Global Gas Turbine Market size was valued at USD 20.28 Bn. in 2023 and the total Gas Turbine revenue is expected to grow by 3.6 % from 2024 to 2030, reaching nearly USD 25.98 Bn.Gas Turbine Market Overview:

A Gas Turbine is a type of internal combustion engine that transfers chemical energy in the form of rotational power into mechanical energy. This mechanical energy may be employed to drive a variety of industrial activities. A Gas Turbine has several advantages, including great dependability, low operating costs, and high power density. The Gas Turbine may also be powered by clean and renewable energy, lowering carbon emissions. Gas Turbines used in cogeneration or Combined Heat and Power (CHP) processes improve plant efficiency by using exhaust gases to create steam, which may then be utilized for a variety of Technologies without the usage of extra fuel. Because of these advantages, as well as others such as higher efficiency, severe carbon emission laws, and cost savings provided by the use of these turbines, Gas Turbine demand is likely to rise further in the coming years.To know about the Research Methodology :- Request Free Sample Report

Research Methodology

The research report highly depends on both primary and secondary data sources. The research process involves the investigation of various factors affecting the industry, such as government policy, market environment, competitive landscape, historical data, current market trends, technological innovation, upcoming technologies, and technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalised, and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. This data is combined and added with detailed inputs and analysis, and presented in the report. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics; market size estimations; market forecasts; market breakdown; and data triangulation. The bottom-up technique is widely employed in the whole market engineering process, along with multiple data triangulation methodologies, to perform market estimation and forecasting for the overall market segments and sub-segments covered in this research. Gas Turbine Market Manufacturers Investing in R&D: Global demand for efficient turbines is driving Gas Turbine manufacturers to spend extensively in the development of high-efficiency Gas Turbine. One example of a Gas Turbine with improved efficiency levels is GENERAL ELECTRIC's 9HA/7HA series CCGT created by the Power and Water division. As a result, the increased emphasis of Gas Turbine makers on supplying technologically sturdy products, the global market is expected to grow more than 3 % of CAGR during the forecast period. To remain competitive in this rapidly expanding industry, leading Gas Turbine manufacturers are continually developing and integrating the new technologies into their products, such as the Gas Turbine combined cycle (GTCC) and integrated coal gasification combined cycle (IGCC). This will help them provide environmentally friendly and high-efficiency Gas Turbine. For example, in 2003, MHI commercialized a Gas Turbine based on IGCC technology with NOx levels less than 25ppm at base load with steady combustion. Many of the world's major Gas Turbine manufacturers also provide devices that can be tailored to meet the needs of the client and can run on numerous fuels. All of these elements are expected to be important for the gas turbine market outlook. Growing Aviation Industry and Increasing Consumption of Electricity: Global demand for power is rising, and governments are focusing their efforts on reducing the usage of fossil fuels, which are increasing global emissions. Several governments are replacing coal-fired steam plants and combined-cycle power plants with such turbines. The principal fuel for these turbines is natural gas. Gas-powered electricity emits less greenhouse emissions. The aviation business is quickly developing across the world, offering a great opportunity for this market. Emerging economies are concentrating their efforts on upgrading the aviation industry. Rising aviation investment is predicted to generate a potential opportunity for this industry. Rising Electricity Demand Across the World: Electricity demand is expanding globally as a result of increased urbanization and infrastructure development. Industrialization is spreading in underdeveloped countries. Many nations have begun smart building and smart city programs, which have increased power demand. To encounter the rising demand for energy, the power plant capacity are boosted by both the public and private sectors, either by building new facilities or expanding existing ones. These turbines are often used in projects since both are efficient and environmentally friendly. Governments have also imposed tough pollution standards, prompting firms to switch to gas-powered turbines on a significant scale. As a result, this aspect is likely to fuel market expansion in the future years. Nuclear and Coal-Driven Turbine Replacement by Gas: Coal-fired power facilities release significant volumes of hazardous gases. The discharge of such gases significantly adds to warmth. Nuclear-powered turbines also emit enormous volumes of hazardous gases, which have long-term negative consequences on the environment. Several governments intend to minimize greenhouse gas emissions and replace nuclear and coal-powered turbines with gas-powered turbines. These turbines often produce less hazardous gases than coal power stations. In 2019, approximately 2,044 GW of coal-fired power plants were operational around the world. By 2022, China will have around 1,082 coal-fired power plants in operation, which will significantly contribute to increased air pollution. Junliangcheng Power Plant installed around 650 MW of gas-driven turbine power plant in February 2022, which is a milestone toward the transition from coal to gas. Growing Trend of Distributed Power Generation: Previously, small power plants with low voltage DC-based power distribution were employed to distribute energy. Distributed production can assist with both electricity and mechanical tasks. Because Gas Turbines are more efficient and have a more reliable production capacity than other distributed generation technologies for backup power and onsite generation, there is a growth in distributed power generation, which provides a significant potential for the micro gas turbine market. Gas Turbine Market Shifting Focus towards Renewable Energy: According to BP's statistical review of world energy in June 2017, total global natural gas reserves are 186.6 trillion cubic meters, which is insufficient to last for 55 years at current consumption rates. However, if the United States begins exporting natural gas to other markets, the reserve-to-production ratio will decrease. At present production rates, global natural gas supplies are barely enough to last half as long as coal. The expected impact on fossil-fired power plants is due to the increased investment in renewable energy, posing a threat to the Gas Turbine industries. Volatility in Natural Gas Price: The prices of Natural gas are impacted by intervals or interruptions in natural gas supply. Geopolitical tension is a disruptive element that creates uncertainty about gas supplies or demand. Due to the extraction of shale gas, the cost of gas in the United States has dropped dramatically, while the value remains relatively high elsewhere in the globe. The majority of the nations in the Middle East area have large natural gas reserves. Because of political and cultural difficulties, it is a highly volatile region. Furthermore, because to the Covid-19 epidemic, demand for natural gas has reduced dramatically in recent months. As a result, gas prices have fallen, which has a detrimental influence on market growth.Gas Turbine Market Segment Analysis:

Based on Type, the Gas Turbine Market is segmented into Heavy Duty and Aeroderivative. The heavy-duty category dominates the market because of its cheap cost structure, large capacity operations, and low pressure, resulting in maximum power. Because of its small turbine dimensions and cheap investment cost, delivering optimum cycle efficiency contributes to the increasing demand for heavy-duty Gas Turbines. The consistent technological advancements in efficiency, flexibility, and dependability are expected to drive the commercial environment. During the forecast period, the aero-derivative segment is expected to increase at an 8.1% CAGR. It is built around aircraft engines, often known as aviation Gas Turbines. It is easier to install, starts up faster, and weighs less than a large-duty engine. Based on Technology, the Gas Turbine Market is segmented into open cycle and combined cycle. The combined cycle technology has the highest revenue (78%), and it is expected to maintain its dominance. They use less fuel to achieve the desired energy output while also lowering transmission and distribution losses. Because of its great efficiency and ease of use, combined cycle turbines have efficiencies ranging from 60 to 80%. Aside from this growing demand, the technology is supported by strict coal plant regulations, low gas prices, and the incorporation of renewable energy power. Because it can start and stop fast, the combined cycle power plant complements solar and wind power and provides a variety of renewable energy generation. The expansion is mostly owing to efficient waste heat usage, closeness to the environment, and operational efficiency.Based on Application, the gas turbine services market is segmented into power generation, oil and gas, marine, Aerospace, process plants, and others. During the forecast period, the power utility sector is likely to dominate the global market. The replacement of traditional steam and coal-fired turbines is gaining popularity in many power-generating units. When compared to typical power plants, they deliver excellent efficiency in Gas turbine power generation or electricity generation. As gas exploration grows more active, there are several gas-fueled turbine plants that primarily use natural gas as fuel. According to the Energy Information Administration (EIA), coal accounts for more than 40% of the country's power while natural gas accounts for about 25%. More than 49 GW of coal-fired power plants had been retired by the end of 2019, 14GW of boilers had been converted to natural gas, and 15GW had been replaced with natural gas combined cycle power plants. Because of the rapid expansion in the usage of turbines in this industry, the aviation segment is expected to develop considerably during the forecast period. The aviation market is growing rapidly all over the world as a result of feasible and high-speed needs. The oil and gas industry is expected to rise during the forecast period due to the fast increase in global demand and consumption of oil and gas.

