The 3D Medical Imaging Market size was valued at USD 33.76 Billion in 2023 and the total 3D Medical Imaging revenue is expected to grow at a CAGR of 6.92 % from 2024 to 2030, reaching nearly USD 53.93 Billion by 2030. 3D medical imaging is the process of creating three-dimensional visual representations of the interior body structures using various imaging techniques, providing detailed and comprehensive views for diagnostic purposes or medical analysis. Due to its widespread applicability in practically all patient-related management, medical imaging is at the heart of the healthcare sector. The use of computed tomography, magnetic resonance imaging (MRI), and other medical imaging modalities has improved health practitioners' ability to identify and treat patients' diseases. These modalities are fast evolving, moving from black-and-white to color, two-dimensional to three-dimensional, and, most recently, four-dimensional. This coincides with the rise of 3D printing, which can convert these medical imaging data sets from virtual to actual models.To know about the Research Methodology :- Request Free Sample Report Countless engineers are continuously looking for more sophisticated imaging applications for 3D printing technology. The most recent development that is gaining international interest is the ability to create 3D-printed substitute tissues and organs from living tissue. A few firms and institutes have already begun to investigate these possibilities, and they are known as bio-printers. EnvisionTEC Inc., a German corporation, has created a bio-printer known as the "3D bio-plotter system." This machine makes scaffolds out of a variety of materials, including soft hydrogels, polymer melts, and hard ceramics and metals. Organovo Holdings Inc. uses another bio-printer and has already begun selling 3D-printed liver cells as well as kidney and skin tissues. Major Key Players in the 3D Medical Imaging Market are identified through secondary research and their market revenues are determined through primary and secondary research. Secondary research included a review of annual and financial reports of leading manufacturers, while primary research included interviews with important opinion leaders and industry experts such as skilled front-line personnel, entrepreneurs, and marketing professionals. Some of the leading key players in the global 3D Medical Imaging Market include GE Healthcare, Philips Healthcare, Analogic, and Context Vision. They are continuously strategizing on mergers and acquisitions, strategic alliances, joint ventures, and partnerships for the growth of their market shares.

3D Medical Imaging Market Dynamics:

Rising Demand for User-Friendly 3D Medical Imaging Driven by Home Medication Self-Administration The rising demand for biologic drugs such as insulin, monoclonal antibodies, and vaccines driving the growth of 3D Medical Imaging market. With the global insulin market expected to reach USd 39.2 billion by 2026, the reliance on 3D Medical Imaging as a primary delivery system is evident, especially with the rising prevalence of diabetes. As patients require convenient drug delivery mechanisms, the 3D Medical Imaging market for continues to grow. Innovations in syringe technology have played a significant role in 3D Medical Imaging Market growth, particularly in response to safety concerns. Needlestick injuries prompted the development of safety-enhanced syringes, spurring companies such as BD to report increased sales in safety-engineered devices, including 3D Medical Imaging, leading to substantial revenue growth. The 3D Medical Imaging Market has seen a growth due to the growing trend of patients self-administering medications at home, with over 60% preferring self-injectable treatments. This preference has amplified the demand for user-friendly 3D Medical Imaging, boosting 3D Medical Imaging Market growth. Regulatory intervention mandating safety-engineered devices to minimize needlestick injuries, such as the Needlestick Safety and Prevention Act in the U.S. This has significantly amplified the adoption of 3D Medical Imaging in healthcare settings, driving 3D Medical Imaging Market growth. The aging population, prone to chronic diseases requiring regular medication, has fostered increased demand for 3D Medical Imaging. Diseases such as rheumatoid arthritis and multiple sclerosis, which necessitate long-term drug therapies, have further boosted the market, with the global rheumatoid arthritis market expected to surpass USD 38 billion by 2026, primarily reliant on 3D Medical Imaging. The surge in vaccine development and immunization programs globally, particularly witnessed during the COVID-19 vaccination drive, has also bolstered prefilled syringe demand significantly. These drivers collectively showcase the multifaceted growth trajectory of the 3D Medical Imaging market. Initial Investments and Drug-Syringe Compatibility Challenges Affect Drug Stability and Integrity Assurance Pose Barriers to Accessing 3D Medical Imaging The production complexities of 3D Medical Imaging, driven by stringent quality control and sterility demands, present formidable challenges for manufacturers resulting as a challenge to the growth of 3D Medical Imaging Market. Ensuring drug-syringe compatibility necessitates extensive testing and specialized techniques, significantly elevating production intricacies and costs. Complying with varied regional regulations, such as the divergent guidelines set by the FDA and EMA, substantially affects manufacturing approaches and 3D Medical Imaging market access across different regions. Compatibility issues between drugs and syringe materials pose a threat to drug stability, particularly for biologics that require rigorous testing and specialized manufacturing processes to maintain their integrity. The capital-intensive nature of specialized manufacturing infrastructure and sophisticated equipment creates substantial barriers for new entrants, imposing significant setup costs that deter 3D Medical Imaging market growth. Disruptions in the supply chain, especially during global crises, impede raw material availability, disrupting production schedules and impacting prefilled syringe market supply. The growing prevalence of alternative drug delivery methods, such as auto-injectors and wearable devices, intensifies competition, mandating continuous innovation to sustain 3D Medical Imaging market share. Environmental concerns surrounding the disposal of single-use plastic syringes drive regulatory and consumer preferences toward eco-friendly alternatives, challenging the conventional materials used in 3D Medical Imaging. The rapid pace of technological advancements necessitates continual adaptation and investment for manufacturers to remain competitive, creating additional hurdles amid evolving trends and innovations. The increasing cost pressures within global healthcare systems, despite the waste-reducing benefits of 3D Medical Imaging, impede adoption, particularly in resource-constrained settings. Consumer perceptions favoring alternative delivery methods and hesitancy toward self-administration also hamper the widespread adoption of 3D Medical Imaging, necessitating robust educational and marketing efforts to drive acceptance and usage.Financial Barriers in the 3D Medical Imaging Market

