API Testing Market was valued at US$ 937.37 Mn. in 2022. API Testing Market size is expected to grow at a CAGR of 20.5% through the forecast period.API Testing Market Overview:

The hub of development, the Application Programming Interface (API), transfers data and logic across systems and applications. The API serves as the underlying framework that links many systems or application layers together. It allows for data sharing and communication between two different software systems. It includes a number of procedures, guidelines, and resources for creating software applications. APIs also define how software applications should communicate with one another. Application programming interfaces (APIs) are validated by API testing tools, which examine the programming interface's usability, dependability, performance, and security. The goal of API testing is to identify errors, inconsistent behaviour, or other departures from the norm. It also guarantees that it will function even after the whole public gets access to it.To know about the Research Methodology :- Request Free Sample Report API Testing Market COVID-19 Insights: The emergence of the COVID-19 pandemic has severely impacted most industries globally. In addition, measures to prevent and restrict the movement of non-essential goods and resources in different countries have disrupted the supply chain of electronic components and network equipment. This has caused a delay in the supply of electronic components in the manufacture of network equipment. US and global technology market growth is expected to slow to nearly 2%, so ICT spending in major economies, such as the US, declined in the second half of early 2022 but managed to recover in the second half of the year. The US is an important market for the ICT industry, and the decline in its spending power is expected to negatively impact the growth of the API testing market in the coming years. In addition, spending on technology consulting and system integration services is temporarily decelerating and is expected to decline by 5% if large IT organisations cancel new technology projects. However, the industry is expected to suffer a downturn in most sectors. IT and equipment spending is expected to be the weakest sector, followed by technology and system integration spending. Software spending growth is expected to decline. Fortunately, organizations are still anticipating growth in demand for cloud infrastructure services and the potential for increased spending on specialized software.

API Testing Market Dynamics:

The market has been growing as a result of factors such as the increasing use of agile methods for software development and open API policies, the adoption of current application software development methodologies, and the rise in complexity of the IT industry. The market is growing as a result of increased consumer knowledge of the many advantages, including simple application access without user interaction; protection against malicious code and software breakage; lower testing costs; and a growing need for performance testing of software. The market's growth is hampered by expensive initial setup costs for API testing and issues with data security and privacy. Launches of new products aimed at enhancing testing efficiency and an increase in the use of agile are also forecast to improve the prospects. Drivers: Rising adoption of open API by Organizations- The rapid deployment of technology in organisations has resulted in the formation of complex structures, necessitating the need for an improved API testing tool. Adopting an open API strategy is also creating new demand for testing and QA teams and driving adoption of AI-related skill sets. These new skills include the irreplaceable integration of data science, statistics, and math. But it will lead to the provision of enhanced API testing for organizations, which will also lead to providing businesses with a cost-effective testing program. Demand for AI/ML (Artificial Intelligence/Machine learning)- Recent advances in AI/ML with the presence of large amounts of data present new opportunities for AI/ML experimental adoption. As a result, the great demand for AI/ML testing in the organisation leads to the optimization of the testing processes and further leads to the provision of test cases, test scripts, test data, and better reporting. These advanced testing skills also enable intelligent analytics and visualisation that help teams spot defects and understand test coverage and high-risk areas. Hence, the significant importance of AI/ML testing for quality prediction, test case prioritization, error classification, and attribution in the coming years will drive the API testing market even further. Challenges: The biggest issue the API testing market has is that many areas lack quality service and lack knowledge of the API testing procedure, which results in inefficient software and slow market growth. Data security issues are another difficulty the API testing market is now facing. The market growth for API testing is severely constrained by the fact that applications and software that have passed testing can result in data theft and concept theft, which costs software developers money and effort.API Testing Market Segment Analysis:

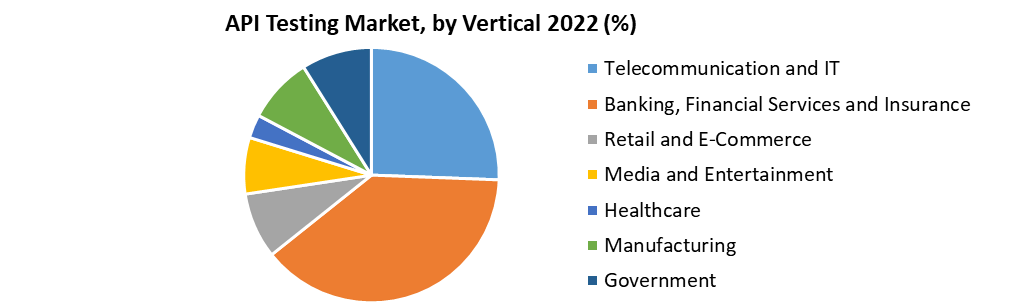

Based on Deployment Type: Organizations favor the on-premises deployment method for supporting secure zone initiatives, custom portals, and multiple business divisions. A cloud-based methodology of API testing is used by organizations without stand-up infrastructure. On-premises API testing is forecast to have a bigger market share throughout the course of the forecast period. This is a result of businesses' reluctance to test their APIs on cloud-based platforms. After all, there are serious data security risks associated with exposing internal and public APIs to a cloud platform. Based on the Component: Services test software applications using the HTTP or SOAP protocols. Although there are other techniques to deploy services, SOAP (Simple Object Access Protocol) and REST (Representational State Transfer) are the most popular (Representational State Transfer architecture). Software programmes can exchange data and communicate with one another thanks to services. REST is based on CML, JSON, and basic URL data communication, whereas SOAP is based on XML data interchange. The services offered by services like SOAP are defined using the WSDL language, which is based on XML. Based on the Vertical: The vertical for banking and financial services is forecast to grow at the quickest rate in the future. The Open API movement, which makes a variety of banking APIs available to other firms, is what is driving the banking industry's API business.

