Global Endpoint Protection Platform Market size was valued at USD 3.75 Bn. in 2022 and the total Endpoint Protection Platform Size (EPP) revenue is expected to grow by 10.4 % from 2023 to 2029, reaching nearly USD 7.50 Bn.Endpoint Protection Platform Market Overview:

As businesses throughout the world deal with more complex cyber threats, EPP solutions have become essential. This industry is characterized by a wide variety of products from different suppliers, including firewall, advanced Threat Detection and Response (TDR), and antivirus and anti-malware programs. Due to their extensive enterprise environments, North America and Europe have historically been the leading regions in terms of EPP implementation. Emerging markets in Asia-Pacific are catching up swiftly, though, as local enterprises have realized the value of strong Endpoint Security Software. The EPP market is anticipated to keep increasing due to innovation and the growing need for comprehensive endpoint protection in light of the threat landscapes constant change.To know about the Research Methodology :- Request Free Sample Report

Endpoint Protection Platform Market Drivers

Enterprises are prioritizing comprehensive EPP solutions as a result of the ongoing and constantly changing threat landscape in the digital world. Comprehensive endpoint protection is required due to the sophistication and frequency of cyberattacks, including ransomware and advanced persistent threats (APTs). The growing use of Bring Your Own Device (BYOD) rules and remote work has increased the threat surface, making endpoint security more important than ever. EPP solutions provide a centralized method to safeguard devices in various contexts. In order to protect sensitive data and guarantee legal compliance, enterprises must invest in EPP solutions to meet compliance standards and regulations like GDPR and HIPAA. Organizations looking for advanced security measures are drawn to EPP solutions thanks to the incorporation of artificial intelligence and machine learning, which improves threat detection and response capabilities. As businesses give priority to proactive cybersecurity initiatives, the growing understanding of EPP's role in preventing data breaches and limiting business disruptions promotes market growth. As enterprises look for comprehensive, adaptable, and proactive endpoint protection, these factors work together to drive the global growth of the EPP market.Endpoint Protection Platform Market Restraints

The constantly changing world of cyber threats is one of the biggest obstacles. EPP solutions must keep up with the constant development of sophisticated attack strategies by hostile actors, which puts a significant burden on budgets and necessitates significant research and development. Another limitation is the growing complexity of IT environments. Organizations frequently use a variety of endpoint ecosystems, including old-school PCs, smartphones, and Internet of Things (IoT) devices. Effective protection of this diverse landscape requires EPP solutions to adapt, which can be both technically difficult and resources Type-intensive. Regulations and compliance standards also increase the restrictions. Businesses must make sure that their EPP solutions comply with various data protection laws, industry standards, and governmental restrictions, which require a lot of resources Types. Budgetary restrictions also have an impact. Larger businesses may have trouble maximizing their investments, while smaller businesses may find it difficult to afford robust EPP solutions. User resistance to security precautions may reduce the efficiency of EPP. For both EPP providers and businesses, balancing security with user ease and productivity is a constant struggle. Together, these limitations show how the EPP market must constantly innovate and adapt if it is to successfully fend off emerging challenges.Endpoint Protection Platform Market Opportunities

The Endpoint Protection Platform Size (EPP) industry offers numerous significant potential. The demand for effective EPP solutions has been primarily driven by the frequency and sophistication of cyberattacks, which are on the rise. The market for EPP solutions is positioned for significant growth as businesses increasingly understand how crucial it is to protect their endpoints. The shifting threat environment presents yet another important opportunity. Endpoints have grown more varied and exposed as a result of the spread of IoT devices and remote workforce development. EPP solutions that can adapt and protect across a range of devices and network environments are therefore required. Further encouraging the implementation of EPP are legislative compliance requirements, such as GDPR and CCPA, which have imposed strict data protection safeguards. Providers of EPP services can supply solutions that promote compliance as organizations try to avoid expensive fines. The addition of cutting-edge technologies like AI and machine learning to EPP systems improves their capacity for threat detection and response, making them more desirable to businesses. The integration of cutting-edge technologies, rising compliance requirements, and the expanding threat landscape are all factors that are fueling demand for endpoint protection solutions that are more robust and flexible.Endpoint Protection Platform Market Challenge

