The Edible Insect Animal Feed Market was valued at USD 1.12 billion in 2023 & is expected to grow to USD 9.80 billion by 2030, representing a compound annual growth rate (CAGR) of 36.2% during the forecast period.Overview

The edible insect animal feed market is witnessing significant growth propelled by the rising global demand for animal protein and the need for sustainable protein sources in the livestock industry. Extensive research and development efforts focused on insect farming and processing technologies are expanding the market size. Diverse insect species like black soldier fly larvae, mealworms, crickets, and silkworms are being carefully chosen for their nutritional composition and suitability as animal feed. Edible insects offer a highly nutritious alternative to conventional protein sources, supplying essential proteins, fats, vitamins, minerals, and amino acids necessary for animal growth and development. A key advantage of utilizing edible insects as animal feed is their minimal environmental impact. Insect farming requires significantly less land, water, and feed compared to traditional livestock farming, while also exhibiting high feed conversion efficiency and emitting fewer greenhouse gases. The primary applications of edible insects in animal feed lie within the poultry, aquaculture, and pet food sectors. Insects can be incorporated into feed formulations as whole insects, insect meal (in powdered or pelletized form), or as insect-derived extracts. While the widespread adoption of insect-based animal feed faces challenges such as scaling up production, ensuring consistent quality and safety standards, optimizing feed formulations, and addressing consumer acceptance concerns, these obstacles present opportunities for research, innovation, and technological advancements in insect farming and processing. The regulatory landscape governing edible insects as animal feed varies across countries and regions, with some already approving specific insect species while others work towards establishing comprehensive regulatory frameworks to guarantee safety and quality standards.To know about the Research Methodology :- Request Free Sample Report

Edible Insect Animal Feed Market Report Scope

The report provides an overview of the edible insect animal feed market, including its definition, key market segments, and an estimation of market size. It analyzes the market drivers, such as the increasing global demand for animal protein and the need for sustainable protein sources, as well as the challenges faced, including scaling up production and addressing consumer acceptance concerns. The market is segmented based on insect species, animal type, and geographical regions. The report evaluates different insect species used as animal feed, their nutritional composition, farming techniques, and market potential. It assesses the applications of edible insects in animal feed, such as poultry, aquaculture, and pet food, and provides insights into market size, growth potential, and specific requirements for each segment. The competitive landscape is analysed, including profiles of key market players, their product portfolios, strategies, and recent developments. A regional analysis is conducted, highlighting growth prospects, market dynamics, and regulatory frameworks in different regions. The report presents a market forecast, projecting future trends, growth prospects, and estimated market size.Edible Insect Animal Feed market dynamics

