The Beer Market size was valued at USD 743.79 Billion in 2024 and the total Beer revenue is expected to grow at a CAGR of 4.28% from 2025 to 2032, reaching nearly USD 1040.07 Billion.Overview and Scope

Beer is a popular alcoholic drink globally, with a market that includes production, distribution, and consumption. Beer is a fermented drink made from grains, hops, water, and yeast. Alternative grains like wheat, maize, and rice are feasible options. Consumer preferences, craft beer trends, and beer's social and cultural appeal drive the growth and innovation of the beer market. Report analysing global beer market, covering production, distribution, consumption, and growth potential. Research analyses market factors like demographics, urbanisation, lifestyles, and consumer tastes and brewing processes, raw materials, techniques, fermentation, packaging. Beer market is highly competitive with diverse styles like lagers, ales, stouts, pilsners, and specialty brews. Report analyses market trends, growing demand for craft/artisanal beers, flavoured/low-alcohol options, and emergence of non-alcoholic beer as viable segment. The report provides insights on consumer preferences, purchase behaviour, and branding/product innovation influence. The beer market is diverse, with established markets in North America, Europe, and Asia, and growing markets in South America, Africa. Regional insights on beer consumption, including market dynamics, regulations, and cultural influences are provided. Report analyses beer industry's sustainability practises, including water/energy conservation, waste management, and eco-friendly packaging. Analysing the trend towards organic and local ingredients and promoting responsible consumption. Report covers market forecasts, industry segmentation, and competitive analysis of top beer producers' strategies, products, market positioning, analyses mergers and acquisitions and partnerships, global economy, and regulations' impact on market dynamics. The report aims to aid industry stakeholders to make informed decisions and capitalising on evolving beer market opportunities by providing a global outlook with trends, drivers, challenges, and opportunities, focusing on sustainability, innovation, and consumer preferences. Report is valuable for breweries, distributors, retailers, and investors navigating the beer market.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics

A thorough analysis of the worldwide beer industry has been performed, revealing that various crucial elements are impacting its expansion and progress. The evolving preferences of consumers are having a noteworthy impact on the beer industry. Consumers are increasingly in search of distinctive and high-quality beer experiences, which has resulted in a surge in demand for craft and artisanal beers. The market is being influenced by health and wellness trends, with a growing number of consumers looking for healthier beer alternatives, including low-calorie, low-alcohol, and gluten-free options. The current trend has led manufacturers to explore new avenues and provide more nutritious options in comparison to conventional beer choices. There is a noticeable trend in the market towards premiumization and flavour innovation. Consumers are showing a willingness to pay a higher price for speciality and flavoured beers that provide distinctive and thrilling taste experiences. There is a growing trend towards sustainability and environmental consciousness among consumers, which has led breweries to implement sustainable practises in order to meet this demand for eco-friendly products. The current trend of globalisation and market expansion has led breweries to explore emerging beer markets and expand their global presence. The increasing prevalence of digital platforms and e-commerce has facilitated consumer access to a diverse range of beers, thereby bolstering market expansion. By analysing these market trends and utilising the opportunities they offer, breweries can strategically position themselves for success in this ever-changing and highly competitive industry.Global Beer Market Segment Analysis

Variety, packaging, sales channels, and location characterise the beer industry. The market includes lagers, ales, stouts, pilsners, wheat beers and speciality beers. Lagers are popular and mass-produced, dominating the market. Due to customer interest in unique tastes, handcrafted brewing methods, and high-end products, the craft beer business, which includes ales, stouts, and speciality beers, is growing. Bottles, cans, and kegs contain beer. Bottled beer dominates the market. Its convenience and availability are the main reasons. Due to its simplicity, eco-friendliness, and canning advances, canned beer is becoming more popular, especially among younger people. When assessing distribution channels, the on-trade segment—bars, restaurants, and pubs—continues to drive sales. Due to e-commerce and at-home consumption, the off-trade segment, which comprises supermarkets, convenience stores, and online platforms, has grown significantly. Regional tastes shape the beer market. Due to its high beer consumption and rich beer history, Europe dominates the beer market. Breweries can tailor their products, packaging, distribution strategies, and marketing to meet consumer preferences and regional demands by understanding the segmentation categories and their market shares. This ensures global beer market growth and competitiveness.