Gas Turbine Market Share(%), by Application (2023)

Based on Power Rating, the market is segmented into below 40 MW, 40-120 MW, 120-300 MW, and above 300 MW. The turbines with power ratings of 120-300 MW are expected to dominate the market and are commonly selected for power generation. The increase is attributed to expanding urbanization, which is increasing product demand and increasing power use. The transition from coal to gas-fired power facilities is largely driving demand. Furthermore, the lower-size turbines aid in maintenance and operation, which is a key driving element.

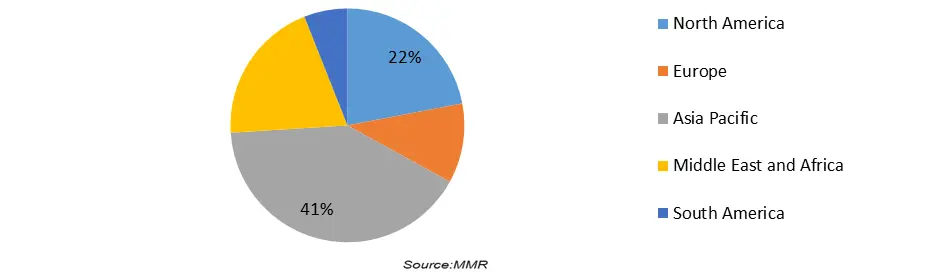

Gas Turbine Market Regional Insights:

Asia Pacific region dominated the market in the year 2023 with 41% market share and is expected to dominate the market during the forecast period. China, Japan, Indonesia, Thailand, and India are the countries that are expected to grow at the fastest rate. Emerging economies such as India and China, as well as labor and low-cost raw materials, are tempting international corporations to extend their operations in this region. Rapid industrialization and urbanization increased the consumption of energy, as well as the desire for sustainable energy solutions like renewable energy, and hence the demand for the industrial gas turbine market. This region is heavily reliant on coal for electricity generation and coal burning, both of which create pollution. This region's governments have taken many initiatives to reduce carbon emissions using Gas turbine emissions, which have increased owing to the deployment of these turbines in Japan, China, India, Australia, and South Korea. Europe region is expected to reach a CAGR of xx% during the forecast period. This region is working hard to minimize the emissions of carbon, numerous nations have opted to phase out coal and nuclear power plants from their energy mix. The emphasis is shifting toward gas-powered turbine Types, which run on natural gas and may be utilized as an alternative to coal. Natural gas contributes far less than coal. This is why it will fuel market growth in the European area. North America, dominated by the United States, Mexico, and Canada, is expected to develop at a rapid pace during the forecast period. The shale gas deposit and technical advancements in extraction and mining technologies, which are continually decreasing the operational cost of gas extraction in the region, are driving demand. Furthermore, large-scale gas-based power plant commissioning has occurred in the North American area. Because of technical advances in completion methods like as multistage hydraulic fracturing and drilling techniques such as horizontal wellbores, oil and gas firms have been able to create shale gas on a commercial scale. According to trends, the aforementioned technical developments, as well as commercial shale gas production, are expected to propel the regional market in the near future. Saudi Arabia is a significant end-user of the Gas turbines and steam turbine market in the Middle East and Africa area. As a result, the country now has a huge number of Gas Turbine suppliers, all of whom are vying for a larger market share. Major OEMs such as Siemens Energy, General Electric, and Mitsubishi Power, Ltd. supply Gas turbines throughout the country.Gas Turbine Market Share(%), by Region in 2023

Report Scope:

The Gas Turbine Market research report includes product categorization, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, and the most recent dynamic analysis, among other things. The study discusses the worldwide market's drivers, opportunities, and limitations. It discusses the influence of various drivers, trends, and constraints on market demand during the forecast period. The research also outlines market potential on a global scale. The research includes the production time, base distribution, technical characteristics, research and development trends, technology sources, and raw material sources of significant Gas Turbine Market firms in terms of production bases and technologies. The more precise research also contains the key application areas of market and consumption, significant regions and consumption, major producers, distributors, raw material suppliers, equipment providers, and their contact information, as well as an analysis of the industry chain relationship. This report's study also contains product specifications, manufacturing processes, cost structure, and data information organized by area, technology, and application. The objective of the report is to present a comprehensive analysis of the Gas Turbine Market including all the stakeholders of the Technology. The past and current status of the Technology with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Technology with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Technology to the decision-makers. The report also helps in understanding the Gas Turbine Market dynamics, and structure by analyzing the market segments and projecting the Gas Turbine Market size. Clear representation of competitive analysis of key players by type, price, financial position, Type portfolio, growth strategies, and regional presence in the Gas Turbine Market makes the report an investor’s guide.Gas Turbine Market Scope: Inquiry Before Buying

Gas Turbine Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 20.228 Bn. Forecast Period 2024 to 2030 CAGR: 3.6% Market Size in 2030: US$ 25.98 Bn. Segments Covered: by Type Heavy Duty Aeroderivative by Technology Open cycle Combined cycle by Power Rating Below 40 40-120 120-300 Above 300 by Application Power generation Oil & gas Aerospace Process plants Gas Turbine Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Gas Turbine Market Key Players

1) General Electric Company 2) Siemens AG 3) Mitsubishi Hitachi Power Systems, Ltd. 4) Rolls-Royce Holdings plc 5) Ansaldo Energia S.p.A. 6) Solar Turbines Incorporated 7) Bharat Heavy Electricals Limited (BHEL) 8) Kawasaki Heavy Industries, Ltd. 9) Man Energy Solutions SE 10) Caterpillar Inc. 11) Harbin Electric Company Limited 12) Sulzer Ltd. 13) MTU Aero Engines AG 14) EthosEnergy Group 15) PW Power Systems, Inc. 16) NPO Saturn Frequently Asked Questions: 1] What segments are covered in the Global Gas Turbine Market report? Ans. The segments covered in the Gas Turbine Market report are based on Type, Application, Technology, Power Rating, and Region. 2] Which region is expected to hold the highest share of the Global Gas Turbine Market? Ans. The Asia Pacific region which includes countries such as China, South Korea, Japan are expected to hold the highest share of the Gas Turbine Market. 3] What is the market size of the Global Gas Turbine Market by 2030? Ans. The market size of the Gas Turbine Market by 2030 is expected to reach US$ 25.98 Bn. 4] What is the forecast period for the Global Gas Turbine Market? Ans. The forecast period for the Gas Turbine Market is 2024-2030. 5] What was the market size of the Global Gas Turbine Market in 2023? Ans. The market size of the Gas Turbine Market in 2023 was valued at US$ 20.28 Bn.

