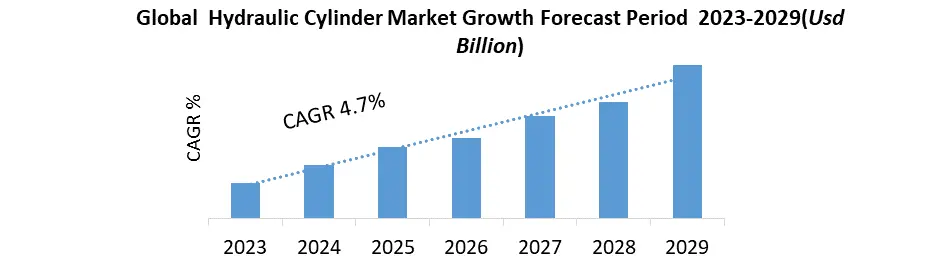

The Global Hydraulic Cylinder Market size was valued at US $15.91 Billion in 2023 and is forecasted to grow at a CAGR of 4.7% from 2024 to 2030, reaching nearly US $21.95 Billion. The Hydraulic Cylinder Market is a vital segment of the fluid power industry which caters to diverse applications across multiple sectors such as construction, agriculture, oil and gas, automotive, aerospace, and manufacturing. Hydraulic cylinders are mechanical devices that convert hydraulic energy into linear force and motion. The global demand for hydraulic cylinder market in crane market is increasing in both developed and developing economies, such as India, China, and Brazil, and end users are adopting these changes in consideration of low labor cost. These factors give boost to the global demand in the hydraulic cylinder market. The global construction industry growth is forecasted to increase demand for heavy construction vehicles with hydraulic cylinders. They are predominantly used in earth-moving apparatus to generate linear motion and force. North America is the biggest contributor to global hydraulic cylinder market by revenue. The governments of the United States and Canada are more driven towards make investments in the aerospace and defense industries which bound to increase North American demand in the hydraulic cylinder market.To know about the Research Methodology :- Request Free Sample Report Research Methodology The market research methodology for hydraulic cylinder market entails a strategic approach of data collection and performing insightful analysis on various statistical tools available in market such as power BI, Tableau, R, Python, and SPSS. Primary research entails conducting interviews and surveys with industry experts, stakeholders, manufacturers, and customers, whereas secondary research entails collecting data from existing sources like reports, publications, and academic journals. Using both top-down and bottom-up approaches, the hydraulic cylinder market is scrutinized by analyzing market sizing and forecasting techniques to estimate market value and growth. Qualitative data is used to evaluate identify trends, drivers, and challenges, quantitative analysis provides numerical insights. Market segmentation and regional analysis is done to comprehend specific market segments and geographic dynamics. A comprehensive competitive analysis is conducted to evaluate the strategies and market share of key players.

