Extruders Market size was valued at USD 8.20 Billion in 2023 and the total Extruders Revenue is expected to grow at a CAGR of 4.5 % from 2024 to 2030, reaching nearly USD 11.16 Billion in 2030.Extruders Market Overview:

An ‘Extruder’ is an extruding machine that is used to extrude metals like copper, steel, aluminium and plastics. Some brittle metals extruded very easily through the extruder. The main function of an extruder is conversion of raw material directly into finished goods ready for supply and packaging.To know about the Research Methodology :- Request Free Sample Report The main driver of market growth is the increase in demand for extruded products in the building and construction industry. The rapidly growing automotive industry, increasing demand in the packaging industry and growing extruders are contributing to the growth of the extrusion market. The growth of the middle class, the recovery of the global economy and the growth of global personal consumption fuelling the high demand for consumer goods are the main drivers of market development. Technological advances are emerging as an important trend in the extrusion market. Major companies in the market are focusing on developing their products using advanced technology to strengthen their positions. Key companies in the Extruders market are focusing on developing innovative solutions including introducing new end extruders to gain competitive advantage. End extruders usually refer to specialized tools or equipment used in additive manufacturing processes, especially 3D printing. An example of the trend seen in November 2023, when Carol, an Italian company specialized in robotic large-scale polymer additive manufacturing, launched the "High Versatility" extruder. Designed specifically for Carol's large Heron AM rig, the extruder is used in a variety of applications including medium-sized gear, jigs, single gear, fasteners, architectural panels, furniture components and ship superstructures. The "High Versatility" extruder offers precision, efficiency and fast processing for a variety of thermoplastic pellets, including advanced compounds. It is an example of the industry's commitment to developing cutting-edge solutions to improve the versatility and performance of extruders on the market.

Extruders Market Dynamics:

Exploring the Intersection of Food Extrusion and Automotive Plastics Demand The rising processes food sector are driving the food extrusion market. The population’s changing lifestyles and high disposable incomes have increased demand for ready-to-eat product varieties, saving time and effort. The need for extruded product types is also fuelled by increased per capita income and the growing tendency to snack between meals. The rising plastics demands in the automotive industry are driven by the need for lightweight and fuel-efficient vehicles. Plastics are used in automotive applications, such as body panels, dashboards, door panels, and bumpers. Advancements in technology, such as improved automation and control systems, are enhancing the efficiency and effectiveness of food industry extruders. It is enabling manufacturers to produce a wider variety of products with higher precision and consistency, which is driving the market growth.The Growing Influence of Extrusion Technology Extrusion-based additive manufacturing (EB-AM) is a 3D fabrication process in which the material is heated and extracted through a nozzle before being deposited one layer at a time. It uses two types of technologies: filament and pellet extrusion. Filament extrusion machines entail transforming raw plastic pellets into a spool of filament; hence, these machines use limited materials. Pellet extrusion printers are more complex machines and use a screw inside a barrel. Screw feeds, transports, and melts the material before forcing it to be deposited at the required temperatures. Besides the complexities, a pellet extruder offers lower costs, higher speeds, and a wide variety of materials that can be used Extrusion technology is gaining increasing popularity in the global agro-food processing industry, which employs mixing, forming, texturing, and cooking to develop a novel food product. Extrusion cooking is a high-temperature short-time (HTST) process that inactivates enzymes and reduces microbial contamination. Extrusion cooking is mostly preferred, as it has high productivity and significant nutrient retention as compared to conventional cooking.

Extruders Market Segment Analysis:

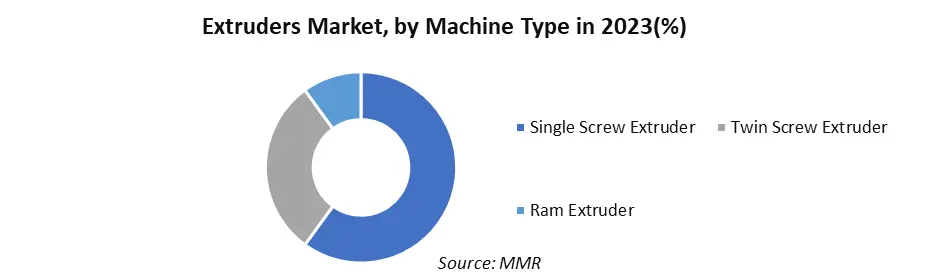

By Machine Type, Single screw has largest market share of 60% in 2023. The extruder includes the barrel, a screw that fits inside the barrel, a motor-drive system for rotating the screw, and a control system for the barrel heaters and motor speed. Many innovations in the construction of the components have been developed by machine suppliers in 2023. The single-screw extruder screw single flighted or multiple-flighted. Multiple-flighted screws with two or more helixes started on the core are very common on high-performance screws and on large-diameter melt-fed machines. Single screw extruders are usually divided into three zones: feeding, kneading, and cooling. Single-screw extruders, in contrast to twin-screw extruders, have limited mixing capabilities, necessitating pre-mixing or preconditioning of the ingredients.Single Screw Extruder Line Machines are offered for the extrusion of polyolefin (HDPE/LDPE/PLB Ducting, PP, PPR) PIPES. The extruder with screw diameters 25-120 mm is available for an output range of 5 Kg/hr to 1000 Kg/hr. The next-generation extruders with barrier screw and groove feed bush result in a higher output rate, homogeneous plasticizing, and less material slippage. North America is one of the largest markets for single screw press equipment, mainly due to its strong presence in the packaging and automotive industries. Technological advances in extrusion design aimed at improving efficiency and effectiveness can be seen in the region. Europe has a significant market share due to the growing demand for single screw extruders in the construction industry.

Extruders Market Regional Insight

Asia Pacific region holds the largest share of 40% in Extruder market. China is the world’s leading producer of plastic extruders with a dominant market share. The country’s popular China plastic extrusion machine is known for its high quality and reliability, making it a popular choice for manufacturers worldwide. The plastic extruder industry is currently in the leading position in the world, with a market share of more than 50%. The dominance is attributed to a variety of factors, including the large number of extruder manufacturers in China, the country’s low labor costs, and China’s growing demand for plastics. Additionally, Chinese manufacturers quickly adopt new technologies, which helps them stay ahead of the competition. As China’s economy continues to grow, so does the demand for plastic products. This has led to the rapid expansion of the plastic extruder industry which is currently having a major impact on the global market. Chinese extruders produce products at a lower cost than their counterparts in other countries, leading to a surge in demand for Chinese-made plastics. This could have a major impact on the global plastics market, with Chinese manufacturers likely to dominate the market for years to come. China’s plastic extruder has had a great influence on the global market. Their low prices and high quality have forced many Western manufacturers out of business, and this trend is likely to continue in the future. This has led to a situation where Chinese manufacturers now dominate the global plastic extruder market. 1. China imports most of its Twin-screw extruders from Germany, India, and Vietnam. 2. The top 3 importers of Twin screw extruders are India with 4,369 shipments followed by the United States with 1,013 and Vietnam at the 3rd spot with 568 shipments. Owing to food regulations imposed by the US Food and Drug Administration (FDA), the North American market is likely to grow significantly through the forecast period. The increasing sales of single-screw food extruders is thanks to increased demand for processed foods and changing lifestyles regarding health safety and hazards in the United States, Canada, and Mexico. Growth in the food sector is expected to increase the consumption of processed product categories in Eastern and Southeastern European countries. Since domestic production is not sufficient to satisfy the demand of the European food industry, companies have had to import extruded snacks from other parts of the world to ensure a constant supply of raw materials.Extruders Market Competitive Landscape: 1. In November 2023, Davis-Standard, a specialist in the extrusion equipment and services sector, reached a definitive agreement to acquire the Extrusion Technology Group (ETG) from entities controlled by the Dutch Investor Nimbus. 2. In September 2022, it was announced that the ISEC evo shredder-extruder combination developed by PURE LOOP enhances the recycled synthetic nonwoven content.

