Digital Inspection Market size is expected to reach US$ 40.83 Bn by 2029, at a CAGR of 7.5% during the forecast period. The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.To know about the Research Methodology :- Request Free Sample Report Digital inspection market is segmented on the basis of Technology, Offering, Dimensions, Vertical, and Geography. Growing adoption of industrial automation and technological advantages over traditional methods, improving economic growth, stabilized prices and healthy chip demand, increasing consumer awareness raising the bar of safety and quality standards, and growing utilization of Digital Inspection by institutes such as zoo are the major driving factors for the growth of the digital inspection market. However, high deployment cost of digital inspection systems is the key restraining factor for the growth of digital inspection market.

Further Key Findings From the Report:

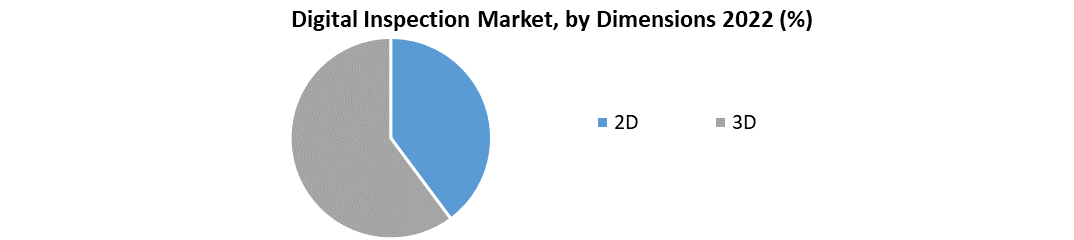

• Hardware segment held the largest share of digital inspection market from the offering segment owing to the introduction of new technologies, which further led to the development of compact and cost-effective hardware for digital inspection systems thus driving the growth of digital inspection market • However, a market for software is anticipated to grow at the highest CAGR during the forecast period owing to the growing adoption of industrial automation. Adoption of industry 4.0 is one of the key factors driving the growth of software as it is being adopted to improve productivity, by maximizing asset utilization and minimizing downtime • Digital inspection market for metrology is anticipated to grow at the highest CAGR between 2017 and 2024. Growing automation and in-line metrology, rising need for accurate inspection of 3D data used for modeling and analysis of 3D models, the inability of traditional measurement devices to address several manufacturing issues, and the growing focus on quality control are the major factors driving the growth of metrology segment • From the dimensions segment, 3D held the larger share of the digital inspection market. 3D technology is widely used as compared with the 2D technology, as it offers numerous advantages over 2D technology • Among geographical regions, North America held the largest share of the overall digital inspection market and is anticipated to dominate the digital inspection market during the forecast period. North America is developing as a major hub for manufacturing and power generation verticals owing to the presence of major players operating in this region. However, APAC is expected to witness the highest CAGR during the forecast period owing to accelerated economies and increasing a population • From the industry vertical, manufacturing industry accounted for the largest share of the digital inspection market and is further expected to grow at the highest CAGR during the forecast period. Growth of this segment can be attributed to the advent of the new technological revolution, the imposition of strict rules and regulations by food & beverages authorities, keeping in mind the health and safety of peopleDigital Inspection Market Key Highlights:

• Analysis of competitive developments such as contracts, joint ventures, mergers & acquisitions, collaborations, product launches & developments, and research and development (R&D) in the Digital Inspection Market • The objective of the report is to provide a detailed analysis of the Digital Inspection Market on the basis of technology, offering, dimensions, vertical, and geography • Complete quantitative analysis of the industry from 2017 to 2024 to enable the stakeholders to capitalize on the prevailing market opportunities • In-depth analysis of the industry on the basis of market segments, market dynamics, market size, competition & companies involved value chain • Analysis of the Digital Inspection Market with respect to individual growth trends, prospects, and contribution to the total market • Segment wise business performance detailed in the report will be worthwhile for the organizations willing to enhance its business • Provides detailed information regarding the major factors influencing the growth of the Digital Inspection Market (drivers, restraints, opportunities, and challenges) • This report would help stakeholders understand their competitors better and gain more insights to enhance their position in the businessDigital Inspection Market Research Methodology:

Bloomberg, Hoovers, Factiva are some of the sites that are being referred to gain insights about Digital Inspection Market. Experts from top manufacturing companies along with other stakeholders have been considered. This is done to validate and collect critical information for evaluating trends related to this market during the forecast period. Top-down and bottom-up approaches have been used to estimate the global and regional size of this market. Data triangulation techniques along with other comparative analysis are also used to calculate the exact size of the Digital Inspection Market globally.Digital Inspection Market Scope:Inquire before buying

Research report categorizes the Digital Inspection Market based on technology, offering, dimensions, vertical, and geography (region wise). Market size by value is estimated and forecasted with the revenues of leading companies operating in the Digital Inspection Market with key developments in companies and market trends.

