Artificial Organ Market size was valued at USD 31.46 Bn. in 2023 and the total market revenue is expected to grow by 10 % from 2024 to 2030, reaching nearly USD 61.30 Bn.Artificial Organ Market Overview:

The Artificial organs are human-made organs. These organs are placed into human bodies with living tissues and can perform functions comparable to human body parts. Bionics is the enhancement or replacement of bodily components with mechanical types. As prosthetic organs are constructed of plastic and are seeded with stem cells from the relocated recipient, the body's immune system does not reject them. Manufacturers and researchers are always working to increase the odds of artificial organ acceptance by the recipient. Artificial organ innovation provides patients who do not qualify for traditional organ transplants with equally effective treatment options. Technological developments in the manufacturing process, such as bioartificial organ manufacture, standardization, and automation, drive the Artificial Organ Market growth even in the forecast year. Artificial organs lessen the likelihood of organ rejection while also allowing for mass manufacture. According to the American Transplant Foundation, around 114,000 people are on the waiting list for organ transplantation, with roughly 20 people dying owing to organ shortages. With such rising demand for organ transplants, the artificial organ market grows significantly as artificial organs aid to alleviate donor organ shortages.Report Scope:

The report on Artificial Organs provides a quantitative analysis of market size, price, M&A, demand, supply chain, investment and expansion plans by key competitors, and predictions. Porter's five forces study explains how buyers and suppliers build supplier-buyer networks and make profit-driven decisions. The present Artificial Organ Market potential is assessed through detailed analysis and segmentation. The analysis will provide investors with a full insight into the industry's future, as well as the elements likely to affect the firm favorably or adversely. The research offers a complete understanding of the market for those investors wishing to invest. The reports contain scenarios for the Artificial Organ Market from the past and present, along with projected market numbers. The report's thorough analysis of important competitors, including market leaders, followers, and new entrants, covers every aspect of the market. The research contains strategic profiles of the top market participants, a full examination of their key competencies, and their company-specific plans for the introduction of new products, growth, partnerships, joint ventures, and acquisitions. With its clear portrayal of competitive analysis of significant companies by product, pricing, financial condition, product portfolio, growth strategies, and regional presence in the domestic as well as the local market, the research acts as an investor's guide.To know about the Research Methodology :- Request Free Sample Report

Artificial Organ Market Dynamics:

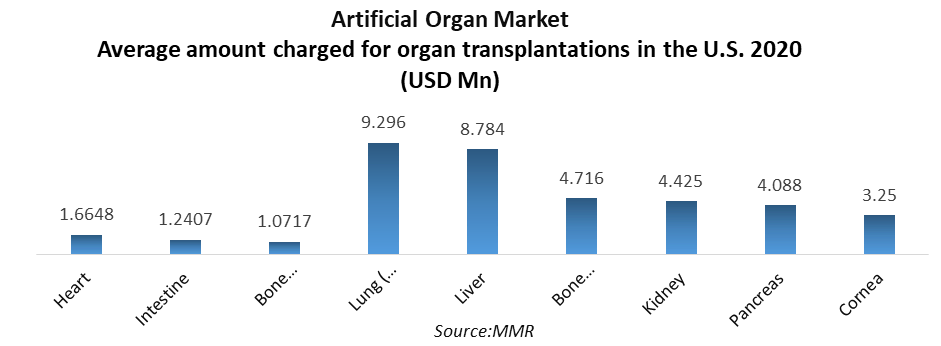

Product inventions aimed at mitigating the disadvantages of organ shortage The increasing prevalence of organ failure due to severe infections, cardiovascular illness, and trauma boosts the number of organ transplant surgeries. According to the World Health Organization, around 48.9 million cases of sepsis were reported in 2019. Adoption of bad behaviors such as alcohol use and smoking results in liver and heart failure. As the incidence of such illnesses rises, so does the danger of organ malfunction, which drives up artificial organ market demand across the world. In the forecast years, technological improvements predominantly drive the growth of the artificial organ market. BiVACOR has created a complete artificial heart (TAH) system that offers a new solution to patients with end-stage heart failure who are unable to receive transplants. Additionally, SynCardia Systems has developed a temporarily implanted complete artificial heart system capable of performing cardiac functions in patients with end-stage biventricular heart failure. Thus, the introduction of new revolutionary items that provide useful solutions would provide enormous chances for Artificial Organ Market development. However, the danger of organ rejection and the substantial expense of artificial organs might limit product demand to some extent. Growing Demand for Organ Transplants to Drive Artificial Organ Market Growth The growing number of transplants, combined with the growing number of people waiting for donors, are the primary drivers of the market for artificial organs and bionics. According to the Human Resources and Services Administration (HRSA), more than 106,108 people are on the national waiting list in the United States in 2022. According to the HRSA, a person is added to the transplant waiting list in the United States every nine minutes, resulting in increased demand for artificial medical devices. The delay in other medical procedures was caused by prioritizing COVID-19 patients, which hampered artificial organ market growth. This delay impacted many elective procedures, reducing product adoption even further. Following amputation surgery, orthopedic bionic devices are commonly used to help partially or completely restore movement in limbs or arms. The decreased number of amputation procedures during the epidemic, on the other hand, hampered industry growth by lowering device acceptance rates. However, the artificial organ market is expected to thrive during the forecast period due to the ease of lockdowns and several restrictions. Market Restraints: Lack of skilled professionals, transplant side effects such as skin irritation, high procedure costs, low technology penetration in developing countries, and other factors are impeding the artificial organ market growth. The presence of the disease in the base tissue used to create the organ is a major concern. Even foreign body tissue is sometimes used to regenerate or reconstruct an organ. There is a chance that the tissue is already infected with another disease in such cases. The total cost of growing and transplanting an artificial organ is prohibitively expensive, limiting its application to the general public. There is a high risk of organ failure, and the body might need time to adjust to the new organ. The body's reaction to the new organ may differ from person to person. If the organ fails to function properly, patients need to have another transplant.

Artificial Organ Market Opportunities:

Advances in 3D bioprinting have proven to be critical in organ transplantation as it is used to develop artificial organs. As it reduces the risk of organ rejection, 3D bioprinting is becoming increasingly popular. Additionally, artificial intelligence is poised to change global trends in artificial device usage. Many countries are currently focusing on a tool that provides a personalized assessment of organ and donor suitability. This tool will be very useful in making effective decisions about organ retrieval, as well as in determining whether patients should accept donor organs or wait for better options. Factors such as increased product launches increased R&D activities, and strategies adopted by key market players are expected to drive the growth of the artificial organ market. Addtionally, new product approvals and ongoing government support are expected to drive the segment's growth. For example, Abbott received Breakthrough Device designation from the US Food and Drug Administration (FDA) in February 2020 for its in-development Fully Implantable Left Ventricular Assist System (FILVAS). In addition, Penn State Health Milton S. Hershey Medical Center became the second hospital in the country to implant a newly designed EvaHeart2 Left Ventricular Assist System (LVAS) in a patient with severe heart failure in March 2021. The procedure was performed as part of the COMPETENCE Trial, a multi-center clinical study that included 40 clinical sites and 399 patients with severe heart failure through 2023. Such advanced device transplants and trials demonstrating the efficacy of the devices drive market growth. Thus, the artificial organ market is expected to grow significantly as a result of the aforementioned factors.Artificial Organ Market Segment Analysis:

