Europe Medical Imaging Market size was valued at USD 21.10 Bn in 2023 and is expected to reach USD 34.17 Bn by 2030, at a CAGR of 5.8 %. Medical Imaging involves non-invasive techniques to create visual representations of the interior of a body for clinical analysis and medical intervention. It encompasses various modalities such as X-ray, MRI, CT, and ultrasound. The Europe Medical Imaging Market refers to the collective industry in European countries focused on providing advanced imaging solutions for medical diagnostics. As technology evolves, medical imaging becomes crucial for early and accurate disease detection. The market in Europe continues to expand with innovations, addressing the rising demand for precise diagnostic tools in healthcare, and emphasizing the integration of cutting-edge technologies for improved patient outcomes and effective medical interventions. One major driver propelling the growth of the Europe Medical Imaging Market is the increasing prevalence of chronic diseases, driving the demand for advanced diagnostic imaging technologies. With a rising aging population and changing lifestyle patterns, there is a surge in conditions like cardiovascular diseases and cancer. The need for accurate and timely diagnosis to facilitate effective treatment strategies has fueled the adoption of sophisticated medical imaging solutions. Advanced technologies such as MRI, CT scans, and ultrasound are in high demand for their ability to provide detailed insights into anatomical structures and aid in early disease detection. This escalating demand for precise diagnostics is a significant catalyst for the expansion of the Europe Medical Imaging Market.To know about the Research Methodology :- Request Free Sample Report Siemens Healthiness, a prominent player in the Europe Medical Imaging Industry, recently introduced state-of-the-art imaging technologies, such as high-resolution MRI and CT scanners. This strategic development has bolstered Siemens Healthiness' position in the market, contributing to its substantial market share growth. The Europe Medical Imaging Market is witnessing notable advancements, with Siemens Healthiness playing a pivotal role in shaping the landscape of diagnostic imaging technologies.

