Global Acetaldehyde Market size was valued at USD 2.02 Bn in 2023 and is expected to reach USD 3.14 Bn by 2030, at a CAGR of 6.5%. Acetaldehyde Market Acetaldehyde, with the chemical formula CH3CHO, is a volatile organic compound known for its pungent odor and flammable properties. It is primarily produced as an intermediate in the oxidation of ethanol and is found naturally in various fruits, vegetables, and fermented beverages. Acetaldehyde serves as a building block in the synthesis of many chemicals, including acetic acid, acetic anhydride, and pyridine derivatives, making it valuable in industrial applications such as plastics, pharmaceuticals, and perfumes. Prolonged exposure to acetaldehyde, prevalent in excessive alcohol consumption and industrial processes, causes harmful health effects such as eye, skin, and respiratory irritation, impacting the acetaldehyde market. Acetaldehyde is classified as a Group 1 carcinogen by the International Agency for Research on Cancer (IARC), promising its potential role in the development of cancer. Therefore, understanding its properties and managing exposure is essential in both industrial and environmental settings.To know about the Research Methodology :- Request Free Sample Report The increasing demand for acetaldehyde as a key intermediate chemical in various industrial processes, such as the production of acetic acid, flavors and fragrances. The expanding applications of acetaldehyde in sectors such as plastics, pharmaceuticals and fuel additives contribute to its Acetaldehyde Market growth. Unique to the industry is the continuous research and development efforts aimed at discovering novel applications and refining production processes. Innovations in biotechnology, for instance, have led to the exploration of bio-based routes for acetaldehyde synthesis, leveraging microbial fermentation of renewable feedstocks as a sustainable alternative to traditional chemical methods. The rising focus on environmental sustainability and regulatory pressures to reduce emissions have spurred interest in greener manufacturing practices within the acetaldehyde industry, the development the adoption of cleaner technologies and catalytic processes. This blend of traditional demand drivers and novel advancements ensures a dynamic landscape for the growth and evolution of the acetaldehyde industry, poised to meet diverse market needs while embracing innovation and sustainability.

Acetaldehyde Market Trend

Shift towards Bio-based Acetaldehyde Production The growing awareness and concerns regarding environmental sustainability have prompted industries to seek renewable and eco-friendly alternatives to traditional chemical processes drive Acetaldehyde Market growth. Bio-based production methods, derived from renewable biomass sources including agricultural residues or waste streams, offer a more sustainable solution compared to conventional petrochemical routes. The bio-based acetaldehyde production aligns with the increasing demand for green chemicals and bio-based materials across various industries, including pharmaceuticals, food and beverage, and plastics. Advancements in biotechnology and fermentation techniques have improved the efficiency and viability of bio-based acetaldehyde production, making it a commercially attractive option. The transition towards bio-based acetaldehyde production reflects a broader global shift towards sustainable and environmentally responsible manufacturing practices, driving the growth of this market segment. 1. For Instance, Sekab's bio-based acetaldehyde is produced through an environmentally conscious process, utilizing renewable bioenergy and closed-loop systems to minimize toxicological effects. Derived from the catalytic oxidation of ethanol sourced from renewable feedstocks like sugar cane, corn, or sugar beet, Sekab's acetaldehyde offers a sustainable alternative to fossil-based counterparts. With a short shelf life posing challenges to warehouse logistics, Sekab ensures product quality and fulfillment of all requirements. Certified by ISCC (International Sustainability & Carbon Certification), Sekab's acetaldehyde guarantees 100% physical bio-based content, contributing to a reduced climate impact of up to 50% compared to fossil alternatives. Used as a key raw material in various industries including paints, plastics, construction materials, and pharmaceuticals, Sekab's bio-based acetaldehyde meets the needs of customers with high environmental standards. The production process, powered by green bio-energy, significantly lowers carbon dioxide emissions to just 0.75 kg per kg of acetaldehyde produced, distinguishing it from its fossil-derived counterparts which emit 5.7 kg of CO2 per kg produced.Acetaldehyde Market Dynamics

