Emission Trading Schemes Market is expected to reach US$ XX Mn by 2027 from US$ XX Mn in 2019 at a CAGR of XX% during the forecast period. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology :- Request Free Sample Report

Emission Trading Schemes Market Dynamics:

Emission Trading Schemes shapes the foundation of present-day pollution managing function around the world. This is a function in which productive incentives are provided to industries for attaining depletions in the release of pollution. Different nations have acquired trading plans as one of the advantages for reverse attacking temperature adjustments and directing international greenhouse releases. Pollution managing standards, worldwide confirmation, and price advantages are the major factors on which the market of release trading plans counts on. Emission trading plans observe implementations in healthcare companies, the production industry, aerospace, and automobile zone. The rise in investigation and development projects in various companies is assisting as a compulsion for the development of discharge trading schemes market over the projected period. Furthermore, increasing recognition of atmospheric pollution financed by technological investigation and contamination control capability by various nations around the world are the factors operating the emission trading plans market worldwide. The most successful charge of pollution depletion with the utilization of emission trading schemes is also increasing the market and operating the need at an augmented price. The rising implementation of emission trading schemes in automobile pollution management and production zone by giving productive inducement is estimated to distribute as a market chance for subsequent development. The effects of greenhouse gas releases pursue to be of considerable concern worldwide. Changes have happened in market build mixtures, automation development, and worldwide law, and there are 18 GHG release deals that have been accepted worldwide, functioning in 35 nations, 12 states, and 8 cities. These dealing plans present a market build perspective to directing GHG releases and reducing the consequences of climate transformation by restricting the number of industrial release attributes from the market contributors.Emission Trading Schemes Market Segment Analysis:

Emission Trading Schemes Market is divided by Application (Cement, Newsprint, Steel, Aluminum, and Petroleum), and by Region (North America, Europe, Asia Pacific, Middle East, and Africa, and Latin America). The worldwide emission trading schemes market is expected to increase over the projected period due to the increasing environmental threat over rising release. Emission trading plans are a market builds perspective to restrain release amounts by giving commercial inducements for managing emission depletion. Execution of the Kyoto agreements and the rising significance of the completely developed mechanization are estimated to have a constructive influence on the market to manage releases. In January 2005, the European release executed the European Union release trading plans to encounter its release control in the Kyoto agreement. The Plans protect over 11,000 carbon concentrated implementations with power capability over 20 MW through energy plants in 31 nations. The rising significance of release allocation with the execution of phase III is estimated to have a constructive impact on the market over the projected period. The incorporation of aviation release in the plan is estimated to unfasten new markets over the upcoming years. Increasing power in Germany, France, UK, and Italy is estimated to operate the need for power commissions and is estimated to have a constructive impact on the release plans market. The rising significance of receiving carbon advantages in the production industry is estimated to unfastened new markets over the predicted period.Emission Trading Schemes Market Regional Insights:

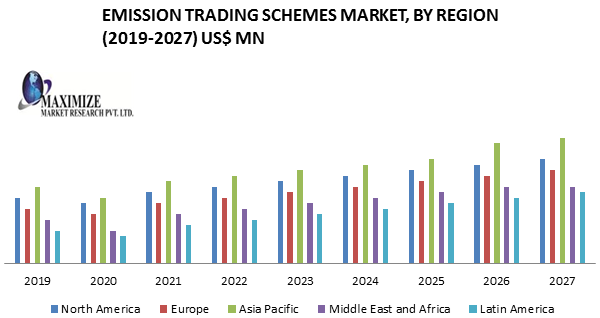

On the basis of region, Emission Trading Schemes market is divided into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. The Asia Pacific is estimated to be the dominant region in the emission trading schemes market. The Asia Pacific is the highest captivating zone for trading schemes market. The remarkable rise in implementations of emission trading in power inducement zones like newsprint, aluminum, and crude oil in Asia Pacific zone is operating the market for emission trading planning’s. Additionally, existence of unfulfilled modern automations, constant investigation and development by various production and crude oil industries are the major operators of the market in the Asia Pacific zone. North America and Europe market for emission trading schemes is estimated to develop at a stable step over the projected period. Stable retrieval from the current plans is estimated to develop at a stable step over the projected period. Stable improvement from the current productive calamity is accountable for the development in the production and manufacturing zone in North America which is operating the market for emission trading plans in the zones. Furthermore, rising environmental recognition among the people with the demand for lowering carbon footsteps financed by government advantages is estimated to increase the market in North America. The necessity to lower CO2 release and administration regulations about substantial pollution rules in UK is operating the emission trading schemes market in Europe.Key Development

