The Geoengineering Market size was valued at US 23.9 Bn in 2023 and market revenue is growing at a CAGR of 15.5 % from 2024 to 2030, reaching nearly USD 65.53 Bn by 2030. Geoengineering Market: Bolstering Growth through Cost-Efficient Loss Mitigation and Biodiversity Preservation to Fuel the Market Growth over the Forecast PeriodOverview of the Geoengineering Market

Geoengineering involves the deliberate manipulation of the Earth's atmosphere with the intent of influencing the climate in a manner that mitigates or counteracts certain impacts of global warming. This terminology also frequently encompasses a range of technologies under development for such objectives, colloquially referred to as "negative emission technologies. The graphical representation and structural exclusive information showed the dominating region of the Geoengineering Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Geoengineering Market.To know about the Research Methodology :- Request Free Sample Report

Geoengineering Market Dynamics

Costs of Loss and Damage Mitigation and Preservation of Biodiversity are major drivers of the Geoengineering Market The escalating financial ramifications linked to the impacts of climate change, commonly referred to as "loss and damage," are fuelling a growing interest in geoengineering as a plausible remedy. As the economic strain resulting from extreme weather occurrences and environmental deterioration rises, governmental bodies and institutions are actively investigating geoengineering as a means to alleviate these financial burdens. Geoengineering techniques such as ocean fertilization and cloud brightening are undergoing exploration due to their potential to bolster marine ecosystems and uphold biodiversity. These methodologies aim to enhance nutrient availability within oceans or augment cloud reflectivity, potentially providing advantages to marine life and ecosystems. The swift warming of the Arctic locale, recognized as Arctic amplification, has sparked apprehension regarding potential feedback loops that might intensify global warming. Geoengineering strategies with a focus on cooling the Arctic, such as solar radiation management, have garnered attention as a potential means of decelerating these feedback loops and their associated repercussions. The mounting frequency and severity of extreme weather phenomena, such as hurricanes and droughts, have stimulated interest in geoengineering methodologies capable of altering weather patterns or diminishing the impacts of such events. These approaches are regarded as prospective tools for reducing disaster risks and mitigating their consequences.Rise of Nature-Based Solutions and Advancements in Carbon Capture Technologies are important trends in the Geoengineering Market An escalating trend within the realm of geoengineering is the integration of nature-based solutions. These innovative approaches harness natural processes to attain climate objectives. Illustrations encompass reforestation, afforestation, and soil carbon sequestration, which not only facilitate carbon capture but also foster biodiversity and the health of ecosystems. A noteworthy trend pertains to the development of pioneering carbon capture, utilization, and storage (CCUS) technologies. This encompasses the creation of direct air capture (DAC) systems capable of directly extracting CO2 from the atmosphere, offering a potential avenue to achieve negative emissions. Research centered around solar radiation management (SRM) techniques is gaining prominence. These methods involve activities such as injecting aerosols into the stratosphere to reflect sunlight and cool the Earth. While sparking controversy, SRM holds promise for swift cooling effects and is being explored as a potential tool to manage extreme heat events.

Geoengineering Market Segment Analysis:

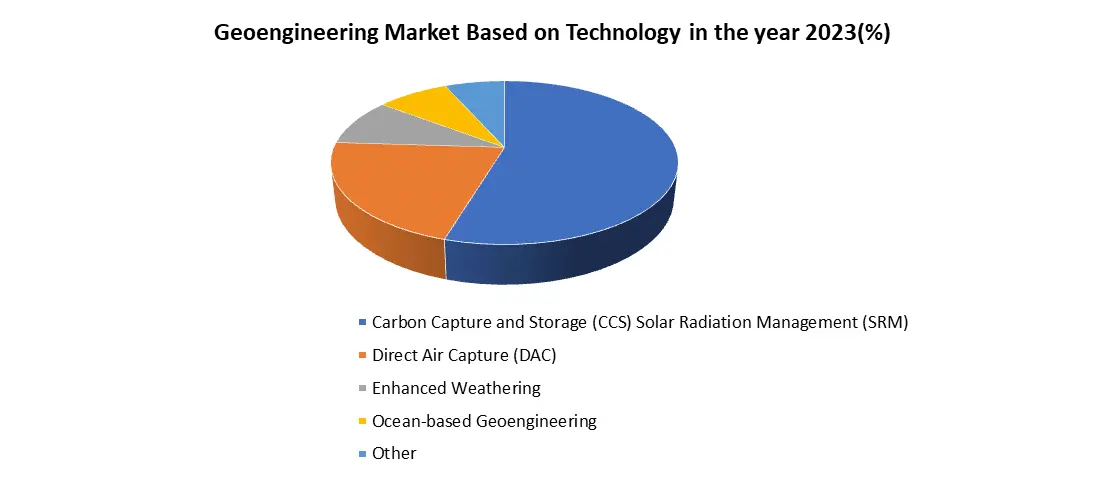

Based on Technology Carbon capture and storage technology dominated the Geoengineering Market in the year 2023. Carbon capture and storage (CCS) technology has gained prominence in the geoengineering market due to its potential to mitigate climate change by capturing carbon dioxide emissions from industrial processes and power plants. CCS offers a practical solution to reduce greenhouse gas emissions from large point sources, such as power plants and industrial facilities, which are major contributors to global carbon dioxide emissions. By capturing CO2 before it is released into the atmosphere, CCS enables the continued use of fossil fuels while reducing their environmental impact. The CCS has garnered significant attention from governments, industries, and research institutions worldwide, leading to substantial investments in research, development, and demonstration projects. This support has accelerated the advancement of CCS technologies and lowered costs, making it more economically viable for widespread deployment. Also, CCS aligns with international climate goals and regulatory frameworks aimed at reducing emissions and limiting global warming. As countries strive to meet their climate targets under agreements like the Paris Agreement, CCS is recognized as a crucial tool for achieving carbon neutrality and transitioning to a low-carbon economy. The dominance of CCS in the geoengineering market is driven by its effectiveness in reducing emissions, technological maturity, growing support from stakeholders, and alignment with climate mitigation efforts on a global scale.

