The Generator Sales Market Size was valued at USD 27.29 Billion in 2023 and the total Generator Sales revenue is expected to grow at a CAGR of 5.82 % from 2024 to 2030, reaching nearly USD 40.55 Billion by 2030Generator Sales Market Overview

Generators are useful devices that provide electrical power during a power cut-off and prevent discontinuity of day and night affairs and activities or disruption in operations in different conditions and places. Generators are devices that convert mechanical energy into electrical energy. It consist of an engine or motor that drives a rotor, which creates a rotating magnetic field. The field induces an electric current in the stator windings, producing usable electrical power for various applications, such as providing backup power during outages.To know about the Research Methodology :- Request Free Sample Report A generator supplies electricity to some of the circuits at the property in the event of a power outage, enabling it to keep things like fridges and freezers, telephones, or water-pumping appliances running until the main power supply is restored. There are many types of generators, including inverter, single-phase, three-phase, diesel, or petrol options, with power outputs ranging from five watts to five kilowatts. Generators are useful devices that provide electrical power during a power cut-off and prevent discontinuity of day and night affairs and activities or disruption in operations in different conditions and places. All a generator does is to convert the mechanical energy provided from an external source, to electrical energy to provide enough energy for other appliances. Generators with power rating of 501 kVA 1000 kVA are suitable for various industrial and commercial applications that require a substantial amount of electricity. The generator sales market is highly competitive, the technology used is maturing and replaceable. The Asia Pacific region is estimated to be the largest market for generator sales, followed by North America. Asia Pacific region is attributed to be mainly driven by the oil and gas and mining industries in the region.

Generator Sales Market Dynamics

Driving Forces Behind the Surge Generator Sales Market Construction activities usually require high electric power to run various equipment and machinery. As these sites are in remote areas and cannot avail of grid supply, a significant rise in the number of construction activities is positively influencing the sales of high-power generators across the globe. To growing environmental concerns, natural gas generators are gaining traction in industrial sites to survive power overloads. Stringent regulations are implemented by governments of various countries to reduce the negative environmental impact of generators. Additionally, rapidly increased urbanization and increasing dependence on electricity, resulted in a rise in the utilization of portable generators in residential applications. In Addition, commercial generators are employed as an emergency power backup in the healthcare industry to keep life support machines and other necessary medical tools working. Additionally, The rise in the need for hydrogen-oxygen generators with a nebulizer to alleviate the symptoms of pneumonia in patients with various disease, which is strengthening the market growth.Opportunities Driving Generator Sales Markets Amidst Environmental Challenges and Innovation Electricity grids, which are operational in all regions are not able to withstand heavy rainfall, earthquakes, and fire which lead to power outages, have created the need for installation of generators across the industrial, commercial, infrastructure, and residential structure. The rapid development of several fuel sources to replace traditional fossil fuels drives the innovation in the generator sales market. The hybrid generator sales market offers a wide range of opportunities to the end user such as a reduction in fuel consumption, noise, and reduced in running time. Increasing government initiatives to promote building and maintain a robust energy infrastructure driving the market demand for the generator sales market. Navigating Regulations, Renewable Energy Trends, and Environmental Concerns in Generator Sales Market Governments are imposing increasingly strict regulations on emissions from generators, especially diesel generators. The increase in higher compliance costs and potential bans has resulted in restrained market growth. The increasing preference for renewable energy sources such as solar and wind power has created a barrier in the generator sales market as it offers more sustainable and cleaner options to provide backup power. The increase in continuous price fluctuations in fuels such as diesel had restrained the market growth. Noise emissions resulting from generators cause limitations on the usage of generators, particularly in certain areas or times of the day.

