The Fermented Milk Market size was valued at USD 305.97 Billion in 2024 and the total Fermented Milk revenue is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 469.56 Billion.Fermented Milk Industry Snapshot

Fermented milk, a product steeped in tradition and cultural significance across various civilizations, unveils a tapestry of benefits that transcend its culinary origins. The alchemy of fermentation, orchestrated by the synergy between milk and lactic acid bacteria, not only imparts a delightful tang but also orchestrates a profound metamorphosis in its nutritional profile. As enzymes break down milk proteins and lactose, the resulting fermented milk emerges as a lifeline for those battling dietary challenges. For individuals with milk protein allergies and lactose intolerance, this transformation offers a pathway to digestibility, enabling a broader spectrum of individuals to partake in its nourishment within the expanding Fermented Milk Market. Yet, the allure of fermented milk extends far beyond its digestive virtues. Positioned as a potential remedy for various health concerns, its spectrum of end users spans a vast landscape, providing diverse health-conscious consumers seeking wellness-oriented products.To know about the Research Methodology :- Request Free Sample Report From addressing everyday maladies like the common cold to mitigating antibiotic-induced digestive distress, fermented milk emerges as a comforting tonic for gastrointestinal upheavals. Its versatility shines in providing to conditions as diverse as eczema, high blood pressure, and elevated cholesterol levels, elevating its status as a potential dietary adjunct. In the realm of digestive health, its efficacy is particularly pronounced, offering solace to those navigating the intricacies of irritable bowel syndrome (IBS), and lactose intolerance, and even aiding in alleviating constipation. While fermented milk carries promises of ameliorating conditions such as asthma, hay fever, and stomach ulcers, scientific substantiation remains a frontier ripe for exploration. Rapid empirical evidence validating these purported benefits calls for comprehensive scrutiny and thorough investigation, especially within the expanding Fermented Milk Market. As health consciousness continues to soar, fermented milk stands poised at the intersection of traditional wisdom and contemporary wellness, inviting research to unlock its full potential within this burgeoning market segment. The quest for a deeper understanding of its multifaceted benefits fuels ongoing, encouraging a nuanced exploration into the enigmatic world of fermented milk and its intricate role in fostering holistic well-being.

Trend

Rise of Personalized Probiotics The fermenting world of milk products is experiencing a seismic trend driven by the fusion of probiotics, varied substrates, and inventive manufacturing techniques. With a lineage spanning centuries, fermented milk has undergone a revolution, especially with the infusion of probiotics, catapulting it into an era of ingenuity. A myriad of substrates, from cow to camel milk, adds distinct characteristics to age-old favorites like kefir and koumiss. Today's fermented milk repertoire hosts a diverse palette of probiotic strains, particularly Lactobacillus and Bifidobacterium, meticulously co-fermented within the substrates, infusing each product with unique attributes. The production process mirrors traditional fermentation practices but now necessitates tailored incubation for individual probiotic strains. Techniques range from direct substrate fermentation to introducing probiotics into starter cultures, birthing a diverse range of beverages, including ambient-temperature brews and specialized probiotic-infused variants that redefine Fermented Milk Market standards. Innovation extends beyond probiotics to embrace additives like sweeteners, thickeners, and prebiotics, revolutionizing contemporary fermented milk production. These enhancements supplement probiotics, enriching products with enhanced nutritional profiles and heightened appeal. Novel iterations such as ambient-temperature varieties, infused with roasted flavors or fortified with probiotics, lead the innovation charge, providing to a diverse consumer base. Quality assurance remains pivotal, necessitating adherence to legal standards and vigilant manufacturing practices to address concerns and ensure product integrity. The most compelling facet of this trend emerges unveiling the profound health potential of probiotic fermented milk.Fermented Milk Market Key Dynamics

