Global Aerographite Market size was valued at USD 4.9 Mn in 2022 and is expected to reach USD 7.77 Mn by 2029, at a CAGR of 6.8 %.Aerographite Market Overview

Aerographite, a significant synthetic foam composed of an interconnected network of tabular carbon structures, has garnered substantial attention in the fields of science and industry due to its extraordinary properties. As the lightest known substance on Earth, Aerographite exhibits an array of unique characteristics that render it invaluable in a multitude of applications. One of the key areas where Aerographite has found utility is in the realm of energy storage, especially in bike and automobile batteries. Its ultralight nature allows for enhanced energy storage without adding substantial weight, thus improving the overall efficiency and performance of these energy storage systems. Furthermore, its remarkable porous structure facilitates efficient air or water purification systems, making it a game-changer in the environmental sector. By offering an ideal balance between lightweight and strength, Aerographite's applications extend to the aerospace industry, where it is employed in satellites and airplanes, thanks to its high vibration tolerance. In the construction sector, Aerographite's unparalleled qualities come into play, as it exhibits impressive strength, stability at ambient temperatures, and exceptional electrical conductivity. These attributes make it a prime choice for a wide range of construction applications, from reinforcing materials to enhancing structural integrity. Aerographite's composition of hollow carbon tubes distinguishes it from traditional materials like Styrofoam, enabling it to be lighter and yet more robust. Moreover, its unique ability to be compressed into a fraction of its original size while still maintaining structural integrity adds to its versatility and functionality. The significant application of Aerographite is in water treatment, where its porous structure and exceptional absorption capabilities make it a valuable asset in the quest for clean and safe water sources. In the realm of pollution control, Aerographite excels as an absorbent material, effectively capturing and mitigating harmful pollutants and contaminants in the air and water, contributing to a healthier environment. The construction industry has witnessed a transformative impact from the introduction of Aerographite. Its outstanding strength and conductivity are leveraged in a multitude of construction projects, enhancing both the structural integrity and the energy efficiency of buildings. The automotive sector benefits from its lightweight properties, which lead to improved fuel efficiency and reduced environmental impact. Furthermore, the aerospace industry has recognized the incredible potential of Aerographite in the design and production of satellites and airplanes, where its high vibration tolerance ensures the longevity and reliability of these complex systems.To know about the Research Methodology :- Request Free Sample Report

Aerographite Market Dynamics

Aerographite's Lightweight Marvel Drives Market Growth The Aerographite market has experienced substantial growth in recent years, driven by the substantial properties of Aerographite, a cutting-edge synthetic material that has captured the imagination of scientists engineers and innovators worldwide. At the heart of this market's expansion is Aerographite's incredibly lightweight nature and its unique combination of properties that make it a game-changer in several industries. Aerographite, often touted as the world's lightest material, is a synthetic foam constructed from a complex network of interconnected tabular carbon structures. This material is not just lightweight; it is exceptionally low in density, setting it apart from conventional materials. Its structure resembles a three-dimensional lattice, characterized by a vast number of hollow carbon tubes, contributing to its high porosity and remarkable strength. These characteristics make Aerographite a marvel of materials science and an attractive option for a wide range of applications. Aerographite's exceptional lightweight properties are essential to its appeal and its role as a growth driver in the Aerographite market. With an incredibly low density, it possesses an exceptional strength-to-weight ratio, making it a preferable choice for applications where weight reduction is paramount. The significant balance between weight and strength has had a transformative impact on several industries. One of the most prominent industries benefiting from Aerographite's lightweight marvel is the aerospace sector. In aerospace, weight is a critical factor, as it directly affects fuel efficiency, payload capacity, and overall performance. Aerographite's introduction to this industry has been revolutionary, as its lightweight properties enable substantial weight reduction in key components, such as airframes, aircraft interiors, and satellite structures. The result is improved fuel efficiency, leading to significant cost savings and a reduced environmental footprint.Market Growth Trend