1. Gas Turbine Market: Research Methodology 2. Gas Turbine Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 2.4. Impact of Uncertain Gas Prices on Gas Turbine Industry 3. Gas Turbine Market: Dynamics 3.1. Gas Turbine Market Trends 3.2. Gas Turbine Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape 3.7. Key Opinion Leader Analysis for Gas Turbine Market 3.8. Analysis of Government Schemes and Initiatives for Gas Turbine Market 3.9. The Global Pandemic Impact on Gas Turbine Market 3.10. Trade Analysis 3.10.1. Top Importing Countries 3.10.2. Top Exporting Countries 4. Gas Turbine Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 4.1. Gas Turbine Market Size and Forecast, by Type (2023-2030) 4.1.1. Heavy Duty 4.1.2. Aero-derivative 4.2. Gas Turbine Market Size and Forecast, by Technology (2023-2030) 4.2.1. Open cycle 4.2.2. Combined cycle 4.3. Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 4.3.1. Below 40 4.3.2. 40-120 4.3.3. 120-300 4.3.4. Above 300 4.4. Gas Turbine Market Size and Forecast, by Application (2023-2030) 4.4.1. Power generation 4.4.2. Oil & gas 4.4.3. Aerospace 4.4.4. Process plants 4.5. Gas Turbine Market Size and Forecast, by Region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Gas Turbine Market Size and Forecast, by Type (2023-2030) 5.1.1. Heavy Duty 5.1.2. Aero-derivative 5.2. North America Gas Turbine Market Size and Forecast, by Technology (2023-2030) 5.2.1. Open cycle 5.2.2. Combined cycle 5.3. North America Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 5.3.1. Below 40 5.3.2. 40-120 5.3.3. 120-300 5.3.4. Above 300 5.4. Gas Turbine Market Size and Forecast, by Application (2023-2030) 5.4.1. Power generation 5.4.2. Oil & gas 5.4.3. Aerospace 5.4.4. Process plants 5.5. North America Gas Turbine Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Gas Turbine Market Size and Forecast, by Type (2023-2030) 5.5.1.1.1. Heavy Duty 5.5.1.1.2. Aero-derivative 5.5.1.2. United States Gas Turbine Market Size and Forecast, by Technology (2023-2030) 5.5.1.2.1. Open cycle 5.5.1.2.2. Combined cycle 5.5.1.3. United States Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 5.5.1.3.1. Below 40 5.5.1.3.2. 40-120 5.5.1.3.3. 120-300 5.5.1.3.4. Above 300 5.5.1.4. United States Gas Turbine Market Size and Forecast, by Application (2023-2030) 5.5.1.4.1. Power generation 5.5.1.4.2. Oil & gas 5.5.1.4.3. Aerospace 5.5.1.4.4. Process plants 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Gas Turbine Market Size and Forecast, by Type (2023-2030) 5.5.2.1.1. Heavy Duty 5.5.2.1.2. Aero-derivative 5.5.2.2. Canada Gas Turbine Market Size and Forecast, by Technology (2023-2030) 5.5.2.2.1. Open cycle 5.5.2.2.2. Combined cycle 5.5.2.3. Canada Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 5.5.2.3.1. Below 40 5.5.2.3.2. 40-120 5.5.2.3.3. 120-300 5.5.2.3.4. Above 300 5.5.2.4. Canada Gas Turbine Market Size and Forecast, by Application (2023-2030) 5.5.2.4.1. Power generation 5.5.2.4.2. Oil & gas 5.5.2.4.3. Aerospace 5.5.2.4.4. Process plants 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Gas Turbine Market Size and Forecast, by Type (2023-2030) 5.5.3.1.1. Heavy Duty 5.5.3.1.2. Aero-derivative 5.5.3.2. Mexico Gas Turbine Market Size and Forecast, by Technology (2023-2030) 5.5.3.2.1. Open cycle 5.5.3.2.2. Combined cycle 5.5.3.3. Mexico Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 5.5.3.3.1. Below 40 5.5.3.3.2. 40-120 5.5.3.3.3. 120-300 5.5.3.3.4. Above 300 5.5.3.4. Mexico Gas Turbine Market Size and Forecast, by Application (2023-2030) 5.5.3.4.1. Power generation 5.5.3.4.2. Oil & gas 5.5.3.4.3. Aerospace 5.5.3.4.4. Process plants 5.5.3.4.5. Others 6. Europe Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.2. Europe Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.3. Europe Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.4. Europe Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5. Europe Gas Turbine Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.1.2. United Kingdom Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.1.3. United Kingdom Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.1.4. United Kingdom Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5.2. France 6.5.2.1. France Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.2.2. France Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.2.3. France Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.2.4. France Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Germany Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.3.3. Germany Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.3.4. Germany Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.4.2. Italy Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.4.3. Italy Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.4.4. Italy Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Spain Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.5.3. Spain Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.5.4. Spain Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Sweden Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.6.3. Sweden Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.6.4. Sweden Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5.7. Austria 6.5.7.1. Austria Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Austria Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.7.3. Austria Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.7.4. Austria Gas Turbine Market Size and Forecast, by Application (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Gas Turbine Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Rest of Europe Gas Turbine Market Size and Forecast, by Technology (2023-2030) 6.5.8.3. Rest of Europe Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 6.5.8.4. Rest of Europe Gas Turbine Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.3. Asia Pacific Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.4. Asia Pacific Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5. Asia Pacific Gas