The Biodiesel Market size was valued at USD 35.22 Billion in 2023 and the total Biodiesel revenue is expected to grow at a CAGR of 10.11% from 2024 to 2030, reaching nearly USD 69.12 Billion by 2030.Biodiesel Market Overview:

Biodiesel Market, plays a pivotal role in a renewable and sustainable fuel gaining prominence in the global energy landscape, contributing significantly to the ongoing shift toward cleaner alternatives. Derived from natural sources such as vegetable oils, animal fats, and recycled cooking oil, biodiesel serves as a key player in the effort to reduce reliance on traditional fossil fuels. The biodiesel market is witnessing remarkable growth, driven by increasing environmental awareness, government regulations promoting renewable fuels, and advancements in production technologies. As a cleaner and greener alternative to conventional diesel, biodiesel offers a substantial reduction in carbon emissions, aligning with global initiatives to combat climate change.To know about the Research Methodology :- Request Free Sample Report The biodiesel market is marked by diverse feedstocks, including soybean oil, palm oil, and animal fats, contributing to a rich and varied production landscape. Its applications span across the automotive, marine, agriculture, and power generation sectors, showcasing its versatility and adaptability. Key regions driving biodiesel market growth include North America, Europe, and Asia-Pacific, where regulatory frameworks and environmental initiatives play a pivotal role. As biodiesel industry players focus on ensuring quality and sustainability through adherence to certification standards, such as those set by the Roundtable on Sustainable Biomaterials (RSB), biodiesel emerges as a pivotal player in the global energy transition, offering a cleaner and more environmentally conscious fuel option. The detailed and constructive formation of biodiesel market key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Biodiesel Market.

Biodiesel Market Dynamics

Environmental Concerns and Sustainable Practices Driving the Biodiesel Market The increasing global awareness of environmental issues and concerns about climate change are significant drivers for the biodiesel market. Consumers and industries are actively seeking cleaner and more sustainable alternatives to traditional fossil fuels, positioning biodiesel as a key solution to reduce carbon emissions and environmental impact. Stringent environmental regulations and government incentives play a pivotal role in driving the biodiesel market. Governments are implementing policies that encourage the production and consumption of biodiesel through measures such as tax credits, subsidies, and renewable energy standards, fostering market growth and sustainability. Biodiesel's attractiveness is amplified by the volatility in crude oil prices. The unpredictable nature of oil prices makes biodiesel an appealing and stable alternative. As crude oil prices fluctuate, businesses and consumers seek cost-effective and reliable options, positioning biodiesel as a viable and competitive choice. The desire for energy security and independence is a driving force behind the adoption of biodiesel. As a domestically producible fuel derived from renewable resources, biodiesel contributes to reducing dependence on imported fossil fuels. This driver aligns with national interests in achieving greater energy autonomy and security. Ongoing advancements in biodiesel production technologies contribute significantly to biodiesel market growth. Innovations in feedstock utilization, processing methods, and overall production efficiency enhance the feasibility and attractiveness of biodiesel. These technological strides improve the competitiveness and sustainability of biodiesel in the energy market. Feedstock Availability and Competition with Economic Viability and Price Competitiveness Restraining the Biodiesel Market The limited availability of suitable feedstocks poses a restraint on the scalability of biodiesel production. Additionally, competition with food production for certain feedstock raises concerns about resource allocation and potential ethical dilemmas, challenging the consistent and large-scale manufacturing of biodiesel. The need for separate storage and distribution infrastructure for biodiesel presents a significant restraint. Compatibility issues with existing diesel engines and infrastructure challenges hinder the seamless integration of biodiesel into conventional fuel systems, affecting its widespread adoption and market penetration. Biodiesel's economic