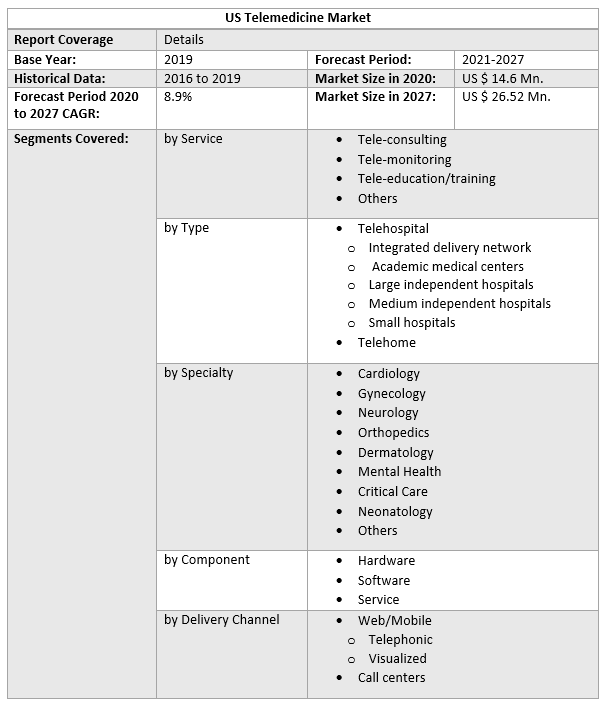

US Telemedicine Market size was valued at US$ 14.6 Mn. in 2020 and the total revenue is expected to grow at 8.9% through 2021 to 2027, reaching nearly US$ 26.52 Mn.US Telemedicine Market Overview:

Telemedicine is the practise of medicine that uses technology to provide care to patients who are located far away. Telemedicine uses telecommunications technology to allow health care providers to evaluate, diagnose, and treat patients from a distance. In the previous decade, the method has undergone a significant transformation, and it is now an increasingly vital part of the American healthcare system.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2026. 2019 is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report

US Telemedicine Market Dynamics:

Telemedicine is the most adaptable technology for providing health education, information, and care to those who reside far away. Advanced patient-centered treatment and increased access to remote regions are now possible because to technological advancements. It also aids in the reduction of emergency room visits and hospitalisation rates, boosting market growth. Nevertheless, the industry is facing various challenges, including professional and patient resistance to technology, high implementation costs, and worries about data privacy and security. These factors may reduce the rate of growth to a degree. The rapidly expanding telecommunication infrastructure is to blame for the market's rise. Furthermore, the growth in infectious diseases, as well as the rising frequency of chronic diseases, would help to expand the market. Data security issues, on the other hand, have been identified as one of the most significant roadblocks to market demand. Also Telemedicine Technologies are playing an important role in the growth of the market. SOC Telemed, a telemedicine technology and services firm based in the United States, reported an increase in demand for on-demand acute care via telemedicine in March 2020. During the COVID-19 pandemic, companies in the telemedicine sector grew at an exponential rate compared to the previous year. Teladoc Health, Inc., for example, grew 109 percent year over year from Quarter 3 of 2019 to Quarter 3 of 2020. During the COVID-19 epidemic, this had a favourable impact on the market.US Telemedicine Market Segment Analysis:

The Teleconsulting Segment is dominating the US Telemedicine Market:

In 2020, the teleconsulting market is expected to be worth roughly USD 16.2 billion. Even in rural places, the growing acceptance of virtual consultation has enhanced access to healthcare services. In addition, the user adoption rate jumped from 11 % to 38 % in a year. Furthermore, tele-consulting increases patient outreach at a low cost, resulting in cost-effectiveness. Further, 24/7 help assistance is projected to drive the growth of the market in the forecast period. The major factor boosting the growth of the market is patient engagement with remote monitoring.The Telehospital segment is considered to supplement the growth of the US Telemedicine Market:

In 2020, the telehospital category accounted for more than 64.7 % of the telemedicine market in the United States. The demand for tele-hospital services is growing as the necessity for remote patient monitoring grows. In addition, the growing demand for efficient, high-quality healthcare services at a cheap cost contributes significantly to the industry's income. Furthermore, increased public awareness of telehospital services such as daytime patient rounds, emergency department consults, night calls or admissions, among others, is expected to boost telemedicine sector demand.The Dermatology segment is gaining more attention in the US Telemedicine Market:

Due to the increased frequency of skin-related diseases, exponential increases in skincare expenditure, and expanding demand for cosmetic procedures in the country, the dermatology industry is expected to reach USD 20.4 billion by 2027. Skin cancer is relatively common in the United States, according to the American Academy of Dermatology Association. According to the AADA, more than 9,570 persons in the U. S. are diagnosed with skin cancer each year. Melanoma is also one of the most frequent malignancies in the U. S. As a result, rising skin cancer instances, rising demand for beauty operations, and expanding need for skincare consultations will drive the telemedicine market forward in the next years.The objective of the report is to present a comprehensive analysis of the US Telemedicine Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the US Telemedicine Market dynamics, structure by analyzing the market segments and project the US Telemedicine Market size. Clear representation of competitive analysis of key players by Service, price, financial position, Service portfolio, growth strategies, and regional presence in the US Telemedicine Market make the report investor’s guide

US Telemedicine Market Scope: Inquire before buying

US Telemedicine Market Key Players

• McKesson Corporation • Cisco Systems • Honeywell International • Philips • Cerner Corporation • Teladoc Health. • Allscripts Healthcare Solutions • AMD U.S. • BioTelemetry • InTouch Technologies • American Well • Specialist Telemed • SOC Telemed • InSight • Eagle Telemedicine • Blue SkyFAQs:

1. What is the US Telemedicine Market value in 2020? Ans: the US Telemedicine Market value in 2020, was 14.6 Million USD. 2. Which segment is dominating the US Telemedicine Market? Ans: The Web/Mobile segment dominated the market for US Telemedicine and accounted for the largest revenue share of over 68.0% in 2020 3. Which specialty segment is expected to dominate the market during the forecast period? Ans: Dermatology segment is dominating the growth of the market in the forecast period. 4. What are the factors driving the US Telemedicine market? Ans: Key factors driving the telemedicine market include lack of access to care & rising provider adoption of telemedicine, rising consumer demand, and increasing patient acceptance, and enhanced quality of care. 5. What are the key players of the Prokaryotic Expression System market? Ans: Following are the key players responsible for the growth of the market Merck McKesson Corporation, Cisco Systems, Honeywell International, Philips, Cerner Corporation and Teladoc Health. Other leaders such as Allscripts Healthcare Solutions, AMD U.S., BioTelemetry, InTouch Technologies, American Well, Specialist Telemed, SOC Telemed, InSight, Eagle Telemedicine and Blue Sky.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Type 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Type 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: US Telemedicine Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. By Region (US) 3.3. Geographical Snapshot of the US Telemedicine Market 3.4. Geographical Snapshot of the US Telemedicine Market, By Manufacturer share 4. US Telemedicine Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. By Region (US) 4.1.2. Restraint 4.1.2.1. By Region (US) 4.1.3. Opportunities 4.1.3.1. By Region (US) 4.1.4. Challenges 4.1.4.1. By Region (US) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the US Telemedicine Market 5. Supply Side and Demand Side Indicators 6. US Telemedicine Market Analysis and Forecast, 2020-2027 6.1. US Telemedicine Market Size & Y-o-Y Growth Analysis. 7. US Telemedicine Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Service, 2020-2027 7.1.1. Tele-consulting 7.1.2. Tele-monitoring 7.1.3. Tele-education/training 7.1.4. Others 7.2. Market Size (Value) Estimates & Forecast By Type, 2020-2027 7.2.1. Telehospital 7.2.1.1. Integrated delivery network 7.2.1.2. Academic medical centers 7.2.1.3. Large independent hospitals 7.2.1.4. Medium independent hospitals 7.2.1.5. Small hospitals 7.2.2. Telehome 7.3. Market Size (Value) Estimates & Forecast By Component, 2020-2027 7.3.1. Cardiology 7.3.2. Gynecology 7.3.3. Neurology 7.3.4. Orthopedics 7.3.5. Dermatology 7.3.6. Mental Health 7.3.7. Critical Care 7.3.8. Neonatology 7.3.9. Others 7.4. Market Size (Value) Estimates & Forecast By Specialty, 2020-2027 7.4.1. Hardware 7.4.2. Software 7.4.3. Service 7.5. Market Size (Value) Estimates & Forecast By Delivery Channel, 2020-2027 7.5.1. Web/Mobile 7.5.1.1. Telephonic 7.5.1.2. Visualized 7.5.2. Call centers 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the US Telemedicine Market 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Specialty and R&D Investment 8.2.2. New Product Launches and Product Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 8.3. Company Profile: Key Players 8.3.1. Merck KGaA. 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Product Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. McKesson Corporation 8.3.3. Cisco Systems 8.3.4. Honeywell International 8.3.5. Philips 8.3.6. Cerner Corporation 8.3.7. Teladoc Health. 8.3.8. Allscripts Healthcare Solutions 8.3.9. AMD U.S. 8.3.10. BioTelemetry 8.3.11. InTouch Technologies 8.3.12. American Well 8.3.13. Specialist Telemed 8.3.14. SOC Telemed 8.3.15. InSight 8.3.16. Eagle Telemedicine 8.3.17. Blue Sky 9. Primary Key Insight