The Global Dog and Cat Food Market size was valued at USD 87.13 Billion in 2022 and the total Dog and Cat Food revenue is expected to grow at a CAGR of 3.98% from 2023 to 2029, reaching nearly USD 110.07 Billion.Dog and Cat Food Market Overview:

Dog and Cat Food refers to specially formulated food products designed to meet the nutritional needs of dogs and cats. These products are commercially produced and available in various forms such as dry kibble, wet/canned food, treats, and snacks. Dog and Cat Food is typically formulated with a balance of essential nutrients, vitamins, and minerals to support the overall health and well-being of pets.To know about the Research Methodology :- Request Free Sample Report The composition of Dog and Cat Food may vary depending on factors such as the age, size, breed, and specific dietary requirements of the animals. Common ingredients found in these products include meat, poultry, fish, grains, vegetables, fruits, and added supplements. Some pet food manufacturers also offer specialized formulations to address specific health conditions, such as food allergies, weight management, or dental health. The quality and safety of Dog and Cat Food are regulated by government agencies in many countries to ensure that the products meet certain standards and do not pose health risks to pets. Pet owners choose specific brands and types of Dog and Cat Food based on factors such as their pets' preferences, dietary needs, health considerations, and budget. Due to rampant misrepresentation surrounding pets and Covid-19, there was a regrettable increase in the abandonment of pets by some individuals. In response, the pet food industry launched awareness campaigns to dispel rumors and educate the public about the lack of evidence regarding pets and Covid-19 transmission. Moreover, panic buying of pet food among concerned pet parents resulted in a significant supply and demand gap. However, the Dog and cat food industry faced challenges in meeting the increased demand due to disruptions in the supply chain and logistical issues. In the context of some of the countries, the concept of owning pets and caring for them is primarily prevalent in urban areas. The growth of the Dog And Cat Food Market in the many countries is closely linked to the pace of urbanization. For instance, over the last two decades, India has witnessed significant infrastructural changes, which indicate a positive and rapid urbanization trend. As urbanization progresses, there is a notable shift in Indian consumers' behavior towards their pets. The tendency to overspend on pets is transforming into a sense of pet humanization and increased awareness of pet sensitization. This shift is evident in the rising adoption rates of pets in the country. Thus, the growing concern for pet health and nutrition serves as a major driver for the Dog and cat market's growth in India.

