The Europe agriculture Drone Market size was valued at USD 660.1Mn in 2023. The Europe agriculture Drone Market revenue is growing at a CAGR of 18.5 % from 2023 to 2030, reaching nearly USD 2165.90 Mn by 2030.Europe Agriculture Drone Market

The Agriculture Drone Market in Europe is experiencing significant growth and transformation, primarily in response to the significant challenges faced by the agricultural sector. In 2018, the European Union (EU) counted over 10.5 million agricultural holdings, with the majority about less than 5 hectares of land. This demographic composition has increased a growing demand for innovative technologies to address the escalating need for food production. Traditional farming methods are falling short, necessitating a paradigm shift towards innovative solutions. Drones are enhancing agricultural efficiency and productivity by offering monitoring capabilities for crops through the integration of cameras and sensors. These UAVs are deployed for the precise application of fertilizers, weedicides, pesticides, and other essential substances. The autonomous flight capability, facilitated by dedicated software featuring GPS, speed control, altitude management, Region of Interest (ROI) setting, geo-fencing, and fail-safe modes, positions drones as versatile and efficient tools for modern agriculture.To know about the Research Methodology:-Request Free Sample Report In the face of various challenges confronting the agriculture sector in Europe, such as labor shortages, escalating production costs, and environmental degradation, drones have emerged as advanced technologies offering viable solutions. Despite a decline in the number of farms within the EU, the total land utilized for agricultural production remains consistent at approximately 173 million hectares, representing 39% of the EU's total land area. To tackle these challenges and meet the increasing demand for food production, the adoption of Information and Communication Technologies becomes imperative. Drones, as a non-human-centric, transparent, and evidence-based technology, present themselves as a solution to these challenges, offering a way to enhance agricultural practices sustainably. As Europe contends with the imperative of achieving increased food production, the Europe Agriculture Drone Market stands as a major in this transformative landscape. The adoption of drones is a response to the pressing challenges faced by the agriculture sector and an instrumental shift towards more efficient and technologically advanced farming practices. The Europe Agriculture Drone Market is thus positioned to play an important role in reshaping the agricultural landscape in Europe, contributing to sustainable and productive outcomes. European drone regulations have a direct impact on agriculture drones and their operations. The European Union has adopted EU drone rules that take an 'operation-centric' approach, considering the risk of a particular operation as the starting point. These rules affect agriculture drones by providing a legal framework for their use and ensuring safe, secure, green, and privacy-respectful operations Key aspects of the EU drone regulations include: Drone classification: Drones are classified into open, specific, and certified categories. The open category includes drones up to 25 kg, mostly for leisure purposes and not requiring prior authorization. The specific and certified categories concern mostly the professional use of drones. Registration: Operators of drones above 250 g must register with their country's National Aviation Authority (NAA). Competences: The regulations require all operators of drones above 250 g to have the necessary competencies appropriate to the risk category of the operation. Drone spraying: In Europe, due to reasonably strict regulations on drift, drone spraying is allowed at around 2-2.5-3 meters above the crop stand. The European Union is also working on further liberalization and the development of a European drone strategy, which aims to capitalize on the advantages of agricultural drones, such as precise application of chemicals, efficient coverage of larger croplands, and reduced chemical usage. The European Commission has been financing research and innovation projects to develop, deploy, and validate new drone technologies, and the EU institutions are engaging with stakeholders to promote SME involvement in drone operations to drive the Europe Agriculture Drone Market growth.