The Endpoint Protection Platform Size (EPP) industry faces numerous significant obstacles. The difficulty is the constantly changing threat landscape. Malware and attack vectors are always being created by cybercriminals, making it challenging for EPP solutions to stay current. The growing complexity of IT environments is another challenge. Many firms use a variety of endpoints, such as classic PCs, mobile phones, and Internet of Things (IoT) devices, all of which need distinct security precautions. Integrating thorough protection across these several endpoints can be difficult and time-consuming. The attack surface has increased as a result of the popularity of remote work and BYOD regulations. EPP solutions must change to successfully secure mobile and distant endpoints. Stronger controls over endpoint data are required by privacy concerns and legal compliance, such as GDPR.Endpoint Protection Platform Market Trends

The demand for advanced EPP solutions has increased as a result of the sophistication of cyber-attacks. Endpoint Protection Platform Size (EPP) providers are combining AI and machine learning to improve threat detection and response capabilities as cyberattacks get more complex. Organizations are able to remain ahead of new risks because of the evolution of EPP solutions that are more intelligent. The COVID-19 epidemic has pushed the growth of remote work, making Endpoint Security Software outside of traditional office contexts more important. To protect distant workforces, EPP vendors have reacted quickly by providing cloud-based and remote monitoring solutions. Enterprises are under increased pressure to safeguard sensitive data as a result of regulatory compliance measures like GDPR and CCPA. To assist organizations in meeting these demands, EPP solutions are advancing to offer improved data protection and compliance reporting features. User-friendly interfaces and seamless integration with other security solutions are becoming more and more important to EPP suppliers. This trend toward integration streamlines Endpoint Security Management for security teams and supports a comprehensive approach to cybersecurityarchite The growth of integration, remote work, compliance-driven demand, and developments in threat detection are all key trends in the worldwide EPP market. Businesses are looking for all-encompassing solutions to safeguard their endpoints from a constantly changing threat landscape.Endpoint Protection Platform Market: Competitive Landscape

With numerous competitors fighting for market dominance across multiple verticals, the Endpoint Protection Platform Market is extremely competitive on a worldwide scale. In the financial industry, emerging companies like CrowdStrike and SentinelOne, which provide advanced Threat Detection and Response (TDR) capabilities, compete with well-established EPP suppliers like Symantec and McAfee. Given the industry's strict requirements for data security, EPP suppliers like Trend Micro and Sophos compete hard in healthcare. With their integrated solutions, companies like Microsoft and Palo Alto Networks are dominating the technology sector. Companies like FireEye and Bitdefender, meanwhile, serve the specific security requirements of the government and military. As EPP suppliers adjust to shifting cybersecurity threats and compliance rules, the market environment is still changing.Endpoint Protection Platform Market Segment Analysis