Advancements in Manufacturing Techniques Improved manufacturing techniques enable the production of Aerographite with more consistent and desirable properties. This includes better control over its porosity, density, mechanical strength, and electrical conductivity. These enhancements expand its applications across a wide range of industries. Advanced manufacturing techniques potentially reduce the production costs of Aerographite. As production becomes more efficient and scalable, the material becomes more affordable, encouraging its use in a broader spectrum of applications. Scaling up the manufacturing of Aerographite is essential for its widespread adoption. Advancements in manufacturing help in achieving large-scale production, making it more accessible for industries such as aerospace, energy storage, and composites. Innovative manufacturing processes allow for greater customization of Aerographite materials to meet specific industry requirements. This led to tailored solutions for applications in aerospace, electronics, energy storage, and others. Better manufacturing techniques enhance quality control measures, ensuring that Aerographite materials meet the necessary industry standards and specifications. This is particularly important for safety-critical applications in aerospace. As manufacturing techniques advance, they uncover new and previously unexplored applications for Aerographite. These discoveries open up new markets and drive demand. Advancements in manufacturing techniques have led to increased production volume of graphite electrodes, a key component in several industries. This increase in graphite electrode production stimulates the production and development of advanced materials including Aerographite, with its lightweight and high-performance properties, for applications across aerospace, electronics, and others.High Production Costs to hamper Aerographite Market Growth High production costs result in elevated material prices. This makes Aerographite less cost-effective compared to other materials with similar properties, especially in price-sensitive markets or industries. Industries and businesses are hesitant to adopt Aerographite due to its high cost. This limits the potential customer base and restricts its adoption to only high-value applications where its unique properties justify the expense. In applications where Aerographite competes with other advanced materials such as carbon nanotube composites, aerogels, or graphene, cost considerations become crucial. If these alternatives offer similar performance at a lower cost, they are preferred. High production costs slow down the pace of market penetration and adoption. Companies are cautious about investing in research and development, and end-users delay integrating the material into their products until more cost-effective options are available.

Aerographite Market Segment Analysis

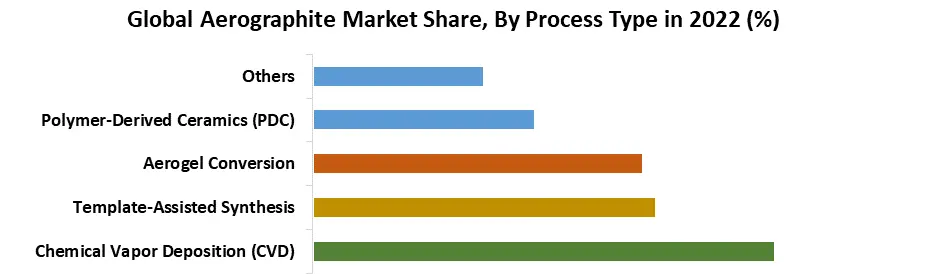

Based on Process Type, the market is segmented into Chemical Vapor Deposition (CVD), Template-Assisted Synthesis, Aerogel Conversion, Polymer-Derived Ceramics (PDC) and others. CVD offers precise control over the growth and properties of Aerographite. This control is essential for tailoring the material to meet specific application requirements. Manufacturers can adjust parameters such as temperature, pressure and precursor gases to fine-tune the properties of the resulting material. CVD processes yield high-purity Aerographite with excellent consistency in terms of its structure and properties. This is crucial for applications in industries where quality and reliability are paramount, such as aerospace and electronics. CVD processes are often scalable, making them suitable for larger production volumes. The capability to produce Aerographite at scale is critical for addressing the demands of several industries and applications. Chemical Vapor Deposition (CVD) is pivotal in the Aerographite market due to its exceptional capacity for tailoring Aerographite materials to meet the precise demands of a multitude of industries, particularly in the burgeoning sectors of Aerographite for energy storage and aerospace, where customized materials are indispensable for optimizing performance and ensuring safety. CVD serves as a catalyst for innovation through its extensive use in research and development, empowering scientists and engineers to unlock the full potential of Aerographite in applications crucial for groundbreaking solutions in energy storage and aerospace. Its impact extends across a spectrum of applications, including aerospace, electronics, energy storage, and composites, enabling these sectors to harness Aerographite's promise for enhanced performance and efficiency. The consistency and high quality of Aerographite materials produced through CVD processes are vital in industries where unwavering performance and safety are paramount, exemplified by the burgeoning markets in Aerographite for energy storage and aerospace. The future of Aerographite is intricately linked to CVD's adaptability and precision, reshaping industries, propelling innovation, and driving advancements in energy storage and aerospace, where the material's distinct properties are revolutionizing solutions.

