The Dental Software Market size was valued at USD 2.8 Billion in 2023 and the total Dental Software Market Size is expected to grow at a CAGR of 10.2 % from 2024 to 2030, reaching nearly USD 5.53 Billion in 2030.Dental Software Market Overview:

Dental software is a type of computer technology used by dental laboratories, professionals, dental academic and research institutes along forensic laboratories for the diagnosis, deterrence, treatment, research, and investigation of various oral health conditions. Dental software refers to computer programs designed specifically for managing the operations of dental clinics, including patient records, appointment scheduling, billing, and treatment planning. It helps streamline workflows and improve efficiency in dental practices, ultimately enhancing patient care. As dental clinics seek to provide better and more efficient services, dental practice software is becoming a crucial tool.To know about the Research Methodology :- Request Free Sample Report As per MMR analysis, 90% of small-to-medium-sized dental offices use dental practice management software to manage patient data, billing, and insurance claims. More than, 35,000 dental offices use Dentrix to run stronger practices. One of the main drivers of the market growth in the United States is the strategic presence of major players like Henry Schein One & Curve Dental, as well as the rapid uptake of oral care services by baby boomers. The use of dental software has significantly impacted the dental workflow throughout the dental industry. The American Cancer Society’s recent estimates for oral cavity and oropharyngeal cancers in the United States. 1. About 58,450 new cases of oral cavity or oropharyngeal cancer. 2. About 12,230 deaths from oral cavity or oropharyngeal cancer. Oral cavity and oropharyngeal cancers occur most often in the 1. The tongue 2. The tonsils and oropharynx (the part of the throat behind the mouth) 3. The gums, floor of the mouth, and other parts of the mouth The average age of people diagnosed with these cancers is 64, but they occur in young people. Just over 20% (1 in 5) of cases occur in people younger than 55.

Dental Software Market Dynamic:

Revolutionizing the Dental Software Market The primary driver of the Dental Software Market is the flexible, scalable, and affordable nature of cloud-based technology. Additionally, advantages such as remote access, low upfront costs, and data security also contribute to the high growth of the segment. Growing demand for the automation of clinical and administrative procedures in dental practices is expected to drive the market. Increased dental needs among older adults drive demand for efficient practice management software. Rising oral care awareness in developing countries and the growing geriatric population have resulted in an increased number of patients in dental clinics. Impact of Digital Technology and Cloud-Based Solutions Dental practice management software runs in the cloud as software as a service (SaaS) or apps, eliminating the need to store patient information on paper and allowing doctors to access data remotely. Experts in modern dentistry are increasingly turning to digital dental radiography systems for improved detection, diagnostic testing, therapeutic interventions, and tracking of oral conditions and diseases. From digital X-rays to 3D printing, technological advancements have transformed the way dental care is delivered, making it more accurate, safe, and patient-friendly. Digital X-ray sensors are used in digital dental radiography, x-rays capture several intra-oral X-rays in a fraction of the time and with significantly less radiation than traditional radiography. The market is mainly driven by the significant applications of Digital Dental X-ray sensors in various end-use industries. The expanding demands from Hospital, Dental Clinic, and Other, are propelling the Digital Dental X-Ray Sensors market.Challenges of Adopting Dental Software Solutions The lack of awareness about the benefits of using dental software systems among health professionals is likely to hinder the market. Dentists hesitated to adopt innovative software and solutions for structural and financial reasons. The dental care industry has always been highly fragmented unlike most of the other sectors of the healthcare system. Owing to a lack of infrastructure and the unaffordability of dental software, the reluctance persists among the dental care industry in various regions. Rising inflation across developed countries, the use of advanced and high technology, and frequent innovation in technologies are the main reasons behind the high cost of the solutions.

