT infrastructures. Consulting and system integration emerge as a booming segment with high potential for market penetration. Training and support services are essential for ensuring that organizations harness the full potential of Big Data technologies. Training programs and ongoing support contribute to skill development and effective utilization, making training and support a major segment in the Big Data Market. Managed services involve outsourcing aspects of Big Data infrastructure management. This segment offers organizations operational efficiency, scalability, and expert management of their Big Data solutions, establishing it as a prominent segment with a significant market share. Data Type: Structured data, organized in a tabular format, includes databases and spreadsheets. Big Data solutions for structured data focus on processing and analyzing information with well-defined categories, making it a major segment with a dominant market share. Semi-structured data combines elements of both structured and unstructured data. This includes data with tags, metadata, and hierarchical structures, requiring specialized processing techniques. The semi-structured data segment is characterized by emerging trends and innovation in the Big Data Market. Unstructured data encompasses text, images, audio, and video files. Big Data solutions for unstructured data leverage advanced techniques, such as natural language processing and image recognition, to extract insights. The unstructured data segment represents an opportunity for innovation and growth in the Big Data Market. Deployment Model: On-premises deployment involves implementing Big Data solutions within an organization's infrastructure. This model provides greater control over data but requires substantial hardware and maintenance investments, making it a major segment in the Big Data Market. On-demand, or cloud-based, deployment allows organizations to access Big Data services over the internet. This model offers scalability, cost-effectiveness, and flexibility, enabling businesses to pay for resources as needed. The on-demand deployment segment showcases fluctuation and evolving preferences in the Big Data Market. Industry Vertical: The BFSI sector leverages Big Data for risk management, fraud detection, customer insights, and personalized financial services, making it a leading and major segment in the Big Data Market. Governments and defense entities utilize Big Data for intelligence analysis, cybersecurity, and public service optimization. The government and defense segment hold a dominant position in the Big Data Market due to its critical applications. Big Data applications in healthcare include patient care optimization, drug discovery, and personalized medicine. The healthcare and life sciences segment represents a booming sector with significant growth potential in the Big Data Market. Big Data supports predictive maintenance, supply chain optimization, and quality control in the manufacturing sector. Manufacturing is a major segment in the Big Data Market, contributing to the industry's growth and innovation. Retailers benefit from Big Data in areas like inventory management, demand forecasting, and personalized marketing, making the retail and consumer goods segment a key player in the Big Data Market. Big Data enhances content recommendation, audience analysis, and marketing strategies in the media and entertainment industry. The media and entertainment segment contributes significantly to the Big Data Market's share with its innovative applications. Big Data aids in smart grid management, predictive maintenance, and energy consumption optimization in the energy and utility sector. The energy and utility segment represent a major player in the Big Data Market, driving innovation and efficiency. The transportation industry utilizes Big Data for route optimization, predictive maintenance, and demand forecasting. Transportation is a significant regional segment with unique challenges and opportunities in the Big Data Market. Big Data applications in this sector include network optimization, customer experience enhancement, and predictive analytics. The IT and telecommunication segment showcase fluctuation and responsiveness to emerging trends in the Big Data Market. Academic and research institutions leverage Big Data for scientific research, data-driven insights, and collaborative projects. The academia and research segment represent a regional focus on knowledge creation and innovation in the Big Data Market. This category encompasses various industries adopting Big Data for specific applications tailored to their needs. The "others" segment showcases diversity and niche opportunities within the Big Data Market.