The Increasing Demand for Acetic Acid Production to Boost Market Growth Acetic acid, a key derivative of acetaldehyde, is utilized in various industries including chemicals, pharmaceuticals, textiles, polymers, paints, and food and beverages. Increasing demand for acetic acid drives the need for acetaldehyde, a vital intermediate in its synthesis, bolstering the Acetaldehyde Market. The chemical industry predominantly relies on the oxidation of acetaldehyde to produce acetic acid, making acetaldehyde an essential precursor in the production process. The growth in acetic acid production directly translates into increased demand for acetaldehyde, as industries seek to meet the escalating needs of diverse markets. The demand for acetaldehyde production has been continuously rising, with global demand reaching approximately tons annually, driven by its multifaceted applications across diverse industries including chemicals, plastics, pharmaceuticals, perfumes, and food additives. Acetaldehyde, primarily synthesized through oxidation processes, holds pivotal importance as an intermediate compound in various industrial applications. Chemical routes, employing efficient oxidation processes, dominate current industrial practices, driving mass production and shaping the acetaldehyde market. Recent advancements in acetaldehyde production have been geared towards enhancing process sustainability, intensification, and catalysis, aligning with growing environmental consciousness. These developments aim to optimize production efficiency while minimizing environmental footprint, ensuring the industry's long-term viability. In industrial utility, acetaldehyde used in the food and beverage sector, contributing to flavor enhancement, microbial decontamination, and preservation. Innovative applications such as its utilization as an antimicrobial agent in edible food coatings underscore its evolving significance within the food industry, reflecting an ongoing demand for novel solutions in food safety and quality assurance. Industrial-scale production predominantly relies on catalytic oxidation processes, with modern methodologies such as the Cativa process gaining prominence due to their enhanced efficiency and cost-effectiveness compared to traditional methods. Utilizing advanced iridium-based catalysts, the Cativa method enables enhanced selectivity and purity, leading to streamlined downstream purification processes and ensuring high-quality acetaldehyde production at scale. This evolution in production methodologies reflects the industry's commitment to innovation and sustainability, positioning acetaldehyde as a versatile and indispensable compound across diverse industrial and consumer sectors which boosts Acetaldehyde Market growth. Regulatory Hurdles and Compliance Requirements to hamper Market Growth Stringent regulations, often aimed at ensuring safety, environmental protection, and product quality, impose challenges for manufacturers and suppliers. Compliance with diverse sets of regulations across different regions adds complexity and cost to production processes. The evolving regulatory landscapes necessitate continuous adaptation and investment in monitoring, testing and documentation, burdening businesses. The need for extensive safety measures and risk management protocols in handling acetaldehyde due to its flammability and potential health hazards adds operational constraints. Ensuring adherence to regulatory standards requires substantial resources, expertise, and time, affecting the agility and competitiveness of Acetaldehyde Market players The regulatory changes or uncertainties disrupt supply chains, impact investment decisions, and deter innovation in the industry. Navigating through regulatory frameworks and ensuring compliance becomes an important challenge for stakeholders in the acetaldehyde market, influencing market dynamics and growth prospects.Acetaldehyde Market Segment Analysis

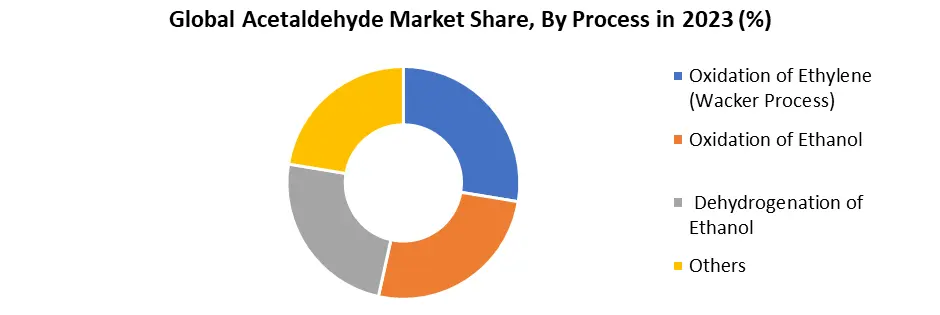

