Account-Based Marketing Market size was valued at USD 1.07 Bn. in 2023 and the total Account-Based Marketing Market revenue is expected to grow at 13% from 2024 to 2030, reaching nearly USD 2.39 Bn.Account-Based Marketing Market Overview:

The Account-based marketing (ABM) is a technique provider focuses on a certain group of accounts that represent noticeably higher growth opportunities with specialized marketing and sales support. ABM software readjusts sales and marketing organizations away from generic branding and lead-generation strategies by finding high-quality target accounts and adopting a tailored marketing strategy. The time-consuming process of identifying prospects and delivering the relevant assets to build acceptable accounts can be automated and streamlined with the help of ABM software. Owing to the growth in businesses' demand for account-based marketing, which enables sales and marketing units to close more deals by focusing on specific accounts, the account-based marketing software market is expected to grow.To know about the Research Methodology:-Request Free Sample Report Software for account-based marketing provides tools to speed up and automate the common process of creating appropriate accounts by identifying prospects. The application can identify prospects and provides the appropriate resources for account growth. With the help of this tool, users develop highly qualified leads, increase opportunities for customers that are already in the pipeline, and design unique buying journeys. Users can connect prospect data with real-time customer experience technology with the help of account-based marketing tools. This makes it possible to implement a market strategy based on accounts. Consequently, it is simpler to integrate sales and marketing personnel with line operations to meet corporate objectives. The market for account-based marketing is rapidly growing as it gives B2B marketers additional opportunities for achieving strategic client engagement. A key factor in growing the business within existing client accounts is account-based marketing. In situations when initial sales are slow, account-based marketing software has shown to boost the customers' long-term worth. Additionally, account-based marketing enables the implementation of essential prospect accounts for the initial sale. The implementation of account-based marketing software is being heavily funded by a number of industry participants. As a result, the account-based marketing market experiences explosive growth on a global scale.

Report Scope:

The report covers market features, size, growth, segmentation, geographical breakdowns, market shares by region for key players in account based market, trends, and demand and supply sides. Future aspects of the Market mainly presented based on factors on which the companies contribute to the market estimation, key trends, and segment analysis. It covers effective business strategies, consumer preferences, governmental regulations, recent competitor actions, as well as future business prospects and market concerns. In-depth financial information about kay manufacturers, such as year-after-year sales, revenue growth, CAGR, production cost analysis, and value chain structure, is highlighted in the Account-Based Marketing Market study.Account-Based Marketing Market Dynamics:

Market Drivers: Growing demand for Account-Based Marketing Organization’s software Growing need for account-based marketing, in the era of lot of data and social media content is increased and is driving the market. As it offers new approaches for B2B marketers to manage strategic client engagement, the account-based marketing software market is becoming more popular in B2B sector. It is suggested that account-based marketing increases the customer's long-term worth in scenarios with modest initial sales. For the first sale, account-based marketing can also be used for significant potential accounts. The option of purchasing irrelevant traffic for highly focused campaigns is decreased thanks to the account-based market. Real-time account selection raises the likelihood of a higher return on investment by preventing the expenditure of resources on statements that aren't a good fit. This is regarded as the market's main motivator on a global scale for account-based marketing. Aligning the sales and marketing teams is made easy using ABM. The demand for ABM solutions in this industry is driven by marketers that focus more on sales, finding new clients, to increase the topline. Since the ABM system is automated it requires least supervision and manual work and can be done with minimum cost and same is making it more popluer amongst the senior sales community. Massive expenditure on marketing services Across all industries, a considerable amount of money is spent on marketing services, and businesses are implementing technologies to maximize their investment. For instance, research released by the US found that global spending on marketing services increased from 380.20 billion USD in 2013 to 463.62 billion USD in 2023. The report has analysed how much of total sales expendtuer of the world can be penetrated by ABM in how much of time period. Continual improvement is ABM solutions making it attractive in developing as well as developed economies. . For instance, Triblio introduced its "Ask an ABM Expert" series of brief instructional films in January 2020. These films seek to provide crucial insights into ABM and contemporary B2B marketing. This encourages companies and marketers to implement innovative ABM solutions in their organizations. Faster Sales Process An increase in the use of account-based marketing (ABM). Consumers profit from messages that are specifically designed for them thanks to their personalized approach and attention to detail. According to data by SiriusDecisions, ABM accounted for up to 70% of a B2B marketer's budget in 2016 and is anticipated to increase further this year. ABM is projected to play a significant role in many businesses' marketing plans this year, and several members of the Forbes Agency Council discussed the benefits of utilizing this marketing strategy. Personalization and nurturing of important consumers and prospects are age-old techniques that goes by the name of account-based marketing (ABM). ABM enables marketing teams to get rid of the bad leads that upset their sales colleagues and go nowhere. Additionally, it highlights the customer acquisition process more, strengthening marketing teams over time. the Metis Communications' Cathy Atkins Market Restraints: Lack of marketing knowledge Understanding the individual needs of the accounts and how they want to communicate enables to development of an effective ABM system and enables a more thorough analysis. ABM technology is still viewed as being in its early stages. There are several restrictions, particularly when using IP addresses and Cookie Files to identify accounts. ABM does indeed reduce costs and boost ROI, but it also necessitates the initial investment in a new platform. Setting up a successful ABM system also demands some marketing expertise, which is slowing down its quick development. Market Opportunities: Greater ROI Clarity ABM is specific, targeted, customized, and quantifiable. Among B2B marketing approaches and strategies, it offers the highest ROI with the least waste and risk. The strategy makes it simpler to coordinate sales and marketing for ongoing account growth marketing. Direct marketing to accounts that the company has selected as prospects can be very cost-effective. This is especially true if utilizing some of the targeting features available on some of the more recently social media networks. From a financial standpoint, ABM makes a tonne of sense for companies who are aware of who their most desirable targets are. To generate the highest income, ABM builds marketing initiatives around critical accounts. These efforts optimize the most valuable resources time and money owing to their focused focus. The Marketing team concentrates on working closely with sales to target and create content for key accounts and create a productive communication channel with sales by merging sales and marketing operations. Account-based marketing enables businesses to benefit from a shorter sales cycle. Resources across the entire firm are conserved by excluding unqualified candidates early on. Teams from sales and marketing can concentrate all of their efforts on the accounts that are most likely to convert and give those prospects and accounts more specialized/personalized services. Account-based marketing enables a more focused and intentional marketing effort that is closely related to sales efforts. By doing this, both departments develop purpose-driven activities that specifically meet the particular needs of each account while holding each other accountable for progress toward their individual goals. This is a practical technique to guarantee that time and money are used wisely.Account-Based Marketing Market Segment Analysis:

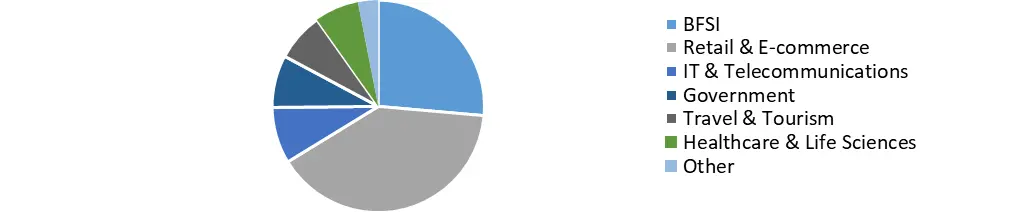

Based on Components, the tools segment is expected to grow at the highest CAGR during the forecast period. There are numerous instruments available, each with a unique purpose, advantage, and cost. Leadfeeder not only displays contact information for the company's personnel but also reveals what companies visit. LeadGenius is a hybrid resource that combines human and software expertise. Data intelligence is acquired and filtered on the platform, but human research teams are made available to their clients to assure consistently high-quality data. It follows that it is a very precise solution. Marketers create and curate a list of prospects using Datanyze, and they also have the opportunity to score leads both before and after they enter the pipeline. Although Datanyze offers a free Chrome extension for marketers and salespeople wishing to prospect on a small budget, pricing for the entire product is not yet accessible. Marketers can use DataFox to look for businesses that fulfill a certain set of requirements as well as businesses that are comparable to their existing client profiles. Reviewers claim that it is generally dependable and that it is more hands-on than some of the previously stated solutions, although it works best for locating specific people as opposed to important decision-makers inside a single organization. Another tool that marketers use to look for and learn more about prospects is InsideView. For marketers to know how and when to act, it includes access to contact information and publicly available activity. As a result, all these factors boost the growth of the market during the forecast period. Based on Deployment, the on-cloud segment is expected to grow at the highest CAGR during the forecast period. Owing to increasing workflow efficiency, providing high-end protection for datasets, improved scalability, speed, 24/7 services, and IT security. Cloud computing enables businesses to store, manage, and process vital data on remote computers that are hosted online. A few factors influencing the growth of emerging technologies include the growing focus on delivering customer-centric applications to increase customer satisfaction, the growing volume of data generation in websites and mobile apps, and the increasing need to control and reduce Capital Expenditure (CAPEX) and Operational Expenditure (OPEX). Global demand for cloud computing is increasing as a result of emerging technologies like big data, AI, and machine learning (ML). The development of cloud computing services is being fueled by important factors including data security, quicker Disaster Recovery (DR), and compliance. The rise of cloud computing is accredited to the desire to reduce risks, achieve scalability and flexibility for moving and storing data, reduce storage and infrastructure complexity, and boost corporate productivity. Based on End-user Industry, the BFSI segment is expected to grow at the highest CAGR during the forecast period. Financial services companies are implementing digital marketing strategies as part of the BFSI industry's digital transformation objectives. This aids in the automation of marketing procedures and greatly increases customer reach for marketers. Account-Based Marketing is a key tool used by financial services marketers to identify and target the accounts that are most valuable to them in industries including insurance, asset management, investments, and commercial banking.Account-Based Marketing Market, by End Use Industry in 2023(%)

ABM enables businesses in the BFSI sector to manage their client relationships and rank them according to factors such as consistency, investment potential, and creditworthiness, among many others. By giving their clients top priority and offering services that are specifically tailored to meet their demands, financial services marketers increase revenues and lead generation. The BFSI industry has already embraced technological advances like AI and Cloud Computing, which give businesses rich marketing information about their clients. Additionally, advertisers like Tata Capital are experimenting with account-based marketing solutions and smarter advertising. In order to achieve results on a human level, they also intend to incorporate AI solutions that assist them with individualized keyword searches, social profiles, and other internet data.Regional Insights:

The existence of numerous regional ABM solution providers, including Terminus Software, Marketo by Adobe, Uberflip, Engagio, 6sense Insights, Inc., and many others, causes North America to dominate the account-based marketing market. To increase their market presence both locally and globally, the industry participants are implementing sizable improvements to their products. To improve their offers and reach more customers, businesses in the region are integrating technologies like AI, Cloud, and automation, among others. Additionally, it aids in their ability to draw in local marketers. For instance, Terminus updated its ABM platform in October 2019 by leveraging the existing Terminus B2B Graph, which has the largest database of company-level digital identities, and by integrating machine learning and predictive analytics, allowing marketers to scale their ABM practices more quickly and easily to increase their revenue. Strategic alliances and collaborations are also taking place in the region, which aids solution providers in utilizing the technology and industry knowledge of other businesses and boosting their market position. For instance, in April 2020, RollWorks, a branch of NextRoll, Inc., became an Accelerate partner of Marke to, an Adobe company, and LaunchPoint. The account-based platforms of Marketo Engage and RollWorks combined through certified integration to enable customers to easily identify high-value accounts.Account-Based Marketing Market Scope: Inquire before buying

Global Account-Based Marketing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.07 Bn. Forecast Period 2024 to 2030 CAGR: 13% Market Size in 2030: US $ 2.39 Bn. Segments Covered: by Component Tools Services by Deployment On-Cloud On-Premise by End User Industry BFSI Retail & E-commerce IT & Telecommunications Government Travel & Tourism Healthcare & Life Sciences Other Account-Based Marketing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Account-Based Marketing Market, Key Players are

1. Terminus Software (US) 2. Act-On Software (US) 3. AdDaptive Intelligence, Inc. (US) 4. 6sence (US) 5. MRP Prelytix (US) 6. Drift.com, Inc. (US) 7. HubSpot (US) 8. Integrate (US) 9. Iterable (US) 10.Kwanzoo (US) 11.Alyce, Inc. (US) 12.MetricFox (US) 13.Obility (US) 14.Madison Logic (US) 15.TechTarget (US) 16.Triblio (US) 17.Uberflip (Canada) 18.Jabmo (France) 19.Momentum Group Limited (UK) 20.EngageTech (UK) 21.Vendemore ( Sweden) 22.Albacross Nordic AB (Sweden) Frequently Asked Questions: 1] What segments are covered in the Global Account-Based Marketing Market report? Ans. The segments covered in the Account-Based Marketing Market report are based on Component, Deployment, End-user Industry, and Region. 2] Which region is expected to hold the highest share in the Global Account-Based Marketing Market? Ans. The North America region is expected to hold the highest share in the Account-Based Marketing Market. 3] What is the market size of the Global Account-Based Marketing Market by 2030? Ans. The market size of the Account-Based Marketing Market by 2030 is expected to reach US$ 2.39 Bn. 4] What is the forecast period for the Global Account-Based Marketing Market? Ans. The forecast period for the Account-Based Marketing Market is 2024-2030. 5] What was the market size of the Global Account-Based Marketing Market in 2023? Ans. The market size of the Account-Based Marketing Market in 2023 was valued at US$ 1.07 Bn.

1. Account-Based Marketing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Account-Based Marketing Market: Dynamics 2.1. Account-Based Marketing Market Trends by Region 2.1.1. North America Account-Based Marketing Market Trends 2.1.2. Europe Account-Based Marketing Market Trends 2.1.3. Asia Pacific Account-Based Marketing Market Trends 2.1.4. Middle East and Africa Account-Based Marketing Market Trends 2.1.5. South America Account-Based Marketing Market Trends 2.2. Account-Based Marketing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Account-Based Marketing Market Drivers 2.2.1.2. North America Account-Based Marketing Market Restraints 2.2.1.3. North America Account-Based Marketing Market Opportunities 2.2.1.4. North America Account-Based Marketing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Account-Based Marketing Market Drivers 2.2.2.2. Europe Account-Based Marketing Market Restraints 2.2.2.3. Europe Account-Based Marketing Market Opportunities 2.2.2.4. Europe Account-Based Marketing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Account-Based Marketing Market Drivers 2.2.3.2. Asia Pacific Account-Based Marketing Market Restraints 2.2.3.3. Asia Pacific Account-Based Marketing Market Opportunities 2.2.3.4. Asia Pacific Account-Based Marketing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Account-Based Marketing Market Drivers 2.2.4.2. Middle East and Africa Account-Based Marketing Market Restraints 2.2.4.3. Middle East and Africa Account-Based Marketing Market Opportunities 2.2.4.4. Middle East and Africa Account-Based Marketing Market Challenges 2.2.5. South America 2.2.5.1. South America Account-Based Marketing Market Drivers 2.2.5.2. South America Account-Based Marketing Market Restraints 2.2.5.3. South America Account-Based Marketing Market Opportunities 2.2.5.4. South America Account-Based Marketing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Account-Based Marketing Industry 2.8. Analysis of Government Schemes and Initiatives For Account-Based Marketing Industry 2.9. Account-Based Marketing Market Trade Analysis 2.10. The Global Pandemic Impact on Account-Based Marketing Market 3. Account-Based Marketing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 3.1.1. Tools 3.1.2. Services 3.2. Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 3.2.1. On-Cloud 3.2.2. On-Premise 3.3. Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 3.3.1. BFSI 3.3.2. Retail & E-commerce 3.3.3. IT & Telecommunications 3.3.4. Government 3.3.5. Travel & Tourism 3.3.6. Healthcare & Life Sciences 3.3.7. Other 3.4. Account-Based Marketing Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Account-Based Marketing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 4.1.1. Tools 4.1.2. Services 4.2. North America Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 4.2.1. On-Cloud 4.2.2. On-Premise 4.3. North America Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 4.3.1. BFSI 4.3.2. Retail & E-commerce 4.3.3. IT & Telecommunications 4.3.4. Government 4.3.5. Travel & Tourism 4.3.6. Healthcare & Life Sciences 4.3.7. Other 4.4. North America Account-Based Marketing Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 4.4.1.1.1. Tools 4.4.1.1.2. Services 4.4.1.2. United States Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 4.4.1.2.1. On-Cloud 4.4.1.2.2. On-Premise 4.4.1.3. United States Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 4.4.1.3.1. BFSI 4.4.1.3.2. Retail & E-commerce 4.4.1.3.3. IT & Telecommunications 4.4.1.3.4. Government 4.4.1.3.5. Travel & Tourism 4.4.1.3.6. Healthcare & Life Sciences 4.4.1.3.7. Other 4.4.2. Canada 4.4.2.1. Canada Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 4.4.2.1.1. Tools 4.4.2.1.2. Services 4.4.2.2. Canada Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 4.4.2.2.1. On-Cloud 4.4.2.2.2. On-Premise 4.4.2.3. Canada Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 4.4.2.3.1. BFSI 4.4.2.3.2. Retail & E-commerce 4.4.2.3.3. IT & Telecommunications 4.4.2.3.4. Government 4.4.2.3.5. Travel & Tourism 4.4.2.3.6. Healthcare & Life Sciences 4.4.2.3.7. Other 4.4.3. Mexico 4.4.3.1. Mexico Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 4.4.3.1.1. Tools 4.4.3.1.2. Services 4.4.3.2. Mexico Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 4.4.3.2.1. On-Cloud 4.4.3.2.2. On-Premise 4.4.3.3. Mexico Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 4.4.3.3.1. BFSI 4.4.3.3.2. Retail & E-commerce 4.4.3.3.3. IT & Telecommunications 4.4.3.3.4. Government 4.4.3.3.5. Travel & Tourism 4.4.3.3.6. Healthcare & Life Sciences 4.4.3.3.7. Other 5. Europe Account-Based Marketing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.2. Europe Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.3. Europe Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 5.4. Europe Account-Based Marketing Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.1.2. United Kingdom Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.1.3. United Kingdom Account-Based Marketing Market Size and Forecast, by End User Industry(2023-2030) 5.4.2. France 5.4.2.1. France Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.2.2. France Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.2.3. France Account-Based Marketing Market Size and Forecast, by End User