The European Telematics market value is projected to reach US$ 5.2 billion at the end of the forecast period and it is expected to grow at the CAGR of 7.3%.To Know About The Research Methodology :- Request Free Sample Report

European Telematics Market Overview:

After decades as a niche feature, telematics is merging into the automotive mainstream. Research on car-data-monetization trends & characteristics advise that this value pool could be as large as USD 750 Bn by 2030. While current acceptance rates remain low through markets, they could rise significantly through the 1st part of the next decade, according to the MMR report, an organization included mobile-network operators. There are two motives for this. 1st is the improved willingness of governments to mandate specific telematics services, like emergency-call capabilities, which is already happening in the EU & Russia. 2nd is a growing appetite from customers for greater connectivity & intelligence in their vehicles. Car telematics has the potential to rise road safety, increase driving behavior, align insurance premiums through actual need via usage-based insurance, & boost car-insurance-industry productivity. It also seems clear that telematics can bring extra benefits to persons, corporations, & governments beyond insurance & road-safety improvements. Cases contain driving-style improvements to increase fuel economy, location-based services like stolen-vehicle recovery, real-time tracking, vehicle-finder services, vehicle-maintenance alerts, & fuel & routing optimization. Today’s acceptance levels remain below 20 %:The technology’s profits become evident even at these niche levels. For instance, most users cite antitheft, lower insurance premiums, &developed driving behavior as importantprofits of telematics today. Its use in the US reached about 20 % in 2018, Italy saw 17 %, & Singapore 9 %. That same year, global UBI adoption made possible by telematics expanded to 14 Mn policies. While virtually all markets now feature voluntary car-telematics systems, regulators in many nations want to mandate the technology in specific conditions. For example, the EU seeks e-assistance systems in case of accidents. The eCall system, compulsory for all new EU vehicles as of March 2019, should speed up emergency-response times by 40 % in cities & 50 % in rural areas in the process decreasing the number of fatalities by at least 4 %. Russia mandated a similar system for new cars by the end of 2018, while Mexico has sought mandatory RFID tags to boost vehicle-antitheft systems. Many other nations, with China, Germany, Singapore, & South Africa, have voluntary systems which provide UBI incentives. Connecting the connected car: Today, car owners have many options for supplying their vehicles for telematics services. These range from do-it-yourself add-on devices to skillfully installed systems. Many players have begun to offer consumers telematics devices & solutions. For example, some insurance firms bundle telematics devices with their motor-insurance policies, car companies may offer built-in telematics devices & customized services to distinguish their offerings from other manufacturers, & certain fleet operators leverage telematics devices to optimize & manage a network of cars. Key Market Trends: • The Demand for technology allowing the safety, navigation, & remote diagnostic is elevating the commercial vehicle space. The main drivers of commercial vehicle telematics remain the EU regulations, Local policy rules, Increase in manufacturing number of commercial vehicles, small revenues margins in the transportation industry added with advancements like route calculation, vehicle tracking, fuel pilferage is driving the development of the market. • Due to such examples, global telematics vendors invest in the region through partnerships & acquisitions as their competitive advantage. For Example, In November 2019, Geotab Telematics, a telematics provider, said the acquisition of Intendia. This Spanish engineering firm is mainly engaged in integrating tech solutions for the European heavy-truck market. This acquisition leverages the company's engineering capabilities & complements the product portfolio as the company aims to increase its growth opportunities in Europe. • Going forward, according to MMR report suggests that current models allowing access to the vehicle data would potentially cost European customers & aftermarket service providers 65 Bn per year by 2030, due to this several OEMs in the region are starting to develop their own models for remote access to vehicle data leveraging service providers. • For example, In April 2019, Iveco, an LCV manufacturer, said a partnership with Verizon Connect to provide its consumers comprehensive telematics & mobile workforce management software platforms. Under the partnership, Iveco's users would be allowed to select among 3 Verizon Connect strategies, i.e., Fleet Essential Plan, Fleet Enhanced, & Verizon Connect Tachograph. The integration of the Verizon Connect Platforms would extend value & benefits to their consumers & help them better control their operations. Due to the ongoing Corona Virus pandemic, governments of different European nations are taking measures to control operations, in order to curb the spread of the disease. The market, with vehicle manufacturers, suppliers, & retailers & technology, and service providers, is facing the mass shutdown of production & slump in demand through nearly all European countries. Thus, the companies of automotive telematics products through the region have been witnessing the adverse impact of this crisis, which, in turn, is temporarily impeding the development of the European automotive telematics market. The report covers Type and Provider Type,with detailed analysis European Telematics Market industry with the classifications of the market on theType, Provider Type & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it.The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Types, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.

