Global Food Blenders and Mixers Market size was valued at USD 8.93 Bn. in 2023 and the total Food Blenders and Mixers revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 13.7 Bn.Food Blenders and Mixers Market Overview:

Food blenders and mixers are kitchen appliances used to blend, mix, or grind food ingredients. They consist of motorized bases blending jars, pitchers, or mixing bowls with controls and various attachments. Blenders are commonly used for tasks like making smoothies, sauces, soups, or pureeing fruits and vegetables. Nowadays Consumers are increasingly looking for blenders and mixers with multiple features such as pre-programmed settings, multiple speeds, and attachments. The increasing demand for healthy and convenient food, the rising popularity of home cooking, and the growing popularity of online shopping is driving the sales of food blenders and mixers during the forecast period.To know about the Research Methodology :- Request Free Sample Report The market for food blenders and mixers is highly competitive with a number of top manufacturers struggling for the lead in the market. Food Blenders and Mixers market key Players are using targeted marketing by advertising in trade publications and online, as well as attending trade shows and events to reach their target customers. Food blenders and mixer manufacturers' pricing strategy is determined by several factors such as the type of product, target market, competitive environment, and the manufacturer's goals. Hamilton Beach Brands Holding Company is a leading manufacturer of food blenders and mixers. The company's product line includes anything from basic blenders to high-powered mixers.

Food Blenders and Mixers Market Report Scope:

The report provides a quantitative analysis of the current Food Blenders and Mixers market drivers, restraints, trends, estimations, and opportunities of the market to identify the prevailing opportunities in the market during the forecast period. PORTER's five forces analysis shows the ability of buyers and suppliers to make profit-oriented strategic decisions and build their supplier-buyer network. In-depth analysis as well as the market size and segmentation assist in determining the current Food Blenders and Mixers market potential. Some factors that are supposed to affect the business positively or negatively have been analyzed in this report which will give a clear futuristic view of the industry to the decision-makers. The report presents a comprehensive analysis of the global Food Blenders and Mixers market to the stakeholders who want to invest in this market. The report includes past and current scenarios of the market with the forecasted market size. The report covers all the aspects of the market with a thorough study of key players that include market leaders, followers, and new entrants. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies like new product launches, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the internal or local market make the report investor’s guide. They are continuously strategizing on mergers & acquisitions for the expansion of their market share and growth opportunities during the forecast period.Food Blenders and Mixers Market Dynamics:

Growing Food Industry to Drive the Food Blenders and Mixers market The rising population has led to an increased demand for processed foods that are convenient, ready to eat, and require minimal preparation. Blenders and mixers help to meet this demand by providing efficient and effective food processing solutions. The food industry is focusing on optimizing production workflows and maximizing output. This has led to the adoption of advanced blenders and mixers with higher capacity and improved performance. Manufacturers of blenders and mixers have incorporated advanced features such as programmable settings, automated controls, improved motor power, and user-friendly designs to meet customer demand. The technological advancements meet the evolving needs of the food industry. Asia Pacific region is experiencing rapid growth in the food sector because of the growing population and increasing demand for convenience foods in this region. The region's growing consumer base and changing lifestyles have created a need for efficient and time-saving food processing equipment in the food industry for food processing, preparation, and packaging. Furthermore, the food service sectors such as a restaurant, cafes, and catering businesses have experienced significant growth in recent years. Food blenders and mixers have an important role in this sector to prepare sauces, dressings, beverages, and other culinary creations. The need for high-performance blenders and mixers that handles a range of ingredients has driven commercial-grade Food Blenders and Mixers market during the forecast period. Recent advancements in blenders & mixers design to drive the Food Blenders and Mixers market The advancements in food blenders & mixers design such as digital controls and wireless connectivity are making them more powerful, versatile, and user-friendly driving the demand for blenders and mixers, both in the commercial and residential markets. Food Blenders and Mixers market key players continue to innovate and introduce new features and technologies to meet demands. Some Food blenders and mixers now come with smart connectivity features of Bluetooth or Wi-Fi, which allow users to control the device from their smartphone or tablet. NutriBullet is a popular brand of personal blenders that are ideal for single servings. For instance, the NutriBullet Smart Touch Blender has a built-in scale and Bluetooth connectivity, so users can easily measure ingredients and track their progress while blending. Vitamix is a leading brand of high-quality blenders known for its innovative designs and powerful motors. The Vitamix Ascent Series blenders show recent advancements in blender design that bring together technological innovation, precise functionality, and enhanced user convenience. The notable improvements such as self-detect technology, wireless connectivity, variable speed control, and advanced blade technology contribute to a superior blending experience. With self-detect technology, the blender intelligently recognizes the container size and adjusts the blending settings accordingly, ensuring optimal performance. The addition of wireless connectivity enables users to access a wide range of recipes and utilize built-in timers and scales for precise measurements. Variable speed control empowers users to adjust blending speeds to suit their preferences or specific recipe requirements. The advanced blade technology used by Vitamix ensures durability and efficient blending, resulting in consistently smooth textures. The increased consumption of bakery and dairy products in developing countries drives the market Food blenders and mixers play a crucial role in the manufacturing of bakery and dairy products by enabling efficient mixing, blending, and processing of ingredients. Blenders are used in preparing cake batters, doughs, and fillings, while mixers are employed in the production of dairy-based items like yogurt and cheese. By incorporating food blenders and mixers into their operations, bakery manufacturers can enhance production capacities, ensure consistent product quality, and meet the increasing demand. This Food Blenders & Mixers equipment facilitate the effective mixing of ingredients, ensuring uniform distribution and proper integration of flavors, textures, and other essential components. As a result, the increased consumption of bakery and dairy products in developing countries is a significant driver for the Food Blenders and Mixers market. Food Blenders and Mixers market restraint The lack of awareness regarding the benefits of food blenders and mixers in certain underdeveloped regions poses a significant obstacle to the growth of the Food Blenders and Mixers market. The large footprint and high installation costs associated with systems make it challenging for small-scale industrial players to afford their implementation. Furthermore, global manufacturers of food blenders and mixers often limit their operations in developing or underdeveloped countries where the demand for such equipment is limited. As a result, the lack of knowledge and inadequate infrastructure support for food blenders and mixers are expected to hamper the Food Blenders and Mixers market's growth during the forecast period.Food Blenders and Mixers Market Segment Analysis:

