The Crypto Currency ATM Market size was valued at USD 154.68 Million in 2023 and the total Crypto Currency ATM revenue is expected to grow at a CAGR of 54.9 % from 2024 to 2030, reaching nearly USD 3309.74 Million by 2030.Crypto Currency ATM Market Overview

Crypto Currency ATM, is a physical kiosk allowing users to buy or sell cryptocurrencies using cash, credit/debit cards, or digital payments, providing access to digital assets outside of traditional online exchanges. The Crypto Currency ATM Market is undergoing a transformative phase, marked by substantial growth and increasing prominence globally. The current scenario underscores an increasing landscape of Crypto Currency ATMs, with over 25,000 machines deployed worldwide, signifying a surge in installations, particularly in regions such as North America, Europe, and Asia-Pacific. The Crypto Currency ATM Market growth is driven by various factors, including the escalating adoption of cryptocurrencies as alternative investment assets, the rising demand for decentralized financial services, and increasing awareness among the general population about digital currencies. Recent developments involve Crypto Currency ATM key players like CoinFlip, a leading operator that expanded its network to over 6,000 Crypto Currency ATMs across various countries, emphasizing accessibility and convenience for users seeking to engage in cryptocurrency transactions. Crypto Currency ATM companies like Genesis Coin and BitAccess have focused on technological advancements, introducing user-friendly interfaces, enhancing security measures, and facilitating smoother transactions, thereby bolstering consumer trust and participation in the Crypto Currency ATM ecosystem. These strategic advancements and expansions underscore a pivotal phase in the Crypto Currency ATM Market, showcasing a heightened emphasis on innovation, user experience, and geographic outreach as the industry evolves to meet the escalating demand for accessible and user-friendly cryptocurrency transactions.To know about the Research Methodology:-Request Free Sample Report

Crypto Currency ATM Market Dynamics:

Increasing Demand for Cash-to-Crypto Transactions Driving Crypto Currency ATM Market Growth The rise in demand for cash-to-crypto transactions has become a key driver boosting the growth of Crypto Currency ATM Market. In regions with limited banking infrastructure such as south America and Africa, these ATMs play a major role in facilitating access to digital assets. Countries such as Nigeria have witnessed a rapid growth in Crypto ATMs due to the pressing need for alternative financial services in underserved areas. Simultaneously, the soaring popularity and wider acceptance of cryptocurrencies, particularly Bitcoin, have significantly fueled the demand for Crypto ATMs. As the value of Bitcoin surged and gained wider recognition, more users sought convenient means to engage in buying and selling digital currencies, spurring the deployment of ATMs worldwide. These ATMs enable easy access to digital currencies, attracting individuals who prefer physical interactions when acquiring cryptocurrencies, thereby complementing the offerings of online exchanges. The expansion of the range of supported cryptocurrencies beyond Bitcoin, encompassing coins like Ethereum, Litecoin, or Ripple, has increased the Crypto Currency ATM Market growth. This diversification caters to a wider array of investors and users with varying interests in different digital assets.Progressive regulatory frameworks and the increasing acceptance of cryptocurrencies have significantly impacted the Crypto Currency ATM Market. Clarity in regulations in certain countries like Switzerland or Canada has fostered an environment conducive to the proliferation of Crypto ATMs. Fegions with underbanked populations like Venezuela, where hyperinflation devalues local currency, these ATMs have played a crucial role in providing access to more stable digital assets, fostering financial inclusion. Additionally, collaborations between Crypto ATM providers and established financial institutions or retail chains have been instrumental in expanding the ATM network reach, increasing accessibility to a broader audience. Overall, technological advancements, growing investor interest, and the use of cryptocurrencies as a hedge during economic uncertainties have collectively propelled the adoption and growth of Crypto Currency ATM Market. Fluctuating Stance on Cryptocurrency Legality Hinders the Crypto Currency ATM Market Growth Evolving global regulations present a significant hurdle for Crypto Currency ATM Market Growth. The landscape is fraught with uncertainty, as seen in India's wavering stance on cryptocurrency legality, causing ambiguity and potentially curtailing ATM growth due to potential bans or stringent restrictions. Such regulatory shifts significantly impact market prospects and inhibit expansion efforts. Security concerns stand as another formidable challenge, with incidents like the hacking of a Japanese exchange severely impacting user trust and confidence in both cryptocurrencies and Crypto ATMs. These breaches, alongside fraudulent activities, create a pervasive sense of vulnerability, discouraging potential users and impeding market growth. The lack of widespread understanding and awareness about cryptocurrencies restrains ATM usage. In regions where knowledge gaps exist, the unfamiliarity with digital currencies slows down the adoption of Crypto ATMs, hindering their acceptance and usage. The financial viability of operating Crypto ATMs remains a concern, with high operational costs encompassing maintenance, security, and compliance. These increased expenses particularly affect independent ATM operators, impacting profitability and stifling market growth. Meeting evolving regulatory requirements is another significant challenge, with compliance complexities constraining market growth, especially in regions with stringent cryptocurrency regulations like the United States.

