Electric Insulator Market was valued at US$ 12.80 Bn. in 2022. Global Electric Insulator Market size is estimated to grow at a CAGR of 6%.Electric Insulator Market Overview:

An electrical insulator is used in an electrical system to prevent unwanted flow of current. The insulator plays a vital role in the electrical system. It is a very high resistive path through which practically no current can flow. The material of electrical conductor enables the flow of the electrical current or charges in a single or multiple directions. Electrical conductor prevents the passing of high voltage in an electric circuit and helps to reduce the cost of energy. It is also help to save the environment and emission of pollutants, which enhances the process performances in electronic system. It also protects from getting electric shocks or electrocution.To know about the Research Methodology:-Request Free Sample Report The report has covered the market trends from 2018 to forecast the market through 2029. 2022 is considered a base year however 2022’s numbers are on the real output of the companies in the market. Special attention is given to 2022, the effect of lockdown on the demand and supply, and the impact of lockdown for the next two years on the market.

Electric Insulator Market Dynamics:

Growing Investments in Transmission and Distribution Networks The world electricity demand is expected to grow at a 1.85% rate of CAGR and a total of more than 60 million kilometers of transmission & distribution lines will need to be added, refurbished, or replaced to meet the increasing demand. In the power baseline scenario, the global power sector will require about $16.4 trillion in investment during the next 30 years, with transmission & distribution infrastructure that representing the largest sub-sector share. The Industrial inclination towards the advancement of existing electrical infrastructure have positively influenced the industry outlook. Electricity demand, opportunities to realize efficiency gains, and the potential to lower carbon emissions are some of the key factors that driving massive global investment in the transmission of electricity infrastructure and electric insulator. Emerging Investment Opportunities in Electrical Insulators Business Drive the Market Growth Electrical Insulators stopovers the electron flow of current. It is used in high-voltage systems, circuit boards & also in electric wire coating & cables. High investments toward the refurbishment of aging grid infrastructure across developed and developing economies along with the acceptance of smart grid technology are expected to drive the global electric insulators market. The expenditure toward modernization of electrical infrastructure along with rapid urbanization and refurbishment and replacement of existing assets are showing the huge demand and opportunities for market growth. Increased demand, capacity bottlenecks, along with rising emphasis toward the capacity addition of power generation will enhance the industry growth of electric insulators. Rising Smart Grid Systems: One of the Key Trends A smart grid is an advanced technology in the circuits, which enable remote monitoring of the normal operation. The smart devices have two-way communication technologies, which allows the utility to interact and control their working to detect faults. An increase in Investments in smart city projects have presented huge opportunity for the key players operating in the markets, service providers, utility providers, and consulting companies. The key services like utility, safety, transportation, and health have to be manage more efficiently and intelligently with the technology and proper utilization of resources. Smart cities development rate is depending on the smart grids to provide robust energy to perform the function. High urbanization in APAC is expected to adopt smart city technologies. High investments in smart grid technologies, distribution grid automation, and power quality equipment in countries Japan, South Korea, India, China and Australia are driving the demand for electric insulator.Electric Insulator Market Segment Analysis:

Based on material, electric insulator market is segmented into ceramic/porcelain, glass and composite. The porcelain electric insulators held the dominant position in 2022 and is projected to continue its dominance during the forecast period. Porcelain is the most commonly used material in the present day. The porcelain is aluminum silicate. The aluminum silicate is mixed with plastic kaolin, feldspar, and quartz. Porcelain is free from porosity since porosity, which is the main cause of deterioration of its dielectric property. It has an ability to offer mechanical strength and withstanding considerable stress resistance. An increase in prominence of polymeric counterparts is expected to offer a competitive edge to these insulators.