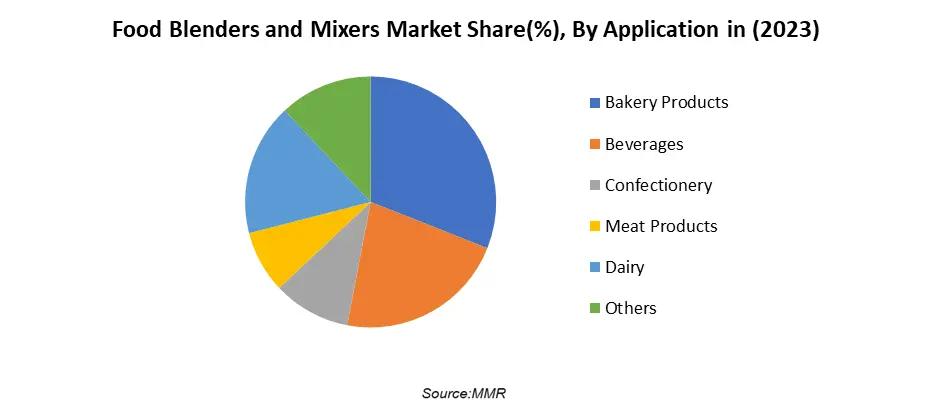

Based on the Type, the high shear mixers segment held the largest revenue share of 9.2 % in 2023 and is expected to grow during the forecast period. The demand for high-shear mixers is witnessing significant growth in various industries because of their unique capabilities and advantages. High-shear mixers offer faster processing times as compared to traditional mixing methods. Their high-speed rotation and intense shearing action reduce processing time, leading to increased productivity and cost savings for manufacturers. As a result, the Food Blenders and Mixers market is expected to grow during the forecast period.Based on the Application, the Bakery Products segment is expected to grow during the forecast period. The demand for Food Blenders & Mixers specifically for bakery applications is significant and shows a positive trend due to the increasing consumption of bakery products such as bread, cakes, pastries, and cookies. As consumer preferences for freshly baked goods and a wide variety of bakery items continue to rise, the need for food blenders and mixers in bakery production is also growing. Food Blenders and mixers play a crucial role in improving the efficiency and consistency of bakery manufacturing processes. They offer the capability to handle large quantities of ingredients, thereby reducing manual labor and ensuring consistent outcomes. By saving time and effort, these machines contribute to the optimization of production operations. Additionally, their precise control over mixing parameters allows for uniformity across batches, minimizing product variations and maintaining high-quality standards.

Food Blenders and Mixers Market Regional Insights:

In the North American region, the Food Blenders and Mixers market is expected to grow at a CAGR of 10.5% due to Increased demand for convenience foods, the presence of established food processing companies, and the Technological advancements in the manufacturing of Food Blenders & Mixers. Food Blenders and Mixers market key players in the region are focusing on introducing advanced features, such as automated controls, improved precision, energy efficiency, and easy maintenance, to cater to the evolving needs of the food processing industry. The food sectors in the North American region operate under stringent regulatory standards and quality control measures. Food blenders and mixers used in the region comply with these regulations to ensure food safety and meet the expectations of consumers regarding product quality and traceability. These factors are contributing to the continuous growth and development of the market in the region. The Food Blenders and Mixers market in this region is fragmented with a large number of small and medium-sized companies competing for market share. The leading players in the market such as Hamilton Beach, KitchenAid, Ninja, and Oster are focusing on innovation, product development, and marketing to maintain their market share. Europe has emerged as a prominent market for Food Blenders & Mixers, ranking second globally and experiencing rapid growth because of the growing food industry and the increasing consumer demand for convenience foods in the region. There is a constant need for efficient processing equipment with a diverse range of food sectors such as bakery, confectionery, dairy, and processed foods. The European market is characterized by a wide range of consumer tastes and preferences, resulting in a growing demand for diverse convenience food options.Ready-to-eat meals, bakery products, sauces, and spreads are among the food products experiencing increased popularity in the region. Food blenders and mixers are essential for ensuring consistent textures, flavors, and ingredient incorporation, ultimately delivering the desired product attributes that European consumers seek. By utilizing these Food Blenders & Mixers, manufacturers can ensure efficient mixing, blending, and processing of ingredients, resulting in consistent and high-quality food products. The Food Blenders and Mixers market key players in the food blenders and mixers market are GEA Group, Tetra Laval, SPX Flow, Alfa Laval, Marel, Krones, Sulzer, Buhler, John Bean Technologies, and KHS. The market leaders in Europe's food blenders and mixers segment are committed to meeting the evolving needs of consumers by offering efficient and technologically advanced blending and mixing solutions. Through continuous innovation and strategic expansions, these companies aim to enhance their market share and establish themselves as prominent players in the European market.