Dental Software Market Segment:

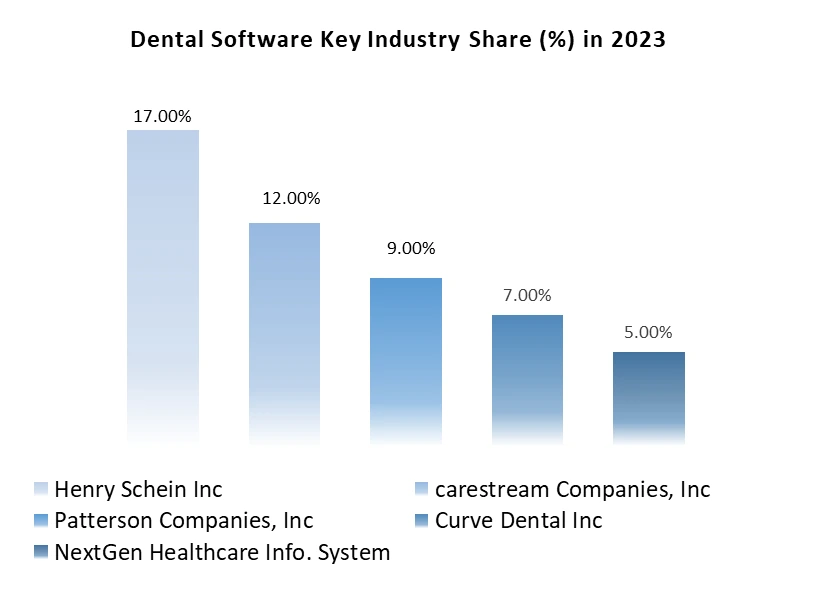

By Type, The practice management segment is the highest contributor to the market and is expected to grow at a CAGR of 9.10 % and Reach US$3.8 Billion by 2030. Dental practice management software automates various administrative tasks such as appointment scheduling, patient records management, and billing, reducing the need for manual paperwork. Additionally, Dental practice management software often includes robust reporting and analytics features that provide valuable insights into practice performance, financial metrics, patient demographics, and treatment outcomes. Data helps dentists make informed decisions, optimize practice operations, and identify areas for improvement. According to World Population Prospects, the number of older people, aged 60 years or more, is expected to grow more than two-fold by 2030. Major companies operating in the dental practice management market report are Henry Schein Inc., Patterson Companies Inc., NextGen Healthcare Information Systems LLC, ACE Dental, Carestream Dental LLC, Planet DDS Inc., CD Newco LLC (Curve Dental), Open Dental Software,

Dental Software Market Regional Insight:

North America held a market share of 55 % in 2023 and is expected to grow at the highest CAGR of around 10.8 % during the forecast period. North America has been the first and fastest to use dental software. The strategic presence of significant competitors such as Henry Schein One and Curve Dental, as well as the increased acceptance of dental care services by baby boomers, are among the important reasons driving market expansion in the United States. According to the American Cancer Society, 54,540 adults (39,290 men and 15,250 women) Americans are estimated to be diagnosed with oral cavity or oropharyngeal cancer in the United States in 2022. In Canada, approximately 25,500 licensed dentists are operating out of roughly 16,000 dental offices. The rising number of dentists and dental practices in the country is expected to increase demand for dental software, resulting in the dental software market growth.Competitive Landscape: 1. In January 2023 - Planet DDS Announces Cloud 9 Software Acquisition. The acquisition enables the company to better serve the demands of orthodontic and pediatric practices across the US. Planet DDS's acquisition of Cloud 9 allows it to continue its rapid growth as a multi-specialty dental software platform while gaining Cloud 9's strength and experience in orthodontic and pediatric practice management software. 2. In February 2023- Cloud Dentistry announced the release of CloudDent, a new dental office management software system. The cloud-based software system is intended to assist dental clinics in saving money and increasing efficiency. 3. In May 2023- Parrerson Companies Inc. a major supplier of dental supplies and equipment, announced the acquisition of Dental Claims, Inc., a dental claim about processing software development.

Dental Software Market Scope: Inquire before buying

Global Dental Software Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.8 Bn. Forecast Period 2024 to 2030 CAGR: 10.2% Market Size in 2030: US $ 5.53 Bn. Segments Covered: by Type Practice Management Software Patient Communication Software Planning Software Patient Education Software Dental Imaging Software by End Users Dental Clinics Hospitals Dental Software Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Industry Player in the Dental Software Market.