Regional Insights:

Asia-Pacific Region: Hold the Dominant Position Asia-Pacific held the dominant position in electric insulator market and is projected to contribute more than 40% share in the global market. Favourable government reforms toward energy efficiency along with strengthening focus on up-gradation and expansion of the existing R&D infrastructure are some of the prominent driving factors behind the market growth. The rapid growth and increasing investments in the transmission and distribution sector and for the up-gradation of aging grid infrastructure, demand for smart grids, along with stringent policies for energy efficiency is expected to have a good impact on the Asia Pacific electric insulator market. Technological developments in the emerging economies like China, Japan, and India, government initiatives for energy efficiency to obtain a reliable and efficient grid infrastructure are expected to further drive the electric insulator market. The presence of high population, urbanization, and the growth of the industrial sector are increasing demand for power in countries such as China and India. The government is planning to develop more electrical grid and power generation capacity, which is expected to boost the production of electric insulator. The total installed capacity of the European power grid is high and is projected to be account high during the forecast period thanks to presence of a great benchmark for integration and utilization of renewable energy in the region. It can also to promote energy transformation and achieve a high proportion of renewable energy consumption for other developed and developing countries. Electricity transmission across the gulf, Africa & APAC regions has pre-dominantly been driven by its ongoing and planned industrial and renewable power projects expansions. Henceforth, the demand for electrical insulator devices to cater the energy demand across these regions are expected too high. Furthermore, In the United States, efforts to upgrade the electric grid to meet energy demand, environmental, and security needs for the 21st century have accelerated public and private sector investments in grid modernization. The objective of the report is to present a comprehensive analysis of the global Electric Insulator Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Electric Insulator Market dynamic, structure by analyzing the market segments and projecting the Electric Insulator Market size. Clear representation of competitive analysis of key players by Application, price, financial position, product portfolio, growth strategies, and regional presence in the Electric Insulator Market make the report investor’s guide.Electric Insulator Market Scope: Inquire before buying

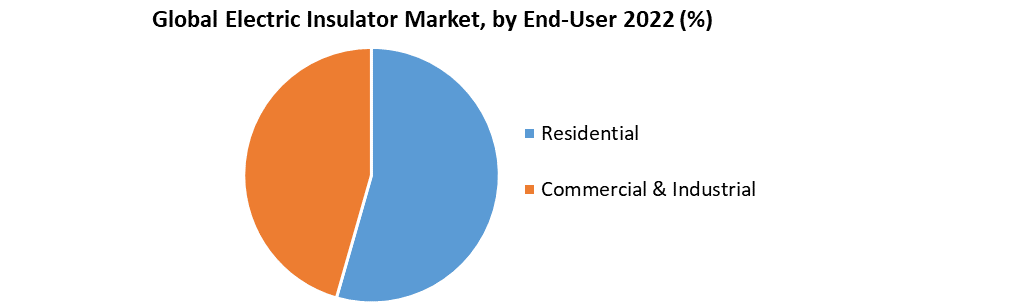

Electric Insulator Market Base Year 2022 Forecast Period 2023-2029 Historical Data CAGR Market Size in 2022 Market Size in 2029 2018 to 2022 6% US$ 12.80 Bn US$ 19.26 Bn Segments Covered by Material Ceramic/Porcelain Glass Composite byVoltage High Medium Low by Application Cables and transmission lines Switchgears Transformers Busbars Others by Product Pin Suspension Shackle Others by End-Use Residential Commercial & Industrial Regions Covered North America United States Canada Mexico Europe UK France Germany Italy Spain Sweden Austria Rest of Europe Asia Pacific China S Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh PakistanRest of APAC Middle East and Africa South Africa GCC Egypt Nigeria Rest of ME&A South America Brazil Argentina Rest of South America Key Players

1. Eaton Corporation 2. Lutron Electronics Company 3. Acuity Brands 4. Zumtobel Group 5. Flexonics 6. Hubbell Lighting Inc 7. Alera Lighting 8. Hytronik 9. Crestron Electronics, Inc 10.ROHM Semiconductor 11.Northlight Group LLP 12.Kosnic Lighting Ltd 13.Cooper Lighting LLC 14.Texas Instrument Frequently Asked Questions: 1. Which region has the largest share in Global Electric Insulator Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Electric Insulator Market? Ans: The Global Electric Insulator Market is growing at a CAGR of 6% during forecasting period 2023-2029. 3. What is scope of the Global Electric Insulator market report? Ans: Global Electric Insulator Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Electric Insulator market? Ans: The important key players in the Global Electric Insulator Market are – Eaton Corporation, Lutron Electronics Company, Acuity Brands, Zumtobel Group, Flexonics, Hubbell Lighting Inc, Alera Lighting, Hytronik, Crestron Electronics, Inc, ROHM Semiconductor, Northlight Group LLP, Kosnic Lighting Ltd, Cooper Lighting LLC, Texas Instrument, and 5. What is the study period of this market? Ans: The Global Electric Insulator Market is studied from 2022 to 2029.