viability and competitiveness against conventional diesel are restrained by various factors. Fluctuations in feedstock costs, production efficiency challenges, and market fluctuations impact the broader acceptance of biodiesel. Achieving price competitiveness remains a key challenge for widespread adoption. The expansion of biodiesel feedstock cultivation raises concerns about land use change and potential deforestation. These environmental and sustainability concerns pose restraints on market growth, prompting the industry to address and mitigate the ecological impact associated with biodiesel production. Advanced Feedstock Exploration and Second, Third-Generation Biodiesel Booming Trend in the Biodiesel Market Continued exploration of advanced feedstocks, including algae and waste oils, is a prominent trend in the biodiesel market. These alternative feedstocks offer new opportunities for biodiesel production, addressing concerns related to conventional feedstock availability and contributing to feedstock diversification. The biodiesel market is witnessing a trend toward research and development in second and third-generation biodiesel technologies. Innovations in synthetic biology and advanced conversion processes aim to enhance efficiency, yield, and overall sustainability, positioning biodiesel as a more advanced and impactful renewable fuel. Efforts to enlarge biodiesel markets globally, especially in emerging economies, represent a notable trend. Increasing environmental consciousness, coupled with supportive regulatory frameworks, contributes to the growth of the industry on a global scale, as biodiesel becomes an integral part of the energy transition. Collaborations between governments, industry players, and research institutions are a prevailing trend in the biodiesel market. These collaborative efforts focus on overcoming challenges, sharing expertise, and investing in technological advancements to drive positive evolution and sustainability in the biodiesel industry. There is a growing trend in the biodiesel market toward a heightened focus on adhering to certification and quality standards. Organizations like the Roundtable on Sustainable Biomaterials (RSB) play a crucial role in setting industry benchmarks. This trend underscores the industry's commitment to sustainability and responsible production practices, aligning with global environmental goals.Biodiesel Market Segment Analysis

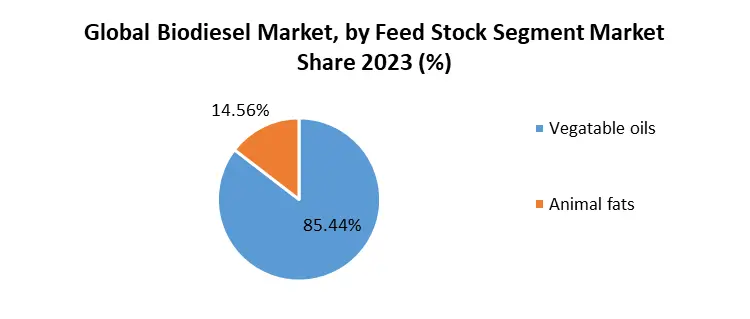

Product: Soybean oil emerges as a standout feedstock for biodiesel production, owing to its widespread availability and efficient extraction processes. The favorable characteristics of soybean oil position it as a leading choice in the competitive landscape of vegetable oils, making it a Biodiesel Market dominant segment. Palm oil significantly contributes to the biodiesel market, boasting a high energy content and versatility in production processes. Despite its prominence, concerns about sustainable sourcing underscore the need for responsible practices in the palm oil segment. Palm oil stands out as a Biodiesel Market major segment. While less common than soybean and palm oil, castor oil is gaining attention for biodiesel applications. Its unique composition and the potential for cultivation in various regions add a layer of diversity to biodiesel feedstock sources. Castor oil is an emerging and Biodiesel Market booming segment. Sunflower oil is emerging as a viable feedstock option, supported by its availability and favorable fatty acid composition. Its presence adds competition and diversity to the vegetable oils segment, contributing to the overall richness of the biodiesel market. Sunflower oil is positioned as a noteworthy Biodiesel Market regional segment. Animal fats constitute a distinctive category within biodiesel feedstocks. While not as predominant as vegetable oils, they present an alternative source, with potential contributions from fats such as tallow and lard. Animal fats represent a niche but the Biodiesel Market segment shares. Application: Biodiesel finds extensive use in the automotive sector, particularly in passenger and commercial vehicles. Its adoption is fuelled by environmental concerns, government incentives, and the automotive industry's commitment to cleaner and more sustainable fuels. The automotive sector remains a Biodiesel Market major segment. The marine sector is increasingly recognizing the potential of biodiesel as a sustainable alternative fuel. Biodiesel's applications in marine engines contribute to reducing emissions and aligning with global environmental