Edible Insect Animal Feed market drivers The demand for animal protein is on the rise due to the growing global population and an expanding middle class. The consumption of edible insects presents a promising and eco-friendly solution to address the increasing demand for food. There is a growing demand for sustainable protein sources due to concerns about the environmental impact of traditional livestock farming practises. Edible insects have emerged as a promising solution to the growing concern of resource depletion. By requiring fewer resources such as land, water, and feed, edible insects offer a more sustainable protein source. Edible insects offer significant nutritional advantages such as proteins, healthy fats, vitamins, minerals, and amino acids. These benefits make them a valuable feed option for animals. Insects have been found to exhibit a remarkable feed conversion efficiency, which implies that they can convert the feed they consume into body mass more efficiently than conventional livestock. The enhanced efficiency of feed production not only results in cost reduction for farmers but also reduces the environmental impact of the process. Edible insects have been identified as a promising and sustainable source of protein. The presence of favourable regulations, coupled with augmented funding for research and partnerships, are key drivers of innovation and expansion within the market. The incorporation of edible insects in animal feed can enhance feed supply chain security by broadening the protein supply chain. This can help mitigate the dependence on conventional feed ingredients that may be susceptible to price fluctuations or supply interruptions. The localization and year-round availability of insect production can potentially enhance the reliability and durability of the feed source. The increasing awareness among consumers about sustainability and alternative protein sources is a key factor driving the acceptance of edible insects as animal feed. Insect-based feed is being actively promoted by industry stakeholders who aim to educate consumers about its nutritional benefits and positive environmental impact. Edible Insect Animal Feed market challenges The edible insect animal feed market faces several challenges that impact its growth and development. Expanding insect farming operations to meet the increasing demand for edible insect animal feed requires careful planning and investment in terms of infrastructure, technology, and operational efficiency. Scaling production while maintaining quality standards and meeting market demand is a complex task. The regulatory environment governing edible insects as animal feed varies across regions and countries, leading to inconsistencies and compliance hurdles. Harmonizing regulations, addressing compliance requirements, and establishing consistent standards are crucial for market participants and international trade. Consumer perception remains a significant challenge. Overcoming resistance and educating consumers about the nutritional benefits, safety, and sustainability advantages of using edible insects in animal feed are necessary for wider acceptance and market adoption. Managing the supply chain poses another challenge. Sourcing reliable and consistent insect supply, ensuring efficient processing and packaging, and maintaining quality throughout the distribution process require careful attention and strategic management. Establishing and maintaining stringent quality and safety standards for edible insect animal feed is essential. Adhering to hygiene practices, mitigating potential allergenic risks, and implementing robust quality control measures are ongoing challenges that need to be addressed. Investing in research and development is vital for the growth and advancement of the market. Continuous efforts are needed to enhance insect farming techniques, optimize feed formulations, and address specific nutritional requirements for different animal species. Achieving economic viability and competitiveness is a challenge. Striking a balance between cost-effective production, efficient processing, and pricing strategies that ensure affordability without compromising profitability is crucial for the market's long-term sustainability. Edible Insect Animal Feed market opportunities Edible insect animal feed is a lucrative market. The world population is increasing need for sustainable protein sources. Edible insects are a resource- and environmentally-friendly alternative to cattle production. This allows sustainable animal feed to satisfy rising demand. Market players benefit from the growing animal feed sector. Edible insects in animal feed provide a sustainable answer to the rising need for animal protein. This allows new enterprises to enter the animal feed market to meet demand. Edible insects outperform animals in feed conversion efficiency and nutrition. High-quality proteins, lipids, vitamins, and minerals increase animal health, performance, and feed efficiency. These advantages enable market growth and development. Research and technology drive edible insect animal feed innovation. Insect farming, feed formulation, and processing methods improve efficiency, scalability, and cost. Market companies might improve their manufacturing and offer new items to fulfil market demands. Edible insects are becoming a sustainable protein source for governments and regulators. Regulations and initiatives encourage insect use in animal feed, creating a favourable market. As consumer awareness and acceptance of alternative protein sources grows, there is an opportunity to capitalise on insect-based animal feed demand. Insect farming helps the circular economy and trash management. Insects produce protein-rich biomass from organic waste. This allows waste management companies and insect growers to collaborate on environmentally friendly feed manufacturing methods. Edible insect animal feed offers international expansion prospects. Market companies can penetrate new regions and meet demand for sustainable and alternative protein sources as insect-based feed becomes more widely accepted.Edible Insect Animal Feed Market Trends

Insect-based proteins in animal feed are gaining popularity. Animal diets include insects because of their nutritional value and sustainability. Market participants are broadening their products to fulfil animal species' nutritional needs. Insect-based feed formulations for poultry, aquaculture, and pet food are among these. Vertical farming, automated technologies, and optimised breeding procedures are improving insect production efficiency, scalability, and quality. Processing innovations are boosting insect-to-feed efficiency and safety. Freeze-drying, extrusion, and enzymatic treatments preserve nutrients and improve product quality. Sustainability drives insect-based animal feed adoption. Insects are more environmentally friendly than animals and can turn organic waste into protein, following circular economy principles. Edible insect research aims to maximise animal nutrition. This includes exploring appropriate feed formulations, identifying novel insect species with desired features, and understanding how insect-based diets affect animal health and performance. Edible insect animal feed sales are rising worldwide. Consumer awareness, supportive regulations, and demand for sustainable protein alternatives drive this expansion. Insect growers, feed manufacturers, and research organisations collaborate to innovate, share knowledge, and increase the market. Insect-based animal feed education is growing. Awareness campaigns, marketing, and transparent labelling help consumers choose insect-based products and overcome their reservations. The edible insect animal feed market consolidates through mergers, acquisitions, and partnerships. These partnerships boost market presence, production, and R&D.Edible Insect Animal Feed Market Regional Analysis