Europe Agriculture Drone Market Dynamics

Driver Increasing Adoption of Precision Agriculture Drives Market Growth Precision Agriculture Adoption refers to the utilization of advanced technologies to improve the efficiency and sustainability of farming methods. In the Europe Agriculture Drone Market, precision agriculture incorporates drones to gather and analyze data for crop management. These drones are equipped with various sensors that capture detailed information about soil health, crop growth, and pest infestations. By utilizing this data, farmers make well-informed decisions regarding irrigation, fertilization, and pesticide application, thereby optimizing resource usage and minimizing environmental impact. The Europe Agriculture Drone Market, which is driven by the trend of Precision Agriculture Adoption, benefits greatly from the ability of drones to swiftly cover large farmlands and provide real-time insights. This integration of technology enhances overall farm productivity, reduces operational costs, and aligns with the current focus on sustainable and data-driven agricultural practices, making agricultural drones an essential component of modern farming methodologies in Europe. For instance, BASF and Bosch have collaborated to develop a smart spraying technology that combines the use of drones which includes cameras, crop and weed modeling, algorithms, and artificial intelligence. This system is capable of identifying weeds and selectively applying herbicides only where they are necessary. The system possesses the capability to identify and spray weeds within an outstanding time frame of 300 milliseconds. This time limit ensures swift recognition and targeted spraying of weeds. The speed of application is comparable to traditional technologies, maintaining efficiency in the weed management process. During the experimental stage, Smart Spraying has demonstrated significant success, achieving up to a 90% reduction in herbicide volume. This reduction is attributed to the precision and intelligence of Smart Spraying technology, showcasing its potential to enhance herbicide application practices.Restrain Data Privacy Concerns limits the Market Growth Data privacy concerns in the Europe Agriculture Drone Market turn around the collection, storage, and utilization of sensitive agricultural data by unmanned aerial vehicles (UAVs). As drones equipped with advanced sensors capture detailed information on crop health and field conditions, farmers express apprehension about the protection of this data. Issues related to unauthorized access, data breaches, and the potential misuse of agricultural data raise legitimate privacy concerns among farmers. Ensuring strong data encryption, secure storage solutions, and compliance with data protection regulations are essential to addressing these apprehensions. Establishing transparent data management practices and educating stakeholders about privacy measures are important for the development of trust in the adoption of agricultural drone technology. Balancing the benefits of data-driven insights with stringent data privacy safeguards is imperative for the sustainable growth of the Europe Agriculture Drone Market, where maintaining trust and data integrity are dominant considerations. Opportunity Technological Innovations Create Lucrative Growth Opportunities for Market Growth The Europe agriculture Drone Market is transforming due to technological advancements that are revolutionizing farming practices. These innovations include advanced sensors, real-time data analysis using artificial intelligence, and improved battery life. Precision agriculture is benefiting from enhanced navigation and communication systems, while variable rate technology is optimizing resource utilization. The integration of drone-generated data into farm management systems is highlighting the importance of these innovations, promoting data-driven decision-making and sustainable practices across the Europe Agriculture Drone Market. Recent progress in agricultural drones has the potential to revolutionize farming practices by increasing productivity and efficiency. These advancements involve the development of small drones capable of pollinating plants without causing any damage, as well as the creation of autonomous pollinating drones that independently work and monitor crop health without constant human instruction. Also, agricultural drones are now being utilized for various tasks, including assessing soil quality, monitoring crop health, tracking livestock, and applying targeted pesticides, all of which contribute to improved efficiency and precision in farming operations. Drones equipped with specialized imaging technology for agriculture create and analyze vegetation indices maps, assisting farmers in planning their planting and treatments more effectively.

Europe Agriculture Drone Market Segment Analysis:

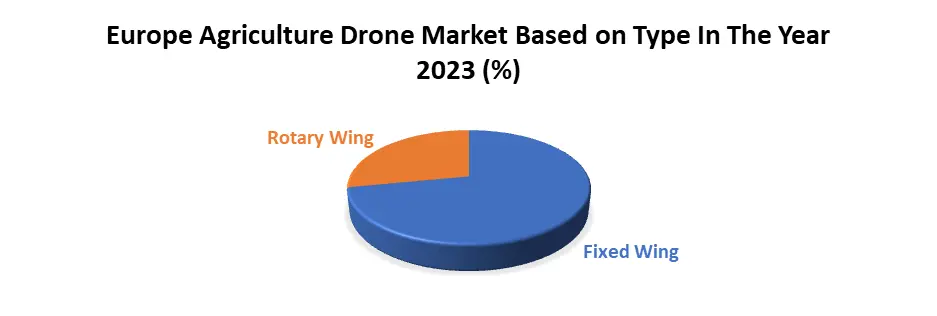

Based on Type, the fixed-wing segment dominated the type segment of the Europe Agriculture Drone Market in the year 2023. Fixed-wing drones boast higher payload capacities, enabling the incorporation of advanced imaging technologies like multispectral or hyperspectral sensors. This facilitates the acquisition of precise data on crop health, soil conditions, and pest occurrences, empowering farmers with informed decision-making capabilities for optimized resource use and enhanced yields The rotary wing segment is the fastest-growing segment of the Europe Agriculture Drone Market Due to maintaining dominance. Comprising drones such as quadcopters, these devices offer heightened agility and maneuverability, particularly suitable for navigating intricate terrains. Their ability to fly at lower altitudes and hover in specific areas makes them versatile for diverse agricultural applications. The vertical take-off and landing (VTOL) capability of rotary wing drones enhances operational simplicity, eliminating the need for runways or specialized launch/recovery equipment. This operational convenience contributes to their widespread adoption among farmers and agronomists in the European market.

Europe Agriculture Drone Market Regional Analysis:

The Europe Agriculture Drone Market Western Europe dominated the Europe Agriculture Drone market in the year 2023. The countries such as Germany, France, and the United Kingdom, advanced farming practices and a sustainability focus drive the adoption of precision agriculture using drones. Southern Europe, exemplified by Italy and Spain, leverages drones for crop monitoring in the Mediterranean climate. Northern Europe, including Denmark and the Netherlands, utilizes drones for large-scale operations, optimizing resources and enhancing overall productivity. Emerging markets in Eastern Europe, including Poland and Hungary, observe a gradual uptake of drone technology to address agricultural challenges. In Scandinavian countries, such as Norway and Sweden, drones contribute to sustainable and eco-friendly farming practices. Regional variations in climate, government regulations, and technological adoption collectively shape the Market landscape, with collaborative efforts and awareness programs fostering innovation and growth.Europe Agriculture Drone Market Scope Table:Inquire before buying

Europe Agriculture Drone Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 660.1 Mn. Forecast Period 2024 to 2030 CAGR: 18.5% Market Size in 2030: US $ 2165.90 Mn. Segments Covered: by Type Fixed Wing Rotary Wing by Component Hardware Software Services by Farming Environment Indoor Farming Outdoor Farming by Application Crop Management Field Management Crop Spraying Livestock Monitoring Variable Rate Application (VRA) Others Europe Agriculture Drone Market Key Players

1. Parrot SA (Paris, France) 2. AgEagle Aerial Systems Inc (Switzerland) 3. Quantum Systems GmbH (Gilching, Germany) 4. Delair-Tech (Toulouse, France) 5. Sentera, LLC (United Kingdom) 6. Kespry (United Kingdom) 7. Gamaya (Switzerland) 8. H3 Dynamics (Singapore) 9. Topcon (United Kingdom) 10. XAG (Europe) Limited (United Kingdom)Frequently Asked Questions:

1] What segments are covered in the Europe agriculture Drone Market report? Ans. The segments covered in the Europe agriculture Drone Market report are based on Type, Component, Farming Environment, Application, and Regions. 2] Which region is expected to hold the highest share in the Europe agriculture Drone Market? Ans. The Western Europe is expected to hold the largest share of the Europe agriculture Drone Market. 3] What is the market size of the Europe agriculture Drone Market by 2030? Ans. The market size of the Europe agriculture Drone Market by 2030 is expected to reach US$ 2165.90 Mn. 4] What is the forecast period for the Europe agriculture Drone Market? Ans. The forecast period for the Europe agriculture Drone Market is 2024-2030. 5] What was the market size of the Europe agriculture Drone Market in 2023? Ans. The market size of the Europe agriculture Drone Market in 2023 was valued at US$ 660.1 Mn.