Hydraulic Cylinder Market Dynamics

Market Drivers Material handling equipment demand has a major economic influence on the Hydraulic Cylinder Market The Hydraulic Cylinder Market drivers are industrial sector which encompasses construction, mining, agriculture, automotive, aerospace, and oil and gas industries that plays a significant role in driving the need for hydraulic cylinders in the market as they are extensively used for lifting, pushing, pulling, and steering applications. Investments in infrastructure projects such as roads, bridges, railways, and dams contribute to the demand for hydraulic cylinders, which are critical for heavy lifting and earthmoving equipment. The market trend of automation and industrialization across sectors also fuels the hydraulic cylinder market as hydraulic cylinders are essential components in automation systems for precise and controlled linear motion. The Hydraulic Cylinder Market also drives the energy and power generation sector as they require the hydraulic cylinders in hydraulic power plants, wind turbines, hydroelectric dams, and oil and gas drilling equipment. Replacement and maintenance of aging machinery, ongoing technological advancements in design and manufacturing processes, and the increasing demand for heavy machinery and equipment also contribute to hydraulic cylinder market growth. Emerging markets, growing environmental concerns, and the availability of aftermarket services for repair and maintenance further stimulate the demand for hydraulic cylinders Hydraulic Cylinder Market Opportunities The Hydraulic Cylinder Market has numerous market opportunities for businesses such as customization, which is a key opportunity as there is a growing demand for hydraulic cylinders that is tailored to meet specific requirements of different industries and applications. The integration of IoT and smart technologies, allowing hydraulic cylinder manufacturers to offer connected solutions with remote monitoring, predictive maintenance, and performance optimization capabilities. Energy efficiency is a significant focus for the Hydraulic Cylinder industry as with increasing environmental concerns and regulations driving the demand for greener hydraulic systems. The strategic companies develop energy-efficient hydraulic cylinders with reduced friction and advanced fluid management capabilities to meet this market needs. The adoption of lightweight materials offers opportunities, particularly in aerospace and automotive sectors, where weight reduction is of paramount importance to improve performance. Expanding into emerging markets, retrofitting and modernizing existing hydraulic systems, collaborating with OEMs, and international expansion are all avenues for Hydraulic Cylinder Market growth. The development of high-pressure hydraulic systems and providing aftermarket services and spare parts are opportunities for companies to cater to specialized market segments and establish long-term customer relationships. By seizing these market opportunities, hydraulic cylinder manufacturers drive their business growth, broaden their market reach, and meet the evolving demands of customers in diverse industries. Hydraulic Cylinder Market Restraints and Challenges The Hydraulic Cylinder Market encounters with the challenges and restraints that impacts the market growth and profitability. Intense competition among numerous manufacturers and suppliers leads to price wars, margin pressures, and the necessity for ongoing innovation to maintain a competitive edge. Economic uncertainty and fluctuations affect demand, as industries reduces the capital expenditures during downturns, resulting in a slowdown in new equipment purchases and decreased demand for hydraulic cylinders in the market. The Hydraulic Cylinder market also faces restraints of volatility in raw material prices, such as steel, aluminum, and rubber as manufacturers must monitor unpredictable costs and mitigate the inability to pass on increased expenses to customers. Technological advancements and automation, while providing opportunities, also pose challenges, as rapid progress in alternative technologies and automation reduces the demand or displace hydraulic cylinders in certain applications. Environmental regulations and sustainability requirements impose further constraints, demanding the development of eco-friendly hydraulic systems and components. Limited market awareness, supply chain disruptions, the skills gap, and safety and environmental concerns pose hurdles to the hydraulic cylinder industry. These challenges require adaptability, innovation, customer-centric approaches, and a focus on sustainability to ensure the continued success and growth of hydraulic cylinder manufacturers.Hydraulic Cylinder Market Trends

The Hydraulic Cylinder Market is witnesses significant trends shaping its growth and industry dynamics. The demand for electric and hybrid hydraulic systems is increasing, driven by the need for improved energy efficiency and control. Integration of IoT and Industry 4.0 technologies enables real-time monitoring and predictive maintenance. Compact and lightweight designs are gaining prominence in industries like aerospace and automotive to enhance efficiency. Intelligent and self-monitoring hydraulic cylinders with smart sensors and monitoring systems are emerging for real-time performance tracking. Servo-hydraulic systems provide precise control for applications requiring accurate positioning. Energy recovery systems capture and reuse energy for enhanced efficiency. Additive manufacturing allows for customized designs. Emphasis on predictive maintenance, remote monitoring, and growing demand in emerging markets like Asia-Pacific and Latin America are also key trends. Manufacturers that align with these trends positions themselves for growth and maintain a competitive edge in the hydraulic cylinder industry. Oxford Economics and Global Construction Perspective (GCP) forecast that the construction industry will reach $15.5 trillion by 2029.

Hydraulic Cylinder Market Segment Analysis:

The Hydraulic Cylinder Market is segmented by type, application, product type, end user, and region. Based on the Type, the Hydraulic Cylinder Market is segmented into double acting and single acting. The double acting is forecasted to have a lead the hydraulic cylinder market in this segment. Double acting cylinders distributes the load in both the directions which is useful for the applications where more than one motion is necessary. Single acting cylinder design is of one port and small housing without spring that extends and retracts during the field use. By Application, the hydraulic cylinder market is segmented based on application in Three main categories - Aerospace and industrial and Other applications. The Aerospace is leading the market. hydraulic cylinders find extensive use in diverse applications such as elevators, drilling equipment, airplane landing gears, suspension systems in cars, log-splitters, gym equipment, and more. This dominance is attributed to their efficient power transmission capabilities, enabling the lifting, pulling, or pushing of heavy equipment and objects with ease.By Design, the hydraulic cylinder market is segmented into 4 categories – Tie Rod, Welded, Telescopic, and Mill type. By End User, The Hydraulic Cylinder market in the agricultural sector is forecasted to govern the hydraulic cylinder market. The End user segment includes Agriculture, Energy Industry, Construction machinery, Manufacturing vehicles, Mining, Industrial tools, Aerospace and Defense, automobiles. The Hydraulic Cylinder Market is divided in 5 regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Hydraulic Cylinder Market Regional Insights

