Advanced Metering Infrastructure Market has valued at US$ 13.58Bn. in 2022. The Global Advanced Metering Infrastructure Market size is estimated to grow at a CAGR of 13.9% over the forecast period.Advanced Metering Infrastructure Market Overview:

The Ambient Intelligence Market analyzes and forecasts the market size, in terms of value, for the market. Further, the Ambient Intelligence Markets are segmented by Product Type, End-User, and Region. The Ambient Intelligence Markets are segmented under Smart Metering Devices (electricity, gas, water), Solutions (meter communication, infrastructure, and software), and Services (system integration, deployment, and program consulting) based on Product Type. Based on End-User, the market is segmented into Residential, Commercial, and Industrial. The market sizing and forecasts for each segment are based on value (in USD Billion). North America is the dominant player in the market. The report thoroughly analyzes market drivers, limitations, and opportunities. The presentation of facts and figures gives key data for the historic period. The report explores the different segments and data that have been provided by market participants and regions.To know about the Research Methodology:- Request Free Sample Report Advanced metering infrastructure is a two-way communication system that combines smart meters, communication networks, and data management systems. The system can automatically and remotely measure power use, connect and deactivate service, detect tampering, identify and isolate outages, and monitor voltage, among other operations that were previously unavailable or had to be performed manually.

Advanced Metering Infrastructure Market Dynamics:

The growing requirement to reduce manual meter reading and the use of meter reading devices is fueling the market. The advanced metering infrastructure market is increasing because of the acceptance of advanced metering infrastructure and its multiple benefits for customers and utilities. Increased Internet of Things penetration is driving the growth of the advanced metering infrastructure market around the world. Owing to the growing demand for low-bandwidth, low cost, and delay-insensitive metering, AMI communication networks are expected to develop during the forecast period. The network and communications modules of the meter both be as low-cost as possible. The main communication technologies driving AMI adoption in the early days are narrow-band power-line communication (PLC) and RF-Mesh. Increasing Demand for Energy: The growing trend of digitalization is driving up energy demand. The Energy Information Administration (EIA) expects to increase by 28% between 2015 and 2040. Population growth and economic development are driving up energy demand. Increased acceptance of smart home technology leads to an increase in the use of IoT-based smart devices. Hence, energy consumption increases market growth. The advanced metering infrastructure is restrained by high implementation costs, insufficient financial incentives for utilities, and the need for improved customer service levels. Inadequate financial incentives for utilities and the need to improve customer service levels can hinder the growth of the advanced measurement infrastructure market.Advanced Metering Infrastructure Market Trends:

New technologies such as broadband PLCs and low power wide area networks (LPWAN) are becoming more important with the development of communication technologies in the market. These are some of the global market trends in advanced metering infrastructure. The latest advancements in sophisticated metering infrastructure utilities are adopting these technologies because of their numerous advantages. Indianapolis Power & Light in the United States chose Landis+Gyr to extend its smart metering infrastructure program in May 2020. They want to install 350,000 smart meters and upgrade the utility's existing network to improve data telemetry from smart meters already in place, which should assist them in improving energy distribution management, renewable resource integration, consumer energy efficiency, and service quality.Advanced Metering Infrastructure Market Segment Analysis:

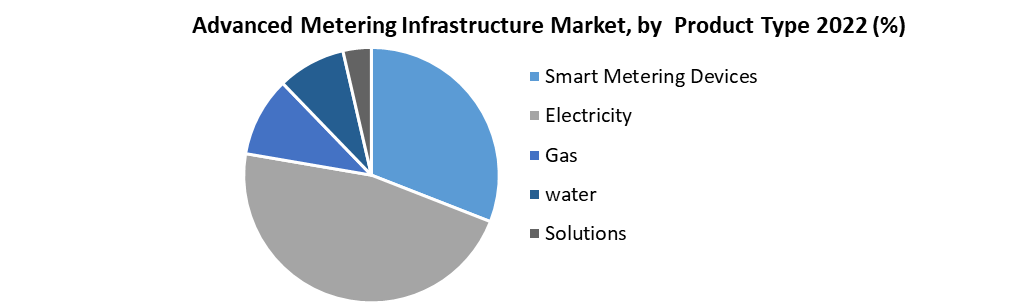

Based on the Product Type, the smart metering device is again segmented into electricity, gas, and water. In 2022, the electricity segment had the largest share, and the water segment had the highest CAGR of 14%. Smart meters are a game-changing technology for the utility industry. These technologically sophisticated meters provide more information about energy usage. Smart meters have been employed all around the world to build sophisticated metering infrastructure initiatives. The solutions segment is divided into meter communication, infrastructure, and software. The software sector has the largest market share and is expected to increase at a CAGR of 12.2% in 2022. The development of an integrated IT-enabled power grid and other support software for pattern analysis will bring benefits to users. The services sector is again segmented into system integration, deployment, and program consulting. The program consulting sector had the largest share in 2022, and the system integration is expected to grow at the fastest rate of 15%. Based on the End-User, the residential segment contributed the most revenue in 2022. AMI systems are being used by government agencies and utilities as a part of wider "smart grid" programs. According to the International Energy Agency, electricity consumption around the world is anticipated to increase by nearly 80% between 2012 and 2040.

