Antifreeze Market is expected to reach US$ 7.93 Bn. in 2027, with a CAGR of 6.88% for the period 2021-2027, because of growing demand in the automotive industry.Antifreeze Market Overview:

Antifreeze is in high demand in the automotive industry because it lowers engine heat. Antifreeze coolant is used to keep engine parts cold and prevent the engine from overheating. Also, glycols such as ethylene glycol, propylene glycol, and others keep the engine from freezing when it is utilized in extremely cold temperatures. Ethylene glycols improve the cooling system's effectiveness and extend the life of water pumps. As a corrosion preventative for heavy-duty diesel engines, the organic acid technique is based on ethylene glycols. Thus, rising engine coolant consumption in the end-use industry is expected to have an impact on the market size during the estimated period (2021-2027).To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2019 is considered a base year however 2020’s numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

Antifreeze Market Dynamics:

The global antifreeze market is expected to increase due to rising automotive sales in the Asia Pacific as a result of rising consumer disposable income and the developing construction industry, both of which are driving product demand throughout the HVAC system. Furthermore, rising air traffic around the world because of lower airline fares has increased the number of planes and is expected to have a favorable impact on product demand in the coming years. Growing demand in the end-use industry such as the automotive industry majorly contributes to the antifreeze market growth. In Europe, light commercial vehicle manufacturing go up by 0.2 percent from 2,249,348 in 2018 to 2,254,153 in 2019. The Chinese government expects to produce 35 million autos by 2025, according to the International Trade Administration (ITA). Additionally, the India Brand Equity Foundation (IBEF) estimates that by 2023, the Indian government expects the automobile sector to attract US$ 8 billion to US$ 10 billion in domestic and foreign investment. Therefore, rising vehicle production is predicted to boost demand for antifreeze coolants, which protect engines from corrosion, boosting the market situation over the forecast period (2021-2027).The Antifreeze Market is driven by Demand for High-Performance Lubricants:

The beginnings of high-performance lubrication may be traced back to changing environmental rules aimed at decreasing vehicle carbon footprints, which necessitated the use of high-performance lubricants to improve the vehicle's fuel efficiency. Antifreeze is added to high-performance lubricants to prevent them from freezing. Moreover, car owners actively seek engine maintenance to improve the engine's durability and, hence, the vehicle's overall durability. Furthermore, the need for high-quality automotive antifreeze has increased.Antifreeze Market Trends:

One of the important aspects leading to the antifreeze market's growth has been recognized as rising glycerin usage. Glycerin and matter organic non-glycerin (MONG) are both biodiesel byproducts that can be treated and filtered into fatty acids and glycerin. When compared to ethylene glycol, glycerin is considered a safer antifreeze. During the forecast period, the antifreeze market is benefiting from the growing popularity and usage of glycerin as an antifreeze agent. For instance, Europe is the world's leading producer of glycerin, with biodiesel accounting for more than a third of all glycerin produced. South Asian countries manufacture glycerin as a byproduct of their main fatty alcohols and fatty acid synthesis.Antifreeze Market Challenges:

Ethylene glycol and propylene glycol are two types of glycols made from crude oil and natural gas. So, the shortage of crude oil output is limiting glycol production. However, the price of glycols fluctuates in tandem with the price of crude oil. According to BP statistics, a drop in global oil production of 60,000 barrels per day was more than offset by a drop in OPEC production, which was led by the United States (-2 million b/d), Iran (-1.3 million b/d), Venezuela (-560,000 b/d), and Saudi Arabia (-430,000 b/d). Moreover, according to the US Energy Information Administration (EIA), crude oil prices in 2020 are US$ 41.69 per barrel lower than they were in 2019. Oil prices, meanwhile, fell to US$64.21/bbl in 2019 from US$71.31/bbl in 2018, according to BP static. Thus, fluctuations in crude oil prices may limit the manufacture of glycols, limiting the growth of the antifreeze industry.COVID-19 Impact on the Antifreeze Market:

COVID-19 has harmed major industries such as an automobile. So, demand for engine coolant fell, putting a damper on the antifreeze coolant business. According to the Society of Indian Automobile Manufacturers (SIAM), passenger car sales decreased by 2% in FY20-FY21, affecting demand for antifreeze coolants.Antifreeze based on propylene glycol is still very popular:

Propylene glycol is highly sought after by automobile antifreeze makers due to its high compatibility, low cost, and lack of toxicity. Propylene glycol is the principal component used in the cooling system based on inorganic acid technology in the traditionally used green, yellow, and blue antifreeze. Inorganic acid technology adoption continues to be at the forefront of demand, pushing demand for propylene glycol-based antifreeze. While ethylene glycol is also a highly sought-after chemical by automakers, its high cost of handling and storage, caustic qualities, and toxicity have moved manufacturers' preference towards propylene glycol-based antifreeze products. Furthermore, advancements in processing technology and a favorable regulatory framework for harmful chemical substitution are driving the demand for propylene glycol-based automobile antifreeze. For example, Dow is the world's largest manufacturer of propylene glycol (PG) and a major producer of ethylene glycol (EG).Based on the Technology Segment:

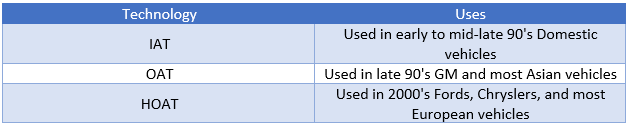

The antifreeze market is further sub-segmented into OAT, HOAT, and IAT. Among these, in 2020, the OAT category was the most profitable, generating nearly USD 3.19 billion in revenue. Instead of phosphate or silicates, sebacate, 2-ethylhexanoic acid, and other organic acids are found in OAT. They have a longer service life because they are nitrite-free. They also contain neutral inorganic salts and acids that break down without harming the environment. The use of IATs has decreased in recent years because of strict environmental laws in North America and Europe, whereas the use of OATs has increased. Because of its environmental friendliness and longer replacement cycle, global demand for OAT is expected to rise.

Antifreeze Market Regional Insights:

Thanks to the increasing vehicle production in Asian countries such as India, China, Japan, Indonesia, South Korea, and others, the Asia Pacific dominates the antifreeze industry with 34% in 2020. Antifreeze coolant is used in the cooling system of vehicles to prevent overheating. Thus, the growing automotive sector in various countries is expected to increase antifreeze coolant demand. The Indian automobile sector (including component production) is expected to reach US$ 251 to US$ 282 billion by 2026, according to the India Brand Equity Foundation (IBEF). By 2023, the Indian government expects the vehicle sector to attract $8 to $10 billion in local and global investment, according to the Indian government. For example, the Federation of Automobile Dealers Associations (FADA) reports that passenger vehicle sales in India reached 2, 91,001 units in November 2020, up from 2, 79,365 units in November 2019. In addition, the International Organization of Motor Vehicle Manufacturers reports that commercial and passenger vehicle manufacturing climbed by 1.2 percent in 2019 to 571632 units, up from 564800 units in 2018. Therefore, the usage of non-toxic propylene glycol cooling liquid is expected to promote antifreeze sector growth.The objective of the report is to present a comprehensive analysis of the global Antifreeze market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Antifreeze dynamics, structure by analyzing the market segments and projecting the Antifreeze size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Antifreeze market make the report investor’s guide.

Antifreeze Market Scope: Inquire before buying

Antifreeze Market Report Coverage Details Base Year: 2020 Forecast Period: 2021-2027 Historical Data: 2016 to 2020 Market Size in 2020: US $ 4.98 Bn. Forecast Period 2021 to 2027 CAGR: 6.88% Market Size in 2027: US $ 7.93 Bn Segments Covered: by Product Type • Ethylene Glycol • Propylene Glycol • Glycerin by Application • Automotive • Aerospace • Industrial heat transfer and cooling applications by Technology • OAT • HOAT • IAT Antifreeze Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaAntifreeze Market Key Players