Europe Medical Imaging Market Driver

Revolutionizing Healthcare: Europe's Aging Population Fuels Advancements in Medical Imaging for Precise Diagnoses and Cost-Efficient Treatments In-depth analysis of the driving forces behind the Europe Medical Imaging Market reveals a prominent factor: the escalating burden of chronic diseases. Europe stands out with the world's highest proportion of seniors (65+), projected to reach 25% by 2050, increasing susceptibility to conditions like cancer, cardiovascular problems, and neurological disorders. Medical imaging emerges as a pivotal player, ensuring early detection and precise diagnosis of chronic diseases, thereby enhancing treatment efficacy and survival rates. The imperative for early intervention, exemplified by advanced techniques like MRI or PET/CT in cancer diagnosis, leads to less invasive procedures and higher cure rates. Moreover, given the escalating healthcare costs associated with chronic diseases, medical imaging optimizes treatment plans, reducing unnecessary procedures, hospital stays, and contributing to significant cost savings in the Europe Medical Imaging Market. Recent developments in key European countries underscore the market's dynamism. In Germany, Siemens Healthineers' Biograph Vision Quadra PET/CT scanner, utilizing AI-powered image reconstruction, exemplifies innovation by optimizing image quality and reducing scan time, enhancing patient comfort and workflow efficiency. Meanwhile, France's dedicated €120 million investment in the ANRS-PEA2 program establishes a national network of PET/CT scanners, emphasizing early cancer diagnosis and personalized treatment planning. In Italy, researchers at the University of Bologna contribute to the market with an AI algorithm analyzing chest X-rays, achieving a remarkable 94% accuracy in detecting lung nodules. These advancements underscore the vibrant landscape of the Europe Medical Imaging Market, driven by cutting-edge technologies and strategic investments. Technological Advancements Propel Europe Medical Imaging Market into the Future: AI and Precision Medicine Take Center Stage In a groundbreaking shift, the Europe Medical Imaging Market is undergoing a transformative wave propelled by the seamless integration of artificial intelligence (AI) and precision medicine. AI algorithms have emerged as the linchpin, fundamentally reshaping the landscape of image analysis within medical imaging. Through the automation of the interpretation process, these algorithms not only elevate diagnostic accuracy but also significantly reduce the time required for radiologists to analyze images, paving the way for efficiency and accuracy in the Europe Medical Imaging Market. Moreover, the synergy between AI and medical imaging is ushering in the era of personalized medicine. This innovative approach tailors imaging protocols to the unique genetic and medical profiles of individual patients in the Europe Medical Imaging Market. The result is an optimization of image quality, a reduction in unnecessary radiation exposure, and an improvement in diagnostic accuracy, especially in complex medical cases where precision is paramount, shaping a new paradigm for patient-centric care. Recent developments in key European countries further underscore the profound impact of these advancements. In the United Kingdom, Royal Philips has collaborated with the National Health Service (NHS) to implement the ChestWise AI solution, revolutionizing chest X-ray analysis for pneumonia diagnosis with enhanced accuracy. The outcome is not only a reduction in patient waiting times but also a more streamlined and efficient healthcare process, minimizing unnecessary antibiotic prescriptions and setting a benchmark for AI integration in the Europe Medical Imaging Market. Spain's Vall d'Hebron University Hospital is pioneering the use of 3D printing technology in pre-surgical planning for complex orthopaedic procedures. By creating patient-specific 3D models derived from CT scans, surgeons can visualize and optimize their approach, leading to superior surgical outcomes and faster recovery times, showcasing the transformative potential of AI in the Europe Medical Imaging Market. In Sweden, Qventus Medical's AI-powered ultrasound technology, known as Q-View, is making waves by providing real-time image guidance during biopsies. This breakthrough enhances accuracy, reduces the number of needle insertions, and ultimately improves both patient comfort and procedure success rates, highlighting the versatility and impact of AI technologies in the Europe Medical Imaging Market. These detailed developments underscore the transformative impact of AI and precision medicine on the European Medical Imaging Market. This dynamic fusion of technology, coupled with a patient-centric approach, is not just reshaping the industry but heralding a future where innovation and efficiency redefine the standards of medical imaging in the Europe Medical Imaging Market. Europe Medical Imaging Market Restrain and Challenges The Europe Medical Imaging Market faces significant restraints and challenges that influence its growth trajectory. One major restraint is the high cost associated with acquiring and maintaining advanced medical imaging equipment. The cutting-edge technologies, such as MRI machines and high-end CT scanners, come with substantial initial investments and ongoing maintenance expenses. This cost burden can limit the accessibility of advanced imaging services, particularly in smaller healthcare facilities or those with constrained budgets. Affordability issues can, in turn, impede the widespread adoption of sophisticated medical imaging technologies across the European healthcare landscape. Another critical Europe Medical Imaging Market restraint is the potential for radiation exposure in certain imaging modalities, such as CT scans. Despite their diagnostic benefits, repeated exposure to ionizing radiation raises concerns about long-term health risks, including an increased likelihood of cancer. Balancing the benefits of accurate diagnosis with the potential risks poses a challenge for healthcare providers and influences patient perceptions. regulatory compliance and standardization pose challenges in the European medical Imaging Market. The diverse regulatory landscape across European countries can create complexities for manufacturers aiming to adhere to varying standards. Achieving uniformity in quality and safety regulations is crucial for ensuring consistency and interoperability across medical imaging devices and technologies in the region. In navigating these challenges, stakeholders in the Europe Medical Imaging Market must work towards addressing cost barriers, enhancing safety measures, and promoting regulatory harmonization to foster a more sustainable and accessible healthcare imaging environment across the continent.Europe Medical Imaging Market Trends

Two prominent trends are shaping the landscape of the Europe Medical Imaging Market, influencing its evolution and future trajectory. there is a notable surge in the integration of artificial intelligence (AI) into medical imaging practices. AI algorithms are revolutionizing image analysis, enhancing diagnostic accuracy, and expediting the interpretation of medical images. This trend is driving advancements in automation, allowing for quicker and more precise diagnoses, thereby significantly impacting the efficiency and effectiveness of medical imaging procedures. The utilization of AI in medical imaging not only improves diagnostic capabilities but also contributes to the overall growth and innovation within the Europe Medical Imaging Market. there is a growing emphasis on telemedicine and remote imaging solutions. The increasing demand for accessibility and convenience has led to the development of remote medical imaging technologies. Telemedicine applications allow healthcare professionals to conduct diagnostic imaging procedures remotely, expanding access to medical services, especially in rural or underserved areas. This trend is particularly relevant in the context of the Europe Medical Imaging Market, where the implementation of telemedicine is contributing to enhanced patient care, reduced healthcare disparities, and improved overall healthcare infrastructure. These trends underscore the dynamic nature of the Europe Medical Imaging Market, driven by technological advancements and a shift towards more patient-centric and accessible healthcare solutions. As the market continues to evolve, the integration of AI and the expansion of telemedicine are poised to play pivotal roles in shaping the future of medical imaging across European countries.Europe Medical Imaging Market Segment Analysis