Driver Rising Health Awareness Fuels Fermented Milk's Surge as a Digestive Champion and Gut Health Ally to Drive Market Growth Consumers are increasingly recognizing the essential role of gut health in overall well-being. Scientific research highlighting the significance of a balanced gut microbiome in supporting immunity, digestion, mental health, and various physiological functions has driven this awareness. Fermented milk, teeming with probiotics and beneficial bacteria, aligns perfectly with this narrative as it aids in nurturing a healthy gut environment. The market's growth is propelled by consumers seeking natural, gut-friendly options to support their overall health. Fermented milk products are perceived as functional foods due to their inherent properties that assist in digestion. With lactose intolerance being a prevalent issue, fermented milk's ability to break down lactose and make dairy more digestible for individuals with intolerance or sensitivity serves as a significant driver. The Fermented Milk Market capitalizes on this by offering solutions to consumers who struggle with traditional dairy products, positioning fermented milk as a digestible, gut-friendly alternative. Probiotics found in fermented milk are linked to immune system support. As immunity gains attention as a cornerstone of overall health, consumers are drawn to products that offer this added benefit. Fermented milk, with its probiotic content, is increasingly seen as a convenient way to incorporate immune-boosting elements into one's diet, contributing to its market growth. There's a notable shift in consumer preferences towards natural, minimally processed, and functional foods. Fermented milk aligns perfectly with these preferences, being a natural product transformed by fermentation, packed with live cultures and nutrients. The market's expansion is fueled by consumers seeking healthier, wholesome options that not only provide sustenance but also offer functional health benefits. Fermented milk products are becoming staples in the broader health and wellness narrative. They are viewed as not dairy products but as allies in promoting holistic well-being. As consumers increasingly prioritize health in their lifestyle choices, fermented milk's positioning as a digestive champion and gut health ally amplifies its relevance and drives Fermented Milk Market growth. Diversification and Product Innovation to Boost Market Growth Introducing a diverse range of fermented milk products appeals to a broader consumer base. Diversification allows manufacturers to provide to varying preferences, dietary needs, and cultural tastes. By offering options like flavored kefir, drinkable yogurts, or lactose-free fermented milk, companies attract consumers who have different flavor preferences or dietary restrictions, consequently expanding their market reach. Diversification aligns with the evolving health and wellness trends. Consumers are increasingly seeking functional foods that offer specific health benefits. Innovation in the Fermented Milk Market involves probiotic-rich variants and additions of vitamins, minerals, or plant-based ingredients, providing to health-conscious consumers seeking gut-friendly or immune-boosting products. These innovations captivate consumer interest, driving engagement within the market and meeting evolving health preferences. Unique product formulations, novel flavors, or convenient packaging entice consumers to explore and try new fermented milk offerings. This approach taps into consumer curiosity and the desire for novel food experiences, encouraging brand loyalty and repeat purchases. Amidst a competitive landscape, diversification through innovation offers a unique selling proposition. Companies that continuously innovate and diversify their fermented milk product lines set themselves apart, fostering a competitive edge in the Fermented Milk Market. This differentiation allows brands to command premium pricing and capture a loyal consumer base seeking distinct and innovative offerings. India's fermented milk production embodies a rich tradition, with Dahi, akin to Western yogurt, being its oldest variant, evolving into popular derivatives including Shrikhand and Lassi. These indigenous products offer significant dietary value and therapeutic properties. Enhancing traditional Dahi production involves employing acid and flavor-producing organisms, enabling a two-stage fermentation process for superior quality. Biotechnological strides advocate incorporating probiotics and beneficial bacteria, elevating nutritional properties. Innovations also propose leveraging bio-preservatives and gentle thermization for shelf-life extension, ensuring broader market accessibility. These advancements amalgamate tradition with biotechnological innovation, amplifying the nutritional prowess and market viability of India's revered fermented milk products. Restraints Regulatory complexities and compliance challenges to hamper Market Growth Making specific health claims about fermented milk products, especially those related to probiotics, requires substantial scientific evidence and regulatory approval. Obtaining these approvals is time-consuming and costly, and often necessitates extensive clinical trials or studies. Meeting these standards delays product launches and limits the scope of health-related marketing claims. Operating in different regions or countries involves navigating diverse regulatory frameworks, each with its own set of standards and approval processes. Adhering to these varying standards requires comprehensive understanding and adaptation, adding complexity and costs to market entry and product compliance efforts. Stringent regulations often restrict manufacturers from effectively communicating the health benefits of fermented milk products to consumers. The limitations in making specific health claims or conveying complex scientific information to consumers hinder their understanding of the product's benefits, impacting consumer perception and Fermented Milk Market adoption. Compliance requirements also limit product innovation and formulation changes. Implementing novel ingredients or introducing improved strains of probiotics face regulatory hurdles, slowing down the pace of innovation within the market.Fermented Milk Market Segment Overview