Generator Sales Market Segment Analysis

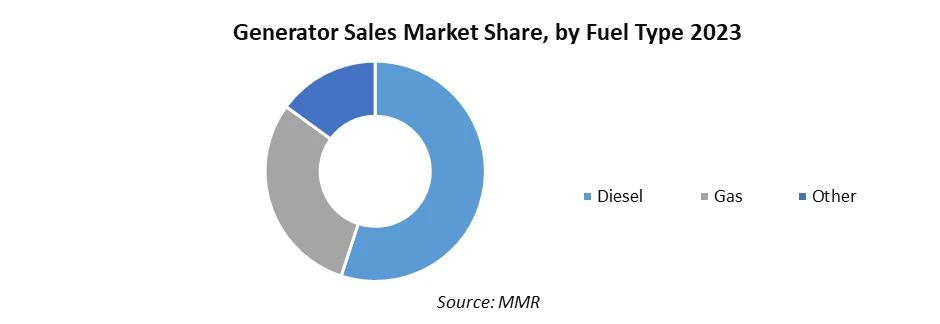

Based on Fuel Type, the Diesel segment dominated the market with a growing CAGR of 5.97% in 2023. Diesel engine manufacturers have produced engines to meet the increasingly stringent emissions standards through improvements to the combustion process itself. Maintaining good fuel quality at the dispenser requires attention to the quality of the fuel upstream, including monitoring of other fuels and blend components that are added during distribution. In April 2023, biodiesel prices had fallen by more than 40% since 2022 for several reasons, including lower vegetable oil prices and increased imports of lower-priced advanced biofuels and feedstocks. Advanced biodiesel is produced from used cooking oil, tallow, palm oil mill effluent, and other residues. The increase in population and rising industrialization have led to the market growth. The demand for diesel is rising owing to an increase in transportation. The enhanced infrastructure such as roads, airports etc. drives market growth. Based on the End-user, the Commercial segment holds the highest share of 38% with a growing CAGR of 5.90%. Generators are a key component of a business continuity plan. Generators, typically powered by diesel engines, protect business interests by restoring normal power when the regular power grid is disrupted owing to bad weather, animal damage to power lines, a brownout, a blackout, or scheduled maintenance. With the increase in demand to maintain productivity during a power outage, it is essential to invest in a backup generator. Commercial generators not only keep the lights on but also keep key equipment and machinery operating normally to help continue day-to-day tasks. Large-scale industrial businesses use 20kW to 250kW, which influences the market growth of generator sales. The Generator sales market growth is fuelled by commercial buildings such as malls, hospitals, data centers, and industries that have high energy demands as it require an uninterrupted power supply to run critical systems and ensure smooth operations.

Generator Sales Market Regional Insights

Asia Pacific dominates the Generator sales Market with the highest market share accounting for 35% in 2023, the region is expected to grow with a CAGR of 6.10% during the forecast period and maintain its dominance by 2030. The growing population and rising per capita income are the key drivers behind the growing demand for generators in the Asia Pacific region. Manufacturers are adopting advanced generators with advanced features such as automatic start/stop and compatibility with renewable energy sources to meet increasing demand. Governments offer incentives and subsidies to encourage market growth, especially in areas with blackouts or unreliable grid infrastructure outages. China and India are expected to witness robust industrial growth in the forecast years thanks to an increase in manufacturing sectors, which is expected to drive the demand for the generator sales market. North America is expected to be the fastest-growing region with a 31% market share and a growing CAGR of 5.92% during the forecast period. The increase in diesel-powered portable generators has gained significant momentum owing to the key factors that influence the market growth high portability, easy availability of fuel and simpler operations have boosted the generator sales market. The rising severe blackouts to curb peak demand coupled with a consumer paradigm shift towards emergency preparedness will strengthen the business scenario has accelerated the growth of generator sales in the region. Additionally, while the commercial, residential, and infrastructure is booming, demand for generator sales has propelled the market growth. The United States dominated the region with the majority of market share in 2023 followed by Canada and Mexico.Generator Sales Market Competitive Landscape 1. In February 2023, Caterpillar partnered with a microgrid technology supplier to offer integrated microgrid solutions, highlighting the growing demand for reliable and resilient power infrastructure. Caterpillar simulated a 48-hour backup power event, and the company’s system was able to power the multi-megawatt data center and ensure uninterrupted power, achieving an overall uptime of 99.999%. The collaboration demonstrates an increasing need for dependable and resilient power infrastructure. 2. In July 20223, Colins Aerospace announced the development of a 1-megawatt electric generator for the air force research laboratory. The generator is expected to power various systems and be paired with a fuel-burning engine to increase fuel efficiency and maximize aircraft range. The generator is expected to be delivered by 2024 along with testing for readiness. 3. In 2023, Generac Power Systems Announced plans to increase its battery storage and microgrid solutions portfolio, aligning with the trend toward distributed power generation