North America experiences significant growth in the edible insect animal feed market due to increasing demand for sustainable protein sources and a well-established animal feed industry. Europe leads in adopting edible insect animal feed with a focus on sustainability, stringent regulations, and collaborations between research institutions and market players. Asia Pacific witnesses rapid market growth driven by population growth, rising demand for animal protein, and countries like China and Thailand embracing insect farming. Latin America, including Mexico, Brazil, and Colombia, invests in insect farming initiatives and recognizes insects as a sustainable protein source. The Middle East and Africa observe gradual adoption, driven by food security concerns, limited arable land, and government initiatives to promote insect farming.Edible Insect Animal Feed Market Segment Analysis

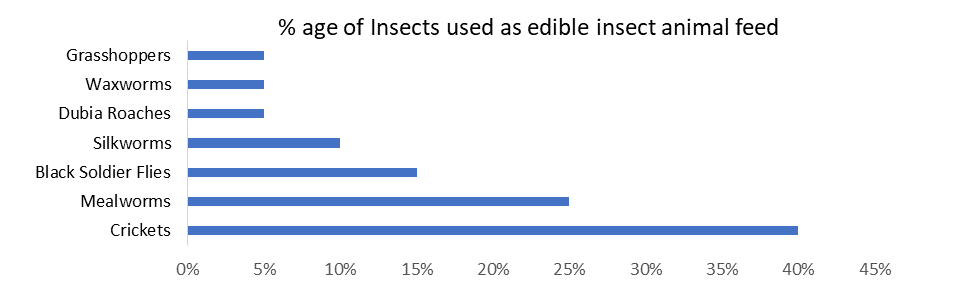

The edible insect animal feed market is analysed based on one important segment based on the type of insects used in animal feed, including mealworms, black soldier flies, crickets, and silkworms, among others. Each insect type offers unique nutritional profiles and can cater to specific animal species and their dietary requirements. Another segment focuses on the animal types for which the edible insect feed is intended. This includes poultry, swine, aquaculture (fish and shrimp), pets, and others. Customized insect-based feed formulations are developed to meet the specific nutritional needs of each animal species. The form of the feed is another segment that categorizes the market. This includes whole insects, insect meal, insect oil, and insect-based pellets or powders. The choice of feed form depends on factors like ease of handling, storage, and the specific nutritional requirements of the target animal species. The distribution channel segment examines how edible insect animal feed is supplied to the market. This includes direct sales to farmers or feed manufacturers, online platforms, specialized pet stores, and agricultural cooperatives. The selection of distribution channels is influenced by accessibility, reach, and the specific needs of the target customers. The end-user segment considers the various end users of edible insect animal feed, such as commercial livestock farms, small-scale farmers, aquaculture farms, pet owners, and zoos. Each end user has unique needs and preferences, and tailored feed solutions are developed accordingly. Regional segment divides the market based on geographic regions, such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region may have distinct market dynamics, regulatory frameworks, and consumer preferences that impact the demand and growth of the edible insect animal feed market.

Edible Insect Animal Feed Market competitive landscape

The edible insect animal feed market is highly competitive with a variety of players. The market has experienced the participation of established firms, new entrants, insect farming companies, feed manufacturers, and start-ups. Multinational corporations have acknowledged the market's potential and have made strategic investments or acquisitions to enhance their position. Companies utilise their distribution networks, brand reputation, and financial resources to gain a competitive advantage. The market for insect farming and feed production is growing with the emergence of new small-scale companies and start-ups, alongside established players. Companies differentiate themselves in the market by focusing on niche markets, specialised feed formulations, or unique farming techniques. Innovation is a crucial factor that propels competition in the market. Research and development investments are made by companies to improve insect farming methods, optimise feed formulations, and enhance processing technologies. The company provides insect-based animal feed products that are of high quality and nutritionally balanced. Collaborations and partnerships are prevalent in the competitive market as companies aim to utilise each other's knowledge and assets. The formation of strategic alliances among insect farmers, feed manufacturers, and research institutions facilitates knowledge exchange, market expansion, and faster product innovation. Effective marketing and branding strategies are essential for increasing market share. Businesses focus on increasing consumer awareness, educating about the advantages of using insect-based animal feed, and building trust in the safety and quality of their offerings. Regulatory compliance is a significant factor that affects the competitive landscape. Compliance with food safety regulations and sustainability standards is crucial for market players to uphold consumer trust and remain competitive.Edible Insect Animal Feed Market Scope: Inquire before buying