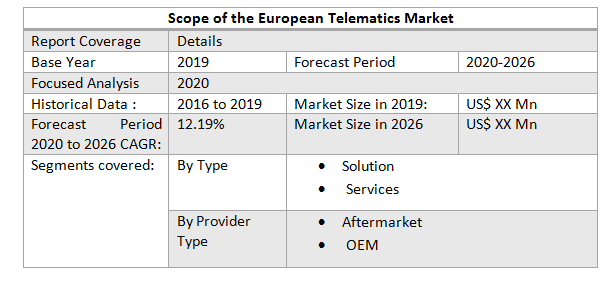

Scope of the European Telematics Market: Inquire before buying

European Telematics Market, By Region

o UK o Germany o France o Spain o Italy o Sweden o CIS countries o Rest of EuropeEuropean Telematics Market Key Players

• Webfleet Solutions B.V. • Verizon Connect • ABAX UK Ltd. • Masternaut Limited • Targa Telematics S.p.A • Gurtam Inc. • Viasat Group • Bornemann AG • Teletrac Navman US Ltd. • Diamler AG • Volvo Group • Scania AB • Man Truck & Bus SE • DAF Trucks N.V.

European Telematics Market

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: European Telematics MarketSize, by Market Value (US$ Bn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. European Telematics MarketAnalysis and Forecast 7. European Telematics MarketAnalysis and Forecast, by Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. European Telematics MarketValue Share Analysis, by Type 7.4. European Telematics MarketSize (US$ Bn) Forecast, by Type 7.5. European Telematics MarketAnalysis, by Type 7.6. European Telematics MarketAttractiveness Analysis, by Type 8. European Telematics MarketAnalysis and Forecast, by Provider Type 8.1. Introduction and Definition 8.2. Key Findings 8.3. European Telematics MarketValue Share Analysis, by Provider Type 8.4. European Telematics MarketSize (US$ Bn) Forecast, by Provider Type 8.5. European Telematics MarketAnalysis, by Provider Type 8.6. European Telematics MarketAttractiveness Analysis, by Provider Type 9. European Telematics MarketAnalysis 9.1. Key Findings 9.2. European Telematics MarketOverview 9.3. European Telematics MarketValue Share Analysis, by Type 9.4. European Telematics MarketForecast, by Type 9.4.1. Solution 9.4.2. Services 9.5. European Telematics MarketForecast, by Provider Type 9.5.1. Aftermarket 9.5.2. OEM 9.6. PEST Analysis 9.7. Key Trends 9.8. Key Developments 10. EuropeCommercial Vehicle Telematics MarketAnalysis 10.1. Key Findings 10.2. EuropeCommercial Vehicle Telematics MarketOverview 10.3. EuropeCommercial Vehicle Telematics MarketForecast, by Type 10.3.1. Solution 10.3.2. Services 10.4. Europe Commercial Vehicle Telematics MarketForecast, by Provider Type 10.4.1. Aftermarket 10.4.2. OEM 10.5. EuropeCommercial Vehicle Telematics MarketForecast, by Country 10.5.1. UK 10.5.2. France 10.5.3. Germany 10.5.4. Russia 10.5.5. Rest of Europe 10.6. UK Commercial Vehicle Telematics MarketForecast, by Type 10.6.1. Solution 10.6.2. Services 10.7. UK Commercial Vehicle Telematics MarketForecast, by Provider Type 10.7.1. Aftermarket 10.7.2. OEM 10.8. France Commercial Vehicle Telematics MarketForecast, by Type 10.8.1. Solution 10.8.2. Services 10.9. France Commercial Vehicle Telematics MarketForecast, by Provider Type 10.9.1. Aftermarket 10.9.2. OEM 10.10. Germany Commercial Vehicle Telematics MarketForecast, by Type 10.10.1. Solution 10.10.2. Services 10.11. Germany Commercial Vehicle Telematics MarketForecast, by Provider Type 10.11.1. Aftermarket 10.11.2. OEM 10.12. RussiaCommercial Vehicle Telematics MarketForecast, by Type 10.12.1. Solution 10.12.2. Services 10.13. RussiaCommercial Vehicle Telematics MarketForecast, by Provider Type 10.13.1. Aftermarket 10.13.2. OEM 10.14. Rest of Europe Commercial Vehicle Telematics MarketForecast, by Type 10.14.1. Solution 10.14.2. Services 10.15. Rest of Europe Commercial Vehicle Telematics MarketForecast, by Provider Type 10.15.1. Aftermarket 10.15.2. OEM 10.16. PEST Analysis 10.17. Key Trends 10.18. Key Developments 11. Company Profiles 11.1. Market Share Analysis, by Company 11.2. Market Share Analysis, by Region 11.3. Market Share Analysis, by Country 11.4. Competition Matrix 11.4.1. Competitive Benchmarking of key players by price, presence, marketshare, Building Height and R&D investment 11.4.2. New Product Launches and Product Enhancements 11.4.3. Market Consolidation 11.4.3.1. M&A by Regions, Investment and Building Height 11.4.3.2. M&A Key Players, Forward Integration and Backward Integration 11.5. Company Profiles: Key Players 11.5.1. Webfleet Solutions B.V. 11.5.2. Verizon Connect 11.5.3. ABAX UK Ltd. 11.5.4. Masternaut Limited 11.5.5. Targa Telematics S.p.A 11.5.6. Gurtam Inc. 11.5.7. Viasat Group 11.5.8. Bornemann AG 11.5.9. Teletrac Navman US Ltd. 11.5.10. Diamler AG 11.5.11. Volvo Group 11.5.12. Scania AB 11.5.13. Man Truck & Bus SE 11.5.14. DAF Trucks N.V.