Big Data Market Regional Analysis

North America, particularly the United States, exhibits robust regional growth in the Big Data Market. The U.S. leads the way with substantial market potential, driven by its advanced technological infrastructure and early adoption of Big Data solutions. In this region, the Big Data Market shares are significant, with key players in the U.S., Canada, and Mexico actively contributing to the industry's growth. Factors such as the widespread application of analytics in finance, healthcare, and IT industries contribute to North America's position as a major player in the global Big Data Market. The emphasis on emerging trends and innovation further strengthens the region's foothold in the industry. Asia Pacific emerges as a dynamic and rapidly growing region in the Big Data Market, showcasing immense potential for market penetration and expansion. Key economies like China, India, and Japan contribute significantly to the region's growth. The adoption of digital technologies and the widespread availability of smartphones and internet connectivity fuel the demand for Big Data solutions. Industries in Asia Pacific, including manufacturing, healthcare, and telecommunications, actively invest in analytics to enhance operational efficiency. The region presents lucrative opportunities for Big Data Market share in countries like China and South Korea, making it a focal point for industry growth. Europe holds a major share in the Big Data Market, driven by a well-established IT landscape and a focus on technological innovation. Key players in Germany, the United Kingdom, and France contribute significantly to the region's Big Data market share. European industries, spanning finance, healthcare, and manufacturing, leverage data analytics for decision-making and optimization. The region's commitment to data privacy and security aligns with the challenges posed by Big Data analytics. Strategic investments in research and development further strengthen Europe's position as a dominant player in the global Big Data Market, with notable regional growth in Germany and France. The Middle East and Africa are witnessing a growing Big Data Market, fueled by increased digitization and a focus on data-driven decision-making. Governments and businesses in the region recognize the potential of Big Data solutions for enhancing efficiency and competitiveness. Industries such as finance, energy, and healthcare actively invest in analytics applications, contributing to regional growth. As an emerging market with untapped potential, the Middle East and Africa present opportunities for Big Data Market share expansion. The region's unique challenges and opportunities, coupled with strategic initiatives, contribute to its significance in the global Big Data landscape.

Big Data Market Competitive Landscape

Deloitte, a major Big Data market share holder, has entered into a global collaboration with IBM to enhance sustainability outcomes for organizations universal. The collaboration integrates IBM’s Envizi ESG Suite with Deloitte’s GreenLight Solution, aiming to streamline data, elevate insights, and accelerate transformation for end-to-end environmental needs. The collaboration emphasizes helping clients achieve improved sustainability outcomes by leveraging multiple IBM solutions and integrating data from the IBM Envizi ESG Suite with Deloitte’s GreenLight Solution. Deloitte’s GreenLight Solution, a global Big Data market player, contributes to sustainability performance improvements, providing analysis on global credits, incentives, abatement strategies, and tools for planning and managing net-zero goals. On the other hand, IBM Envizi, a prominent manufacturer in the Big Data market, consolidates environmental, social, and governance (ESG) data into a single system, supporting emissions calculations, ESG reporting, and providing insights for decarbonization projects. The collaboration allows clients to transform organizations, drawing insights from Envizi while leveraging Deloitte’s extensive experience in sustainability and climate client service. The integration with IBM Envizi aims to streamline capabilities in data-driven insights and strategic action, helping organizations set strategies, embed sustainability, and address disclosure and regulatory requirements. The collaboration focuses on providing organizations with rapid access to data, enhancing insights, and understanding options for accelerated action toward climate and sustainability goals. IBM, a leading key player in the Big Data market, and Meta have jointly launched the AI Alliance, an international community of leading technology developers, researchers, and adopters collaborating to advance open, safe, and responsible AI. The alliance includes over 50 founding members and collaborators globally, such as AMD, CERN, Dell Technologies, Linux Foundation, Oracle, Sony Group, and many others. The AI Alliance aims to support open innovation and open science in AI, fostering collaboration among various institutions to shape AI evolution. The AI Alliance focuses on creating opportunities for AI researchers, builders, and adopters to empower them with information and tools for harnessing advancements in ways that prioritize safety, diversity, economic opportunity, and benefits to all. The alliance