Advanced Metering Infrastructure Market Regional Insights:

North America is expected to have the largest advanced metering infrastructure market share during the forecast period, owing to its early adoption of new technologies and the presence of large players offering advanced metering infrastructure solutions. Asia-Pacific is expected to grow at the fastest rate during the forecast period because of the recent digital transformation and increased awareness about sustainable resource use, which boosts growth. The Europe Union has the world’s greatest working population, requiring a long-term infrastructure. Regulatory mandates and legislative directives are being issued by government entities across Europe addressing the development of smart grids and the deployment of smart meters. By 2022, the European Union replaced mandates that 80% of all traditional electricity meters be replaced with smart metering infrastructure. The objective of the report is to present a comprehensive analysis of the global Advanced Metering Infrastructure Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear, futuristic view of the industry to the decision-makers. The reports also help in understanding the Advanced Metering Infrastructure Market dynamic and structure by analyzing the market segments and projecting the Advanced Metering Infrastructure Market size. Clear representation of competitive analysis of key players by Vehicle Product Type, price, financial position, product portfolio, growth strategies, and regional presence in the Advanced Metering Infrastructure Market make the report investor’s guide.Advanced Metering Infrastructure Market Scope: Inquire before buying

Advanced Metering Infrastructure Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 13.58 Bn. Forecast Period 2023 to 2029 CAGR: 13.9 % Market Size in 2029: US $ 33.79 Bn. Segments Covered: by Product Type •Smart Metering Devices • Electricity • Gas • water • Solutions • meter communication • infrastructure • software • Services • system integration • deployment • program consulting by End-User • Residential • Commercial • Industrial Advanced Metering Infrastructure Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Advanced Metering Infrastructure Market Key Players :

• Itron Inc. • IBM Corporation • Siemens AG • Schneider Electric SE • Honeywell International Inc. • General Electric • Elster Group GmbH • Sensus • Landis+Gyr • Trilliant Inc. • Dynosonic • Eaton Corporation • Echelon Corporation • Cisco Systems Inc Frequently Asked Questions: 1] What segments are covered in the Global Advanced Metering Infrastructure Market report? Ans. The segments covered in the Advanced Metering Infrastructure Market report are based on Product Type and End-Users. 2] Which region is expected to hold the highest share in the Global Advanced Metering Infrastructure Market? Ans. The North American region is expected to hold the highest share in the Advanced Metering Infrastructure Market. 3] What is the market size of the Global Advanced Metering Infrastructure Market by 2029? Ans. The market size of the Advanced Metering Infrastructure Market by 2029 is expected to reach USD 33.79 Bn. 4] What is the forecast period for the Global Advanced Metering Infrastructure Market? Ans. The forecast period for the Advanced Metering Infrastructure Market is 2023-2029. 5] What was the market size of the Global Advanced Metering Infrastructure Market in 2022? Ans. The market size of the Advanced Metering Infrastructure Market in 2022 was valued at USD 13.58 Bn.

1. Global Advanced Metering Infrastructure Market Size: Research Methodology 2. Global Advanced Metering Infrastructure Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Advanced Metering Infrastructure Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Advanced Metering Infrastructure Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • The Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Advanced Metering Infrastructure Market Size Segmentation 4.1. Global Advanced Metering Infrastructure Market Size, by Product Type (2022-2029) • Smart Metering Devices • Electricity • Gas • water • Solutions • meter communication • infrastructure • software • Services • system integration • deployment • program consulting 4.2. Global Advanced Metering Infrastructure Market Size, by End-Users (2022-2029) • Residential • Commercial • Industrial 5. North America Advanced Metering Infrastructure Market (2022-2029) 5.1. North America Advanced Metering Infrastructure Market Size, by Product Type (2022-2029) • Smart Metering Devices • Electricity • Gas • water • Solutions • meter communication • infrastructure • software • Services • system integration • deployment • program consulting 5.2. North America Advanced Metering Infrastructure Market Size, by End-Users (2022-2029) • Residential • Commercial • Industrial 5.3. North America Advanced Metering Infrastructure Market, by Country (2022-2029) • The United States • Canada • Mexico 6. European Advanced Metering Infrastructure Market (2022-2029) 6.1. European Advanced Metering Infrastructure Market, by Product Type (2022-2029) 6.2. European Advanced Metering Infrastructure Market, by End-Users (2022-2029) 6.3. European Advanced Metering Infrastructure Market, by Country (2022-2029) • The UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Advanced Metering Infrastructure Market (2022-2029) 7.1. Asia Pacific Advanced Metering Infrastructure Market, by Product Type (2022-2029) 7.2. Asia Pacific Advanced Metering Infrastructure Market, by End-Users (2022-2029) 7.3. Asia Pacific Advanced Metering Infrastructure Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASIAN • Rest Of APAC 8. Middle East and Africa Advanced Metering Infrastructure Market (2022-2029) 8.1. Middle East and Africa Advanced Metering Infrastructure Market, by Product Type (2022-2029) 8.2. Middle East and Africa Advanced Metering Infrastructure Market, by End-Users (2022-2029) 8.3. Middle East and Africa Advanced Metering Infrastructure Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Advanced Metering Infrastructure Market (2022-2029) 9.1. South America Advanced Metering Infrastructure Market, by Product Type (2022-2029) 9.2. South America Advanced Metering Infrastructure Market, by End-Users (2022-2029) 9.3. South America Advanced Metering Infrastructure Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Itron Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. IBM Corporation 10.3. Siemens AG 10.4. Schneider Electric SE 10.5. Honeywell International Inc. 10.6. General Electric 10.7. Elster Group GmbH 10.8. Sensus 10.9. Landis+Gyr 10.10. Trilliant Inc. 10.11. Dynosonic 10.12. Eaton Corporation 10.13. Echelon Corporation 10.14. Cisco Systems Inc