Based on the Process, the market is segmented into the Oxidation of Ethylene (Wacker Process), Oxidation of Ethanol, Dehydrogenation of Ethanol and Others. Oxidation of Ethylene (Wacker Process) dominated the Acetaldehyde Market during the forecast period. Oxidation of Ethylene (Wacker Process) dominated the Acetaldehyde industry in 2023 and is expected to continue its dominance over the forecast period. The Wacker process, which oxidizes ethylene to produce acetaldehyde, supremacies supreme in the acetaldehyde market due to its efficiency, versatility, and economic viability. Acetaldehyde stands as a cornerstone in the chemical industry, finding diverse applications in the synthesis of acetic acid, plastics, pharmaceuticals and perfumes. The Wacker process offers a dependable means of industrial-scale acetaldehyde production, furnishing manufacturers with a consistent and manageable approach to meet the demand for this vital chemical. A paramount advantage of the Wacker process lies in its exceptional selectivity and yield of acetaldehyde. By meticulously oxidizing ethylene with a palladium-based in the presence of oxygen and water, the process adeptly transforms ethylene into acetaldehyde while minimizing the formation of undesirable by-products. This high selectivity ensures manufacturers obtain acetaldehyde of high purity, adhering to demanding quality standards across several applications. The Wacker process boasts a remarkable conversion rate of ethylene, optimizing raw material utilization and reducing waste, thereby enhancing its sustainability credentials. Additionally, operating under relatively mild conditions compared to alternatives results in lower energy consumption and operational costs, augmenting its appeal to producers. The scalability of the Wacker process facilitates efficient production to accommodate fluctuating market demands, providing manufacturers with operational flexibility and fuel Acetaldehyde Market growth. The amalgamation of high selectivity, efficiency, and scalability positions the Wacker process as the favored method for acetaldehyde production in the chemical industry.

Acetaldehyde Market Regional Insights

Asia Pacific is expected to dominate the Acetaldehyde Market during the forecast period. The region's strong industrial base and expanding manufacturing sector drive substantial demand for acetaldehyde across various end-use industries such as chemicals, plastics, and pharmaceuticals. Rapid economic growth, particularly in developing economies such as China and India, has fueled infrastructure development, urbanization and industrialization, leading to heightened consumption of acetaldehyde-based products. The region's large population and rising disposable incomes contribute to the increasing demand for consumer goods, boosting the market for acetaldehyde-derived products like resins, coatings, and solvents. Asia Pacific boasts abundant feedstock resources essential for acetaldehyde production, including coal, natural gas, and biomass. Access to diverse and cost-effective raw materials provides a competitive advantage to manufacturers in the region, enabling them to produce acetaldehyde at lower costs compared to their counterparts in other parts of the globe. The advancements in technology and process innovation have enhanced the efficiency and sustainability of acetaldehyde production in Asia Pacific, fostering its competitiveness in the market. The favorable government policies and supportive regulatory frameworks in countries such as China and India have bolstered the growth of the Acetaldehyde Market. The production volume of acetaldehyde in India is driven by increased demand from end-use industries such as pharmaceuticals, chemicals, and plastics. The acetaldehyde market in India is poised for growth due to rising industrialization, urbanization, and technological advancements.Incentives for industrial development, investment in infrastructure, and initiatives to promote domestic manufacturing have created a conducive business environment, attracting both domestic and foreign investments in the acetaldehyde sector. The initiatives aimed at promoting renewable energy sources and green manufacturing practices align with the increasing focus on sustainability, driving the adoption of bio-based acetaldehyde production methods in the region. Strategic geographical location, well-established transportation networks, and access to major shipping routes enable efficient distribution of acetaldehyde products to customers across the globe. The presence of major ports and trade corridors further enhances the region's connectivity and trade competitiveness.