regulations in maritime transportation. The marine sector is an emerging Biodiesel Market regional segment. In agriculture, biodiesel is employed for various purposes, including fuelling agricultural machinery. The sector's adoption of biodiesel reflects a commitment to sustainable farming practices and a concerted effort to reduce the carbon footprint of agricultural operations. Agriculture is a significant Biodiesel Market segment share. Biodiesel's applications extend beyond traditional automotive and marine sectors to various industrial and commercial uses, showcasing its adaptability and versatility across diverse applications. Other applications form varied and Biodiesel Market emerging trends. Biodiesel plays a significant role in power generation, with stationary diesel engines utilizing biodiesel for electricity production. This application signifies the potential of biodiesel to contribute to energy needs beyond transportation, emphasizing its versatility. Power generation is an evolving Biodiesel Market segment share. Biodiesel's versatility is further evident in its application across various sectors beyond fuel and power generation. These diverse applications highlight the adaptability and potential for innovation within the biodiesel market, fostering a landscape of continuous evolution and growth. The versatility across sectors positions biodiesel as a Biodiesel Market penetration catalyst. This segmented analysis of the biodiesel market, focusing on products and applications, provides a comprehensive and detailed view of the industry's dynamics. It equips industry participants with valuable insights to make informed decisions, promoting sustainable growth and innovation in the ever-evolving landscape of renewable energy.

Biodiesel Market Regional Analysis

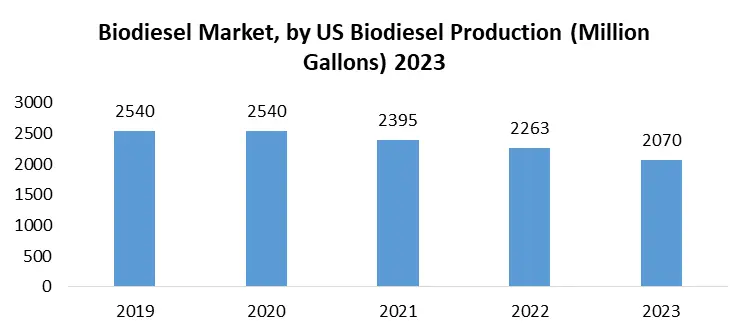

The Biodiesel market undergoes a comprehensive regional analysis to understand the distinct dynamics, trends, and opportunities shaping its growth across key geographical areas, including North America, Asia Pacific, Europe, and the Middle East and Africa (MEA). North America stands as a dominant force in the Biodiesel market. The region benefits from robust regulatory frameworks promoting renewable energy, with the United States being a key contributor to the market's growth. Government incentives, environmental consciousness, and a well-established biodiesel production infrastructure contribute to the region's dominance. In North America, the market experiences a trend toward increased biodiesel production capacity and investments in advanced production technologies. Collaborations between industry players and government initiatives further drive innovation and market expansion. The automotive sector's emphasis on cleaner fuels fuels the demand for biodiesel in the region. North America presents significant growth potential in the Biodiesel market. The region's commitment to reducing carbon emissions and dependence on traditional fuels positions biodiesel as a key player in the transition to sustainable energy. Ongoing research and development activities contribute to unlocking further potential within the North American biodiesel market. Asia Pacific emerges as a booming segment in the global Biodiesel market. The region experiences a surge in demand for cleaner and sustainable energy sources, driven by rapid industrialization and urbanization. Countries like China and India play pivotal roles in shaping the market landscape, with increasing awareness of environmental issues. The Asia Pacific region is a major segment for biodiesel consumption, with a growing emphasis on reducing air pollution and reliance on fossil fuels. Government initiatives, supportive policies, and investments in biodiesel production facilities contribute to the region's major role in the global market. The automotive and agricultural sectors are prominent consumers of biodiesel in Asia Pacific. Innovation in biodiesel production technologies is a notable trend in the Asia Pacific region. Research and development activities focus on enhancing feedstock utilization, production efficiency, and environmental sustainability. The region's commitment to technological advancements positions it as a hub for innovation in the biodiesel industry. Europe stands out as a significant regional segment in the Biodiesel market. The European Union's stringent environmental regulations and ambitious renewable energy targets drive the adoption of biodiesel. The region's commitment to sustainability and reducing greenhouse gas emissions positions biodiesel