aims to accelerate responsible innovation in AI by enabling developers and researchers to work collaboratively on open initiatives that address safety concerns and provide a platform for sharing and developing solutions. Informatica, a global Big Data market player, and Oracle have strengthened their strategic collaboration, enhancing the partnership with the creation of an Oracle Cloud Infrastructure (OCI) point of delivery for thousands of joint customers in North America. The collaboration includes new integrations and capabilities for Informatica’s Intelligent Data Management Cloud (IDMC) across Oracle’s Modern Data Platform. IDMC offers an integrated suite of capabilities, providing clean, secure, and trusted data to empower AI/ML utilization and accelerate modernization journeys. As a cloud-native, AI-powered data management platform, IDMC offers shared Informatica-Oracle customers a common data management experience with consistent governance across cloud and on-premises architectures. The collaboration is designed to deliver a seamless and integrated experience for customers, simplifying the entire data lifecycle and ensuring data governance across various environments. Microsoft, a major Big Data market share holder, has prolonged its partnership with Oracle to bring customers' mission-critical database workloads to Azure. This expansion enables Oracle's 430,000 customers to apply Microsoft cloud services to Oracle's mission-critical databases. Azure becomes the only cloud provider, aside from Oracle Cloud Infrastructure, hosting Oracle services, including Oracle Exadata Database Service and Oracle Autonomous Database on Oracle Cloud Infrastructure in Azure data centers. This collaboration addresses the needs of customers moving critical data environments to the cloud, offering seamless connectivity to new and massive-scale cloud services. The joint effort aims to reduce common hurdles faced by customers during workload migrations to the public cloud. The new offering, Oracle Database Azure, allows customers to migrate Oracle databases "as is" to Oracle Cloud Infrastructure and deploy them in Azure alongside their current workloads in the Microsoft Cloud. Customers, including Fidelity, PepsiCo, Vodafone, and Voya Financial, have expressed interest in this solution, highlighting its relevance across various industriesGlobal Big Data Market Scope: Inquire before buying

Global Big Data Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 217.2 Bn. Forecast Period 2024 to 2030 CAGR: 12.4% Market Size in 2030: US $ 492.29 Bn. Segments Covered: By Component Software Big data analytics Data Discovery and visualization Data management Services Consulting and system integration Training and support Managed services By Data Type Structured Semi-Structured Unstructured By Deployment Model On-Premises On-Demand By Industry Vertical Banking, Financial Services, and Insurance (BFSI) Government and Defense Healthcare and life sciences Manufacturing Retail and consumer goods Media and Entertainment Energy and utility Transportation IT and telecommunication Academia and research Others Global Big Data Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Big Data Market Key Players:

Major Global Key Players: 1. Microsoft Corporation (United States) 2. Oracle Corporation (United States) 3. IBM Corporation (United States) Leading Key Players in North America: 1. Amazon Web Services, Inc. (United States) 2. SAS Institute Inc. (United States) 3. Teradata Corporation (United States) Market Follower key Players in Europe: 1. SAP SE (Germany) 2. Atos SE (France) 3. Capgemini SE (France) 4. Software AG (Germany) 5. Cloudera, Inc. (United Kingdom) Prominent Key player Asia Pacific: 1. Alibaba Group Holding Limited (China) 2. Tata Consultancy Services Limited (TCS) (India) 3. Huawei Technologies Co., Ltd. (China) 4. Baidu, Inc. (China) 5. NEC Corporation (Japan) Market Leader Key Players in Middle East and Africa: 1. SAS Institute Inc. (United Arab Emirates) 2. Teradata Corporation (South Africa) Dominant key Player in South America: 1. Cloudera, Inc. (Brazil)FAQ’s:

1. What is the Big Data market? Ans: The Big Data market refers to the industry involved in providing solutions and services for the collection, storage, processing, and analysis of large and complex datasets. 2. What are the key drivers of growth in the Big Data market? Ans: The major drivers include the increasing volume of data, demand for business intelligence and analytics, emergence of advanced technologies like AI and machine learning, real-time data processing needs, and a focus on enhancing customer experience. 3. Which companies are major players in the Big Data market? Ans: Key global players include Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., SAP SE, and Oracle Corporation. 4. How is Big Data used in different industries? Ans: Big Data is utilized across various sectors, including finance, healthcare, manufacturing, retail, telecommunications, and more, for purposes such as risk management, personalized services, predictive maintenance, and optimization. 5. What are the challenges facing the Big Data market? Ans: Challenges include data privacy and security concerns, high implementation costs, a shortage of skilled professionals, integration complexities, and concerns about data quality.

