Global Dried Scallop Market size was valued at USD 284.08 Mn in 2022 and is expected to reach USD 368.83 Mn by 2029, at a CAGR of 3.8 %.Dried Scallop Market Overview

The Dried Scallop is a kind of Cantonese-dried seafood product that is made from the adductor muscle of scallops. It is also known as Conpoy. Dried scallop has a strong fragrance and delicious taste which has been served either in dishes or as a soup ingredient. It is commonly used in soups, stews, sauces, and other dishes to give the dish a rich umami flavor. The flavor of Dried Scallops is marine, pungent, and reminiscent of certain salt-cured meats. To study the Dried Scallop Market penetration the report includes the competitive environment, upcoming trends, opportunities, growth drivers and risk factors. The key Dried Scallop industry players are mentioned by region along with their revenue, financial standing, portfolio and technical developments for competitive analysis of the Dried Scallop market.To know about the Research Methodology :- Request Free Sample Report

Dried Scallop Market Dynamics

Growing awareness about the health benefits of Dried Scallops to boost the market growth The Dried Scallop is neutral in nature and tastes lightly sweet and salty. it is a health-enhancing food ingredient. The natural flavor of dried scallop content and their rich nutrient properties has been helpful to the consumption of patients who are dispirited and lose appetite after an illness. It contains rich protein, calcium phosphate and vitamin including A, B and D. The Scallop adductor muscles are approximately 20 % protein and when the dried ratio increases approximately 65 percent, making dried scallops a protein food containing super high nutritional value. These muscles have a high amino acid which constitutes umami such as glycine, alanine, glutamic acid and insomniac acid. The Dried Scallops are high in omega-3 fatty acids and healthy fats and thus balance the cholesterols level and reduce risk of the heart disease. Also, it contains high magnesium and this help in relaxing the blood vessels that have been lower the blood pressure and improve the blood circulation. The growing awareness about the above health benefits of Dried Scallops among consumers fuels the Dried Scallop industry’s growth. An increase in the use of Dried Scallop to make food to boost the Dried Scallop Market growth The Dried scallop is a main ingredient in XO sauce and is used in the congress, soups and sauces for infusing the rich value without substituting meat or stock to the dish Dried scallop is the stock cube and has been superior taste. It is used in many types of food dishes such as Dried Scallops Chinese Congee Recipes to make it a flavored and better eating dish. In China, a Dried scallop is used in traditional Chinese medicine and it has a good function in the yin and nourishing the kidney, reconciling the spleen and stomach and is also used for the treatment of dizziness, dry throat and thirst and weak spleen and stomach. In addition, the taste of Dried scallops is especially delicious due to it contains a rich number of sodium glutamate. There is an ancient saying “Three days after eating scallops, chicken and shrimp are still boring.” Chinese people use it more to cook porridge or soup. As a result, an increase in the use of Dried scallops to make food fuels the market growth.Dried Scallop Market Restraints

Depletion in the sea species and for harvesting the scallops the fisherman dredging the ocean floor and bycatch of non-targeted species and damage to the bottom habitat. The dried scallop manufacturers have increased the prices of the end products to maintain their margins for profit margin. The Dried scallops accumulate heavy elements such as arsenic, cadmium, mercury and lead. Thus the large number of these elements has been causing the health problems such as cancer.Dried Scallop Market Regional Insights

Asia Pacific dominated the Dried Scallop Market in 2022 with the largest market share and is expected to maintain its dominance over the forecast period. The regional market is driven by the increase in the number of fast food restaurants, rising disposable income, presence of key companies and increasing awareness about the health benefits of sea products. The increasing penetration E-commerce sector and promotion of the fish culture in developing economies such as China and India are also influencing the growth of the Dried Scallop Market. China is the leading market for Dried Scallops and a major growth driver for the regional market. China holds the world in scallop aquaculture. It has been commercially cultured the four scallop species such as two native species, the Chinese (Zhikong) and noble (Huagui) scallops and two non-native species, the Japanese and bay scallops. Market sizes are witnessed at 8–10 months of age for bay scallops (50–60 mm), and 16–20 months for the Chinese scallop (60–70 mm). North America is expected to hold the second-largest position in the Dried Scallop Market during the forecast period. The increasing online sales of seafood and scallop, changing lifestyles and growth in the food and beverages sector. Canada is the largest exporter of the scallops and it mainly exports the Atlantic sea scallops. The major export market for seafood in Canada dried scallops is the United States.Dried Scallop Market Segment Analysis