Regional Analysis

Global beer market is analysed by region, considering consumption patterns, cultural preferences, and market dynamics in different parts of the world. North America has a strong beer culture & craft beer movement, making it a significant market for beer. US sees rise in craft beer demand due to unique flavours and local brewing. Europe dominates the global beer market due to its rich beer heritage. Germany, Belgium, and the Czech Republic are known for their traditional beer styles and brewing techniques. Craft beer consumption in the region is on the rise, with an emphasis on quality and variety. Asia Pacific has great potential in the beer market. Beer consumption in China, Japan, and India is rapidly increasing due to changing lifestyles, urbanisation, and higher disposable incomes. Craft beers are gaining popularity in this region due to younger demographics and Western beer culture, despite mainstream lagers dominating the market. Vibrant beer market in South America, led by Brazil and Argentina. Regions prefer light and refreshing beers for social and festive occasions. Craft beer is growing in popularity in South America, appealing to a niche market looking for distinct flavours and premium quality beer. Middle East and Africa beer market encounters cultural and regulatory hurdles. Growing demand for beer in South Africa and Nigeria due to urbanisation, population growth, and westernisation of consumer preferences. Non-alcoholic and low-alcohol beer are growing in this region due to cultural and religious reasons. Regional variations and preferences in the global market are crucial for breweries to develop effective marketing strategies, product portfolios, and distribution networks. Analysing regional trends, cultural nuances, and consumer demands helps industry stakeholders identify growth opportunities and tailor their offerings to establish a strong presence in each market, contributing to the overall success of the global beer industry.

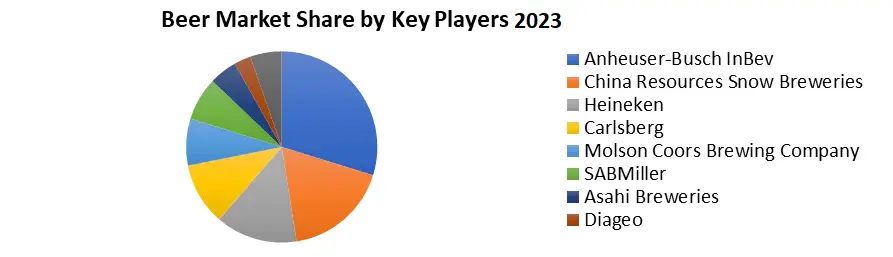

Global Beer Market Competitive Analysis

Multinationals, regional breweries, and craft beer makers have a strong competition in the global beer industry. Anheuser-Busch InBev, Heineken N.V., and China Resources Snow Breweries lead the market with their wide product lines and global distribution networks. Brand recognition, economies of scale, and product innovation keep these enterprises competitive. United Breweries Ltd. (UBL), renowned for Kingfisher, dominates the Indian beer market. UBL offers a variety of beer for diverse tastes. Anheuser-Busch InBev India Pvt. Ltd. is another key player. Budweiser and Corona are strong brands in premium and super-premium beer. Carlsberg India Pvt. Ltd., which makes Carlsberg and Tuborg, is another major Indian beer company. Craft and microbreweries are growing in the Indian beer market alongside these major names. Smaller breweries make specialty beers for specific markets and local markets. Bira 91, White Owl Brewery, and Gateway Brewery are Indian craft beer brands. Brand recognition, quality, pricing, distribution, and marketing drive worldwide beer market competition. Diverse beer styles, flavours, and packaging help breweries stand out. They also address consumer demands for healthier, low-alcohol, and ecologically friendly beer. Breweries engage in R&D to create new recipes, enhance brewing methods, and try novel ingredients to stay competitive. Collaborations with other breweries, suppliers, and distributors are frequent ways to reach new markets. Breweries use traditional and digital venues to promote brand awareness and loyalty. Competitive analysis in the global market entails studying market trends, key player performance, product innovations, and customer preferences. This analysis helps organisations identify market opportunities, implement targeted strategies, and stay ahead in the fast-paced global beer industry.Beer Market Scope: Inquire before buying

Beer Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 743.79 billion Forecast Period 2025 to 2032 CAGR: 4.28% Market Size in 2032: USD 1040.07 billion Segments Covered: by Product Lagers Ales Stouts Pilsners Wheat Beers Specialty Beers by Type Bottles Cans Kegs by Application Bars Restaurants Pubs Supermarkets Convenience Stores Online Platforms by End-User Low-Alcohol Beer Standard-Strength Beer Strong or High-Alcohol Beer Beer Market, Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Beer Market, Key Players

