Advanced Packaging Market was valued at US$ 38.93 Bn in 2023 and is expected to reached at US$ 83.42 Bn in 2030. Advanced Packaging Market size is expected to grow at a CAGR of 11.5% through the forecast period.Advanced Packaging Market Overview:

Advanced packaging is a general grouping of a variety of distinct techniques, including 2.5D, 3D-IC, fan-out wafer-level packaging and system-in-package. Advanced Packaging is also a modern business founded to provide innovative solutions to our customers packaging needs. Advanced packaging allows multiple devices (electrical, mechanical, or semiconductor) to be merged and packaged as a single electronic device. Unlike traditional electronic packaging, advanced packaging employs processes and techniques that are performed at semiconductor fabrication facilities. Advanced packaging thus sits between fabrication and traditional packaging -- or, in other terminology, between BEoL and post-fab. Advanced packaging includes multi-chip modules, 3D ICs, 2.5D ICs, heterogeneous integration, fan-out wafer-level packaging, system-in-package, quilt packaging, etc.To know about the Research Methodology :- Request Free Sample Report The report explores the Advanced Packaging Market segments (By Type, By Product Type, By Industrial Vertical, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2023. The report investigates the Advanced Packaging Market drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Advanced Packaging Market contemporary competitive scenario.

Advanced Packaging Market Dynamics:

Market Drivers: The advanced packaging industry has always been witnessing constant transitions, miniaturization of nodes and increasing size of wafers because of the ULSI fabrication are driving the market growth. An increasing number of manufacturers offering innovative products are increasing as the companies are focused on R&D. Growing consumer electronic users and consumer preference toward smaller, lighter and thinner products, with improved demand for tablets, smartphones and other connected devices, along with the growing need for advanced architecture in electronic products, are also fuelling the growth of this market. The increase in demand for miniaturization of devices, improved system performances and optimization of advanced packaging are the factors which leads to the growth of the Advanced Packaging Market. Due to the increase in demand for miniaturization of devices, manufacturers are laying emphasis in providing compact electronic devices in various industry verticals such as consumer electronics, healthcare, automotive, and semiconductor IC manufacturing. For ensuring fine patterning on the wafers and chips, these manufacturers are reducing the size of the integrated circuits. In addition, medical devices industry is observing an increase in demand for nano-sized robotic surgery equipment with sophistication and advances into wearable and personalized healthcare gadgets. Therefore, the trends toward compact electronic devices have created the need for designers to outgrow the conventional packaging solutions and to adopt advanced packaging. For developing next-generation chip designs, semiconductor packaging industry is providing advanced IC packages. The traditional chip scaling and innovative architectures for new devices are used by the integrated circuit industry. In addition, there exist multi-chip packages in every phone, data center, consumer electronics, and network which drive the growth of advanced packaging. Advance packaging promotes usage of AI, machine learning, and deep learning and it also allows variety of different processing elements and memories to be coupled together using very high-speed interconnects. Therefore, enhanced operation capabilities and precise processing is lucrative for various industry verticals, such as automotive, healthcare, aerospace & defense, and industrial sector, which are now growing the advanced packaging market. Market Restraints: High cost of advanced packaging is restraining the growth of the Advanced Packaging Market. As compared to the conventional packaging solutions which used in semiconductor industry advanced packaging is very costly process. The cost of designing and manufacturing chips at each new node is costly at certain levels. In addition, due to the complexities of the ICs the cost of wafer fabrication is much higher. Packaging of different chips and ICs with complex pattering increases the overall cost of advanced packaging and hinders its adoption. These all factors are hindering the growth of the Advanced Packaging Market during the forecast period. Market Opportunities: With rapid growth in the advanced packaging market, specifically fan out wafer level packaging, along with increase in demand for smartphone and devices and Internet of Things (IoT), advanced packaging suppliers are developing process and ways to reduce the overall cost of advanced packaging and provide maximum operational efficiency. During the recent times, advanced packaging is mainly used for high-end products and for applications which are related to niche-market such as wafer and die production and this is due to high cost in its operation. Different integrated circuits (ICs) have different packaging requirements, which provide growth opportunities for advanced packaging over traditional packaging process. In addition, advanced packaging is expected to offer higher abilities which is expected to offer lucrative opportunities for advanced packaging market trends in the coming years. Recent Developments: • In February 2021 - Siemens Digital Industries Software announced that its collaboration with Advanced Semiconductor Engineering, Inc. (ASE) generated two new enablement solutions engineered to help mutual customers create and evaluate multiple complex integrated circuit (IC) package assemblies and interconnect scenarios in a data-robust graphical environment prior to and during physical design implementation. • In March 2021 - Deca, an industry-leading pure-play technology provider for advanced semiconductor packaging, announced the introduction of its new APDK (Adaptive Patterning Design Kit) methodology. The solution is the result of Deca's collaboration with Advanced Semiconductor Engineering Inc. (ASE) and Siemens Digital Industries Software. • In 29th September 2021- Taiwan Semiconductor Manufacturing Co (TSMC) announced that it is developing new advanced packaging facilities in northern Taiwan. This advanced packaging fab in Chunan will be engaged in developing system on integrated chips (SoIC) technology.Advanced Packaging Market Segment Analysis:

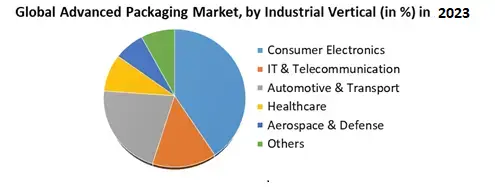

Based on Type, The Flip Chip segment is growing with the highest CAGR of XX% during the forecast period. Due to the rising adoption of compact semiconductor components which are used in high-performance applications such as automotive and aerospace & defense, leads to the growth of the Advanced Packaging Market. Flip-chip advanced packaging offers a small footprint and high input/output density that increases their adoption by several foundries and IDMs.Based on Industrial Vertical, the segment consumer electronics is estimated to grow with the highest market share in industrial vertical. The growing demand for various devices including tablets, smartphones, wearable devices and other connected consumer electronics leads to the advanced packaging technologies. Meanwhile, System-In-Package (SIP) technology is also gaining momentum as it allows more features to be integrated into small form factors such as medical implants and wearable devices. The rising trend of compact electronic devices also driving the growth of the Advanced Packaging Market. These packaging types helps to reduce packaging size, increase chip connectivity, improve reliability, and offer multi-function integration, accelerating their demand in smartphones and smartwatches. The consumer electronics players in the U.S. are inclined toward the adoption of these advanced packaging technologies in their newly launched models to gain high competitiveness in the market.

Advanced Packaging Market Regional Insights:

The Asia-Pacific region is expected to witness significant growth at a CAGR of XX% through the forecast period because of the growing population and the customer-side demand. Prominent semiconductor industrial companies present in the region are driving the demand for advanced packaging. Also, China is the largest growing economy with a large population, and according to statistics from China’s semiconductor association, the import of IC is increasing. The Chinese government has worked on a multi-pronged strategy to support domestic IC industry development in order to achieve the goal of becoming the global leader in all primary IC industrial supply chain segments by 2030. This growth in the semiconductor IC industry in the region is expected to stimulate advanced packaging demand. In China, Taiwan, and South Korea, the Advanced Packaging Market is boosting due to the rising production of semiconductor components and consumer electronic devices. The region also includes some of the major foundry providers, such as Global Foundries, TSMC, and UMC, among others which accelerates market expansion opportunities. South Korea held majority share in the region on account of several initiatives which are passed by the government. The objective of the report is to present a comprehensive analysis of the Advanced Packaging Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Advanced Packaging Market dynamic, structure by analyzing the market segments and projecting the Advanced Packaging Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Advanced Packaging Market make the report investor’s guide.Advanced Packaging Market Scope: Inquiry Before Buying

Global Advanced Packaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 38.93 Bn. Forecast Period 2024 to 2030 CAGR: 11.5% Market Size in 2030: US$ 83.42 Bn. Segments Covered: by Type 3D Integrated Circuit Fan Out Silicon in Package Fan Out Wafer Lever Package 3D Wafer Level Package Wafer Level Chip Scale Package 2.5D Flip Chip by Industrial Vertical Consumer Electronics IT & Telecommunication Automotive & Transport Healthcare Aerospace & Defense Others by Product Type Active Packaging Smart Packaging Intelligent Packaging Advanced Packaging Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Advanced Packaging Market Key Players

1. ASE Group 2. Amkor Technology 3. Siliconware Precision Industries Co., Ltd. (SPIL) 4. STATS ChipPAC Pte. Ltd. 5. Jiangsu Changjiang Electronics Technology Co. Ltd. 6. SSS MicroTec AG. 7. International Business Machines Corporation (IBM) 8. Intel Corporation 9. Qualcomm Technologies, Inc. 10.Taiwan Semiconductor Manufacturing Company 11.Advanced Semiconductor Engineering Inc. 12.Chipbond Technology Corporation 13.Samsung Electronics Co. Ltd 14.Texas Instruments 15.Analog Devices 16.Microchip Technology 17.Renesas Electronics Corporation 18.TSMC 19.Deca Technologies 20.Sanmina Corporation 21.China Wafer Level CSP Co., Ltd. 22.ChipMOS Technologies, Inc. 23.FlipChip International LLC 24.HANA Micron Inc. 25.Jiangsu Changjiang Electronics Technology Co., Ltd Frequently Asked Questions: 1] What segments are covered in the Advanced Packaging Market report? Ans. The segments covered in the Advanced Packaging Market report are based on Type, Industrial Vertical and Product Type. 2] Which region is expected to hold the highest share in the Advanced Packaging Market? Ans. Asia-Pacific region is expected to hold the highest share in the Advanced Packaging Market. 3] What is the market size of the Advanced Packaging Market by 2030? Ans. The market size of the Advanced Packaging Market by 2030 is expected to reach US$ 83.42 Bn. 4] What is the forecast period for the Advanced Packaging Market? Ans. The forecast period for the Advanced Packaging Market is 2024-2030 5] What was the market size of the Advanced Packaging Market in 2023? Ans. The market size of the Advanced Packaging Market in 2023 was valued at US$ 38.93 Bn.

