Global Tight Gas Market was valued at US$ 36.35 Bn. in 2022. The Tight Gas Market size is estimated to grow at a CAGR of 5.2% over the forecast period.Tight Gas Market Overview:

The Tight Gas Market is expected to grow in the forecasted period, shifting toward unconventional gases. It is a type of natural gas with low porous that comes from reservoir rocks. For best tight gas, Massive Hydraulic fracturing is required that contains a very low matrix permeability of less than 0.1mD. Tight gas is known for being the cleanest burning fossil fuel, with low carbon and low sulfur emission and carbon dioxide. In the US the, shale will be assumed to grow by 85%, and tight gas will grow by 34% The report explores the Tight Gas market's segments (Type, Application, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). This market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2022. The report investigates the Tight Gas market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Tight Gas market's contemporary competitive scenario.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Countries Shifting to Decarbonization: Many countries like Brazil, China, Colombia, etc., are decarbonizing their energy system. The US again rejoined the Paris Agreement in 2021 to reduce greenhouse gas and decarbonization the world economy. Decarbonization has increased by market forces. The world’s largest economies are increasingly using renewables. 40% of electricity is generated by Germany from renewables, 38% of electricity by Spain and 30% by the UK. Costa Rica and Ethiopia are mostly getting their electricity from clean sources and hydropower. Many countries are progressing their electricity decarbonization mange by investing in wind and solar. Shale Gases and Tight Gases: Shale Gases and Tight Gases both are the hydrocarbon resources that are mainly found in tight reservoir rocks with very tiny pores on them from which oil and natural gases cannot flow from it. Some of the hydrocarbons are juxtaposed rock layers that are easy to extract because of their high receptiveness and vulnerability. Strict policies are made for the safety purpose of the atmosphere, and the government also extended the assessment and licenses, also expecting to have control of the expansion of the tight gas. For example, Ascent Resources company didn’t get the official permit for the change, which was very important for expanding the manufacturing in the company.Tight Gas Market Segment Analysis:

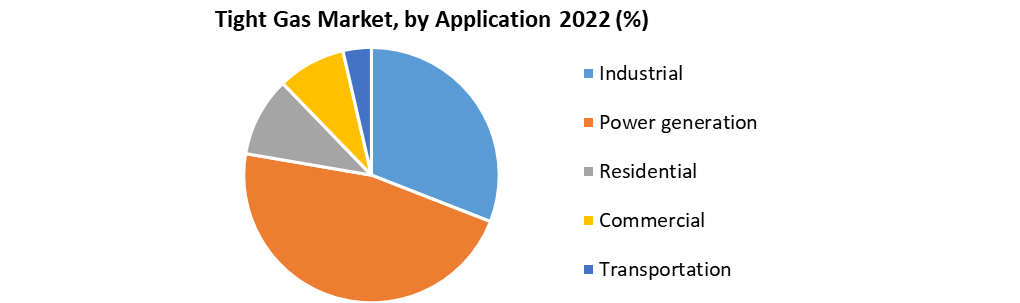

Based on Application, the Tight Gas Market is segmented into Industrial, Power Generation, Residential, Commercial, and Transportation. The industrial segment is dominating the market with the largest volume size of 34%. The growth of tight gas is totally dependent on the usage of gas in the industrial sector. Currently, it is used as biofuel for the manufacturing of fertilizers, chemicals, and various other commodities. This is bringing opportunities for the countries that are already using it as a resource in order to expand the industrial output in upcoming years. Power generation segments are expected to grow fast in CAGR of 5.3% in terms of volume in the forecasted period. This is expected to grow trends as the shifting of coal to gas in power plants in many countries. Lower carbon emissions, when compared to tight gas combustion and combustion of other fossil fuels, are expected to expand the share of tight gas in several countries. The residential segment contains a remarkable market share in the market due to its broad application in the requirement of the household. The tight gas is used in households for water heating or space heating. The increasing rate of usage of tight gas in the household sector has increased the development of piped natural gas networks directly supplied to the houses.