as a key component of its energy strategy. Europe commands a substantial share in the global biodiesel market, with countries like Germany, France, and Spain leading in production and consumption. The European biodiesel market benefits from a well-established infrastructure, government support, and a mature understanding of the environmental benefits of biodiesel. Biodiesel pricing analysis in Europe reflects the region's commitment to sustainability. Government incentives, tax credits, and favorable pricing structures contribute to the competitiveness of biodiesel in the energy market. The pricing analysis underscores the economic viability of biodiesel as a fuel alternative. The Middle East and Africa (MEA) region exhibit emerging trends in biodiesel adoption. While the region is traditionally associated with oil production, there is a growing recognition of the need for diversification in the energy sector. Biodiesel represents an emerging trend as countries explore renewable energy sources. MEA presents a substantial opportunity for biodiesel market growth. As countries in the region seek to reduce dependence on fossil fuels, biodiesel emerges as a viable and sustainable alternative. Government initiatives and investments in renewable energy projects create opportunities for market players to establish a presence in MEA. Market fluctuations in MEA are influenced by geopolitical factors, economic conditions, and the region's transition to renewable energy. While the biodiesel market is in the early stages of development in MEA, the potential for market fluctuation exists as countries navigate the complexities of energy transition.

Global Biodiesel Market Scope: Inquire before buying

Global Biodiesel Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 35.22 Bn. Forecast Period 2024 to 2030 CAGR: 10.11% Market Size in 2030: US $ 69.12 Bn. Segments Covered: by Product Vegetable Oils Soybean oil Palm oil Castor oil Sunflower Animal Fats by Application Fuel Automotive Marine Agriculture Others Power Generation Others Biodiesel Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Biodiesel Market Key Players:

Major Global Key Players: 1. Archer Daniels Midland Company (Chicago, Illinois, USA) 2. Louis Dreyfus Company (Rotterdam, Netherlands) 3. Bunge Limited (White Plains, New York, USA) 4. Cargill, Incorporated (Minnetonka, Minnesota, USA) 5. Sime Darby Plantation (Kuala Lumpur, Malaysia) Leading Key Players in North America: 1. REGI U.S., Inc. (Renewable Energy Group) (Ames, Iowa, USA) 2. Imperium Renewables (Seattle, Washington, USA) 3. World Energy (Boston, Massachusetts, USA) Market Follower key Players in Europe: 1. Neste corporation (Espoo, Finland) 2. Diester Industrie (Grand-Couronne, France) 3. VERBIO Vereinigte BioEnergie AG (Leipzig, Germany) Prominent Key player Asia Pacific: 1. Wilmar International Limited (Singapore) 2. BIOX Corporation (Toronto, Canada) (Asia-Pacific Operations) 3. PT. Wilmar Bioenergi Indonesia (Jakarta, Indonesia) Dominant Key Players in South America: 1. BIO TINS S.A. (Tocantins, Brazil) 2. Biocombustíveis do Cerrado S.A. (Goiás, Brazil) 3. Caramuru Alimentos S.A. (Itumbiara, Brazil) Leading Key players in Middle East & Africa: 1. Biocom Energia (Luanda, Angola) 2. Eco Fuels Kenya Limited (Nairobi, Kenya) 3. Eco-Oil (Cape Town, South Africa) FAQ’s: 1. How is Biodiesel Produced? Ans: Biodiesel is typically produced through a process called transesterification, where natural oils or fats react with alcohol to create biodiesel and glycerin. This process makes it a sustainable and versatile fuel option. 2. What Feedstocks are used in Biodiesel Production? Ans: Common feedstocks include soybean oil, palm oil, animal fats, and recycled cooking oil. These feedstocks vary based on regional availability and contribute to the diversity of biodiesel sources. 3. What are the Main Applications of Biodiesel? Ans: Biodiesel is primarily used as a fuel, particularly in the automotive and marine sectors. It is also employed in agriculture for machinery and finds applications in power generation and various industrial uses. 4. What Factors Drive the Growth of the Biodiesel Market? Ans: Key drivers include increasing environmental awareness, government regulations promoting renewable fuels, volatility in crude oil prices, and advancements in biodiesel production technologies. 5. Which Regions Are Pioneering Biodiesel Market Growth? Ans: North America, Europe, and Asia-Pacific are leading regions, with established regulatory frameworks, environmental initiatives, and a growing emphasis on renewable energy sources.