Turbine Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.1.2. China Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. China Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.1.4. China Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.2.2. S Korea Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. S Korea Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.2.4. S Korea Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Japan Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Japan Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.3.4. Japan Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.4. India 7.5.4.1. India Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.4.2. India Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. India Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.4.4. India Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.5.2. Australia Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.5.3. Australia Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.5.4. Australia Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.6.2. Indonesia Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.6.3. Indonesia Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.6.4. Indonesia Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.7.2. Malaysia Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.7.3. Malaysia Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.7.4. Malaysia Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.8.2. Vietnam Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.8.3. Vietnam Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.8.4. Vietnam Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.9.2. Taiwan Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.9.3. Taiwan Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.9.4. Taiwan Gas Turbine Market Size and Forecast, by Application (2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Gas Turbine Market Size and Forecast, by Type (2023-2030) 7.5.10.2. Rest of Asia Pacific Gas Turbine Market Size and Forecast, by Technology (2023-2030) 7.5.10.3. Rest of Asia Pacific Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 7.5.10.4. Rest of Asia Pacific Gas Turbine Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Gas Turbine Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Gas Turbine Market Size and Forecast, by Technology (2023-2030) 8.3. Middle East and Africa Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 8.4. Middle East and Africa Gas Turbine Market Size and Forecast, by Application (2023-2030) 8.5. Middle East and Africa Gas Turbine Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Gas Turbine Market Size and Forecast, by Type (2023-2030) 8.5.1.2. South Africa Gas Turbine Market Size and Forecast, by Technology (2023-2030) 8.5.1.3. South Africa Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 8.5.1.4. South Africa Gas Turbine Market Size and Forecast, by Application (2023-2030) 8.5.2. GCC 8.5.2.1. GCC Gas Turbine Market Size and Forecast, by Type (2023-2030) 8.5.2.2. GCC Gas Turbine Market Size and Forecast, by Technology (2023-2030) 8.5.2.3. GCC Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 8.5.2.4. GCC Gas Turbine Market Size and Forecast, by Application (2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Gas Turbine Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Nigeria Gas Turbine Market Size and Forecast, by Technology (2023-2030) 8.5.3.3. Nigeria Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 8.5.3.4. Nigeria Gas Turbine Market Size and Forecast, by Application (2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Gas Turbine Market Size and Forecast, by Type (2023-2030) 8.5.4.2. Rest of ME&A Gas Turbine Market Size and Forecast, by Technology (2023-2030) 8.5.4.3. Rest of ME&A Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 8.5.4.4. Rest of ME&A Gas Turbine Market Size and Forecast, by Application (2023-2030) 9. South America Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Gas Turbine Market Size and Forecast, by Type (2023-2030) 9.2. South America Gas Turbine Market Size and Forecast, by Technology (2023-2030) 9.3. South America Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 9.4. South America Gas Turbine Market Size and Forecast, by Application (2023-2030) 9.5. South America Gas Turbine Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Gas Turbine Market Size and Forecast, by Type (2023-2030) 9.5.1.2. Brazil Gas Turbine Market Size and Forecast, by Technology (2023-2030) 9.5.1.3. Brazil Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 9.5.1.4. Brazil Gas Turbine Market Size and Forecast, by Application (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Gas Turbine Market Size and Forecast, by Type (2023-2030) 9.5.2.2. Argentina Gas Turbine Market Size and Forecast, by Technology (2023-2030) 9.5.2.3. Argentina Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 9.5.2.4. Argentina Gas Turbine Market Size and Forecast, by Application (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Gas Turbine Market Size and Forecast, by Type (2023-2030) 9.5.3.2. Rest Of South America Gas Turbine Market Size and Forecast, by Technology (2023-2030) 9.5.3.3. Rest Of South America Gas Turbine Market Size and Forecast, by Power Rating (2023-2030) 9.5.3.4. Rest Of South America Gas Turbine Market Size and Forecast, by Application (2023-2030) 10. Global Gas Turbine Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Application Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Gas Turbine Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. General Electric Company 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. General Electric Company 11.3. Siemens AG 11.4. Mitsubishi Hitachi Power Systems, Ltd. 11.5. Rolls-Royce Holdings plc 11.6. Ansaldo Energia S.p.A. 11.7. Solar Turbines Incorporated 11.8. Bharat Heavy Electricals Limited (BHEL) 11.9. Kawasaki Heavy Industries, Ltd. 11.10. Man Energy Solutions SE 11.11. Caterpillar Inc. 11.12. Harbin Electric Company Limited 11.13. Sulzer Ltd. 11.14. MTU Aero Engines AG 11.15. EthosEnergy Group 11.16. PW Power Systems, Inc. 11.17. NPO Saturn 12. Key Findings 13. Industry Recommendations