North America, South America, Europe, Asia-Pacific, Middle East and Africa, and South America are the five geographic divisions for the hydraulic cylinder market. Rising demand in Asia-Pacific region boosts the Western markets to outsource the manufacture of the hydraulic cylinders. Rapidly growing emerging economies, China and India, has led to an increased the demand for hydraulic cylinders in the past decade and is expected to grow with the same trend. The hydraulic cylinder industry in India has been growing at an average of more than 20%. North America is currently leading the market. Asia Pacific market is forecasted to lead the hydraulic cylinder industry in the forecasted period from 2024-2030. North America is also forecasted to grow in the same period due to demand rise in the oil and gas, and mining industry. Europe has been one of the lucrative region for hydraulic cylinder market because of many OEMs have been located in the region itself. Latin America and Middle East & Africa is also forecasted to grow.Hydraulic Cylinder Competitive Analysis

The competitive landscape of the Hydraulic Cylinders Market is characterized by the presence of several key companies engage in strategic initiatives, such as product launches, partnerships, collaborations, and acquisitions, to maintain their market position and gain a competitive edge. While specific players and their market shares may vary over time. Some of the key players are Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation, Wipro Enterprises (Parker), Actuant Corporation, KYB Corporation, Jiangsu Hengli Hydraulic Co., Ltd., Weber-Hydraulik GmbH, Hengli America Co., Ltd., and Hydac International GmbH. These companies are known for their extensive product portfolios, technological advancements, and global distribution networks. They cater to diverse industries, including construction, mining, oil & gas, automotive, aerospace, and industrial machinery. It's important to note that the competitive landscape may evolve as new players enter the market, technological advancements emerge, and market dynamics shift.Hydraulic Cylinder Market Scope: Inquire before buying

Hydraulic Cylinder Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 15.91 Bn. Forecast Period 2024 to 2030 CAGR: 4.7% Market Size in 2030: US $ 21.95 Bn. Segments Covered: by Type Single acting Double acting by Design Tie Rod Welded Telescopic Mill type Other by Application Industrial Aerospace Others by Industry Construction Aerospace Material Handling Agriculture Mining Automotive Others Hydraulic Cylinder Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Companies in the Global Hydraulic Cylinder Market

1. Bosch Rexroth AG 2. Caterpillar Inc. 3. Komatsu Ltd. 4. Parker Hannifin Corporation 5. Eaton Corporation 6. Wipro Enterprises 7. KYB Corporation 8. Jiangsu Hengli Hydraulic Co., Ltd. 9. Weber-Hydraulik GmbH 10. Hydac International GmbH 11. Hitachi Construction Machinery Co., Ltd. 12. Liebherr Group 13. SMC Corporation 14. Bucher Hydraulics GmbH 15. Danfoss Power Solutions 16. Prince Manufacturing Corporation 17. Bailey International LLC FAQs 1) What is the estimated value of the Global Hydraulic Cylinder Market in 2023? Ans. The Global market was estimated to be valued at $15.91 Bn in 2023. 2) What is the growth rate of the Global Hydraulic Cylinder Market? Ans. The growth rate of the market globally is 4.7% CAGR, with a forecasted value of $21.95 Bn by 2030. 3) Which region has the highest growing potential across the globe? Ans. Asia Pacific region is forecasted to grow for the global Hydraulic Cylinder Market at highest rate among all regions in the forecast period of 2024-2030. 4) How is Global Hydraulic Cylinder Market segmented by End user? Ans. The Hydraulic Cylinder Market is segmented in 4types – Agriculture, Energy, Construction, and Manufacturing. 5) Based on application, how is Global Hydraulic Cylinder Market segmented? Ans. Based on application, the Hydraulic Cylinder Market is segmented as – Mobile and Industrial. 6) How are the top players in Global Hydraulic Cylinder Market? Ans. As per the studies and research conducted, the report states that the key players in this industry are, Bosch Rexroth AG, Caterpillar Inc., Komatsu Ltd., Parker Hannifin Corporation, Eaton Corporation, and Wipro Enterprises (Parker).