Financial Barriers Description Cost Estimate(in millions) Initial Investment Costs Substantial capital needed for specialized manufacturing infrastructure and sophisticated equipment. $50 - $100 Manufacturing Complexities Higher production costs due to stringent quality control, sterility requirements, and compatibility testing. $10 - $20 Technological Adaptation Ongoing investment required to keep up with rapid technological advancements in the industry. $5 - $15 Market Entry Challenges Varied regional regulations influencing production methodologies and requiring compliance investments. $20 - $30 Supply Chain Disruptions Impact on production costs due to disruptions in raw material availability caused by logistical challenges. $15 - $25 Environmental Compliance Additional costs incurred to transition to eco-friendly materials in response to environmental concerns. $8 - $12 3D Medical Imaging Market Segment Analysis:

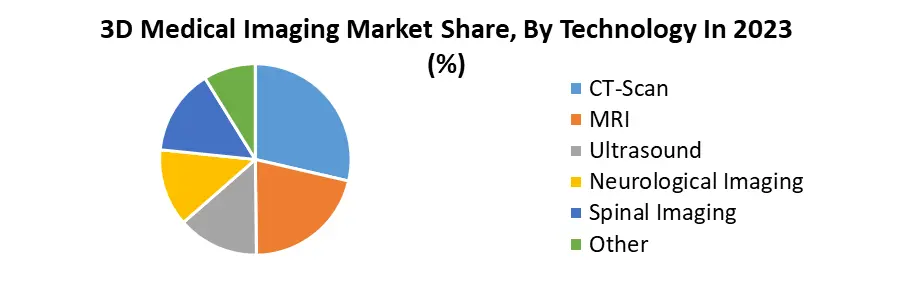

Based on Application, the cardiology segment is expected to grow at the fastest rate of 3.2% during the forecast period. This rapid growth rate is due to the ongoing developments in 3-dimensional echocardiography technology. Continuous advancements in 3-dimensional (3D) echocardiography innovation continue to broaden the scope of this imaging paradigm in therapeutic cardiology by introducing additional characteristics derived from the capacity to view the heart as its whole. Numerous papers have documented these benefits and explored new areas where 3D echocardiographic imaging appeared to provide potential approaches to improve patients' treatment throughout the years. Improved chamber measurement techniques and innovative means to observe heart valves, such as 3D printing, VR technology, and holography, are among them.Based on Technology, CT-Scans segment dominated the 3D Medical Imaging Market, renowned for their detailed cross-sectional images, find extensive use in diagnosing bone injuries, cardiovascular conditions, and detecting tumors. MRI technology is rapidly growing segment in 3D Medical Imaging Industry, utilizing magnetic fields and radio waves, excels in visualizing soft tissues and is crucial for neurological studies, oncology, and musculoskeletal evaluations. Ultrasound, with its non-invasive nature, remains pivotal in obstetrics, cardiology, and