The Europe Artificial Intelligence (AI) Market size was valued at USD 304.02 Billion in 2023 and the total Europe Artificial Intelligence (AI) revenue is expected to grow at a CAGR of 36.38 % from 2024 to 2030, reaching nearly USD 2667.82 Billion by 2030. Artificial intelligence (AI) is a branch of computer science that focuses on creating machines able to perform tasks traditionally requiring human intelligence, such as perception, reasoning, and learning. The Artificial Intelligence (AI) market includes a wide range of applications, such as speech recognition, image processing, and autonomous vehicles and has seen rapid growth in recent years due to advancements in technology and increased investment. The Artificial Intelligence (AI) market includes software, hardware, and services that enable organizations to develop and deploy AI applications. The Europe Artificial Intelligence (AI) Market expected a rapid growth, primarily driven by increased investments in AI technologies across various sectors such as healthcare, automotive, finance, and manufacturing. The Europe Artificial Intelligence (AI) Market is driven by factors such as a growing emphasis on automation, the proliferation of big data, advancements in deep learning and neural networks, and government initiatives supporting AI innovation. The European Union's AI strategy, aiming to position Europe as a global leader in AI, further catalyzes market growth through funding initiatives and regulatory frameworks to promote ethical AI deployment.To know about the Research Methodology :- Request Free Sample Report Europe Artificial Intelligence (AI) Market Key players such as DeepMind, a subsidiary of Alphabet Inc., have made significant strides in AI research, particularly in healthcare with AI-assisted diagnoses and drug discovery. Companies like Siemens, IBM, and SAP are actively integrating AI into their solutions to enhance efficiency and customer experience across industries. Recent developments also include collaborations between tech giants and academia for AI research, fostering innovation hubs and startup ecosystems across European cities such as London, Berlin, and Paris. Despite these advancements, challenges persist, including the need for robust data privacy measures, skill shortages in AI talent, and ethical concerns surrounding AI implementation. Nevertheless, the Europe Artificial Intelligence (AI) Market is poised for exponential growth, with forecasts indicating substantial market expansion driven by ongoing technological advancements, supportive government policies, and increased adoption of AI-driven solutions across diverse sectors.

Europe Artificial Intelligence (AI) Market Dynamics:

European Artificial Intelligence Market Driven by the Need for More Efficient Operations and Enhanced Security The Europe Artificial Intelligence (AI) Market is witnessing exponential growth, defying economic and political challenges to surge ahead. With a predictable spend of $33.2 billion in 2023, constituting a significant 20% share of the global AI market, Europe remains a pivotal player despite adversities such as the war in Ukraine, inflation, IT budget cuts, and layoffs in prominent tech companies. The region anticipates a remarkable Compound Annual Growth Rate (CAGR) of 29.6% between 2021 and 2026, surpassing the global CAGR of 27.0%. Western and Central and Eastern Europe jointly drive this growth, poised to surpass $70 billion in AI spending by 2026. This growth is primarily steered by software, set to command nearly two-thirds of total spending by 2023. Among the industries boosting this growth, banking, retail, manufacturing (both discrete and process), and professional services emerge as the primary spenders on AI, jointly contributing over half (55.5%) of the total European AI market spending in 2023. The paramount emphasis on enhanced security underscores key use cases, spanning augmented threat intelligence and prevention systems and fraud analysis and investigation. These priorities transcend financial services, expanding into the public sector and industries susceptible to heightened threats, such as telecommunications, utilities, and transportation.Examples abound across sectors showcasing the fervent adoption of AI. In manufacturing, ABB Robotics epitomizes efficiency enhancement through AI-driven robotics, optimizing production processes while diminishing human intervention. Meanwhile, financial giants like HSBC leverage AI algorithms to fortify their security apparatus, deploying real-time transaction analysis to swiftly flag potentially fraudulent activities. In healthcare, Aidoc's AI radiology platform expedites diagnosis by identifying abnormalities in medical imaging, facilitating quicker interventions for patients. Governmental impetus, exemplified by France's strategic AI investments fostering research and innovation, bolsters the ecosystem. Graphcore's focus on AI chip development for deep learning amplifies technological advancements, enabling swifter and more efficient model training across diverse sectors. This AI surge extends to personalized customer interactions in beauty conglomerates like L'Oreal, autonomous driving initiatives by firms like Volvo, precision farming endeavors by startups like Connecterra, and educational transformation through platforms like Knewton's adaptive learning systems. Zalando’s AI-driven demand forecasting in retail typifies how AI optimizes inventory management and bolsters sales efficiency. The confluence of industry demands for operational efficiency, amplified security needs, and technological advancements across sectors continues to drive Europe Artificial Intelligence (AI) Market growth, showcasing resilience and unwavering momentum in the face of external disruptions. Fluctuating Stance on Cryptocurrency Legality Hinders the Europe Artificial Intelligence (AI) Market Growth Stricter data privacy regulations hindering the growth the Europe Artificial Intelligence (AI) Market exemplified by GDPR, present complexities for AI companies such as Google, leading to significant fines for mishandling user data, underscoring the intricate compliance requirements in data-driven AI applications. A glaring shortage of AI talent across Europe hampers progress, evidenced by unfilled roles in AI engineering due to skill mismatches, hindering the widespread implementation of AI initiatives. Ethical quandaries surrounding AI persist, in controversial uses like facial recognition by Clearview AI, sparking debates about privacy infringement and ethical boundaries in deploying AI technologies. Concerns regarding biased AI algorithms, illustrated by instances such as Amazon's biased recruitment AI, raise alarms about discriminatory practices perpetuated by AI systems, posing ethical and social challenges in employment and decision-making processes. Regulatory complexities, such as the slow pace of AI governance establishment by the EU, create uncertainties for businesses navigating AI regulations, hindering smooth integration and adherence to evolving compliance standards. The integration of AI with existing systems poses technological hurdles for businesses, impacting the seamless adoption and operational effectiveness of AI solutions. The substantial initial investment required for AI implementation deters small and medium-sized enterprises (SMEs) from embracing AI technologies, limiting their accessibility and impeding widespread adoption. Challenges in understanding AI decision-making processes due to its 'black box' nature led to transparency concerns, as seen in debates over algorithmic content curation, raising questions about misinformation propagation. Data quality issues persist, hindering AI performance due to incomplete or biased datasets, undermining the accuracy and reliability of AI-driven insights or predictions. Organizational inertia in sectors like agriculture and cultural resistance to AI adoption pose significant challenges, limiting the broader acceptance and deployment of AI-driven innovations. The potential risks associated with both underuse and overuse of AI, liability concerns regarding damage caused by AI-operated devices or services, and threats to fundamental rights and democracy due to biased AI, data privacy infringements, and potential manipulation of public debates all contribute to the complex landscape of challenges hindering the Europe AI market's seamless evolution. While companies acknowledge AI's importance, particularly in optimizing operations and engaging customers, the existing challenges in addressing talent shortages, ethical concerns, regulatory complexities, and technological integration hinder the full realization of AI's transformative potential across various European sectors, necessitating concerted efforts in addressing these multifaceted challenges for ethical and sustainable AI advancements.

Europe Artificial Intelligence (AI) Market Segment Analysis:

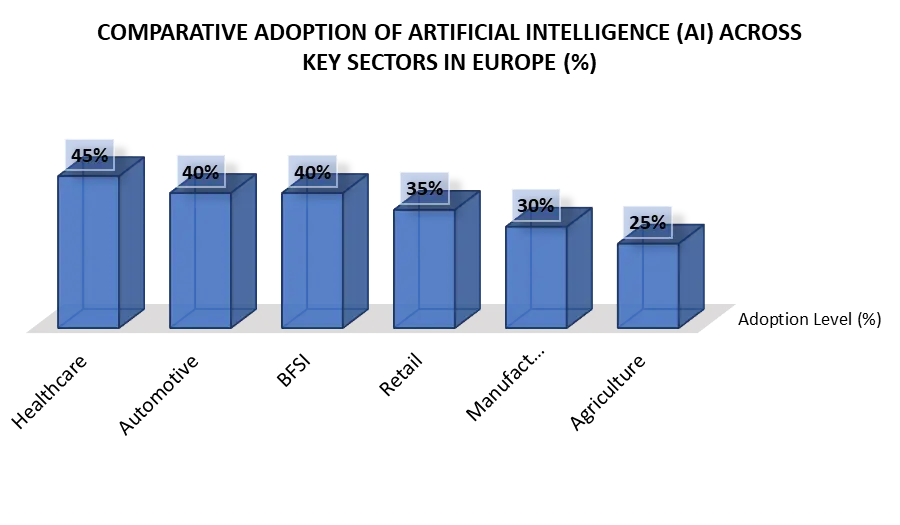

Based on Technology, Machine Learning dominated the Europe Artificial Intelligence (AI) Market in 2023 as it finds extensive use across industries such as finance, healthcare, and marketing. Its adaptable nature allows for predictive analytics, personalized recommendations, and process optimization. Natural Language Processing (NLP) follows suit, witnessing notable adoption in customer service, translation services, and sentiment analysis, enhancing interactions through chatbots and language processing. Computer Vision sees robust implementation in sectors like automotive (for autonomous vehicles), healthcare (medical imaging analysis), and retail (facial recognition for personalized experiences). Robotics, though advancing steadily, finds prominent application in manufacturing and logistics, streamlining production and warehouse operations. While Machine Learning and NLP enjoy widespread adoption in diverse domains, Computer Vision and Robotics show promising growth, particularly in specialized sectors, demonstrating varied but significant impacts on Europe Artificial Intelligence (AI) Market.Based on Application, Healthcare segment dominated the Europe Artificial Intelligence (AI) Market in 2023 and is expected to maintain its dominance over the forecast period. It leveraging AI for diagnostic imaging, drug discovery, and personalized medicine, significantly improving patient care and treatment outcomes. Automotive sees rapid integration of AI in autonomous vehicles, enhancing safety features and revolutionizing transportation. In the BFSI sector, AI algorithms drive fraud detection, risk assessment, and personalized financial services, ensuring secure transactions and efficient operations. Retail experiences AI's impact through personalized recommendations, inventory optimization, and enhanced customer experiences using chatbots and recommendation engines. Manufacturing witnesses increased efficiency with AI-driven robotics optimizing production lines and predictive maintenance. Agriculture benefits from precision farming, employing AI for crop monitoring, yield optimization, and livestock management, thereby revolutionizing traditional farming methods. While healthcare, automotive, and BFSI lead in extensive AI adoption, other sectors like retail, manufacturing, and agriculture exhibit promising growth potential, showcasing diverse but impactful applications driving the evolution of Europe's AI market.

Europe Artificial Intelligence (AI) Market Regional Insights:

The Europe Artificial Intelligence (AI) market showcases a diverse landscape across its regional segments, each contributing unique dynamics to the overall AI ecosystem. In Western Europe, leading tech hubs such as Germany, the UK, and France spearhead AI innovation. Germany leverages AI predominantly in its manufacturing sector, optimizing processes with automation, while the UK emphasizes AI applications in financial services and healthcare, focusing on improving customer experiences and medical diagnostics. France sets its focus on AI ethics and regulations, fostering a conducive environment for AI startups and innovation hubs. Meanwhile, Central and Eastern Europe, encompassing countries like Poland, Czech Republic, and Hungary, witness a rising tide in AI adoption and boost the growth of Europe Artificial Intelligence (AI) Market. The region benefits from a growing pool of tech talent and governmental support, driving AI integration across various sectors such as manufacturing, finance, and IT services. The Nordic countries—Sweden, Norway, Denmark—emphasize AI's role in innovation and sustainability. These nations prioritize green technologies and digitalization, employing AI in renewable energy, healthcare, and smart city development. Their substantial investments in AI research and collaborations with startups position the Nordic region as a key AI innovation center. Southern European countries, including Spain, Italy, and Portugal, exhibit a growing interest in AI applications, albeit at a slightly slower pace than their Western counterparts. These regions witness AI integration in sectors like agriculture, tourism, and smart infrastructure, with efforts to bridge the AI skill gap and amplify investments in AI startups. While each region faces its distinct challenges, encompassing regulatory complexities, skill shortages, and ethical concerns surrounding AI deployment, these obstacles also present opportunities for collaboration, skill development, and innovation. The European Union's strategies emphasizing ethical AI deployment and cross-border collaboration aim to harmonize AI practices and foster a cohesive AI landscape across regions. The future outlook for the Europe AI market is promising, driven by continued investments, technological advancements, and cross-sectoral applications. Collaborative efforts and a focus on skill development and ethical AI practices are poised to shape a more unified and innovative AI landscape across Europe, leveraging regional diversity to driven AI-driven advancements across industries.Europe Artificial Intelligence (AI) Market Scope: Inquire Before Buying