Acetaldehyde Market Scope : Inquire before buying

Global Acetaldehyde Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.02 Bn. Forecast Period 2024 to 2030 CAGR: 6.5% Market Size in 2030: US $ 3.14 Bn. Segments Covered: by Process Oxidation of Ethylene (Wacker Process) Oxidation of Ethanol Dehydrogenation of Ethanol Others by Derivation Pyridine & Pyridine Bases Pentaerythritol Acetic Acid Ethyl Acetate Others by Application Chemical Intermediates Plastics and Resins Food and Beverages Pharmaceuticals Others Acetaldehyde Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&AAcetaldehyde Key Players

Global 1. Eastman Chemical Company (Kingsport, Tennessee, USA) 2. Celanese Corporation (Irving, Texas, USA) 3. Jubilant Life Sciences Limited (Noida, India) 4. LCY Chemical Corp. (Taipei, Taiwan) 5. Showa Denko K.K. (Tokyo, Japan) North America 1. Gelest, Inc. (Morrisville, Pennsylvania, USA) Europe) 1. Wacker Chemie AG (Munich, Germany) 2. Lonza Group Ltd. (Basel, Switzerland) 3. Merck KGaA (Darmstadt, Germany) 4. SEKAB (Ornsköldsvik, Sweden) Asia Pacific 1. Jubilant Life Sciences(Noida, India) 2. LCY Chemical Corp. (Taipei, Taiwan) 3. Showa Denko K.K. (Tokyo, Japan) 4. Laxmi Organic Industries Ltd. (Mumbai, India) 5. Shijiazhuang Xinyuan Chemical Industry Co., Ltd. (Shijiazhuang, China) 6. Ashok Alco-chem Limited (Mumbai, India) 7. Sumitomo Chemical Co., Ltd. (Tokyo, Japan) 8. CNPC Lanzhou Chemical Co., Ltd. (Lanzhou, China) 9. China National Petroleum Corporation (CNPC) (Beijing, China) 10. Hebei Chengxin Co., Ltd. (Shijiazhuang, China) 11. Shandong Hongda Group (Zibo, China) 12. Ashok Organic Industries Ltd. (Mumbai, India) 13. Gujrat Organics Ltd. (Mumbai, India) 14. Nantong Acetic Acid Chemical Co., Ltd. (Nantong, China) 15. Chinasun Specialty Products Co., Ltd. (Nanjing, China) 16. China National BlueStar (Group) Co., Ltd. (Beijing, China) Frequently Asked Questions: 1] What is the growth rate of the Global Acetaldehyde Market? Ans. The Global Acetaldehyde Market is growing at a significant rate of 6.5% during the forecast period. 2] Which region is expected to dominate the Global Acetaldehyde Market? Ans. Asia Pacific is expected to dominate the Acetaldehyde Market during the forecast period. 3] What is the expected Global Acetaldehyde Market size by 2030? Ans. The Acetaldehyde Market size is expected to reach USD 3.14 Billion by 2030. 4] Which are the top players in the Global Acetaldehyde Market? Ans. The major top players in the Global Acetaldehyde Market are Eastman Chemical Company (Kingsport, Tennessee, USA), Celanese Corporation (Irving, Texas, USA),Jubilant Life Sciences Limited (Noida, India),LCY Chemical Corp. (Taipei, Taiwan),Showa Denko K.K. (Tokyo, Japan),Gelest, Inc. (Morrisville, Pennsylvania, USA),Wacker Chemie AG (Munich, Germany) and Others. 5] What are the factors driving the Global Acetaldehyde Market growth? Ans. The growing use of acetaldehyde in chemical production and increasing demand for plastics and resins are expected to drive market growth during the forecast period.

1. Acetaldehyde Market: Research Methodology 2. Global Acetaldehyde Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Type Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Headquarter 2.4. Leading Acetaldehyde Market Companies, by Market share 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Acetaldehyde Market Introduction 3.1. Study Assumption and Market Definition 3.2. Scope of the Study 3.3. Executive Summary 4. Acetaldehyde Market: Dynamics 4.1. Acetaldehyde Market Trends by Region 4.1.1. North America Acetaldehyde Market Trends 4.1.2. Europe Acetaldehyde Market Trends 4.1.3. Asia Pacific Acetaldehyde Market Trends 4.1.4. Middle East and Africa Acetaldehyde Market Trends 4.1.5. South America Acetaldehyde Market Trends 4.2. Acetaldehyde Market Dynamics by Region 4.2.1. North America 4.2.1.1. North America Acetaldehyde Market Drivers 4.2.1.2. North America Acetaldehyde Market Restraints 4.2.1.3. North America Acetaldehyde Market Opportunities 4.2.1.4. North America Acetaldehyde Market Challenges 4.2.2. Europe 4.2.2.1. Europe Acetaldehyde Market Drivers 4.2.2.2. Europe Acetaldehyde Market Restraints 4.2.2.3. Europe Acetaldehyde Market Opportunities 4.2.2.4. Europe Acetaldehyde Market Challenges 4.2.3. Asia Pacific 4.2.3.1. Asia Pacific Acetaldehyde Market Drivers 4.2.3.2. Asia Pacific Acetaldehyde Market Restraints 