Based on Product, Artificial organs segment dominated the artificial organ market in 2023, accounting for more than 70.9% of the total. Demand for kidney, heart, lung, and liver transplants is driving the segment's growth. In the United States, the average median waiting time for a kidney transplant is 5 years. While on the waiting list, many factors are taken into account, including body size, blood type, distance from a donor, and severity of illness. As a result of the challenge of meeting unmet demand, manufacturers have developed bio-lungs, artificial pancreas, and wearable artificial kidneys. During the forecast period, the artificial bionics segment is expected to grow at the fastest rate. The increasing demand for cochlear implants, vision, exoskeleton, limbs, and brain bionics are the primary factors driving the segment's growth. Additionally, favorable reimbursement policies and expedited FDA approval for implants are fueling the growth of the artificial organ market and bionics market. For example, Cochlear Limited's Cochlear Nucleus Implants were approved by the US Food and Drug Administration in January 2022 to treat unilateral hearing loss and single-sided deafness. Based on the Technology, Mechanical bionics dominated the market in 2023, accounting for 67.1% of the total. This is due primarily to the increasing prevalence of organ failure and the low cost of mechanical bionics. Mechanical artificial heart valves last much longer than other options, resulting in high demand. Rapid FDA approvals and reimbursement policies are also factors driving growth. For example, the FDA approved Abbott's Portico with FlexNav TAVR system in September 2021 to treat patients with symptomatic and aortic stenosis who are at high or very high risk for open-heart surgery. During the forecast period, the electronic bionics segment is expected to grow at the fastest rate in the artificial organ market. Approximately 1.5 billion people are physically disabled, with 190.5 million adults experiencing primary functional difficulty. Most developing countries continue to face significant logistical and financial challenges. For many disabled people, the only option is to obtain prosthetics such as artificial hands, arms, and legs. These prosthetics are myoelectrical controlled batteries and electronic systems that can generate nerve movement via sensors. These sensory electric technologies allow artificial organs to move. To achieve mobility, machine learning, smart wearables, and element modeling are used. Furthermore, an increase in the number of road accidents, amputees, and individuals born without limbs is expected to drive demand for electronic bionics.Artificial Organ Market Regional Insights:

North America currently dominates the artificial organ market and is expected to do so for the forecast period. The growing burden of chronic diseases such as heart disease, chronic kidney disease, pulmonary fibrosis, organ failure, and others, rising adoption of technologies, increasing product approvals, increasing investments, and key initiatives taken by key market players are the primary driving factors for the growth of the North American artificial organ market. During the forecast period, the United States is expected to grow significantly within North America. The rising prevalence of cardiovascular diseases that result in heart failure is expected to fuel advancements in the artificial heart market. For example, heart disease is one of the leading causes of death in the United States, according to the Centers for Disease Control and Prevention's (CDC) article titled 'Heart Disease Facts,' which was updated in February 2022. According to the same source, approximately 659,050 Americans have a heart attack each year. As the mortality rate from heart disease rises, there is an ongoing need for devices that can improve heart efficiency, driving the artificial organ market. Launching products and services in the region will also significantly drive the market. For example, Abiomed's cardiopulmonary bypass system received 515(k) clearance from the US Food and Drug Administration (FDA) in October 2020. This artificial lung will aid in the treatment of COVID-19 patients as well as others suffering from cardiogenic shock or respiratory failure. Baxter received 510(k) clearance from the US Food and Drug Administration for its portable hemodialysis machine, Artificial Kidney 98, in March 2021. It will assist dialysis providers in reducing the operational challenges that can arise from administering multiple hemodialysis sessions per machine on a daily basis. Furthermore, rising R&D activities and investments are expected to drive market growth. For example, The Kidney Project, a nationwide collaboration led by Shuvo Roy, Ph.D. of the University of California San Francisco, and William Fissell, MD of Vanderbilt University Medical Center (VUMC), received USD 650,000 from KidneyX in September 2021 for its first-ever demonstration of a functional prototype of its implantable artificial kidney. Such developments in the artificial organ market will increase its acceptance, thereby driving the artificial organ market.Artificial Organs Market Scope: Inquire before buying

