The Autonomous Robot Market size was valued at USD 3.82 Bn in 2023 and the market is expected to reach USD 12.42 Bn to grow by 2030 at a CAGR of 18.34 % from 2024-2030Autonomous Robots Market Overview

Autonomous Robots are increasingly being integrated into working tasks to replace humans. They are currently used in many fields of applications including office, military tasks, hospital operations, industrial automation, security systems, dangerous environments, and agriculture. The autonomous robot has been assigned the task of creating and discovering the existence of humans or things that are trapped inside unstable, collapsed buildings or not reachable areas by humans. With the development of artificial intelligence technology the use of these technologies has boosted the growth of the autonomous robots market. As companies are inclined towards the use of Industry 4.0 technology, the Autonomous robot market has witnessed a rise in use in the manufacturing sector where robots are used in processes like welding, painting, and assembly. The usage of robotic systems is been found in many manufacturing companies, including stores and factories boosts the autonomous robot market share. In today's industrial landscape, the integration of robotic systems is essential for the functioning of smart factories, leading to a substantial uptick in production efficiency. This technological advancement is being harnessed in the exploration, creation, and production of novel robots that adhere to safety protocols, ultimately yielding more sophisticated autonomous robots for widespread use. Leveraging data-driven insights plays an essential role in enhancing product development, aligning with industrial requirements, reshaping marketing approaches, and ultimately propelling the growth of the autonomous robot market.To know about the Research Methodology :- Request Free Sample Report

Autonomous Robots Market Dynamics

Increasing technological advancement in the robotics industry Granting robots the capacity to acquire knowledge, adapt, and autonomously make decisions leads to improved efficiency and flexibility. Advanced sensors like LiDAR, cameras, and radar are pivotal in enhancing a robot's awareness and comprehension of its surroundings, consequently enhancing safety and overall operational effectiveness and driving the autonomous robots market. Employing more robust actuators, motors, and advancements in battery technology provides robots with enhanced speed, strength, and versatility to undertake a diverse array of tasks. The real-time analysis of data and seamless communication through cloud platforms facilitate remote monitoring and control, ultimately augmenting the capabilities and scalability of autonomous robots. The automation brought about by the robotic industry proves to be a cost-effective solution, particularly in tasks that are repetitive or pose hazards, offering an alternative to reducing human labor. The growing demands of online shopping through e-commerce platforms, with an emphasis on efficient and rapid delivery, are propelling the integration of autonomous robots into logistics and warehousing operations.High cost and investment of autonomous robots Acquiring and putting into operation cutting-edge robots involves substantial initial investments, making them inaccessible to smaller enterprises and individuals. The financial burden is further increased by research, development, and maintenance expenses, creating a hurdle for many autonomous robot users. Sophisticated robots often depend on complicated AI algorithms, sensors, and data processing systems, demanding specialized expertise for programming, operation, and upkeep which hamper the growth of the autonomous robot market, as the complex algorithms are not easy to understand by other people. The integration of robots into existing infrastructure and workflows may prove challenging, necessitating considerable modifications and adjustments. The absence of well-defined regulations and legal frameworks regarding robot autonomy, liability, and safety raises concerns regarding potential misuse and ethical considerations. Widespread acceptance and adoption can be impeded by public apprehension regarding job displacement and robot safety. Need for more personalized and customized robots The progress in artificial intelligence and sensor technology empowers robots to tailor services and adjust to individual requirements, generating fresh market prospects in healthcare, education, and customer service. Altering robots for specific tasks and environments allows for the fulfillment of diverse user needs, expanding the autonomous robot market's outreach in different industrial sectors. Automation of repetitive and monotonous tasks by autonomous robots liberates human workers to engage in more imaginative and strategic roles. Enhanced efficiency and productivity in sectors such as manufacturing, logistics, and agriculture can propel economic growth and bolster competitiveness. The implementation of automation contributes to improved safety in hazardous environments, thereby reducing workplace accidents and fatalities. Robots play a role in assisting surgeons, providing physical therapy, and offering companionship to the elderly, leading to enhanced patient care and a better quality of life. Remote monitoring and medication delivery by robots contribute to enabling independent living for older adults and address shortages in caregivers. Privacy concerns related to the use of Autonomous Robot in the market Autonomous robots engage in the collection and analysis of extensive volumes of sensitive data, prompting worries about potential privacy violations and inappropriate use of information which has raised data and privacy concerns for the autonomous robot market. It is commanding to establish robust cyber security measures to prevent hacking attempts and unauthorized access, guaranteeing the security of data and the integrity of operations. The matters such as the consciousness of robots, their autonomous decision-making capabilities, and the potential biases in algorithms demand thoughtful examination and the establishment of ethical frameworks for the autonomous robot market. This is crucial to ensure the responsible development and deployment of robotic systems in the industry. The installation of robot systems often requires substantial enhancements in infrastructure and technological progress, particularly in areas such as connectivity and data management.