• BP PLC • Royal Dutch Shell • Exxon Mobil Corporation • Chevron • Total • BASF SE • DOW Chemicals • Old world industries • Prestone • Amsoil • Kost USA Inc. • Cummins Inc. • Sinopec • Valvoline • LUKOIL • OthersFrequently Asked Questions:

1. Which region has the largest share in Antifreeze Market? Ans: the Asia Pacific held the largest share in 2020. 2. What is the growth rate of the Antifreeze Market? Ans: The Antifreeze Market is growing at a CAGR of 6.88% during the forecasting period 2021-2027. 3. What segments are covered in the Antifreeze market? Ans: Antifreeze Market is segmented into Product Type, Application, Technology, and Region. 4. Who are the key players in the Antifreeze market? Ans: The important key players in the Antifreeze Market are – BP PLC, Royal Dutch Shell, Exxon Mobil, Chevron, Total, BASF SE, DOW Chemicals, Old world industries, Prestone, Amsoil, Kost USA Inc., Cummins Inc., Sinopec, Valvoline, LUKOIL, and among others. 5. What is the study period of this market? Ans: The Antifreeze Market is studied from 2020 to 2027.

1. Global Antifreeze Market: Research Methodology 2. Global Antifreeze Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Antifreeze Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Antifreeze Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Antifreeze Market Segmentation 4.1. Global Antifreeze Market, by Product Type (2020-2027) • Ethylene Glycol • Propylene Glycol • Glycerin 4.2. Global Antifreeze Market, by Application (2020-2027) • Automotive • Aerospace • Industrial heat transfer and cooling applications 4.3. Global Antifreeze Market, by Technology (2020-2027) • OAT • HOAT • IAT 5. North America Antifreeze Market(2020-2027) 5.1. North America Antifreeze Market, by Product Type (2020-2027) 5.1.1. Ethylene Glycol 5.1.2. Propylene Glycol 5.1.3. Glycerin 5.2. North America Antifreeze Market, by Application (2020-2027) • Automotive • Aerospace • Industrial heat transfer and cooling applications 5.3. North America Antifreeze Market, by Technology (2020-2027) • OAT • HOAT • IAT 5.4. North America Antifreeze Market, by Country (2020-2027) • United States • Canada • Mexico 6. European Antifreeze Market (2020-2027) 6.1. European Antifreeze Market, by Product Type (2020-2027) 6.2. European Antifreeze Market, by Application (2020-2027) 6.3. European Antifreeze Market, by Technology (2020-2027) 6.4. European Antifreeze Market, by Country (2020-2027) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Antifreeze Market (2020-2027) 7.1. Asia Pacific Antifreeze Market, by Product Type (2020-2027) 7.2. Asia Pacific Antifreeze Market, by Application (2020-2027) 7.3. Asia Pacific Antifreeze Market, by Technology (2020-2027) 7.4. Asia Pacific Antifreeze Market, by Country (2020-2027) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Antifreeze Market (2020-2027) 8.1. Middle East and Africa Antifreeze Market, by Product Type (2020-2027) 8.2. Middle East and Africa Antifreeze Market, by Application (2020-2027) 8.3. Middle East and Africa Antifreeze Market, by Technology (2020-2027) 8.4. Middle East and Africa Antifreeze Market, by Country (2020-2027) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Antifreeze Market (2020-2027) 9.1. South America Antifreeze Market, by Product Type (2020-2027) 9.2. South America Antifreeze Market, by Application (2020-2027) 9.3. South America Antifreeze Market, by Technology (2020-2027) 9.4. South America Antifreeze Market, by Country (2020-2027) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. BP PLC. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Royal Dutch Shell 10.3. Exxon Mobil 10.4. Chevron 10.5. Total 10.6. BASF SE 10.7. DOW Chemicals 10.8. Old world industries 10.9. Prestone 10.10. Amsoil 10.11. Kost USA Inc. 10.12. Cummins Inc. 10.13. Sinopec 10.14. Valvoline 10.15. LUKOIL 10.16. Others.