1. Big Data Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Big Data Market: Dynamics 2.1. Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.2.1. Drivers 2.2.2.2. Restraints 2.2.2.3. Opportunities 2.2.2.4. Challenges 2.2.3. Asia Pacific 2.2.3.1. Drivers 2.2.3.2. Restraints 2.2.3.3. Opportunities 2.2.3.4. Challenges 2.2.4. Middle East and Africa 2.2.4.1. Drivers 2.2.4.2. Restraints 2.2.4.3. Opportunities 2.2.4.4. Challenges 2.2.5. South America 2.2.5.1. Drivers 2.2.5.2. Restraints 2.2.5.3. Opportunities 2.2.5.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technological Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Analysis of Government Schemes and Initiatives For Big Data Industry 2.8. Key Opinion Leader Analysis 2.9. The Global Pandemic Impact on Big Data Market 3. Big Data Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Big Data Market Size and Forecast, By Component (2023-2030) 3.1.1. Software 3.1.2. Big data analytics 3.1.3. Data Discovery and visualization 3.1.4. Data management 3.1.5. Services 3.1.6. Consulting and system integration 3.1.7. Training and support 3.1.8. Managed services 3.2. Big Data Market Size and Forecast, By Data Type (2023-2030) 3.2.1. Structured 3.2.2. Semi-Structured 3.2.3. Unstructured 3.3. Big Data Market Size and Forecast, By Deployment Model (2023-2030) 3.3.1. On-Premises 3.3.2. On-Demand 3.4. Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 3.4.1. Banking, Financial Services, and Insurance (BFSI) 3.4.2. Government and Defense 3.4.3. Healthcare and life sciences 3.4.4. Manufacturing 3.4.5. Retail and consumer goods 3.4.6. Media and Entertainment 3.4.7. Energy and utility 3.4.8. Transportation 3.4.9. IT and telecommunication 3.4.10. Academia and research 3.4.11. Others 3.5. Big Data Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Big Data Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Big Data Market Size and Forecast, By Component (2023-2030) 4.1.1. Software 4.1.2. Big data analytics 4.1.3. Data Discovery and visualization 4.1.4. Data management 4.1.5. Services 4.1.6. Consulting and system integration 4.1.7. Training and support 4.1.8. Managed services 4.2. North America Big Data Market Size and Forecast, By Data Type (2023-2030) 4.2.1. Structured 4.2.2. Semi-Structured 4.2.3. Unstructured 4.3. North America Big Data Market Size and Forecast, By Deployment Model (2023-2030) 4.3.1. On-Premises 4.3.2. On-Demand 4.4. North America Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 4.4.1. Banking, Financial Services, and Insurance (BFSI) 4.4.2. Government and Defense 4.4.3. Healthcare and life sciences 4.4.4. Manufacturing 4.4.5. Retail and consumer goods 4.4.6. Media and Entertainment 4.4.7. Energy and utility 4.4.8. Transportation 4.4.9. IT and telecommunication 4.4.10. Academia and research 4.4.11. Others 4.5. North America Big Data Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Big Data Market Size and Forecast, By Component (2023-2030) 4.5.1.1.1. Software 4.5.1.1.2. Big data analytics 4.5.1.1.3. Data Discovery and visualization 4.5.1.1.4. Data management 4.5.1.1.5. Services 4.5.1.1.6. Consulting and system integration 4.5.1.1.7. Training and support 4.5.1.1.8. Managed services 4.5.1.2. United States Big Data Market Size and Forecast, By Data Type (2023-2030) 4.5.1.2.1. Structured 4.5.1.2.2. Semi-Structured 4.5.1.2.3. Unstructured 4.5.1.3. United States Big Data Market Size and Forecast, By Deployment Model (2023-2030) 4.5.1.3.1. On-Premises 4.5.1.3.2. On-Demand 4.5.1.4. United States Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 4.5.1.4.1. Banking, Financial Services, and Insurance (BFSI) 4.5.1.4.2. Government and Defense 4.5.1.4.3. Healthcare and life sciences 4.5.1.4.4. Manufacturing 4.5.1.4.5. Retail and consumer goods 4.5.1.4.6. Media and Entertainment 4.5.1.4.7. Energy and utility 4.5.1.4.8. Transportation 4.5.1.4.9. IT and telecommunication 4.5.1.4.10. Academia and research 4.5.1.4.11. Others 4.5.2. Canada 4.5.2.1. Canada Big Data Market Size and Forecast, By Component (2023-2030) 4.5.2.1.1. Software 4.5.2.1.2. Big data analytics 4.5.2.1.3. Data Discovery and visualization 4.5.2.1.4. Data management 4.5.2.1.5. Services 4.5.2.1.6. Consulting and system integration 4.5.2.1.7. Training and support 4.5.2.1.8. Managed services 4.5.2.2. Canada Big Data Market Size and Forecast, By Data Type (2023-2030) 4.5.2.2.1. Structured 4.5.2.2.2. Semi-Structured 4.5.2.2.3. Unstructured 4.5.2.3. Canada Big Data Market Size and Forecast, By Deployment Model (2023-2030) 4.5.2.3.1. On-Premises 4.5.2.3.2. On-Demand 4.5.2.4. Canada Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 4.5.2.4.1. Banking, Financial Services, and Insurance (BFSI) 4.5.2.4.2. Government and Defense 4.5.2.4.3. Healthcare and life sciences 4.5.2.4.4. Manufacturing 4.5.2.4.5. Retail and consumer goods 4.5.2.4.6. Media and Entertainment 4.5.2.4.7. Energy and utility 4.5.2.4.8. Transportation 4.5.2.4.9. IT and telecommunication 4.5.2.4.10. Academia and research 4.5.2.4.11. Others 4.5.3. Mexico 4.5.3.1. Mexico Big Data Market Size and Forecast, By Component (2023-2030) 4.5.3.1.1. Software 4.5.3.1.2. Big data analytics 4.5.3.1.3. Data Discovery and visualization 4.5.3.1.4. Data management 4.5.3.1.5. Services 4.5.3.1.6. Consulting and system