1. Carestream Dental LLC. (United States) 2. Allscripts Healthcare Solutions (United States) 3. Dovetail Dental Software (United States) 4. DentiMax LLC. (United States) 5. Software of Excellence (UK) Ltd. (United Kingdom) 6. ABEL Dental Software (Ireland) 7. Epic Systems Corporation (United States) 8. Patterson Companies Inc. (United States) 9. Datacon Dental Systems (Switzerland) 10. Curve Dental Inc. (United States) 11. Quality Systems Inc. (United States) 12. Henry Schein (United States) 13 NextGen Healthcare Information Systems, LLC. (United States) 14. Open Dental Software (United States) 15. Planet DDS Inc. (United States) 16. MOGO Inc. (United States) 17. Orthotrac (United States) 18. Sopro-Comeg (France) 19. Cliniq Apps Ltd. (United Kingdom) 20. Practice-Web, Inc. (United States) 21. ACE Dental Software (United States) 22. CareStack (Good Methods Global Inc.) (United States) 23. Dentiflow (United States) 24. CD Nevco, LLC (Curve Dental) (United States) 25. Dental4Windows (Australia) 26. Dental Suite (France) 27. Software4Dentists (United Kingdom) 28. Swissmeda (Switzerland) 29. b-plus Dental Software GmbH (Austria) 30. FD System (Italy) Frequently Asked Questions: 1] What segments are covered in the Dental Software Market report? Ans. The segments covered in the Dental Software Market report are based on Type and End User. 2] Which region is the dominant market in the Dental Software Market? Ans. The North American region is the dominant market in the Dental Software Market. 3] What is the market size of the Dental Software Market by 2030? Ans. The market size of the Dental Software Market by 2030 is US$ 5.53 Billion. 4] What is the forecast period for the Dental Software Market? Ans. The Forecast period for the Dental Software Market is 2024- 2030. 5] What was the market size of the Dental Software Market in 2023? Ans. The market size of the Dental Software Market in 2023 was USD 2.8 Billion. 6] What is the expected growth rate of the Dental Software Market by 2030? Ans. The Dental Software Market Size is expected to grow at a CAGR of 10.2 % from 2024 to 2030.

