Contract Furniture and Furnishing Market was valued at US$ 3.92 Bn. in 2022 the total revenue is expected to grow at 4.34% (CAGR) through 2022 to 2029, reaching US$ 5.29 Bn.Global Contract Furniture and Furnishing Market Overview:

Contract furniture and furnishing are used for commercial purposes. it is often used in industries such as restaurants, hospitality, education industry and other venues, this includes all types of furnishers which are specially designed and manufactured from durable materials to withstand the heavy use associated with a contract or commercial use.To know about the Research Methodology :- Request Free Sample Report The rising use of Contract Furniture and Furnishing Market boost employee morale increases comfort levels in the office and maintains professionalism this will increase demand for market. Contract Furniture and Furnishing Market, By Type (Desks and Tables, Chairs and Stools, Storage Cabinets, Sofas, Cafeteria Tables and Chairs, Others), End User (Corporate Offices, Hospitals, Hospitality and Food Services, Others), Distribution Channel (Offline, Online), Country. Major Key Players in the Contract Furniture and Furnishing market are identified through secondary research and their market revenues are determined through primary and secondary research. Secondary research involved a study of the top manufacturers' annual and financial reports. Some of the leading key players in the global Contract Furniture and Furnishing market are Contract, Haworth Inc, Herman miller. inc Impact of Covid-19 on Contract Furniture and Furnishing Market The coronavirus pandemic is creating dramatic changes in the contract furniture and furnishing market, particularly in 2020, home office furniture and accessories have been in high demand .as people are started working from home and desire to Mack their workspace better. another furniture has also seen an increase in demand as a result of compared to before the outbark, people are staying at home much more frequently. Consumers are improving their living spaces and looking for the perfect pieces of furniture to suit their homes. While the pandemic has brought a significant increase in demand to many parts of the furniture industry, it is reverse in corporate furniture. Over the past two years, companies have switched temporarily or permanently to remote work setups, downsized, or closed altogether, leaving behind a massive surplus of used furniture and low demand for new items.

Contract Furniture and Furnishing Market Dynamics:

A Key driving factor behind the furniture demand was Increased interest in eco-friendly furniture Furniture manufacturers have been influenced by business and consumer interest in green products and an increased focus on sustainability. To reduce environmental impact, furniture can be made with recycled materials or more sustainable woods such as acacia, bamboo, or reclaimed wood. Some well-known furniture brands offer product lines that promote sustainability. For example, Pottery Barn offers reclaimed wood furniture made with salvaged materials, and Crate & Barrel sells furniture with frames that are certified by the Forest Stewardship Council. Another key driving factor is that multi-functional, versatile furniture is gaining popularity. Consumers have also been looking for furniture that is multi-purpose, foldable, and technology-driven, especially when it comes to living in smaller spaces. Because the number of single- and two-person households has been increasing, resulting in the demand for small and portable furniture Restraint for the Market When smaller furniture businesses enter the market, a larger company can mack it challenging for them to attract customers. Large companies often are household names, have significant resources for marketing drives and can take advantage of economies of scale, thus decreasing their manufacturing costs and prices charged to the customer. As an example, the largest furniture store in the world, IKEA, can control its size to lower manufacturing costs and provide furniture at low prices.Contract Furniture and Furnishing Market Segment Analysis:

By Product, the setting chairs and stools category had the highest revenue shear in 2021. as the employees spend more than 8 to10 hours at work each day to minimize illness and fatigue, office chairs must be designed according to scientific principles as the optimal posture while working has a significant impact on health. In the U.S., there is a growing need for ergonomic seats, which aid in improving staff productivity, efficiency, and workplace aesthetics.By end users- The healthcare and commercial applications segment held the greatest market share in 2021.Contract furnishers are majorly used for healthcare and commercial applications including wallcoverings, furniture, acoustic solutions, sitting, and panels. Different types of architectural walls, seating, medical recliners, medical gliders, chairs, stools, lounge seating, and lobby benches consume a variety of contract furnishers. Advanced fabric products, when used in wallcoverings, offer high thermal resistance, flame resistance, and acoustic insulation. The demand for wall coverings used in healthcare applications The office space is the second largest segment and is anticipated to grow at a CAGR of 3.5%, in terms of revenue, over the forecast period. The growing trend of aesthetic buildings improvements and the creation of new offices buildings supported by multinational corporations enter in the area is probably favourable to the contract furniture.