Edible Insect Animal Feed Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 1.12 Bn. Forecast Period 2024 to 2030 CAGR: 36.2% Market Size in 2030: USD 9.80 Bn. Segments Covered: by insect type Crickets Mealworms Black soldier flies Silkworms Grasshoppers Others (such as beetles, ants, and locusts) by Animal Type Poultry Swine Aquaculture (fish, shrimp, and other aquatic species) Pet food (dogs, cats, and other pets) Others (such as cattle, horses, and birds) by Product Type Whole insects Meal and flour Oil and fat Protein powder Others (such as pellets, granules, and treats by Application Feed ingredients Complete feed Supplements Additives Others (such as treats and specialty products) by Form Dried Fresh Frozen Processed (such as extruded, pelleted, or powdered) by Distribution Channel Direct sales (farmers, breeders, and insect farms) Retail stores (pet stores, feed stores, and supermarkets) Online platforms Animal feed distributors Others (such as specialty stores and wholesalers) by End-Use Industrial farms Commercial farms Household and backyard farming Aquaculture facilities Pet owners Others (zoos, research institutions, and wildlife rehabilitation centres) Edible Insect Animal Feed Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Company Profile: Edible Insect Animal Feed Key players

North America: Entomo Farms (Canada) Aspire Food Group (United States) EnviroFlight (United States) Beta Hatch (United States) Next Millennium Farms (Canada) Europe: Protix (Netherlands) Ynsect (France) Ÿnsect (France) AgriProtein (United Kingdom) Micronutris (France) Asia Pacific: Haocheng Mealworms Inc. (China) Entobel (Vietnam) Tiny Farms (Singapore) AgriProtein Asia Pacific (Singapore) Innovafeed (Singapore) South & Latin America: Protinal Protenorte SA (Colombia) Nuseed (Brazil) Agroproteinos (Mexico) Go Insecta (Brazil) Bioibérica (Mexico) Middle East and Africa: AgriProtein (South Africa) EntoFood (United Arab Emirates) Beta Bugs (South Africa) Premier Nutrition Corporation (Egypt) Yemoja Ltd (Nigeria) FAQs 1: What factors are driving the growth of the edible insect animal feed market? Ans: The growth of the edible insect animal feed market is primarily driven by the increasing demand for sustainable protein sources, the need to reduce environmental impact, the expanding animal feed industry, and the nutritional advantages offered by edible insects. 2: Which regions are leading in the adoption of edible insect animal feed? Ans: Europe and North America are leading regions in the adoption of edible insect animal feed, driven by favourable regulatory frameworks, growing consumer awareness, and a focus on sustainable practices. However, the Asia Pacific region is expected to witness rapid growth due to its large population, increasing demand for animal protein, and the search for sustainable feed alternatives. 3: What are the commonly used edible insect in animal feed production? Ans: The most commonly used edible insects in animal feed production include crickets, mealworms, black soldier flies, and silkworms. These insects are rich in protein, have favourable nutritional profiles, and can be efficiently farmed and processed for feed applications. 4: How are edible insect incorporated into animal feed? Ans: Edible insects are incorporated into animal feed in various forms such as whole insects, meal, flour, or protein powder. They can be used as a primary protein source or blended with other ingredients to create balanced feed formulations tailored to the nutritional requirements of different animal species. 5: Are there any regulatory considerations for edible insect animal feed? Ans: The regulatory landscape for edible insect animal feed varies across countries and regions. Some jurisdictions have specific regulations governing the production, labelling, and safety of insect-based animal feed. It is important for market players to ensure compliance with applicable regulations and standards in the regions where they operate. 6: What are the key challenges in the edible insect animal feed market? Ans:The key challenges in the edible insect animal feed market include scaling up production, addressing regulatory complexities, consumer acceptance, supply chain management, quality assurance, research and development, and achieving economic viability. 7: What are the growth opportunities in the edible insect animal feed market? Ans: The edible insects animal feed market presents growth opportunities driven by the rising demand for sustainable protein sources, expanding animal feed industry, advancements in farming techniques and processing technologies, supportive regulatory frameworks, and increasing consumer awareness and acceptance of alternative protein sources.