Autonomous Robots Market Segment Analysis

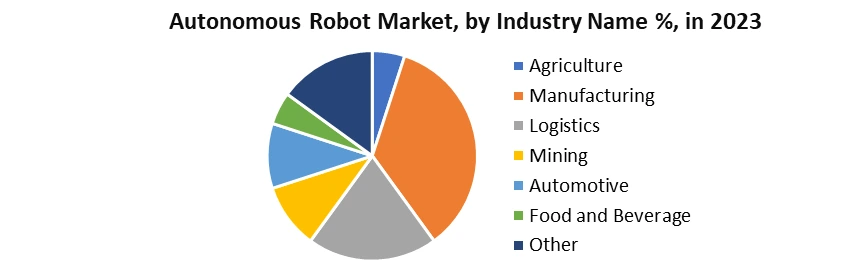

Based on Product, the increasing e-commerce and delivery systems have increased the use of robots, which is dominating the autonomous robot market. The e-commerce sector has shown a high usage of robots in efficient and convenient delivery systems providing solutions. The use of delivery robots offers a faster delivery system with lower labor costs making it perfect for use in the e-commerce industry. In addition to this, the research and education autonomous robots are designed for children to deliver a better teaching programming principle. This robot are designed to provide interactive activities and live coding platforms. Research robots give the flexibility for accelerating research and development in various fields. They also help in data collection and testing of algorithms on robots in a properly controlled manner.Based on Industry, the manufacturing sector has increased the use of robots which dominates the autonomous robot market. This increased use of robots has lowered the labor cost while increasing the efficiency of the work. The growing use of automation in production technologies has raised the autonomous robot market growth. with the introduction and use of collaborative robots in the assembly lines, factories, and warehouses, where the robots are used for the logistics and supply chain of products and heavy equipment. This technological advancement has resulted in reducing human efforts, while the robots can be easily trained and programmed for performing specific tasks. The robots being programmed properly can be used in sorting, packing, and transportation of products from assembly lines to warehouses. While the use of robots in the drilling and blasting processes in mines. Also, the excavation of heavy material from the mines is done by autonomous robots.

Autonomous Robots Market Regional Analysis

Asia Pacific region is considered to be the economic powerhouse, generating increasing demand for labor-saving technologies across industries. The region's rising purchasing power creates a wide market for smart appliances and household assistants. As a global manufacturing hub with advanced production capabilities, the need for efficiency and cost reductions drives the adoption of industrial robots. Booming online shopping requires seamless delivery and streamlined operations, leading to the rise of autonomous mobile robots in logistics and warehousing. Many government policies and regulations support the use of robots and robotic development by lowering the tax and funding the research facilities. The major countries in this region such as China, Japan, and South Korea have shown potential growth in using the robots and driving the autonomous robot market growth. India is an emerging market with significant growth in upcoming years due the government initiatives to increase automation and drive the autonomous robot market growth.North America possesses a well-established market with experienced participants and a strong history of innovative developments. This results in the creation, production, and implementation of robots. North America consistently channels significant investments into research and development, continuously pushing the limits of robot technology. This commitment to creativity ensures that North America stays at the forefront of progress in areas such as artificial intelligence, navigation, and sensor technology. Within its borders, they have hosts prominent technology leaders and educational institutions, nurturing a cooperative atmosphere for the evolution of robots and their integration into existing technological landscapes. Although not as highly visible as in the Asia-Pacific (APAC) region, governments in North America continue to provide different incentives and financial backing to support the research and development of robotics. This involvement plays a role in the autonomous robot market growth. The technological advancements in artificial intelligence, navigation, and sensor technology have created fresh opportunities and improved the functionalities of robots. The growing recognition of the advantages of robots results in their increased adoption across diverse sectors like retail, construction, and agriculture.