Dog and Cat Food market Dynamics

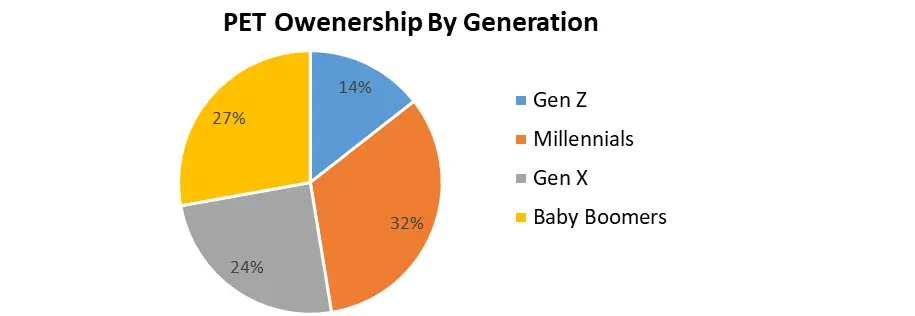

The global top players in the Dog and Cat Food market continue to maintain their strength, there is a notable rise of local players in emerging markets. In 2022, Nestlé SA and Mars Inc remained the top players in the global pet care industry. Nestlé gained value share by effectively responding to high demand, while Mars Inc, despite experiencing sales growth, lost marginal value share in a more competitive market environment. The top-selling brands for the industry leader, including Pedigree, Royal Canin, and Whiskas, maintained their positions. Colgate-Palmolive's Hill's brand performed well in 2022, resonating with consumers concerned about pet health issues such as improved immunity, thanks to its scientific positioning. In Asia Pacific, local brands saw an increase in market share by offering a value-for-money proposition. This resulted in significant Dog And Cat Food Market share losses for leading players in the region. For instance, Xuzhou Suchong Pet Products, a Chinese company, witnessed a remarkable value compound annual growth rate (CAGR) of 104%. Its success can be attributed to more affordable pricing, a deep understanding of the preferences of younger pet owners, and a digital-first distribution strategy that expanded its reach to new areas, including lower-tier cities. Although private label products faced supply issues in 2020 due to stockpiling, they maintained their leading position in Western Europe. Their price advantage during the pandemic, amidst reduced incomes, contributed to their continued market presence. The main focus of innovation within the Dog and Cat Food market lies in enhancing the health and wellness of dogs and cats. During the forecast poeriod, the Dog and Cat Food market is expected to witness a growing momentum towards ethical products that prioritize sustainability. Pet care companies recognize the importance of developing a sustainable strategy and establishing a clear purpose in this space, effectively communicating it to pet owners. Dog and cat owners are increasingly inclined to adopt sustainable practices in their lives. This shift in consumer behavior has influenced the purchasing decisions in the Dog and cat food market, leading to the development of new products with a focus on sustainable packaging and ingredients. According to MMR study report, there has been a notable increase in the inclusion of animal welfare, environmentally friendly practices, sustainable packaging, and sustainable sourcing claims under ethical labels in the global Dog and cat food market. In 2022, the number of SKUs (stock keeping units) with these ethical labels experienced an 11% growth compared to the last year, reflecting the rising demand for sustainable Dog and cat food products. Moreover, there is a growing interest among pet owners with sustainability concerns in insect-based and vegan pet foods. These alternative options are being closely observed and are expected to gain relevance in the near future as sustainable choices for pet nutrition. Average Annual Pet Expenses:The United States is positioned to maintain its position as the leading Dog and cat food market, with expected sales growth from $128.6 billion to $195.6 billion by 2030. This growth will primarily be driven by the pet nutrition segment, as pet owners increasingly opt for premium pet food options. Additionally, the demand for veterinary care, diagnostics, and pet pharmaceuticals will contribute to the expansion of the Dog And Cat Food Market. These factors are a result of pets living longer, leading to a greater need for products and services catering to the elderly pet population. In terms of costs, MMR estimates that owning a dog in the United States incurs an annual expense of $1,520, while owning a cat costs approximately $950 per year. These figures encompass various expenditures associated with pet ownership, including food, healthcare, and other essential supplies. In addition, MMR report study expects that the advancement of elderly pet care will drive a 13% increase in the dog and cat population in the country. This trend reflects the growing focus on providing specialized products and services tailored to the needs of aging pets, contributing to the overall growth and dynamics of the Dog and cat food market in the United States. According to MMR report, the global impact of increased pet nutrition on extending the lives of pets. As a result, there is a growing need for healthcare expenditures associated with the aging pet population. This Dog And Cat Food Market trend is expected to continue and contribute to significant healthcare spending for pets during the forecast period. In the United States, the acquisition of pets by younger generations and the formation of families are expected to drive pet ownership rates. While pet ownership remains robust in the United States, MMR expects that the country's dog and cat population will be surpassed by Europe, which is expected to reach 209 million by 2030. This indicates a strong and growing trend of pet ownership in Europe compared to the United States.

Expense Dog Cat Food $287 $254 Surgical Vet Procedures $458 $201 Routine Vet Visit $242 $178 Kennel Boarding $228 $78 Food Treats $81 $72 Vitamins $81 $47 Toys $56 $41 Groomer/Grooming Tools $47 $31 The dominant force in the e-commerce industry

Dog and cat food industry's expansion in e-commerce is set to continue as digital pet retailers in many counties such as Chewy, make significant investments to deliver a seamless and convenient shopping experience and capture a larger market share. According to MMR, the estimated e-commerce Dog and cat food sales in the north america is expected to reach XX billion by 2030, accounting for nearly one-third (29.5%) of the market. Chewy and Amazon are well-positioned to capitalize on the e-commerce boom. Together, these retail giants currently dominate XX% of the Dog and cat food e-commerce space, with Chewy leading at XX%. While both companies are highly competitive in terms of pricing, Chewy is striving to differentiate itself from Amazon by adopting a more comprehensive approach, offering additional pet services such as insurance, pharmacy, and veterinary telehealth. According to MMR, this strategy will enhance consumer loyalty and enable Chewy to expand its target market by XX%.Key trends are emerging in the Latin American dog and cat food market.