Europe Artificial Intelligence (AI) Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 304.02 Bn. Forecast Period 2024 to 2030 CAGR: 36.38% Market Size in 2030: US $ 2667.82 Bn. Segments Covered: by Technology Machine Learning Natural Language Processing (NLP) Computer Vision Robotics Others by Component Hardware Software Services by Deployment Model On-Premises Cloud-Based by Application Healthcare Automotive BFSI Retail Manufacturing Agriculture Others by End User Enterprises Small and Medium-sized Enterprises (SMEs) Government Healthcare Providers Others Leading players in the Europe Artificial Intelligence (AI) Market:

1. DeepMind Technologies, London, United Kingdom 2. Cognizant Softvision, Bucharest, Romania 3. UiPath, Bucharest, Romania 4. BenevolentAI, London, United Kingdom 5. Darktrace, Cambridge, United Kingdom 6. Dataiku, Paris, France 7. Babylon Health, London, United Kingdom 8. Zalando, Berlin, Germany 9. Freenome, San Francisco, United States (with a strong presence in Europe) 10. Graphcore, Bristol, United Kingdom 11. ThoughtSpot, London, United Kingdom 12. Cyberdyne, Tsukuba, Japan (with a European base in the Netherlands) 13. Luminance, London, United Kingdom 14. Peak AI, Manchester, United Kingdom 15. Leverton (MRI Software), Berlin, Germany FAQs: 1] What Major Key players in the Global Europe Artificial Intelligence (AI) Market report? Ans. The Major Key players covered in the Europe Artificial Intelligence (AI) Market report are DeepMind Technologies, London, Cognizant Softvision,UiPath, BenevolentAI. 2] Which region is expected to hold the highest share in the Global Europe Artificial Intelligence (AI) Market? Ans. U. K. region is expected to hold the highest share in the Europe Artificial Intelligence (AI) Market. 3] What is the market size of the Global Europe Artificial Intelligence (AI) Market by 2030? Ans. The market size of the Europe Artificial Intelligence (AI) Market by 2030 is expected to reach US$ 2667.82 Billion. 4] What is the forecast period for the Global Europe Artificial Intelligence (AI) Market? Ans. The forecast period for the Europe Artificial Intelligence (AI) Market is 2024-2030. 5] What was the market size of the Global Europe Artificial Intelligence (AI) Market in 2023? Ans. The market size of the Europe Artificial Intelligence (AI) Market in 2023 was valued at US$ 304.02 Billion.