4.2.3.3. Asia Pacific Acetaldehyde Market Opportunities 4.2.3.4. Asia Pacific Acetaldehyde Market Challenges 4.2.4. Middle East and Africa 4.2.4.1. Middle East and Africa Acetaldehyde Market Drivers 4.2.4.2. Middle East and Africa Acetaldehyde Market Restraints 4.2.4.3. Middle East and Africa Acetaldehyde Market Opportunities 4.2.4.4. Middle East and Africa Acetaldehyde Market Challenges 4.2.5. South America 4.2.5.1. South America Acetaldehyde Market Drivers 4.2.5.2. South America Acetaldehyde Market Restraints 4.2.5.3. South America Acetaldehyde Market Opportunities 4.2.5.4. South America Acetaldehyde Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Derivatives Roadmap 4.6. Regulatory Landscape by Region 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 4.7. Key Opinion Leader Analysis For Acetaldehyde Market 4.8. Analysis of Government Schemes and Initiatives For Acetaldehyde Market 5. Acetaldehyde Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2023-2030) 5.1. Acetaldehyde Market Size and Forecast, by Process (2023-2030) 5.1.1. Oxidation of Ethylene (Wacker Process) 5.1.2. Oxidation of Ethanol 5.1.3. Dehydrogenation of Ethanol 5.1.4. Others 5.2. Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 5.2.1. Pyridine & Pyridine Bases 5.2.2. Pentaerythritol 5.2.3. Acetic Acid 5.2.4. Ethyl Acetate 5.2.5. Others 5.3. Acetaldehyde Market Size and Forecast, by Application (2023-2030) 5.3.1. Chemical Intermediates 5.3.2. Plastics and Resins 5.3.3. Food and Beverages 5.3.4. Pharmaceuticals 5.3.5. Others 5.4. Acetaldehyde Market Size and Forecast, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Acetaldehyde Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2023-2030) 6.1. North America Acetaldehyde Market Size and Forecast, by Process (2023-2030) 6.1.1. Oxidation of Ethylene (Wacker Process) 6.1.2. Oxidation of Ethanol 6.1.3. Dehydrogenation of Ethanol 6.1.4. Others 6.2. North America Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 6.2.1. Pyridine & Pyridine Bases 6.2.2. Pentaerythritol 6.2.3. Acetic Acid 6.2.4. Ethyl Acetate 6.2.5. Others 6.3. North America Acetaldehyde Market Size and Forecast, by Application (2023-2030) 6.3.1. Chemical Intermediates 6.3.2. Plastics and Resins 6.3.3. Food and Beverages 6.3.4. Pharmaceuticals 6.3.5. Others 6.4. North America Acetaldehyde Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.1.1. United States Acetaldehyde Market Size and Forecast, by Process (2023-2030) 6.4.1.1.1. Oxidation of Ethylene (Wacker Process) 6.4.1.1.2. Oxidation of Ethanol 6.4.1.1.3. Dehydrogenation of Ethanol 6.4.1.1.4. Others 6.4.1.2. United States Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 6.4.1.2.1. Pyridine & Pyridine Bases 6.4.1.2.2. Pentaerythritol 6.4.1.2.3. Acetic Acid 6.4.1.2.4. Ethyl Acetate 6.4.1.2.5. Others 6.4.1.3. United States Acetaldehyde Market Size and Forecast, by Application (2023-2030) 6.4.1.3.1. Chemical Intermediates 6.4.1.3.2. Plastics and Resins 6.4.1.3.3. Food and Beverages 6.4.1.3.4. Pharmaceuticals 6.4.1.3.5. Others 6.4.2. Canada 6.4.2.1. Canada Acetaldehyde Market Size and Forecast, by Process (2023-2030) 6.4.2.1.1. Oxidation of Ethylene (Wacker Process) 6.4.2.1.2. Oxidation of Ethanol 6.4.2.1.3. Dehydrogenation of Ethanol 6.4.2.1.4. Others 6.4.2.2. Canada Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 6.4.2.2.1. Pyridine & Pyridine Bases 6.4.2.2.2. Pentaerythritol 6.4.2.2.3. Acetic Acid 6.4.2.2.4. Ethyl Acetate 6.4.2.2.5. Others 6.4.2.3. Canada Acetaldehyde Market Size and Forecast, by Application (2023-2030) 6.4.2.3.1. Chemical Intermediates 6.4.2.3.2. Plastics and Resins 6.4.2.3.3. Food and Beverages 6.4.2.3.4. Pharmaceuticals 6.4.2.3.5. Others 6.4.3. Mexico 6.4.3.1. Mexico Acetaldehyde Market Size and Forecast, by Process (2023-2030) 6.4.3.1.1. Oxidation of Ethylene (Wacker Process) 6.4.3.1.2. Oxidation of Ethanol 6.4.3.1.3. Dehydrogenation of Ethanol 6.4.3.1.4. Others 6.4.3.2. Mexico Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 6.4.3.2.1. Pyridine & Pyridine Bases 6.4.3.2.2. Pentaerythritol 6.4.3.2.3. Acetic Acid 6.4.3.2.4. Ethyl Acetate 6.4.3.2.5. Others 6.4.3.3. Mexico Acetaldehyde Market Size and Forecast, by Application (2023-2030) 6.4.3.3.1. Chemical Intermediates 6.4.3.3.2. Plastics and Resins 6.4.3.3.3. Food and Beverages 6.4.3.3.4. Pharmaceuticals 6.4.3.3.5. Others 7. Europe Acetaldehyde Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2023-2030) 