India Display Market was valued at US$ 1820.21 Mn. in 2020, and the total India display revenue is expected to grow at a CAGR of 11.8 % for the period 2021-2027, reaching nearly US$ 3973.87 Mn. in 2027.India Display Market Overview:

The display is a device that displays information in a visual or tactile style. An electronic display receives input information in the form of an electrical signal. Television sets and computer monitors are two common uses for electronic visual displays. Different types of displays available in the market are liquid crystal display (LCD), IPS-LCD, organic light-emitting diode (OLED), an active-matrix organic light-emitting diode. The presence of benefits such as low energy consumption, long-lasting, and no screen burn-in phenomenon, etc. are increasingly used in smartphones, tablets, television, PC & laptops, and vehicle displays. As a result, the Indian display market is expected to reach US$ 3973.87 Mn. by 2027.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2019 is considered a base year however 2020’s numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

India Display Market Dynamics:

Growing demand for the consumer electronics like television, laptops, mobiles, rising disposal income, and consumers' attraction towards IoT devices are driving the growth of the Indian display market. In 2020 more than 22.6 Mn television set units are sold in India and this growth is expected to record 65% by 2027. On the other hand, growing demand for the 5G network and an increasing number of internet users in rural areas are fuelling the display market growth in India. In 2020, India had 749 Mn internet users across the country and this number is expecting an increase at a rate of 32.6% by 2027. And in December 2021, the “Department of Telecommunication” (DOT) under the Government of India had confirmed that the 5G network will enter India by 2022 in 13 major cities known as Bengaluru, Chennai, Hyderabad, and Pune, etc. In 2020, the overall demand for the displays in India was stood at 253 Mn. units and valued at US$ 5.4 Bn. The increasing adoption of automated equipment in the manufacturing, healthcare, and logistics sectors is adding an advantage to the market growth. At the healthcare facilities, large TV displays are used in the entrance and lobby for visitors' engagements and helping the healthcare workers in multimodality imaging and ergonomic reading. Furthermore, the expansion of the BFSI sector and their deployment of next-generation ATMs are boosting the market growth. The recent Fintech startups like Lendingkart, Instamojo, Razorpay, and ZestMoney are expecting to fuel the Indian display market. The Government of India is expecting to raise a fund of US$ 400 Bn to boost the electronic market by 2025. To achieve this aim India launched several schemes like production linked incentives (PLI), a scheme for promotion of manufacturing of electronic components and semiconductors (SPECS) and electronic manufacturing clusters (EMC 2.0), etc.TouchMagix a Pune-based startup in India introduced new technologies called MagicFone (any display any phone interactive technology), MagicTable (interactive display screen with ready application suite), etc. Hindonics, a Gorakhpur-based startup developed touch-less interactive screens, and Sahaj Interactive Solutions a Mumbai-based startup developing hardware’s for AR, VR, and 3D augmented reality, etc. Some of the factors slowing the growth of the Indian display market are lack of awareness among the rural areas in the adoption of such displays, increasing use of projectors in educational and entertainment sectors, and high consumption of electricity resulting in a lot of heat, etc. Furthermore, in 2021 rapid decline in the smartphone market stood at 5% due to shortages of chips for entry-level smartphones and a high volume of sales during quarter 3 of 2020.

India Display Market Segmentation:

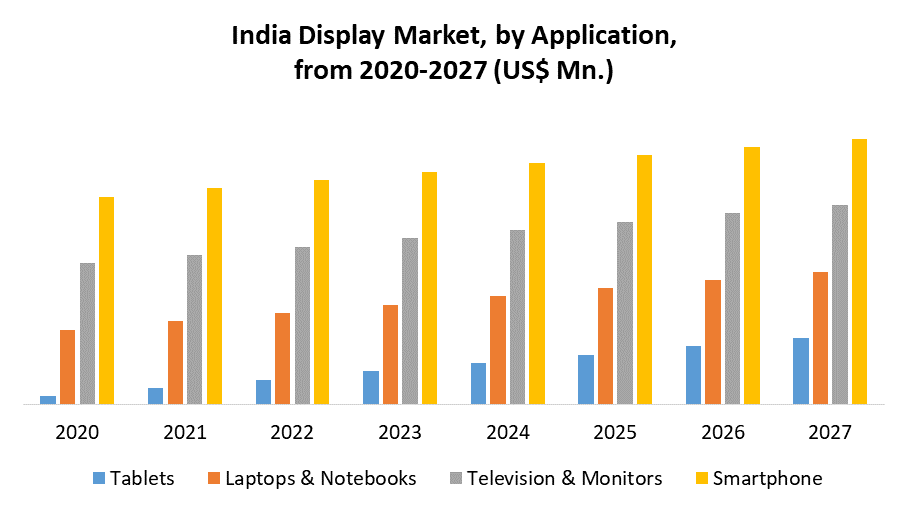

Based on Type, The India Display Market is sub-segmented into LCD, LED, and OLED. The LCD segment dominates the global market and it held a share of 55 % in 2020. The LCD is a passive device that is made up of liquid substances having crystal properties. It works by altering the light traveling through it and it does not produce any light. Due to its features like energy-efficient properties, long-lasting and LED backlighting, etc. increasingly used in smartphones, digital cameras, calculators, and digital clocks. In 2020, “Videocon Industries” was the largest manufacturer of LCDs in India by having a share of 41.22% followed by Teronixindia and BPL limited. Recently under the “MAKE IN INDIA” scheme, the VEDANTA GROUPS set an LCD panel manufacturing plant by investing US$ 10 Bn. in Maharashtra. This move expecting to boost the Indian display market by 2027.Based on the Application, the India Display Market is sub-segmented into smartphones, Television & Monitors, Tablets, and Laptops & Notebooks. The smartphone segment dominates the global market and was valued at US$ 423. Mn. in 2020. The increasing production of low-cost smartphones, the growing number of internet users in the regional cities, and the rapid expansion of the gaming industry are creating a huge demand for the display market in India. In 2020, the number of mobile games players in India are stood at 365 Mn and this number is expected 852 Mn by 2027 with a growth rate of 165%. The television segment stands at the second position by having a share of 31%. An increasing number of housewives and large penetration of TV programs fuelling the display market growth. Because people are attracted towards the high quality and IoT-enabled devices in their houses or work areas. In 2020 Sun TV stood at first place by telecasting the 2826.17 programs per year.

India Display Market regional insights:

In 2020, Uttar Pradesh took the largest share in the India Displays market. The main factors propelling the growth of the market in this region are rising dependency on IoT devices, high disposable income, and the presence of large key players in this region. Increasing government support boosts the local market under MAKE IN INDIA and increases foreign direct investment (FDI) propelling the market growth. In 2021 VEDANTA GROUP announced their plan about investing US$ 15 Bn in the manufacturing of displays and semiconductor chips. This investment will be made through “Avanstrate Inc” Tokyo-based makers of the special glass used in LCD panels. The objective of the report is to present a comprehensive analysis of the global market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the India Display Market dynamics, structure by analyzing the market segments and projecting the India Display Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the India Display Market make the report investor’s guide.India Display Market Scope: Inquiry Before Buying

India Display Market Report Coverage Details Base Year: 2020 Forecast Period: 2021-2027 Historical Data: 2016 to 2020 Market Size in 2020: US $ 1820.21 Mn. Forecast Period 2021 to 2027 CAGR: 11.8 % Market Size in 2027: US $ 3973.87 Mn. Segments Covered: by Type • LCD • LED • OLED by Application • Smartphone • Television & Monitors • Tablets • Laptops & Notebooks by Technology • Quantum Dot • Others by End User • Digital Signage • PC • Vehicle Display • Smart Wearable • Others India Display Market, by Region

• North India • South India • East India • West IndiaIndia Display Market Key Players

• NCR Corporation • Fujitsu Limited • Epson America Inc. • Fametech, Inc. • Displax SA • Diebold Nixdorf, Inc. • Ingenico Group • 3M • Samsung • LG Display Co., Ltd. • AU Optronics Corp • TCL Display Technology Holdings Limited • Sharp Corp. • Xiaomi Technology India Private Limited • BBK Electronics • NEC India Pvt. Limited • Palas Software Pvt. • Oasis Touch technologies Frequently Asked Questions: 1. Which region has the largest share in India Display Market? Ans: Uttar Pradesh held the largest share in 2020. 2. What is the growth rate of the India Display Market? Ans: The India Display Market is growing at a CAGR of 11.8 % during the forecasting period 2021-2027. 3. What segments are covered in India Display Market? Ans: India Display Market is segmented into type and application. 4. What is the study period of this market? Ans: The India Display Market is studied from 2020 to 2027. 5. Who are the key players in Fall Detection System Market? Ans; NCR Corporation, Fujitsu Limited, Epson America Inc., Fametech, Inc., Displax SA, Diebold Nixdorf, Inc., Ingenico Group, 3M, Samsung, LG Display Co., Ltd., AU Optronics Corp, TCL Display Technology Holdings Limited, Sharp Corp., Xiaomi Technology India Private Limited, BBK Electronics, NEC India Pvt. Limited, Palas Software Pvt., Oasis Touch technologies

1. India Display Market: Research Methodology 2. India Display Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to India Display Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. India Display Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. India Display Market Segmentation 4.1 India Display Market, by Type (2021-2029) • LCD • LED • OLED 4.2 India Display Market, by Segment-B (2021-2029) • Smartphone • Television & Monitors • Tablets • Laptops & Notebooks 4.3 India Display Market, by Segment-C (2021-2029) • Quantum Dot • Others 4.4 India Display Market, by Segment-D (2021-2029) • Digital Signage • PC • Vehicle Display • Smart Wearable • Others 5. Company Profile: Key players 5.1 NCR Corporation 5.1.1. Company Overview 5.1.2. Financial Overview 5.1.3. Global Presence 5.1.4. Capacity Portfolio 5.1.5. Business Strategy 5.1.6. Recent Developments 5.2 Fujitsu Limited 5.3 Epson America Inc. 5.4 Fametech, Inc. 5.5 Displax SA 5.6 Diebold Nixdorf, Inc. 5.7 Ingenico Group 5.8 3M 5.9 Samsung 5.10 LG Display Co., Ltd. 5.11 AU Optronics Corp 5.12 TCL Display Technology Holdings Limited 5.13 Sharp Corp. 5.14 Xiaomi Technology India Private Limited 5.15 BBK Electronics 5.16 NEC India Pvt. Limited 5.17 Palas Software Pvt. 5.18 Oasis Touch technologies