Aerographite Market Regional Insights

Asia Pacific dominated the Aerographite Market in 2022 and is expected to continue its dominance over the forecast period. The Asia-Pacific region, particularly countries including China, Japan, and South Korea, has become a major industrial and technological hub. These countries have made substantial investments in research and development, including advanced materials such as Aerographite. Asia-Pacific nations have extensive manufacturing capabilities, which are crucial for the production of materials including Aerographite. These capabilities enable the scaling up of production and the development of cost-effective manufacturing techniques. The Asia-Pacific region is a burgeoning hotspot for emerging markets spanning diverse sectors, including aerospace, electronics, energy storage, and composites, all of which exhibit a consistent demand for lightweight and high-performance materials including Aerographite, Ultralight graphene materials and Graphene foam. Several countries in the region have proactively introduced government initiatives and funding programs to catalyze research and development in advanced materials, fostering an environment of innovation and facilitating the widespread adoption of materials such as Aerographite, Ultralight graphene materials, and Graphene foam. Collaborative endeavors between academic institutions, research centers and industries in the Asia-Pacific have been instrumental in driving advancements in materials science and encouraging the integration of these cutting-edge materials. As industries within the region continue to experience rapid expansion, the requirement for advanced materials to meet their specific needs is on the increase. The unique properties of Aerographite, including its significant low density and high surface area, make it an enticing choice for a multitude of applications, meeting the ever-evolving and several needs of industries throughout the region.Aerographite Market Scope: Inquiry Before Buying

Aerographite Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.9 Bn. Forecast Period 2023 to 2029 CAGR: 6.8% Market Size in 2029: US $ 7.77 Bn. Segments Covered: by Process Type Chemical Vapor Deposition (CVD) Template-Assisted Synthesis Aerogel Conversion Polymer-Derived Ceramics (PDC) Others by Application Aerospace and Aviation Electronics and Sensors Energy Storage Medical Devices Others Aerographite Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Aerographite Key Players

1. Pingdingshan Kaiyuan Special Graphite Co., Ltd. 2. Xinghe County Muzi Carbon Co., Ltd. 3. Miami Advanced Material Technology Co. LTD 4. Aero Industries 5. Zhejiang Huarong Technology Co., Ltd. 6. The Boeing Company 7. Airbus Group 8. Samsung 9. Siemens 10. General Electric 11. Lockheed Martin 12. 3M 13. Tesla, Inc. 14. Panasonic 15. BASF 16. IBM 17. Nanocyl 18. Nanocomp Technologies 19. Zotefoams 20. Haydale Graphene IndustriesFrequently Asked Questions:

1] What is the growth rate of the Global Aerographite Market? Ans. The Global Aerographite Market is growing at a significant rate of 6.8 % during the forecast period. 2] Which region is expected to dominate the Global Aerographite Market? Ans. Asia Pacific is expected to dominate the Aerographite Market during the forecast period. 3] What is the expected Global Aerographite Market size by 2029? Ans. The Aerographite Market size is expected to reach USD 7.77 Mn by 2029. 4] Which are the top players in the Global Aerographite Market? Ans. The major top players in the Global Aerographite Market are Pingdingshan Kaiyuan Special Graphite Co., Ltd., Xinghe County Muzi Carbon Co., Ltd., Miami Advanced Material Technology Co. LTD, Aero Industries, Zhejiang Huarong Technology Co., Ltd., The Boeing Company, Airbus Group, Samsung, Siemens, General Electric, Lockheed Martin and Others. 5] What are the factors driving the Global Aerographite Market growth? Ans. The increasing demand for Aerographite in aerospace and aviation is expected to drive market growth during the forecast period.