abdominal imaging due to its real-time capabilities. Neurological Imaging, encompassing PET and SPECT scans, supports brain function analysis and Alzheimer's research. Spinal Imaging techniques, such as X-rays and specialized MRI sequences, aid in spinal trauma assessment and degenerative disorders. Other emerging technologies like optical coherence tomography (OCT) contribute to ophthalmology and dermatology. The market's evolution reflects an increasing demand for personalized medicine and minimally invasive diagnostics, driving advancements in these technologies and their applications across diverse medical fields.

3D Medical Imaging Market Regional Insights:

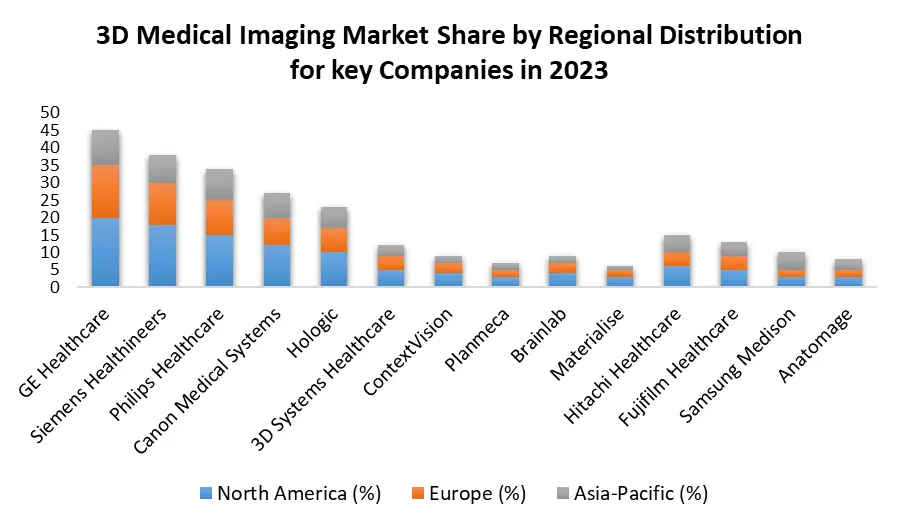

North America Dominance in the 3D Medical Imaging Market North America dominated 3D Medical Imaging Market in 2023 and is expected to maintain its dominance over the forecast period, due to its robust technological advancements, substantial R&D investments, and a high concentration of key market players. The region also serves as a major consumer owing to its well-established healthcare infrastructure and increasing demand for cutting-edge medical imaging technologies. Europe follows suit as another substantial producer and consumer, driven by sophisticated healthcare systems and a growing geriatric population demanding advanced diagnostic tools. Import-export data reveals an intricate global trade network where Asia-Pacific emerges as a prominent importer, facilitated by rising healthcare expenditure, increasing awareness, and a surge in demand for better diagnostic capabilities in countries such as China, India, and Japan. Despite being a producer, the region's demand often exceeds local supply, leading to significant imports. The Middle East and Africa exhibit a growing trend in imports, driven by initiatives to improve healthcare access and infrastructure development. South America, while showing potential in production, relies considerably on imports due to technological advancements and the demand for state-of-the-art medical imaging solutions. These regional dynamics indicate a global market characterized by a complex interplay of production, consumption, and trade, shaped by varying healthcare needs, technological prowess, and economic factors across different geographical domains.