7.1. Europe Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.2. Europe Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.3. Europe Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4. Europe Acetaldehyde Market Size and Forecast, by Country (2023-2030) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.1.2. United Kingdom Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.1.3. United Kingdom Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4.2. France 7.4.2.1. France Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.2.2. France Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.2.3. France Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4.3. Germany 7.4.3.1. Germany Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.3.2. Germany Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.3.3. Germany Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4.4. Italy 7.4.4.1. Italy Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.4.2. Italy Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.4.3. Italy Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4.5. Spain 7.4.5.1. Spain Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.5.2. Spain Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.5.3. Spain Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4.6. Sweden 7.4.6.1. Sweden Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.6.2. Sweden Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.6.3. Sweden Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4.7. Austria 7.4.7.1. Austria Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.7.2. Austria Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.7.3. Austria Acetaldehyde Market Size and Forecast, by Application (2023-2030) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Acetaldehyde Market Size and Forecast, by Process (2023-2030) 7.4.8.2. Rest of Europe Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 7.4.8.3. Rest of Europe Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8. Asia Pacific Acetaldehyde Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2023-2030) 8.1. Asia Pacific Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.2. Asia Pacific Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.3. Asia Pacific Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4. Asia Pacific Acetaldehyde Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.1.1. China Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.1.2. China Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.1.3. China Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.2. S Korea 8.4.2.1. S Korea Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.2.2. S Korea Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.2.3. S Korea Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.3. Japan 8.4.3.1. Japan Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.3.2. Japan Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.3.3. Japan Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.4. India 8.4.4.1. India Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.4.2. India Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.4.3. India Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.5. Australia 8.4.5.1. Australia Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.5.2. Australia Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.5.3. Australia Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.6. Indonesia 8.4.6.1. Indonesia Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.6.2. Indonesia Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.6.3. Indonesia Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.7. Malaysia 8.4.7.1. Malaysia Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.7.2. Malaysia Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.7.3. Malaysia Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.8. Vietnam 8.4.8.1. Vietnam Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.8.2. Vietnam Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.8.3. Vietnam Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.9. Taiwan 8.4.9.1. Taiwan Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.9.2. Taiwan Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.9.3. Taiwan Acetaldehyde Market Size and Forecast, by Application (2023-2030) 8.4.10. Rest of Asia Pacific 8.4.10.1. Rest of Asia Pacific Acetaldehyde Market Size and