1. Biodiesel Market: Research Methodology 2. Biodiesel Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Biodiesel Market: Dynamics 3.1. Biodiesel Market Trends by Region 3.1.1. North America Biodiesel Market Trends 3.1.2. Europe Biodiesel Market Trends 3.1.3. Asia Pacific Biodiesel Market Trends 3.1.4. Middle East and Africa Biodiesel Market Trends 3.1.5. South America Biodiesel Market Trends 3.2. Biodiesel Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Biodiesel Market Drivers 3.2.1.2. North America Biodiesel Market Restraints 3.2.1.3. North America Biodiesel Market Opportunities 3.2.1.4. North America Biodiesel Market Challenges 3.2.2. Europe 3.2.2.1. Europe Biodiesel Market Drivers 3.2.2.2. Europe Biodiesel Market Restraints 3.2.2.3. Europe Biodiesel Market Opportunities 3.2.2.4. Europe Biodiesel Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Biodiesel Market Drivers 3.2.3.2. Asia Pacific Biodiesel Market Restraints 3.2.3.3. Asia Pacific Biodiesel Market Opportunities 3.2.3.4. Asia Pacific Biodiesel Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Biodiesel Market Drivers 3.2.4.2. Middle East and Africa Biodiesel Market Restraints 3.2.4.3. Middle East and Africa Biodiesel Market Opportunities 3.2.4.4. Middle East and Africa Biodiesel Market Challenges 3.2.5. South America 3.2.5.1. South America Biodiesel Market Drivers 3.2.5.2. South America Biodiesel Market Restraints 3.2.5.3. South America Biodiesel Market Opportunities 3.2.5.4. South America Biodiesel Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For the Biodiesel Market 3.8. Analysis of Government Schemes and Initiatives For the Biodiesel Market 3.9. The Global Pandemic Impact on the Biodiesel Market 4. Biodiesel Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 4.1. Biodiesel Market Size and Forecast, By Product (2022-2029) 4.1.1. Vegetable Oils 4.1.2. Soybean oil 4.1.3. Palm oil 4.1.4. Castor oil 4.1.5. Sunflower 4.1.6. Animal Fats 4.2. Biodiesel Market Size and Forecast, By Application (2022-2029) 4.2.1. Fuel 4.2.2. Automotive 4.2.3. Marine 4.2.4. Agriculture 4.2.5. Others 4.2.6. Power Generation 4.2.7. Others 4.3. Biodiesel Market Size and Forecast, by Region (2022-2029) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Biodiesel Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 5.1. North America Biodiesel Market Size and Forecast, By Product (2022-2029) 5.1.1. 5.1.2. Vegetable Oils 5.1.3. Soybean oil 5.1.4. Palm oil 5.1.5. Castor oil 5.1.6. Sunflower 5.1.7. Animal Fats 5.2. North America Biodiesel Market Size and Forecast, By Application (2022-2029) 5.2.1. Fuel 5.2.2. Automotive 5.2.3. Marine 5.2.4. Agriculture 5.2.5. Others 5.2.6. Power Generation 5.2.7. Others 5.3. North America Biodiesel Market Size and Forecast, by Country (2022-2029) 5.3.1. United States 5.3.1.1. United States Biodiesel Market Size and Forecast, By Product (2022-2029) 5.3.1.1.1. Vegetable Oils 5.3.1.1.2. Soybean oil 5.3.1.1.3. Palm oil 5.3.1.1.4. Castor oil 5.3.1.1.5. Sunflower 5.3.1.1.6. Animal Fats 5.3.1.2. United States Biodiesel Market Size and Forecast, By Application (2022-2029) 5.3.1.2.1. Fuel 5.3.1.2.2. Automotive 5.3.1.2.3. Marine 5.3.1.2.4. Agriculture 5.3.1.2.5. Others 5.3.1.2.6. Power Generation 5.3.1.2.7. Others 5.3.2. Canada 5.3.2.1. Canada Biodiesel Market Size and Forecast, By Product (2022-2029) 5.3.2.1.1. Vegetable Oils 5.3.2.1.2. Soybean oil 5.3.2.1.3. Palm oil 5.3.2.1.4. Castor oil 5.3.2.1.5. Sunflower 5.3.2.1.6. Animal Fats 5.3.2.2. Canada Biodiesel Market Size and Forecast, By Application (2022-2029) 