Industry(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.3.2. Germany Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.3.3. Germany Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.4.2. Italy Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.4.3. Italy Account-Based Marketing Market Size and Forecast, by End User Industry(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.5.2. Spain Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.5.3. Spain Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.6.2. Sweden Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.6.3. Sweden Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.7.2. Austria Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.7.3. Austria Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 5.4.8.2. Rest of Europe Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 5.4.8.3. Rest of Europe Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific Account-Based Marketing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.3. Asia Pacific Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4. Asia Pacific Account-Based Marketing Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.1.2. China Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.1.3. China Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.2.2. S Korea Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.2.3. S Korea Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.3.2. Japan Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.3.3. Japan Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.4. India 6.4.4.1. India Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.4.2. India Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.4.3. India Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.5.2. Australia Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.5.3. Australia Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.6.2. Indonesia Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.6.3. Indonesia Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.7.2. Malaysia Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.7.3. Malaysia Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.8.2. Vietnam Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.8.3. Vietnam Account-Based Marketing Market Size and Forecast, by End User Industry(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.9.2. Taiwan Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.9.3. Taiwan Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 6.4.10.2. Rest of Asia Pacific Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 6.4.10.3. Rest of Asia Pacific Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa Account-Based Marketing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 7.3. Middle East and Africa Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 7.4. Middle East and Africa Account-Based Marketing Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 7.4.1.2. South Africa Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 7.4.1.3. South Africa Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 7.4.2.2. GCC Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 7.4.2.3. GCC Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 7.4.3.2. Nigeria Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 7.4.3.3. Nigeria Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 7.4.4.2. Rest of ME&A Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 7.4.4.3. Rest of ME&A Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 8. South America Account-Based Marketing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 8.2. South America Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 8.3. South America Account-Based Marketing Market Size and Forecast, by End User Industry(2023-2030) 8.4. South America Account-Based Marketing Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 8.4.1.2. Brazil Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 8.4.1.3. Brazil Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 8.4.2.2. Argentina Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 8.4.2.3. Argentina Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Account-Based Marketing Market Size and Forecast, by Component (2023-2030) 8.4.3.2. Rest Of South America Account-Based Marketing Market Size and Forecast, by Deployment (2023-2030) 8.4.3.3. Rest Of South America Account-Based Marketing Market Size and Forecast, by End User Industry (2023-2030) 9. Global Account-Based Marketing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Account-Based Marketing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Terminus Software (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Act-On Software (US) 10.3. AdDaptive Intelligence, Inc. (US) 10.4. 6sence (US) 10.5. MRP Prelytix (US) 10.6. Drift.com, Inc. (US) 10.7. HubSpot (US) 10.8. Integrate (US) 10.9. Iterable (US) 10.10. Kwanzoo (US) 10.11. Alyce, Inc. (US) 10.12. MetricFox (US) 10.13. Obility (US) 10.14. Madison Logic (US) 10.15. TechTarget (US) 10.16. Triblio (US) 10.17. Uberflip (Canada) 10.18. Jabmo (France) 10.19. Momentum Group Limited (UK) 10.20. EngageTech (UK) 10.21. Vendemore ( Sweden) 10.22. Albacross Nordic AB (Sweden) 11. Key Findings 12. Industry Recommendations 13. Account-Based Marketing Market: Research Methodology 14. Terms and Glossary