Competitive Landscape

The Autonomous Robot market is dominated by numerous medium-sized players operating in different countries. These players are focused on technological development for making more advanced autonomous robots that can be used for heavy industrial purposes. Consumers in the regions are increasingly drawn towards health concerns by widespread diseases through germs. Key companies such as Aviation Industry Corporation have invested USD 1.4 Billion in the research and development of more sustainable products and making use of automation and robotics systems to improve efficiency and manufacturing consistency. Focusing on autonomous drone robot delivery, partnering with retailers and food delivery services for last-mile solutions. This technological advancement has led to a rise in competition in the autonomous robots market. Also, Locus robotics using LocusBots utilizes learned algorithms and sensor fusion (LiDAR, cameras, etc.) for precise and efficient navigation in complex warehouse environments. These top companies are focusing on the development of new materials for the robotics infrastructure and emphasizing the use of more AI-based technology to make the robots work under human interaction.Autonomous Robot Market Scope: Inquire before buying

Autonomous Robot Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.82 Bn. Forecast Period 2024 to 2030 CAGR: 18.34% Market Size in 2030: US $ 12.42 Bn. Segments Covered: by Product Delivery Robots Research and education mobile robots Others by Type Programmable Non-programmable Adaptive Intelligent by Industry Forest & Agriculture Industrial & Manufacturing Logistics & Warehouse Mining & Minerals Automotive Food and Beverage Others Autonomous Robot Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Aethon Inc 2. Aviation Industry Corporation of China, Ltd 3. Bluefin Robotics 4. Cimcorp Automation, Ltd 5. Clearpath Robotics Inc. 6. Fetch Robotics, Inc. 7. Gecko Systems Intl. Corp. 8. Hi Tech Robotics Systemz Ltd. 9. Locus Robotics 10.Oceaneering International, Inc. 11.SAAB 12.Seegrid Corporation 13.Vecna Technologies, Inc 14.Mobile Industrial Robots Ap 15.SMP Robotics 16.Swisslog Holding Ltd. 17.Savioke, Inc. 18.Omron Corporation 19.AtriCure, Inc. 20.Biosensors International Group, Ltd. Frequently Asked Questions: 1. Which region has the largest share in Global Autonomous Robot Market? Ans: North America region holds the highest share in 2023. 2. What is the growth rate of Global Autonomous Robot Market? Ans: The Global Autonomous Robot Market is growing at a CAGR of 18.34% during forecasting period 2024-2030. 3. What is scope of the Global Autonomous Robot market report? Ans: Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Autonomous Robot market? Ans: The important key players in the Robot Market are – Aethon Inc, Aviation Industry Corporation of China, Ltd, Bluefin Robotics, Cimcorp Automation, Ltd, Clearpath Robotics Inc., Fetch Robotics, Inc., Gecko Systems Intl. Corp., Hi Tech Robotics Systemz Ltd., Locus Robotics, Oceaneering International, Inc., SAAB, Seegrid Corporation, Vecna Technologies, Inc, Mobile Industrial Robots Ap, SMP Robotics, Swisslog Holding Ltd., Savioke, Inc., Omron Corporation, AtriCure, Inc., Biosensors International Group, and Ltd. 5. What is the study period of this market? Ans: The Global Autonomous Robot Market is studied from 2023 to 2030.