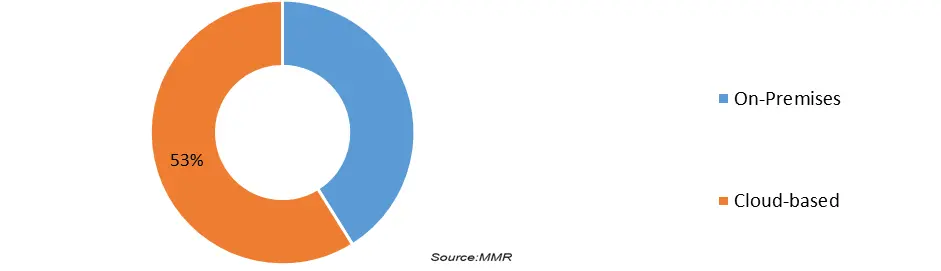

Based on the Deployment Type The cloud-based deployment approach is flexible and scalable, which makes it a popular option for companies seeking cost-efficiency and agility. It improves security by enabling remote management and automated updates. On-premises implementation, however, is still essential for businesses with stringent compliance and data privacy requirements. While it provides total control over security infrastructure, the initial costs could be greater. Hybrid deployments, which include cloud and on-premises components, are popular because they provide a good mix of flexibility and control. Organizations can select the EPP deployment that best satisfies their unique operational requirements thanks to the segmentation, which follows the changing cybersecurity scenario.Endpoint Protection Platform Market Share(%), By Deployment Type (2022)

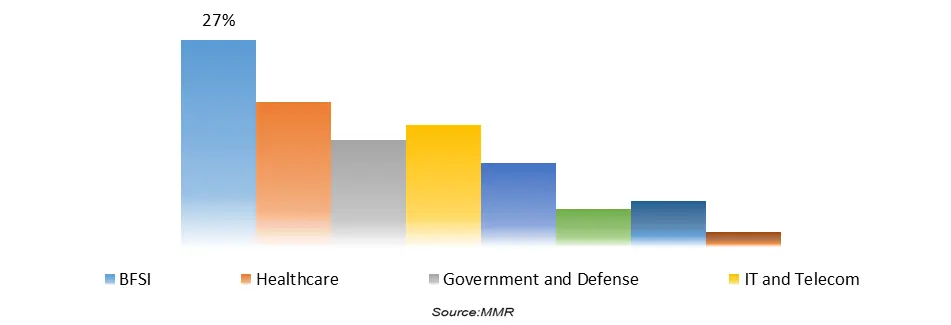

Based on Enterprise Size The Endpoint Protection Platform Market displays segmentation based on company size, which is crucial in determining the landscape. Because of their complicated network architectures and enormous user bases, large businesses frequently look for all-encompassing EPP solutions Endpoint Security Architecture. These enterprises demand strong scalability, incident response, and threat detection features. Small and medium-sized businesses (SMEs), in contrast, like EPP options since they are more sources and budget-friendly. Easy deployment and management are priorities for SMEs, who frequently use cloud-based EPP products. Vendors continuously adjust to fulfill the specific needs of both major corporations and SMEs in the dynamic EPP market. This segmentation is still essential for delivering individualized protection across a range of organization sizes as cybersecurity threats change. Based on Vertical The Endpoint Protection Platform Size (EPP) industry is split internationally across a number of verticals. EPP solutions are vital in the financial sector for securing sensitive data and combating financial fraud. EPP Effectiveness Metrics are essential to the healthcare industry for safeguarding patient data and ensuring adherence to strict standards like HIPAA. The manufacturing sector needs EPP to protect intellectual property and guarantee ongoing business operations. EPP Effectiveness Metrics are needed by the public sector to protect against cyber threats to national security. Retail relies on EPP to safeguard clients in formation and uphold confidence. Each vertical has specific difficulties that require specialized EPP solutions, which drive the market's rapid expansion and transformation.Endpoint Protection Platform Market Share(%), By Vertical (2022)

Endpoint Protection Platform Market Regional Insights:

North America dominated the market in the year 2022 and is expected to dominate the market during the forecast period. The sophisticated technological infrastructure and high level of cybersecurity awareness in North America have historically dominated the worldwide Endpoint Protection Platform Market. Data breaches and cyberattacks are a common occurrence in the region, which is why there is a strong demand for EPP solutions. Leading EPP suppliers like Symantec, McAfee, and CrowdStrike are well-represented in North America and provide thorough security solutions that are adapted to various corporate needs. Asia Pacific is witnessing growth in the market for endpoint protection Platform Sizes (EPP), and the Asia Pacific area has become a key player. EPP solutions to protect enterprises from cyber-attacks are becoming more and more in demand, especially in countries with economies that are expanding quickly, like China and India.Endpoint Protection Platform Market Share(%), By Region in 2022

