The Europe UV LED Market size was valued at USD 110.11 Million in 2022 and the total Europe UV LED Market revenue is expected to grow at a CAGR of 24.59 % from 2023 to 2029, reaching nearly USD 513.11 Million. The UV LED market in Europe has witnessed substantial growth in recent years, driven by the growing demand for UV LED technology across different industries. UV LEDs offer significant advantages over traditional UV lamps, including higher energy efficiency, a longer lifespan, and lower heat generation. These benefits, combined with the rising need for efficient disinfection, curing, and purification procedures, have fuelled market expansion in Europe. The Europe UV LED market is driven by the rising adoption of UV LED technology in diverse applications. Industries such as printing, automotive, electronics, packaging, and water and air purification have increasingly embraced UV LED solutions. UV LEDs are used for UV printing, UV coating, UV adhesive curing, and disinfection in water treatment plants, healthcare facilities, and air purification systems. The European Union has implemented stringent environmental regulations and initiatives that promote energy efficiency and sustainability. These regulations encourage UV LED technology adoption as a more eco-friendly alternative to traditional UV lamps. Such initiatives create a favorable market environment and stimulate UV LED application growth across industries. Ongoing advancements in UV LED technology, such as improvements in wavelength options, intensity, and curing speed, have expanded the range of applications. In addition, they have enhanced UV LED systems' performance. These advancements have increased UV LED technology's attractiveness and accelerated its adoption in various sectors. Europe UV LED Market Scope and research methodology: The scope of the Europe UV LED market encompasses UV LED technology and its applications across various industries in European countries. It includes an analysis of market trends, growth drivers, challenges, and opportunities specific to the region. The market scope covers both the current state and future projections of the Europe UV LED market. The research methodology employed for analyzing the Europe UV LED market involves gathering and analyzing data from multiple reliable sources. Relevant data and information are collected from various sources, including articles, industry publications, company websites, government databases, and other credible sources. The collected data is used to estimate the Europe UV LED market size. This includes assessing historical data and current market trends. It also forecasts future market growth based on factors such as the industry growth rate, market drivers, and market potential. The collected data is analyzed using statistical tools and techniques to derive meaningful insights and trends. This involves analyzing market segmentation, the competitive landscape, market share, growth rates, and other relevant parameters.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Rising demand for market in different industries: The demand for UV LED (Ultraviolet Light Emitting Diode) technology has indeed increased across different industries in Europe. UV LEDs offer several advantages over traditional UV lamps, like higher energy efficiency, a longer lifespan, compact size, and reduced environmental impact. UV LEDs are used for disinfection in healthcare facilities. They can sterilize air, surfaces, and water, reducing healthcare-associated infections. UV LED technology is also utilized in medical devices, such as germicidal wands and portable sterilizers. UV LEDs are becoming increasingly popular in water and wastewater treatment applications. They are employed for disinfection purposes, effectively eliminating harmful microorganisms and pathogens. UV LED-based systems offer efficient and sustainable water treatment solutions. UV LEDs are utilized in various manufacturing processes, such as curing, bonding, and printing. The Europe UV LED Market provides instant and precise curing of adhesives, coatings, and inks. UV LED curing systems offer enhanced productivity, energy savings, and improved product quality. UV LED technology is widely used in the food and beverage industry for sterilization and preservation. UV LEDs can disinfect packaging materials, water, and food surfaces, extending the shelf life of perishable products without chemicals. The rising demand for UV LED technology in these industries can be attributed to the numerous benefits. These benefits include energy efficiency, cost-effectiveness, improved performance, and environmental sustainability. The Initial Investment Challenge for UV LED Implementation: UV LED technology is initially expensive to implement compared to traditional UV lamp solutions. The cost of UV LED systems, including the LEDs themselves and associated equipment, is higher. This upfront cost deters some businesses, especially smaller companies or those with budget constraints. UV LEDs have limitations in output power compared to traditional UV lamps. UV LEDs currently available have lower power levels, which restrict their application in some industries that require high-intensity UV irradiation. Limited output power impacts UV processes' speed and efficiency. UV LED technology has advanced significantly but is still relatively new compared to traditional UV lamp technology. As a result, concerns exist about the technology's long-term reliability and performance. Some businesses prefer proven and established technologies until UV LED technology matures further. UV LEDs typically operate within specific wavelength ranges, such as UV-A, UV-B, or UV-C. While each range has its applications, the limited wavelength options may not cover all the specialized needs of certain industries or disinfection requirements. This limitation can hinder Europe UV LED Market adoption in applications that require specific UV wavelengths.Europe UV LED Market Segment Analysis:

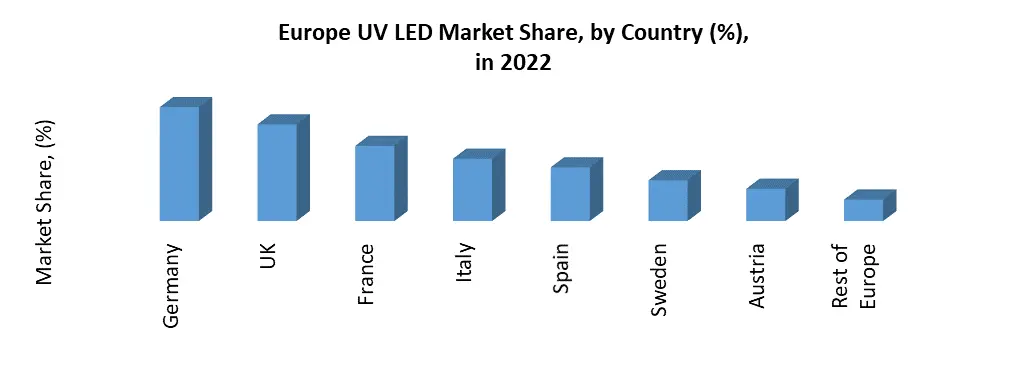

Based on technology, UV LED is segmented into UV-A, UV-B, and UV-C. UV-C light, with wavelengths ranging from 200-280 nm, has proven to be highly effective in deactivating or eradicating a wide range of pathogens, including viruses like COVID-19. This effectiveness has garnered significant attention, particularly during the pandemic, and has led to increased demand for UV-C disinfection solutions. UV-C disinfection using mercury vapor lamps has been common in the past. Mercury lamps have several drawbacks, including toxic materials and careful handling and disposal. UV-C LED technology offers a safer and environmentally friendly alternative. UV-C LED lights do not contain harmful substances and have a longer lifespan, reducing waste and overall environmental impact. UV-C LED technology allows for more flexible design and integration into various applications. UV-C LED modules can be smaller, lighter, and easier to integrate into existing systems than traditional mercury vapor lamps. This flexibility opens up possibilities for UV-C disinfection in a wide range of industries and applications, including healthcare, water treatment, and food processing. UV-C LEDs are known for their high energy efficiency compared to mercury vapor lamps. UV-C LED systems require less energy to generate the same level of UV-C radiation, resulting in cost savings and reduced electricity consumption. This energy efficiency aligns with the European Commission's focus on sustainability and energy reduction as part of the Green Deal initiative. Major lighting vendors, such as Signify, Osram, and others, have recognized the growing demand for UV-C disinfection and are ramping up UV-C LED production. As more companies invest in UV-C LED research and development, the market availability of UV-C LED solutions is expanding, further driving the dominance of the UV-C segment in the Europe UV LED market.Europe UV LED Market Regional Insights: Germany is one of the leading country in Europe’s UV LED markets. The country's strong manufacturing sector, technological advancements, and focus on sustainability make it a key player in UV LED adoption. German industries, such as automotive, electronics, and healthcare, utilize UV LED technology for curing, sterilization, and other applications. The country's strict environmental regulations and commitment to reducing carbon emissions also contribute to the UV LED market's growth. The UK has witnessed significant growth in the Europe UV LED market. The country focuses on sustainability and energy efficiency, driving UV LED technology adoption across various sectors. Industries such as healthcare, water treatment, and manufacturing are actively implementing UV LED solutions for disinfection, curing, and other applications. The UK's supportive regulatory environment and investments in research and development contribute to market growth. France, Italy, Spain, and the Netherlands are also experiencing growing UV LED demand. The country's emphasis on environmental protection and sustainability aligns with UV LED solutions' benefits. Industries, including healthcare, automotive, and food processing, adopt UV LED technology for disinfection, curing, and other purposes. The French government's initiatives promoting energy efficiency and sustainable practices further drive the Europe UV LED market in the country.

