Digital Video Advertising Market size was valued at USD 73.84 Bn in 2024, and the Global Digital Video Advertising Market revenue is expected to grow at a CAGR of 11.9% from 2025 to 2032, reaching nearly USD 181.52 Bn.Digital Video Advertising Market Overview:

Advertisers are increasingly turning to digital video advertising as a result of technological improvements and changing customer behavior. Individuals are increasingly adopting visual media via venues other than traditional cable and satellite TVs. Non-traditional platforms, such as computers, mobile phones, OTT media platforms, and social media applications, are allowing advertisers to improve their service delivery techniques and open up new revenue streams for marketers and broadcasters.To know about the Research Methodology :- Request Free Sample Report

Digital Video Advertising Market Dynamics:

Increased usage of digital media

Since the widespread availability of internet access, the global population has increasingly turned to social media platforms such as Facebook, Twitter, Instagram, and others for entertainment, online communication, and other purposes. Furthermore, the growing popularity of OTT platforms for entertainment, such as Netflix, Amazon Prime, and others, is propelling the digital video advertising market forward. Organizations have increased their expenditure on digital advertisements as a result of the rising popularity of digital media platforms, particularly among the youth population. YouTube, which is used for a variety of purposes such as entertainment, education, and many more, uses various digital video adverts in between the videos to increase the number of people who visit the platform. Certain YouTube videos are accompanied by various digital advertisements that must be seen in order to complete the video content on the platform.Growing adoption from E-commerce sector

One of the primary driving factors for considerable market growth has been the increasing adoption of digital video advertising by the e-commerce industry. Increasing technical breakthroughs have forced the E-commerce sector to devote a significant amount of money to digital video advertising in order to attract and retain more clients and increase corporate efficiency. As there are certain commercials while visiting eCommerce sites, the use of digital video advertising helps to offer a favorable impact on business marketing and sales. Furthermore, large rising eCommerce companies like Amazon, Flipchart, and others have been generating significant sales through online advertising on social networking platforms, gaming platforms, television, and other platforms, which has assisted them in selling their items more efficiently. By capturing consumers' attention in short time intervals, high-quality digital video content presentation aids in growing investments in eCommerce products displayed on multiple platforms.High Costs

High costs have been a major stumbling block to the growth of the digital video advertising sector. Advertisements have grown significantly in recent years as a result of the rise of social media and digital content. The cost of digital video advertisements continues to rise as it is highly dependent on the quality of the material, the amount of traffic required, and other factors, resulting in slower demand from small businesses. Furthermore, digital advertising on some of the most popular and largest platforms, such as YouTube, Facebook, and others, necessitate large investments in order to reach a larger audience.Digital Video Advertising Market Segment Analysis:

Based on Ad Format, Digital Video Advertising Market is segmented into Desktop Video Advertising, Mobile Video Advertising, Connected TV (CTV), In-stream Ads, Out-stream Ads. among them Mobile video advertising dominates the global digital video advertising market. Smartphone usage, affordable mobile internet, and social media video consumption (on platforms like YouTube, TikTok, Instagram) have made mobile the primary screen for users. Its personalized targeting, high engagement rates, and cost efficiency drive advertisers to prioritize mobile video over other formats. Based on Advertisement Type, Digital Video Advertising Market is segmented into Skippable & Non-skippable Ads, Bumper Ads, Interactive Video Ads, Programmatic Video Ads. Among them Skippable & Non-skippable Ads These formats are widely used across YouTube, social media, and OTT platforms, offering broad reach and flexible ad durations. They ensure high viewer engagement, allow advertisers to balance cost with visibility, and provide measurable performance, making them the most preferred choice for brands across industries.