The objective of the report is to present a comprehensive analysis of the Endpoint Protection Platform Size (EPP) Industry including all the stakeholders of the Vertical. The past and current status of the Vertical with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Vertical with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Vertical to the decision-makers. The report also helps in understanding the Endpoint Protection Platform Market dynamics, and structure by analyzing the market segments and projecting the Endpoint Protection Platform Size (EPP) Industry size. Clear representation of competitive analysis of key players by type, price, financial position, Deployment Type portfolio, growth strategies, and regional presence in the Endpoint Protection Platform Market makes the report an investor’s guide.

Endpoint Protection Platform Market Scope: Inquire Before Buying

Global Endpoint Protection Platform Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.75 Bn. Forecast Period 2023 to 2029 CAGR: 10.4% Market Size in 2029: US $ 7.50 Bn. Segments Covered: by Deployment Type On-Premises Cloud-based by Enterprise Size Small and Medium Enterprises Large Enterprises by Vertical BFSI Healthcare Government and Defense IT and Telecom Retail and E-commerce Manufacturing Education Others Endpoint Protection Platform Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Endpoint Protection Platform Market Key Players

1. Symantec [Arizona, United States] 2. McAfee 3. Trend Micro 4. Kaspersky Lab 5. Sophos 6. CrowdStrike 7. Palo Alto Networks 8. Bitdefender 9. Cisco Systems [California, United States] 10. Carbon Black 11. Webroot 12. ESET 13. Fortinet 14. SentinelOne 15. FireEye 16. Cylance 17. Check Point Software Technologies 18. F-Secure 19. Malwarebytes 20. Ivanti (Formerly LANDESK) 21. Avast Business 22. Comodo 23. Panda Security 24. Avira 25. Trustwave 26. Endgame 27. Forcepoint 28. SonicWall 29. Microsoft Defender for Endpoint 30. Cybereason Frequently Asked Questions: 1] What segments are covered in the Global Endpoint Protection Platform Market report? Ans. The segments covered in the Endpoint Protection Platform Market report are based on Deployment Type, Enterprise Size, Vertical, and Region. 2] Which region is expected to hold the highest share of the Global Endpoint Protection Platform Market? Ans. The North American region is expected to hold the highest share of the Endpoint Protection Platform Market. Countries such as United States, and Canada are leading the market in this region. 3] What is the market size of the Global Endpoint Protection Platform Market by 2029? Ans. The market size of the Endpoint Protection Platform Market by 2029 is expected to reach US$ 7.50 Bn. 4] What is the forecast period for the Global Endpoint Protection Platform Market? Ans. The forecast period for the Endpoint Protection Platform Market is 2023-2029. 5] What was the market size of the Global Endpoint Protection Platform Market in 2022? Ans. The market size of the Endpoint Protection Platform Market in 2022 was valued at US$ 3.75 Bn.