Food Blenders and Mixers Market Scope: Inquire before buying

Global Food Blenders and Mixers Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.93 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 13.7 Bn. Segments Covered: by Technology Continuous Mixing Batch Mixing by Type Double Cone Blender Screw Mixer & Blender High Shear Mixer Planetary Mixer Ribbon Blender Others by Application Bakery Products Beverages Confectionery Meat Products Dairy Others by End-User Household Commercial Others Food Blenders and Mixers Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Food Blenders and Mixers Market Key Players

1. Buhler Industries Inc (Switzerland) 2. GEA Group Aktiengesellschaft (Germany) 3. Hosokawa Micron Limited (Japan) 4. John Bean Technologies Corporation (US) 5. KHS GmbH (Germany) 6. Krones AG (Germany) 7. Marel HF (Iceland) 8. SPX Flow Inc (US) 9. Sulzer Ltd. (Switzerland) 10. Tetra Laval International S.A. (Switzerland) 11. Sulzer Ltd. (Switzerland) 12. Paul Mueller Co (U.S.) 13. Alfa Laval Corporate AB (Sweden) 14. EKATO Holding GmbH (Germany) 15. Philadelphia Mixing Solutions Ltd. (U.S.) 16. Diosna GmbH (Germany) 17. SilversonMachines Inc. (United Kingdom) 18. Fristam Pumps (U.S.) 19. Pentair PLC (The Netherlands) 20. ARDE Barinco (U.S.) 21. General Machine Company (GEMCo) (U.S.) Frequently Asked Questions: 1. Who are the key players in the Food Blenders and Mixers market? Ans. GEA Group (Germany), Tetra Laval (Switzerland), SPX Flow, (US), Alfa Laval (Sweden), Marel (Iceland), and Krones AG (Germany)are the major companies operating in the Food Blenders and Mixers market. 2. Which Type segment dominates the Food Blenders and Mixers market? Ans. The High Shear Mixer segment accounted for the largest share of the global Food Blenders and Mixers market in 2023. 3. How big is the Food Blenders and Mixers market? Ans. The Global Food Blenders and Mixers market size reached USD 8.93 Bn in 2023 and is expected to reach USD 13.7 Bn by 2030, growing at a CAGR of 6.3 % during the forecast period. 4. What are the key regions in the global Food Blenders and Mixers market? Ans. Based On the region, the Food Blenders and Mixers market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and Latin America. North America dominates the global Food Blenders and Mixers market. 5. What is the study period of this market? Ans. The Global Food Blenders and Mixers market is studied from 2023 to 2030.