1. Aerographite Market: Research Methodology 2. Aerographite Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Aerographite Market: Dynamics 3.1 Aerographite Market Trends by Region 3.1.1 North America Aerographite Market Trends 3.1.2 Europe Aerographite Market Trends 3.1.3 Asia Pacific Aerographite Market Trends 3.1.4 Middle East and Africa Aerographite Market Trends 3.1.5 South America Aerographite Market Trends 3.2 Aerographite Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Aerographite Market Drivers 3.2.1.2 North America Aerographite Market Restraints 3.2.1.3 North America Aerographite Market Opportunities 3.2.1.4 North America Aerographite Market Challenges 3.2.2 Europe 3.2.2.1 Europe Aerographite Market Drivers 3.2.2.2 Europe Aerographite Market Restraints 3.2.2.3 Europe Aerographite Market Opportunities 3.2.2.4 Europe Aerographite Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Aerographite Market Market Drivers 3.2.3.2 Asia Pacific Aerographite Market Restraints 3.2.3.3 Asia Pacific Aerographite Market Opportunities 3.2.3.4 Asia Pacific Aerographite Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Aerographite Market Drivers 3.2.4.2 Middle East and Africa Aerographite Market Restraints 3.2.4.3 Middle East and Africa Aerographite Market Opportunities 3.2.4.4 Middle East and Africa Aerographite Market Challenges 3.2.5 South America 3.2.5.1 South America Aerographite Market Drivers 3.2.5.2 South America Aerographite Market Restraints 3.2.5.3 South America Aerographite Market Opportunities 3.2.5.4 South America Aerographite Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives For the Aerographite Industry 3.7 The Global Pandemic and Redefining of The Aerographite Industry Landscape 3.8 Technological Road Map 4. Global Aerographite Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 4.1 Global Aerographite Market Size and Forecast, by Process Type (2022-2029) 4.1.1 Chemical Vapor Deposition (CVD) 4.1.2 Template-Assisted Synthesis 4.1.3 Aerogel Conversion 4.1.4 Polymer-Derived Ceramics (PDC) 4.1.5 Others 4.2 Global Aerographite Market Size and Forecast, by Application (2022-2029) 4.2.1 Aerospace and Aviation 4.2.2 Electronics and Sensors 4.2.3 Energy Storage 4.2.4 Medical Devices 4.2.5 Others 4.3 Global Aerographite Market Size and Forecast, by Region (2022-2029) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Aerographite Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 5.1 North America Aerographite Market Size and Forecast, by Process Type (2022-2029) 5.1.1 Chemical Vapor Deposition (CVD) 5.1.2 Template-Assisted Synthesis 5.1.3 Aerogel Conversion 5.1.4 Polymer-Derived Ceramics (PDC) 5.1.5 Others 5.2 North America Aerographite Market Size and Forecast, by Application (2022-2029) 5.2.1 Aerospace and Aviation 5.2.2 Electronics and Sensors 5.2.3 Energy Storage 5.2.4 Medical Devices 5.2.5 Others 5.3 North America Aerographite Market Size and Forecast, by Country (2022-2029) 5.3.1 United States 5.3.1.1 United States Aerographite Market Size and Forecast, by Process Type (2022-2029) 5.3.1.1.1 Chemical Vapor Deposition (CVD) 5.3.1.1.2 Template-Assisted Synthesis 5.3.1.1.3 Aerogel Conversion 5.3.1.1.4 Polymer-Derived Ceramics (PDC) 5.3.1.1.5 Others 5.3.1.2 United States Aerographite Market Size and Forecast, by Application (2022-2029) 5.3.1.2.1 Aerospace and Aviation 5.3.1.2.2 Electronics and Sensors 5.3.1.2.3 Energy Storage 5.3.1.2.4 Medical Devices 5.3.1.2.5 Others 5.3.2 Canada 5.3.2.1 Canada Aerographite Market Size and Forecast, by Process Type (2022-2029) 5.3.2.1.1 Chemical Vapor Deposition (CVD) 5.3.2.1.2 Template-Assisted Synthesis 5.3.2.1.3 Aerogel Conversion 5.3.2.1.4 Polymer-Derived Ceramics (PDC) 5.3.2.1.5 Others 5.3.2.2 Canada Aerographite