3D Medical Imaging Market Scope: Inquire before buying

Global 3D Medical Imaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 33.76 Bn. Forecast Period 2024 to 2030 CAGR: 6.92 % Market Size in 2030: US $ 53.93 Bn. Segments Covered: by Technology CT-Scan MRI Ultrasound Neurological Imaging Spinal Imaging Other by Deployment On-premise based platform Cloud-based platform Web-based platform by Application Oncology Cardiology Orthopedic Other by End-User Hospitals Ambulatory & healthcare centers Diagnostic centers Research centers 3D Medical Imaging Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)3D Medical Imaging Market Key Players:

Major Contributors in the 3D Medical Imaging Industry in North America: 1. GE Healthcare Chicago, Illinois, USA 2. 3D Systems Healthcare, South Carolina, USA 3. Hologic, Marlborough, Massachusetts, USA Leading players in the Europe 3D Medical Imaging Market: 1. Siemens Healthineers Erlangen, Germany 2. Philips Healthcare, Amsterdam, Netherlands 3. ContextVision Stockholm, Sweden 4. Planmeca, Helsinki, Finland 5. Brainlab, Munich, Germany 6. Materialise, Leuven, Belgium Key players driving the Asia-Pacific 3D Medical Imaging market: 1. Canon Medical Systems, Tochigi, Japan 2. Hitachi Healthcare, Tokyo, Japan 3. Fujifilm Healthcare, Tokyo, Japan 4. Samsung Medison, Seoul, South Korea FAQs: 1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Technology, Deployment, Application, End-User and Region. 2] Which region is expected to hold the highest share in the Global Market? Ans. Europe region is expected to hold the highest share in the market. 3] What is the market size of the Global Market by 2030? Ans. The market size of the 3D Medical Imaging Market by 2030 is expected to reach US$ 53.93 Bn. 4] What is the forecast period for the Global 3D Medical Imaging Market? Ans. The forecast period for the 3D Medical Imaging Market is 2024-2030. 5] What was the market size of the Global 3D Medical Imaging Market in 2023? Ans. The market size of the 3D Medical Imaging Market in 2023 was valued at US$ 33.76 Bn.