5.3.2.2.1. Fuel 5.3.2.2.2. Automotive 5.3.2.2.3. Marine 5.3.2.2.4. Agriculture 5.3.2.2.5. Others 5.3.2.2.6. Power Generation 5.3.2.2.7. Others 5.3.3. Mexico 5.3.3.1. Mexico Biodiesel Market Size and Forecast, By Product (2022-2029) 5.3.3.1.1. Vegetable Oils 5.3.3.1.2. Soybean oil 5.3.3.1.3. Palm oil 5.3.3.1.4. Castor oil 5.3.3.1.5. Sunflower 5.3.3.1.6. Animal Fats 5.3.3.2. Mexico Biodiesel Market Size and Forecast, By Application (2022-2029) 5.3.3.2.1. Fuel 5.3.3.2.2. Automotive 5.3.3.2.3. Marine 5.3.3.2.4. Agriculture 5.3.3.2.5. Others 5.3.3.2.6. Power Generation 5.3.3.2.7. Others 6. Europe Biodiesel Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 6.1. Europe Biodiesel Market Size and Forecast, By Product (2022-2029) 6.2. Europe Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3. Europe Biodiesel Market Size and Forecast, by Country (2022-2029) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.1.2. United Kingdom Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3.2. France 6.3.2.1. France Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.2.2. France Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3.3. Germany 6.3.3.1. Germany Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.3.2. Germany Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3.4. Italy 6.3.4.1. Italy Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.4.2. Italy Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3.5. Spain 6.3.5.1. Spain Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.5.2. Spain Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3.6. Sweden 6.3.6.1. Sweden Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.6.2. Sweden Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3.7. Austria 6.3.7.1. Austria Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.7.2. Austria Biodiesel Market Size and Forecast, By Application (2022-2029) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Biodiesel Market Size and Forecast, By Product (2022-2029) 6.3.8.2. Rest of Europe Biodiesel Market Size and Forecast, By Application (2022-2029) 7. Asia Pacific Biodiesel Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 7.1. Asia Pacific Biodiesel Market Size and Forecast, By Product (2022-2029) 7.2. Asia Pacific Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3. Asia Pacific Biodiesel Market Size and Forecast, by Country (2022-2029) 7.3.1. China 7.3.1.1. China Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.1.2. China Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.2. S Korea 7.3.2.1. S Korea Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.2.2. S Korea Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.3. Japan 7.3.3.1. Japan Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.3.2. Japan Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.4. India 7.3.4.1. India Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.4.2. India Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.5. Australia 7.3.5.1. Australia Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.5.2. Australia Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.6. Indonesia 7.3.6.1. Indonesia Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.6.2. Indonesia Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.7. Malaysia 7.3.7.1. Malaysia Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.7.2. Malaysia Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.8. Vietnam 7.3.8.1. Vietnam Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.8.2. Vietnam Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.9. Taiwan 