1. Food Blenders and Mixers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Food Blenders and Mixers Market: Dynamics 2.1. Food Blenders and Mixers Market Trends by Region 2.1.1. North America Food Blenders and Mixers Market Trends 2.1.2. Europe Food Blenders and Mixers Market Trends 2.1.3. Asia Pacific Food Blenders and Mixers Market Trends 2.1.4. Middle East and Africa Food Blenders and Mixers Market Trends 2.1.5. South America Food Blenders and Mixers Market Trends 2.2. Food Blenders and Mixers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Food Blenders and Mixers Market Drivers 2.2.1.2. North America Food Blenders and Mixers Market Restraints 2.2.1.3. North America Food Blenders and Mixers Market Opportunities 2.2.1.4. North America Food Blenders and Mixers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Food Blenders and Mixers Market Drivers 2.2.2.2. Europe Food Blenders and Mixers Market Restraints 2.2.2.3. Europe Food Blenders and Mixers Market Opportunities 2.2.2.4. Europe Food Blenders and Mixers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Food Blenders and Mixers Market Drivers 2.2.3.2. Asia Pacific Food Blenders and Mixers Market Restraints 2.2.3.3. Asia Pacific Food Blenders and Mixers Market Opportunities 2.2.3.4. Asia Pacific Food Blenders and Mixers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Food Blenders and Mixers Market Drivers 2.2.4.2. Middle East and Africa Food Blenders and Mixers Market Restraints 2.2.4.3. Middle East and Africa Food Blenders and Mixers Market Opportunities 2.2.4.4. Middle East and Africa Food Blenders and Mixers Market Challenges 2.2.5. South America 2.2.5.1. South America Food Blenders and Mixers Market Drivers 2.2.5.2. South America Food Blenders and Mixers Market Restraints 2.2.5.3. South America Food Blenders and Mixers Market Opportunities 2.2.5.4. South America Food Blenders and Mixers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Food Blenders and Mixers Industry 2.8. Analysis of Government Schemes and Initiatives For Food Blenders and Mixers Industry 2.9. Food Blenders and Mixers Market Trade Analysis 2.10. The Global Pandemic Impact on Food Blenders and Mixers Market 3. Food Blenders and Mixers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 3.1.1. Continuous Mixing 3.1.2. Batch Mixing 3.2. Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 3.2.1. Double Cone Blender 3.2.2. Screw Mixer & Blender 3.2.3. High Shear Mixer 3.2.4. Planetary Mixer 3.2.5. Ribbon Blender 3.2.6. Others 3.3. Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 3.3.1. Bakery Products 3.3.2. Beverages 3.3.3. Confectionery 3.3.4. Meat Products 3.3.5. Dairy 3.3.6. Others 3.4. Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 3.4.1. Household 3.4.2. Commercial 3.4.3. Others 3.5. Food Blenders and Mixers Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Food Blenders and Mixers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 4.1.1. Continuous Mixing 4.1.2. Batch Mixing 4.2. North America Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 4.2.1. Double Cone Blender 4.2.2. Screw Mixer & Blender 4.2.3. High Shear Mixer 4.2.4. Planetary Mixer 4.2.5. Ribbon Blender 4.2.6. Others 4.3. North America Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 4.3.1. Bakery Products 4.3.2. Beverages 4.3.3. Confectionery 4.3.4. Meat Products 4.3.5. Dairy 4.3.6. Others 4.4. North America Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 4.4.1. Household 4.4.2. Commercial 4.4.3. Others 4.5. North America Food Blenders and Mixers Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 4.5.1.1.1. Continuous Mixing 4.5.1.1.2. Batch Mixing 4.5.1.2. United States Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 4.5.1.2.1. Double Cone Blender 4.5.1.2.2. Screw Mixer & Blender 4.5.1.2.3. High Shear Mixer 4.5.1.2.4. Planetary Mixer 4.5.1.2.5. Ribbon Blender 4.5.1.2.6. Others 4.5.1.3. United States Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Bakery Products 4.5.1.3.2. Beverages 4.5.1.3.3. Confectionery 4.5.1.3.4. Meat Products 4.5.1.3.5. Dairy 4.5.1.3.6. Others 4.5.1.4. United States Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Household 4.5.1.4.2. Commercial 4.5.1.4.3. Others 4.5.2. Canada 4.5.2.1. Canada Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 4.5.2.1.1. Continuous Mixing 4.5.2.1.2. Batch Mixing 4.5.2.2. Canada Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 4.5.2.2.1. Double Cone Blender 4.5.2.2.2. Screw Mixer & Blender 4.5.2.2.3. High Shear Mixer 4.5.2.2.4. Planetary Mixer 4.5.2.2.5. Ribbon Blender 4.5.2.2.6. Others 4.5.2.3. Canada Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Bakery Products 4.5.2.3.2. Beverages 4.5.2.3.3. Confectionery 4.5.2.3.4. Meat Products 4.5.2.3.5. Dairy 4.5.2.3.6. Others 4.5.2.4. Canada Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Household 4.5.2.4.2. Commercial 4.5.2.4.3. Others 4.5.3. Mexico 4.5.3.1. Mexico Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 4.5.3.1.1. Continuous Mixing 4.5.3.1.2. Batch Mixing 4.5.3.2. Mexico Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 4.5.3.2.1. Double Cone Blender 4.5.3.2.2. Screw Mixer & Blender 4.5.3.2.3. High Shear Mixer 4.5.3.2.4. Planetary Mixer 4.5.3.2.5. Ribbon Blender 4.5.3.2.6. Others 4.5.3.3. Mexico Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Bakery Products 4.5.3.3.2. Beverages 4.5.3.3.3. Confectionery 4.5.3.3.4. Meat Products 4.5.3.3.5. Dairy 4.5.3.3.6. Others 4.5.3.4. Mexico Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Household 4.5.3.4.2. Commercial 4.5.3.4.3. Others 5. Europe Food Blenders and