Scope of the Extruders Market: Inquire before buying

Global Profiled in Extruders Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.20 Bn. Forecast Period 2024 to 2030 CAGR: 4.5% Market Size in 2030: US $ 11.26 Bn. Segments Covered: by Machine Type Single Screw Extruder Twin Screw Extruder Ram Extruder by End Use Industry Building & Construction Transportation Consumer Goods Others Profiled in Extruders Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Extruders Market Key Players:

1. Bühler Group - Switzerland 2. KraussMaffei Group - Germany 3. Leistritz AG - Germany 4. Davis-Standard, LLC - United States 5. Toshiba Machine Co., Ltd. - Japan 6. Milacron Holdings Corp. - United States 7. The Bonnot Company - United States 8. Wenger Manufacturing, Inc. - United States 9. Clextral SAS - France 10. American Kuhne - United States 11. Reifenhäuser Group - Germany 12. Macro Engineering & Technology Inc. - Canada 13. Steer Engineering Pvt. Ltd. - India 14. Groupe Gorgé - France 15. Thermo Fisher Scientific Inc. - United States 16. Battenfeld-Cincinnati Group - Austria 17. Everplast Machinery Co., Ltd. - Taiwan 18. USEON (Nanjing) Extrusion Machinery Co., Ltd. - China Frequently Asked Questions: 1] What segments are covered in the Extruders Market report? Ans. The segments covered in the Extruders Market report are based on Machine Type and End Use Industry. 2] Which region is expected to hold the highest share in the Extruders Market? Ans. The North American region is expected to hold the highest share of the Extruders Market. 3] What is the market size of the Extruders Market by 2030? Ans. The market size of the Extruders Market by 2030 will be $ 11.26 Billion. 4] What is the forecast period for the Extruders Market? Ans. The Forecast period for the Extruders Market is 2024- 2030.