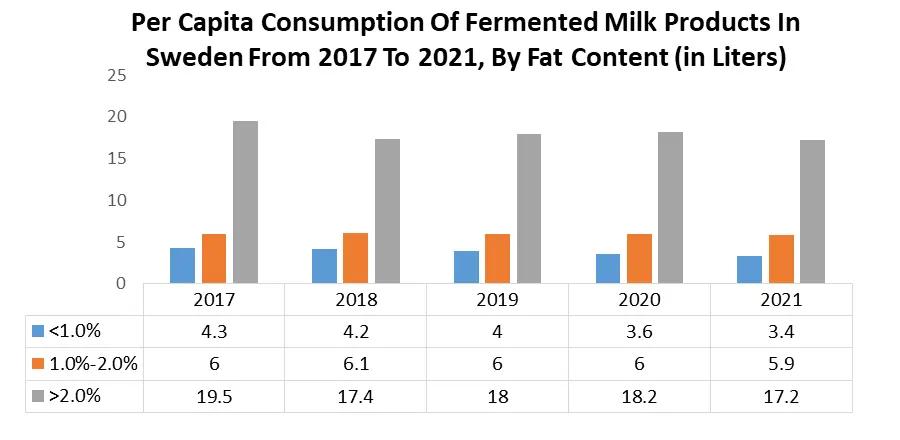

Based on the Product Type, Yogurt product type is expected to dominate the Fermented Milk Market during the forecast period. Yogurt stands tall as the predominant type within the realm of fermented milk products, offering an array of science-backed health benefits that beckon consumers worldwide. Yogurt's magic comes from fermenting milk with bacteria, giving it a creamy texture and loads of nutrients. It's a nutrient-packed powerhouse, with calcium for strong bones, B vitamins (like B12 and riboflavin) for heart health, and essential minerals (phosphorus, magnesium, potassium) regulating blood pressure and metabolism. Beyond its nutrient richness, yogurt packs a protein punch, with 12 grams per 8-ounce serving. Protein's prowess in supporting metabolism and regulating appetite renders yogurt not just a satisfying snack but a potential ally in weight management. Particularly, Greek yogurt, dense with 20 grams of protein in 7 ounces, offers heightened satiety, influencing appetite management and potentially curbing overall calorie intake. Certain yogurt variations contain live probiotics, beneficial bacteria renowned for digestive health. Strains like Bifidobacteria and Lactobacillus offer numerous benefits, easing irritable bowel syndrome and reducing antibiotic-associated digestive issues. These live cultures are integral within the Fermented Milk Market in Europe, promoting digestive wellness and expanding the realm of functional dairy products. Yogurt's immune-boosting potential comes to the fore, armed with probiotics that reduce inflammation and even shorten the duration and severity of the common cold. Fortified with essential vitamins like D, yogurt strengthens the immune system, potentially defending against various diseases. In heart health discussions, while debate surrounds its saturated fat, research hints at yogurt's nuanced impact. Evidence suggests whole milk yogurt's saturated fats boost HDL (good) cholesterol, potentially guarding against heart disease. Its contribution to lowering high blood pressure emphasizes yogurt's significance in heart-healthy diets within the expanding Fermented Milk Market in Europe. Sweden's per capita consumption of fermented milk, including yogurt, kefir, and cultured buttermilk, varies based on fat content, with a leaning towards low-fat and non-fat options. The European market thrives on health awareness, diverse products, organic demand, innovations, and the rising interest in plant-based alternatives. Recent post-2022 data needs updated industry reports for specifics.