1. Europe Artificial Intelligence (AI) Market: Research Methodology 2. Europe Artificial Intelligence (AI) Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Europe Artificial Intelligence (AI) Market: Dynamics 3.1. Europe Artificial Intelligence (AI) Market Trends 3.2. Europe Artificial Intelligence (AI) Market Drivers 3.3. Europe Artificial Intelligence (AI) Market Restraints 3.4. Europe Artificial Intelligence (AI) Market Opportunities 3.5. Europe Artificial Intelligence (AI) Market Challenges 3.6. PORTER’s Five Forces Analysis 3.7. PESTLE Analysis 3.8. Technological Roadmap 3.9. Regulatory Landscape 3.10. Key Opinion Leader Analysis for Europe Artificial Intelligence (AI) End User 3.11. Analysis of Government Schemes and Initiatives for Europe Artificial Intelligence (AI) End User 3.12. The Covid 19 Pandemic Impact on Europe Artificial Intelligence (AI) Market 4. Europe Artificial Intelligence (AI) Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. Europe Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.1.1. Machine Learning 4.1.2. Natural Language Processing (NLP) 4.1.3. Computer Vision 4.1.4. Robotics 4.1.5. Others 4.2. Europe Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.2.1. Hardware 4.2.2. Software 4.2.3. Services 4.3. Europe Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.3.1. On-Premises 4.3.2. Cloud-Based 4.4. Europe Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.4.1. Healthcare 4.4.2. Automotive 4.4.3. BFSI 4.4.4. Retail 4.4.5. Manufacturing 4.4.6. Agriculture 4.4.7. Others 4.5. Europe Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.5.1. Enterprises 4.5.2. Small and Medium-sized Enterprises (SMEs) 4.5.3. Government 4.5.4. Healthcare Providers 4.5.5. Others 4.6. Europe Artificial Intelligence (AI) Market Size and Forecast, by Country (2022-2029) 4.6.1. United Kingdom 4.6.1.1. United Kingdom Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.1.2. United Kingdom Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.1.3. United Kingdom Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.1.4. United Kingdom Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.1.5. United Kingdom Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.6.2. France 4.6.2.1. France Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.2.2. France Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.2.3. France Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.2.4. France Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.2.5. France Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.6.3. Germany 4.6.3.1. Germany Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.3.2. Germany Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.3.3. Germany Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.3.4. Germany Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.3.5. Germany Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.6.4. Italy 4.6.4.1. Italy Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.4.2. Italy Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.4.3. Italy Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.4.4. Italy Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.4.5. Italy Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.6.5. Spain 4.6.5.1. Spain Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.5.2. Spain Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.5.3. Spain Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.5.4. Spain Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.5.5. Spain Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.6.6. Sweden 4.6.6.1. Sweden Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.6.2. Sweden Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.6.3. Sweden Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.6.4. Sweden Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.6.5. Sweden Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.6.7. Austria 4.6.7.1. Austria Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.7.2. Austria Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.7.3. Austria Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.7.4. Austria Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.7.5. Austria Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 4.6.8. Rest of Europe 4.6.8.1. Rest of Europe Artificial Intelligence (AI) Market Size and Forecast, by Technology (2022-2029) 4.6.8.2. Rest of Europe Artificial Intelligence (AI) Market Size and Forecast, by Component (2022-2029) 4.6.8.3. Rest of Europe Artificial Intelligence (AI) Market Size and Forecast, by Deployment Model (2022-2029) 4.6.8.4. Rest of Europe Artificial Intelligence (AI) Market Size and Forecast, by Application (2022-2029) 4.6.8.5. Rest of Europe Artificial Intelligence (AI) Market Size and Forecast, by End-User (2022-2029) 5. Europe Artificial Intelligence (AI) Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Service Segment 5.3.3. End-user Segment 5.3.4. Revenue (2022) 5.3.5. Company Locations 5.4. Leading Europe Artificial Intelligence (AI) Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. DeepMind Technologies, London, United Kingdom 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Scale of Operation (Small, Medium, and Large) 6.1.7. Details on Partnership 6.1.8. Regulatory Accreditations and Certifications Received by Them 6.1.9. Awards Received by the Firm 6.1.10. Recent Developments 6.2. Cognizant Softvision, Bucharest, Romania 6.3. UiPath, Bucharest, Romania 6.4. BenevolentAI, London, United Kingdom 6.5. Darktrace, Cambridge, United Kingdom 6.6. Dataiku, Paris, France 6.7. Babylon Health, London, United Kingdom 6.8. Zalando, Berlin, Germany 6.9. Freenome, San Francisco, United States (with a strong presence in Europe) 6.10. Graphcore, Bristol, United Kingdom 6.11. ThoughtSpot, London, United Kingdom 6.12. Cyberdyne, Tsukuba, Japan (with a European base in the Netherlands) 6.13. Luminance, London, United Kingdom 6.14. Peak AI, Manchester, United Kingdom 6.15. Leverton (MRI Software), Berlin, Germany 7. Key Findings 8. End User Recommendations