API Testing Market Regional Insights:

The North America region dominated the market with 44 % share in 2021. The adoption of APIs, which enables companies to make money by selling their APIs, is mostly occurring in North America. The market in North America is experiencing considerable growth because of the rising usage of APIs to improve business processes in the US. Additionally, the US market is expanding because of the existence of significant companies like Oracle, IBM, CA Technologies, and others. The Asia-Pacific region is expected to witness significant growth at a CAGR of 20.5% through the forecast period. The objective of the report is to present a comprehensive analysis of the global API Testing Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the API Testing Market dynamic, structure by analyzing the market segments and projecting the API Testing Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the API Testing Market make the report investor’s guide.API Testing Market Scope: Inquire before buying

API Testing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 937.37 Mn Forecast Period 2023 to 2029 CAGR: 20.5% Market Size in 2029: US$ 3458 Mn. Segments Covered: by Deployment Type On-Premises Cloud by Component API Testing Tools API Testing Services by Vertical Telecommunication and IT Banking, Financial Services and Insurance Retail and E-Commerce Media and Entertainment Healthcare Manufacturing Government API Testing Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)API Testing Market Key Players are:

1. Bleum 2. CA Technologies 3. Cigniti 4. IBM 5. Infosys 6. Micro Focus 7. Oracle 8. Parasoft 9. Qualitylogic 10.Runscope 11.Smartbear Software 12.Tricentis Frequently Asked Questions: 1] What segments are covered in the Global API Testing Market report? Ans. The segments covered in the API Testing Market report are based on Deployment Type, Component, Vertical. 2] Which region is expected to hold the highest share in the Global API Testing Market? Ans. The North America region is expected to hold the highest share in the API Testing Market. 3] What is the market size of the Global API Testing Market by 2029? Ans. The market size of the API Testing Market by 2029 is expected to reach US$ 3458 Mn. 4] What is the forecast period for the Global API Testing Market? Ans. The forecast period for the API Testing Market is 2023-2029. 5] What was the market size of the Global API Testing Market in 2022? Ans. The market size of the API Testing Market in 2022 was valued at US$ 937.37 Mn.

1. Global API Testing Market Size: Research Methodology 2. Global API Testing Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global API Testing Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global API Testing Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global API Testing Market Size Segmentation 4.1. Global API Testing Market Size, by Deployment Type (2022-2029) • On-Premises • Cloud 4.2. Global API Testing Market Size, by Component (2022-2029) • API Testing Tools • API Testing Services 4.3. Global API Testing Market Size, by Vertical (2022-2029) • Telecommunication and IT • Banking, Financial Services and Insurance • Retail and E-Commerce • Media and Entertainment • Healthcare • Manufacturing • Government 5. North America API Testing Market (2022-2029) 5.1. North America API Testing Market Size, by Deployment Type (2022-2029) • On-Premises • Cloud 5.2. North America API Testing Market Size, by Component (2022-2029) • API Testing Tools • API Testing Services 5.3. North America API Testing Market Size, by Vertical (2022-2029) • Telecommunication and IT • Banking, Financial Services and Insurance • Retail and E-Commerce • Media and Entertainment • Healthcare • Manufacturing • Government 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European API Testing Market (2022-2029) 6.1. European API Testing Market, by Deployment Type (2022-2029) 6.2. European API Testing Market, by Component (2022-2029) 6.3. European API Testing Market, by Vertical (2022-2029) 6.4. European API Testing Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific API Testing Market (2022-2029) 7.1. Asia Pacific API Testing Market, by Deployment Type (2022-2029) 7.2. Asia Pacific API Testing Market, by Component (2022-2029) 7.3. Asia Pacific API Testing Market, by Vertical (2022-2029) 7.4. Asia Pacific API Testing Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa API Testing Market (2022-2029) 8.1. Middle East and Africa API Testing Market, by Deployment Type (2022-2029) 8.2. Middle East and Africa API Testing Market, by Component (2022-2029) 8.3. Middle East and Africa API Testing Market, by Vertical (2022-2029) 8.4. Middle East and Africa API Testing Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America API Testing Market (2022-2029) 9.1. South America API Testing Market, by Deployment Type (2022-2029) 9.2. South America API Testing Market, by Component (2022-2029) 9.3. South America API Testing Market, by Vertical (2022-2029) 9.4. South America API Testing Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Bleum 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. CA Technologies 10.3. Cigniti 10.4. IBM 10.5. Infosys 10.6. Micro Focus 10.7. Oracle 10.8. Parasoft 10.9. Qualitylogic 10.10. Runscope 10.11. Smartbear Software 10.12. Tricentis