In 2022, the Artificial Meat market was estimated to be worth US$ 4.19 billion. Over the forecast period, the global Artificial Meat Market is expected to increase at a CAGR of 6.49%.Artificial Meat Market Overview:

Artificial meat is meat manufactured in vitro from animal cells rather than from defeated animals. It is acknowledged as a type of cellular farming. Many of the tissue engineering practices used in regenerative medicine are used to generate artificial meat. In comparison to unadventurous meat, the use of artificial meat has several approaches health, environmental, cultural, and economic deliberations. This market is expected to be driven by factors such as an increase in demand for meat substitutes and alternative protein sources.To know about the Research Methodology :- Request Free Sample Report Growing ecological concerns, combined with increasing health concerns, are driving up demand for artificial meat merchandise. Cultured meat, also known as lab-grown, clean, or cultivated meat, is generated in a laboratory from a few animal cells. It's real meat, but it doesn't oblige the slaughter of animals as customary meat does.

Artificial Meat Market Dynamics:

The artificial meat market is anticipated to grow vividly as a response to meat alternatives and alternative protein sources increases. Accumulative health consciousness, ecological concerns, and improved health remunerations are anticipated to have a positive impact on the market expansion. Other major drivers that are expected to drive the artificial meat market include intensifying customer inclination toward animal welfare and modernisms in cellular agriculture. Moreover, rising meat consumption, collective with rising demand for nourishing meat, is expected to aid market growth during the forecast period. Consumer demand for meat and animal-derived foods has worked the growth of cellular agriculture, which uses in-vitro agriculture to produce animal proteins with less animal-derived material than the prevailing meat industry. The procedure aims to satisfy an end-user who wants to devour meat products while also confirming total food security and reducing the environmental impact of food production. However, there are certain stringent regulations in certainly adapted food products that can harm the expansion of artificial meat, which is hindering the market growth. Nonetheless, with the steady growth of the food processing industry and the tissue engineering sector, market players have opportunities to invest in this market. Certain stringent rules in logically adapted food products can be injurious to the development of cultured meat. The Food and Drug Administration plans to comprise cultured meat in US legislation as of June 2019. The US Secretary of Agriculture shall control foodstuffs made from cells of acquiescent species of livestock grown under measured conditions for use as human food. The Corona Virus may hasten the transition to meatless alternatives: During the onset of the Covi-19 pandemic, the meat industry was astounded by warnings of meat shortages due to padlocked plants, resulting in price upsurges and an increasing number of sick workforces, conditions that could open up new opportunities for artificial meat-based businesses. Traditional meat dissemination channels have been and continue to be dislocated, with restaurants, schools, and other amenities closing. Customers had fewer options as output reduced and prices rose, and artificial meat alternatives were instigated to gain popularity. Recent Development in Artificial Meat Market: • Cargill Corporation invested in Aleph Farms in 2022 to support the development of the artificial meat market in retort to rising protein demand among customers. Cargill invested in Memphis Meats in 2017. • Mosa Meat BV received funding from M Ventures, MerckKGaA's premeditated corporate venture capital arm, in 2018 to develop an end-to-end process for alternative meat production at a suggestively lower cost. • Tyson Ventures, Tyson Foods' venture capital arm, invested USD 2.2 million in Future Meat Technologies in 2018 to inaugurate engineering activities and upsurge biological research, permitting them to reduce the production cost of cultured meats.Artificial Meat Market Segment Analysis:

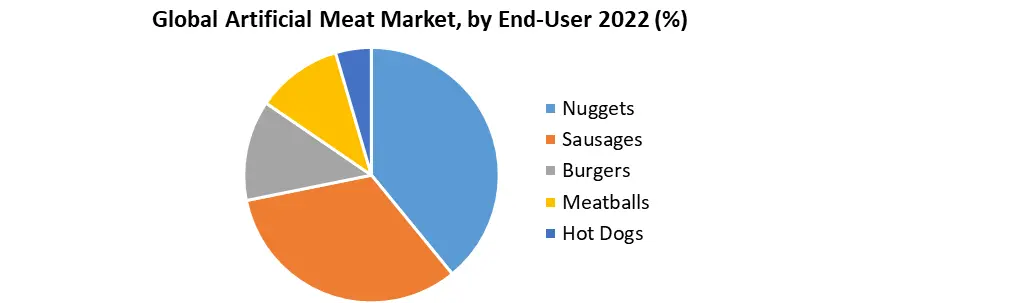

By Source, the market is segmented into Poultry, Pork, Beef and Duck. The Poultry segment is expected to hold the highest market share in terms of revenue by 2029. This is due to the increasing popularity of poultry products in various quick-service restaurants (QSRs), which has stimulated manufacturers to develop innovative alternative products to meet future meat consumer mandates. Cultured chicken products are predictable to be less expensive than other sources and to gain widespread popularity around the world. Moreover, the augmented demand for animal protein raises the request for poultry products. This is expected to quicken the market growth of cultured meat. Additionally, the rising demand for chicken meat, owing to emerging countries' rapidly emergent urban populations, is expected to support the cultured meat market. The increasing tendency of dining out, as well as high R&D speculation by companies such as Tyson Foods and Cargill, are some of the key factors predictable to boost the poultry segment as well as other segments of the flea market space in North America. By End-User, the market is segmented into Nuggets, Sausages, Burgers, Meatballs, and Hot Dogs. The Nuggets segment is expected to hold the highest market share in terms of revenue by 2029. As an important treated meat product, the demand for nuggets is increasing suggestively. As a result, in 2022, North America is anticipated to be the largest market for cultured meat. Chicken remnants are the most popular meat product in the United States and other North American countries. Nuggets are one of the most communal forms of chicken meat products disbursed in various countries. Consumers are looking for possibilities that are convenient to eat anytime due to the cumulative adoption of an on-the-go lifestyle and consumption of snacking products, predominantly in the United States. To attract trades, key companies such as Tyson Foods and Cargill are concentrating on developing clean meat or cultured meat chicken products in the procedure of nuggets.