Digital Video Advertising Market Regional Insights:

North America held the largest share of 43% in 2023. This can be attributable to the region's high smartphone penetration rate. Brands and agencies are increasingly adopting digital video advertising methods in order to capitalize on the growing number of digital viewers and capture a bigger percentage of screen time. Furthermore, rising cord-cutting scenarios and an incremental trend among individuals in this region to switch from traditional cable TVs to OTT media delivery platforms are giving market growth potential. The Asia Pacific is the second dominant segment and it held xx% of the share in 2023. The availability of affordable high-speed internet connections in the region encourages widespread adoption, encouraging advertisers to use digital media as a video advertising medium. The rise in social media usage in the area provides advertisers with a new income generation channel, further promoting market growth potential. The popularity of short video apps like Kuaishou and TikTok in India, as well as their vast user base, is pushing marketers and businesses to utilize these platforms for digital video advertising. The objective of the report is to present a comprehensive analysis of the Digital Video Advertising Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Digital Video Advertising Market dynamics, structure by analyzing the market segments and project the Digital Video Advertising Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Digital Video Advertising Market make the report investor’s guide.Digital Video Advertising Market Scope: Inquire before buying

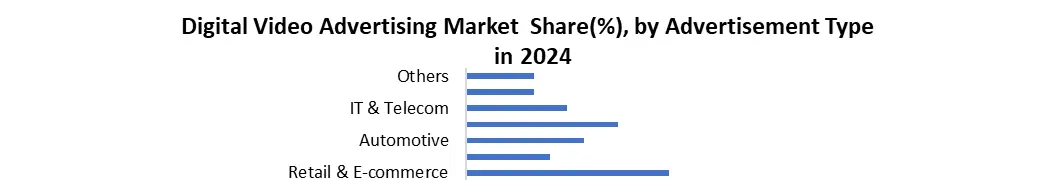

Digital Video Advertising Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 73.84 Bn. Forecast Period 2025 to 2032 CAGR: 11.9% Market Size in 2032: USD 181.52 Bn. Segments Covered: by Ad Format Desktop Video Advertising Mobile Video Advertising Connected TV (CTV) In-stream Ads Out-stream Ads by Advertisement Type Skippable & Non-skippable Ads Bumper Ads Interactive Video Ads Programmatic Video Ads by End user Retail & E-commerce Media & Entertainment Automotive Healthcare IT & Telecom Travel & Hospitality Others Digital Video Advertising Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Digital Video Advertising Market, Key Players are

1.Verizon Communications 2. Tremor International 3. RTL Group S.A. 4. Publicis Groupe 5.Advertise.com 6. PubMatic 7. Viant Technology 8. ZypMedia, Inc. 9. JW Player, Inc. 10. Chocolate, Inc. 11. Conversant LLC 12. Longtail Ad Solutions 13. Verizon Media 14. Google LLC 15. Facebook, Inc. 16. Amazon.com, Inc. 17. Netflix, Inc. 18. Snap Inc. 19. Twitter, Inc. 20. Apple Inc. 21. Hulu LLC 22. Youku Tudou, Inc.Frequently Asked Questions:

1. Which region has the largest share in Digital Video Advertising Market? Ans: North America region holds the highest share in 2024. 2. What is the growth rate of Digital Video Advertising Market? Ans: The Digital Video Advertising Market is growing at a CAGR of 11.9 % during forecasting period 2025-2032 3. What segments are covered in Digital Video Advertising Market? Ans: Digital Video Advertising Market is segmented into type, industry and region. 4. Who are the key players in Digital Video Advertising Market? Ans: The important key players in the Digital Video Advertising Market are – Verizon Communications, Tremor International, RTL Group S.A., Publicis Groupe, Advertise.com, PubMatic, Viant Technology, ZypMedia, Inc., JW Player, Inc. 5. What is the study period of this market? Ans: The Digital Video Advertising Market is studied from 2024 to 2032