1. Dental Software Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Dental Software Market: Dynamics 2.1. Dental Software Market Trends by Region 2.1.1. North America Dental Software Market Trends 2.1.2. Europe Dental Software Market Trends 2.1.3. Asia Pacific Dental Software Market Trends 2.1.4. Middle East and Africa Dental Software Market Trends 2.1.5. South America Dental Software Market Trends 2.2. Dental Software Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Dental Software Market Drivers 2.2.1.2. North America Dental Software Market Restraints 2.2.1.3. North America Dental Software Market Opportunities 2.2.1.4. North America Dental Software Market Challenges 2.2.2. Europe 2.2.2.1. Europe Dental Software Market Drivers 2.2.2.2. Europe Dental Software Market Restraints 2.2.2.3. Europe Dental Software Market Opportunities 2.2.2.4. Europe Dental Software Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Dental Software Market Drivers 2.2.3.2. Asia Pacific Dental Software Market Restraints 2.2.3.3. Asia Pacific Dental Software Market Opportunities 2.2.3.4. Asia Pacific Dental Software Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Dental Software Market Drivers 2.2.4.2. Middle East and Africa Dental Software Market Restraints 2.2.4.3. Middle East and Africa Dental Software Market Opportunities 2.2.4.4. Middle East and Africa Dental Software Market Challenges 2.2.5. South America 2.2.5.1. South America Dental Software Market Drivers 2.2.5.2. South America Dental Software Market Restraints 2.2.5.3. South America Dental Software Market Opportunities 2.2.5.4. South America Dental Software Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Dental Software Industry 2.8. Analysis of Government Schemes and Initiatives For Dental Software Industry 2.9. Dental Software Market Trade Analysis 2.10. The Global Pandemic Impact on Dental Software Market 3. Dental Software Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Dental Software Market Size and Forecast, by Type (2023-2030) 3.1.1. Practice Management Software 3.1.2. Patient Communication Software 3.1.3. Planning Software 3.1.4. Patient Education Software 3.1.5. Dental Imaging Software 3.2. Dental Software Market Size and Forecast, by End Users (2023-2030) 3.2.1. Dental Clinics 3.2.2. Hospitals 3.3. Dental Software Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Dental Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Dental Software Market Size and Forecast, by Type (2023-2030) 4.1.1. Practice Management Software 4.1.2. Patient Communication Software 4.1.3. Planning Software 4.1.4. Patient Education Software 4.1.5. Dental Imaging Software 4.2. North America Dental Software Market Size and Forecast, by End Users (2023-2030) 4.2.1. Dental Clinics 4.2.2. Hospitals 4.3. North America Dental Software Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Dental Software Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Practice Management Software 4.3.1.1.2. Patient Communication Software 4.3.1.1.3. Planning Software 4.3.1.1.4. Patient Education Software 4.3.1.1.5. Dental Imaging Software 4.3.1.2. United States Dental Software Market Size and Forecast, by End Users (2023-2030) 4.3.1.2.1. Dental Clinics 4.3.1.2.2. Hospitals 4.3.2. Canada 4.3.2.1. Canada Dental Software Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Practice Management Software 4.3.2.1.2. Patient Communication Software 4.3.2.1.3. Planning Software 4.3.2.1.4. Patient Education Software 4.3.2.1.5. Dental Imaging Software 4.3.2.2. Canada Dental Software Market Size and Forecast, by End Users (2023-2030) 4.3.2.2.1. Dental Clinics 4.3.2.2.2. Hospitals 4.3.3. Mexico 4.3.3.1. Mexico Dental Software Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Practice Management Software 4.3.3.1.2. Patient Communication Software 4.3.3.1.3. Planning Software 4.3.3.1.4. Patient Education Software 4.3.3.1.5. Dental Imaging Software 4.3.3.2. Mexico Dental Software Market Size and Forecast, by End Users (2023-2030) 4.3.3.2.1. Dental Clinics 4.3.3.2.2. Hospitals 5. Europe Dental Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Dental Software Market Size and Forecast, by Type (2023-2030) 5.2. Europe Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3. Europe Dental Software Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3.2. France 5.3.2.1. France Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Dental Software Market Size and Forecast, by End Users (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Dental Software Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Dental Software Market Size and Forecast, by End Users (2023-2030) 6. Asia Pacific Dental Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Dental Software Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3. Asia Pacific Dental Software Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.4. India 6.3.4.1. India Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Dental Software Market Size and Forecast, by End Users (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Dental Software Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Dental Software Market Size and Forecast, by End Users (2023-2030) 7. Middle East and Africa Dental Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Dental Software Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Dental Software Market Size and Forecast, by End Users (2023-2030) 7.3. Middle East and Africa Dental Software Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Dental Software Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Dental Software Market Size and Forecast, by End Users (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Dental Software Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Dental Software Market Size and Forecast, by End Users (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Dental Software Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Dental Software Market Size and Forecast, by End Users (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Dental Software Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Dental Software Market Size and Forecast, by End Users (2023-2030) 8. South America Dental Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Dental Software Market Size and Forecast, by Type (2023-2030) 8.2. South America Dental Software Market Size and Forecast, by End Users (2023-2030) 8.3. South America Dental Software Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Dental Software Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Dental Software Market Size and Forecast, by End Users (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Dental Software Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Dental Software Market Size and Forecast, by End Users (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Dental Software Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Dental Software Market Size and Forecast, by End Users (2023-2030) 9. Global Dental Software Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Dental Software Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Carestream Dental LLC. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Allscripts Healthcare Solutions (United States) 10.3. Dovetail Dental Software (United States) 10.4. DentiMax LLC. (United States) 10.5. Software of Excellence (UK) Ltd. (United Kingdom) 10.6. ABEL Dental Software (Ireland) 10.7. Epic Systems Corporation (United States) 10.8. Patterson Companies Inc. (United States) 10.9. Datacon Dental Systems (Switzerland) 10.10. Curve Dental Inc. (United States) 10.11. Quality Systems Inc. (United States) 10.12. Henry Schein (United States) 10.13. NextGen Healthcare Information Systems, LLC. (United States) 10.14. Open Dental Software (United States) 10.15. Planet DDS Inc. (United States) 10.16. MOGO Inc. (United States) 10.17. Orthotrac (United States) 10.18. Sopro-Comeg (France) 10.19. Cliniq Apps Ltd. (United Kingdom) 10.20. Practice-Web, Inc. (United States) 10.21. ACE Dental Software (United States) 10.22. CareStack (Good Methods Global Inc.) (United States) 10.23. Dentiflow (United States) 10.24. CD Nevco, LLC (Curve Dental) (United States) 10.25. Dental4Windows (Australia) 10.26. Dental Suite (France) 10.27. Software4Dentists (United Kingdom) 10.28. Swissmeda (Switzerland) 10.29. b-plus Dental Software GmbH (Austria) 10.30. FD System (Italy) 11. Key Findings 12. Industry Recommendations 13. Dental Software Market: Research Methodology 14. Terms and Glossary