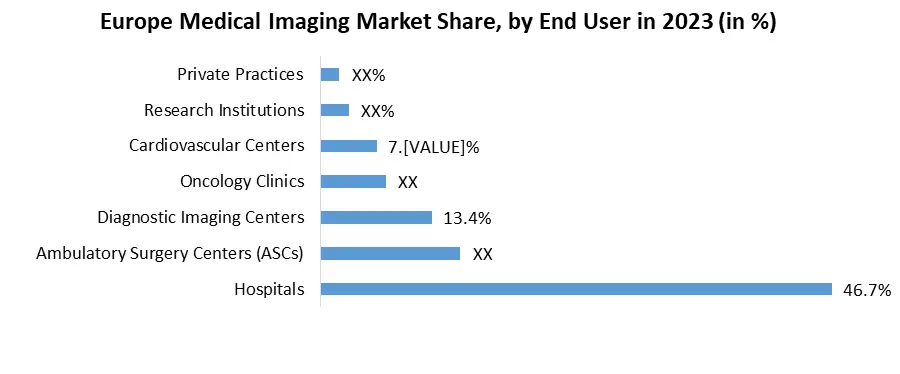

Based on Product Type, In the Europe Medical Imaging Market, Magnetic Resonance Imaging (MRI) stands out as the most dominating segment. MRI technology offers detailed and non-invasive imaging across various medical applications, contributing to its widespread adoption. The segment's dominance is fueled by the increasing demand for high-resolution imaging, particularly in neurology, cardiology, and oncology. Recent developments in MRI technology include advancements in image quality and faster scan times, enhancing patient comfort and diagnostic efficiency. Major manufacturers in Europe are introducing innovative MRI systems with AI-powered image reconstruction, improving accuracy. These developments underscore the continuous evolution of the MRI segment, consolidating its dominance in the dynamic Europe Medical Imaging Market.Based on End User, In the Europe Medical Imaging Market, hospitals emerge as the most dominating segment. Hospitals serve as primary hubs for patient care, diagnosis, and treatment, necessitating a comprehensive range of medical imaging modalities to cater to diverse medical conditions. The high patient volume, coupled with the need for extensive diagnostic capabilities, positions hospitals as key contributors to the demand for medical imaging technologies. Moreover, hospitals often house specialized units such as oncology clinics and cardiovascular centers, further intensifying their reliance on advanced imaging solutions. Recent developments in this segment include the integration of artificial intelligence (AI) for enhanced diagnostic accuracy and efficiency. Major hospitals across Europe are adopting AI-powered imaging solutions to streamline workflows and improve patient outcomes. For instance, leading hospitals in Germany and the United Kingdom have implemented AI algorithms for chest X-ray analysis, expediting pneumonia diagnosis with higher accuracy. The Europe Medical Imaging Market continues to witness dynamic advancements, with hospitals at the forefront of adopting cutting-edge technologies to meet the evolving healthcare demands.

