5G Connections Market size was valued at US$ 88.77 Bn. in 2022 and the total revenue is expected to grow at 29.42 % through 2023 to 2029, reaching nearly US$ 539.86 Bn.5G Connections Market Overview:

The preceding digital cellular standards GSM (2G), UMTS (3G), and LTE have all been replaced by 5G. The 3GPP standards organisation is in charge of development and standardisation, which has not yet been completed. The new communication standard encompasses a lot more than just digital telephone and high-speed mobile internet. It's viewed as a response to the rise in global data traffic as a result of digitalization, which is fueled by things like streaming, big data, and the Internet of Things (IoT). Throughout the last project phase, 5G is intended to optimise strong beliefs in Wi-Fi connectivity, cellular technologies, incident management, high dependability, and data quality, as well as provide critical data linkage. New application possibilities include the Industrial Internet, the IoT, and self-driving automobiles, to name a few.To know about the Research Methodology :- Request Free Sample Report

5G Connections Market Dynamics:

5G networks provide an improved internet experience of 100 Mbps and long spans, as well as a basis for cloud and AI-based services. Data-intensive applications such as augmented reality (AR), virtual reality (VR), and video apps are gaining popularity in both personal and corporate (B2B) settings. High connections, power consumption, ultra-low latency, and high speed are all service criteria in industries like IT and telecom, retail, healthcare, automotive, media and entertainment, BFSI, and agricultural. To fulfil the growing demand for mobile broadband services, network capacity must be enhanced through the utilisation of new spectrum, culminating in widespread adoption of the 5G core and 5G technology for improved mobile broadband services. Ericsson revised its forecast for the number of 5G subscribers at the end of 2021 in November 2021, estimating roughly 218 million connections. This is primarily due to a faster than estimated acceptance in China, which is fueled by a national strategic emphasis, intense rivalry among connection providers, and more cheap 5G smartphones from a variety of vendors. However, over the forecast period, LTE is expected to be the most popular mobile access technology by subscription, with 5G connections expected to finally overtake 4G LTE connections. In order to prevent unauthorized access and lifestyle, countries have higher economic circumstances have deployed numerous IoT-based applications in the residential and commercial sectors. The Internet of Things (IoT) has increased the number of automatic door locks, air conditioning controllers, and other devices. These devices rely heavily on continuous internet access. In industrialised countries, the increased use of IoT-based devices has had a substantial impact on the market share of 5G technology. These devices require a stable and high-quality internet connection to function properly. The faster internet connection has been widely employed in industries including automobile and healthcare. Though the technology has various advantages, one of the most significant disadvantages is that signals cannot pass through solid objects such as trees or walls. In addition, the distance between the towers and the gadget must be kept to a bare minimum. This dynamic is driving firms to build far more towers than they can with current technologies. Though its firms say that 5G technology is available in the city, the geographical region is limited. The technology also necessitates more power, and microchips implanted in gadgets will only support 5G when the application requires it.5G Connections Market Segment Analysis:

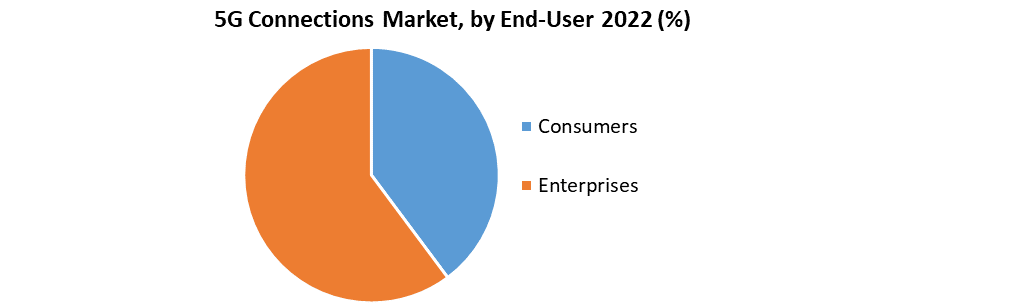

Based on the End-User, the 5G Connections market is sub-segmented into Consumers and Enterprises. The Enterprises segment held the largest market share of xx% in 2022. 5G's ability to give continuous connectivity to infrastructures, machines, and objects, rather than merely connecting people, will be its most valuable feature. Manufacturing, aviation, and healthcare are just a handful of the new vertical applications expected to be enabled by 5G. On the other hand, the capabilities and standards needed to open up a new world of enterprise services are still in the works. As a result, commercial 5G business applications including Industry 4.0 factories, self-driving cars, and robotic operations are already being deployed. Based on the End-User, the 5G Connections market is sub-segmented into Manufacturing, Energy and Utilities, Media and Entertainment, Government, Transportation and Logistics, Healthcare and Others. The Manufacturing segment held the largest market share of xx% in 2022. Cyberphysical systems and the Internet of Things are projected to power Industry 4.0, which would necessitate the use of 5G networks. This will allow future factories to be more efficient, networked, and flexible. Inside factories, 5G will make manufacturing procedures easier, such as more efficient production lines (with machine vision and high definition video for process management), AGVs (autonomous transportation) in industries, and machine control, all with latency of less than 5ms using URLLC.