1. Autonomous Robot Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Autonomous Robot Market: Dynamics 2.1. Autonomous Robot Market Trends by Region 2.1.1. North America Autonomous Robot Market Trends 2.1.2. Europe Autonomous Robot Market Trends 2.1.3. Asia Pacific Autonomous Robot Market Trends 2.1.4. Middle East and Africa Autonomous Robot Market Trends 2.1.5. South America Autonomous Robot Market Trends 2.2. Autonomous Robot Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Autonomous Robot Market Drivers 2.2.1.2. North America Autonomous Robot Market Restraints 2.2.1.3. North America Autonomous Robot Market Opportunities 2.2.1.4. North America Autonomous Robot Market Challenges 2.2.2. Europe 2.2.2.1. Europe Autonomous Robot Market Drivers 2.2.2.2. Europe Autonomous Robot Market Restraints 2.2.2.3. Europe Autonomous Robot Market Opportunities 2.2.2.4. Europe Autonomous Robot Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Autonomous Robot Market Drivers 2.2.3.2. Asia Pacific Autonomous Robot Market Restraints 2.2.3.3. Asia Pacific Autonomous Robot Market Opportunities 2.2.3.4. Asia Pacific Autonomous Robot Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Autonomous Robot Market Drivers 2.2.4.2. Middle East and Africa Autonomous Robot Market Restraints 2.2.4.3. Middle East and Africa Autonomous Robot Market Opportunities 2.2.4.4. Middle East and Africa Autonomous Robot Market Challenges 2.2.5. South America 2.2.5.1. South America Autonomous Robot Market Drivers 2.2.5.2. South America Autonomous Robot Market Restraints 2.2.5.3. South America Autonomous Robot Market Opportunities 2.2.5.4. South America Autonomous Robot Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.7. Analysis of Government Schemes and Initiatives For Autonomous Robot Industry 2.8. The Global Pandemic Impact on Autonomous Robot Market 2.9. Autonomous Robot Price Trend Analysis (2022-23) 2.10. Global Autonomous Robot Market Trade Analysis (2018-2023) 2.10.1. Global Import of Display Panel 2.10.1.1. Ten Largest Importer 2.10.2. Global Export of Display Panel 2.10.3. Ten Largest Exporter 3. Autonomous Robot Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2024-2030) 3.1. Autonomous Robot Market Size and Forecast, by Product (2024-2030) 3.1.1. Delivery Robot 3.1.2. Research and education mobile 3.1.3. Robots 3.1.4. Others 3.2. Autonomous Robot Market Size and Forecast, by Type (2024-2030) 3.2.1. Programmable 3.2.2. Non-Programmable 3.2.3. Adaptive 3.2.4. Intelligent 3.3. Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 3.3.1. Forest and Agriculture 3.3.2. Industrial and Manufacturing 3.3.3. Logistics and Warehouse 3.3.4. Mining and Minerals 3.3.5. Automotive 3.3.6. Food and Beverages 3.3.7. Others 3.4. Autonomous Robot Market Size and Forecast, by Region (2024-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Autonomous Robot Market Size and Forecast by Segmentation (by Value and Volume in USD Billion) (2024-2030) 4.1. North America Autonomous Robot Market Size and Forecast, by Product (2024-2030) 4.1.1. Delivery Robot 4.1.2. Research and education mobile 4.1.3. Robots 4.1.4. Others 4.2. North America Autonomous Robot Market Size and Forecast, by Type (2024-2030) 4.2.1. Programmable 4.2.2. Non-Programmable 4.2.3. Adaptive 4.2.4. Intelligent 4.3. North America Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 4.3.1. Forest and Agriculture 4.3.2. Industrial and Manufacturing 4.3.3. Logistics and Warehouse 4.3.4. Mining and Minerals 4.3.5. Automotive 4.3.6. Food and Beverages 4.3.7. Others 4.4. North America Autonomous Robot Market Size and Forecast, by Country (2024-2030) 4.4.1. United States 4.4.1.1. United States Autonomous Robot Market Size and Forecast, by Product (2024-2030) 4.4.1.1.1. Delivery Robot 4.4.1.1.2. Research and education mobile 4.4.1.1.3. Robots 4.4.1.1.4. Others 4.4.1.2. United States Autonomous Robot Market Size and Forecast, by Type (2024-2030) 4.4.1.2.1. Programmable 4.4.1.2.2. Non-Programmable 4.4.1.2.3. Adaptive 4.4.1.2.4. Intelligent 4.4.1.3. United States Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 4.4.1.3.1. Forest and Agriculture 4.4.1.3.2. Industrial and Manufacturing 4.4.1.3.3. Logistics and Warehouse 4.4.1.3.4. Mining and Minerals 4.4.1.3.5. Automotive 4.4.1.3.6. Food and Beverages 4.4.1.3.7. Others 4.4.2. Canada 4.4.2.1. Canada Autonomous Robot Market Size and Forecast, by Product (2024-2030) 4.4.2.1.1. Delivery Robot 4.4.2.1.2. Research and education