Europe Medical Imaging Market Regional Analysis

In 2023, the Europe Medical Imaging Market asserted its global dominance, capturing a noteworthy 30.5 percent market share. This commanding position can be attributed to the region's wealth of manufacturing companies and the consistent introduction of innovative medical imaging products. The European market thrives on the extensive adoption of advanced yet costly imaging modalities, driven by favorable reimbursement scenarios and heightened patient awareness. Notably, service charges in developed nations are over 1000 times higher than those in emerging countries, promising a rapid return on investment for expensive diagnostic systems. Europe leads in healthcare expenditure as a percentage of GDP, with Germany allocating nearly 12.8 percent in 2015, expected to rise to 15.42 percent in the forecast period. This substantial investment, coupled with an aging population, a surge in chronic diseases, and a rising trend in preventive diagnostic practices, solidifies Europe as a pivotal driver for the Europe Medical Imaging Market. Germany: Pioneering Precision in the Europe Medical Imaging Market Germany has solidified its leadership in the Europe Medical Imaging Market, boasting a remarkable USD 3.2 billion market size and an imposing 25% share in 2023. This commanding position is rooted in a sophisticated healthcare infrastructure, featuring state-of-the-art facilities and a cadre of highly skilled professionals. Germany's unwavering commitment to innovation, especially in technologies such as AI and personalized medicine, positions it at the forefront of the advanced medical landscape. Aging Population Dynamics With over 25% of its population comprising seniors, Germany faces an increasing burden of chronic diseases. The imperative for early and accurate diagnosis of conditions like cancer, cardiovascular issues, and neurological disorders becomes paramount, propelling market growth. The integration of advanced imaging techniques, including AI-powered PET/CT scans, becomes indispensable in addressing these complex healthcare challenges. Innovation at the Helm Industry giants like Siemens Healthiness lead the charge in technological advancements, exemplified by the Biograph Vision Quadra PET/CT scanner. Infused with AI capabilities, this innovation underscores Germany's commitment to enhancing image clarity and workflow efficiency. The benefits extend to both patients and healthcare providers, streamlining operations and improving overall healthcare outcomes. Precision Medicine Initiatives Germany's substantial investments in initiatives like the USD 40 million national precision medicine network underscore its dedication to personalized healthcare. By tailoring cancer treatment plans based on individual genetic and medical profiles, the country aims to deliver more effective therapies and significantly contribute to the expansion of the Europe Medical Imaging Market. Collaborations between esteemed institutions such as Heidelberg University Hospital and global players like Philips drive further innovation. Notable joint projects, like the exploration of AI-powered MRI for brain tumor diagnosis, exemplify Germany's commitment to collaborative research. These efforts hold the promise of advancements in early detection and treatment protocols, shaping the future of medical imaging in the Europe Medical Imaging Market.United Kingdom: Pioneering Innovation in the Europe Medical Imaging Market The United Kingdom emerges as a formidable force in the Europe Medical Imaging Market, boasting a substantial USD 2.8 billion market size in 2023 and capturing a noteworthy 22% share of the European landscape. Distinguished by its steadfast commitment to innovation, the UK stands out as a dynamic player in this evolving market. The UK distinguishes itself through proactive government initiatives, notably the AI in Healthcare strategy. This program champions the widespread adoption of AI-powered imaging tools, promising enhanced accuracy and efficiency in medical diagnostics. This governmental thrust positions the UK as a fertile ground for the integration of cutting-edge technologies in the Europe Medical Imaging Market. Early Diagnosis Focus Similar to Germany, the UK confronts an aging population grappling with rising chronic diseases. The nation's focus on early diagnosis is evident in initiatives such as the deployment of Royal Philips Chest Wise solution across NHS hospitals. This AI-powered tool accelerates and enhances the accuracy of pneumonia diagnosis, showcasing a commitment to leveraging advanced imaging for improved patient outcomes. Personalized Medicine Champion Recognizing the potential of personalized medicine, the UK invests significantly in initiatives like the USD 120 million AI-powered drug discovery collaboration between pharmaceutical giants GSK and AstraZeneca. By leveraging medical imaging data, this venture aims to revolutionize drug development, paving the way for more targeted and effective treatments. This aligns with the broader trends in the Europe Medical Imaging Market, emphasizing the move towards personalized healthcare solutions. The UK's academic prowess, exemplified by institutions like Oxford University, positions it at the forefront of innovation. Ongoing research initiatives, such as the development of a deep learning algorithm for early prostate cancer detection in MRI scans, underscore the nation's dedication to pushing the boundaries of medical imaging technology. This academic excellence contributes significantly to the overall growth and advancement of the Europe Medical Imaging Market. The UK's narrative extends beyond these groundbreaking developments. A robust private healthcare sector fosters healthy competition and encourages investments in cutting-edge technology. Continuous research efforts by universities and medical institutions form a vital pipeline for future innovations. Moreover, a steadfast commitment to patient-centered care ensures the ethical and responsible implementation of AI and other advanced technologies, aligning with the evolving trends in the Europe Medical Imaging Market. Stakeholders keen on navigating the Europe Medical Imaging glean valuable insights from the UK's unique approach to innovation. Prioritizing government-backed initiatives, personalized medicine, and academic research presents promising opportunities. Investing in AI-powered solutions, forging partnerships with research institutions, and tailoring offerings to meet the specific needs of the UK market can prove highly successful in this dynamic and competitive landscape. Key market players such as Hitachi, SHIMADZU CORPORATION, SuperSonic Imagine, and Hologic, Inc. play a significant role. These companies strategically employ expansion and innovation to broaden their consumer base and meet escalating demands. A notable example is Esaote, which, in 2020, shipped 103 portable ultrasound systems in response to the COVID-19 outbreak, showcasing adaptability and resilience. This proactive strategy not only fortified the company's position but also contributed to substantial revenue growth during the pandemic, underscoring Europe's robust standing in the Europe Medical Imaging Market. The objective of the report is to present a comprehensive analysis of the Europe Medical Imaging Industry to the stakeholders in the industry. The past and current status of the industry with the forecasted Market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include Market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Europe Medical Imaging Market dynamics, and structure by analyzing the Market segments and project the Europe Medical Imaging Market size. Clear representation of competitive analysis of key players by Product, price, financial position, Product portfolio, growth strategies, and regional presence in the Europe Medical Imaging Market make the report an investor’s guide.