Technological advancements are vital for maintaining functional ATMs. Outdated systems or inadequate integrations hinder user experiences, impacting market growth. Uneven geographical distribution of Crypto ATMs restricts accessibility, limiting convenience and usage, particularly in underserved areas. Transaction limits imposed by these ATMs also hinder large-scale investors or users seeking substantial transactions, limiting their appeal. The inherent volatility of cryptocurrencies deters potential users, as market fluctuations create perceived risks. The convenience and low transaction fees offered by online exchanges present strong competition, affecting the demand for Crypto ATMs and impeding their Crypto Currency ATM Market Growth.

Country Regulatory Status Details United States Partially Regulated SEC regulates ICOs; IRS treats crypto as property for tax; State laws vary. China Mostly banned Bans ICOs and cryptocurrency exchanges; individual possession is legal. Japan Regulated Legalized crypto as a legal payment method; exchanges need FSA registration. South Korea Regulated KYC norms for exchanges; bans anonymous trading; taxes crypto transactions. India Mostly Unregulated No legal framework; intermittent bans; discussion about a potential bill. United Kingdom Regulated FCA oversees crypto firms; registration mandatory for crypto businesses. Germany Regulated Recognizes Bitcoin as a legal form of payment; requires licenses for exchanges. Russia Mostly Unregulated No specific laws; plans for regulations; unclear stance on crypto ownership. Brazil Mostly Unregulated No specific regulations; discussions on a potential regulatory framework. Australia Regulated AML/CFT laws apply to crypto exchanges; regulated by AUSTRAC. Crypto Currency ATM Market Segment Analysis:

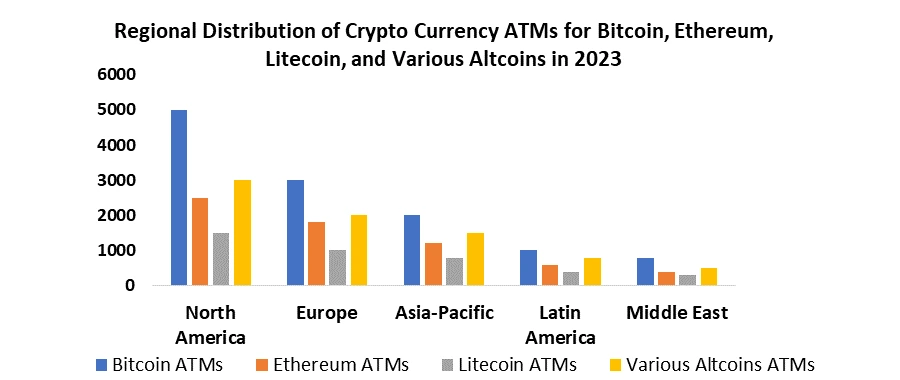

Based on type of cryptocurrency supported, Bitcoin segment dominated the Crypto Currency ATM Market. Its widespread recognition and significant market dominance contribute to its prevalent use in these machines. Ethereum, with its smart contract capabilities and substantial market share, holds a prominent position in Crypto ATMs, catering to users involved in decentralized applications and platforms. Litecoin, known for its faster transaction speeds and lower fees, also finds considerable support in ATMs, particularly among users prioritizing quicker transactions. Various altcoins encompass a spectrum of lesser-known cryptocurrencies, each with its unique features, which are gradually gaining traction in Crypto ATMs, aiming to fulfill to specific niche Crypto Currency ATM Market.Based on Accessibility, Public ATMs dominated the Crypto Currency ATM Market in 2023 and is expected to maintain their dominance throughout the forecast period. It is accessible to anyone, fulfill to a broader user base, facilitating easier entry into the crypto sphere. Their widespread availability in public spaces such as malls or high-traffic areas promotes greater adoption among the general populace, fostering familiarity and ease of access to digital currencies. Conversely, private ATMs, with restricted access often tied to memberships or specific locations, serve niche communities or tailored clientele. While these private ATMs may offer specialized services, their limited accessibility inhibits widespread adoption, primarily utilized by specific user groups or within closed networks. Overall, public ATMs significantly contribute to the democratization of cryptocurrencies by fostering broader acceptance and usage, while private ATMs, although serving specific purposes, have a narrower reach, impacting their overall adoption rates within the Crypto Currency ATM Market.