1. Hydraulic Cylinder Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hydraulic Cylinder Market: Dynamics 2.1. Hydraulic Cylinder Market Trends by Region 2.1.1. North America Hydraulic Cylinder Market Trends 2.1.2. Europe Hydraulic Cylinder Market Trends 2.1.3. Asia Pacific Hydraulic Cylinder Market Trends 2.1.4. Middle East and Africa Hydraulic Cylinder Market Trends 2.1.5. South America Hydraulic Cylinder Market Trends 2.2. Hydraulic Cylinder Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Hydraulic Cylinder Market Drivers 2.2.1.2. North America Hydraulic Cylinder Market Restraints 2.2.1.3. North America Hydraulic Cylinder Market Opportunities 2.2.1.4. North America Hydraulic Cylinder Market Challenges 2.2.2. Europe 2.2.2.1. Europe Hydraulic Cylinder Market Drivers 2.2.2.2. Europe Hydraulic Cylinder Market Restraints 2.2.2.3. Europe Hydraulic Cylinder Market Opportunities 2.2.2.4. Europe Hydraulic Cylinder Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Hydraulic Cylinder Market Drivers 2.2.3.2. Asia Pacific Hydraulic Cylinder Market Restraints 2.2.3.3. Asia Pacific Hydraulic Cylinder Market Opportunities 2.2.3.4. Asia Pacific Hydraulic Cylinder Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Hydraulic Cylinder Market Drivers 2.2.4.2. Middle East and Africa Hydraulic Cylinder Market Restraints 2.2.4.3. Middle East and Africa Hydraulic Cylinder Market Opportunities 2.2.4.4. Middle East and Africa Hydraulic Cylinder Market Challenges 2.2.5. South America 2.2.5.1. South America Hydraulic Cylinder Market Drivers 2.2.5.2. South America Hydraulic Cylinder Market Restraints 2.2.5.3. South America Hydraulic Cylinder Market Opportunities 2.2.5.4. South America Hydraulic Cylinder Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Hydraulic Cylinder Industry 2.8. Analysis of Government Schemes and Initiatives For Hydraulic Cylinder Industry 2.9. Hydraulic Cylinder Market Trade Analysis 2.10. The Global Pandemic Impact on Hydraulic Cylinder Market 3. Hydraulic Cylinder Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 3.1.1. Single acting 3.1.2. Double acting 3.2. Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 3.2.1. Tie Rod 3.2.2. Welded 3.2.3. Telescopic 3.2.4. Mill type 3.2.5. Other 3.3. Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 3.3.1. Aerospace 3.3.2. Industrial 3.3.3. Others 3.4. Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 3.4.1. Construction 3.4.2. Aerospace 3.4.3. Material Handling 3.4.4. Agriculture 3.4.5. Mining 3.4.6. Automotive 3.4.7. Others 3.5. Hydraulic Cylinder Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Hydraulic Cylinder Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 4.1.1. Single acting 4.1.2. Double acting 4.2. North America Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 4.2.1. Tie Rod 4.2.2. Welded 4.2.3. Telescopic 4.2.4. Mill type 4.2.5. Other 4.3. North America Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 4.3.1. Aerospace 4.3.2. Industrial 4.3.3. Others 4.4. North America Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 4.4.1. Construction 4.4.2. Aerospace 4.4.3. Material Handling 4.4.4. Agriculture 4.4.5. Mining 4.4.6. Automotive 4.4.7. Others 4.5. North America Hydraulic Cylinder Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 4.5.1.1.1. Single acting 4.5.1.1.2. Double acting 4.5.1.2. United States Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 4.5.1.2.1. Tie Rod 4.5.1.2.2. Welded 4.5.1.2.3. Telescopic 4.5.1.2.4. Mill type 4.5.1.2.5. Other 4.5.1.3. United States Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Aerospace 4.5.1.3.2. Industrial 4.5.1.3.3. Others 4.5.1.4. United States Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 4.5.1.4.1. Construction 4.5.1.4.2. Aerospace 4.5.1.4.3. Material Handling 4.5.1.4.4. Agriculture 4.5.1.4.5. Mining 4.5.1.4.6. Automotive 4.5.1.4.7. Others 4.5.2. Canada 4.5.2.1. Canada Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 4.5.2.1.1. Single acting 4.5.2.1.2. Double acting 4.5.2.2. Canada Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 4.5.2.2.1. Tie Rod 4.5.2.2.2. Welded 4.5.2.2.3. Telescopic 4.5.2.2.4. Mill type 4.5.2.2.5. Other 4.5.2.3. Canada Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Aerospace 4.5.2.3.2. Industrial 4.5.2.3.3. Others 4.5.2.4. Canada Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 4.5.2.4.1. Construction 4.5.2.4.2. Aerospace 4.5.2.4.3. Material Handling 4.5.2.4.4. Agriculture 4.5.2.4.5. Mining 4.5.2.4.6. Automotive 4.5.2.4.7. Others 4.5.3. Mexico 4.5.3.1. Mexico Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 4.5.3.1.1. Single acting 4.5.3.1.2. Double acting 4.5.3.2. Mexico Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 4.5.3.2.1. Tie Rod 4.5.3.2.2. Welded 4.5.3.2.3. Telescopic 4.5.3.2.4. Mill type 4.5.3.2.5. Other 4.5.3.3. Mexico Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Aerospace 4.5.3.3.2. Industrial 4.5.3.3.3. Others 4.5.3.4. Mexico Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 4.5.3.4.1. Construction 4.5.3.4.2. Aerospace 4.5.3.4.3. Material Handling 4.5.3.4.4. Agriculture 4.5.3.4.5. Mining 4.5.3.4.6. Automotive 4.5.3.4.7. Others 5. Europe Hydraulic Cylinder Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.2. Europe Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.3. Europe Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.4. Europe Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5. Europe