Artificial Meat Market Regional Insights:

North America is expected to lead the industry in terms of cultured meat market share in 2022. The rise in innovations and expansions, as well as high expenditure on efficient R&D, are anticipated to be major backers to its largest share. Consumers are flowing from conventional meat to cultured meat products due to health apprehensions about meat consumption, an intensification in investor interest in alternative proteins, and the prospective to provide the required nutrition in tailor-made proteins. Metropolitan areas in the United States and Canada are expected to lead evolution due to a higher number of flexitarians who are open to and receive meat substitutes and alternative proteins. The region's rising demand for substitute protein encourages increased production. The objective of the report is to present a comprehensive analysis of the market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the market dynamics, structure by analyzing the market segments and projecting the market size. Clear representation of competitive analysis of key players by Technology, price, financial position, product portfolio, growth strategies, and regional presence in the market makes the report investor's guide.Artificial Meat Market Scope: Inquiry Before Buying

Global Artificial Meat Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 4.19 Bn. Forecast Period 2023 to 2029 CAGR: 6.49% Market Size in 2029: US $ 6.51 Bn. Segments Covered: by Source Poultry Pork Beef Duck by End-User Nuggets Sausages Burgers Meatballs Hot Dogs by Type Red Meat Poultry Seafood Artificial Meat Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Artificial Meat Market Key Players

1. MosaMeat 2. Just, Inc 3. SuperMeat 4. Aleph Farms Ltd 5. Finless Foods Inc 6. Integriculture 7. Balletic Foods 8. Future Meat Technologies Ltd 9. Avant Meats Company Limited 10.Higher Steaks 11.Appleton Meats 12.Fork & Goode 13.Biofood Systems LTD 14.Mission Barns 15.BlueNalu, Inc. Frequently Asked Questions: 1] What segments are covered in the Artificial Meat Market report? Ans. The segments covered in the Artificial Meat Market report are based on Source and End-User. 2] Which region is expected to hold the highest share in the Artificial Meat Market? Ans. The North American region is expected to hold the highest share in the Artificial Meat Market. 3] What is the market size of the Artificial Meat Market by 2029? Ans. The market size of the Artificial Meat Market is expected to be 6.51 Bn. by 2029. 4] What is the forecast period for the Artificial Meat Market? Ans. The forecast period for the Artificial Meat Market is 2022-2029. 5] What was the market size of the Artificial Meat market in 2022? Ans. The market size of the Artificial Meat market in 2022 was US$ 4.19 Bn.

1. Global Artificial Meat Market: Research Methodology 2. Global Artificial Meat Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Artificial Meat Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Artificial Meat Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Artificial Meat Market Segmentation 4.1 Global Artificial Meat Market, by Source (2022-2029) • Poultry • Pork • Beef • Duck 4.2 Global Artificial Meat Market, by End-User (2022-2029) • Nuggets • Sausages • Burgers • Meatballs • Hot Dogs 4.3 Global Artificial Meat Market, by Type (2022-2029) • Red Meat • Poultry • Seafood 5. North America Artificial Meat Market(2022-2029) 5.1 North America Artificial Meat Market, by Source (2022-2029) • Poultry • Pork • Beef • Duck 5.2 North America Artificial Meat Market, by End-User (2022-2029) • Nuggets • Sausages • Burgers • Meatballs • Hot Dogs 5.3 North America Artificial Meat Market, by Type (2022-2029) • Red Meat • Poultry • Seafood 5.4 North America Artificial Meat Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Artificial Meat Market (2022-2029) 6.1. European Artificial Meat Market, by Source (2022-2029) 6.2. European Artificial Meat Market, by End-User (2022-2029) 6.3. European Artificial Meat Market, by Type (2022-2029) 6.4. European Artificial Meat Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Artificial Meat Market (2022-2029) 7.1. Asia Pacific Artificial Meat Market, by Source (2022-2029) 7.2. Asia Pacific Artificial Meat Market, by End-User (2022-2029) 7.3. Asia Pacific Artificial Meat Market, by Type (2022-2029) 7.4. Asia Pacific Artificial Meat Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Artificial Meat Market (2022-2029) 8.1 Middle East and Africa Artificial Meat Market, by Source (2022-2029) 8.2. Middle East and Africa Artificial Meat Market, by End-User (2022-2029) 8.3. Middle East and Africa Artificial Meat Market, by Type (2022-2029) 8.4. Middle East and Africa Artificial Meat Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Artificial Meat Market (2022-2029) 9.1. South America Artificial Meat Market, by Source (2022-2029) 9.2. South America Artificial Meat Market, by End-User (2022-2029) 9.3. South America Artificial Meat Market, by Type (2022-2029) 9.4 South America Artificial Meat Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 MosaMeat 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Just, Inc 10.3 SuperMeat 10.4 Aleph Farms Ltd 10.5 Finless Foods Inc 10.6 Integriculture 10.7 Balletic Foods 10.8 Future Meat Technologies Ltd 10.9 Avant Meats Company Limited 10.10 Higher Steaks 10.11 Appleton Meats 10.12 Fork & Goode 10.13 Biofood Systems LTD 10.14 Mission Barns 10.15 BlueNalu, Inc.