Generator Sales Industry Ecosystem

Generator Sales Market Scope: Inquire before buying

Generator Sales Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 27.29 Bn. Forecast Period 2024 to 2030 CAGR: 5.82 % Market Size in 2030: US$ 40.55 Bn. Segments Covered: by Power Rating Below 75 kVA 75-375 kVA 375-750 kVA Above 750 Kva by Fuel Type Diesel Gas Others by Application Continuous Load Peak Load Standby Load by End-User Industrial Commercial Residential Generator Sales Market, by Region:

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Generator Sales Market Key Players

1. Caterpillar, Inc. (United States) 2. Atlas Copco ( Sweden) 3. MAN Energy Solutions (Germany) 4. Zwart Techniek (Netherlands) 5. Cummins Inc. (United States) 6. Wacker Neuson (Germany) 7. Himoinsa (Spain) 8. Kohler-SDMO (France) 9. Inmesol S.L.U. (Spain) 10. Aggreko (United Kingdom) 11. Daihatsu Diesel Mfg. Co., Ltd. (Japan) 12. Ingersoll Rand – (Ireland ) 13. Wartsila (Finland) 14. American Honda Motor Company, Inc. (United States) 15. JCB (United Kingdom) 16. John Deere (U.S.) 17. Aggreko (U.K.) 18. Atlas Copco (Sweden) 19. Ingersoll Rand (U.S.) 20. Kirloskar Electric Co. Ltd. (India) 21. Generac Power Systems (U.S. 22. Honda Motor Co. Inc. (Japan) Frequently Asked Questions: 1] What is the projected market size & and growth rate of the Generator Sales Market? Ans. The Generator Sales Market size was valued at USD 27.29 Billion in 2023 and the total Generator Sales revenue is expected to grow at a CAGR of 5.82 % from 2024 to 2030, reaching nearly USD 40.55 Billion By 2030 2] What segments are covered in the Generator Sales Market report? Ans. The segments covered in the Generator Sales Market report are based on Power Rating, Fuel Type, Application and End User. 3] Which region is expected to hold the highest share in the Generator Sales Market? Ans. The Asia Pacific region is expected to hold the highest share of the Generator Sales Market. 4] What are the growth drivers for the Generator Sales market? Ans. The rising demand for natural gas based generator, etc. is expected to be the major driver for the Generator Sales market. 5] What is the forecast period for the Generator Sales Market? Ans. The forecast period for the Generator Sales Market is 2024-2030.