Geoengineering Market Regional Analysis

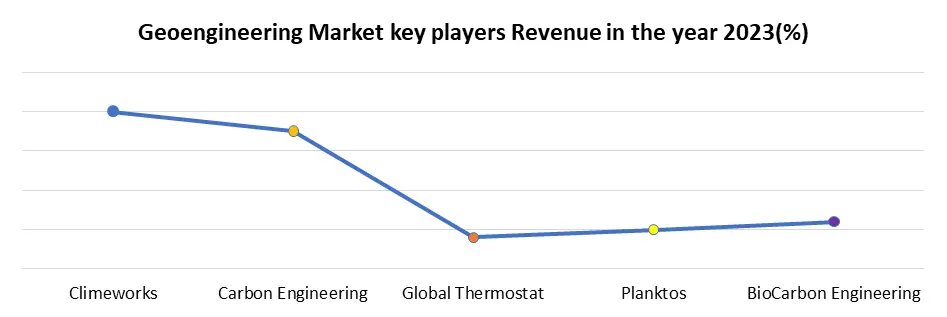

In North America, mainly within the United States, it is important to adapt proactive strategies to efficiently manage the potential risks and uncertainties connected to the deployment of geoengineering solutions. This preparedness strategy comprises a multifaceted method focused at deepening the understanding of global climate dynamics, both with and without geoengineering interventions. This informed understanding plays a pivotal role in guiding judicious decision-making processes. The United States prioritizes the establishment of a robust capacity to detect and closely monitor geoengineering activities on a global scale. This endeavour involves the development of cutting-edge monitoring technologies and collaborative efforts with international partners to ensure the utmost transparency and accountability in all geoengineering initiatives. Central to North America's readiness is the creation of a comprehensive policy framework that discourages specific forms of geoengineering while simultaneously devising strategies to effectively respond if other nations deploy geoengineering techniques. This necessitates comprehensive research, resilient legal structures, and collaborative engagements across borders, all working towards forming a unified stance on responsible geoengineering practices. On the international front, the United States adopted a leadership role in nurturing the establishment of a global governance structure tailored specifically for geoengineering. This endeavour initially involves leveraging well-established international platforms to engage in substantive discussions on geoengineering matters of global significance. Simultaneously, advocating for the formulation of an encompassing code of conduct governing geoengineering research on an international scale is indispensable to uphold ethical standards and prevent hasty interventions. The regional analysis delves into the role of geoengineering in specific European countries, comprising EU member states, Iceland, Norway, Switzerland, and the United Kingdom. The examination was grounded in a comprehensive review of national strategic plans with a focus on climate relevance. This comprehensive assessment encompassed a thorough examination of National Energy and Climate Plans (NECPs), National Recovery and Resilience Plans (NRRPs), and Nationally Determined Contributions (NDCs), all of which were submitted to both the European Commission and the UNFCCC secretariat. NECPs provided valuable insights into the individual national energy and climate objectives for the 2021-2030 period, ensuring alignment with the regulations outlined in the Governance of the Energy Union and Climate Action Regulation. The NRRPs, essential for eligibility in the European Recovery and Resilience Facility, mandated a minimum allocation of 37% for investments related to climate action. Geoengineering Market Competitive Analysis Carbon Engineering (CE) has revealed its initiation of front-end planning and engineering for new Direct Air Capture (DAC) facilities, marking a significant step forward. This development is unfolding at a second location in the United States, specifically in Kleberg County, Texas. The site holds the promise of accommodating the potential construction of multiple DAC facilities, collectively capable of eliminating up to 30 million tonnes of carbon dioxide annually from the atmosphere for dedicated sequestration efforts. Under a partnership with its U.S. development collaborator, 1PointFive, Carbon Engineering has secured the responsibility for front-end planning and engineering for a one-megatonne DAC facility. This facility is designed as a blueprint for future multi-million tonne deployments. Meanwhile, in another ground breaking initiative, biotechnology firm LanzaTech UK and cleantech leader Carbon Engineering (CE) have joined forces for Project AtmosFUEL. This pioneering endeavor aims to transform atmospheric carbon dioxide (CO2) into sustainable aviation fuel (SAF). The project sets its sights on the feasibility of establishing a large-scale, commercial air-to-jet facility in the United Kingdom, with a projected annual production capacity exceeding 100 million liters of SAF. Climeworks has been selected for three direct air capture (DAC) hub proposals as part of the U.S. Department of Energy's initiatives. These selections, achieved alongside their project partners, mark a remarkable stride in Climeworks' DAC journey. This collaboration holds particular significance for Partners Group, which, in 2022, unveiled its ambitious plan to attain net-zero corporate greenhouse gas emissions by 2030 through a comprehensive decarbonisation program. While the program places emphasis on overall emission reduction, the integration of atmospheric CO₂ capture and storage to tackle residual emissions plays a vital role in realizing the net-zero target. Climeworks' partnership stands as a pioneering step in Partners Group's adoption of technology-based solutions, complementing its expanding portfolio of nature-based approaches like reforestation, further bolstering biodiversity. The momentum continues as Boston Consulting Group (BCG), a global leader in management consulting, embarks on a transformative journey by entering a decade-long carbon removal agreement with Climeworks. This landmark commitment aligns with BCG's pledge to achieve net-zero climate impact by 2030. By engaging Climeworks' carbon dioxide removal service, BCG actively captures atmospheric carbon dioxide and securely stores it underground. This remarkable 10-year accord, Climeworks' second of its kind, not only underscores the market's strong demand for effective, verifiable, and enduring carbon dioxide removal solutions but also signals the thriving trajectory of this demand, poised for significant expansion.