Fermented Milk Market Regional Insights

Europe dominated the Fermented Milk Market in 2024 with the largest market share. Fermented milk products like yogurt, kefir, and various cheese varieties have been part of European diets for centuries. The longstanding tradition of consuming these products has created a strong market base. European countries offer a wide array of fermented milk products, providing to diverse tastes and preferences. This variety attracts both local consumers and international markets. European consumers are increasingly health-conscious, seeking products that offer probiotic benefits and improved digestive health. Fermented milk products are known for these health benefits, further driving their popularity in the region. Europe has a strong dairy industry with advanced production technologies and infrastructure. This allows for efficient manufacturing and distribution of fermented milk products, ensuring high-quality standards and availability. European companies continuously innovate in product development, flavors, packaging, and marketing strategies. This innovation keeps the market dynamic and meets evolving consumer demands. European countries often export their fermented dairy products worldwide, leveraging their reputation for quality and authenticity. This export capability contributes to the dominance of European products in the global fermented milk market. Europe boasts traditional products including yogurt, kefir, and various cheeses. The market thrives due to cultural heritage, health consciousness, innovation, and a strong dairy industry.Table No 1. Traditional Fermented Milk Products in Europe

Sweden exhibits a prominent production volume of organic fermented milk products, reflecting the nation's emphasis on sustainable and health-oriented dairy options. Within Europe's vibrant Fermented Milk Market, Sweden contributes to the region's increasing demand for these products, aligning with broader trends favoring organic, probiotic-rich offerings. The country's commitment to quality and eco-consciousness resonates with the evolving consumer preferences for wholesome and environmentally friendly choices, influencing the trajectory of fermented dairy consumption across the European market.

Country Fermented Milk Product Description Scandinavia Tettemelk, Langfil, Pitkapiima Thick and sticky fermented milk products with unique consistency and flavor due to Lactococcus lactis subsp. cremoris Iceland Skyr Thick, protein-rich fermented milk product made by mixing and curdling skim milk with lactic acid bacteria and rennet Sweden, Langfil, Filmjölk, Lactofil Thick fermented milk product typically made in Lapland and a traditional cultured dairy made with mesophilic lactic acid bacteria Denmark Ymer, Tykmaelk Fermented milk products with high protein content and mild texture, and cultured dairy made with butter starters Norway Tettemelk, Melkering Thick fermented milk product with sour flavor and a cultured dairy made with mesophilic lactic acid bacteria Finland Piima Pitkapiima, Viili, Kokkelipiima Viscous fermented milk products, condensed cultured milk, cultured milk products with velvety milk fungi, and condensed cultured milk are traditionally made by fermenting milk and heating it in the oven Asia Pacific and North America are expected to have a significant growth rate for the fermented milk market during the forecast period. Japan and South Korea have extensive cultural backgrounds in consuming fermented dairy items like yogurt, kefir, and traditional fermented milk beverages over many generations. These products are ingrained in their culinary traditions. There's a growing awareness of the health benefits associated with fermented milk products in Asia Pacific. The demand for probiotics in these items is rising due to their digestive health benefits. The region's expanding urban population has spurred a shift in dietary preferences. There's a rising demand for convenient and healthy food options, including fermented milk products, among urban consumers. North American consumers are increasingly health-conscious and are actively seeking products that offer health benefits. Fermented milk products fit into this trend due to their probiotic content and associated health advantages. North America has a culturally diverse population with varying dietary preferences. This diversity encourages a wide variety of fermented milk products from different cultural backgrounds, providing to various tastes. Companies in North America have focused on innovation, introducing new types of fermented milk products and flavors to attract consumers. This innovation has expanded the market and increased consumer interest.