Competitive Landscape

The Europe UV LED market is characterized by several key players and a growing number of emerging companies. Here are some prominent players in the market including Baldwin Technology Company, Inc, Halma Plc, Heraeus Holding, Koninklijke Philips N.V., LG Innotek, Lumileds Holding B.V, Nichia Corporation, Nordson Corporation, Schott, Seoulviosys Co., Ltd., Sglux, Signify Holding, Sram Opto Semiconductors Gmbh, Thorlabs, and UV-Technik. These companies represent a mix of established players with long-standing expertise in the lighting industry and emerging companies focusing specifically on UV LED technology. The market is highly competitive, with players vying to develop innovative UV LED solutions that meet the increasing demand for energy-efficient and sustainable applications in Europe. OSRAM is a well-established lighting manufacturer that has expanded its portfolio to include UV LED solutions. The company offers UV LED modules and systems for applications such as water purification, disinfection, and industrial processes. LG Innotek, a subsidiary of LG Group, develops and produces UV LED modules and components. The company offers UV-C LED modules for disinfection applications in healthcare, food processing, and water treatment.Europe UV LED Market Scope: Inquire before buying

Global Europe UV LED Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 110.11 Mn. Forecast Period 2023 to 2029 CAGR: 24.59% Market Size in 2029: US $ 513.11 Mn. Segments Covered: by Technology UV-A UV-B UV-C by Industry vertical Healthcare and Medical Agriculture Residential Industrial Commercial by Application UV curing Medical light therapy Disinfection & sterilization Counterfeit detection Optical sensing & instrumentation Others Key Players:

1. Baldwin Technology Company, Inc 2. Halma Plc 3. Heraeus Holding. 4. Koninklijke Philips N.V. 5. Lg Innotek 6. Lumileds Holding B.V 7. Nichia Corporation 8. Nordson Corporation, 9. Schott 10. Seoulviosys Co., Ltd. 11. Sglux 12. Signify Holding 13. Osram Opto Semiconductors Gmbh, 14. Thorlabs 15. UV-Technik FAQs: 1. What are the growth drivers for the Europe UV LED Market? Ans. Rising demand for UV LED in different industries is expected to be the major driver for the Europe UV LED Market. 2. What are the major restraints for the Europe UV LED Market growth? Ans. The Initial Investment Challenge for UV LED Implementation restrains the Europe UV LED market. 3. Which country is expected to lead the global Market during the forecast period? Ans. Germany is expected to lead the Europe UV LED Market during the forecast period. 4. What is the projected market size & growth rate of the Europe UV LED Market? Ans. The Europe UV LED Market size was valued at USD 110.11 Million in 2022 and the total Europe UV LED Market revenue is expected to grow at a CAGR of 24.59 % from 2022 to 2029, reaching nearly USD 513.11 Million. 5. What segments are covered in the Market report? Ans. The segments covered in the Europe UV LED Market report are Technology, Application, Industry Vertical, and Region.

Table of Content: 1. Europe UV LED Market: Research Methodology 2. Europe UV LED Market: Executive Summary 3. Europe UV LED Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Market Structure 3.3.1. Market Leaders 3.3.2. Market Followers 3.3.3. Emerging Players 3.4. Consolidation of the Market 4. Europe UV LED Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Europe UV LED Market: Segmentation (by Value USD and Volume Units) 5.1. Europe UV LED Market, By Technology (2022-2029) 5.1.1. UV-A 5.1.2. UV-B 5.1.3. UV-C 5.2. Europe UV LED Market, By Application (2022-2029) 5.2.1. UV curing 5.2.2. Medical light therapy 5.2.3. Disinfection & sterilization 5.2.4. Counterfeit detection 5.2.5. Optical sensing & instrumentation 5.2.6. Others 5.3. Europe UV LED Market, By Industry Vertical (2022-2029) 5.3.1. Healthcare and Medical 5.3.2. Agriculture 5.3.3. Residential 5.3.4. Industrial 5.3.5. Commercial 5.4. Europe UV LED Market, by Country (2022-2029) 5.4.1. UK 5.4.2. France 5.4.3. Germany 5.4.4. Italy 5.4.5. Spain 5.4.6. Sweden 5.4.7. Austria 5.4.8. Rest of Europe 6. Company Profile: Key players 6.1. Baldwin Technology Company, Inc 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Halma Plc 6.3. Heraeus Holding. 6.4. Koninklijke Philips N.V. 6.5. Lg Innotek 6.6. Lumileds Holding B.V 6.7. Nichia Corporation 6.8. Nordson Corporation, 6.9. Schott 6.10. Seoulviosys Co., Ltd. 6.11. Sglux 6.12. Signify Holding 6.13. Osram Opto Semiconductors Gmbh, 6.14. Thorlabs 6.15. UV-Technik 7. Key Findings 8. Industry Recommendation