1. Generator Sales Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.2.1. Generator Sales: Market Segmentation 1.2.2. Region Covered 1.3. Executive Summary 2. Global Generator Sales Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Product Segment 2.4.3. End-user Segment 2.4.4. Revenue (2023) 2.4.5. Key Development 2.4.6. Market Share 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Consolidation of the Market 2.6.1. Strategic Initiatives and Developments 2.6.2. Mergers and Acquisitions 2.6.3. Collaborations and Partnerships 2.6.4. Product Launches and Innovations 3. Pricing Analysis: 3.1. Average Selling Price of Generator Sales Offered by Key Players in the Market 4. Generator Sales Market: Dynamics 4.1. Generator Sales Market Trends 4.2. Generator Sales Market Dynamics 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. Value Chain Analysis 4.4.1. Raw material providers 4.4.2. Component Manufacturers 4.4.3. Generator Manufacturers 4.4.4. Distributors/end users 4.4.5. Post-sales services providers 4.5. Technology Analysis 4.5.1. Digitalization and IoT integration in generators 4.5.2. Hybrid generators systems 4.5.3. Power management systems 4.6. Ecosystem analysis/ market map 4.7. Key Stakeholder and Buying Criteria 4.7.1. Influence of Stakeholders on the Buying Process for the Top Applications 4.7.2. Key Buying Criteria for Top Applications 4.8. Regulatory Landscape 4.8.1. Regulation by Region 4.8.2. Tariff and Taxes 4.8.3. Analysis of Government Schemes and Initiatives on the Global Industry 5. Generator Sales Market: Global Market Size and Forecast by Segmentation 5.1. Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 5.1.1. Below 75 kVA 5.1.2. 75-375 kVA 5.1.3. 375-750 kVA 5.1.4. Above 750 kVA 5.2. Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 5.2.1. Diesel 5.2.2. Gas 5.2.3. Others 5.3. Generator Sales Market Size and Forecast, by Application (2023-2030) 5.3.1. Continuous Load 5.3.2. Peak Load 5.3.3. Standby Load 5.4. Generator Sales Market Size and Forecast, by End-User (2023-2030) 5.4.1. Industrial 5.4.2. Commercial 5.4.3. Residential 5.5. Generator Sales Market Size and Forecast, by Region (2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. South America 5.5.5. MEA 6. North America Generator Sales Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 6.1. North America Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 6.1.1. Below 75 kVA 6.1.2. 75-375 kVA 6.1.3. 375-750 kVA 6.1.4. Above 750 kVA 6.2. North America Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 6.2.1. Diesel 6.2.2. Gas 6.2.3. Others 6.3. North America Generator Sales Market Size and Forecast, by Application (2023-2030) 6.3.1. Continuous Load 6.3.2. Peak Load 6.3.3. Standby Load 6.4. North America Generator Sales Market Size and Forecast, by End-User (2023-2030) 6.4.1. Industrial 6.4.2. Commercial 6.4.3. Residential 6.5. North America Generator Sales Market Size and Forecast, by Country (2023-2030) 6.5.1. United States 6.5.1.1. United States Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 6.5.1.1.1. Below 75 kVA 6.5.1.1.2. 75-375 kVA 6.5.1.1.3. 375-750 kVA 6.5.1.1.4. Above 750 kVA 6.5.1.2. United States Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 6.5.1.2.1. Diesel 6.5.1.2.2. Gas 6.5.1.2.3. Others 6.5.1.3. United States Generator Sales Market Size and Forecast, by Application (2023-2030) 6.5.1.3.1. Continuous Load 6.5.1.3.2. Peak Load 6.5.1.3.3. Standby Load 6.5.1.4. United States Generator Sales Market Size and Forecast, by End-User (2023-2030) 6.5.1.4.1. Industrial 6.5.1.4.2. Commercial 6.5.1.4.3. Residential 6.5.2. Canada 6.5.2.1. Canada Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 6.5.2.1.1. Below 75 kVA 6.5.2.1.2. 75-375 kVA 6.5.2.1.3. 375-750 kVA 6.5.2.1.4. Above 750 kVA 6.5.2.2. Canada Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 6.5.2.2.1. Diesel 6.5.2.2.2. Gas 6.5.2.2.3. Others 6.5.2.3. Canada Generator Sales Market Size and Forecast, by Application (2023-2030) 6.5.2.3.1. Continuous Load 6.5.2.3.2. Peak Load 6.5.2.3.3. Standby Load 6.5.2.4. Canada Generator Sales Market Size and Forecast, by End-User (2023-2030) 6.5.2.4.1. Industrial 6.5.2.4.2. Commercial 6.5.2.4.3. Residential 6.5.3. Mexico 6.5.3.1. Mexico Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 6.5.3.1.1. Below 75 kVA 6.5.3.1.2. 75-375 kVA 6.5.3.1.3. 