Regional Insights:

The North America region held the largest market share accounting for 80.5% in 2022, and is expecting to maintain the same in upcoming years. The US is the largest revenue provider for the tight gas. Advanced drilling technologies with existing various reserves of tight gas across the Permian Basin, Niobrara, etc., are the key factors that are driving in the various countries. China is expected to achieve a large market share in the forecasted period and also aims to boost domestic natural gas production and the growing demand for energy security across the world. Most of the tight gas plants in China are located in the mountainous region. Such geographical region increases the drilling cost that restricts the market growth to grow to that extent. The Chinese government has come up with new subsidies under the subsidy program related to the production of natural gases. The objective of the report is to present a comprehensive analysis of the global Tight Gas Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear, futuristic view of the industry to the decision-makers. The reports also help in understanding the Tight Gas Market dynamic, and structure by analyzing the market segments and projecting the Tight Gas Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Tight Gas Market make the report investor’s guide.Tight Gas Market Scope: Inquiry Before Buying

Tight Gas Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 36.35 Bn. Forecast Period 2023 to 2029 CAGR: 5.2% Market Size in 2029: US$ 51.84 Bn. Segments Covered: by Application Industrial Power generation Residential Commercial Transportation by Type Processed Tight Gas Unprocessed Tight Gas Tight Gas Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tight Gas Market, Key Players:

1. Chevron Corporation 2. Chesapeake 3. ConocoPhillips Company 4. Equinor ASA 5. Exxon Mobil Corporation 6. PetroChina Company Limited 7. Repsol 8. Royal Dutch Shell PLC 9. Southwestern Energy Company 10.Sinopec Oilfield Service Corporation 11.Marathon Oil 12.Pioneer Natural Resources 13.Devon Energy 14.EOG Resources Frequently Asked Questions: 1) What is the Tight Gas? Ans. It’s a natural gas produced from the reservoir rocks with low permeability. 2) What is the expected growth of the Tight Gas market in the forecasted year by 2029? Ans. The tight gas market will grow by 5.2% CAGR by 2029. 3) What is the use of Tight Gas? Ans. The uses of tight gas are to flow at economic gas rates and to recover the economic volume of gas. 4) Is Tight Gas unconventional? Ans. Tight gas is considered to be an unconventional source of natural gas. 5) Types of unconventional gas resources. Ans. Tight gas, Shell gas, and Coal bed methane.

1. Global Tight Gas Market Size: Research Methodology 2. Global Tight Gas Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Tight Gas Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Tight Gas Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.1.2.1. Consolidation in the Market 3.2.1 M&A by region 3.2. Key Developments by Companies 3.3. Market Drivers 3.4. Market Restraints 3.5. Market Opportunities 3.6. Market Challenges 3.7. Market Dynamics 3.8. PORTERS Five Forces Analysis 3.9. PESTLE 3.10. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.11. COVID-19 Impact 4. Global Tight Gas Market Size Segmentation 4.1. Global Tight Gas Market Size, by Application (2022-2029) • Industrial • Transportation • Power generation • Residential • Commercial 5. North America Tight Gas Market (2022-2029) 5.1. North America Tight Gas Market Size, by Application (2022-2029) • Industrial • Transportation • Power generation • Residential • Commercial 5.2. North America Tight Gas Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Tight Gas Market (2022-2029) 6.1. European Tight Gas Market, by Application (2022-2029) • Industrial • Transportation • Power generation • Residential • Commercial 6.2. European Tight Gas Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Tight Gas Market (2022-2029) 7.1. Asia Pacific Tight Gas Market, by Application (2022-2029) • Industrial • Transportation • Power generation • Residential • Commercial 7.2. Asia Pacific Tight Gas Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASIAN • Rest Of APAC 8. Middle East and Africa Tight Gas Market (2022-2029) 8.1. Middle East and Africa Tight Gas Market, by Application (2022-2029) • Industrial • Transportation • Power generation • Residential • Commercial 8.2. Middle East and Africa Tight Gas Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Tight Gas Market (2022-2029) 9.1. South America Tight Gas Market, by Application (2022-2029) • Industrial • Transportation • Power generation • Residential • Commercial 9.2. South America Tight Gas Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1.1. Chevron Corporation 10.1.2. Company Overview 10.1.3. Financial Overview 10.1.4. Global Presence 10.1.5. Capacity Portfolio 10.1.6. Business Strategy 10.1.7. Recent Developments 10.1.8. Chesapeake 10.1.9. ConocoPhillips Company 10.1.10. Equinor ASA 10.1.11. Exxon Mobil Corporation 10.1.12. PetroChina Company Limited 10.1.13. Repsol 10.1.14. Royal Dutch Shell PLC 10.1.15. Southwestern Energy Company 10.1.16. Sinopec Oilfield Service Corporation 10.1.17. Marathon Oil 10.1.18. Pioneer Natural Resources 10.1.19. Devon Energy