integration 4.5.3.1.7. Training and support 4.5.3.1.8. Managed services 4.5.3.2. Mexico Big Data Market Size and Forecast, By Data Type (2023-2030) 4.5.3.2.1. Structured 4.5.3.2.2. Semi-Structured 4.5.3.2.3. Unstructured 4.5.3.3. Mexico Big Data Market Size and Forecast, By Deployment Model (2023-2030) 4.5.3.3.1. On-Premises 4.5.3.3.2. On-Demand 4.5.3.4. Mexico Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 4.5.3.4.1. Banking, Financial Services, and Insurance (BFSI) 4.5.3.4.2. Government and Defense 4.5.3.4.3. Healthcare and life sciences 4.5.3.4.4. Manufacturing 4.5.3.4.5. Retail and consumer goods 4.5.3.4.6. Media and Entertainment 4.5.3.4.7. Energy and utility 4.5.3.4.8. Transportation 4.5.3.4.9. IT and telecommunication 4.5.3.4.10. Academia and research 4.5.3.4.11. Others 5. Europe Big Data Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Big Data Market Size and Forecast, By Component (2023-2030) 5.2. Europe Big Data Market Size and Forecast, By Data Type (2023-2030) 5.3. Europe Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.4. Europe Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5. Europe Big Data Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Big Data Market Size and Forecast, By Component (2023-2030) 5.5.1.2. United Kingdom Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.1.3. United Kingdom Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.1.4. United Kingdom Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5.2. France 5.5.2.1. France Big Data Market Size and Forecast, By Component (2023-2030) 5.5.2.2. France Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.2.3. France Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.2.4. France Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Big Data Market Size and Forecast, By Component (2023-2030) 5.5.3.2. Germany Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.3.3. Germany Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.3.4. Germany Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Big Data Market Size and Forecast, By Component (2023-2030) 5.5.4.2. Italy Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.4.3. Italy Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.4.4. Italy Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Big Data Market Size and Forecast, By Component (2023-2030) 5.5.5.2. Spain Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.5.3. Spain Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.5.4. Spain Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Big Data Market Size and Forecast, By Component (2023-2030) 5.5.6.2. Sweden Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.6.3. Sweden Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.6.4. Sweden Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Big Data Market Size and Forecast, By Component (2023-2030) 5.5.7.2. Austria Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.7.3. Austria Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.7.4. Austria Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Big Data Market Size and Forecast, By Component (2023-2030) 5.5.8.2. Rest of Europe Big Data Market Size and Forecast, By Data Type (2023-2030) 5.5.8.3. Rest of Europe Big Data Market Size and Forecast, By Deployment Model (2023-2030) 5.5.8.4. Rest of Europe Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6. Asia Pacific Big Data Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Big Data Market Size and Forecast, By Component (2023-2030) 6.2. Asia Pacific Big Data Market Size and Forecast, By Data Type (2023-2030) 6.3. Asia Pacific Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.4. Asia Pacific Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5. Asia Pacific Big Data Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Big Data Market Size and Forecast, By Component (2023-2030) 6.5.1.2. China Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.1.3. China Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.1.4. China Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Big Data Market Size and Forecast, By Component (2023-2030) 6.5.2.2. S Korea Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.2.3. S Korea Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.2.4. S Korea Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Big Data Market Size and Forecast, By Component (2023-2030) 6.5.3.2. Japan Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.3.3. Japan Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.3.4. Japan Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.4. India 6.5.4.1. India Big Data Market Size and Forecast, By Component (2023-2030) 6.5.4.2. India Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.4.3. India Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.4.4. India Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Big Data Market Size and Forecast, By Component (2023-2030) 6.5.5.2. Australia Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.5.3. Australia Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.5.4. Australia Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Big Data Market Size and Forecast, By Component (2023-2030) 6.5.6.2. Indonesia Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.6.3. Indonesia Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.6.4. Indonesia Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Big