Market Size and Forecast, by Application (2022-2029) 5.3.2.2.1 Aerospace and Aviation 5.3.2.2.2 Electronics and Sensors 5.3.2.2.3 Energy Storage 5.3.2.2.4 Medical Devices 5.3.2.2.5 Others 5.3.3 Mexico 5.3.3.1 Mexico Aerographite Market Size and Forecast, by Process Type (2022-2029) 5.3.3.1.1 Chemical Vapor Deposition (CVD) 5.3.3.1.2 Template-Assisted Synthesis 5.3.3.1.3 Aerogel Conversion 5.3.3.1.4 Polymer-Derived Ceramics (PDC) 5.3.3.1.5 Others 5.3.3.2 Mexico Aerographite Market Size and Forecast, by Application (2022-2029) 5.3.3.2.1 Aerospace and Aviation 5.3.3.2.2 Electronics and Sensors 5.3.3.2.3 Energy Storage 5.3.3.2.4 Medical Devices 5.3.3.2.5 Others 6. Europe Aerographite Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 6.1 Europe Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.2 Europe Aerographite Market Size and Forecast, by Application (2022-2029) 6.3 Europe Aerographite Market Size and Forecast, by Country (2022-2029) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.1.2 United Kingdom Aerographite Market Size and Forecast, by Application (2022-2029) 6.3.2 France 6.3.2.1 France Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.2.2 France Aerographite Market Size and Forecast, by Application (2022-2029) 6.3.3 Germany 6.3.3.1 Germany Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.3.2 Germany Aerographite Market Size and Forecast, by Application (2022-2029) 6.3.4 Italy 6.3.4.1 Italy Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.4.2 Italy Aerographite Market Size and Forecast, by Application (2022-2029) 6.3.5 Spain 6.3.5.1 Spain Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.5.2 Spain Aerographite Market Size and Forecast, by Application (2022-2029) 6.3.6 Sweden 6.3.6.1 Sweden Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.6.2 Sweden Aerographite Market Size and Forecast, by Application (2022-2029) 6.3.7 Austria 6.3.7.1 Austria Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.7.2 Austria Aerographite Market Size and Forecast, by Application (2022-2029) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Aerographite Market Size and Forecast, by Process Type (2022-2029) 6.3.8.2 Rest of Europe Aerographite Market Size and Forecast, by Application (2022-2029). 7. Asia Pacific Aerographite Market Size and Forecast by Segmentation for Demand and Supply Side (By Value and Volume) (2022-2029) 7.1 Asia Pacific Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.2 Asia Pacific Aerographite Market Size and Forecast, by Application (2022-2029) 7.3 Asia Pacific Aerographite Market Size and Forecast, by Country (2022-2029) 7.3.1 China 7.3.1.1 China Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.1.2 China Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.2 South Korea 7.3.2.1 S Korea Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.2.2 S Korea Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.3 Japan 7.3.3.1 Japan Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.3.2 Japan Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.4 India 7.3.4.1 India Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.4.2 India Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.5 Australia 7.3.5.1 Australia Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.5.2 Australia Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.6 Indonesia 7.3.6.1 Indonesia Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.6.2 Indonesia Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.7 Malaysia 7.3.7.1 Malaysia Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.7.2 Malaysia Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.8 Vietnam 7.3.8.1 Vietnam Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.8.2 Vietnam Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.9 