Contract Furniture and Furnishing Market Regional Insights:

Asia Pacific to Hold Major Share of Global Contract Furniture and Furnishing Market Asia Pacific is expected to hold a major share of the contract furniture and furnishing market during the forecast period. The growing innovation coupled with increasing demand for aesthetically advanced furniture will drive the Asia Pacific furniture market. leading to unprecedented developments. Furthermore, the entering of major furniture manufacturers into the Asia Pacific region has also boosted the overall market demand in the previous years. Major players, such as IKEA, have adopted various encouraging marketing schemes mainly in the developing economies, which have triggered sales in recent times. Some of the major players in the Asia Pacific furniture market include Kohler, IKEA Group, Heritage Home, OPPEIN, Ashley Furniture, NAFCO Corporation, Godrej Interio, and others. The objective of the report is to present a comprehensive analysis of the Contract Furniture and Furnishing Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Contract Furniture and Furnishing Market dynamics, and structure by analyzing the market segments projectingject the market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Contract Furniture and Furnishing Market make the report investor’s guide.Contract Furniture and Furnishing Market Scope: Inquire before buying

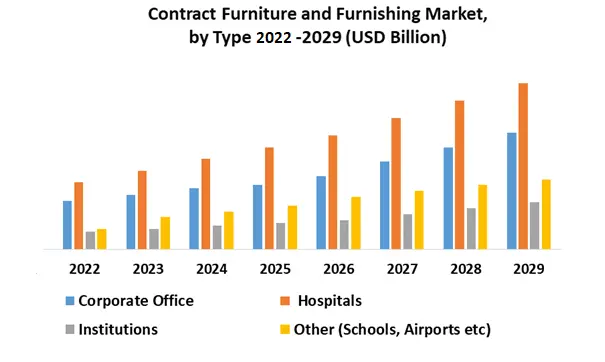

Global Contract Furniture and Furnishing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.92 Bn. Forecast Period 2023 to 2029 CAGR: 4.34 % Market Size in 2029: US $ 5.29 Bn. Segments Covered: by Product Desks Table Chair and stools Storage Cabinets Sofas Cafeteria Table & Chairs Other (stands, lighting etc) by End User Corporate Office Hospitals Institutions Other (Schools, Airports etc) by Distribution Channels Online E-commerce Website Company-Owned Website Office Specialty Stores Furniture marts Other Retail based Contract Furniture and Furnishing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Contract Furniture and Furnishing Market Key Players

1. Forest Contract 2. Haworth Inc. 3. Herman Miller, Inc. 4. Humanscale International Holdings Ltd. 5. Kinnarps AB 6. Knoll Inc. 7. Pioneer Contract Furniture Ltd. 8. Sitraben Contract Furniture Ltd. 9. Steelcase Inc. 10. Ahrend 11.Cefla 12.Fourfront Group 13.Franke Water Systems 14.HMY 15.Input Interior 16.ISG 17.Isku Group 18.Itab Shop Concept 19.Kinnarps 20.Lifestyle Design 21.Marine Interiors 22.Modus Workspace 23.Nobia Group 24.Overbury 25.Stamhuis Groep 26.Steelcase 27.Umdasch Shop Fitting Group 28.Vitra Frequently Asked Questions: 1. What is the forecast period considered for the Contract Furniture and Furnishing Market report? Ans. The forecast period for the market is 2023-2029. 2. Which key factors are hindering the growth of the Contract Furniture and Furnishing Market? Ans. smaller furniture businesses enter the market, a larger company can mack it challenging for them to attract customers are hindering the growth of market. 3. What is the compound annual growth rate (CAGR) of the Contract Furniture and Furnishing Market for the forecast period? Ans. 4.34% is the compound annule growth rate (CAGR) of the market for the forecast period. 4. What are the key factors driving the growth of the Contract Furniture and Furnishing Market? Ans. A Key driving factor behind the furniture demand was Increased interest in eco-friendly furniture. 5. Which are the worldwide major key players covered for the Contract Furniture and Furnishing Market report? Ans. Forest Contract, Haworth Inc., Herman Miller, Inc., Humanscale International Holdings Ltd, Kinnarps AB, Knoll Inc.