North America Dominance in the Crypto Currency ATM Market North America dominated the Crypto Currency ATM Market, particularly the United States and Canada, stands out as a large Crypto Currency ATM-using region, boasting the highest concentration of these ATMs globally. For instance, as of real-time statistics, the U.S. holds a substantial share of the total Crypto Currency ATMs installed worldwide, with major cities like New York, Los Angeles, and Chicago housing a significant number of these machines. Additionally, Europe, including countries such as the United Kingdom, Austria, and Switzerland, also serves as a key region for Crypto Currency ATM adoption, witnessing a steady rise in installations. For example, London alone hosts a noteworthy number of these ATMs, reflecting the growing interest in digital currencies across the continent. Asia-Pacific, led by countries such as Japan and South Korea, is steadily catching up, showcasing a burgeoning trend in Crypto Currency ATM installations. In real-time data, Tokyo and Seoul have seen a considerable increase in the deployment of these ATMs, signaling a growing acceptance and adoption of cryptocurrencies in the region.

Crypto Currency ATM Market Regional Insights:

Crypto Currency ATM Market Scope: Inquire before buying

Global Crypto Currency ATM Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 154.68 Mn. Forecast Period 2024 to 2030 CAGR: 54.9% Market Size in 2030: US $ 3309.74 Mn. Segments Covered: By Type of Cryptocurrency Supported Bitcoin Ethereum Litecoin Various Altcoins By Transaction Type Buy-Only ATMs Sell-Only ATMs Two-Way ATMs (Buying and Selling) By Deployment Type Airports Shopping Malls Retail Stores Standalone Installations By Accessibility Public ATMs Private ATMs By Ownership Type Cryptocurrency Company Operated Financial Institution Operated Independent Operators Global Crypto Currency ATM Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Crypto Currency ATM Market Key Players:

Major Contributors in the Crypto Currency ATM Industry in North America: 1. CoinFlip, Chicago, USA 2. Bitstop Miami, USA 3. Coin Cloud, Las Vegas, USA 4. Bitcoin Depot Atlanta, USA 5. Coinsource, Fort Worth, USA 6. Coinme, Seattle, USA 7. Genesis Coin, San Diego, USA 8. Byte Federal, Florida, USA 9. Paydepot, Los Angeles, USA 10. Robocoin, Las Vegas, USA 11. Bitaccess, Ottawa, Canada Leading players in the Europe Crypto Currency ATM Market: 1. Shitcoins Club Berlin, Germany 2. Lamassu, Luzern, Switzerland 3. BitXatm, Switzerland 4. Bitnovo, Valencia, Spain 5. BCB ATM, London, UK Key players driving the Asia-Pacific Crypto Currency ATM Market: 1. BitOcean, Tokyo, Japan 2. Bitmain, Beijing, China 3. Binance, Tokyo, Japan 4. Coincheck, Tokyo, Japan 5. GMO Coin, Tokyo, Japan 6. Unocoin, Bangalore, IndiaFAQs:

1] What Major Key players in the Global Crypto Currency ATM Market report? Ans. The Major Key players covered in the market report are based on CoinFlip, Chicago, USA, Bitstop, Miami, USA, Coin Cloud, Las Vegas, USA, Bitcoin Depot Atlanta, USA. Coinsource, Fort Worth, USA. 2] Which region is expected to hold the highest share in the Global Crypto Currency ATM Market? Ans. North America region is expected to hold the highest share in the market. 3] What is the market size of the Global Crypto Currency ATM Market by 2030? Ans. The market size of the market by 2030 is expected to reach US$ 3309.74 Mn. 4] What is the forecast period for the Global Crypto Currency ATM Market? Ans. The forecast period for the Crypto Currency ATM Market is 2024-2030. 5] What was the market size of the Global Crypto Currency ATM Market in 2023? Ans. The market size of the market in 2023 was valued at US$ 154.68 Mn.