Taiwan 7.3.9.1 Taiwan Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.9.2 Taiwan Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.10.2 Bangladesh Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.11 Pakistan 7.3.11.1 Pakistan Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.11.2 Pakistan Aerographite Market Size and Forecast, by Application (2022-2029) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Aerographite Market Size and Forecast, by Process Type (2022-2029) 7.3.12.2 Rest of Asia PacificAerographite Market Size and Forecast, by Application (2022-2029) 8. Middle East and Africa Aerographite Market Size and Forecast by Segmentation for Demand and Supply Side (By Value and Volume) (2022-2029) 8.1 Middle East and Africa Aerographite Market Size and Forecast, by Process Type (2022-2029) 8.2 Middle East and Africa Aerographite Market Size and Forecast, by Application (2022-2029) 8.3 Middle East and Africa Aerographite Market Size and Forecast, by Country (2022-2029) 8.3.1 South Africa 8.3.1.1 South Africa Aerographite Market Size and Forecast, by Process Type (2022-2029) 8.3.1.2 South Africa Aerographite Market Size and Forecast, by Application (2022-2029) 8.3.2 GCC 8.3.2.1 GCC Aerographite Market Size and Forecast, by Process Type (2022-2029) 8.3.2.2 GCC Aerographite Market Size and Forecast, by Application (2022-2029) 8.3.3 Egypt 8.3.3.1 Egypt Aerographite Market Size and Forecast, by Process Type (2022-2029) 8.3.3.2 Egypt Aerographite Market Size and Forecast, by Application (2022-2029) 8.3.4 Nigeria 8.3.4.1 Nigeria Aerographite Market Size and Forecast, by Process Type (2022-2029) 8.3.4.2 Nigeria Aerographite Market Size and Forecast, by Application (2022-2029) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Aerographite Market Size and Forecast, by Process Type (2022-2029) 8.3.5.2 Rest of ME&A Aerographite Market Size and Forecast, by Application (2022-2029) 9. South America Aerographite Market Size and Forecast by Segmentation for Demand and Supply Side (By Value and Volume) (2022-2029) 9.1 South America Aerographite Market Size and Forecast, by Process Type (2022-2029) 9.2 South America Aerographite Market Size and Forecast, by Application (2022-2029) 9.3 South America Aerographite Market Size and Forecast, by Country (2022-2029) 9.3.1 Brazil 9.3.1.1 Brazil Aerographite Market Size and Forecast, by Process Type (2022-2029) 9.3.1.2 Brazil Aerographite Market Size and Forecast, by Application (2022-2029) 9.3.2 Argentina 9.3.2.1 Argentina Aerographite Market Size and Forecast, by Process Type (2022-2029) 9.3.2.2 Argentina Aerographite Market Size and Forecast, by Application (2022-2029) 9.3.2.3 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Aerographite Market Size and Forecast, by Process Type (2022-2029) 9.3.3.2 Rest Of South America Aerographite Market Size and Forecast, by Application (2022-2029) 10. Global Aerographite Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Service Segment 10.3.3 Application Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Aerographite Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Pingdingshan Kaiyuan Special Graphite Co., Ltd. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Recent Developments 11.2 Xinghe County Muzi Carbon Co., Ltd. 11.3 Miami Advanced Material Technology Co. LTD 11.4 Aero Industries 11.5 Zhejiang Huarong Technology Co., Ltd. 11.6 The Boeing Company 11.7 Airbus Group 11.8 Samsung 11.9 Siemens 11.10 General Electric 11.11 Lockheed Martin 11.12 3M 11.13 Tesla, Inc. 11.14 Panasonic 11.15 BASF 11.16 IBM 11.17 Nanocyl 11.18 Nanocomp Technologies 11.19 Zotefoams 11.20 Haydale Graphene Industries 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary