Feed Preservatives Market was valued at US$ 4.79 Bn. in 2022. Global Market size is expected to grow at a CAGR of 6.6 % to US$ 7.49 Bn in 2029 through the forecast period.Feed Preservatives Market Overview:

Feed preservatives are the additives which are used in animal nutrition for increasing the quality of the feed and the food from the origin of animal. These are also antioxidants which prevents food from oxidising. Due to the increasing demand for meat consumption, growth in livestock farming, increasing storage of livestock the market is growing. According to MMR research the animal feed industry collectively of 1.1 Bn metric ton and Feed preservatives industry is predicted to grow through forecast period. Also the rising production of animal feed will increase the demand for feed preservatives to elevate the shelf life of products.To know about the Research Methodology:-Request Free Sample Report The Important part in feed preservatives is to use it at the right time and at the right amount which can provide many advantages to animal breeders, which includes improving quality of food and animal products, improves the digestion and digestive system, elevates the amounts of the nutrients, these are the prominent factors which are responsible for driving the market. As Covid 19 is a global public health emergency, due to this almost every industry is affected and the feed preservative industry too. Considering the changes in human behaviour and analysis by MMR, this report gives the correct analytical information and strategies to overcome the loss that happened due to Covid 19.

Feed Preservatives Market Dynamics:

The incidences of animal feed damage caused due to fungal and bacterial contamination are driving the market during forecast period. Further, the feed shows harmful effects which are made without addition of feed preservatives led to increase in demand for preservatives. Moreover, Increase demands for eggs, food industry for livestock has significantly increase the demand for food preservatives. In the feed preservative industry, it is difficult to keep a high margin. Over the last decade, it has been found that high margin seems to decrease the sales volume of the product. The changing cost of raw materials such as maize, biomass, dextrose, which are used for making feed preservatives and rules and regulations about the usage of feed preservatives are expected to inhibit the growth of feed preservatives. To promote growth and controlling diseases antimicrobial components are used and these components are banned by European Union due to the risk Posed to food safety and public health. Due to which feed preservatives manufacturers are embracing new forms of natural feed preservatives, which can led to new opportunities and growth of feed preservatives.Feed Preservatives Market Segment Analysis:

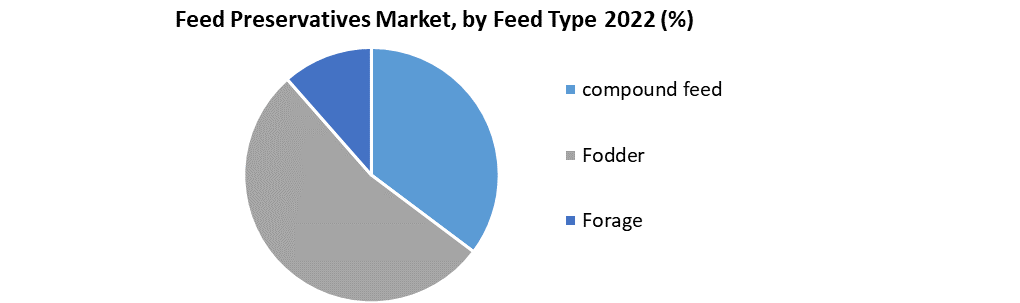

Based on Type, The market is classified into feed acidifiers, mold inhibitors, feed anti-oxidants, and anticaking agents. Feed acidifiers segment is dominating the market with largest market share, and predicted to expand during forecast period. Europe is the largest market for feed acidifiers. Although the market is going to expand at 7.1 %CAGR during the forecast period. The demand for Feed is relatively stagnant but supply has been hit by Covid 19. Based on Livestock, The market is segmented into cattle, Poultry, Swine, and Aquaculture The cattle segment has the largest market share globally and expected to show significant market growth during forecast period. And the poultry market is expected to grow at 6.3% CAGR during the forecast period. Increase in worldwide population is the main element which is likely to drive the market growth. Based on feed type, the market is classified into compound feed, fodder, Forage. Compound feed is the most common type of feed used by farmers, they are blend of various additives and raw materials. Moreover, compound feed segment has the largest market share and it is likely to grow significantly during the forecast period.

Feed Preservatives Market Regional Insights:

Based on regional analysis, the feed Preservatives market is classified into North America, Europe, and Asia pacific. Europe has significant dominance in market, it is in growth stage due to feed cost reduction by regulatory authority. However, North America region also dominating the global market with highest market share and expected to grow further during forecast period. The objective of the report is to present a comprehensive analysis of the Global Feed Preservatives Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Feed preservatives Market dynamic, structure by analyzing the market segments and projecting the Feed Preservatives Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Feed preservatives Market make the report investor’s guide.Feed Preservatives Market Scope: Inquire before buying

Feed Preservatives Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 4.79 Bn. Forecast Period 2023 to 2029 CAGR: 6.6% Market Size in 2029: US$ 7.49 Bn. Segments Covered: by Type • Feed acidifiers • Mold inhibitors • Feed anti-oxidants • Anticaking agents by Livestock • Cattle • Poultry • Swine • Aquaculture by Feed Type • compound feed • Fodder • Forage Feed Preservatives Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Feed Preservatives Market Key Players are:

• BASF SE (Germany) • Cargill, Inc (US) • Nutreco N.V. (Netherlands) • Archer-Daniels-Midland Company (US) • Jungbunzlauer Suisse AG (Switzerland) • Niacet Corporation (US) • Vinayak Ingredients (India) • Saideep Exports Pvt. Ltd. (India) • Avon Animal Health (Bangladesh) • Vee Excel Drugs and Pharmaceuticals Pvt. Ltd. (India) • Nor-Feed (France) • Kemin Industries (US) • Impextraco NV (Belgium) • Eastman Chemical Company (US) • Bluestar Adisseo Nutrition Group Ltd. (China) Frequently Asked Questions: 1] What segments are covered in the Global Feed Preservatives Market report? Ans. The segments covered in the Feed preservatives Market report are based on Product Type, Livestock and Feed type. 2] Which region is expected to hold the highest share in the Global Feed preservatives Market? Ans. The North America region is expected to hold the highest share in the Feed preservatives Market. 3] What is the market size of the Global Feed preservatives Market by 2029? Ans. The market size of the Feed preservatives Market by 2029 is expected to reach US$ 7.49 Bn. 4] What is the forecast period for the Global Feed preservatives Market? Ans. The forecast period for the Feed preservatives Market is 2023-2029. 5] What was the market size of the Global Feed preservatives Market in 2022? Ans. The market size of the Feed preservatives Market in 2022 was valued at US$ 4.79 Bn.

1. Global Feed Preservatives Market Size: Research Methodology 2. Global Feed Preservatives Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Feed Preservatives Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Feed Preservatives Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Feed Preservatives Market Size Segmentation 4.1. Global Feed Preservatives Market Size, by Type (2022-2029) • feed acidifiers • mold inhibitors • feed anti-oxidants • anticaking agents 4.2. Global Feed Preservatives Market Size, by Livestock(2022-2029) • cattle • Poultry • Swine • Aquaculture 4.3. Global Feed Preservatives Market Size, by Feed Type (2022-2029) • Compound feed • Fodder • Forage 5. North America Feed Preservatives Market (2022-2029) 5.1. North America Feed Preservatives Market Size, by Type (2022-2029) • feed acidifiers • mold inhibitors • feed anti-oxidants • anticaking agents 5.2. North America Feed Preservatives Market Size, by Livestock (2022-2029) • cattle • Poultry • Swine • Aquaculture 5.3. North America Feed Preservatives Market Size, by Feed Type (2022-2029) • compound feed • fodder • Forage 6. European Feed Preservatives Market (2022-2029) 6.1. European Feed Preservatives Market, by Type (2022-2029) 6.2. European Feed Preservatives Market, by Livestock(2022-2029) 6.3. European Feed Preservatives Market, by Feed Type(2022-2029) 6.4. European Feed Preservatives Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Feed Preservatives Market (2022-2029) 7.1. Asia Pacific Feed Preservatives Market, by Type (2022-2029) 7.2. Asia Pacific Feed Preservatives Market, by Livestock(2022-2029) 7.3. Asia Pacific Feed Preservatives Market, by Feed Type(2022-2029) 7.4. Asia Pacific Feed Preservatives Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Feed Preservatives Market (2022-2029) 8.1. Middle East and Africa Feed Preservatives Market, by Type (2022-2029) 8.2. Middle East and Africa Feed Preservatives Market, by Livestock(2022-2029) 8.3. Middle East and Africa Feed Preservatives Market, by Feed Type(2022-2029) 8.4. Middle East and Africa Feed Preservatives Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Feed Preservatives Market (2022-2029) 9.1. South America Feed Preservatives Market, by Type (2022-2029) 9.2. South America Feed Preservatives Market, by Livestock(2022-2029) 9.3. South America Feed Preservatives Market, by Feed Type(2022-2029) 9.4. South America Feed Preservatives Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 BASF SE (Germany) 10.1.1 Company Overview 10.1.2 Financial Overview 10.1.3 Global Presence 10.1.4 Capacity Portfolio 10.1.5 Business Strategy 10.1.6 Recent Developments 10.2 Cargill, Inc (US) 10.3 Nutreco N.V. (Netherlands) 10.4 Archer-Daniels-Midland Company (US) 10.5 Jungbunzlauer Suisse AG (Switzerland) 10.6 Niacet Corporation (US) 10.7 Vinayak Ingredients (India) 10.8 Saideep Exports Pvt. Ltd. (India) 10.9 Avon Animal Health (Bangladesh) 10.10 Vee Excel Drugs and Pharmaceuticals Pvt. Ltd. (India) 10.11 Nor-Feed (France) 10.12 Kemin Industries (US) 10.13 Impextraco NV (Belgium) 10.14 Eastman Chemical Company (US) 10.15 Bluestar Adisseo Nutrition Group Ltd. (China)