1. Crypto Currency ATM Market: Research Methodology 2. Crypto Currency ATM Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Crypto Currency ATM Market: Dynamics 3.1. Crypto Currency ATM Market Trends by Region 3.1.1. North America Crypto Currency ATM Market Trends 3.1.2. Europe Crypto Currency ATM Market Trends 3.1.3. Asia Pacific Crypto Currency ATM Market Trends 3.1.4. Middle East and Africa Crypto Currency ATM Market Trends 3.1.5. South America Crypto Currency ATM Market Trends 3.2. Crypto Currency ATM Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Crypto Currency ATM Market Drivers 3.2.1.2. North America Crypto Currency ATM Market Restraints 3.2.1.3. North America Crypto Currency ATM Market Opportunities 3.2.1.4. North America Crypto Currency ATM Market Challenges 3.2.2. Europe 3.2.2.1. Europe Crypto Currency ATM Market Drivers 3.2.2.2. Europe Crypto Currency ATM Market Restraints 3.2.2.3. Europe Crypto Currency ATM Market Opportunities 3.2.2.4. Europe Crypto Currency ATM Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Crypto Currency ATM Market Drivers 3.2.3.2. Asia Pacific Crypto Currency ATM Market Restraints 3.2.3.3. Asia Pacific Crypto Currency ATM Market Opportunities 3.2.3.4. Asia Pacific Crypto Currency ATM Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Crypto Currency ATM Market Drivers 3.2.4.2. Middle East and Africa Crypto Currency ATM Market Restraints 3.2.4.3. Middle East and Africa Crypto Currency ATM Market Opportunities 3.2.4.4. Middle East and Africa Crypto Currency ATM Market Challenges 3.2.5. South America 3.2.5.1. South America Crypto Currency ATM Market Drivers 3.2.5.2. South America Crypto Currency ATM Market Restraints 3.2.5.3. South America Crypto Currency ATM Market Opportunities 3.2.5.4. South America Crypto Currency ATM Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Crypto Currency ATM End Use Industry 3.8. Analysis of Government Schemes and Initiatives For Crypto Currency ATM End Use Industry 3.9. The Global Pandemic Impact on Crypto Currency ATM Market 4. Crypto Currency ATM Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 4.1.1. Bitcoin 4.1.2. Ethereum 4.1.3. Litecoin 4.1.4. Various Altcoins 4.2. Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 4.2.1. Buy-Only ATMs 4.2.2. Sell-Only ATMs 4.2.3. Two-Way ATMs (Buying and Selling) 4.3. Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 4.3.1. Airports 4.3.2. Shopping Malls 4.3.3. Retail Stores 4.3.4. Standalone Installations 4.4. Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 4.4.1. Public ATMs 4.4.2. Private ATMs 4.5. Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 4.5.1. Cryptocurrency Company Operated 4.5.2. Financial Institution Operated 4.5.3. Independent Operators 4.6. Crypto Currency ATM Market Size and Forecast, by Region (2023-2030) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Crypto Currency ATM Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.1.1. Bitcoin 5.1.2. Ethereum 5.1.3. Litecoin 5.1.4. Various Altcoins 5.2. North America Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 5.2.1. Buy-Only ATMs 5.2.2. Sell-Only ATMs 5.2.3. Two-Way ATMs (Buying and Selling) 5.3. North America Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 5.3.1. Airports 5.3.2. Shopping Malls 5.3.3. Retail Stores 5.3.4. Standalone Installations 5.4. North America Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 5.4.1. Public ATMs 5.4.2. Private ATMs 5.5. North America Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 5.5.1. Cryptocurrency Company Operated 5.5.2. Financial Institution Operated 5.5.3. Independent Operators 5.6. Crypto Currency ATM Market Size and Forecast, by Country (2023-2030) 5.6.1. United States 5.6.1.1. United States Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.1.1.1. Bitcoin 5.6.1.1.2. Ethereum 5.6.1.1.3. Litecoin 5.6.1.1.4. Various Altcoins 5.6.1.2. United States Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 5.6.1.2.1. Buy-Only ATMs 5.6.1.2.2. Sell-Only ATMs 5.6.1.2.3. Two-Way ATMs (Buying and Selling) 5.6.1.3. United States Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 5.6.1.3.1. Airports 5.6.1.3.2. Shopping Malls 5.6.1.3.3. Retail Stores 5.6.1.3.4. Standalone Installations 5.6.1.4. United States Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 5.6.1.4.1. Public ATMs 5.6.1.4.2. Private ATMs 5.6.1.5. United States Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 5.6.1.5.1. Cryptocurrency Company Operated 5.6.1.5.2. Financial Institution Operated 5.6.1.5.3. Independent Operators 5.6.2. Canada 5.6.2.1. Canada Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.2.1.1. Bitcoin 5.6.2.1.2. Ethereum 5.6.2.1.3. Litecoin 5.6.2.1.4. Various Altcoins 5.6.2.2. Canada Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 5.6.2.2.1. Buy-Only ATMs 5.6.2.2.2. Sell-Only ATMs 5.6.2.2.3. Two-Way ATMs (Buying and Selling) 5.6.2.3. Canada Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 5.6.2.3.1. Airports 5.6.2.3.2. Shopping Malls 5.6.2.3.3. Retail Stores 5.6.2.3.4. Standalone Installations 5.6.2.4. Canada Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 5.6.2.4.1. Public ATMs 5.6.2.4.2. Private ATMs 5.6.2.5. Canada Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 5.6.2.5.1. Cryptocurrency Company Operated 5.6.2.5.2. Financial Institution Operated 5.6.2.5.3. Independent Operators 5.6.3. Mexico 5.6.3.1. Mexico Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.3.1.1. Bitcoin 5.6.3.1.2. Ethereum 5.6.3.1.3. Litecoin 5.6.3.1.4. Various Altcoins 5.6.3.2. Mexico Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 5.6.3.2.1. Buy-Only ATMs 5.6.3.2.2. Sell-Only ATMs 5.6.3.2.3. Two-Way ATMs (Buying and Selling) 5.6.3.3. Mexico Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 5.6.3.3.1. Airports 5.6.3.3.2. Shopping Malls 5.6.3.3.3. Retail Stores 5.6.3.3.4. Standalone Installations 5.6.3.4. Mexico Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 