Fermented Milk Market Scope : Inquire Before Buying

Global Fermented Milk Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 305.97 Bn. Forecast Period 2025 to 2032 CAGR: 5.5% Market Size in 2032: USD 469.56 Bn. Segments Covered: by Product Type Yogurt Kefir Buttermilk Laban Skyr Other by Distribution Channel Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Direct Sales Fermented Milk Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Leading Companies in the Fermented Milk Industry

1. Danone 2. Nestle 3. Yakult Honsha Co., Ltd. 4. Lactalis 5. General Mills 6. Chobani 7. Muller Group 8. Yoplait 9. Arla Foods 10. Kraft Heinz 11. FrieslandCampina 12. Parmalat 13. Fonterra Co-operative Group 14. Mother Dairy 15. Meiji Co., Ltd. 16. Clover Industries Limited 17. Grupo Lala 18. Rainbow Dairy Foods 19. Laïta 20. Agrosuper 21. Dairy Farmers of America 22. Müller-Milch 23. Meggle 24. Emmi AG 25. Agri-Mark, Inc. Frequently Asked Questions: 1] What is the growth rate of the Global Fermented Milk Market? Ans. The Global Fermented Milk Market is growing at a significant rate of 5.5 % during the forecast period. 2] Which region is expected to dominate the Global Fermented Milk Market? Ans. Europe is expected to dominate the Fermented Milk Market during the forecast period. 3] What was the Global Fermented Milk Market size in 2024? Ans: The Global Fermented Milk Market size was USD 305.97 Billion in 2024. 4] Which are the top players in the Global Fermented Milk Market? Ans. The major top players in the Global Fermented Milk Market are Danone, Nestle, Yakult Honsha Co., Ltd., Lactalis, General Mills, Chobani, Müller Group, Yoplait, Arla Foods, Kraft Heinz, FrieslandCampina, Parmalat, Fonterra Co-operative Group, Mother Dairy, Meiji Co., Ltd. and Others. 5] What are the factors driving the Global Fermented Milk Market growth? Ans. The rising health awareness diversification and product innovations are expected to drive market growth during the forecast period.