Geoengineering Market Scope: Inquire Before Buying

Global Geoengineering Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 23.9 Bn. Forecast Period 2024 to 2030 CAGR: 15.5% Market Size in 2030: US $ 65.53 Bn. Segments Covered: by Technology Carbon Capture and Storage (CCS) Solar Radiation Management (SRM) Direct Air Capture (DAC) Enhanced Weathering Ocean-based Geoengineering Other by Type Carbon Dioxide Removal Solar Geoengineering by Application Climate Mitigation Extreme Event Management Biodiversity Conservation Disaster Resilience Geoengineering Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Geoengineering Market Key players

North America 1. Carbon Engineering (Canada) 2. Ice911 Research (USA) 3. Planktos (USA) 4. Global Thermostat (USA) 5. Project Vesta (USA) 6. Ocean Thermal Energy Corporation (OTE Corp) (USA) 7. Atmospheric Research (USA) 8. Plasma Environmental Technologies (USA) 9. Climate Corporation (a subsidiary of Bayer) (USA) 10. SilverLining (USA) 11. Carbon Removal Network (USA) 12. Center for Negative Carbon Emissions (CNCE) (USA) 13. Blue Planet (USA) 14. Carbon180 (USA) 15. Clean Air Task Force (USA) Europe 1. Climeworks (Switzerland) 2. BioCarbon Engineering (United Kingdom) 3. Geoengineering Ltd. (United Kingdom) 4. Reflective Solutions (Australia) 5. Global Carbon Capture and Storage Institute (Australia) Frequently Asked Questions 1] What segments are covered in the Global Geoengineering Market report? Ans. The segments covered in the Geoengineering Market report are based on Technology, Type, Application, and Regions. 2] Which region is expected to hold the highest share of the Global Geoengineering Market? Ans. The North America region is expected to hold the highest share of the Geoengineering Market. 3] What is the market size of the Global Geoengineering Market by 2030? Ans. The market size of the Geoengineering Market by 2030 is expected to reach US$ 65.53Bn. 4] What was the market size of the Global Geoengineering Market in 2023? Ans. The market size of the Geoengineering Market in 2023 was valued at US$ 23.90 Bn. 5] Key players in the Geoengineering Market. Ans. Carbon Engineering (Canada), Ice911 Research (USA), Planktos (USA), Global Thermostat (USA) and Project Vesta (USA)