1. Electric Insulator Market: Research Methodology 2. Electric Insulator Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Electric Insulator Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Electric Insulator Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis Electric Insulator 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Electric Insulator Market Segmentation 4.1 Electric Insulator Market, By Electric Insulator (2022-2029) • Ceramic/Porcelain • Glass • Composite 4.2 Electric Insulator Market, By Voltage (2022-2029) • High • Medium • Low 4.3 Electric Insulator Market, By Product (2022-2029) • Pin • Suspension • Shackle • Others 4.4 Electric Insulator Market, By End Use (2022-2029) • Residential • Commercial & Industrial • Utilities 4.5 Electric Insulator Market, By Application (2022-2029) • Cables and transmission lines • Switchgears • Transformers • Busbars • Others 5. North America Electric Insulator Market (2022-2029) North America Electric Insulator Market, By Electric Insulator (2022-2029) • Ceramic/Porcelain • Glass • Composite 5.2 North America Electric Insulator Market, By Voltage (2022-2029) • High • Medium • Low 5.3 North America Electric Insulator Market, By Product (2022-2029) • Pin • Suspension • Shackle • Others 5.4 North America Electric Insulator Market, By End Use (2022-2029) • Residential • Commercial & Industrial • Utilities 5.5 North America Electric Insulator Market, By Application (2022-2029) • Cables and transmission lines • Switchgears • Transformers • Busbars • Others 5.6 North America Electric Insulator Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Electric Insulator Market (2022-2029) 6.1. Asia Pacific Electric Insulator Market, By Electric Insulator (2022-2029) 6.2. Asia Pacific Electric Insulator Market, By Voltage (2022-2029) 6.3. Asia Pacific Electric Insulator Market, By Product (2022-2029) 6.4. Asia Pacific Electric Insulator Market, By End Use (2022-2029) 6.5. Asia Pacific Electric Insulator Market, By Application (2022-2029) 6.6. Asia Pacific Electric Insulator Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Electric Insulator Market (2022-2029) 7.1 Middle East and Africa Electric Insulator Market, By Electric Insulator (2022-2029) 7.2. Middle East and Africa Electric Insulator Market, By Voltage (2022-2029) 7.3. Middle East and Africa Electric Insulator Market, By Product (2022-2029) 7.4. Middle East and Africa Electric Insulator Market, By End Use (2022-2029) 7.5. Middle East and Africa Electric Insulator Market, By Application (2022-2029) 7.6. Middle East and Africa Electric Insulator Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Electric Insulator Market (2022-2029) 8.1. Latin America Electric Insulator Market, By Electric Insulator (2022-2029) 8.2. Latin America Electric Insulator Market, By Voltage (2022-2029) 8.3. Latin America Electric Insulator Market, By Product (2022-2029) 8.4. Latin America Electric Insulator Market, By End Use (2022-2029) 8.5. Latin America Electric Insulator Market, By Application (2022-2029) 8.6. Latin America Electric Insulator Market, by Country (2022-2029) • Brazil • Argentina • Rest of Latin America 9. European Electric Insulator Market (2022-2029) 9.1. European Electric Insulator Market, By Electric Insulator (2022-2029) 9.2. European Electric Insulator Market, By Voltage (2022-2029) 9.3. European Electric Insulator Market, By Product (2022-2029) 9.4. European Electric Insulator Market, By End Use (2022-2029) 9.5. European Electric Insulator Market, By Application (2022-2029) 9.6. European Electric Insulator Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest of Europe 10. Company Profile: Key players 6.1. General Electric 6.1.1. Overview 6.1.2. Financial Overview 6.1.3. Presence 6.1.4. Capacity Portfolio 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. ABB 6.3. Siemens 6.4. Hubbell Lapp Insulators 6.5. NGK Insulators 6.6. Aditya Birla. 6.7. Maclean Fogg 6.8. Elsewedy Electric 6.9. Seves Group 6.10. BHEL 6.11. TE Connectivity 6.12. Toshiba 6.13. LAPP Insulators 6.14. DuPont 6.15. K-Line Insulators Limited 6.16. PPC Austria Holding GmbH 6.17. Alstom S.A 6.18. Dalian Yilian Technology Co. Ltd. 6.19. ELANTAS GmbH 6.20. PFISTERER 6.21. WT Henley 6.22. Krempel