Artificial Organ Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 31.46 Bn. Forecast Period 2024 to 2030 CAGR: 10% Market Size in 2030: US$ 61.30 Bn. Segments Covered: by Type Artificial Organs Kidney Heart Lungs Liver Pancreas Artificial Bionics Cochlear implant Exoskeleton Bionic limbs Vision bionics Brain bionics by Technology Mechanical bionics Electronic bionics by Material Silicone Plastic Steel Biomaterials by End Users Hospitals Ambulatory Surgical Centers Laboratories and Diagnostic Centers Research and Academic Institute Others Artificial Organ Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Artificial Organ Market Key Players are:

1. Baxter International Inc. (US) 2. Boston Scientific Corporation (US) 3. ALung Technologies, Inc. (US) 4. Zimmer Biomet (US) 5. MyLVAD Foundation, LTD (US) 6. Abiomed, Inc. (US) 7. Cleveland HeartLab, Inc. (US) 8. Edwards Lifesciences (US) 9. Ekso Bionics Holdings Inc. (US) 10.Jarvik Heart Inc. (US) 11.SynCardia Systems, LLC (US) 12.Abbott Laboratories (US) 13.Excorp Medical Inc (US) 14.Berlin Heart GmbH (Germany) 15.B. Braun Melsungen AG (Germany) 16.CEGLA Medizintechnik GmbH (Germany) 17.Fresenius Medical Care AG & Co. KGaA (Germany) 18.Carmat SA (France) 19.Defymed (France) 20.Getinge AB (Sweden) 21.F. Hoffmann-La Roche AG (Switzerland) 22.Medtronic PLC (Ireland) 23.Nikkiso Co. Ltd. (Japan) 24.Nipro Corporation (Japan) 25.Toray Medical Company Limited (Japan) Asahi Kasei Medical Co. Ltd (Japan) Terumo Corporation (Japan) Frequently Asked Questions: 1] What is an Artificial Organ? Ans. An artificial organ is a man-made organ device or tissue that is implanted or integrated into a human interacting with living tissue to replace a natural organ, duplicate or augment a specific function or function, and allow the patient to resume normal life as soon as possible. The replaced function is not required to be related to life support, but it is frequently. Replacement bones and joints, such as those used in hip replacements, could be regarded as artificial organs. 2] What are examples of artificial organs? Ans. Artificial organs include the artificial heart and pacemaker, dialysis to perform kidney functions, and artificial substitutes for missing limbs. 3] Are artificial organs available? Ans. Cardiovascular-related artificial organs are implanted when the heart, its valves, or another part of the circulatory system is dysfunctional. The artificial heart is typically used to bridge the time between heart transplantation and permanent replacement of the heart if heart transplantation is not possible. 4] What is the main problem with artificial organs? Ans. They are as follows: 1) surface or gas effects on solid and fluid blood constituents; 2) immunologic problems; 3) hydrodynamic effects; 4) biochemical effects; 5) potential carcinogens; 6) potential teratogens; and 7) a group of physical incompatibilities including heat, electricity, and mechanical support problems. 5] What is the future of artificial organs? Ans. Scientists are developing newer, cheaper, and safer methods of creating artificial organs, which could reduce the waiting list for organ transplants and transform surgery. In laboratories, scientists are successfully creating artificial hearts, livers, lungs, urethras, windpipes, and other organs.