7.3.9.1. Taiwan Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.9.2. Taiwan Biodiesel Market Size and Forecast, By Application (2022-2029) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Biodiesel Market Size and Forecast, By Product (2022-2029) 7.3.10.2. Rest of Asia Pacific Biodiesel Market Size and Forecast, By Application (2022-2029) 8. Middle East and Africa Biodiesel Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029 8.1. Middle East and Africa Biodiesel Market Size and Forecast, By Product (2022-2029) 8.2. Middle East and Africa Biodiesel Market Size and Forecast, By Application (2022-2029) 8.3. Middle East and Africa Biodiesel Market Size and Forecast, by Country (2022-2029) 8.3.1. South Africa 8.3.1.1. South Africa Biodiesel Market Size and Forecast, By Product (2022-2029) 8.3.1.2. South Africa Biodiesel Market Size and Forecast, By Application (2022-2029) 8.3.2. GCC 8.3.2.1. GCC Biodiesel Market Size and Forecast, By Product (2022-2029) 8.3.2.2. GCC Biodiesel Market Size and Forecast, By Application (2022-2029) 8.3.3. Nigeria 8.3.3.1. Nigeria Biodiesel Market Size and Forecast, By Product (2022-2029) 8.3.3.2. Nigeria Biodiesel Market Size and Forecast, By Application (2022-2029) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Biodiesel Market Size and Forecast, By Product (2022-2029) 8.3.4.2. Rest of ME&A Biodiesel Market Size and Forecast, By Application (2022-2029) 9. South America Biodiesel Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029 9.1. South America Biodiesel Market Size and Forecast, By Product (2022-2029) 9.2. South America Biodiesel Market Size and Forecast, By Application (2022-2029) 9.3. South America Biodiesel Market Size and Forecast, by Country (2022-2029) 9.3.1. Brazil 9.3.1.1. Brazil Biodiesel Market Size and Forecast, By Product (2022-2029) 9.3.1.2. Brazil Biodiesel Market Size and Forecast, By Application (2022-2029) 9.3.2. Argentina 9.3.2.1. Argentina Biodiesel Market Size and Forecast, By Product (2022-2029) 9.3.2.2. Argentina Biodiesel Market Size and Forecast, By Application (2022-2029) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Biodiesel Market Size and Forecast, By Product (2022-2029) 9.3.3.2. Rest Of South America Biodiesel Market Size and Forecast, By Application (2022-2029) 10. Global Biodiesel Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Biodiesel Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Archer Daniels Midland Company (Chicago, Illinois, USA) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Louis Dreyfus Company (Rotterdam, Netherlands) 11.3. Bunge Limited (White Plains, New York, USA) 11.4. Cargill, Incorporated (Minnetonka, Minnesota, USA) 11.5. Sime Darby Plantation (Kuala Lumpur, Malaysia) 11.6. REGI U.S., Inc. (Renewable Energy Group) (Ames, Iowa, USA) 11.7. Imperium Renewables (Seattle, Washington, USA) 11.8. World Energy (Boston, Massachusetts, USA) 11.9. Neste Corporation (Espoo, Finland) 11.10. Diester Industrie (Grand-Couronne, France) 11.11. VERBIO Vereinigte BioEnergie AG (Leipzig, Germany) 11.12. Wilmar International Limited (Singapore) 11.13. BIOX Corporation (Toronto, Canada) (Asia-Pacific Operations) 11.14. PT. Wilmar Bioenergi Indonesia (Jakarta, Indonesia) 11.15. BIO TINS S.A. (Tocantins, Brazil) 11.16. Biocombustíveis do Cerrado S.A. (Goiás, Brazil) 11.17. Caramuru Alimentos S.A. (Itumbiara, Brazil) 11.18. Biocom Energia (Luanda, Angola) 11.19. Eco Fuels Kenya Limited (Nairobi, Kenya) 11.20. Eco-Oil (Cape Town, South Africa) 12. Key Findings 13. Industry Recommendations