5.6.3.4.1. Public ATMs 5.6.3.4.2. Private ATMs 5.6.3.5. Mexico Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 5.6.3.5.1. Cryptocurrency Company Operated 5.6.3.5.2. Financial Institution Operated 5.6.3.5.3. Independent Operators 6. Europe Crypto Currency ATM Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.2. Europe Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.3. Europe Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.4. Europe Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.5. Europe Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6. Europe Crypto Currency ATM Market Size and Forecast, by Country (2023-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.1.2. United Kingdom Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.1.3. United Kingdom Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.1.4. United Kingdom Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.1.5. United Kingdom Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6.2. France 6.6.2.1. France Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.2.2. France Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.2.3. France Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.2.4. France Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.2.5. France Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6.3. Germany 6.6.3.1. Germany Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.3.2. Germany Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.3.3. Germany Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.3.4. Germany Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.3.5. Germany Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6.4. Italy 6.6.4.1. Italy Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.4.2. Italy Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.4.3. Italy Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.4.4. Italy Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.4.5. Italy Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6.5. Spain 6.6.5.1. Spain Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.5.2. Spain Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.5.3. Spain Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.5.4. Spain Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.5.5. Spain Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6.6. Sweden 6.6.6.1. Sweden Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.6.2. Sweden Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.6.3. Sweden Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.6.4. Sweden Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.6.5. Sweden Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6.7. Austria 6.6.7.1. Austria Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.7.2. Austria Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.7.3. Austria Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.7.4. Austria Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.7.5. Austria Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.8.2. Rest of Europe Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 6.6.8.3. Rest of Europe Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 6.6.8.4. Rest of Europe Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 6.6.8.5. Rest of Europe Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7. Asia Pacific Crypto Currency ATM Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.2. Asia Pacific Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.3. Asia Pacific Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.4. Asia Pacific Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.5. Asia Pacific Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6. Asia Pacific Crypto Currency ATM Market Size and Forecast, by Country (2023-2030) 7.6.1. China 7.6.1.1. China Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.1.2. China Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.1.3. China Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.1.4. China Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.1.5. China Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.2. S Korea 7.6.2.1. S Korea Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.2.2. S Korea Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.2.3. S Korea Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.2.4. S Korea Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.2.5. S Korea Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.3. Japan 7.6.3.1. Japan Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.3.2. Japan Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.3.3. Japan Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.3.4. Japan Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.3.5. Japan Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.4. India 7.6.4.1. India Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.4.2. India Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.4.3. India Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.4.4. India Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.4.5. India Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.5. Australia 7.6.5.1. Australia Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.5.2. Australia Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.5.3. Australia Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.5.4. Australia Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.5.5. Australia Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.6. Indonesia 7.6.6.1. Indonesia Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.6.2. Indonesia Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.6.3. Indonesia Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.6.4. Indonesia Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.6.5. Indonesia Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.7. Malaysia 