1. Endpoint Protection Platform Market: Research Methodology 2. Endpoint Protection Platform Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Endpoint Protection Platform Market: Dynamics 3.1. Endpoint Protection Platform Market Trends by Region 3.1.1. North America Endpoint Protection Platform Market Trends 3.1.2. Europe Endpoint Protection Platform Market Trends 3.1.3. Asia Pacific Endpoint Protection Platform Market Trends 3.1.4. Middle East and Africa Endpoint Protection Platform Market Trends 3.1.5. South America Endpoint Protection Platform Market Trends 3.2. Endpoint Protection Platform Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Endpoint Protection Platform Market Drivers 3.2.1.2. North America Endpoint Protection Platform Market Restraints 3.2.1.3. North America Endpoint Protection Platform Market Opportunities 3.2.1.4. North America Endpoint Protection Platform Market Challenges 3.2.2. Europe 3.2.2.1. Europe Endpoint Protection Platform Market Drivers 3.2.2.2. Europe Endpoint Protection Platform Market Restraints 3.2.2.3. Europe Endpoint Protection Platform Market Opportunities 3.2.2.4. Europe Endpoint Protection Platform Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Endpoint Protection Platform Market Drivers 3.2.3.2. Asia Pacific Endpoint Protection Platform Market Restraints 3.2.3.3. Asia Pacific Endpoint Protection Platform Market Opportunities 3.2.3.4. Asia Pacific Endpoint Protection Platform Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Endpoint Protection Platform Market Drivers 3.2.4.2. Middle East and Africa Endpoint Protection Platform Market Restraints 3.2.4.3. Middle East and Africa Endpoint Protection Platform Market Opportunities 3.2.4.4. Middle East and Africa Endpoint Protection Platform Market Challenges 3.2.5. South America 3.2.5.1. South America Endpoint Protection Platform Market Drivers 3.2.5.2. South America Endpoint Protection Platform Market Restraints 3.2.5.3. South America Endpoint Protection Platform Market Opportunities 3.2.5.4. South America Endpoint Protection Platform Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Endpoint Protection Platform Market 3.8. Analysis of Government Schemes and Initiatives For Endpoint Protection Platform Market 3.9. The Global Pandemic Impact on Endpoint Protection Platform Market 4. Endpoint Protection Platform Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029) 4.1. Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 4.1.1. On-Premises 4.1.2. Cloud-based 4.2. Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 4.2.1. Small and Medium Enterprises 4.2.2. Large Enterprises 4.3. Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 4.3.1. BFSI 4.3.2. Healthcare 4.3.3. Government and Defense 4.3.4. IT and Telecom 4.3.5. Retail and E-commerce 4.3.6. Manufacturing 4.3.7. Education 4.3.8. Others 4.4. Endpoint Protection Platform Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Endpoint Protection Platform Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029) 5.1. North America Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 5.1.1. On-Premises 5.1.2. Cloud-based 5.2. North America Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 5.2.1. Small and Medium Enterprises 5.2.2. Large Enterprises 5.3. North America Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 5.3.1. BFSI 5.3.2. Healthcare 5.3.3. Government and Defense 5.3.4. IT and Telecom 5.3.5. Retail and E-commerce 5.3.6. Manufacturing 5.3.7. Education 5.3.8. Others 5.4. North America Endpoint Protection Platform Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 5.4.1.1.1. On-Premises 5.4.1.1.2. Cloud-based 5.4.1.2. United States Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 5.4.1.2.1. Small and Medium Enterprises 5.4.1.2.2. Large Enterprises 5.4.1.3. United States Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 5.4.1.3.1. BFSI 5.4.1.3.2. Healthcare 5.4.1.3.3. Government and Defense 5.4.1.3.4. IT and Telecom 5.4.1.3.5. Retail and E-commerce 5.4.1.3.6. Manufacturing 5.4.1.3.7. Education 5.4.1.3.8. Others 5.4.2. Canada 5.4.2.1. Canada Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 5.4.2.1.1. On-Premises 5.4.2.1.2. Cloud-based 5.4.2.2. Canada Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 5.4.2.2.1. Small and Medium Enterprises 5.4.2.2.2. Large Enterprises 5.4.2.3. Canada Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 5.4.2.3.1. BFSI 5.4.2.3.2. Healthcare 5.4.2.3.3. Government and Defense 5.4.2.3.4. IT and Telecom 5.4.2.3.5. Retail and E-commerce 5.4.2.3.6. Manufacturing 5.4.2.3.7. Education 5.4.2.3.8. Others 5.4.3. Mexico 5.4.3.1. Mexico Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 5.4.3.1.1. On-Premises 5.4.3.1.2. Cloud-based 5.4.3.2. Mexico Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 5.4.3.2.1. Small and Medium Enterprises 5.4.3.2.2. Large Enterprises 5.4.3.3. Mexico Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 5.4.3.3.1. BFSI 5.4.3.3.2. Healthcare 5.4.3.3.3. Government and Defense 5.4.3.3.4. IT and Telecom 5.4.3.3.5. Retail and E-commerce 5.4.3.3.6. Manufacturing 5.4.3.3.7. Education 5.4.3.3.8. Others 6. Europe Endpoint Protection Platform Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029) 6.1. Europe Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.2. Europe Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.3. Europe Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4. Europe Endpoint Protection Platform Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.1.2. United Kingdom Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.1.3. United Kingdom Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4.2. France 