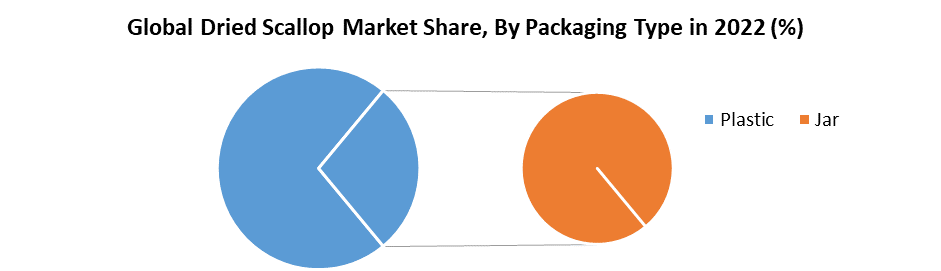

Dried Scallop Market Segment-wise insights are categorized into type, packaging type, application, distribution Channel and region to understand the market dynamics and Dried Scallop industry penetration. The market is broadly classified into North America, Europe, Asia Pacific and South America, the Middle East & Africa to study the regional wise market potential. By Type On the basis of the Type, the market is categorized into the Bay scallop and sea scallop. In 2022, Bay Scallop dominated the Dried Scallop Market and is expected to continue its dominance over the forecast period. The Bay scallops are sweeter and tenderer than sea scallops and are used in seafood casseroles and stews. Bay scallops are commonly less expensive than their larger sea scallop counterparts and it is the more affordable option. The Bay scallop is largely used in pasta dishes, salads, paellas and others. As the demand for fast food increases it positively affects the increase in demand for the bay scallop. The bay scallop is low in saturated fat and a good source of Potassium and Zinc, Vitamin B12, Calcium, Iron, and Magnesium. The 3.5 Oz portion of the Bay Scallop has 112 calories 0 carbohydrates, 1 gram of fat, 53 mg of cholesterol, 265 mg of sodium and 23 grams of protein. All the mentioned health-beneficial properties drive the Bay Scallop segment.By Packaging Type Based on the Packaging Type, the market is divided into Plastic and Jar. Plastic packaging for Dried Scallops is expected to have a significant growth rate for the market over the forecast period. The plastic packaging preserve Dried Scallop from oxidations, dehydration and contamination. Plastic packaging is used for hot as well as cold filling and for microwave reheating. Plastic packaging barriers from water, oxygen, and nitrogen and sea foods in plastic packaging retain their flavor, aroma and nutritional value and are also preserved from external contamination. It has moisture profess and loss of water during the frozen storage resulting in the condition which is called freezer burn.

Dried Scallop Market Competitive Landscape

The global Dried Scallop markets include several market players at the country, regional and global levels. These key players are adopting several strategies including investments, partnerships, mergers and acquisitions and joint ventures. Some of the Dried Scallop key players are the are lund's fisheries,Blue Harvest Fisheries , Gyoren Hokko,Hannaford Bros. Co., LLC. , Fruge Seafood Company, WHOLEY'S, Seacore Seafood Inc, seng hong company (private) limited, HK JEBN and others. Dried Scallop Market key players have adopted strategies including pricing investments, expansion of the product portfolio, mergers and acquisition collaboration, agreements and geographical expansion for the enhancement of the Avascular Necrosis industry. The companies invested in research and development activities regarding Dried scallops. Lund's Fisheries is making a major new investment in its scallop operations, with the acquisition of a new tunnel freezer for its Cape May, New Jersey facility. The USD 2 million dollar purchase have been allow the company to continue to grow its scallop sales and demonstrates its commitment to the upcoming growth of the scallop fishery.Dried Scallop Market Scope: Inquire before buying

Dried Scallop Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 284.08 Mn Forecast Period 2023 to 2029 CAGR: 3.8 % Market Size in 2029: USD 368.83 Mn Segments Covered: by Type 1. Bay Scallop 2. Sea Scallop by Packaging Type1 1.Plastic 2. Jar by Application 1. Institutions 2.Food Service by Distribution Channel 1. Retail 2. Supermarkets 3. Hypermarkets 3.1 Online 3.2 Offline 4. Specialty stores 5. others Dried Scallop Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Dried Scallop Key Players

lund's fisheries 1. Blue Harvest Fisheries 2. Gyoren Hokko 3. Hannaford Bros. Co., LLC. 4. Fruge Seafood Company 5. WHOLEY'S, Seacore Seafood Inc 6. seng hong company (private) limited 7. HK JEBN 8. Marubeni America 9. ZONECO 10.Guo Lian 11.Zhoushan Fisheries 12.Xing Ye 13.Oriental Ocean 14.Liao Yu 15.Hui Yang 16.Nippon Suisan Kaisha 17.Northeast Seafood 18.Aeon 19.Marudai Food 20.Cape Cod Shellfish Seafood 21.Berwick Shellfish 22.Ocean Family 23.CTLE Seafood 24.China National Fisheries 25.MJ Seafood Frequently Asked Questions: 1] What is the growth rate of the Global Dried Scallop Market? Ans. The Global Dried Scallop Market is growing at a significant rate of 3.8 % during the forecast period. 2] Which region is expected to dominate the Global Dried Scallop Market? Ans. North America is expected to dominate the Dried Scallop Market during the forecast period. 3] What is the expected Global Dried Scallop Market size by 2029? Ans. The Dried Scallop Market size is expected to reach USD 368.83 Mn by 2029. 4] Which are the top players in the Global Dried Scallop Market? Ans. The major top players in the Global Dried Scallop Market are lund's fisheries,Blue Harvest Fisheries , Gyoren Hokko,Hannaford Bros. Co., LLC. , Fruge Seafood Company, WHOLEY'S, Seacore Seafood Inc, seng hong company (private) limited, HK JEBN and others. 5] What are the factors driving the Global Dried Scallop Market growth? Ans. The growing awareness about the health benefits of Dried Scallops and increasing demand for dried scallops in the food and beverages sector are expected to drive market growth during the forecast period.