1. Edible Insect Animal Feed Market: Research Methodology 2. Edible Insect Animal Feed Market: Executive Summary 3. Edible Insect Animal Feed Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Edible Insect Animal Feed Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Edible Insect Animal Feed Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Edible Insect Animal Feed Market Size and Forecast, by Product type (2023-2030) 5.1.1. Snacks 5.1.2. Beverages 5.1.3. Frozen meals 5.1.4. Baked Goods 5.1.5. Dairy products 5.2. Edible Insect Animal Feed Market Size and Forecast, by Distribution channels (2023-2030) 5.2.1. Supermarket 5.2.2. Hypermarket 5.2.3. Convenience store 5.2.4. Online retail stores 5.3. Edible Insect Animal Feed Market Size and Forecast, by Packaging type (2023-2030) 5.3.1. Bottles 5.3.2. Cans 5.3.3. Pouches 5.4. Edible Insect Animal Feed Market Size and Forecast, by Ingredients (2023-2030) 5.4.1. Natural sweeteners 5.4.2. Sugar substitutes 5.4.3. Low fat 5.4.4. Fat free 5.4.5. Plant based 5.5. Edible Insect Animal Feed Market Size and Forecast, by Brand positioning (2023-2030) 5.5.1. Mainstream 5.5.2. Health focused 5.5.3. Organic or natural 5.5.4. Plant based 5.6. Edible Insect Animal Feed Market Size and Forecast, by region (2023-2030) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Edible Insect Animal Feed Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Edible Insect Animal Feed Market Size and Forecast, by Product type (2023-2030) 6.1.1. Snacks 6.1.2. Beverages 6.1.3. Frozen meals 6.1.4. Baked Goods 6.1.5. Dairy products 6.2. North America Edible Insect Animal Feed Market Size and Forecast, by Distribution channels (2023-2030) 6.2.1. Supermarket 6.2.2. Hypermarket 6.2.3. Convenience store 6.2.4. Online retail stores 6.3. North America Edible Insect Animal Feed Market Size and Forecast, by Packaging type (2023-2030) 6.3.1. Bottles 6.3.2. Cans 6.3.3. Pouches 6.4. North America Edible Insect Animal Feed Market Size and Forecast, by Ingredients (2023-2030) 6.4.1. Natural sweeteners 6.4.2. Sugar substitutes 6.4.3. Low fat 6.4.4. Fat free 6.4.5. Plant based 6.5. North America Edible Insect Animal Feed Market Size and Forecast, by Brand positioning (2023-2030) 6.5.1. Mainstream 6.5.2. Health focused 6.5.3. Organic or natural 6.5.4. Plant based 6.6. North America Edible Insect Animal Feed Market Size and Forecast, by Country (2023-2030) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Edible Insect Animal Feed Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Edible Insect Animal Feed Market Size and Forecast, by Product type (2023-2030) 7.1.1. Snacks 7.1.2. Beverages 7.1.3. Frozen meals 7.1.4. Baked Goods 7.1.5. Dairy products 7.2. Europe Edible Insect Animal Feed Market Size and Forecast, by Distribution channels (2023-2030) 7.2.1. Supermarket 7.2.2. Hypermarket 7.2.3. Convenience store 7.2.4. Online retail stores 7.3. Europe Edible Insect Animal Feed Market Size and Forecast, by Packaging type (2023-2030) 7.3.1. Bottles 7.3.2. Cans 7.3.3. Pouches 7.4. Europe Edible Insect Animal Feed Market Size and Forecast, by Ingredients (2023-2030) 7.4.1. Natural sweeteners 7.4.2. Sugar substitutes 7.4.3. Low fat 7.4.4. Fat free 7.4.5. Plant based 7.5. Europe Edible Insect Animal Feed Market Size and Forecast, by Brand positioning (2023-2030) 7.5.1. Mainstream 7.5.2. Health focused 7.5.3. Organic or natural 7.5.4. Plant based 7.6. Europe Edible Insect Animal Feed Market Size and Forecast, by Country (2023-2030) 7.6.1. UK 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Sweden 7.6.7. Austria 7.6.8. Rest of Europe 8. Asia Pacific Edible Insect Animal Feed Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Edible Insect Animal Feed Market Size and Forecast, by Product type (2023-2030) 8.1.1. Snacks 8.1.2. Beverages 8.1.3. Frozen meals 8.1.4. Baked Goods 8.1.5. Dairy products 8.2. Asia Pacific Edible Insect Animal Feed Market Size