Orbeo and Carbonica are constantly innovating new technologies to enhance the Emission Trading Schemes Market in the forthcoming year. The objective of the report is to present a comprehensive analysis of the Emission Trading Schemes Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Emission Trading Schemes Market dynamics, structure by analyzing the market segments and projects the Emission Trading Schemes Market size. Clear representation of competitive analysis of key players By Product, price, financial position, Product portfolio, growth strategies, and regional presence in the Emission Trading Schemes Market make the report investor’s guide.Emission Trading Schemes Market Scope: Inquire before buying

Emission Trading Schemes Market, by Application

• Cement • Newsprint • Steel • Aluminum • PetroleumEmission Trading Schemes Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • Latin AmericaEmission Trading Schemes Market Key Players:

• Carbon TradeXchange • Orbeo • Carbonica • RBC Capital Markets • Ecosur Afrique • Delphi Group • Total • British Petroleum • BNP Paribas • Chevron • Exxon Mobil • Baker Hughes • Schlumberger Ltd. • Total S.A • Halliburton Inc. • National Oilwell Varco • Royal Dutchshell pLc. • Weatherford International plc. • Penrite Oil Company • Eastern Petroleum Pvt. Ltd.

Emission Trading Schemes Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Emission Trading Schemes Market 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Emission Trading Schemes Market Analysis and Forecast 6.1. Emission Trading Schemes Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Emission Trading Schemes Market Analysis and Forecast, By Application 7.1. Introduction and Definition 7.2. Key Findings 7.3. Emission Trading Schemes Market Value Share Analysis, By Application 7.4. Emission Trading Schemes Market Size (US$ Bn) Forecast, By Application 7.5. Emission Trading Schemes Market Analysis, By Application 7.6. Emission Trading Schemes Market Attractiveness Analysis, By Application 8. Emission Trading Schemes Market Analysis, by Region 8.1. Emission Trading Schemes Market Value Share Analysis, by Region 8.2. Emission Trading Schemes Market Size (US$ Bn) Forecast, by Region 8.3. Emission Trading Schemes Market Attractiveness Analysis, by Region 9. North America Emission Trading Schemes Market Analysis 9.1. Key Findings 9.2. North America Emission Trading Schemes Market Overview 9.3. North America Emission Trading Schemes Market Value Share Analysis, By Application 9.4. North America Emission Trading Schemes Market Forecast, By Application 9.4.1. Cement 9.4.2. Newsprint 9.4.3. Steel 9.4.4. Aluminum 9.4.5. Petroleum 9.5. North America Emission Trading Schemes Market Value Share Analysis, by Country 9.6. North America Emission Trading Schemes Market Forecast, by Country 9.6.1. U.S. 9.6.2. Canada 9.7. North America Emission Trading Schemes Market Analysis, by Country 9.8. U.S. Emission Trading Schemes Market Forecast, By Application 9.8.1. Cement 9.8.2. Newsprint 9.8.3. Steel 9.8.4. Aluminum 9.8.5. Petroleum 9.9. Canada Emission Trading Schemes Market Forecast, By Application 9.9.1. Cement 9.9.2. Newsprint 9.9.3. Steel 9.9.4. Aluminum 9.9.5. Petroleum 9.10. North America Emission Trading Schemes Market Attractiveness Analysis 9.10.1. By Application 9.11. PEST Analysis 9.12. Key Trends 9.13. Key Developments 10. Europe Emission Trading Schemes Market Analysis 10.1. Key Findings 10.2. Europe Emission Trading Schemes Market Overview 10.3. Europe Emission Trading Schemes Market Value Share Analysis, By Application 10.4. Europe Emission Trading Schemes Market Forecast, By Application 10.4.1. Cement 10.4.2. Newsprint 10.4.3. Steel 10.4.4. Aluminum 10.4.5. Petroleum 10.5. Europe Emission Trading Schemes Market Value Share Analysis, by Country 10.6. Europe Emission Trading Schemes Market Forecast, by Country 10.6.1. Germany 10.6.2. U.K. 10.6.3. France 10.6.4. Italy 10.6.5. Spain 10.6.6. Russia 10.6.7. Norway 10.6.8. Rest of Europe 10.7. Europe Emission Trading Schemes Market Analysis, by Country 10.8. Germany Emission Trading Schemes Market Forecast, By Application 10.8.1. Cement 10.8.2. Newsprint 10.8.3. Steel 10.8.4. Aluminum 10.8.5. Petroleum 10.9. U.K. Emission Trading Schemes Market Forecast, By Application 10.9.1. Cement 10.9.2. Newsprint 10.9.3. Steel 10.9.4. Aluminum 10.9.5. Petroleum 10.10. France Emission Trading Schemes Market Forecast, By Application 10.10.1. Cement 10.10.2. Newsprint 10.10.3. Steel 10.10.4. Aluminum 10.10.5. Petroleum 10.11. Italy Emission Trading Schemes Market Forecast, By Application 10.11.1. Cement 10.11.2. Newsprint 10.11.3. Steel 10.11.4. Aluminum 10.11.5. Petroleum 10.12. Spain Emission Trading Schemes Market Forecast, By Application 10.12.1. Cement 10.12.2. Newsprint 10.12.3. Steel 10.12.4. Aluminum 10.12.5. Petroleum 10.13. Russia Emission Trading Schemes Market Forecast, By Application 10.13.1. Cement 10.13.2. Newsprint 10.13.3. Steel 10.13.4. Aluminum 10.13.5. Petroleum 10.14. Norway Emission Trading Schemes Market Forecast, By Application 10.14.1. Cement 10.14.2. Newsprint 10.14.3. Steel 10.14.4. Aluminum 10.14.5. Petroleum 10.15. Rest of Europe Emission Trading Schemes Market Forecast, By Application 10.15.1. Cement 10.15.2. Newsprint 10.15.3. Steel 10.15.4. Aluminum 10.15.5. Petroleum 10.16. Europe Emission Trading Schemes Market Attractiveness Analysis 10.16.1. By Application 10.17. PEST Analysis 10.18. Key Trends 10.19. Key Developments 11. Asia Pacific Emission Trading Schemes Market Analysis 11.1. Key Findings 11.2. Asia Pacific Emission Trading Schemes Market Overview 11.3. Asia Pacific Emission Trading Schemes Market Value Share Analysis, By Application 11.4. Asia Pacific Emission Trading Schemes Market Forecast, By Application 11.4.1. Cement 11.4.2. Newsprint 11.4.3. Steel 11.4.4. Aluminum 11.4.5. Petroleum 11.5. Asia Pacific Emission Trading Schemes Market Value Share Analysis, by Country 11.6. Asia Pacific Emission Trading Schemes Market Forecast, by Country 11.6.1. China 11.6.2. India 11.6.3. Japan 11.6.4. South Korea 11.6.5. Australia 11.6.6. Indonesia 11.6.7. Malaysia 11.6.8. Vietnam 11.6.9. Rest of Asia Pacific 11.7. Asia Pacific Emission Trading Schemes Market Analysis, by Country 11.8. China Emission Trading Schemes Market Forecast, By Application 11.8.1. Cement 11.8.2. Newsprint 11.8.3. Steel 11.8.4. Aluminum 11.8.5. Petroleum 11.9. India Emission Trading Schemes Market Forecast, By Application 11.9.1. Cement 11.9.2. Newsprint 11.9.3. Steel 11.9.4. Aluminum 11.9.5. Petroleum 11.10. Japan Emission Trading Schemes Market Forecast, By Application 11.10.1. Cement 11.10.2. Newsprint 11.10.3. Steel 11.10.4. Aluminum 11.10.5. Petroleum 11.11. South Korea Emission Trading Schemes Market Forecast, By Application 11.11.1. Cement 11.11.2. Newsprint 11.11.3. Steel 11.11.4. Aluminum 11.11.5. Petroleum 11.12. Australia Emission Trading Schemes Market Forecast, By Application 11.12.1. Cement 11.12.2. Newsprint 11.12.3. Steel 11.12.4. Aluminum 11.12.5. Petroleum 11.13. Indonesia Emission Trading Schemes Market Forecast, By Application 11.13.1. Cement 11.13.2. Newsprint 11.13.3. Steel 11.13.4. Aluminum 11.13.5. Petroleum 11.14. Malaysia Emission Trading Schemes Market Forecast, By Application 11.14.1. Cement 11.14.2. Newsprint 11.14.3. Steel 11.14.4. Aluminum 11.14.5. Petroleum 11.15. Vietnam Emission Trading Schemes Market Forecast, By Application 11.15.1. Cement 11.15.2. Newsprint 11.15.3. Steel 11.15.4. Aluminum 11.15.5. Petroleum 11.16. Rest of Asia Pacific Emission Trading Schemes Market Forecast, By Application 11.16.1. Cement 11.16.2. Newsprint 11.16.3. Steel 11.16.4. Aluminum 11.16.5. Petroleum 11.17. Asia Pacific Emission Trading Schemes Market Attractiveness Analysis 11.17.1. By Application 11.18. PEST Analysis 11.19. Key Trends 11.20. Key Developments 12. Middle East & Africa Emission Trading Schemes Market Analysis 12.1. Key Findings 12.2. Middle East & Africa Emission Trading Schemes Market Overview 12.3. Middle East & Africa Emission Trading Schemes Market Value Share Analysis, By Application 12.4. Middle East & Africa Emission Trading Schemes Market Forecast, By Application 12.4.1. Cement 12.4.2. Newsprint 12.4.3. Steel 12.4.4. Aluminum 12.4.5. Petroleum 12.5. Middle East & Africa Emission Trading Schemes Market Value Share Analysis, by Country 12.6. Middle East & Africa Emission Trading Schemes Market Forecast, by Country 12.6.1. GCC 12.6.2. South Africa 12.6.3. Rest of Middle East & Africa 12.7. Middle East & Africa Emission Trading Schemes Market Analysis, by Country 12.8. GCC Emission Trading Schemes Market Forecast, By Application 12.8.1. Cement 12.8.2. Newsprint 12.8.3. Steel 12.8.4. Aluminum 12.8.5. Petroleum 12.9. South Africa Emission Trading Schemes Market Forecast, By Application 12.9.1. Cement 12.9.2. Newsprint 12.9.3. Steel 12.9.4. Aluminum 12.9.5. Petroleum 12.10. Rest of Middle East & Africa Emission Trading Schemes Market Forecast, By Application 12.10.1. Cement 12.10.2. Newsprint 12.10.3. Steel 12.10.4. Aluminum 12.10.5. Petroleum 12.11. Middle East & Africa Emission Trading Schemes Market Attractiveness Analysis 12.11.1. By Application 12.12. PEST Analysis 12.13. Key Trends 12.14. Key Developments 13. South America Emission Trading Schemes Market Analysis 13.1. Key Findings 13.2. South America Emission Trading Schemes Market Overview 13.3. South America Emission Trading Schemes Market Value Share Analysis, By Application 13.4. South America Emission Trading Schemes Market Forecast, By Application 13.4.1. Cement 13.4.2. Newsprint 13.4.3. Steel 13.4.4. Aluminum 13.4.5. Petroleum 13.5. South America Emission Trading Schemes Market Value Share Analysis, By End User 13.6. South America Emission Trading Schemes Market Value Share Analysis, by Country 13.7. South America Emission Trading Schemes Market Forecast, by Country 13.7.1. Brazil 13.7.2. Mexico 13.7.3. Argentina 13.7.4. Rest of South America 13.8. South America Emission Trading Schemes Market Analysis, by Country 13.9. Brazil Emission Trading Schemes Market Forecast, By Application 13.9.1. Cement 13.9.2. Newsprint 13.9.3. Steel 13.9.4. Aluminum 13.9.5. Petroleum 13.10. Mexico Emission Trading Schemes Market Forecast, By Application 13.10.1. Cement 13.10.2. Newsprint 13.10.3. Steel 13.10.4. Aluminum 13.10.5. Petroleum 13.11. Argentina Emission Trading Schemes Market Forecast, By Application 13.11.1. Cement 13.11.2. Newsprint 13.11.3. Steel 13.11.4. Aluminum 13.11.5. Petroleum 13.12. Rest of South America Emission Trading Schemes Market Forecast, By Application 13.12.1. Cement 13.12.2. Newsprint 13.12.3. Steel 13.12.4. Aluminum 13.12.5. Petroleum 13.13. South America Emission Trading Schemes Market Attractiveness Analysis 13.13.1. By Application 13.14. PEST Analysis 13.15. Key Trends 13.16. Key Developments 14. Company Profiles 14.1. Market Share Analysis, by Company 14.2. Competition Matrix 14.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 14.2.2. New Product Launches and Product Enhancements 14.2.3. Market Consolidation 14.2.3.1. M&A by Regions, Investment and Applications 14.2.3.2. M&A Key Players, Forward Integration and Backward Integration 14.3. Company Profiles: Key Players 14.3.1. Carbon TradeXchange 14.3.1.1. Company Overview 14.3.1.2. Financial Overview 14.3.1.3. Product Portfolio 14.3.1.4. Business Strategy 14.3.1.5. Recent Developments 14.3.1.6. Development Footprint 14.3.2. Orbeo 14.3.3. Carbonica 14.3.4. RBC Capital Markets 14.3.5. Ecosur Afrique 14.3.6. Delphi Group 14.3.7. Total 14.3.8. British Petroleum 14.3.9. BNP Partners 14.3.10. Chevron 14.3.11. Exxon Mobil 14.3.12. Baker Hughes 14.3.13. Schlumberger Ltd. 14.3.14. Total S.A 14.3.15. Halliburton Inc. 14.3.16. National Oilwell Varco 14.3.17. Royal Dutchshell plc. 14.3.18. Weatherford International plc. 14.3.19. Penrite Oil Company 14.3.20. Eastern Petroleum Pvt.Ltd. Primary Key Insights