Digital Inspection Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 24.61 Bn. Forecast Period 2023 to 2029 CAGR: 7.5% Market Size in 2029: US $ 40.83 Bn. Segments Covered: by Technology • Metrology • Machine Vision • NDT by Offering • Software • Hardware • Services by Dimensions • 2D • 3D by Vertical • Manufacturing • Public Infrastructure • Oil & Gas • Automotive • Electronics and Semiconductor • Aerospace & Defense • Food and Pharmaceuticals • Energy and Power Digital Inspection Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Available Customization

Maximize Market Research offers customization of report and scope of the report as per the specific requirement of our client.Digital Inspection Market Key Players

• General Electric • Olympus • Mistras Group • Cognex • Hexagon • Zetec • Nikon • Omron • Faro Technologies • Basler Frequently Asked Questions: 1. Which region has the largest share in Global Digital Inspection Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Digital Inspection Market? Ans: The Global Digital Inspection Market is growing at a CAGR of 7.5% during forecasting period 2023-2029. 3. What is scope of the Global Digital Inspection Market report? Ans: Global Digital Inspection Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Digital Inspection Market? Ans: The important key players in the Global Digital Inspection Market are – General Electric, Olympus, Mistras Group, Cognex, Hexagon, Zetec, Nikon, Omron, Faro Technologies, Basler 5. What is the study period of this Market? Ans: The Global Digital Inspection Market is studied from 2022 to 2029.