The captured list of leading manufacturers of Beer industry has been compiled after an analysis of multiple factors. It is not an exhaustive list based only on market share ranking. After a regional analysis, a competitive analysis and other such considerations, the company profiles were selected based on a variety of factors. The comprehensive report contains information on the position of each company in the market from local and global perspective. 1. Anheuser-Busch InBev 2. SABMiller 3. Molson Coors Brewing Company 4. Heineken 5. Carlsberg 6. China Resources Snow Breweries 7. Tsingtao Brewery 8. Yanjing Brewery 9. Grupo Modelo 10. Kirin Brewery Company 11. Asahi Breweries 12. Mahou San Miguel 13. Estrella Galicia 14. Fuller's 15. Diageo 16. AB InBev Efes 17. Boston Beer Company 18. Sierra Nevada Brewing Company 19. New Belgium Brewing 20. Oskar Blues Brewery 21. Stone Brewing 22. Deschutes Brewery 23. Lagunitas Brewing Company 24. Founders Brewing Company 25. Ballast Point Brewing Company FAQs 1. What was the Global Beer Market size in 2024? Ans: The Global Beer Market size was USD 743.79 Billion in 2024. 2. What is the projected growth rate of the global market? Ans: The forecasted CAGR of the global market is 4.28% during the forecast period. 3. What are the different types of beers available in the market? Ans: The global beer market offers various types of beers, including lagers, ales, stouts, pilsners, wheat beers, and specialty beers, among others. 4. Which regions are the major consumers of beer? Ans: Beer consumption is prevalent across various regions, with major consumption markets including Europe, North America and Asia Pacific. 5. What are the key factors driving the growth of the global beer market? Ans: Factors driving the growth of the global beer market include shifting consumer preferences towards craft and premium beers, the rise of the craft beer movement, increasing demand for healthier beer options, flavour innovation and premiumization, sustainability practices, globalization and market expansion, and the growth of digital and e-commerce platforms facilitating easier access to a wide variety of beers.