375-750 kVA 6.5.3.1.4. Above 750 kVA 6.5.3.2. Mexico Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 6.5.3.2.1. Diesel 6.5.3.2.2. Gas 6.5.3.2.3. Others 6.5.3.3. Mexico Generator Sales Market Size and Forecast, by Application (2023-2030) 6.5.3.3.1. Continuous Load 6.5.3.3.2. Peak Load 6.5.3.3.3. Standby Load 6.5.3.4. Mexico Generator Sales Market Size and Forecast, by End-User (2023-2030) 6.5.3.4.1. Industrial 6.5.3.4.2. Commercial 6.5.3.4.3. Residential 7. Europe Generator Sales Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 7.1. Europe Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.2. Europe Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.3. Europe Generator Sales Market Size and Forecast, by Application (2023-2030) 7.4. Europe Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5. Europe Generator Sales Market Size and Forecast, by Country (2023-2030) 7.5.1. United Kingdom 7.5.1.1. United Kingdom Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.1.2. United Kingdom Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.1.3. United Kingdom Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.1.4. United Kingdom Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5.2. France 7.5.2.1. France Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.2.2. France Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.2.3. France Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.2.4. France Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5.3. Germany 7.5.3.1. Germany Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.3.2. Germany Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.3.3. Germany Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Germany Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5.4. Italy 7.5.4.1. Italy Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.4.2. Italy Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.4.3. Italy Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Italy Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5.5. Spain 7.5.5.1. Spain Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.5.2. Spain Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.5.3. Spain Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.5.4. Spain Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5.6. Sweden 7.5.6.1. Sweden Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.6.2. Sweden Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.6.3. Sweden Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.6.4. Sweden Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5.7. Austria 7.5.7.1. Austria Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.7.2. Austria Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.7.3. Austria Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.7.4. Austria Generator Sales Market Size and Forecast, by End-User (2023-2030) 7.5.8. Rest of Europe 7.5.8.1. Rest of Europe Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 7.5.8.2. Rest of Europe Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 7.5.8.3. Rest of Europe Generator Sales Market Size and Forecast, by Application (2023-2030) 7.5.8.4. Rest of Europe Generator Sales Market Size and Forecast, by End-User (2023-2030) 8. Asia Pacific Generator Sales Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 8.1. Asia Pacific Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.2. Asia Pacific Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.3. Asia Pacific Generator Sales Market Size and Forecast, by Application (2023-2030) 8.4. Asia Pacific Generator Sales Market Size and Forecast, by End-User (2023-2030) 8.5. Asia Pacific Generator Sales Market Size and Forecast, by Country (2023-2030) 8.5.1. China 8.5.1.1. China Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.5.1.2. China Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.5.1.3. China Generator Sales Market Size and Forecast, by Application (2023-2030) 8.5.1.4. China Generator Sales Market Size and Forecast, by End-User (2023-2030) 8.5.2. S Korea 8.5.2.1. S Korea Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.5.2.2. S Korea Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.5.2.3. S Korea Generator Sales Market Size and Forecast, by Application (2023-2030) 8.5.2.4. S Korea Generator Sales Market Size and Forecast, by End-User (2023-2030) 8.5.3. Japan 8.5.3.1. Japan Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.5.3.2. Japan Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.5.3.3. Japan Generator Sales Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Japan Generator Sales Market Size and Forecast, by End-User (2023-2030) 8.5.4. India 8.5.4.1. India Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.5.4.2. India Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.5.4.3. India Generator Sales Market Size and Forecast, by Application (2023-2030) 8.5.4.4. India Generator Sales Market Size and Forecast, by End-User (2023-2030) 8.5.5. Australia 8.5.5.1. Australia Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.5.5.2. Australia Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.5.5.3. Australia Generator Sales Market Size and Forecast, by Application (2023-2030) 8.5.5.4. Australia Generator Sales Market Size and Forecast, by End-User (2023-2030) 8.5.6. ASEAN 8.5.6.1. ASEAN Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.5.6.2. ASEAN Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.5.6.3. ASEAN Generator