1. Digital Video Advertising Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Digital Video Advertising Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Digital Video Advertising Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Digital Video Advertising Market: Dynamics 3.1. Digital Video Advertising Market Trends by Region 3.1.1. North America Digital Video Advertising Market Trends 3.1.2. Europe Digital Video Advertising Market Trends 3.1.3. Asia Pacific Digital Video Advertising Market Trends 3.1.4. Middle East and Africa Digital Video Advertising Market Trends 3.1.5. South America Digital Video Advertising Market Trends 3.2. Digital Video Advertising Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Digital Video Advertising Market Drivers 3.2.1.2. North America Digital Video Advertising Market Restraints 3.2.1.3. North America Digital Video Advertising Market Opportunities 3.2.1.4. North America Digital Video Advertising Market Challenges 3.2.2. Europe 3.2.2.1. Europe Digital Video Advertising Market Drivers 3.2.2.2. Europe Digital Video Advertising Market Restraints 3.2.2.3. Europe Digital Video Advertising Market Opportunities 3.2.2.4. Europe Digital Video Advertising Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Digital Video Advertising Market Drivers 3.2.3.2. Asia Pacific Digital Video Advertising Market Restraints 3.2.3.3. Asia Pacific Digital Video Advertising Market Opportunities 3.2.3.4. Asia Pacific Digital Video Advertising Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Digital Video Advertising Market Drivers 3.2.4.2. Middle East and Africa Digital Video Advertising Market Restraints 3.2.4.3. Middle East and Africa Digital Video Advertising Market Opportunities 3.2.4.4. Middle East and Africa Digital Video Advertising Market Challenges 3.2.5. South America 3.2.5.1. South America Digital Video Advertising Market Drivers 3.2.5.2. South America Digital Video Advertising Market Restraints 3.2.5.3. South America Digital Video Advertising Market Opportunities 3.2.5.4. South America Digital Video Advertising Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Digital Video Advertising Industry 3.8. Analysis of Government Schemes and Initiatives For Digital Video Advertising Industry 3.9. Digital Video Advertising Market Trade Analysis 3.10. The Global Pandemic Impact on Digital Video Advertising Market 4. Digital Video Advertising Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 4.1.1. Desktop Video Advertising 4.1.2. Mobile Video Advertising 4.1.3. Connected TV (CTV) 4.1.4. In-stream Ads 4.1.5. Out-stream Ads 4.2. Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 4.2.1. Skippable & Non-skippable Ads 4.2.2. Bumper Ads 4.2.3. Interactive Video Ads 4.2.4. Programmatic Video Ads 4.3. Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 4.3.1. Retail & E-commerce 4.3.2. Media & Entertainment 4.3.3. Automotive 4.3.4. Healthcare 4.3.5. IT & Telecom 4.3.6. Travel & Hospitality 4.3.7. Others 4.4. Digital Video Advertising Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Digital Video Advertising Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 5.1.1. Desktop Video Advertising 5.1.2. Mobile Video Advertising 5.1.3. Connected TV (CTV) 5.1.4. In-stream Ads 5.1.5. Out-stream Ads 5.2. North America Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 5.2.1. Skippable & Non-skippable Ads 5.2.2. Bumper Ads 5.2.3. Interactive Video Ads 5.2.4. Programmatic Video Ads 5.3. North America Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 5.3.1. Retail & E-commerce 5.3.2. Media & Entertainment 5.3.3. Automotive 5.3.4. Healthcare 5.3.5. IT & Telecom 5.3.6. Travel & Hospitality 5.3.7. Others 5.4. North America Digital Video Advertising Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 5.4.1.1.1. Desktop Video Advertising 5.4.1.1.2. Mobile Video Advertising 5.4.1.1.3. Connected TV (CTV) 5.4.1.1.4. In-stream Ads 5.4.1.1.5. Out-stream Ads 5.4.1.2. United States Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 5.4.1.2.1. Skippable & Non-skippable Ads 5.4.1.2.2. Bumper Ads 5.4.1.2.3. Interactive Video Ads 5.4.1.2.4. Programmatic Video Ads 5.4.1.3. United States Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 5.4.1.3.1. Retail & E-commerce 5.4.1.3.2. Media & Entertainment 5.4.1.3.3. Automotive 5.4.1.3.4. Healthcare 5.4.1.3.5. IT & Telecom 5.4.1.3.6. Travel & Hospitality 5.4.1.3.7. Others 5.4.2. Canada 5.4.2.1. Canada Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 5.4.2.1.1. Desktop Video Advertising 5.4.2.1.2. Mobile Video Advertising 5.4.2.1.3. Connected TV (CTV) 5.4.2.1.4. In-stream Ads 5.4.2.1.5. Out-stream Ads 5.4.2.2. Canada Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 5.4.2.2.1. Skippable & Non-skippable Ads 5.4.2.2.2. Bumper Ads 5.4.2.2.3. Interactive Video Ads 5.4.2.2.4. Programmatic Video Ads 5.4.2.3. Canada Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 5.4.2.3.1. Retail & E-commerce 5.4.2.3.2. Media & Entertainment 5.4.2.3.3. Automotive 5.4.2.3.4. Healthcare 5.4.2.3.5. IT & Telecom 5.4.2.3.6. Travel & Hospitality 5.4.2.3.7. Others 5.4.3. Mexico 5.4.3.1. Mexico Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 5.4.3.1.1. Desktop Video Advertising 5.4.3.1.2. Mobile Video Advertising 5.4.3.1.3. Connected TV (CTV) 5.4.3.1.4. In-stream Ads 5.4.3.1.5. Out-stream Ads 5.4.3.2. Mexico Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 5.4.3.2.1. Skippable & Non-skippable Ads 5.4.3.2.2. Bumper Ads 5.4.3.2.3. Interactive Video Ads 5.4.3.2.4. Programmatic Video Ads 5.4.3.3. Mexico Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 5.4.3.3.1. Retail & E-commerce 5.4.3.3.2. Media & Entertainment 5.4.3.3.3. Automotive 5.4.3.3.4. Healthcare 5.4.3.3.5. IT & Telecom 5.4.3.3.6. Travel & Hospitality 5.4.3.3.7. Others 6. Europe