Data Market Size and Forecast, By Component (2023-2030) 6.5.7.2. Malaysia Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.7.3. Malaysia Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.7.4. Malaysia Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Big Data Market Size and Forecast, By Component (2023-2030) 6.5.8.2. Vietnam Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.8.3. Vietnam Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.8.4. Vietnam Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Big Data Market Size and Forecast, By Component (2023-2030) 6.5.9.2. Taiwan Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.9.3. Taiwan Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.9.4. Taiwan Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Big Data Market Size and Forecast, By Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Big Data Market Size and Forecast, By Data Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Big Data Market Size and Forecast, By Deployment Model (2023-2030) 6.5.10.4. Rest of Asia Pacific Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 7. Middle East and Africa Big Data Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Big Data Market Size and Forecast, By Component (2023-2030) 7.2. Middle East and Africa Big Data Market Size and Forecast, By Data Type (2023-2030) 7.3. Middle East and Africa Big Data Market Size and Forecast, By Deployment Model (2023-2030) 7.4. Middle East and Africa Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 7.5. Middle East and Africa Big Data Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Big Data Market Size and Forecast, By Component (2023-2030) 7.5.1.2. South Africa Big Data Market Size and Forecast, By Data Type (2023-2030) 7.5.1.3. South Africa Big Data Market Size and Forecast, By Deployment Model (2023-2030) 7.5.1.4. South Africa Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Big Data Market Size and Forecast, By Component (2023-2030) 7.5.2.2. GCC Big Data Market Size and Forecast, By Data Type (2023-2030) 7.5.2.3. GCC Big Data Market Size and Forecast, By Deployment Model (2023-2030) 7.5.2.4. GCC Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Big Data Market Size and Forecast, By Component (2023-2030) 7.5.3.2. Nigeria Big Data Market Size and Forecast, By Data Type (2023-2030) 7.5.3.3. Nigeria Big Data Market Size and Forecast, By Deployment Model (2023-2030) 7.5.3.4. Nigeria Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Big Data Market Size and Forecast, By Component (2023-2030) 7.5.4.2. Rest of ME&A Big Data Market Size and Forecast, By Data Type (2023-2030) 7.5.4.3. Rest of ME&A Big Data Market Size and Forecast, By Deployment Model (2023-2030) 7.5.4.4. Rest of ME&A Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 8. South America Big Data Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Big Data Market Size and Forecast, By Component (2023-2030) 8.2. South America Big Data Market Size and Forecast, By Data Type (2023-2030) 8.3. South America Big Data Market Size and Forecast, By Deployment Model (2023-2030) 8.4. South America Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 8.5. South America Big Data Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Big Data Market Size and Forecast, By Component (2023-2030) 8.5.1.2. Brazil Big Data Market Size and Forecast, By Data Type (2023-2030) 8.5.1.3. Brazil Big Data Market Size and Forecast, By Deployment Model (2023-2030) 8.5.1.4. Brazil Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Big Data Market Size and Forecast, By Component (2023-2030) 8.5.2.2. Argentina Big Data Market Size and Forecast, By Data Type (2023-2030) 8.5.2.3. Argentina Big Data Market Size and Forecast, By Deployment Model (2023-2030) 8.5.2.4. Argentina Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Big Data Market Size and Forecast, By Component (2023-2030) 8.5.3.2. Rest Of South America Big Data Market Size and Forecast, By Data Type (2023-2030) 8.5.3.3. Rest Of South America Big Data Market Size and Forecast, By Deployment Model (2023-2030) 8.5.3.4. Rest Of South America Big Data Market Size and Forecast, By Industry Vertical (2023-2030) 9. Global Big Data Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Manufacturing Locations 9.4. Leading Big Data Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Microsoft Corporation (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Oracle Corporation (United States) 10.3. IBM Corporation (United States) 10.4. Amazon Web Services, Inc. (United States) 10.5. SAS Institute Inc. (United States) 10.6. Teradata Corporation (United States) 10.7. SAP SE (Germany) 10.8. Atos SE (France) 10.9. Capgemini SE (France) 10.10. Software AG (Germany) 10.11. Cloudera, Inc. (United Kingdom) 10.12. Alibaba Group Holding Limited (China) 10.13. Tata Consultancy Services Limited (TCS) (India) 10.14. Huawei Technologies Co., Ltd. (China) 10.15. Baidu, Inc. (China) 10.16. NEC Corporation (Japan) 10.17. SAS Institute Inc. (United Arab Emirates) 10.18. Teradata Corporation (South Africa) 10.19. Cloudera, Inc. (Brazil) 11. Key Findings 12. Industry Recommendations 13. Big Data Market: Research Methodology.