Regional Insights:

North America held the largest market share of xx% in 2022. Some of the largest telecom companies in the world, including AT&T, Verizon, Ericsson, and others, are headquartered in the region, and they are constantly investing in extending their infrastructure to keep up with technological breakthroughs. Over the forecast period, this is expected to enhance the usage of 5G connections. Additionally, both wireless broadband access and mobile 5G services have already been introduced in the region by service providers. According to research, the area will have about 270 million 5G connections, accounting for nearly 60% of all mobile connections. Asia Pacific is expected to grow at a highest CAGR of xx% in the global 5G Connections market during the forecast period. More than half of all 5G customers are likely to be from China. According to the research, China will continue to lead until 2025, when it is expected to account for 40% of global 5G connections. China already has the world's largest smartphone market and the world's largest 4G market, with 843.7 million 4G subscribers. The objective of the report is to present a comprehensive analysis of the global 5G Connections Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global 5G Connections Market dynamic, structure by analyzing the market segments and project the global 5G Connections Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global 5G Connections Market make the report investor’s guide.5G Connections Market Scope: Inquiry Before Buying

5G Connections Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 88.77Bn. Forecast Period 2023 to 2029 CAGR: 29.42 % Market Size in 2029: US $ 539.86 Bn. Segments Covered: by Communication Types FWA eMBB URLLC MMTC by End-User Consumers Enterprises by Enterprises Manufacturing Energy and Utilities Media and Entertainment Government Transportation and Logistics Healthcare Others 5G Connections Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)5G Connections Market Key Players:

1. AT&T Inc. 2. Verizon Communications Inc. 3. Vodafone Group Plc 4. T-Mobile US Inc. (Sprint Corporation) 5. Telstra Corporation Ltd. 6. ZipWhip 7. OpenMarket 8. Microsoft 9. Google 10.Boingo Wireless 11.RingCentral 12.Cognizant Softvision 13.Celonis 14.ZTE Corporation 15.Ericsson 16.Deutsche Telekom 17.Bell Canada 18.Swisscom 19.Reliance Jio Frequently Asked Questions: 1] What segments are covered in 5G Connections Market report? Ans. The segments covered in 5G Connections Market report are based on Communication Types, End-User and Enterprises. 2] Which region is expected to hold the highest share in the 5G Connections Market? Ans. North America is expected to hold the highest share in the 5G Connections Market. 3] What is the market size of 5G Connections Market by 2029? Ans. The market size of 5G Connections Market is expected to reach US $ 539.86Bn. by 2029. 4] Who are the top key players in the 5G Connections Market? Ans. AT&T Inc., Verizon Communications Inc., Vodafone Group Plc, T-Mobile US Inc. (Sprint Corporation), Telstra Corporation Ltd. and ZipWhip are the top key players in the global 5G Connections Market. 5] What was the market size of 5G Connections Market in 2022? Ans. The market size of 5G Connections Market in 2022 was US $ 88.77 Bn.

1. Global 5G Connections Market: Research Methodology 2. Global 5G Connections Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global 5G Connections Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global 5G Connections Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global 5G Connections Market Segmentation 4.1 Global 5G Connections Market, by Communication Types (2022-2029) • FWA • eMBB • URLLC • MMTC 4.2 Global 5G Connections Market, by End-User (2022-2029) • Consumers • Enterprises 4.3 Global 5G Connections Market, by Enterprises (2022-2029) • Manufacturing • Energy and Utilities • Media and Entertainment • Government • Transportation and Logistics • Healthcare • Others 5. North America 5G Connections Market(2022-2029) 5.1 Global 5G Connections Market, by Communication Types (2022-2029) • FWA • eMBB • URLLC • MMTC 5.2 Global 5G Connections Market, by End-User (2022-2029) • Consumers • Enterprises 5.3 Global 5G Connections Market, by Enterprises (2022-2029) • Manufacturing • Energy and Utilities • Media and Entertainment • Government • Transportation and Logistics • Healthcare • Others 5.3 North America 5G Connections Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific 5G Connections Market (2022-2029) 6.1. Asia Pacific 5G Connections Market, by Communication Types (2022-2029) 6.2 Global 5G Connections Market, by End-User (2022-2029) 6.3. Asia Pacific 5G Connections Market, by Enterprises (2022-2029) 6.4. Asia Pacific 5G Connections Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa 5G Connections Market (2022-2029) 7.1 Middle East and Africa 5G Connections Market, by Communication Types (2022-2029) 7.2 Global 5G Connections Market, by End-User (2022-2029) 7.3. Middle East and Africa 5G Connections Market, by Enterprises (2022-2029) 7.4. Middle East and Africa 5G Connections Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America 5G Connections Market (2022-2029) 8.1. Latin America 5G Connections Market, by Communication Types (2022-2029) 8.2 Global 5G Connections Market, by End-User (2022-2029) 8.3. Latin America 5G Connections Market, by Enterprises (2022-2029) 8.4. Latin America 5G Connections Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European 5G Connections Market (2022-2029) 9.1. European 5G Connections Market, by Communication Types (2022-2029) 9.2 Global 5G Connections Market, by End-User (2022-2029) 9.3. Latin America 5G Connections Market, by Enterprises (2022-2029) 9.4. European 5G Connections Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. AT&T Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Verizon Communications Inc. 10.3. Vodafone Group Plc 10.4. T-Mobile US Inc. (Sprint Corporation) 10.5. Telstra Corporation Ltd. 10.6. ZipWhip 10.7. OpenMarket 10.8. Microsoft 10.9. Google 10.10. Boingo Wireless 10.11. RingCentral 10.12. Cognizant Softvision 10.13. Celonis 10.14. ZTE Corporation 10.15. Ericsson 10.16. Deutsche Telekom 10.17. Bell Canada 10.18. Swisscom 10.19. Reliance Jio