Forecast, by Process (2023-2030) 8.4.10.2. Rest of Asia Pacific Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 8.4.10.3. Rest of Asia Pacific Acetaldehyde Market Size and Forecast, by Application (2023-2030) 9. Middle East and Africa Acetaldehyde Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2022-2029 9.1. Middle East and Africa Acetaldehyde Market Size and Forecast, by Process (2023-2030) 9.2. Middle East and Africa Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 9.3. Middle East and Africa Acetaldehyde Market Size and Forecast, by Application (2023-2030) 9.4. Middle East and Africa Acetaldehyde Market Size and Forecast, by Country (2023-2030) 9.4.1. South Africa 9.4.1.1. South Africa Acetaldehyde Market Size and Forecast, by Process (2023-2030) 9.4.1.2. South Africa Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 9.4.1.3. South Africa Acetaldehyde Market Size and Forecast, by Application (2023-2030) 9.4.2. GCC 9.4.2.1. GCC Acetaldehyde Market Size and Forecast, by Process (2023-2030) 9.4.2.2. GCC Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 9.4.2.3. GCC Acetaldehyde Market Size and Forecast, by Application (2023-2030) 9.4.3. Nigeria 9.4.3.1. Nigeria Acetaldehyde Market Size and Forecast, by Process (2023-2030) 9.4.3.2. Nigeria Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 9.4.3.3. Nigeria Acetaldehyde Market Size and Forecast, by Application (2023-2030) 9.4.4. Rest of ME&A 9.4.4.1. Rest of ME&A Acetaldehyde Market Size and Forecast, by Process (2023-2030) 9.4.4.2. Rest of ME&A Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 9.4.4.3. Rest of ME&A Acetaldehyde Market Size and Forecast, by Application (2023-2030) 10. South America Acetaldehyde Market Size and Forecast by Segmentation (by Value in USD Billion and Volume Units) (2022-2029 10.1. South America Acetaldehyde Market Size and Forecast, by Process (2023-2030) 10.2. South America Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 10.3. South America Acetaldehyde Market Size and Forecast, by Application (2023-2030) 10.4. South America Acetaldehyde Market Size and Forecast, by Country (2023-2030) 10.4.1. Brazil 10.4.1.1. Brazil Acetaldehyde Market Size and Forecast, by Process (2023-2030) 10.4.1.2. Brazil Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 10.4.1.3. Brazil Acetaldehyde Market Size and Forecast, by Application (2023-2030) 10.4.2. Argentina 10.4.2.1. Argentina Acetaldehyde Market Size and Forecast, by Process (2023-2030) 10.4.2.2. Argentina Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 10.4.2.3. Argentina Acetaldehyde Market Size and Forecast, by Application (2023-2030) 10.4.3. Rest Of South America 10.4.3.1. Rest Of South America Acetaldehyde Market Size and Forecast, by Process (2023-2030) 10.4.3.2. Rest Of South America Acetaldehyde Market Size and Forecast, by Derivatives (2023-2030) 10.4.3.3. Rest Of South America Acetaldehyde Market Size and Forecast, by Application (2023-2030) 11. Company Profile: Key Players 11.1. Eastman Chemical Company (Kingsport, Tennessee, USA) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Celanese Corporation (Irving, Texas, USA) 11.3. Jubilant Life Sciences Limited (Noida, India) 11.4. LCY Chemical Corp. (Taipei, Taiwan) 11.5. Showa Denko K.K. (Tokyo, Japan) 11.6. Gelest, Inc. (Morrisville, Pennsylvania, USA) 11.7. Wacker Chemie AG (Munich, Germany) 11.8. Lonza Group Ltd. (Basel, Switzerland) 11.9. Merck KGaA (Darmstadt, Germany) 11.10. SEKAB (Ornsköldsvik, Sweden) 11.11. Jubilant Life Sciences Limited (Noida, India) 11.12. LCY Chemical Corp. (Taipei, Taiwan) 11.13. Showa Denko K.K. (Tokyo, Japan) 11.14. Laxmi Organic Industries Ltd. (Mumbai, India) 11.15. Shijiazhuang Xinyuan Chemical Industry Co., Ltd. (Shijiazhuang, China) 11.16. Ashok Alco-chem Limited (Mumbai, India) 11.17. Sumitomo Chemical Co., Ltd. (Tokyo, Japan) 11.18. CNPC Lanzhou Chemical Co., Ltd. (Lanzhou, China) 11.19. China National Petroleum Corporation (CNPC) (Beijing, China) 11.20. Hebei Chengxin Co., Ltd. (Shijiazhuang, China) 11.21. Shandong Hongda Group (Zibo, China) 11.22. Ashok Organic Industries Ltd. (Mumbai, India) 11.23. Gujrat Organics Ltd. (Mumbai, India) 11.24. Nantong Acetic Acid Chemical Co., Ltd. (Nantong, China) 11.25. Chinasun Specialty Products Co., Ltd. (Nanjing, China) 11.26. China National BlueStar (Group) Co., Ltd. (Beijing, China) 12. Key Findings and Analyst Recommendations