mobile 4.4.2.1.3. Robots 4.4.2.1.4. Others 4.4.2.2. Canada Autonomous Robot Market Size and Forecast, by Type (2024-2030) 4.4.2.2.1. Programmable 4.4.2.2.2. Non-Programmable 4.4.2.2.3. Adaptive 4.4.2.2.4. Intelligent 4.4.2.3. Canada Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 4.4.2.3.1. Forest and Agriculture 4.4.2.3.2. Industrial and Manufacturing 4.4.2.3.3. Logistics and Warehouse 4.4.2.3.4. Mining and Minerals 4.4.2.3.5. Automotive 4.4.2.3.6. Food and Beverages 4.4.2.3.7. Others 4.4.3. Mexico 4.4.3.1. Mexico Autonomous Robot Market Size and Forecast, by Product (2024-2030) 4.4.3.1.1. Delivery Robot 4.4.3.1.2. Research and education mobile 4.4.3.1.3. Robots 4.4.3.1.4. Others 4.4.3.2. Mexico Autonomous Robot Market Size and Forecast, by Type (2024-2030) 4.4.3.2.1. Programmable 4.4.3.2.2. Non-Programmable 4.4.3.2.3. Adaptive 4.4.3.2.4. Intelligent 4.4.3.3. Mexico Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 4.4.3.3.1. Forest and Agriculture 4.4.3.3.2. Industrial and Manufacturing 4.4.3.3.3. Logistics and Warehouse 4.4.3.3.4. Mining and Minerals 4.4.3.3.5. Automotive 4.4.3.3.6. Food and Beverages 4.4.3.3.7. Others 5. Europe Autonomous Robot Market Size and Forecast by Segmentation (by Value and Volume in USD Billion) (2024-2030) 5.1. Europe Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.2. Europe Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.3. Europe Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4. Europe Autonomous Robot Market Size and Forecast, by Country (2024-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.1.2. United Kingdom Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.1.3. United Kingdom Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4.2. France 5.4.2.1. France Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.2.2. France Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.2.3. France Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4.3. Germany 5.4.3.1. Germany Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.3.2. Germany Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.3.3. Germany Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4.4. Italy 5.4.4.1. Italy Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.4.2. Italy Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.4.3. Italy Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4.5. Spain 5.4.5.1. Spain Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.5.2. Spain Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.5.3. Spain Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4.6. Sweden 5.4.6.1. Sweden Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.6.2. Sweden Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.6.3. Sweden Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4.7. Austria 5.4.7.1. Austria Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.7.2. Austria Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.7.3. Austria Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Autonomous Robot Market Size and Forecast, by Product (2024-2030) 5.4.8.2. Rest of Europe Autonomous Robot Market Size and Forecast, by Type (2024-2030) 5.4.8.3. Rest of Europe Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6. Asia Pacific Autonomous Robot Market Size and Forecast by Segmentation (by Value and Volume in USD Billion) (2024-2030) 6.1. Asia Pacific Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.2. Asia Pacific Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.3. Asia Pacific Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4. Asia Pacific Autonomous Robot Market Size and Forecast, by Country (2024-2030) 6.4.1. China 6.4.1.1. China Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.1.2. China Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.1.3. China Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.2. S Korea 6.4.2.1. S Korea Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.2.2. S Korea Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.2.3. S Korea Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.3. Japan 6.4.3.1. Japan Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.3.2. Japan Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.3.3. Japan Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.4. India 6.4.4.1. India Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.4.2. India Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.4.3. India Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.5. Australia 