1. Contract Furniture and Furnishing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Contract Furniture and Furnishing Market: Dynamics 2.1. Contract Furniture and Furnishing Market Trends by Region 2.1.1. North America Contract Furniture and Furnishing Market Trends 2.1.2. Europe Contract Furniture and Furnishing Market Trends 2.1.3. Asia Pacific Contract Furniture and Furnishing Market Trends 2.1.4. Middle East and Africa Contract Furniture and Furnishing Market Trends 2.1.5. South America Contract Furniture and Furnishing Market Trends 2.2. Contract Furniture and Furnishing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Contract Furniture and Furnishing Market Drivers 2.2.1.2. North America Contract Furniture and Furnishing Market Restraints 2.2.1.3. North America Contract Furniture and Furnishing Market Opportunities 2.2.1.4. North America Contract Furniture and Furnishing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Contract Furniture and Furnishing Market Drivers 2.2.2.2. Europe Contract Furniture and Furnishing Market Restraints 2.2.2.3. Europe Contract Furniture and Furnishing Market Opportunities 2.2.2.4. Europe Contract Furniture and Furnishing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Contract Furniture and Furnishing Market Drivers 2.2.3.2. Asia Pacific Contract Furniture and Furnishing Market Restraints 2.2.3.3. Asia Pacific Contract Furniture and Furnishing Market Opportunities 2.2.3.4. Asia Pacific Contract Furniture and Furnishing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Contract Furniture and Furnishing Market Drivers 2.2.4.2. Middle East and Africa Contract Furniture and Furnishing Market Restraints 2.2.4.3. Middle East and Africa Contract Furniture and Furnishing Market Opportunities 2.2.4.4. Middle East and Africa Contract Furniture and Furnishing Market Challenges 2.2.5. South America 2.2.5.1. South America Contract Furniture and Furnishing Market Drivers 2.2.5.2. South America Contract Furniture and Furnishing Market Restraints 2.2.5.3. South America Contract Furniture and Furnishing Market Opportunities 2.2.5.4. South America Contract Furniture and Furnishing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Contract Furniture and Furnishing Industry 2.8. Analysis of Government Schemes and Initiatives For Contract Furniture and Furnishing Industry 2.9. Contract Furniture and Furnishing Market Trade Analysis 2.10. The Global Pandemic Impact on Contract Furniture and Furnishing Market 3. Contract Furniture and Furnishing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 3.1.1. Desks Table 3.1.2. Chair and stools 3.1.3. Storage Cabinets 3.1.4. Sofas 3.1.5. Cafeteria Table & Chairs 3.1.6. Other (stands, lighting etc) 3.2. Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 3.2.1. Corporate Office 3.2.2. Hospitals 3.2.3. Institutions 3.2.4. Other (Schools, Airports etc) 3.3. Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 3.3.1. Online 3.3.2. E-commerce Website 3.3.3. Company-Owned Website 3.3.4. Office 3.3.5. Specialty Stores 3.3.6. Furniture marts 3.3.7. Other Retail based 3.4. Contract Furniture and Furnishing Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Contract Furniture and Furnishing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 4.1.1. Desks Table 4.1.2. Chair and stools 4.1.3. Storage Cabinets 4.1.4. Sofas 4.1.5. Cafeteria Table & Chairs 4.1.6. Other (stands, lighting etc) 4.2. North America Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 4.2.1. Corporate Office 4.2.2. Hospitals 4.2.3. Institutions 4.2.4. Other (Schools, Airports etc) 4.3. North America Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 4.3.1. Online 4.3.2. E-commerce Website 4.3.3. Company-Owned Website 4.3.4. Office 4.3.5. Specialty Stores 4.3.6. Furniture marts 4.3.7. Other Retail based 4.4. North America Contract Furniture and Furnishing Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Desks Table 4.4.1.1.2. Chair and stools 4.4.1.1.3. Storage Cabinets 4.4.1.1.4. Sofas 4.4.1.1.5. Cafeteria Table & Chairs 4.4.1.1.6. Other (stands, lighting etc) 4.4.1.2. United States Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 4.4.1.2.1. Corporate Office 4.4.1.2.2. Hospitals 4.4.1.2.3. Institutions 4.4.1.2.4. Other (Schools, Airports etc) 4.4.1.3. United States Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 4.4.1.3.1. Online 4.4.1.3.2. E-commerce Website 4.4.1.3.3. Company-Owned Website 4.4.1.3.4. Office 4.4.1.3.5. Specialty Stores 4.4.1.3.6. Furniture marts 4.4.1.3.7. Other Retail based 4.4.2. Canada 4.4.2.1. Canada Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Desks Table 4.4.2.1.2. Chair and stools 4.4.2.1.3. Storage Cabinets 4.4.2.1.4. Sofas 4.4.2.1.5. Cafeteria Table & Chairs 4.4.2.1.6. Other (stands, lighting etc) 4.4.2.2. Canada Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 4.4.2.2.1. Corporate Office 4.4.2.2.2. Hospitals 4.4.2.2.3. Institutions 4.4.2.2.4. Other (Schools, Airports etc) 4.4.2.3. Canada Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 4.4.2.3.1. Online 4.4.2.3.2. E-commerce Website 4.4.2.3.3. Company-Owned Website 4.4.2.3.4. Office 