1. Extruders Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Extruders Market: Dynamics 2.1. Extruders Market Trends by Region 2.1.1. North America Extruders Market Trends 2.1.2. Europe Extruders Market Trends 2.1.3. Asia Pacific Extruders Market Trends 2.1.4. Middle East and Africa Extruders Market Trends 2.1.5. South America Extruders Market Trends 2.2. Extruders Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Extruders Market Drivers 2.2.1.2. North America Extruders Market Restraints 2.2.1.3. North America Extruders Market Opportunities 2.2.1.4. North America Extruders Market Challenges 2.2.2. Europe 2.2.2.1. Europe Extruders Market Drivers 2.2.2.2. Europe Extruders Market Restraints 2.2.2.3. Europe Extruders Market Opportunities 2.2.2.4. Europe Extruders Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Extruders Market Drivers 2.2.3.2. Asia Pacific Extruders Market Restraints 2.2.3.3. Asia Pacific Extruders Market Opportunities 2.2.3.4. Asia Pacific Extruders Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Extruders Market Drivers 2.2.4.2. Middle East and Africa Extruders Market Restraints 2.2.4.3. Middle East and Africa Extruders Market Opportunities 2.2.4.4. Middle East and Africa Extruders Market Challenges 2.2.5. South America 2.2.5.1. South America Extruders Market Drivers 2.2.5.2. South America Extruders Market Restraints 2.2.5.3. South America Extruders Market Opportunities 2.2.5.4. South America Extruders Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Extruders Industry 2.8. Analysis of Government Schemes and Initiatives For Extruders Industry 2.9. Extruders Market Trade Analysis 2.10. The Global Pandemic Impact on Extruders Market 3. Extruders Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Extruders Market Size and Forecast, by Machine Type (2023-2030) 3.1.1. Single Screw Extruder 3.1.2. Twin Screw Extruder 3.1.3. Ram Extruder 3.2. Extruders Market Size and Forecast, by End Use Industry (2023-2030) 3.2.1. Building & Construction 3.2.2. Transportation 3.2.3. Consumer Goods 3.2.4. Others 3.3. Extruders Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Extruders Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Extruders Market Size and Forecast, by Machine Type (2023-2030) 4.1.1. Single Screw Extruder 4.1.2. Twin Screw Extruder 4.1.3. Ram Extruder 4.2. North America Extruders Market Size and Forecast, by End Use Industry (2023-2030) 4.2.1. Building & Construction 4.2.2. Transportation 4.2.3. Consumer Goods 4.2.4. Others 4.3. North America Extruders Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Extruders Market Size and Forecast, by Machine Type (2023-2030) 4.3.1.1.1. Single Screw Extruder 4.3.1.1.2. Twin Screw Extruder 4.3.1.1.3. Ram Extruder 4.3.1.2. United States Extruders Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1.2.1. Building & Construction 4.3.1.2.2. Transportation 4.3.1.2.3. Consumer Goods 4.3.1.2.4. Others 4.3.2. Canada 4.3.2.1. Canada Extruders Market Size and Forecast, by Machine Type (2023-2030) 4.3.2.1.1. Single Screw Extruder 4.3.2.1.2. Twin Screw Extruder 4.3.2.1.3. Ram Extruder 4.3.2.2. Canada Extruders Market Size and Forecast, by End Use Industry (2023-2030) 4.3.2.2.1. Building & Construction 4.3.2.2.2. Transportation 4.3.2.2.3. Consumer Goods 4.3.2.2.4. Others 4.3.3. Mexico 4.3.3.1. Mexico Extruders Market Size and Forecast, by Machine Type (2023-2030) 4.3.3.1.1. Single Screw Extruder 4.3.3.1.2. Twin Screw Extruder 4.3.3.1.3. Ram Extruder 4.3.3.2. Mexico Extruders Market Size and Forecast, by End Use Industry (2023-2030) 4.3.3.2.1. Building & Construction 4.3.3.2.2. Transportation 4.3.3.2.3. Consumer Goods 4.3.3.2.4. Others 5. Europe Extruders Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.2. Europe Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3. Europe Extruders Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.1.2. United Kingdom Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3.2. France 5.3.2.1. France Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.2.2. France Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.3.2. Germany Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.4.2. Italy Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.5.2. Spain Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.6.2. Sweden Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.7.2. Austria Extruders Market Size and Forecast, by End Use Industry (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Extruders Market Size and Forecast, by Machine Type (2023-2030) 5.3.8.2. Rest of Europe Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Extruders Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.2. Asia Pacific Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3. Asia Pacific Extruders Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.1.2. China Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.2.2. S Korea Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.3.2. Japan Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.4. India 6.3.4.1. India Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.4.2. India Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.5.2. Australia Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.6.2. Indonesia Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.7.2. Malaysia Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.8.2. Vietnam Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.9.2. Taiwan Extruders Market Size and Forecast, by End Use Industry (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Extruders Market Size and Forecast, by Machine Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Extruders Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Extruders Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Extruders Market Size and Forecast, by Machine Type (2023-2030) 7.2. Middle East and Africa Extruders Market Size and Forecast, by End Use Industry (2023-2030) 7.3. Middle East and Africa Extruders Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Extruders Market Size and Forecast, by Machine Type (2023-2030) 7.3.1.2. South Africa Extruders Market Size and Forecast, by End Use Industry (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Extruders Market Size and Forecast, by Machine Type (2023-2030) 7.3.2.2. GCC Extruders Market Size and Forecast, by End Use Industry (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Extruders Market Size and Forecast, by Machine Type (2023-2030) 7.3.3.2. Nigeria Extruders Market Size and Forecast, by End Use Industry (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Extruders Market Size and Forecast, by Machine Type (2023-2030) 7.3.4.2. Rest of ME&A Extruders Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Extruders Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Extruders Market Size and Forecast, by Machine Type (2023-2030) 8.2. South America Extruders Market Size and Forecast, by End Use Industry (2023-2030) 8.3. South America Extruders Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Extruders Market Size and Forecast, by Machine Type (2023-2030) 8.3.1.2. Brazil Extruders Market Size and Forecast, by End Use Industry (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Extruders Market Size and Forecast, by Machine Type (2023-2030) 8.3.2.2. Argentina Extruders Market Size and Forecast, by End Use Industry (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Extruders Market Size and Forecast, by Machine Type (2023-2030) 8.3.3.2. Rest Of South America Extruders Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Extruders Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Extruders Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Bühler Group - Switzerland 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. KraussMaffei Group - Germany 10.3. Leistritz AG - Germany 10.4. Davis-Standard, LLC - United States 10.5. Toshiba Machine Co., Ltd. - Japan 10.6. Milacron Holdings Corp. - United States 10.7. The Bonnot Company - United States 10.8. Wenger Manufacturing, Inc. - United States 10.9. Clextral SAS - France 10.10. American Kuhne - United States 10.11. Reifenhäuser Group - Germany 10.12. Macro Engineering & Technology Inc. - Canada 10.13. Steer Engineering Pvt. Ltd. - India 10.14. Groupe Gorgé - France 10.15. Thermo Fisher Scientific Inc. - United States 10.16. Battenfeld-Cincinnati Group - Austria 10.17. Everplast Machinery Co., Ltd. - Taiwan 10.18. USEON (Nanjing) Extrusion Machinery Co., Ltd. - China 11. Key Findings 12. Industry Recommendations 13. Extruders Market: Research Methodology 14. Terms and Glossary