Hydraulic Cylinder Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.1.2. United Kingdom Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.1.3. United Kingdom Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5.2. France 5.5.2.1. France Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.2.2. France Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.2.3. France Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.3.2. Germany Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.3.3. Germany Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.4.2. Italy Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.4.3. Italy Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.5.2. Spain Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.5.3. Spain Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.6.2. Sweden Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.6.3. Sweden Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.7.2. Austria Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.7.3. Austria Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 5.5.8.2. Rest of Europe Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 5.5.8.3. Rest of Europe Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6. Asia Pacific Hydraulic Cylinder Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.3. Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5. Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.1.2. China Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.1.3. China Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.2.2. S Korea Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.2.3. S Korea Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Japan Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.3.3. Japan Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.4. India 6.5.4.1. India Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.4.2. India Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.4.3. India Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Australia Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.5.3. Australia Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Indonesia Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.6.3. Indonesia Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Malaysia Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.7.3. Malaysia Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Vietnam Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.8.3. Vietnam Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.9.2. Taiwan Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.9.3. Taiwan Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 6.5.10.3. Rest of Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 7. Middle East and Africa Hydraulic Cylinder Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 7.3. Middle East and Africa Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 7.5. Middle East and Africa Hydraulic Cylinder Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 7.5.1.2. South Africa Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 7.5.1.3. South Africa Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 7.5.2.2. GCC Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 7.5.2.3. GCC Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Nigeria Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 7.5.3.3. Nigeria Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 7.5.4.2. Rest of ME&A Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 7.5.4.3. Rest of ME&A Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 8. South America Hydraulic Cylinder Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 8.2. South America Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 8.3. South America Hydraulic Cylinder Market Size and Forecast, by Application(2023-2030) 8.4. South America Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 8.5. South America Hydraulic Cylinder Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 8.5.1.2. Brazil Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 8.5.1.3. Brazil Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 8.5.2.2. Argentina Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 8.5.2.3. Argentina Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Hydraulic Cylinder Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Rest Of South America Hydraulic Cylinder Market Size and Forecast, by Design (2023-2030) 8.5.3.3. Rest Of South America Hydraulic Cylinder Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Hydraulic Cylinder Market Size and Forecast, by Industry (2023-2030) 9. Global Hydraulic Cylinder Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Hydraulic Cylinder Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Bosch Rexroth AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Caterpillar Inc. 10.3. Komatsu Ltd. 10.4. Parker Hannifin Corporation 10.5. Eaton Corporation 10.6. Wipro Enterprises 10.7. KYB Corporation 10.8. Jiangsu Hengli Hydraulic Co., Ltd. 10.9. Weber-Hydraulik GmbH 10.10. Hydac International GmbH 10.11. Hitachi Construction Machinery Co., Ltd. 10.12. Liebherr Group 10.13. SMC Corporation 10.14. Bucher Hydraulics GmbH 10.15. Danfoss Power Solutions 10.16. Prince Manufacturing Corporation 10.17. Bailey International LLC 11. Key Findings 12. Industry Recommendations 13. Hydraulic Cylinder Market: Research Methodology 14. Terms and Glossary