Mixers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.3. Europe Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.4. Europe Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5. Europe Food Blenders and Mixers Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.1.2. United Kingdom Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.1.3. United Kingdom Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.2.2. France Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.2.3. France Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.3.2. Germany Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.3.3. Germany Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.4.2. Italy Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.4.3. Italy Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.5.2. Spain Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.5.3. Spain Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.6.2. Sweden Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.6.3. Sweden Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.7.2. Austria Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.7.3. Austria Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 5.5.8.2. Rest of Europe Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 5.5.8.3. Rest of Europe Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Food Blenders and Mixers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Food Blenders and Mixers Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.1.2. China Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.1.3. China Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.2.2. S Korea Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.2.3. S Korea Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.3.2. Japan Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.3.3. Japan Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.4.2. India Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.4.3. India Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.5.2. Australia Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.5.3. Australia Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.6.2. Indonesia Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.6.3. Indonesia Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.7.2. Malaysia Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.7.3. Malaysia Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.8.2. Vietnam Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.8.3. Vietnam Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.9.2. Taiwan Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.9.3. Taiwan Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 6.5.10.2. Rest of Asia Pacific Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Food Blenders and Mixers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Food Blenders and Mixers Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 7.5.1.2. South Africa Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 7.5.1.3. South Africa Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 7.5.2.2. GCC Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 7.5.2.3. GCC Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 7.5.3.2. Nigeria Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 7.5.3.3. Nigeria Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 7.5.4.2. Rest of ME&A Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 7.5.4.3. Rest of ME&A Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 8. South America Food Blenders and Mixers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 8.2. South America Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 8.3. South America Food Blenders and Mixers Market Size and Forecast, by Application(2023-2030) 8.4. South America Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 8.5. South America Food Blenders and Mixers Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 8.5.1.2. Brazil Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 8.5.1.3. Brazil Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 8.5.2.2. Argentina Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 8.5.2.3. Argentina Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Food Blenders and Mixers Market Size and Forecast, by Technology (2023-2030) 8.5.3.2. Rest Of South America Food Blenders and Mixers Market Size and Forecast, by Type (2023-2030) 8.5.3.3. Rest Of South America Food Blenders and Mixers Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Food Blenders and Mixers Market Size and Forecast, by End User (2023-2030) 9. Global Food Blenders and Mixers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Food Blenders and Mixers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Buhler Industries Inc (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. GEA Group Aktiengesellschaft (Germany) 10.3. Hosokawa Micron Limited (Japan) 10.4. John Bean Technologies Corporation (US) 10.5. KHS GmbH (Germany) 10.6. Krones AG (Germany) 10.7. Marel HF (Iceland) 10.8. SPX Flow Inc (US) 10.9. Sulzer Ltd. (Switzerland) 10.10. Tetra Laval International S.A. (Switzerland) 10.11. Sulzer Ltd. (Switzerland) 10.12. Paul Mueller Co (U.S.) 10.13. Alfa Laval Corporate AB (Sweden) 10.14. EKATO Holding GmbH (Germany) 10.15. Philadelphia Mixing Solutions Ltd. (U.S.) 10.16. Diosna GmbH (Germany) 10.17. SilversonMachines Inc. (United Kingdom) 10.18. Fristam Pumps (U.S.) 10.19. Pentair PLC (The Netherlands) 10.20. ARDE Barinco (U.S.) 10.21. General Machine Company (GEMCo) (U.S.) 11. Key Findings 12. Industry Recommendations 13. Food Blenders and Mixers Market: Research Methodology 14. Terms and Glossary