Digital Video Advertising Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.2. Europe Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.3. Europe Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4. Europe Digital Video Advertising Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.1.2. United Kingdom Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.1.3. United Kingdom Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4.2. France 6.4.2.1. France Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.2.2. France Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.2.3. France Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.3.2. Germany Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.3.3. Germany Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.4.2. Italy Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.4.3. Italy Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.5.2. Spain Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.5.3. Spain Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.6.2. Sweden Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.6.3. Sweden Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.7.2. Austria Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.7.3. Austria Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 6.4.8.2. Rest of Europe Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 6.4.8.3. Rest of Europe Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7. Asia Pacific Digital Video Advertising Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.2. Asia Pacific Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.3. Asia Pacific Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4. Asia Pacific Digital Video Advertising Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.1.2. China Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.1.3. China Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.2.2. S Korea Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.2.3. S Korea Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.3.2. Japan Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.3.3. Japan Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.4. India 7.4.4.1. India Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.4.2. India Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.4.3. India Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.5.2. Australia Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.5.3. Australia Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.6.2. Indonesia Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.6.3. Indonesia Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.7.2. Malaysia Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.7.3. Malaysia Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.8.2. Vietnam Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.8.3. Vietnam Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.9.2. Taiwan Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.9.3. Taiwan Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 7.4.10.2. Rest of Asia Pacific Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 7.4.10.3. Rest of Asia Pacific Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 8. Middle East and Africa Digital Video Advertising Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 8.2. Middle East and Africa Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 8.3. Middle East and Africa Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 8.4. Middle East and Africa Digital Video Advertising Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 8.4.1.2. South Africa Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 8.4.1.3. South Africa Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 8.4.2.2. GCC Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 8.4.2.3. GCC Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 8.4.3.2. Nigeria Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 8.4.3.3. Nigeria Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 8.4.4.2. Rest of ME&A Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 8.4.4.3. Rest of ME&A Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 9. South America Digital Video Advertising Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 9.2. South America Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 9.3. South America Digital Video Advertising Market Size and Forecast, by End user(2024-2032) 9.4. South America Digital Video Advertising Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 9.4.1.2. Brazil Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 9.4.1.3. Brazil Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 9.4.2.2. Argentina Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 9.4.2.3. Argentina Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Digital Video Advertising Market Size and Forecast, by Ad Format (2024-2032) 9.4.3.2. Rest Of South America Digital Video Advertising Market Size and Forecast, by Advertisement Type (2024-2032) 9.4.3.3. Rest Of South America Digital Video Advertising Market Size and Forecast, by End user (2024-2032) 10. Company Profile: Key Players 10.1. Verizon Communications 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Tremor International 10.3. RTL Group S.A. 10.4. Publicis Groupe 10.5. Advertise.com 10.6. PubMatic 10.7. Viant Technology 10.8. ZypMedia, Inc. 10.9. JW Player, Inc. 10.10. Chocolate, Inc. 10.11. Conversant LLC 10.12. Longtail Ad Solutions 10.13. Verizon Media 10.14. Google LLC 10.15. Facebook, Inc. 10.16. Amazon.com, Inc. 10.17. Netflix, Inc. 10.18. Snap Inc. 10.19. Twitter, Inc. 10.20. Apple Inc. 10.21. Hulu LLC 10.22. Youku Tudou, Inc. 11. Key Findings 12. Industry Recommendations 13. Digital Video Advertising Market: Research Methodology 14. Terms and Glossary