7.6.7.1. Malaysia Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.7.2. Malaysia Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.7.3. Malaysia Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.7.4. Malaysia Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.7.5. Malaysia Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.8. Vietnam 7.6.8.1. Vietnam Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.8.2. Vietnam Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.8.3. Vietnam Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.8.4. Vietnam Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.8.5. Vietnam Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.9. Taiwan 7.6.9.1. Taiwan Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.9.2. Taiwan Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.9.3. Taiwan Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.9.4. Taiwan Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.9.5. Taiwan Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.10.2. Rest of Asia Pacific Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 7.6.10.3. Rest of Asia Pacific Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 7.6.10.4. Rest of Asia Pacific Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 7.6.10.5. Rest of Asia Pacific Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 8. Middle East and Africa Crypto Currency ATM Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.2. Middle East and Africa Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 8.3. Middle East and Africa Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 8.4. Middle East and Africa Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 8.5. Middle East and Africa Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 8.6. Middle East and Africa Crypto Currency ATM Market Size and Forecast, by Country (2023-2030) 8.6.1. South Africa 8.6.1.1. South Africa Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.6.1.2. South Africa Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 8.6.1.3. South Africa Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 8.6.1.4. South Africa Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 8.6.1.5. South Africa Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 8.6.2. GCC 8.6.2.1. GCC Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.6.2.2. GCC Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 8.6.2.3. GCC Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 8.6.2.4. GCC Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 8.6.2.5. GCC Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 8.6.3. Nigeria 8.6.3.1. Nigeria Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.6.3.2. Nigeria Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 8.6.3.3. Nigeria Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 8.6.3.4. Nigeria Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 8.6.3.5. Nigeria Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.6.4.2. Rest of ME&A Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 8.6.4.3. Rest of ME&A Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 8.6.4.4. Rest of ME&A Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 8.6.4.5. Rest of ME&A Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 9. South America Crypto Currency ATM Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 9.2. South America Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 9.3. South America Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 9.4. South America Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 9.5. South America Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 9.6. South America Crypto Currency ATM Market Size and Forecast, by Country (2023-2030) 9.6.1. Brazil 9.6.1.1. Brazil Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 9.6.1.2. Brazil Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 9.6.1.3. Brazil Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 9.6.1.4. Brazil Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 9.6.1.5. Brazil Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 9.6.2. Argentina 9.6.2.1. Argentina Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 9.6.2.2. Argentina Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 9.6.2.3. Argentina Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 9.6.2.4. Argentina Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 9.6.2.5. Argentina Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Crypto Currency ATM Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 9.6.3.2. Rest Of South America Crypto Currency ATM Market Size and Forecast, by Transaction Type (2023-2030) 9.6.3.3. Rest Of South America Crypto Currency ATM Market Size and Forecast, by Deployment Type (2023-2030) 9.6.3.4. Rest Of South America Crypto Currency ATM Market Size and Forecast, by Accessibility (2023-2030) 9.6.3.5. Rest Of South America Crypto Currency ATM Market Size and Forecast, by Ownership Type (2023-2030) 10. Global Crypto Currency ATM Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Crypto Currency ATM Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. CoinFlip, Chicago, USA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Bitstop Miami, USA 11.3. Coin Cloud, Las Vegas, USA 11.4. Bitcoin Depot Atlanta, USA 11.5. Coinsource, Fort Worth, USA 11.6. Coinme, Seattle, USA 11.7. Genesis Coin, San Diego, USA 11.8. Byte Federal, Florida, USA 11.9. Paydepot, Los Angeles, USA 11.10. Robocoin, Las Vegas, USA 11.11. Bitaccess, Ottawa, Canada 11.12. Shitcoins Club Berlin, Germany 11.13. Lamassu, Luzern, Switzerland 11.14. BitXatm, Switzerland 11.15. Bitnovo, Valencia, Spain 11.16. BCB ATM, London, UK 11.17. BitOcean, Tokyo, Japan 11.18. Bitmain, Beijing, China 11.19. Binance, Tokyo, Japan 11.20. Coincheck, Tokyo, Japan 11.21. GMO Coin, Tokyo, Japan 11.22. Unocoin, Bangalore, India 12. Key Findings 13. Ownership Type Recommendations