SuperPet, a pet product retailer in Peru, has responded to the demands of pet owners by launching the private label Nath line. This line of dog and cat foods aims to provide good value for money, offering natural ingredients, fruit and herb extracts, and meat as the primary ingredient. Nath is positioned at the lower end of the premium segment, catering to Latin American pet owners who seek premium-quality pet food at affordable prices. Premiumization has been a significant trend in the global dog and cat food market for several years. Saudavel, a Brazilian pet food company, capitalizes on this trend by offering premium pet foods and treats positioned as natural and organic. The company has successfully expanded its presence in various retail channels, including food, drug, mass market, and pet specialty outlets, primarily in southeast Brazil. While the premium pet food category is still relatively small in Latin America, there are growth opportunities, particularly in e-commerce and among younger pet owners who do not have children. According to MMR Report , Latin American pet owners have a strong preference for premium pet foods that cater to the specific health and wellness needs of their dogs and cats. PremieR, a leading pet food company based in Brazil, has positioned itself as an industry leader in formulating products specifically tailored for indoor dogs. These formulations address the specific challenges faced by dogs that spend a significant amount of time indoors. To provide reassurance to pet owners, PremieR offers a 110% money-back guarantee if customers are not satisfied with the results. In Mexico, Pet Market introduced the Advance brand, a premium therapeutic cat food designed to support cats with kidney problems. The formulation of this cat food helps prevent the formation of oxalate kidney stones while simultaneously preserving the cat's muscle mass. The market for products with clear and well-defined benefits claims is gaining momentum in Mexico, indicating a strong demand for pet foods that address specific health concerns.The growth in Dog and cat food sales in 2023 is primarily driven by an increase in prices.

According to MMR report, pet food prices experienced inflation in 2023, rising at a faster rate compared to the broader consumer price index. However, there has been a recent stabilization in costs for pet food producers, particularly in sectors such as meat processors, renderers, resin, and transportation. This stabilization provides some economic relief and potential savings for pet food manufacturers. To prevent the industry from solely targeting the super-premium and high-income consumer segments and neglecting more value-oriented demographics, it is crucial for manufacturers and marketers to pass on a portion of any cost savings they experience. By doing so, they can maintain a balance and cater to a broader range of pet owners with varying purchasing preferences.Dog and Cat Food Market Segment Analysis:

Based on Product Form, the Dry food segment dominated the global Dog And Cat Food market with the 60% revenue share in 2022. The segment is expected to grow at a CAGR of XX% and present lucrative growth prospects during the forecast period. However, there has been a significant increase in the market share of wet pet food, which now accounts for 40% of the market. This shift is particularly noticeable among cat owners, as usage rates for wet pet food have seen a notable rise in their households. Based on Source, the Animal segment emerged as the leading contributor to the growth of the global Dog And Cat Food market, capturing the highest revenue share in 2022. This segment is expected to maintain a strong compound annual growth rate (CAGR) of XX% during the forecast period, highlighting substantial growth prospects. The reasons behind this trend could include factors such as the preference of pet owners for animal-based ingredients, the nutritional needs of dogs and cats that are best fulfilled by animal proteins, and the overall market demand for high-quality pet food products.Key Points and findings

Dog and cat food industry experienced significant growth in 2020, primarily driven by the COVID-19 pandemic lockdowns. Although the growth rate from that specific source has slowed down, the industry continues to expand due to the rising number of millennials who own pets. These millennials view and treat their pets as beloved family members, leading to increased spending on their pets compared to previous generations. This ongoing trend of pet humanization and increased expenditure is expected to sustain the expansion of the Dog and cat food industry during the forecast period.Dog and Cat Food Market Scope: Inquire before buying

Dog and Cat Food Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 87.13 Bn. Forecast Period 2023 to 2029 CAGR: 3.98% Market Size in 2029: US $ 110.07 Bn. Segments Covered: by Product Form Dry Food Wet Food by Source Animal Plant by Nature Organic Inorganic Dog and Cat Food Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Dog and Cat Food Market Key Players:

1. General Mills, Inc. 2. Archer Daniels Midland Company 3. Saturn Petcare GMBH 4. Unicharm Corporation 5. Tiernahrung Deuerer GmbH 6. Marukan co.,ltd 7. Riverd Corporation Inc 8. Nippon Pet FoodCo. Ltd 9. Glenand Group 10. Purina PetCare India Private Limited 11. Luscious 12. Pedigree 13. Yantai China Pet Food Co., Ltd 14. Premier Pet Food Aust Pty Ltd 15. Real Pet FoodCompany 16. Fressnapf 17. Monge & C. Spa 18. Pet FoodUK 19. Burgess Pet Care 20. GA Pet FoodPartnersFAQs:

1. What are the growth drivers for the Dog And Cat Food market? Ans. The rising number of pet owners worldwide has been a significant driver for the Dog and Cat Food market. 2. What is the major restraint on the Dog And Cat Food market growth? Ans. Increasing concerns and awareness regarding pet health and nutrition. Pet owners are becoming more conscious about the ingredients and quality of the food they provide to their pets. 3. Which region is expected to lead the global Dog And Cat Food market during the forecast period? Ans. North America is expected to lead the global Dog And Cat Food market during the forecast period. 4. What is the projected market size & growth rate of the Dog And Cat Food Market? Ans. The Global Dog And Cat Food Market size was valued at USD 87.13 Billion in 2022 and the total Dog And Cat Food revenue is expected to grow at a CAGR of 3.98% from 2023 to 2029, reaching nearly USD 110.07 Billion. 5. What segments are covered in the Dog And Cat Food Market report? Ans. The segments covered in the DOG AND CAT FOOD market report are Product Form, Source, Nature Transmission Method and Region.

1. Dog and Cat Food Market: Research Methodology 2. Dog And Cat Food Market: Executive Summary 3. Dog And Cat Food Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dog and Cat Food Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 4.10. COVID-19 Impact on the Global Dog and Cat Food Market 5. Dog and Cat Food Market: Segmentation (by Value USD) 5.1. Dog and Cat Food Market, by Product Form (2022-2029) 5.1.1. Dry Food 5.1.2. Wet Food 5.2. Dog and Cat Food Market, by Source (2022-2029) 5.2.1. Animal 5.2.2. Plant 5.3. Dog and Cat Food Market, by Nature (2022-2029) 5.3.1. Organic 5.3.2. Inorganic 5.4. Dog and Cat Food Market, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Dog and Cat Food Market (by Value USD) 6.1. North America Dog and Cat Food Market, by Product Form (2022-2029) 6.1.1. Dry Food 6.1.2. Wet Food 6.2. North America Dog and Cat Food Market, by Source (2022-2029) 6.2.1. Animal 6.2.2. Plant 6.3. North America Dog and Cat Food Market, by Nature (2022-2029) 6.3.1. Organic 6.3.2. Inorganic 6.4. North America Dog and Cat Food Market, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Dog and Cat Food Market (by Value USD) 7.1. Europe Dog and Cat Food Market, by Product Form (2022-2029) 7.2. Europe Dog And Cat FoodMarket, by Source (2022-2029) 7.3. Europe Dog And Cat FoodMarket, by Nature (2022-2029) 7.4. Europe Dog and Cat Food Market, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Dog and Cat Food Market (by Value USD) 8.1. Asia Pacific Dog And Cat FoodMarket, by Product Form (2022-2029) 8.2. Asia Pacific Dog And Cat FoodMarket, by Source (2022-2029) 8.3. Asia Pacific Dog and Cat Food Market, by Nature (2022-2029) 8.4. Asia Pacific Dog And Cat FoodMarket, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Rest of Asia Pacific 9. Middle East and Africa Dog and Cat Food Market (by Value USD) 9.1. Middle East and Africa Dog And Cat FoodMarket, by Product Form (2022-2029) 9.2. Middle East and Africa Dog and Cat Food Market, by Source (2022-2029) 9.3. Middle East and Africa Dog and Cat Food Market, by Nature (2022-2029) 9.4. Middle East and Africa Dog and Cat Food Market, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Dog and Cat Food Market (by Value USD) 10.1. South America Dog and Cat Food Market, by Product Form (2022-2029) 10.2. South America Dog And Cat FoodMarket, by Source (2022-2029) 10.3. South America Dog And Cat FoodMarket, by Nature (2022-2029) 10.4. South America Dog And Cat FoodMarket, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. General Mills, Inc. 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Archer Daniels Midland Company 11.3. Saturn Petcare GMBH 11.4. Unicharm Corporation 11.5. Tiernahrung Deuerer GmbH 11.6. Marukan co.,ltd 11.7. Riverd Corporation Inc 11.8. Nippon Pet FoodCo. Ltd 11.9. Glenand Group 11.10. Purina PetCare India Private Limited 11.11. Luscious 11.12. Pedigree 11.13. Yantai China Pet Food Co., Ltd 11.14. Premier Pet Food Aust Pty Ltd 11.15. Real Pet FoodCompany 11.16. Fressnapf 11.17. Monge & C. Spa 11.18. Pet FoodUK 11.19. Burgess Pet Care 11.20. GA Pet FoodPartners 12. Key Findings 13. Nature Recommendation