1. Europe Agriculture Drone Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Europe Agriculture Drone Market: Dynamics 2.1. Market Trends 2.2. Market Dynamics 2.2.1. Drivers 2.2.2. Restraints 2.2.3. Opportunities 2.2.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape 2.8. Analysis of Government Schemes and Initiatives for Europe Agriculture Drone Industry 2.9. Key Opinion Leader Analysis 2.10. The Covid-19 Pandemic Impact on Europe's Agriculture Drone Market 3. Europe Agriculture Drone Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Europe Agriculture Drone Market Size and Forecast, By Type (2023-2030) 3.1.1. Fixed Wing 3.1.2. Rotary Wing 3.2. Europe Agriculture Drone Market Size and Forecast, By Component (2023-2030) 3.2.1. Hardware 3.2.2. Software 3.2.3. Services 3.3. Europe Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 3.3.1. Indoor Farming 3.3.2. Outdoor Farming 3.4. Europe Agriculture Drone Market Size and Forecast, By Application (2023-2030) 3.4.1. Crop Management 3.4.2. Field Management 3.4.3. Crop Spraying 3.4.4. Livestock Monitoring 3.4.5. Variable Rate Application (VRA) 3.4.6. Others 3.5. Europe Agriculture Drone Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Europe Agriculture Drone Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Europe Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.1.1. Fixed Wing 4.1.2. Rotary Wing 4.2. North America Europe Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.2.1. Hardware 4.2.2. Software 4.2.3. Services 4.3. North America Europe Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.3.1. Indoor Farming 4.3.2. Outdoor Farming 4.4. North America Europe Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.4.1. Crop Management 4.4.2. Field Management 4.4.3. Crop Spraying 4.4.4. Livestock Monitoring 4.4.5. Variable Rate Application (VRA) 4.4.6. Others 4.5. North America Europe Agriculture Drone Market Size and Forecast, by Country (2023-2030) 4.5.1. United Kingdom 4.5.1.1. United Kingdom Europe Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.1.1.1. Fixed Wing 4.5.1.1.2. Rotary Wing 4.5.1.2. United Kingdom Europe Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.1.2.1. Hardware 4.5.1.2.2. Software 4.5.1.2.3. Services 4.5.1.3. United Kingdom Europe Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.1.3.1. Indoor Farming 4.5.1.3.2. Outdoor Farming 4.5.1.4. United Kingdom Europe Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.1.4.1. Crop Management 4.5.1.4.2. Field Management 4.5.1.4.3. Crop Spraying 4.5.1.4.4. Livestock Monitoring 4.5.1.4.5. Variable Rate Application (VRA) 4.5.1.4.6. Others 4.5.2. France 4.5.2.1. France Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.2.1.1. Fixed Wing 4.5.2.1.2. Rotary Wing 4.5.2.2. France Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.2.2.1. Hardware 4.5.2.2.2. Software 4.5.2.2.3. Services 4.5.2.3. France Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.2.3.1. Indoor Farming 4.5.2.3.2. Outdoor Farming 4.5.2.4. France Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.2.4.1. Crop Management 4.5.2.4.2. Field Management 4.5.2.4.3. Crop Spraying 4.5.2.4.4. Livestock Monitoring 4.5.2.4.5. Variable Rate Application (VRA) 4.5.2.4.6. Others 4.5.3. Germany 4.5.3.1. Germany Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.3.1.1. Fixed Wing 4.5.3.1.2. Rotary Wing 4.5.3.2. Germany Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.3.2.1. Hardware 4.5.3.2.2. Software 4.5.3.2.3. Services 4.5.3.3. Germany Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.3.3.1. Indoor Farming 4.5.3.3.2. Outdoor Farming 4.5.3.4. Germany Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.3.4.1. Crop Management 4.5.3.4.2. Field Management 4.5.3.4.3. Crop Spraying 4.5.3.4.4. Livestock Monitoring 4.5.3.4.5. Variable Rate Application (VRA) 4.5.3.4.6. Others 4.5.4. Italy 