1. Dried Scallop Market: Research Methodology 2. Dried Scallop Market: Executive Summary 3. Dried Scallop Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dried Scallop Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Dried Scallop Market: Segmentation (by Value USD and Volume Units) 5.1. Dried Scallop Market, by Type (2022-2029) 5.1.1. Bay Scallop 5.1.2. Sea Scallop 5.2. Dried Scallop Market, by Packaging Type (2022-2029) 5.2.1. Plastic 5.2.2. Jar 5.3. Dried Scallop Market, by Application (2022-2029) 5.3.1. Institutions 5.3.2. Food Service 5.4. Dried Scallop Market, by Distribution Channel (2022-2029) 5.4.1. Retail 5.4.2. Specialty stores 5.4.3. others 5.5. Dried Scallop Market, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Dried Scallop Market (by Value USD and volume Units) 6.1. North America Dried Scallop Market, by Type (2022-2029) 6.1.1. Bay Scallop 6.1.2. Sea Scallop 6.2. North America Dried Scallop Market, by Packaging Type (2022-2029) 6.2.1. Plastic 6.2.2. Jar 6.3. North America Dried Scallop Market, by Application (2022-2029) 6.3.1. Institutions 6.3.2. Food Service 6.4. North America Dried Scallop Market, by Distribution Channel (2022-2029) 6.4.1. Retail 6.4.2. Specialty stores 6.4.3. others 6.5. North America Dried Scallop Market, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Dried Scallop Market (by Value USD Units) 7.1. Europe Dried Scallop Market, by Type (2022-2029) 7.2. Europe Dried Scallop Market, by Packaging Type (2022-2029) 7.3. Europe Dried Scallop Market, by Application (2022-2029) 7.4. Europe Dried Scallop Market, by Distribution Channel (2022-2029) 7.5. Europe Dried Scallop Market, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Dried Scallop Market (by Value USD Units) 8.1. Asia Pacific Dried Scallop Market, by Type (2022-2029) 8.2. Asia Pacific Dried Scallop Market, by Packaging Type (2022-2029) 8.3. Asia Pacific Dried Scallop Market, by Application (2022-2029) 8.4. Asia Pacific Dried Scallop Market, by Distribution Channel (2022-2029) 8.5. Asia Pacific Dried Scallop Market, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Dried Scallop Market (by Value USD Units) 9.1. Middle East and Africa Dried Scallop Market, by Type (2022-2029) 9.2. Middle East and Africa Dried Scallop Market, by Packaging Type (2022-2029) 9.3. Middle East and Africa Dried Scallop Market, by Application (2022-2029) 9.4. Middle East and Africa Dried Scallop Market, by Distribution Channel (2022-2029) 9.5. Middle East and Africa Dried Scallop Market, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Dried Scallop Market (by Value USD and Volume Units) 10.1. South America Dried Scallop Market, by Type (2022-2029) 10.2. South America Dried Scallop Market, by Packaging Type (2022-2029) 10.3. South America Dried Scallop Market, by Application (2022-2029) 10.4. South America Dried Scallop Market, by Distribution Channel (2022-2029) 10.5. South America Dried Scallop Market, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Lund’s fisheries 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. lund's fisheries 11.3. Blue Harvest Fisheries 11.4. Gyoren Hokko 11.5. Hannaford Bros. Co., LLC. 11.6. Fruge Seafood Company 11.7. WHOLEY'S, Seacore Seafood Inc 11.8. seng hong company (private) limited 11.9. HK JEBN 11.10. Marubeni America 11.11. ZONECO 11.12. Guo Lian 11.13. Zhoushan Fisheries 11.14. Xing Ye 11.15. Oriental Ocean 11.16. Liao Yu 11.17. Hui Yang 11.18. Nippon Suisan Kaisha 11.19. Northeast Seafood 11.20. Aeon 11.21. Marudai Food 11.22. Cape Cod Shellfish Seafood 11.23. Berwick Shellfish 11.24. Ocean Family 11.25. CTLE Seafood 11.26. China National Fisheries 11.27. MJ Seafood 11.28. Pangea Shellfish 12. Key Findings 13. Industry Recommendation