6.4.2.1. France Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.2.2. France Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.2.3. France Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.3.2. Germany Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.3.3. Germany Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.4.2. Italy Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.4.3. Italy Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.5.2. Spain Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.5.3. Spain Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.6.2. Sweden Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.6.3. Sweden Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.7.2. Austria Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.7.3. Austria Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 6.4.8.2. Rest of Europe Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.8.3. Rest of Europe Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7. Asia Pacific Endpoint Protection Platform Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029) 7.1. Asia Pacific Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.2. Asia Pacific Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.3. Asia Pacific Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4. Asia Pacific Endpoint Protection Platform Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.1.2. China Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.1.3. China Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.2.2. S Korea Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.2.3. S Korea Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.3.2. Japan Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.3.3. Japan Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.4. India 7.4.4.1. India Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.4.2. India Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.4.3. India Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.5.2. Australia Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.5.3. Australia Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.6.2. Indonesia Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.6.3. Indonesia Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.7.2. Malaysia Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.7.3. Malaysia Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.8.2. Vietnam Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.8.3. Vietnam Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.9.2. Taiwan Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.9.3. Taiwan Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 7.4.10.2. Rest of Asia Pacific Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.10.3. Rest of Asia Pacific Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 8. Middle East and Africa Endpoint Protection Platform Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029 8.1. Middle East and Africa Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 8.2. Middle East and Africa Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 8.3. Middle East and Africa Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 8.4. Middle East and Africa Endpoint Protection Platform Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 8.4.1.2. South Africa Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 8.4.1.3. South Africa Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 8.4.2.2. GCC Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 8.4.2.3. GCC Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 8.4.3.2. Nigeria Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 8.4.3.3. Nigeria Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 8.4.4.2. Rest of ME&A Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 8.4.4.3. Rest of ME&A Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 9. South America Endpoint Protection Platform Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2022-2029 9.1. South America Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 9.2. South America Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 9.3. South America Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 9.4. South America Endpoint Protection Platform Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 9.4.1.2. Brazil Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 9.4.1.3. Brazil Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 9.4.2.2. Argentina Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 9.4.2.3. Argentina Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Endpoint Protection Platform Market Size and Forecast, by Deployment Type (2022-2029) 9.4.3.2. Rest Of South America Endpoint Protection Platform Market Size and Forecast, by Enterprise Size (2022-2029) 9.4.3.3. Rest Of South America Endpoint Protection Platform Market Size and Forecast, by Vertical (2022-2029) 10. Global Endpoint Protection Platform Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Endpoint Protection Platform Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Symantec 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. McAfee 11.3. Trend Micro 11.4. Kaspersky Lab 11.5. Sophos 11.6. CrowdStrike 11.7. Palo Alto Networks 11.8. Bitdefender 11.9. Cisco Systems [California, United States] 11.10. Carbon Black 11.11. Webroot 11.12. ESET 11.13. Fortinet 11.14. SentinelOne 11.15. FireEye 11.16. Cylance 11.17. Check Point Software Technologies 11.18. F-Secure 11.19. Malwarebytes 11.20. Ivanti (Formerly LANDESK) 11.21. Avast Business 11.22. Comodo 11.23. Panda Security 11.24. Avira 11.25. Trustwave 11.26. Endgame 11.27. Forcepoint 11.28. SonicWall 11.29. Microsoft Defender for Endpoint 11.30. Cybereason 12. Key Findings 13. Industry Recommendations 14.Terms and Glossary