1. Fermented Milk Market: Research Methodology 2. Fermented Milk Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Fermented Milk Market: Dynamics 3.1 Fermented Milk Market Trends by Region 3.1.1 North America Fermented Milk Market Trends 3.1.2 Europe Fermented Milk Market Trends 3.1.3 Asia Pacific Fermented Milk Market Trends 3.1.4 Middle East and Africa Fermented Milk Market Trends 3.1.5 South America Fermented Milk Market Trends 3.2 Fermented Milk Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Fermented Milk Market Drivers 3.2.1.2 North America Fermented Milk Market Restraints 3.2.1.3 North America Fermented Milk Market Opportunities 3.2.1.4 North America Fermented Milk Market Challenges 3.2.2 Europe 3.2.2.1 Europe Fermented Milk Market Drivers 3.2.2.2 Europe Fermented Milk Market Restraints 3.2.2.3 Europe Fermented Milk Market Opportunities 3.2.2.4 Europe Fermented Milk Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Fermented Milk Market Market Drivers 3.2.3.2 Asia Pacific Fermented Milk Market Restraints 3.2.3.3 Asia Pacific Fermented Milk Market Opportunities 3.2.3.4 Asia Pacific Fermented Milk Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Fermented Milk Market Drivers 3.2.4.2 Middle East and Africa Fermented Milk Market Restraints 3.2.4.3 Middle East and Africa Fermented Milk Market Opportunities 3.2.4.4 Middle East and Africa Fermented Milk Market Challenges 3.2.5 South America 3.2.5.1 South America Fermented Milk Market Drivers 3.2.5.2 South America Fermented Milk Market Restraints 3.2.5.3 South America Fermented Milk Market Opportunities 3.2.5.4 South America Fermented Milk Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives For the Fermented Milk Industry 3.7 The Global Pandemic and Redefining of The Fermented Milk Industry Landscape 3.8 Technological Road Map 4. Global Fermented Milk Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2024-2032) 4.1 Global Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 4.1.1 Yogurt 4.1.2 Kefir 4.1.3 Buttermilk 4.1.4 Laban 4.1.5 Skyr 4.1.6 Other 4.2 Global Fermented Milk Market Size and Forecast, by End User (2024-2032) 4.2.1 Supermarkets/Hypermarkets 4.2.2 Convenience Stores 4.2.3 Online Retail 4.2.4 Specialty Stores 4.2.5 Direct Sales 4.3 Global Fermented Milk Market Size and Forecast, by Region (2024-2032) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Fermented Milk Market Size and Forecast by Segmentation (By Value and Volume) (2024-2032) 5.1 North America Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 5.1.1 Yogurt 5.1.2 Kefir 5.1.3 Buttermilk 5.1.4 Laban 5.1.5 Skyr 5.1.6 Other 5.2 North America Fermented Milk Market Size and Forecast, by End User (2024-2032) 5.2.1 Supermarkets/Hypermarkets 5.2.2 Convenience Stores 5.2.3 Online Retail 5.2.4 Specialty Stores 5.2.5 Direct Sales 5.3 North America Fermented Milk Market Size and Forecast, by Country (2024-2032) 5.3.1 United States 5.3.1.1 United States Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 5.3.1.1.1 Yogurt 5.3.1.1.2 Kefir 5.3.1.1.3 Buttermilk 5.3.1.1.4 Laban 5.3.1.1.5 Skyr 5.3.1.1.6 Other 5.3.1.2 United States Fermented Milk Market Size and Forecast, by End User (2024-2032) 5.3.1.2.1 Supermarkets/Hypermarkets 5.3.1.2.2 Convenience Stores 5.3.1.2.3 Online Retail 5.3.1.2.4 Specialty Stores 5.3.1.2.5 Direct Sales 5.3.2 Canada 5.3.2.1 Canada Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 5.3.2.1.1 Yogurt 5.3.2.1.2 Kefir 5.3.2.1.3 Buttermilk 5.3.2.1.4 Laban 5.3.2.1.5 Skyr 5.3.2.1.6 Other 5.3.2.2 Canada Fermented Milk Market Size and Forecast, by End User (2024-2032) 5.3.2.2.1 Supermarkets/Hypermarkets 5.3.2.2.2 Convenience Stores 5.3.2.2.3 Online Retail 5.3.2.2.4 Specialty Stores 5.3.2.2.5 Direct Sales 5.3.3 Mexico 5.3.3.1 Mexico Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 5.3.3.1.1 Yogurt 5.3.3.1.2 Kefir 5.3.3.1.3 Buttermilk 5.3.3.1.4 Laban 5.3.3.1.5 Skyr 5.3.3.1.6 Other 5.3.3.2 Mexico Fermented Milk Market Size and Forecast, by End User (2024-2032) 5.3.3.2.1 Supermarkets/Hypermarkets 5.3.3.2.2 Convenience Stores 5.3.3.2.3 Online Retail 5.3.3.2.4 Specialty Stores 5.3.3.2.5 Direct Sales 6. Europe Fermented Milk Market Size and Forecast by Segmentation (By Value and Volume) (2024-2032) 6.1 Europe Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.2 Europe Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3 Europe Fermented Milk Market Size and Forecast, by Country (2024-2032) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.1.2 United Kingdom Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3.2 France 6.3.2.1 France Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.2.2 France Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3.3 Germany 6.3.3.1 Germany Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.3.2 Germany Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3.4 Italy 6.3.4.1 Italy Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.4.2 Italy Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3.5 Spain 6.3.5.1 Spain Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.5.2 Spain Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3.6 Sweden 6.3.6.1 Sweden Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.6.2 Sweden Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3.7 Austria 6.3.7.1 Austria Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.7.2 Austria Fermented Milk Market Size and Forecast, by End User (2024-2032) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 6.3.8.2 Rest of Europe Fermented Milk Market Size and Forecast, by End User (2024-2032). 