1. 3D Medical Imaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. 3D Medical Imaging Market: Dynamics 2.1. 3D Medical Imaging Market Trends by Region 2.1.1. North America 3D Medical Imaging Market Trends 2.1.2. Europe 3D Medical Imaging Market Trends 2.1.3. Asia Pacific 3D Medical Imaging Market Trends 2.1.4. Middle East and Africa 3D Medical Imaging Market Trends 2.1.5. South America 3D Medical Imaging Market Trends 2.2. 3D Medical Imaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America 3D Medical Imaging Market Drivers 2.2.1.2. North America 3D Medical Imaging Market Restraints 2.2.1.3. North America 3D Medical Imaging Market Opportunities 2.2.1.4. North America 3D Medical Imaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe 3D Medical Imaging Market Drivers 2.2.2.2. Europe 3D Medical Imaging Market Restraints 2.2.2.3. Europe 3D Medical Imaging Market Opportunities 2.2.2.4. Europe 3D Medical Imaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific 3D Medical Imaging Market Drivers 2.2.3.2. Asia Pacific 3D Medical Imaging Market Restraints 2.2.3.3. Asia Pacific 3D Medical Imaging Market Opportunities 2.2.3.4. Asia Pacific 3D Medical Imaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa 3D Medical Imaging Market Drivers 2.2.4.2. Middle East and Africa 3D Medical Imaging Market Restraints 2.2.4.3. Middle East and Africa 3D Medical Imaging Market Opportunities 2.2.4.4. Middle East and Africa 3D Medical Imaging Market Challenges 2.2.5. South America 2.2.5.1. South America 3D Medical Imaging Market Drivers 2.2.5.2. South America 3D Medical Imaging Market Restraints 2.2.5.3. South America 3D Medical Imaging Market Opportunities 2.2.5.4. South America 3D Medical Imaging Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis for the 3D Medical Imaging Industry 2.8. Analysis of Government Schemes and Initiatives for 3D Medical Imaging Industry 2.9. The Global Pandemic Impact on 3D Medical Imaging Market 3. 3D Medical Imaging Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 3.1.1. CT-Scan 3.1.2. MRI 3.1.3. Ultrasound 3.1.4. Neurological Imaging 3.1.5. Spinal Imaging 3.1.6. Other 3.2. 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 3.2.1. On-premise based platform 3.2.2. Cloud-based platform 3.2.3. Web-based platform 3.3. 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 3.3.1. Oncology 3.3.2. Cardiology 3.3.3. Orthopedic 3.3.4. Other 3.4. 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 3.4.1. Hospitals 3.4.2. Ambulatory & healthcare centers 3.4.3. Diagnostic centers 3.4.4. Research centers 3.5. 3D Medical Imaging Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America 3D Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 4.1.1. CT-Scan 4.1.2. MRI 4.1.3. Ultrasound 4.1.4. Neurological Imaging 4.1.5. Spinal Imaging 4.1.6. Other 4.2. North America 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 4.2.1. On-premise based platform 4.2.2. Cloud-based platform 4.2.3. Web-based platform 4.3. North America 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 4.3.1. Oncology 4.3.2. Cardiology 4.3.3. Orthopedic 4.3.4. Other 4.4. North America 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.1. Hospitals 4.4.2. Ambulatory & healthcare centers 4.4.3. Diagnostic centers 4.4.4. Research centers 4.5. North America 3D Medical Imaging Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 4.5.1.1.1. CT-Scan 4.5.1.1.2. MRI 4.5.1.1.3. Ultrasound 4.5.1.1.4. Neurological Imaging 4.5.1.1.5. Spinal Imaging 4.5.1.1.6. Other 4.5.1.2. United States 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 4.5.1.2.1. On-premise based platform 4.5.1.2.2. Cloud-based platform 4.5.1.2.3. Web-based platform 4.5.1.3. United States 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 4.5.1.3.1. Oncology 4.5.1.3.2. Cardiology 4.5.1.3.3. Orthopedic 4.5.1.3.4. Other 4.5.1.4. United States 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.5.1.4.1. Hospitals 4.5.1.4.2. Ambulatory & healthcare centers 4.5.1.4.3. Diagnostic centers 4.5.1.4.4. Research centers 4.5.2. Canada 4.5.2.1. Canada 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 4.5.2.1.1. CT-Scan 4.5.2.1.2. MRI 4.5.2.1.3. Ultrasound 4.5.2.1.4. Neurological Imaging 4.5.2.1.5. Spinal Imaging 4.5.2.1.6. Other 4.5.2.2. Canada 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 4.5.2.2.1. On-premise based platform 4.5.2.2.2. Cloud-based platform 4.5.2.2.3. Web-based platform 4.5.2.3. Canada 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 4.5.2.3.1. Oncology 4.5.2.3.2. Cardiology 4.5.2.3.3. Orthopedic 4.5.2.3.4. Other 4.5.2.4. Canada 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.5.2.4.1. Hospitals 4.5.2.4.2. Ambulatory & healthcare centers 4.5.2.4.3. Diagnostic centers 4.5.2.4.4. Research centers 4.5.3. Mexico 4.5.3.1. Mexico 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 4.5.3.1.1. CT-Scan 4.5.3.1.2. MRI 4.5.3.1.3. Ultrasound 4.5.3.1.4. Neurological Imaging 4.5.3.1.5. Spinal Imaging 4.5.3.1.6. Other 4.5.3.2. Mexico 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 4.5.3.2.1. On-premise based platform 4.5.3.2.2. Cloud-based platform 4.5.3.2.3. Web-based platform 4.5.3.3. Mexico 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 4.5.3.3.1. Oncology 4.5.3.3.2. Cardiology 4.5.3.3.3. Orthopedic 4.5.3.3.4. Other 4.5.3.4. Mexico 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.5.3.4.1. Hospitals 4.5.3.4.2. Ambulatory & healthcare centers 4.5.3.4.3. Diagnostic centers 4.5.3.4.4. Research centers 5. Europe 3D Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.2. Europe 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.3. Europe 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.4. Europe 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5. Europe 3D Medical Imaging Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.1.2. United Kingdom 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.1.3. United Kingdom 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.1.4. United Kingdom 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5.2. France 5.5.2.1. France 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.2.2. France 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.2.3. France 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.2.4. France 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.3.2. Germany 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.3.3. Germany 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.3.4. Germany 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.4.2. Italy 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.4.3. Italy 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.4.4. Italy 