Complete Nutrition Products Market Size in 2022 was worth US $ 4.38 Bn. at a CAGR 6% and it is expected to reach US $ 6.58 Bn. in 2029.Complete Nutrition Products Market Overview:

The Complete Nutrition Products Market Size in 2022 was worth US $ 4.38 Bn. Due to the growing emphasis on health, natural ingredients, clean labels, and organic food alternatives, customers are becoming more interested in complete nutrition goods. In addition, in the coming years, consumer demand for simple and easy-to-cook food products is expected to increase, resulting in an increase in demand for complete nutrition products. Because of the growing emphasis on health, natural ingredients, clean labels, and organic food alternatives, complete nutrition products are gaining favor among consumers.To know about the Research Methodology :- Request Free Sample Report

COVID-19 Impact on Complete Nutrition Products Market:

The COVID-19 outbreak has had a good and negative impact on the market for Complete Nutrition Products. During the early stages of the pandemic, prominent firms such as Huel Inc. saw a sharp rise in demand as more and more people began stocking up on handy and nutritious foods. Lockdown measures in most nations drove individuals to stay at home, prompting customers to purchase items that do not require any cooking, resulting in increased demand for complete nutrition products over the projection period.Complete Nutrition Products Market Dynamics:

Consumers' increasing focus on maintaining good health, their preference for clean label products that contain natural ingredients, and the growing trend of using alternative products made from organic food products can all be attributed to the growing popularity of products from the global complete nutrition products market. In addition, rising customer desire for easy-to-cook and convenient food items is likely to drive the global complete nutrition products market forward in the coming years. Furthermore, due to growing internet penetration around the world, the development and quick acceptance of e-commerce services and platforms fuelled demand in the worldwide complete nutrition products market. Other important reasons driving the global complete nutrition products market's growth include rising customer preference for food items made with high-quality and premium ingredients, as well as increased spending on premium packaged and easy-to-cook foods. The prevalence of shortage of vital nutrients such as vitamins, minerals, and calcium in typical meals has increased the need for powders dramatically. As a result, a growing number of health professionals are promoting comprehensive nutrition products. These are not only more cost-effective and handy than conventional items, but they also provide comprehensive nutrition. Vitamins D and B12, minerals like calcium and iron, herbs like echinacea and garlic, and products like glucosamine, probiotics, and fish oils are all found in most of these powders. They also contain fillers, binders, and flavorings in addition to these. Most makers recommend drinking them with milk or lukewarm water, and they often mention the serving size.Complete Nutrition Products Market Segment Analysis:

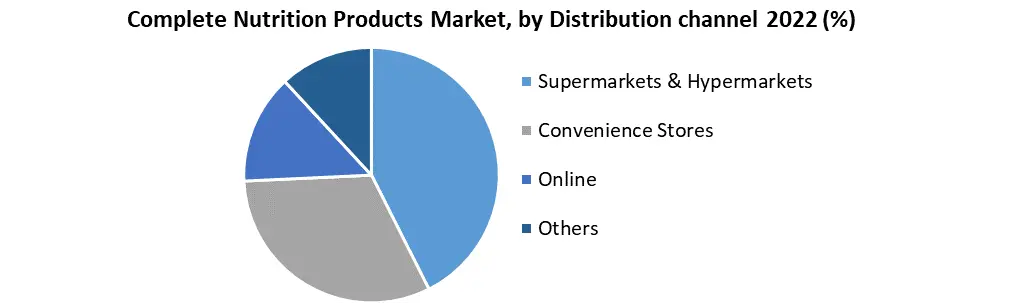

Based on product type, the power segment held the largest market share of 54.3 % in 2022. Powder demand is being driven by key issues such as a better lifestyle and a greater desire for natural and organic products. Powdered complete nutrition products are far less expensive than most of their competitors, which is fuelling demand among customers. From 2023 to 2029, the RTD shakes category is expected to grow at the fastest rate of 6.8%. Most consumers are adopting RTD shakes as a result of the rapidly increasing need for convenient and cost-effective nutrition solutions. Due to strong customer demand, market leaders such as Soylent and Huel Inc. are now selling a variety of RTD shakes in a variety of flavours, which is projected to boost the segment's growth in the coming years. Based on distribution channels, Supermarkets and hypermarkets dominated the market for complete nutrition products in 2022, accounting for nearly 43.6 % of revenue. Independent retail stores such as Walmart, Costco, GNC Holdings, LLC, and The Vitamin Shoppe are increasing their penetration, improving product visibility, and drawing a bigger consumer base. Because of the large number of wellness brands available, consumers choose to shop for specialist nutrition goods in these stores. Furthermore, these establishments have set aside a large amount of shelf space for vitamins and nutritional supplements, increasing product visibility and making it easier for customers to purchase them.