7. Asia Pacific Fermented Milk Market Size and Forecast by Segmentation for Demand and Supply Side (By Value and Volume) (2024-2032) 7.1 Asia Pacific Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.2 Asia Pacific Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3 Asia Pacific Fermented Milk Market Size and Forecast, by Country (2024-2032) 7.3.1 China 7.3.1.1 China Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.1.2 China Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.2 South Korea 7.3.2.1 S Korea Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.2.2 S Korea Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.3 Japan 7.3.3.1 Japan Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.3.2 Japan Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.4 India 7.3.4.1 India Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.4.2 India Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.5 Australia 7.3.5.1 Australia Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.5.2 Australia Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.6 Indonesia 7.3.6.1 Indonesia Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.6.2 Indonesia Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.7 Malaysia 7.3.7.1 Malaysia Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.7.2 Malaysia Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.8 Vietnam 7.3.8.1 Vietnam Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.8.2 Vietnam Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.9 Taiwan 7.3.9.1 Taiwan Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.9.2 Taiwan Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.10.2 Bangladesh Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.11 Pakistan 7.3.11.1 Pakistan Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.11.2 Pakistan Fermented Milk Market Size and Forecast, by End User (2024-2032) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 7.3.12.2 Rest of Asia PacificFermented Milk Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Fermented Milk Market Size and Forecast by Segmentation for Demand and Supply Side (By Value and Volume) (2024-2032) 8.1 Middle East and Africa Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 8.2 Middle East and Africa Fermented Milk Market Size and Forecast, by End User (2024-2032) 8.3 Middle East and Africa Fermented Milk Market Size and Forecast, by Country (2024-2032) 8.3.1 South Africa 8.3.1.1 South Africa Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 8.3.1.2 South Africa Fermented Milk Market Size and Forecast, by End User (2024-2032) 8.3.2 GCC 8.3.2.1 GCC Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 8.3.2.2 GCC Fermented Milk Market Size and Forecast, by End User (2024-2032) 8.3.3 Egypt 8.3.3.1 Egypt Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 8.3.3.2 Egypt Fermented Milk Market Size and Forecast, by End User (2024-2032) 8.3.4 Nigeria 8.3.4.1 Nigeria Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 8.3.4.2 Nigeria Fermented Milk Market Size and Forecast, by End User (2024-2032) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 8.3.5.2 Rest of ME&A Fermented Milk Market Size and Forecast, by End User (2024-2032) 9. South America Fermented Milk Market Size and Forecast by Segmentation for Demand and Supply Side (By Value and Volume) (2024-2032) 9.1 South America Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 9.2 South America Fermented Milk Market Size and Forecast, by End User (2024-2032) 9.3 South America Fermented Milk Market Size and Forecast, by Country (2024-2032) 9.3.1 Brazil 9.3.1.1 Brazil Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 9.3.1.2 Brazil Fermented Milk Market Size and Forecast, by End User (2024-2032) 9.3.2 Argentina 9.3.2.1 Argentina Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 9.3.2.2 Argentina Fermented Milk Market Size and Forecast, by End User (2024-2032) 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Fermented Milk Market Size and Forecast, by Product Type (2024-2032) 9.3.3.2 Rest Of South America Fermented Milk Market Size and Forecast, by End User (2024-2032) 10. Global Fermented Milk Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Service Segment 10.3.3 End User Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Fermented Milk Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Danone 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Recent Developments 11.2 Nestle 11.3 Yakult Honsha Co., Ltd. 11.4 Lactalis 11.5 General Mills 11.6 Chobani 11.7 Müller Group 11.8 Yoplait 11.9 Arla Foods 11.10 Kraft Heinz 11.11 FrieslandCampina 11.12 Parmalat 11.13 Fonterra Co-operative Group 11.14 Mother Dairy 11.15 Meiji Co., Ltd. 11.16 Clover Industries Limited 11.17 Grupo Lala 11.18 Rainbow Dairy Foods 11.19 Laïta 11.20 Agrosuper 11.21 Dairy Farmers of America 11.22 Müller-Milch 11.23 Meggle 11.24 Emmi AG 11.25 Agri-Mark, Inc. 12. Key Findings 13. Industry Recommendations