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.5.2. Spain 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.5.3. Spain 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.5.4. Spain 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.6.2. Sweden 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.6.3. Sweden 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.6.4. Sweden 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.7.2. Austria 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.7.3. Austria 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.7.4. Austria 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 5.5.8.2. Rest of Europe 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 5.5.8.3. Rest of Europe 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 5.5.8.4. Rest of Europe 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific 3D Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.3. Asia Pacific 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.4. Asia Pacific 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5. Asia Pacific 3D Medical Imaging Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.1.2. China 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.1.3. China 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.2. China 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) S Korea 6.5.2.1. S Korea 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.2.2. S Korea 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.2.3. S Korea 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.2.4. S Korea 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.3.2. Japan 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.3.3. Japan 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.3.4. Japan 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.4. India 6.5.4.1. India 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.4.2. India 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.4.3. India 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.4.4. India 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.5.2. Australia 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.5.3. Australia 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.5.4. Australia 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.6.2. Indonesia 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.6.3. Indonesia 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.6.4. Indonesia 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.7.2. Malaysia 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.7.3. Malaysia 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.7.4. Malaysia 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.8.2. Vietnam 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.8.3. Vietnam 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.8.4. Vietnam 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.9.2. Taiwan 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.9.3. Taiwan 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.9.4. Taiwan 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 6.5.10.2. Rest of Asia Pacific 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 6.5.10.3. Rest of Asia Pacific 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 6.5.10.4. Rest of Asia Pacific 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa 3D Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 7.3. Middle East and Africa 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 7.4. Middle East and Africa 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 7.5. Middle East and Africa 3D Medical Imaging Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 7.5.1.2. South Africa 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 7.5.1.3. South Africa 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 7.5.2. South Africa 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) GCC 7.5.2.1. GCC 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 7.5.2.2. GCC 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 7.5.2.3. GCC 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 7.5.2.4. GCC 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 7.5.3.2. Nigeria 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 7.5.3.3. Nigeria 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 7.5.3.4. Nigeria 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 7.5.4.2. Rest of ME&A 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 7.5.4.3. Rest of ME&A 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 7.5.4.4. Rest of ME&A 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 8. South America 3D Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 8.2. South America 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 8.3. South America 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 8.4. South America 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 8.5. South America 3D Medical Imaging Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 8.5.1.2. Brazil 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 8.5.1.3. Brazil 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 8.5.1.4. Brazil 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 8.5.2.2. Argentina 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 8.5.2.3. Argentina 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 8.5.2.4. Argentina 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America 3D Medical Imaging Market Size and Forecast, by Technology (2023-2030) 8.5.3.2. Rest Of South America 3D Medical Imaging Market Size and Forecast, by Deployment (2023-2030) 8.5.3.3. Rest Of South America 3D Medical Imaging Market Size and Forecast, by Therapeutics (2023-2030) 8.5.3.4. Rest Of South America 3D Medical Imaging Market Size and Forecast, by End-User (2023-2030) 9. Global 3D Medical Imaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading 3D Medical Imaging Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. GE Healthcare, Chicago, Illinois, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. 3D Systems Healthcare, South Carolina, USA 10.3. Hologic, Marlborough, Massachusetts, USA 10.4. Siemens Healthineers, Erlangen, Germany 10.5. Philips Healthcare, Amsterdam, Netherlands 10.6. ContextVision Stockholm, Sweden 10.7. Planmeca, Helsinki, Finland 10.8. Brainlab, Munich, Germany 10.9. Materialise, Leuven, Belgium 10.10. Canon Medical Systems, Tochigi, Japan 10.11. Hitachi Healthcare, Tokyo, Japan 10.12. Fujifilm Healthcare, Tokyo, Japan 10.13. Samsung Medison, Seoul, South Korea 11. Key Findings 12. Industry Recommendations 13. 3D Medical Imaging Market: Research Methodology