1. Global Artificial Organ Market: Research Methodology 2. Global Artificial Organ Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Artificial Organ Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Artificial Organ Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Artificial Organ Market Segmentation 4.1 Global Artificial Organ Market, by Segment-A (2023-2030) • Artificial Organs o Kidney o Heart o Lungs o Liver o Pancreas • Artificial Bionics o Cochlear implant o Exoskeleton o Bionic limbs o Vision bionics o Brain bionics 4.2 Global Artificial Organ Market, by Segment-B (2023-2030) • Mechanical bionics • Electronic bionics 4.3 Global Artificial Organ Market, by Segment-C (2023-2030) • Silicone • Plastic • Steel • Biomaterials 4.4 Global Artificial Organ Market, by Segment-D (2023-2030) • Hospitals • Ambulatory Surgical Centers • Laboratories and Diagnostic Centers • Research and Academic Institute • Others 5. North America Artificial Organ Market(2023-2030) 5.1 North America Artificial Organ Market, by Segment-A (2023-2030) • Artificial Organs o Kidney o Heart o Lungs o Liver o Pancreas • Artificial Bionics o Cochlear implant o Exoskeleton o Bionic limbs o Vision bionics o Brain bionics 5.2 North America Artificial Organ Market, by Segment-B (2023-2030) • Mechanical bionics • Electronic bionics 5.3 North America Artificial Organ Market, by Segment-C (2023-2030) • Silicone • Plastic • Steel • Biomaterials 5.4 North America Artificial Organ Market, by Segment-D (2023-2030) • Hospitals • Ambulatory Surgical Centers • Laboratories and Diagnostic Centers • Research and Academic Institute • Others 5.5 North America Artificial Organ Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Artificial Organ Market (2023-2030) 6.1. European Artificial Organ Market, by Segment-A (2023-2030) 6.2. European Artificial Organ Market, by Segment-B (2023-2030) 6.3. European Artificial Organ Market, by Segment-C (2023-2030) 6.4. European Artificial Organ Market, by Segment-D (2023-2030) 6.5. European Artificial Organ Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Artificial Organ Market (2023-2030) 7.1. Asia Pacific Artificial Organ Market, by Segment-A (2023-2030) 7.2. Asia Pacific Artificial Organ Market, by Segment-B (2023-2030) 7.3. Asia Pacific Artificial Organ Market, by Segment-C (2023-2030) 7.4. Asia Pacific Artificial Organ Market, by Segment-D (2023-2030) 7.5. Asia Pacific Artificial Organ Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Artificial Organ Market (2023-2030) 8.1 Middle East and Africa Artificial Organ Market, by Segment-A (2023-2030) 8.2. Middle East and Africa Artificial Organ Market, by Segment-B (2023-2030) 8.3. Middle East and Africa Artificial Organ Market, by Segment-C (2023-2030) 8.4. Middle East and Africa Artificial Organ Market, by Segment-D (2023-2030) 8.5. Middle East and Africa Artificial Organ Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Artificial Organ Market (2023-2030) 9.1. South America Artificial Organ Market, by Segment-A (2023-2030) 9.2. South America Artificial Organ Market, by Segment-B (2023-2030) 9.3. South America Artificial Organ Market, by Segment-C (2023-2030) 9.4. South America Artificial Organ Market, by Segment-D (2023-2030) 9.5. South America Artificial Organ Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Baxter International Inc. (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Boston Scientific Corporation (US) 10.3 ALung Technologies, Inc. (US) 10.4 Zimmer Biomet (US) 10.5 MyLVAD Foundation, LTD (US) 10.6 Abiomed, Inc. (US) 10.7 Cleveland HeartLab, Inc. (US) 10.8 Edwards Lifesciences (US) 10.9 Ekso Bionics Holdings Inc. (US) 10.10 Jarvik Heart Inc. (US) 10.11 SynCardia Systems, LLC (US) 10.12 Abbott Laboratories (US) 10.13 Excorp Medical Inc (US) 10.14 Berlin Heart GmbH (Germany) 10.15 B. Braun Melsungen AG (Germany) 10.16 CEGLA Medizintechnik GmbH (Germany) 10.17 Fresenius Medical Care AG & Co. KGaA (Germany) 10.18 Carmat SA (France) 10.19 Defymed (France) 10.20 Getinge AB (Sweden) 10.21 F. Hoffmann-La Roche AG (Switzerland) 10.22 Medtronic PLC (Ireland) 10.23 Nikkiso Co. Ltd. (Japan) 10.24 Nipro Corporation (Japan) 10.25 Toray Medical Company Limited (Japan)