6.4.5.1. Australia Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.5.2. Australia Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.5.3. Australia Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.6.2. Indonesia Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.6.3. Indonesia Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.7.2. Malaysia Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.7.3. Malaysia Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.8.2. Vietnam Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.8.3. Vietnam Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.9.2. Taiwan Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.9.3. Taiwan Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Autonomous Robot Market Size and Forecast, by Product (2024-2030) 6.4.10.2. Rest of Asia Pacific Autonomous Robot Market Size and Forecast, by Type (2024-2030) 6.4.10.3. Rest of Asia Pacific Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 7. Middle East and Africa Autonomous Robot Market Size and Forecast by Segmentation (by Value and Volume in USD Billion) (2024-2030) 7.1. Middle East and Africa Autonomous Robot Market Size and Forecast, by Product (2024-2030) 7.2. Middle East and Africa Autonomous Robot Market Size and Forecast, by Type (2024-2030) 7.3. Middle East and Africa Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 7.4. Middle East and Africa Autonomous Robot Market Size and Forecast, by Country (2024-2030) 7.4.1. South Africa 7.4.1.1. South Africa Autonomous Robot Market Size and Forecast, by Product (2024-2030) 7.4.1.2. South Africa Autonomous Robot Market Size and Forecast, by Type (2024-2030) 7.4.1.3. South Africa Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 7.4.2. GCC 7.4.2.1. GCC Autonomous Robot Market Size and Forecast, by Product (2024-2030) 7.4.2.2. GCC Autonomous Robot Market Size and Forecast, by Type (2024-2030) 7.4.2.3. GCC Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Autonomous Robot Market Size and Forecast, by Product (2024-2030) 7.4.3.2. Nigeria Autonomous Robot Market Size and Forecast, by Type (2024-2030) 7.4.3.3. Nigeria Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Autonomous Robot Market Size and Forecast, by Product (2024-2030) 7.4.4.2. Rest of ME&A Autonomous Robot Market Size and Forecast, by Type (2024-2030) 7.4.4.3. Rest of ME&A Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 8. South America Autonomous Robot Market Size and Forecast by Segmentation (by Value and Volume in USD Billion) (2024-2030) 8.1. South America Autonomous Robot Market Size and Forecast, by Product (2024-2030) 8.2. South America Autonomous Robot Market Size and Forecast, by Type (2024-2030) 8.3. South America Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 8.4. South America Autonomous Robot Market Size and Forecast, by Country (2024-2030) 8.4.1. Brazil 8.4.1.1. Brazil Autonomous Robot Market Size and Forecast, by Product (2024-2030) 8.4.1.2. Brazil Autonomous Robot Market Size and Forecast, by Type (2024-2030) 8.4.1.3. Brazil Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 8.4.2. Argentina 8.4.2.1. Argentina Autonomous Robot Market Size and Forecast, by Product (2024-2030) 8.4.2.2. Argentina Autonomous Robot Market Size and Forecast, by Type (2024-2030) 8.4.2.3. Argentina Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Autonomous Robot Market Size and Forecast, by Product (2024-2030) 8.4.3.2. Rest Of South America Autonomous Robot Market Size and Forecast, by Type (2024-2030) 8.4.3.3. Rest Of South America Autonomous Robot Market Size and Forecast, by Industry (2024-2030) 9. Global Autonomous Robot Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Autonomous Robot Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Aethon Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Aviation Industry Corporation of China, Ltd 10.3. Bluefin Robotics 10.4. Cimcorp Automation, Ltd 10.5. Clearpath Robotics Inc. 10.6. Fetch Robotics, Inc. 10.7. Gecko Systems Intl. Corp. 10.8. Hi Tech Robotics Systemz Ltd. 10.9. Locus Robotics 10.10. Oceaneering International, Inc. 10.11. SAAB 10.12. Seegrid Corporation 10.13. Vecna Technologies, Inc 10.14. Mobile Industrial Robots Ap 10.15. SMP Robotics 10.16. Swisslog Holding Ltd. 10.17. Savioke, Inc. 10.18. Omron Corporation 10.19. AtriCure, Inc. 10.20. Biosensors International Group, Ltd. 11. Key Findings 12. Industry Recommendations 13. Autonomous Robot Market: Research Methodology