Sales Market Size and Forecast, by Application (2023-2030) 8.5.6.4. ASEAN Generator Sales Market Size and Forecast, by End-User (2023-2030) 8.5.7. Rest of Asia Pacific 8.5.7.1. Rest of Asia Pacific Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 8.5.7.2. Rest of Asia Pacific Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 8.5.7.3. Rest of Asia Pacific Generator Sales Market Size and Forecast, by Application (2023-2030) 8.5.7.4. Rest of Asia Pacific Generator Sales Market Size and Forecast, by End-User (2023-2030) 9. South America Generator Sales Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 9.1. South America Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 9.2. South America Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 9.3. South America Generator Sales Market Size and Forecast, by Application (2023-2030) 9.4. South America Generator Sales Market Size and Forecast, by End-User (2023-2030) 9.5. South America Generator Sales Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 9.5.1.2. Brazil Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 9.5.1.3. Brazil Generator Sales Market Size and Forecast, by Application (2023-2030) 9.5.1.4. Brazil Generator Sales Market Size and Forecast, by End-User (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 9.5.2.2. Argentina Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 9.5.2.3. Argentina Generator Sales Market Size and Forecast, by Application (2023-2030) 9.5.2.4. Argentina Generator Sales Market Size and Forecast, by End-User (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 9.5.3.2. Rest Of South America Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 9.5.3.3. Rest Of South America Generator Sales Market Size and Forecast, by Application (2023-2030) 9.5.3.4. Rest Of South America Generator Sales Market Size and Forecast, by End-User (2023-2030) 10. Middle East and Africa Generator Sales Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 10.1. Middle East and Africa Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 10.2. Middle East and Africa Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 10.3. Middle East and Africa Generator Sales Market Size and Forecast, by Application (2023-2030) 10.4. Middle East and Africa Generator Sales Market Size and Forecast, by End-User (2023-2030) 10.5. Middle East and Africa Generator Sales Market Size and Forecast, by Country (2023-2030) 10.5.1. South Africa 10.5.1.1. South Africa Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 10.5.1.2. South Africa Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 10.5.1.3. South Africa Generator Sales Market Size and Forecast, by Application (2023-2030) 10.5.1.4. South Africa Generator Sales Market Size and Forecast, by End-User (2023-2030) 10.5.2. GCC 10.5.2.1. GCC Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 10.5.2.2. GCC Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 10.5.2.3. GCC Generator Sales Market Size and Forecast, by Application (2023-2030) 10.5.2.4. GCC Generator Sales Market Size and Forecast, by End-User (2023-2030) 10.5.3. Rest Of MEA 10.5.3.1. Rest Of MEA Generator Sales Market Size and Forecast, by Power Rating (2023-2030) 10.5.3.2. Rest Of MEA Generator Sales Market Size and Forecast, by Fuel Type (2023-2030) 10.5.3.3. Rest Of MEA Generator Sales Market Size and Forecast, by Application (2023-2030) 10.5.3.4. Rest Of MEA Generator Sales Market Size and Forecast, by End-User (2023-2030) 11. Company Profile: Key Players 11.1. Atlas Copco ( Sweden) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Caterpillar, Inc. (United States) 11.3. MAN Energy Solutions (Germany) 11.4. Zwart Techniek (Netherlands) 11.5. Cummins Inc. (United States) 11.6. Wacker Neuson (Germany) 11.7. Himoinsa (Spain) 11.8. Kohler-SDMO (France) 11.9. Inmesol S.L.U. (Spain) 11.10. Aggreko (United Kingdom) 11.11. Daihatsu Diesel Mfg. Co., Ltd. (Japan) 11.12. Ingersoll Rand – (Ireland ) 11.13. Wartsila (Finland) 11.14. American Honda Motor Company, Inc. (United States) 11.15. JCB (United Kingdom) 11.16. John Deere (U.S.) 11.17. Aggreko (U.K.) 11.18. Atlas Copco (Sweden) 11.19. Ingersoll Rand (U.S.) 11.20. Kirloskar Electric Co. Ltd. (India) 11.21. Generac Power Systems (U.S. 11.22. Honda Motor Co. Inc. (Japan) 11.23. Others 12. Key Findings and Analyst Recommendations 12.1. Attractive Opportunities for Players in the Generator Sales Market 13. Generator Sales Market: Research Methodology 13.1. Market Size Estimation Methodology 13.1.1. Bottom-Up Approach 13.1.2. Top-Down Approach 13.1.3. Demand-side analysis 13.1.3.1. Regional analysis 13.1.3.2. Country level analysis 13.1.3.3. Demand-side assumption 13.1.3.4. Demand-side calculations 13.1.4. Supply-Side analysis 13.1.4.1. Supply-side assumption 13.1.4.2. Supply-side calculations 13.2. Market Breakdown & Data Triangulation 13.2.1. Generator Sales Market: Data Triangulation