1. Beer Market: Research Methodology 2. Beer Market: Executive Summary 3. Beer Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Beer Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Beer Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Beer Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Lagers 5.1.2. Ales 5.1.3. Stouts 5.1.4. Pilsners 5.1.5. Wheat Beers 5.1.6. Specialty Beers 5.2. Beer Market Size and Forecast, by Packaging (2024-2032) 5.2.1. Bottles 5.2.2. Cans 5.2.3. Kegs 5.3. Beer Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.1. Bars 5.3.2. Restaurants 5.3.3. Pubs 5.3.4. Supermarkets 5.3.5. Convenience Stores 5.3.6. Online Platforms 5.4. Beer Market Size and Forecast, by Alcohol Content (2024-2032) 5.4.1. Low-Alcohol Beer 5.4.2. Standard-Strength Beer 5.4.3. Strong or High-Alcohol Beer 5.5. Beer Market Size and Forecast, by Region (2024-2032) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Beer Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Beer Market Size and Forecast, by Product Type (2024-2032) 6.1.1. Lagers 6.1.2. Ales 6.1.3. Stouts 6.1.4. Pilsners 6.1.5. Wheat Beers 6.1.6. Specialty Beers 6.2. North America Beer Market Size and Forecast, by Packaging (2024-2032) 6.2.1. Bottles 6.2.2. Cans 6.2.3. Kegs 6.3. Pharmaceuticals and Nutraceuticals North America Beer Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.1. Bars 6.3.2. Restaurants 6.3.3. Pubs 6.3.4. Supermarkets 6.3.5. Convenience Stores 6.3.6. Online Platforms 6.4. North America Beer Market Size and Forecast, by Alcohol Content (2024-2032) 6.4.1. Low-Alcohol Beer 6.4.2. Standard-Strength Beer 6.4.3. Strong or High-Alcohol Beer 6.5. North America Beer Market Size and Forecast, by Country (2024-2032) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Beer Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Beer Market Size and Forecast, by Product Type (2024-2032) 7.1.1. Lagers 7.1.2. Ales 7.1.3. Stouts 7.1.4. Pilsners 7.1.5. Wheat Beers 7.1.6. Specialty Beers 7.2. Europe Beer Market Size and Forecast, by Packaging (2024-2032) 7.2.1. Bottles 7.2.2. Cans 7.2.3. Kegs 7.3. Europe Beer Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.1. Bars 7.3.2. Restaurants 7.3.3. Pubs 7.3.4. Supermarkets 7.3.5. Convenience Stores 7.3.6. Online Platforms 7.4. Europe Beer Market Size and Forecast, by Alcohol Content (2024-2032) 7.4.1. Low-Alcohol Beer 7.4.2. Standard-Strength Beer 7.4.3. Strong or High-Alcohol Beer 7.5. Europe Beer Market Size and Forecast, by Country (2024-2032) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Beer Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Beer Market Size and Forecast, by Product Type (2024-2032) 8.1.1. Lagers 8.1.2. Ales 8.1.3. Stouts 8.1.4. Pilsners 8.1.5. Wheat Beers 8.1.6. Specialty Beers 8.2. Asia Pacific Beer Market Size and Forecast, by Packaging (2024-2032) 8.2.1. Bottles 8.2.2. Cans 8.2.3. Kegs 8.3. Asia Pacific Beer Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.1. Bars 8.3.2. Restaurants 8.3.3. Pubs 8.3.4. Supermarkets 8.3.5. Convenience Stores 8.3.6. Online Platforms 8.4. Asia Pacific Beer Market Size and Forecast, by Alcohol Content (2024-2032) 8.4.1. Low-Alcohol Beer 8.4.2. Standard-Strength Beer 8.4.3. Strong or High-Alcohol Beer 8.5. Asia Pacific Beer Market Size and Forecast, by Country (2024-2032) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Beer Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Beer Market Size and Forecast, by Product Type (2024-2032) 9.1.1. Lagers 9.1.2. Ales 9.1.3. Stouts 9.1.4. Pilsners 9.1.5. Wheat Beers 9.1.6. Specialty Beers 9.2. Middle East and Africa Beer Market Size and Forecast, by Packaging (2024-2032) 9.2.1. Bottles 9.2.2. Cans 9.2.3. Kegs 9.3. Middle East and Africa Beer Market Size and Forecast, by Distribution Channel (2024-2032) 9.3.1. Bars 9.3.2. Restaurants 9.3.3. Pubs 9.3.4. Supermarkets 9.3.5. Convenience Stores 9.3.6. Online Platforms 9.4. Middle East and Africa Beer Market Size and Forecast, by Alcohol Content (2024-2032) 9.4.1. Low-Alcohol Beer 9.4.2. Standard-Strength Beer 9.4.3. Strong or High-Alcohol Beer 9.5. Middle East and Africa Beer Market Size and Forecast, by Country (2024-2032) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Beer Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Beer Market Size and Forecast, by Product Type (2024-2032) 10.1.1. Lagers 10.1.2. Ales 10.1.3. Stouts 10.1.4. Pilsners 10.1.5. Wheat Beers 10.1.6. Specialty Beers 10.2. South America Beer Market Size and Forecast, by Packaging (2024-2032) 10.2.1. Bottles 10.2.2. Cans 10.2.3. Kegs 10.3. South America Beer Market Size and Forecast, by Distribution Channel (2024-2032) 10.3.1. Bars 10.3.2. Restaurants 10.3.3. Pubs 10.3.4. Supermarkets 10.3.5. Convenience Stores 10.3.6. Online Platforms 10.4. South America Beer Market Size and Forecast, by Alcohol Content (2024-2032) 10.4.1. Low-Alcohol Beer 10.4.2. Standard-Strength Beer 10.4.3. Strong or High-Alcohol Beer 10.5. South America Beer Market Size and Forecast, by Country (2024-2032) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Anheuser-Busch InBev 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. SABMiller 11.3. Molson Coors Brewing Company 11.4. Heineken 11.5. Carlsberg 11.6. China Resources Snow Breweries 11.7. Tsingtao Brewery 11.8. Yanjing Brewery 11.9. Grupo Modelo 11.10. Kirin Brewery Company 11.11. Asahi Breweries 11.12. Mahou San Miguel 11.13. Estrella Galicia 11.14. Fuller's 11.15. Diageo 11.16. AB InBev Efes 11.17. Boston Beer Company 11.18. Sierra Nevada Brewing Company 11.19. New Belgium Brewing 11.20. Oskar Blues Brewery 11.21. Stone Brewing 11.22. Deschutes Brewery 11.23. Lagunitas Brewing Company 11.24. Founders Brewing Company 11.25. Ballast Point Brewing Company 12. Key Findings 13. Industry Recommendation