and Forecast, by Distribution channels (2023-2030) 8.2.1. Supermarket 8.2.2. Hypermarket 8.2.3. Convenience store 8.2.4. Online retail stores 8.3. Asia Pacific Edible Insect Animal Feed Market Size and Forecast, by Packaging type (2023-2030) 8.3.1. Bottles 8.3.2. Cans 8.3.3. Pouches 8.4. Asia Pacific Edible Insect Animal Feed Market Size and Forecast, by Ingredients (2023-2030) 8.4.1. Natural sweeteners 8.4.2. Sugar substitutes 8.4.3. Low fat 8.4.4. Fat free 8.4.5. Plant based 8.5. Asia Pacific Edible Insect Animal Feed Market Size and Forecast, by Brand positioning (2023-2030) 8.5.1. Mainstream 8.5.2. Health focused 8.5.3. Organic or natural 8.5.4. Plant based 8.6. Asia Pacific Edible Insect Animal Feed Market Size and Forecast, by Country (2023-2030) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Edible Insect Animal Feed Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Edible Insect Animal Feed Market Size and Forecast, by Product type (2023-2030) 9.1.1. Snacks 9.1.2. Beverages 9.1.3. Frozen meals 9.1.4. Baked Goods 9.1.5. Dairy products 9.2. Middle East and Africa Edible Insect Animal Feed Market Size and Forecast, by Distribution channels (2023-2030) 9.2.1. Supermarket 9.2.2. Hypermarket 9.2.3. Convenience store 9.2.4. Online retail stores 9.3. Middle East and Africa Edible Insect Animal Feed Market Size and Forecast, by Packaging type (2023-2030) 9.3.1. Bottles 9.3.2. Cans 9.3.3. Pouches 9.4. Middle East and Africa Edible Insect Animal Feed Market Size and Forecast, by Ingredients (2023-2030) 9.4.1. Natural sweeteners 9.4.2. Sugar substitutes 9.4.3. Low fat 9.4.4. Fat free 9.4.5. Plant based 9.5. Middle East and Africa Edible Insect Animal Feed Market Size and Forecast, by Brand positioning (2023-2030) 9.5.1. Mainstream 9.5.2. Health focused 9.5.3. Organic or natural 9.5.4. Plant based 9.6. Middle East and Africa Edible Insect Animal Feed Market Size and Forecast, by Country (2023-2030) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Egypt 9.6.4. Nigeria 9.6.5. Rest of ME&A 10. South America Edible Insect Animal Feed Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Edible Insect Animal Feed Market Size and Forecast, by Product type (2023-2030) 10.1.1. Snacks 10.1.2. Beverages 10.1.3. Frozen meals 10.1.4. Baked Goods 10.1.5. Dairy products 10.2. South America Edible Insect Animal Feed Market Size and Forecast, by Distribution channels (2023-2030) 10.2.1. Supermarket 10.2.2. Hypermarket 10.2.3. Convenience store 10.2.4. Online retail stores 10.3. South America Edible Insect Animal Feed Market Size and Forecast, by Packaging type (2023-2030) 10.3.1. Bottles 10.3.2. Cans 10.3.3. Pouches 10.4. South America Edible Insect Animal Feed Market Size and Forecast, by Ingredients (2023-2030) 10.4.1. Natural sweeteners 10.4.2. Sugar substitutes 10.4.3. Low fat 10.4.4. Fat free 10.4.5. Plant based 10.5. South America Edible Insect Animal Feed Market Size and Forecast, by Brand positioning (2023-2030) 10.5.1. Mainstream 10.5.2. Health focused 10.5.3. Organic or natural 10.5.4. Plant based 10.6. South America Edible Insect Animal Feed Market Size and Forecast, by Country (2023-2030) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Rest of South America 11. Company Profile: Key players 11.1. Nestle 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. PepsiCo 11.3. Coca-Cola 11.4. General Mills 11.5. Kellogg Company 11.6. Unilever Danone 11.7. Kraft Heinz Company 11.8. Conagra Brands 11.9. Mars, Incorporated 11.10. The Hershey Company 11.11. Campbell Soup Company 11.12. Mondelez International 11.13. Hormel Foods Corporation 11.14. The J.M. Smucker Company 11.15. Abbott Nutrition 11.16. Dean Foods Company 11.17. Hain Celestial Group 11.18. Yili Group 11.19. McCain Foods Limited 11.20. Amy's Kitchen 11.21. Chobani, LLC 11.22. Sargento Foods Inc. 11.23. Premier Foods 11.24. CJ CheilJedang Corporation 12. Key Findings 13. Industry Recommendation