1. Geoengineering Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Geoengineering Market: Dynamics 2.1. Geoengineering Market Trends by Region 2.1.1. North America Geoengineering Market Trends 2.1.2. Europe Geoengineering Market Trends 2.1.3. Asia Pacific Geoengineering Market Trends 2.1.4. Middle East and Africa Geoengineering Market Trends 2.1.5. South America Geoengineering Market Trends 2.2. Geoengineering Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Geoengineering Market Drivers 2.2.1.2. North America Geoengineering Market Restraints 2.2.1.3. North America Geoengineering Market Opportunities 2.2.1.4. North America Geoengineering Market Challenges 2.2.2. Europe 2.2.2.1. Europe Geoengineering Market Drivers 2.2.2.2. Europe Geoengineering Market Restraints 2.2.2.3. Europe Geoengineering Market Opportunities 2.2.2.4. Europe Geoengineering Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Geoengineering Market Drivers 2.2.3.2. Asia Pacific Geoengineering Market Restraints 2.2.3.3. Asia Pacific Geoengineering Market Opportunities 2.2.3.4. Asia Pacific Geoengineering Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Geoengineering Market Drivers 2.2.4.2. Middle East and Africa Geoengineering Market Restraints 2.2.4.3. Middle East and Africa Geoengineering Market Opportunities 2.2.4.4. Middle East and Africa Geoengineering Market Challenges 2.2.5. South America 2.2.5.1. South America Geoengineering Market Drivers 2.2.5.2. South America Geoengineering Market Restraints 2.2.5.3. South America Geoengineering Market Opportunities 2.2.5.4. South America Geoengineering Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Geoengineering Industry 2.8. Analysis of Government Schemes and Initiatives For Geoengineering Industry 2.9. Geoengineering Market Trade Analysis 2.10. The Global Pandemic Impact on Geoengineering Market 3. Geoengineering Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Geoengineering Market Size and Forecast, by Technology (2023-2030) 3.1.1. Carbon Capture and Storage (CCS) Solar Radiation Management (SRM) 3.1.2. Direct Air Capture (DAC) 3.1.3. Enhanced Weathering 3.1.4. Ocean-based Geoengineering 3.1.5. Other 3.2. Geoengineering Market Size and Forecast, by Type (2023-2030) 3.2.1. Carbon Dioxide Removal 3.2.2. Solar Geoengineering 3.3. Geoengineering Market Size and Forecast, by Application (2023-2030) 3.3.1. Climate Mitigation 3.3.2. Extreme Event Management 3.3.3. Biodiversity Conservation 3.3.4. Disaster Resilience 3.4. Geoengineering Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Geoengineering Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Geoengineering Market Size and Forecast, by Technology (2023-2030) 4.1.1. Carbon Capture and Storage (CCS) Solar Radiation Management (SRM) 4.1.2. Direct Air Capture (DAC) 4.1.3. Enhanced Weathering 4.1.4. Ocean-based Geoengineering 4.1.5. Other 4.2. North America Geoengineering Market Size and Forecast, by Type (2023-2030) 4.2.1. Carbon Dioxide Removal 4.2.2. Solar Geoengineering 4.3. North America Geoengineering Market Size and Forecast, by Application (2023-2030) 4.3.1. Climate Mitigation 4.3.2. Extreme Event Management 4.3.3. Biodiversity Conservation 4.3.4. Disaster Resilience 4.4. North America Geoengineering Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Geoengineering Market Size and Forecast, by Technology (2023-2030) 4.4.1.1.1. Carbon Capture and Storage (CCS) Solar Radiation Management (SRM) 4.4.1.1.2. Direct Air Capture (DAC) 4.4.1.1.3. Enhanced Weathering 4.4.1.1.4. Ocean-based Geoengineering 4.4.1.1.5. Other 4.4.1.2. United States Geoengineering Market Size and Forecast, by Type (2023-2030) 4.4.1.2.1. Carbon Dioxide Removal 4.4.1.2.2. Solar Geoengineering 4.4.1.3. United States Geoengineering Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Climate Mitigation 4.4.1.3.2. Extreme Event Management 4.4.1.3.3. Biodiversity Conservation 4.4.1.3.4. Disaster Resilience 4.4.2. Canada 4.4.2.1. Canada Geoengineering Market Size and Forecast, by Technology (2023-2030) 4.4.2.1.1. Carbon Capture and Storage (CCS) Solar Radiation Management (SRM) 4.4.2.1.2. Direct Air Capture (DAC) 4.4.2.1.3. Enhanced Weathering 4.4.2.1.4. Ocean-based Geoengineering 4.4.2.1.5. Other 4.4.2.2. Canada Geoengineering Market Size and Forecast, by Type (2023-2030) 4.4.2.2.1. Carbon Dioxide Removal 4.4.2.2.2. Solar Geoengineering 4.4.2.3. Canada Geoengineering Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Climate Mitigation 4.4.2.3.2. Extreme Event Management 4.4.2.3.3. Biodiversity Conservation 4.4.2.3.4. Disaster Resilience 4.4.3. Mexico 4.4.3.1. Mexico Geoengineering Market Size and Forecast, by Technology (2023-2030) 4.4.3.1.1. Carbon Capture and Storage (CCS) Solar Radiation Management (SRM) 4.4.3.1.2. Direct Air Capture (DAC) 4.4.3.1.3. Enhanced Weathering 4.4.3.1.4. Ocean-based Geoengineering 4.4.3.1.5. Other 4.4.3.2. Mexico Geoengineering Market Size and Forecast, by Type (2023-2030) 4.4.3.2.1. Carbon Dioxide Removal 4.4.3.2.2. Solar Geoengineering 4.4.3.3. Mexico Geoengineering Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Climate Mitigation 4.4.3.3.2. Extreme Event Management 4.4.3.3.3. Biodiversity Conservation 4.4.3.3.4. Disaster Resilience 5. Europe Geoengineering Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Geoengineering Market Size and Forecast, by Type (2023-2030) 5.3. Europe Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4. Europe Geoengineering Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.1.2. United Kingdom Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.1.3. United