Complete Nutrition Products Market Regional Insights:

North America dominated the complete nutrition products market in 2022, accounting for about 42.0% revenue. This increase is due to increased health-related concerns among young consumers, such as obesity and diabetes, which is driving demand across North America. Because of the increased adoption of a healthy lifestyle among consumers, the economies of the United States have seen a relatively high growth rate in recent years. The rising prevalence of health conditions such as obesity, cardiovascular disease, and cancer in the United States is increasing the market's potential. For example, according to the Centers for Disease Control and Prevention (CDC), the obesity prevalence in the United States was expected to be 42.4 % in 2017-2018. Obesity was seen in approximately 40.3 % of persons aged 20 to 39. Recent Developments: • In October 2020, Abbott Laboratories will launch strawberry-flavored food supplements in India. As a result, the company's dietary supplement portfolio will be strengthened. • Amway spent USD 200 million in a nutritional supplement innovation facility in China in November 2019. This aided the company's overall expansion by allowing it to offer custom-made solutions. • To fulfil nutritional supplement demand in the North American market, Herbalife developed a relaxation tea and new immune basics including EpiCor in October 2019. This would add to the company's dietary supplement product portfolio. The objective of the report is to present a comprehensive analysis of the global Complete Nutrition Products market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Complete Nutrition Products market dynamics, structure by analyzing the market segments and projects the global Complete Nutrition Products market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Complete Nutrition Products market make the report investor’s guide.Complete Nutrition Products Market Scope: Inquire before buying

Complete Nutrition Products Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 4.38 Bn. Forecast Period 2023 to 2029 CAGR: 6% Market Size in 2029: US $ 6.58 Bn. Segments Covered: by Product Type • Powder • RTD Shakes • Bars by Distribution channel • Supermarkets & Hypermarkets • Convenience Stores • Online • Others Complete Nutrition Products Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Complete Nutrition Products Market Key Players

• Huel Inc. • Soylent • IdealShape • SlimFast • LadyBoss • RSP Nutrition • Numix • MuscleBlaze • Jimmy Joy • YFood Labs GmbH • Amway • Herbalife Nutrition • ADM • Pfizer • Arkopharma Laboratories Frequently Asked Questions: 1. Which region has the largest share in Global Complete Nutrition Products Market? Ans: North America region holds the highest share in 2022. 2. What is the growth rate of Global Complete Nutrition Products Market? Ans: The Global Complete Nutrition Products Market is growing at a CAGR of 6% during forecasting period 2023-2029. 3. What segments are covered in Global Complete Nutrition Products Market? Ans: Global Complete Nutrition Products Market is segmented into product, distribution channel and region. 4. Who are the key players in Global Complete Nutrition Products Market? Ans: The important key players in the Global Complete Nutrition Products Market are Huel Inc., Soylent, IdealShape, SlimFast, LadyBoss, RSP Nutrition, Numix, MuscleBlaze, Jimmy Joy, YFood Labs GmbH, Amway . 5. What is the study period of this market? Ans: The Global Complete Nutrition Products Market is studied from 2022 to 2029.

1. Global Complete Nutrition Products Market: Research Methodology 2. Global Complete Nutrition Products Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Complete Nutrition Products Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Complete Nutrition Products Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Complete Nutrition Products Market Segmentation 4.1. Global Complete Nutrition Products Market, by Product Type (2022-2029) • Powder • RTD Shakes • Bars 4.2. Global Complete Nutrition Products Market, by Distribution channel (2022-2029) • Supermarkets & Hypermarkets • Convenience Stores • Online • Others 5. North America Complete Nutrition Products Market(2022-2029) 5.1. Global Complete Nutrition Products Market, by Product Type (2022-2029) • Powder • RTD Shakes • Bars 5.2. Global Complete Nutrition Products Market, by Distribution channel (2022-2029) • Supermarkets & Hypermarkets • Convenience Stores • Online • Others 5.3. North America Complete Nutrition Products Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Complete Nutrition Products Market (2022-2029) 6.1. European Complete Nutrition Products Market, by Product Type (2022-2029) 6.2. European Complete Nutrition Products Market, by Distribution channel (2022-2029) 6.3. European Complete Nutrition Products Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Complete Nutrition Products Market (2022-2029) 7.1. Asia Pacific Complete Nutrition Products Market, by Product Type (2022-2029) 7.2. Asia Pacific Complete Nutrition Products Market, by Distribution channel (2022-2029) 7.3. Asia Pacific Complete Nutrition Products Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Complete Nutrition Products Market (2022-2029) 8.1. Middle East and Africa Complete Nutrition Products Market, by Product Type (2022-2029) 8.2. Middle East and Africa Complete Nutrition Products Market, by Distribution channel (2022-2029) 8.3. Middle East and Africa Complete Nutrition Products Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Complete Nutrition Products Market (2022-2029) 9.1. Latin America Complete Nutrition Products Market, by Product Type (2022-2029) 9.2. Latin America Complete Nutrition Products Market, by Distribution channel (2022-2029) 9.3. Latin America Complete Nutrition Products Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Huel Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Soylent 10.3. IdealShape 10.4. SlimFast 10.5. LadyBoss 10.6. RSP Nutrition 10.7. Numix 10.8. MuscleBlaze 10.9. Jimmy Joy 10.10. YFood Labs GmbH 10.11. Amway 10.12. Herbalife Nutrition 10.13. ADM 10.14. Pfizer 10.15. Arkopharma Laboratories