Segment Reason for Dominance Private Practices Hospitals Extensive imaging capabilities, large patient base, diverse range of specialties Royal Philips partners with major European hospitals to implement AI-powered ChestWise solution for faster pneumonia diagnosis, improving patient outcomes and reducing healthcare costs (Europe Medical Imaging Market). Ambulatory Surgery Centers (ASCs) Increasing outpatient procedures, cost-effectiveness compared to hospitals Siemens Healthineers launches compact and affordable MRI system specifically designed for ASCs, expanding access to advanced imaging for outpatient care (Europe Medical Imaging Market). Diagnostic Imaging Centers Specialization in imaging services, focus on shorter wait times and patient convenience Rise of teleradiology in diagnostic imaging centers across Europe, leveraging AI-powered image interpretation for faster diagnosis and improved workflow efficiency (Europe Medical Imaging Market). Oncology Clinics High demand for advanced imaging for cancer diagnosis and treatment monitoring GSK and AstraZeneca partner on €120 million AI-powered drug discovery initiative in Europe, utilizing medical imaging data to personalize cancer treatment plans (Europe Medical Imaging Market). Cardiovascular Centers Crucial role in cardiovascular disease diagnosis and intervention French public-private partnership invests €120 million in a national network of advanced PET/CT scanners for early cancer diagnosis and personalized treatment in cardiovascular centers (Europe Medical Imaging Market). Research Institutions Driving innovation in medical imaging technologies and applications Oxford University researchers develop deep learning algorithm for early prostate cancer detection in MRI scans, potentially leading to improved patient outcomes in research institutions across Europe (Europe Medical Imaging Market). Private Practices Competition from larger healthcare facilities, decreasing reimbursement rates Rise of mobile and portable imaging solutions caters to private practices, offering greater flexibility and cost-effectiveness (Europe Medical Imaging Market). Europe Medical Imaging Market Scope: Inquiry Before Buying

Europe Medical Imaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 21.10 Bn. Forecast Period 2024 to 2030 CAGR: 5.8 % Market Size in 2030: US$ 34.17 Bn. Segments Covered: by Product Type X-ray Imaging Nuclear Medicine Imaging Magnetic Resonance Imaging (MRI) Ultrasound Imaging Other by Application Oncology Cardiology Neurology Orthopedics Gastroenterology Other by End-Use Hospitals Ambulatory Surgery Centers (ASCs) Diagnostic Imaging Centers Oncology Clinics Cardiovascular Centers Research Institutions Private Practices Europe Medical Imaging Market, by Region

Europe United Kingdom France Germany Italy Spain Sweden Austria Rest of EuropeEurope Medical Imaging Market Key players