Kingdom Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.2.2. France Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.2.3. France Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.3.2. Germany Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.3.3. Germany Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.4.2. Italy Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.4.3. Italy Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.5.2. Spain Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.5.3. Spain Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.6.2. Sweden Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.6.3. Sweden Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.7.2. Austria Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.7.3. Austria Geoengineering Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Geoengineering Market Size and Forecast, by Technology (2023-2030) 5.4.8.2. Rest of Europe Geoengineering Market Size and Forecast, by Type (2023-2030) 5.4.8.3. Rest of Europe Geoengineering Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Geoengineering Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Geoengineering Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Geoengineering Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.1.2. China Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.1.3. China Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.2.2. S Korea Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.2.3. S Korea Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.3.2. Japan Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.3.3. Japan Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.4.2. India Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.4.3. India Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.5.2. Australia Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.5.3. Australia Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.6.2. Indonesia Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.6.3. Indonesia Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.7.2. Malaysia Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.7.3. Malaysia Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.8.2. Vietnam Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.8.3. Vietnam Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.9.2. Taiwan Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.9.3. Taiwan Geoengineering Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Geoengineering Market Size and Forecast, by Technology (2023-2030) 6.4.10.2. Rest of Asia Pacific Geoengineering Market Size and Forecast, by Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Geoengineering Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Geoengineering Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Geoengineering Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Geoengineering Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Geoengineering Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Geoengineering Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Geoengineering Market Size and Forecast, by Technology (2023-2030) 7.4.1.2. South Africa Geoengineering Market Size and Forecast, by Type (2023-2030) 7.4.1.3. South Africa Geoengineering Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Geoengineering Market Size and Forecast, by Technology (2023-2030) 7.4.2.2. GCC Geoengineering Market Size and Forecast, by Type (2023-2030) 7.4.2.3. GCC Geoengineering Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Geoengineering Market Size and Forecast, by Technology (2023-2030) 7.4.3.2. Nigeria Geoengineering Market Size and Forecast, by Type (2023-2030) 7.4.3.3. Nigeria Geoengineering Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Geoengineering Market Size and Forecast, by Technology (2023-2030) 7.4.4.2. Rest of ME&A Geoengineering Market Size and Forecast, by Type (2023-2030) 7.4.4.3. Rest of ME&A Geoengineering Market Size and Forecast, by Application (2023-2030) 8. South America Geoengineering Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Geoengineering Market Size and Forecast, by Technology (2023-2030) 8.2. South America Geoengineering Market Size and Forecast, by Type (2023-2030) 8.3. South America Geoengineering Market Size and Forecast, by Application(2023-2030) 8.4. South America Geoengineering Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Geoengineering Market Size and Forecast, by Technology (2023-2030) 8.4.1.2. Brazil Geoengineering Market Size and Forecast, by Type (2023-2030) 8.4.1.3. Brazil Geoengineering Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Geoengineering Market Size and Forecast, by Technology (2023-2030) 8.4.2.2. Argentina Geoengineering Market Size and Forecast, by Type (2023-2030) 8.4.2.3. Argentina Geoengineering Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Geoengineering Market Size and Forecast, by Technology (2023-2030) 8.4.3.2. Rest Of South America Geoengineering Market Size and Forecast, by Type (2023-2030) 8.4.3.3. Rest Of South America Geoengineering Market Size and Forecast, by Application (2023-2030) 9. Global Geoengineering Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Geoengineering Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Carbon Engineering (Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ice911 Research (USA) 10.3. Planktos (USA) 10.4. Global Thermostat (USA) 10.5. Project Vesta (USA) 10.6. Ocean Thermal Energy Corporation (OTE Corp) (USA) 10.7. Atmospheric Research (USA) 10.8. Plasma Environmental Technologies (USA) 10.9. Climate Corporation (a subsidiary of Bayer) (USA) 10.10. SilverLining (USA) 10.11. Carbon Removal Network (USA) 10.12. Center for Negative Carbon Emissions (CNCE) (USA) 10.13. Blue Planet (USA) 10.14. Carbon180 (USA) 10.15. Clean Air Task Force (USA) 10.16. Climeworks (Switzerland) 10.17. BioCarbon Engineering (United Kingdom) 10.18. Geoengineering Ltd. (United Kingdom) 10.19. Reflective Solutions (Australia) 10.20. Global Carbon Capture and Storage Institute (Australia) 11. Key Findings 12. Industry Recommendations 13. Geoengineering Market: Research Methodology 14. Terms and Glossary