1. Advanced Packaging Market: Research Methodology 2. Advanced Packaging Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Advanced Packaging Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Advanced Packaging Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Advanced Packaging Market Segmentation 4.1. Advanced Packaging Market, By Type (2023-2030) • 3D Integrated Circuit • Fan Out Silicon in Package • Fan Out Wafer Lever Package • 3D Wafer Level Package • Wafer Level Chip Scale Package • 2.5D • Flip Chip 4.2. Advanced Packaging Market, By Industrial Vertical (2023-2030) • Consumer Electronics • IT & Telecommunication • Automotive & Transport • Healthcare • Aerospace & Defense • Others 4.3. Advanced Packaging Market, By Product Type (2023-2030) • Active Packaging • Smart Packaging • Intelligent Packaging 5. North America Advanced Packaging Market (2023-2030) 5.1. North America Advanced Packaging Market, By Type (2023-2030) • 3D Integrated Circuit • Fan Out Silicon in Package • Fan Out Wafer Lever Package • 3D Wafer Level Package • Wafer Level Chip Scale Package • 2.5D • Flip Chip 5.2. North America Advanced Packaging Market, By Industrial Vertical (2023-2030) • Consumer Electronics • IT & Telecommunication • Automotive & Transport • Healthcare • Aerospace & Defense • Others 5.3. North America Advanced Packaging Market, By Product Type (2023-2030) • Active Packaging • Smart Packaging • Intelligent Packaging 5.4. North America Advanced Packaging Market, by Country (2023-2030) • United States • Canada • Mexico 6. European Advanced Packaging Market (2023-2030) 6.1. European Advanced Packaging Market, By Type (2023-2030) 6.2. European Advanced Packaging Market, By Industrial Vertical (2023-2030) 6.3. European Advanced Packaging Market, By Product Type (2023-2030) 6.4. European Advanced Packaging Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Advanced Packaging Market (2023-2030) 7.1. Asia Pacific Advanced Packaging Market, By Type (2023-2030) 7.2. Asia Pacific Advanced Packaging Market, By Industrial Vertical (2023-2030) 7.3. Asia Pacific Advanced Packaging Market, By Product Type (2023-2030) 7.4. Asia Pacific Advanced Packaging Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Advanced Packaging Market (2023-2030) 8.1. Middle East and Africa Advanced Packaging Market, By Type (2023-2030) 8.2. Middle East and Africa Advanced Packaging Market, By Industrial Vertical (2023-2030) 8.3. Middle East and Africa Advanced Packaging Market, By Product Type (2023-2030) 8.4. Middle East and Africa Advanced Packaging Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Advanced Packaging Market (2023-2030) 9.1. South America Advanced Packaging Market, By Type (2023-2030) 9.2. South America Advanced Packaging Market, By Industrial Vertical (2023-2030) 9.3. South America Advanced Packaging Market, By Product Type (2023-2030) 9.4. South America Advanced Packaging Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 ASE Group 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Amkor Technology 10.3. Siliconware Precision Industries Co., Ltd. (SPIL) 10.4. STATS ChipPAC Pte. Ltd. 10.5. Jiangsu Changjiang Electronics Technology Co. Ltd. 10.6. SSS MicroTec AG. 10.7. International Business Machines Corporation (IBM) 10.8. Intel Corporation 10.9. Qualcomm Technologies, Inc. 10.10. Taiwan Semiconductor Manufacturing Company 10.11. Advanced Semiconductor Engineering Inc. 10.12. Chipbond Technology Corporation 10.13. Samsung Electronics Co. Ltd 10.14. Texas Instruments 10.15. Analog Devices 10.16. Microchip Technology 10.17. Renesas Electronics Corporation 10.18. TSMC 10.19. Deca Technologies 10.20. Sanmina Corporation 10.21. China Wafer Level CSP Co., Ltd. 10.22. ChipMOS Technologies, Inc. 10.23. FlipChip International LLC 10.24. HANA Micron Inc. 10.25. Jiangsu Changjiang Electronics Technology Co., Ltd.