1. Esaote SpA (Italy) 2. Ziehm Imaging GmbH (Germany) 3. Philips Healthcare (Netherlands) 4. Siemens Healthineers (Germany) 5. Draegerwerk AG & Co. KGaA (Germany) 6. GE Healthcare (UK) 7. Esaote SpA (Italy) 8. SuperSonic Imagine (France) 9. Koninklijke Philips N.V.( Netherlands) 10. Mediso Ltd.(Hungary) 11. MILabs B.V(Netherlands) 12. MR Solutions(, United Kingdom) Frequently Asked Questions: 1] What is the growth rate of the Europe Medical Imaging Market? Ans. The Europe Medical Imaging Market is growing at a significant rate of 5.8 % during the forecast period. 2] What is the expected Market size by 2030? Ans. The Europe Medical Imaging Market size is expected to reach USD 34.17 Bn by 2030. 3] Which are the top players in the Market? Ans. The major top players in the Market are Esaote SpA (Italy), Ziehm Imaging GmbH (Germany), Philips Healthcare (Netherlands), Siemens Healthineers (Germany), Draegerwerk AG & Co. KGaA (Germany), GE Healthcare (UK) 4] What are the factors driving the Market growth? Ans. The Market is driven by factors such as the rising prevalence of chronic diseases, technological advancements in imaging modalities, and a growing aging population. The increasing demand for early and accurate diagnosis, coupled with the integration of artificial intelligence in medical imaging, contributes to market growth. Additionally, favorable reimbursement policies and ongoing research and development activities further fuel the expansion of the Market. 5] Which country held the largest Market share in 2023? Ans. Germany held the largest Market share in 2023.

1. Europe Medical Imaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Europe Medical Imaging Market: Dynamics 2.1. Europe Medical Imaging Market Trends by Region 2.1.1. Europe Medical Imaging Market Trends 2.1.1.1. Europe Medical Imaging Market Drivers 2.1.1.2. Europe Medical Imaging Market Restraints 2.1.1.3. Europe Medical Imaging Market Opportunities 2.1.1.4. Europe Medical Imaging Market Challenges 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Supply Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Analysis of Government Schemes and Initiatives For Europe Medical Imaging Industry 2.8. The Pandemic Impact on Europe Medical Imaging Market 2.9. Europe Medical Imaging Price Trend Analysis (2022-23) 3. Europe Medical Imaging Market: Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 3.1.1. X-ray Imaging 3.1.2. Nuclear Medicine Imaging 3.1.3. Magnetic Resonance Imaging (MRI) 3.1.4. Ultrasound Imaging 3.1.5. Other 3.2. Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 3.2.1. Oncology 3.2.2. Cardiology 3.2.3. Neurology 3.2.4. Orthopedics 3.2.5. Gastroenterology 3.2.6. Other 3.3. Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 3.3.1. Hospitals 3.3.2. Ambulatory Surgery Centers (ASCs) 3.3.3. Diagnostic Imaging Centers 3.3.4. Oncology Clinics 3.3.5. Cardiovascular Centers 3.3.6. Research Institutions 3.3.7. Private Practices 3.4. Europe Medical Imaging Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. Europe Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.2. Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.3. Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4. Europe Medical Imaging Market Size and Forecast, by Country (2023-2030) 4.4.1. United Kingdom 4.4.1.1. United Kingdom Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.1.2. United Kingdom Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.1.3. United Kingdom Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.2. France 4.4.2.1. France Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.2.2. France Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.2.3. France Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.3. Germany 4.4.3.1. Germany Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.3.2. Germany Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.3.3. Germany Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.4. Italy 4.4.4.1. Italy Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.4.2. Italy Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.4.3. Italy Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.5. Spain 4.4.5.1. Spain Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.5.2. Spain Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.5.3. Spain Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.6. Sweden 4.4.6.1. Sweden Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.6.2. Sweden Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.6.3. Sweden Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.7. Austria 4.4.7.1. Austria Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.7.2. Austria Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.7.3. Austria Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 4.4.8. Rest of Europe 4.4.8.1. Rest of Europe Medical Imaging Market Size and Forecast, by Product Type (2023-2030) 4.4.8.2. Rest of Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.4.8.3. Rest of Europe Medical Imaging Market Size and Forecast, by End-User (2023-2030) 5. Europe Medical Imaging Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Product Type Segment 5.3.3. End-user Segment 5.3.4. Revenue (2022) 5.3.5. Company Locations 5.4. Leading Europe Medical Imaging Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. Philips Healthcare (Netherlands) 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Awards Received by the Firm 6.1.6. Recent Developments 6.2. Esaote SpA (Italy) 6.3. Ziehm Imaging GmbH (Germany) 6.4. Siemens Healthineers (Germany) 6.5. Draegerwerk AG & Co. KGaA (Germany) 6.6. GE Healthcare (UK) 6.7. Esaote SpA (Italy) 6.8. SuperSonic Imagine (France) 6.9. Koninklijke Philips N.V.( Netherlands) 6.10. Mediso Ltd.(Hungary) 6.11. MILabs B.V(Netherlands) 6.12. MR Solutions(, United Kingdom) 7. Key Findings 8. Industry Recommendations 9. Europe Medical Imaging Market: Research Methodology