4.5.4.1. Italy Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.4.1.1. Fixed Wing 4.5.4.1.2. Rotary Wing 4.5.4.2. Italy Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.4.2.1. Hardware 4.5.4.2.2. Software 4.5.4.2.3. Services 4.5.4.3. Italy Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.4.3.1. Indoor Farming 4.5.4.3.2. Outdoor Farming 4.5.4.4. Italy Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.4.4.1. Crop Management 4.5.4.4.2. Field Management 4.5.4.4.3. Crop Spraying 4.5.4.4.4. Livestock Monitoring 4.5.4.4.5. Variable Rate Application (VRA) 4.5.4.4.6. Others 4.5.5. Spain 4.5.5.1. Spain Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.5.1.1. Fixed Wing 4.5.5.1.2. Rotary Wing 4.5.5.2. Spain Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.5.2.1. Hardware 4.5.5.2.2. Software 4.5.5.2.3. Services 4.5.5.3. Spain Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.5.3.1. Indoor Farming 4.5.5.3.2. Outdoor Farming 4.5.5.4. Spain Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.5.4.1. Crop Management 4.5.5.4.2. Field Management 4.5.5.4.3. Crop Spraying 4.5.5.4.4. Livestock Monitoring 4.5.5.4.5. Variable Rate Application (VRA) 4.5.5.4.6. Others 4.5.6. Sweden 4.5.6.1. Sweden Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.6.1.1. Fixed Wing 4.5.6.1.2. Rotary Wing 4.5.6.2. Sweden Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.6.2.1. Hardware 4.5.6.2.2. Software 4.5.6.2.3. Services 4.5.6.3. Sweden Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.6.3.1. Indoor Farming 4.5.6.3.2. Outdoor Farming 4.5.6.4. Sweden Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.6.4.1. Crop Management 4.5.6.4.2. Field Management 4.5.6.4.3. Crop Spraying 4.5.6.4.4. Livestock Monitoring 4.5.6.4.5. Variable Rate Application (VRA) 4.5.6.4.6. Others 4.5.7. Austria 4.5.7.1. Austria Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.7.1.1. Fixed Wing 4.5.7.1.2. Rotary Wing 4.5.7.2. Austria Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.7.2.1. Hardware 4.5.7.2.2. Software 4.5.7.2.3. Services 4.5.7.3. Austria Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.7.3.1. Indoor Farming 4.5.7.3.2. Outdoor Farming 4.5.7.4. Austria Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.7.4.1. Crop Management 4.5.7.4.2. Field Management 4.5.7.4.3. Crop Spraying 4.5.7.4.4. Livestock Monitoring 4.5.7.4.5. Variable Rate Application (VRA) 4.5.7.4.6. Others 4.5.8. Rest of Europe 4.5.8.1. Rest of Europe Agriculture Drone Market Size and Forecast, By Type (2023-2030) 4.5.8.1.1. Fixed Wing 4.5.8.1.2. Rotary Wing 4.5.8.2. Rest of Europe Agriculture Drone Market Size and Forecast, By Component (2023-2030) 4.5.8.2.1. Hardware 4.5.8.2.2. Software 4.5.8.2.3. Services 4.5.8.3. Rest of Europe Agriculture Drone Market Size and Forecast, By Farming Environment (2023-2030) 4.5.8.3.1. Indoor Farming 4.5.8.3.2. Outdoor Farming 4.5.8.4. Rest of Europe Agriculture Drone Market Size and Forecast, By Application (2023-2030) 4.5.8.4.1. Crop Management 4.5.8.4.2. Field Management 4.5.8.4.3. Crop Spraying 4.5.8.4.4. Livestock Monitoring 4.5.8.4.5. Variable Rate Application (VRA) 4.5.8.4.6. Others 5. Europe Agriculture Drone Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Product Segment 5.3.3. End use Segment 5.3.4. Revenue (2022) 5.3.5. Manufacturing Locations 5.4. Leading Europe Agriculture Drone Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. Parrot SA (Paris, France) 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Recent Developments 6.2. AgEagle Aerial Systems Inc (Switzerland) 6.3. Quantum Systems GmbH (Gilching, Germany) 6.4. Delair-Tech (Toulouse, France) 6.5. Sentera, LLC (United Kingdom) 6.6. Kespry (United Kingdom) 6.7. Gamaya (Switzerland) 6.8. H3 Dynamics (Singapore) 6.9. Topcon (United Kingdom) 6.10. XAG (Europe) Limited (United Kingdom) 7. Key Findings 8. Industry Recommendations 9. Europe Agriculture Drone Market: Research Methodology.