4.4.2.3.5. Specialty Stores 4.4.2.3.6. Furniture marts 4.4.2.3.7. Other Retail based 4.4.3. Mexico 4.4.3.1. Mexico Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Desks Table 4.4.3.1.2. Chair and stools 4.4.3.1.3. Storage Cabinets 4.4.3.1.4. Sofas 4.4.3.1.5. Cafeteria Table & Chairs 4.4.3.1.6. Other (stands, lighting etc) 4.4.3.2. Mexico Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 4.4.3.2.1. Corporate Office 4.4.3.2.2. Hospitals 4.4.3.2.3. Institutions 4.4.3.2.4. Other (Schools, Airports etc) 4.4.3.3. Mexico Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 4.4.3.3.1. Online 4.4.3.3.2. E-commerce Website 4.4.3.3.3. Company-Owned Website 4.4.3.3.4. Office 4.4.3.3.5. Specialty Stores 4.4.3.3.6. Furniture marts 4.4.3.3.7. Other Retail based 5. Europe Contract Furniture and Furnishing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.2. Europe Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.3. Europe Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 5.4. Europe Contract Furniture and Furnishing Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.1.3. United Kingdom Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels(2022-2029) 5.4.2. France 5.4.2.1. France Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.2.3. France Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.3.3. Germany Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.4.3. Italy Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.5.3. Spain Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.6.3. Sweden Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.7.3. Austria Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 5.4.8.3. Rest of Europe Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6. Asia Pacific Contract Furniture and Furnishing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.3. Asia Pacific Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4. Asia Pacific Contract Furniture and Furnishing Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.1.3. China Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.2.3. S Korea Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.3.3. Japan Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.4. India 6.4.4.1. India Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.4.3. India Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.5.3. Australia Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.6.3. Indonesia Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.7.3. Malaysia Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.8.3. Vietnam Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.9.3. Taiwan Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 6.4.10.3. Rest of Asia Pacific Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 7. Middle East and Africa Contract Furniture and Furnishing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 7.3. Middle East and Africa Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 7.4. Middle East and Africa Contract Furniture and Furnishing Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 7.4.1.3. South Africa Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 7.4.2.3. GCC Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 7.4.3.3. Nigeria Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 7.4.4.3. Rest of ME&A Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 8. South America Contract Furniture and Furnishing Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 8.2. South America Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 8.3. South America Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels(2022-2029) 8.4. South America Contract Furniture and Furnishing Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 8.4.1.3. Brazil Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 8.4.2.3. Argentina Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Contract Furniture and Furnishing Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Contract Furniture and Furnishing Market Size and Forecast, by End User (2022-2029) 8.4.3.3. Rest Of South America Contract Furniture and Furnishing Market Size and Forecast, by Distribution Channels (2022-2029) 9. Global Contract Furniture and Furnishing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Contract Furniture and Furnishing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Forest Contract 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Haworth Inc. 10.3. Herman Miller, Inc. 10.4. Humanscale International Holdings Ltd. 10.5. Kinnarps AB 10.6. Knoll Inc. 10.7. Pioneer Contract Furniture Ltd. 10.8. Sitraben Contract Furniture Ltd. 10.9. Steelcase Inc. 10.10. Ahrend 10.11. Cefla 10.12. Fourfront Group 10.13. Franke Water Systems 10.14. HMY 10.15. Input Interior 10.16. ISG 10.17. Isku Group 10.18. Itab Shop Concept 10.19. Kinnarps 10.20. Lifestyle Design 10.21. Marine Interiors 10.22. Modus Workspace 10.23. Nobia Group 10.24. Overbury 10.25. Stamhuis Groep 10.26. Steelcase 10.27. Umdasch Shop Fitting Group 10.28. Vitra 11. Key Findings 12. Industry Recommendations 13. Contract Furniture and Furnishing Market: Research Methodology 14. Terms and Glossary