Digital Inspection Market

1. EXECUTIVE SUMMARY 2. RESEARCH METHODOLOGY 2.1. Market Definition 2.2. Market Scope 2.3. Data Sources 3. MARKET DYNAMICS 3.1. Market Drivers 3.2. Market Restraints 3.3. Market Opportunities 4. END-USER OVERVIEW 4.1. Value Chain Analysis 4.2. Key Trends 5. DIGITAL INSPECTION MARKET, BY TECHNOLOGY (2022-2029) 5.1. Introduction 5.2. Metrology 5.2.1. Metrology Market Overview 5.2.2. Metrology Market Size & Forecast 5.3. Machine Vision 5.3.1. Machine Vision Market Overview 5.3.2. Machine Vision Market Size & Forecast 5.4. NDT 5.4.1. NDT Market Overview 5.4.2. NDT Market Size & Forecast 6. DIGITAL INSPECTION MARKET, BY OFFERING (2022-2029) 6.1. Introduction 6.2. Software 6.2.1. Digital Inspection Software Market Overview 6.2.2. Digital Inspection Software Market Size & Forecast 6.3. Hardware 6.3.1. Digital Inspection Hardware Market Overview 6.3.2. Digital Inspection Hardware Market Size & Forecast 6.4. Services 6.4.1. Digital Inspection Services Market Overview 6.4.2. Digital Inspection Services Market Size & Forecast 7. DIGITAL INSPECTION MARKET, BY DIMENSIONS (2022-2029) 7.1. Introduction 7.2. 2D 7.2.1. Digital Inspection 2D Market Overview 7.2.2. Digital Inspection 2D Market Size & Forecast 7.3. 3D 7.3.1. Digital Inspection 3D Market Overview 7.3.2. Digital Inspection 3D Market Size & Forecast 8. DIGITAL INSPECTION MARKET, BY VERTICAL (2022-2029) 8.1. Introduction 8.2. Manufacturing 8.2.1. Manufacturing Market Overview 8.2.2. Manufacturing Market Size & Forecast 8.3. Public Infrastructure 8.3.1. Public Infrastructure Market Overview 8.3.2. Public Infrastructure Market Size & Forecast 8.4. Oil & Gas 8.4.1. Oil & Gas Market Overview 8.4.2. Oil & Gas Market Size & Forecast 8.5. Automotive 8.5.1. Automotive Market Overview 8.5.2. Automotive Market Size & Forecast 8.6. Electronics and Semiconductor 8.6.1. Electronics and Semiconductor Market Overview 8.6.2. Electronics and Semiconductor Market Size & Forecast 8.7. Aerospace & Defense 8.7.1. Aerospace & Defense Market Overview 8.7.2. Aerospace & Defense Market Size & Forecast 8.8. Food and Pharmaceuticals 8.8.1. Food and Pharmaceuticals Market Overview 8.8.2. Food and Pharmaceuticals Market Size & Forecast 8.9. Energy and Power 8.9.1. Energy and Power Market Overview 8.9.2. Energy and Power Market Size & Forecast 9. DIGITAL INSPECTION MARKET, BY GEOGRAPHY (2022-2029) 9.1. North America Digital Inspection Market 9.1.1. North America Digital Inspection Market, by Technology 9.1.2. North America Digital Inspection Market, by Offering 9.1.3. North America Digital Inspection Market, by Dimensions 9.1.4. North America Digital Inspection Market, by Vertical 9.1.5. North America Digital Inspection Market, by Region 9.1.5.1. U.S. Digital Inspection Market 9.1.5.2. Canada Digital Inspection Market 9.2. Europe Digital Inspection Market 9.2.1. Europe Digital Inspection Market, by Technology 9.2.2. Europe Digital Inspection Market, by Offering 9.2.3. Europe Digital Inspection Market, by Dimensions 9.2.4. Europe Digital Inspection Market, by Vertical 9.2.5. Europe Digital Inspection Market, by Region 9.2.5.1. France Digital Inspection Market 9.2.5.2. Germany Digital Inspection Market 9.2.5.3. U.K .Digital Inspection Market 9.2.5.4. Rest of Europe Digital Inspection Market 9.3. Asia Pacific Digital Inspection Market 9.3.1. Asia-Pacific Digital Inspection Market, by Technology 9.3.2. Asia-Pacific Digital Inspection Market, by Offering 9.3.3. Asia-Pacific Digital Inspection Market, by Dimensions 9.3.4. Asia-Pacific Digital Inspection Market, by Vertical 9.3.5. Asia-Pacific Digital Inspection Market, by Region 9.3.5.1. China Digital Inspection Market 9.3.5.2. Japan Digital Inspection Market 9.3.5.3. India Digital Inspection Market 9.3.5.4. Australia Digital Inspection Market 9.3.5.5. South Korea Digital Inspection Market 9.3.5.6. Rest of Asia Pacific Digital Inspection Market 9.4. Middle East & Africa Digital Inspection Market 9.4.1. Middle East & Africa Digital Inspection Market, by Technology 9.4.2. Middle East & Africa Digital Inspection Market, by Offering 9.4.3. Middle East & Africa Digital Inspection Market, by Dimensions 9.4.4. Middle East & Africa Digital Inspection Market, by Vertical 9.4.5. Middle East & Africa Digital Inspection Market, by Region 9.4.5.1. South Africa Digital Inspection Market 9.4.5.2. Egypt Digital Inspection Market 9.4.5.3. Nigeria Digital Inspection Market 9.4.5.4. Rest of Middle East & Africa Digital Inspection Market 9.5. Latin America Digital Inspection Market 9.5.1. Latin America Digital Inspection Market, by Technology 9.5.2. Latin America Digital Inspection Market, by Offering 9.5.3. Latin America Digital Inspection Market, by Dimensions 9.5.4. Latin America Digital Inspection Market, by Vertical 9.5.5. Latin America Digital Inspection Market, by Region 9.5.5.1. Brazil Digital Inspection Market 9.5.5.2. Argentina Digital Inspection Market 9.5.5.3. Columbia Digital Inspection Market 9.5.5.4. Mexico Digital Inspection Market 9.5.5.5. Rest of Latin America Digital Inspection Market 10. MARKET COMPETITION ANALYSIS 10.1 Digital Inspection Market Share/Positioning Analysis 10.2 Digital Inspection Key Innovators 10.3 Digital Inspection Company Profiles 10.3.1 General Electric 10.3.1.1 Overview 10.3.1.2 Products/ End-User 10.3.1.3 Strategy 10.3.1.4 Key Developments 10.3.2 Olympus 10.3.2.1 Overview 10.3.2.2 Products/ End-User 10.3.2.3 Strategy 10.3.2.4 Key Developments 10.3.3 Mistras Group 10.3.3.1 Overview 10.3.3.2 Products/ End-User 10.3.3.3 Strategy 10.3.3.4 Key Developments 10.3.4 Cognex 10.3.4.1 Overview 10.3.4.2 Products/ End-User 10.3.4.3 Strategy 10.3.4.4 Key Developments 10.3.5 Hexagon 10.3.5.1 Overview 10.3.5.2 Products/ End-User 10.3.5.3 Strategy 10.3.5.4 Key Developments 10.3.6 Zetec 10.3.6.1 Overview 10.3.6.2 Products/ End-User 10.3.6.3 Strategy 10.3.6.4 Key Developments 10.3.7 Nikon 10.3.7.1 Overview 10.3.7.2 Products/ End-User 10.3.7.3 Strategy 10.3.7.4 Key Developments 10.3.8 Omron 10.3.8.1 Overview 10.3.8.2 Products/ End-User 10.3.8.3 Strategy 10.3.8.4 Key Developments 10.3.9 Faro Technologies 10.3.9.1 Overview 10.3.9.2 Products/ End-User 10.3.9.3 Strategy 10.3.9.4 Key Developments 10.3.10 Basler 10.3.10.1 Overview 10.3.10.2 Products/ End-User 10.3.10.3 Strategy 10.3.10.4 Key Developments